Adobe 3QFY25: Pixels to Pipelines

Model-agnostic workflows, governance, and a data flywheel are the new moat.

TLDR

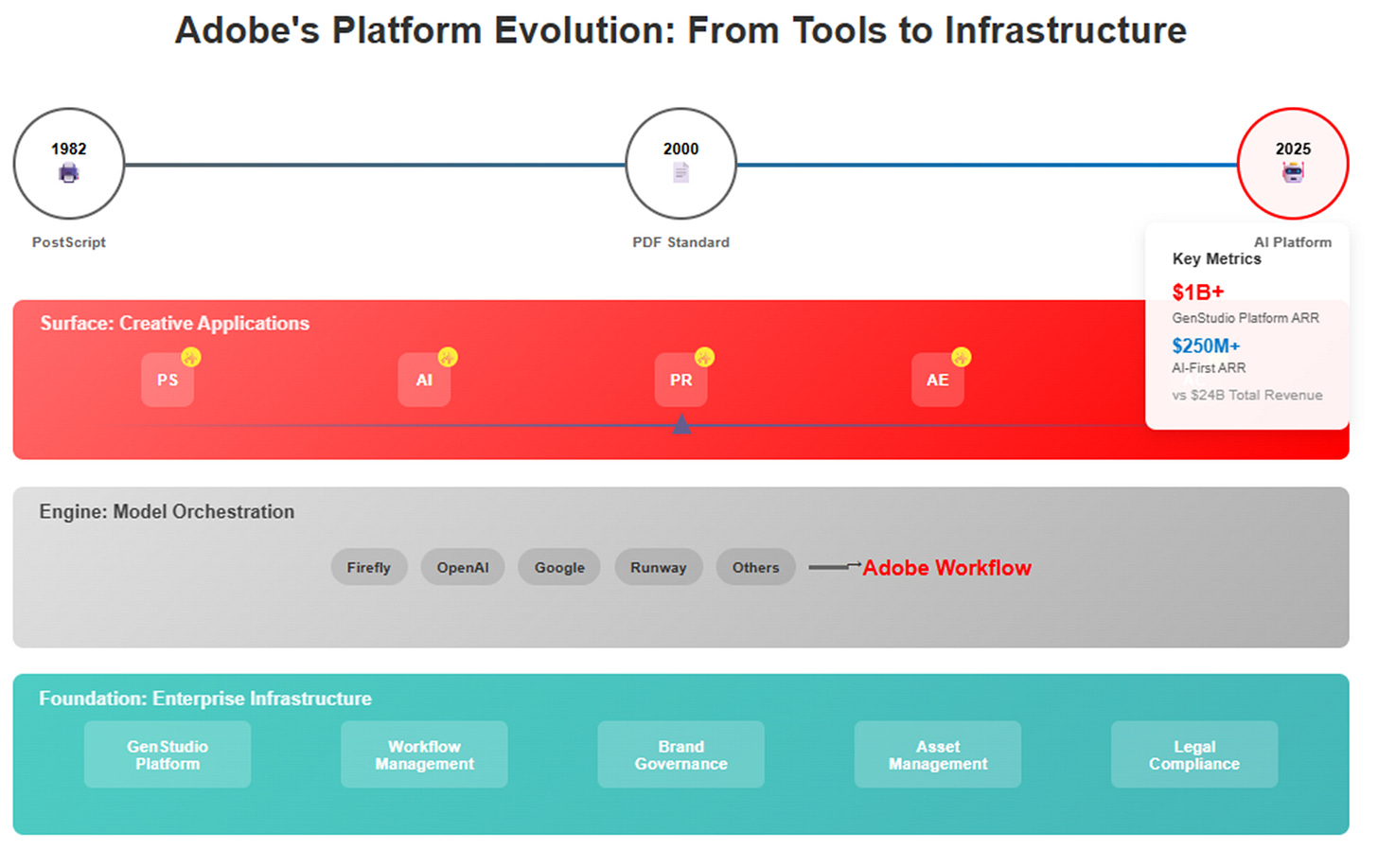

AI Transformation Success: Adobe has exceeded its $250M AI-first ARR target a quarter early while GenStudio platform components now generate >$1B ARR, proving the company is monetizing rather than being disrupted by AI

