Adyen's 3Q25: Architecture Dividend

Q3 wasn't a beat; it was a coupon clipped from a bond Adyen bought in 2006. The question now is how many more coupons are left on the bond.

TL;DR :