Strategic Positioning Advantage: Adobe's "Switzerland strategy" integrating multiple AI models (OpenAI, Google, Runway) while controlling workflows creates defensible platform economics that competitors can't easily replicate

Valuation Disconnect Opportunity: Trading at 6.7x EV/Sales despite demonstrating infrastructure-scale metrics suggests upside potential as market recognizes Adobe's evolution from software tools to content platform provider

In the summer of 1982, John Warnock and Chuck Geschke left Xerox with a revolutionary idea that would reshape computing forever. Their creation, PostScript, wasn't glamorous—it was a programming language for describing how text and images should appear on a printed page. Most people never heard of PostScript, yet it powered every laser printer, every magazine layout, and every book that rolled off printing presses for the next two decades.

PostScript succeeded not because it was the best printing technology, but because it became invisible infrastructure. Publishers didn't buy PostScript; they bought printers that happened to run PostScript. Designers didn't learn PostScript programming; they used applications that happened to output PostScript. Adobe had created something more valuable than software—they had built the essential plumbing that an entire industry couldn't function without.

This pattern would repeat throughout Adobe's history. PDF became the invisible standard for document sharing. Flash powered web video before mobile killed it. Each time, Adobe succeeded not by selling better features, but by becoming indispensable infrastructure that everyone used but few thought about.

Then came the existential crisis of 2022.

Generative AI burst onto the scene with tools like DALL-E, Midjourney, and ChatGPT. Suddenly, anyone could generate professional-quality images, videos, and content with simple text prompts. The question wasn't whether AI would disrupt creative software—it was whether creative software would survive at all. Why pay Adobe hundreds of dollars monthly for Photoshop when AI could generate images from scratch?

Adobe's stock price reflected this uncertainty, falling from pandemic highs as investors grappled with a fundamental question: Would artificial intelligence make Adobe irrelevant?

The answer, delivered in Adobe's Q3 2025 earnings, suggests the opposite may be true.

The Transformation Hidden in Plain Sight

Adobe reported AI-influenced Annual Recurring Revenue of over $5 billion and AI-first ARR exceeding $250 million—hitting their full-year target a quarter early. More significantly, their GenStudio platform, which includes enterprise workflow tools like Workfront, Frame, and AEM Assets, now generates over $1 billion in ARR with 25% year-over-year growth.

These aren't just impressive numbers—they represent a strategic transformation that most observers missed while debating whether AI would kill creative jobs.

While everyone focused on AI's potential to replace human creativity, Adobe quietly built something different: the infrastructure to manage AI-generated content at enterprise scale. It's the California Gold Rush analogy in reverse. Instead of joining the rush to find gold—building better AI models—Adobe positioned itself as the company that would sell picks, shovels, and banking services to everyone else.

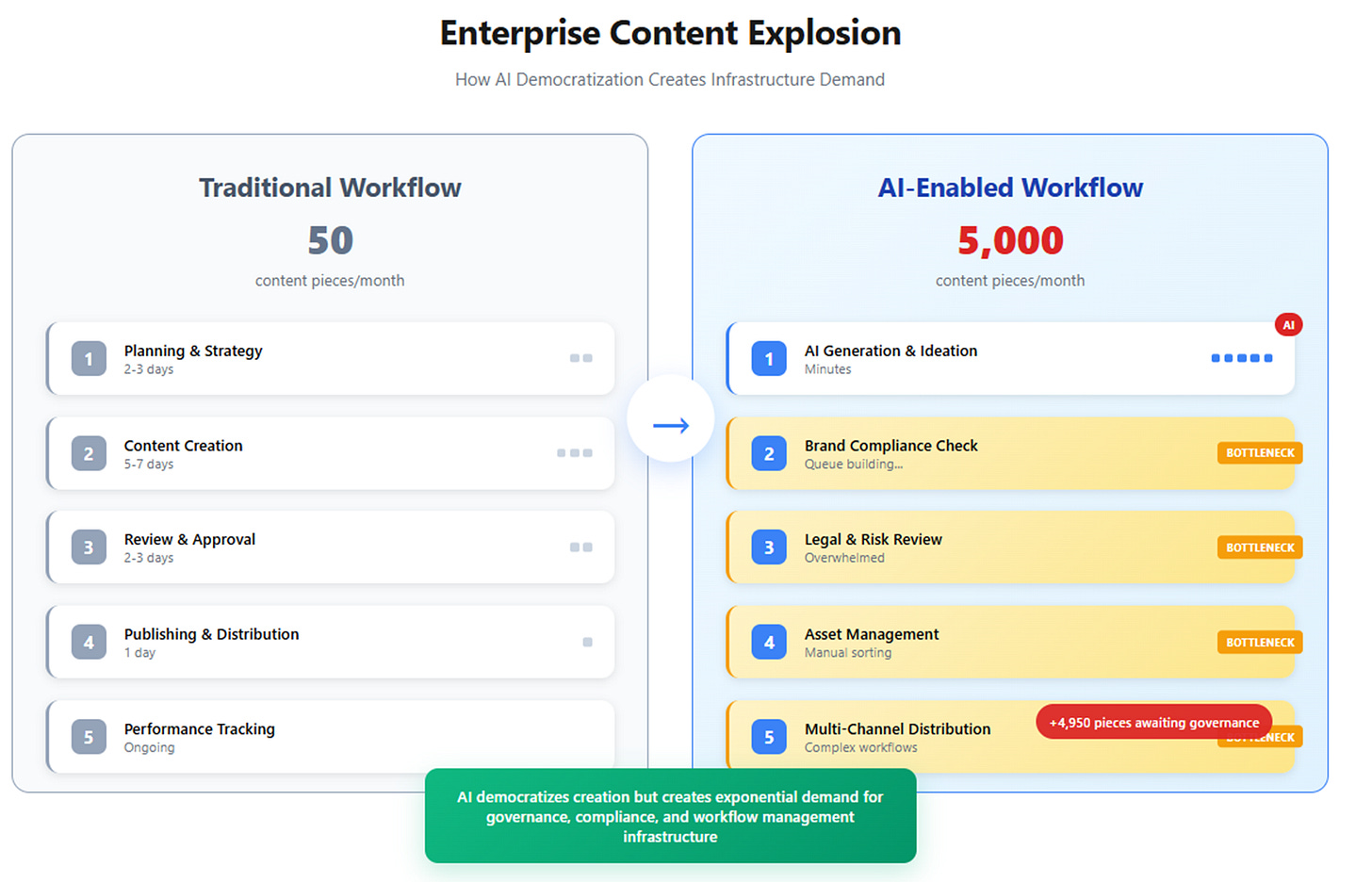

Consider what happens when AI democratizes content creation. A marketing team that previously produced 50 pieces of content monthly can suddenly generate 5,000. That's not a reduction in Adobe's addressable market—it's an explosion in demand for content management, brand governance, workflow orchestration, and creative operations.

The evidence is already visible in Adobe's enterprise metrics. "One Adobe" cross-cloud deals grew 60% year-over-year, and over 40% of their top 50 enterprise accounts have doubled their Adobe spending since fiscal 2023. These customers aren't reducing their Adobe usage as AI capabilities improve—they're expanding it.

The Swiss Strategy

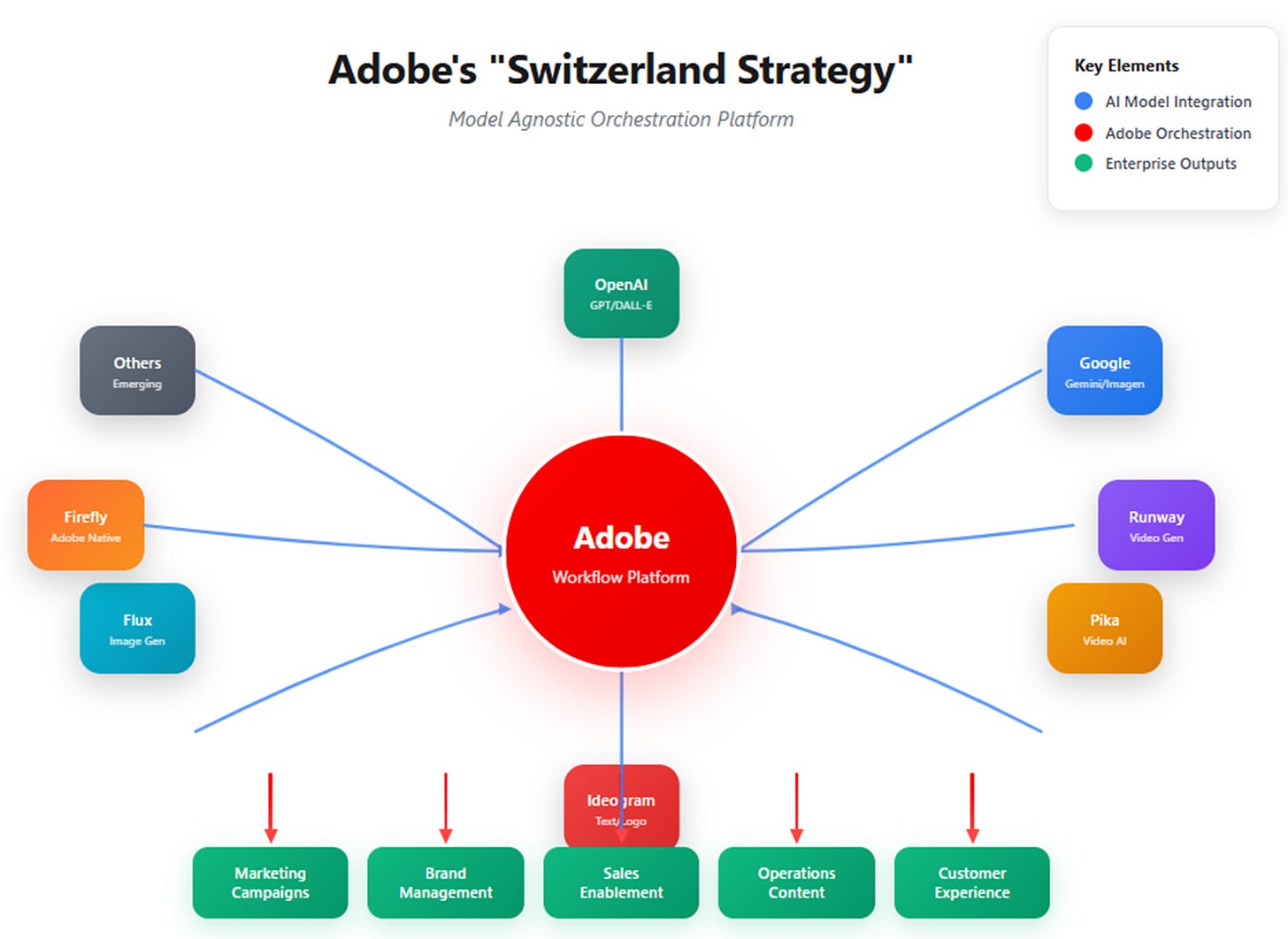

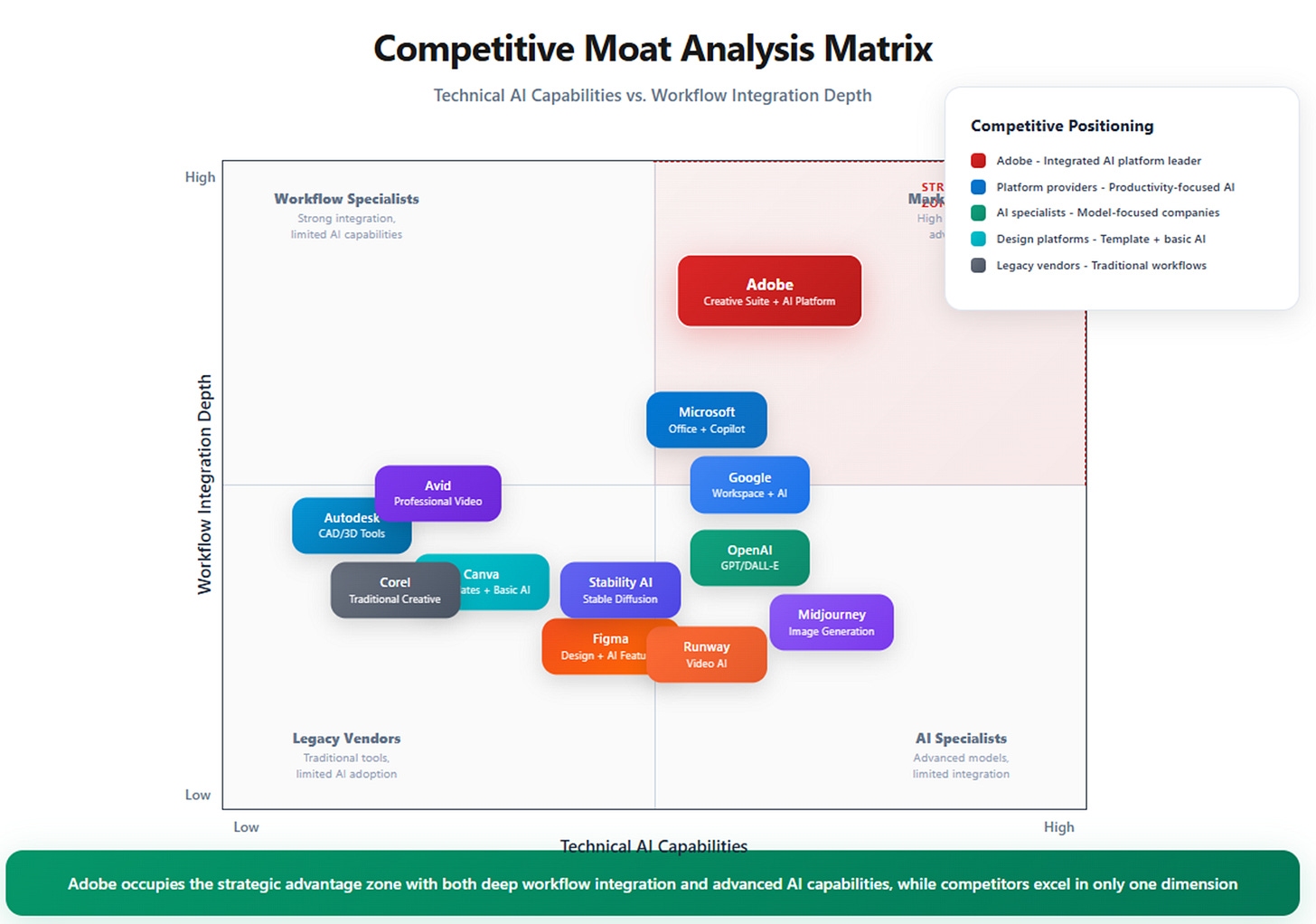

Adobe's most strategically sophisticated move is one that competitors and analysts are still underestimating: their deliberate model agnosticism. Rather than betting everything on their own Firefly AI models, Adobe has systematically integrated third-party models from Google, OpenAI, Runway, Pika, and others directly into Creative Cloud and GenStudio.

As CEO Shantanu Narayen explained: "In the rapidly evolving AI landscape, where each generative AI model has its own aesthetic style, we're offering customers choice and flexibility to use the right model within Adobe applications without the friction of switching between workflows and platforms."

This "Switzerland strategy" accomplishes two critical objectives that will define competitive advantage for the next decade.

First, it neutralizes the primary competitive threat. A startup can no longer beat Adobe simply by creating a marginally better AI model, because Adobe will integrate that model's API and offer it as another choice within Photoshop. The model becomes a commodity; the workflow remains Adobe's differentiator.

Second, it reinforces Adobe's unique value proposition: professional-grade tools, enterprise governance, asset management, and—most critically—legal indemnification. Adobe isn't selling image generation; they're selling a complete, risk-managed creative solution.

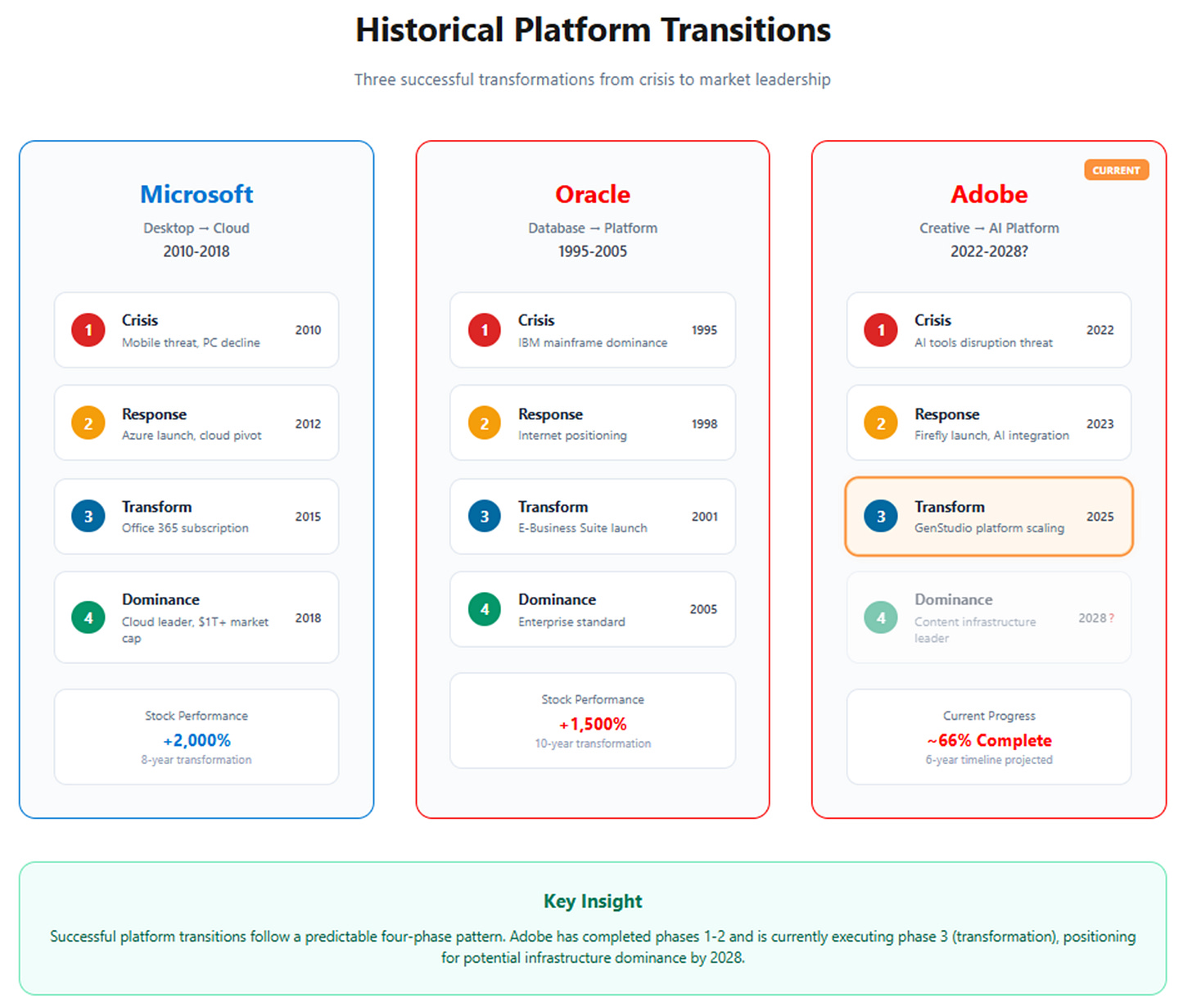

This mirrors the platform strategies that defined previous technology transitions. Microsoft didn't win with Windows by making the best hardware—they won by making hardware interchangeable. AWS didn't win in cloud computing by building the fastest processors—they won by making compute power a utility service.

Adobe is applying the same principle to generative AI: make the models interchangeable while owning the ecosystem where creative work gets done.

The Network Effect That Nobody's Tracking

The most underappreciated aspect of Adobe's AI strategy is the data network effect that's already operational. With 29 billion AI generations in Q3 alone and video generations growing 40% quarter-over-quarter, Adobe is accumulating customer usage data that continuously improves their understanding of creative intent and brand requirements.

This creates exponential switching costs. Every Firefly generation, every GenStudio workflow, every Adobe Experience Platform interaction feeds back into making Adobe's platform more intelligent for that specific customer's needs. A competitor might match Adobe's current AI capabilities, but they can't replicate years of customer-specific learning without rebuilding those customer relationships from scratch.

The 70% adoption rate of Adobe Experience Platform AI Assistant among eligible customers isn't just a usage metric—it's evidence of this data flywheel accelerating. Customers who use AI features more heavily become more locked into Adobe's ecosystem because the platform becomes increasingly customized to their workflows and brand guidelines.

Yet this network effect remains largely invisible to financial markets focused on traditional software metrics like subscription growth and customer acquisition costs.

The Valuation Reality Check

Adobe's current stock price of $350.55 tells a story of measured skepticism rather than transformational optimism. At 6.1x enterprise value to sales, Adobe trades below its historical range of 8-12x, despite demonstrating concrete AI monetization success.

The forward-looking metrics reinforce this conservative positioning. Wall Street expects 10.6% revenue growth over the next three years—respectable for a mature software company, but modest for a business undergoing platform transformation. The consensus price target of $468.58 implies 33% upside, suggesting analysts believe in Adobe's execution but aren't pricing in revolutionary change.

This valuation disconnect creates both opportunity and risk. Either Adobe has successfully navigated one of the most challenging technology transitions in software history while the market remains skeptical, or the market correctly recognizes that platform transformation is harder than quarterly metrics suggest.

The truth likely lies somewhere between these extremes.

Three Scenarios for the Next Three Years

The Bull Case: Platform Evolution ($625, 78% upside)

Adobe successfully transitions from creative software vendor to enterprise content infrastructure provider, though not necessarily achieving the "AWS of content" status that optimists envision.

Revenue grows 14-16% annually as AI-first ARR scales to $2.5-3 billion by fiscal 2028, representing 20-25% of total revenue. GenStudio achieves category leadership in enterprise content operations, and cross-platform adoption accelerates meaningfully among Fortune 1000 accounts.

Operating margins expand to 48-50% as scale benefits offset increased compute costs, and the market re-rates Adobe to 10-11x sales on recognition of platform network effects and competitive moat expansion.

This scenario requires sustained execution across multiple fronts: GenStudio must prove indispensable for enterprise workflows, AI consumption economics must demonstrate clear unit economics advantages, and competitive responses from Microsoft and Google must prove insufficient to dislodge Adobe's integrated advantage.

The Base Case: Steady Evolution ($475, 35% upside)

Adobe successfully integrates AI capabilities across their product portfolio without fundamental business model disruption, maintaining market leadership through enhanced rather than revolutionary capabilities.

Revenue grows 11-13% annually as AI-first ARR reaches $1.5-2 billion by fiscal 2028, representing 15-18% of total revenue. The transformation is real but incremental—AI improves Adobe's products and pricing power without creating new platform dynamics.

Operating margins stabilize at 46-47% as the company balances AI investment with profitability optimization. The market modestly re-rates Adobe to 7-8x sales, recognizing successful AI integration while maintaining skepticism about infrastructure transformation claims.

This scenario aligns most closely with current consensus expectations and reflects successful execution of Adobe's stated strategy without requiring breakthrough platform adoption or competitive moat expansion.

The Bear Case: Bundling Pressure ($275, 22% downside)

Platform providers successfully integrate "good enough" creative capabilities directly into productivity suites, while economic pressure reduces enterprise creative spending and AI-native startups achieve meaningful enterprise adoption.

Revenue growth decelerates to 7-9% annually as competitive pressure limits pricing power and customer expansion. AI-first ARR stalls below $1 billion as initial enthusiasm gives way to more practical evaluation of AI ROI by enterprise customers.

Operating margins compress to 42-44% due to pricing competition and higher compute costs without corresponding revenue acceleration. The market re-rates Adobe to 5-6x sales, recognizing the company as a mature software provider with declining competitive advantages.

This scenario materializes if Microsoft Office or Google Workspace successfully bundle creative tools, if economic downturn significantly reduces marketing and creative budgets, or if AI democratization ultimately reduces rather than increases demand for professional creative infrastructure.

What to Watch

Adobe's platform evolution will be measurable through specific operational indicators over defined timeframes. The most critical quarterly metric is AI-first ARR growth—sustainable expansion above 40% quarter-over-quarter is necessary to reach the $1 billion milestone that would likely trigger institutional re-rating.

GenStudio customer expansion and retention rates will indicate whether enterprise content infrastructure demand is real or represents temporary experimentation during AI adoption. Cross-cloud platform penetration metrics will reveal whether Adobe's integrated ecosystem creates sustainable switching costs or merely convenient bundling.

Operating leverage demonstration through AI scaling may be the most important validation of the transformation thesis. If Adobe can maintain operating margins above 46% while dramatically increasing AI workloads, it suggests the unit economics support platform rather than just software economics.

Annual validation checkpoints will determine the trajectory toward each scenario. Fiscal 2026 represents the critical inflection point: Does AI-first ARR approach $1 billion, triggering broader market recognition of platform transformation? Fiscal 2027 will reveal whether network effects are real—do customers become more locked in over time, or does competitive pressure force commoditization? Fiscal 2028 will determine whether Adobe successfully expands beyond creative workflows into general enterprise productivity infrastructure.

The macro environment will influence all scenarios. Enterprise AI budget allocation trends, economic sensitivity of creative spending, and the regulatory environment for AI indemnification will shape Adobe's opportunity set regardless of execution quality.

The PostScript Parallel

Adobe's current AI transformation bears striking resemblance to their PostScript success four decades ago. PostScript succeeded not because it was technically superior to alternatives—other page description languages existed—but because Adobe made it ubiquitous infrastructure that publishers, printers, and software developers all depended upon.

Similarly, Adobe's AI strategy succeeds not by building superior models—they explicitly integrate competitors' models—but by becoming the ubiquitous infrastructure that enterprises depend upon for AI-powered content operations.

The difference is scale and uncertainty. PostScript addressed a clear technical problem with an obvious solution pathway. Adobe's AI infrastructure opportunity addresses a more complex organizational challenge with multiple possible solution approaches. The total addressable market may be larger, but the execution risk is correspondingly higher.

Whether Adobe's AI transformation ultimately resembles PostScript's infrastructure success or Flash's platform failure will depend on factors that quarterly earnings can illuminate but not definitively resolve. The early indicators are encouraging: enterprise adoption is real, competitive moats appear to be strengthening rather than eroding, and financial discipline remains intact during the investment phase.

Yet transformation is never guaranteed, regardless of early success indicators. The market's current skepticism, reflected in modest forward growth expectations and below-historical valuation multiples, may prove prescient if competitive pressure intensifies or if economic conditions reduce enterprise appetite for creative infrastructure investment.

Adobe has demonstrated that established software companies can navigate platform disruption through strategic innovation rather than defensive positioning. Whether they can complete the transformation from software vendor to infrastructure provider remains the defining question for investors willing to bet on one of technology's most challenging strategic pivots.

The answer will determine whether Adobe's AI transition represents the next chapter in a decades-long infrastructure success story, or a cautionary tale about the limits of platform transformation in an era of accelerating technological change.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.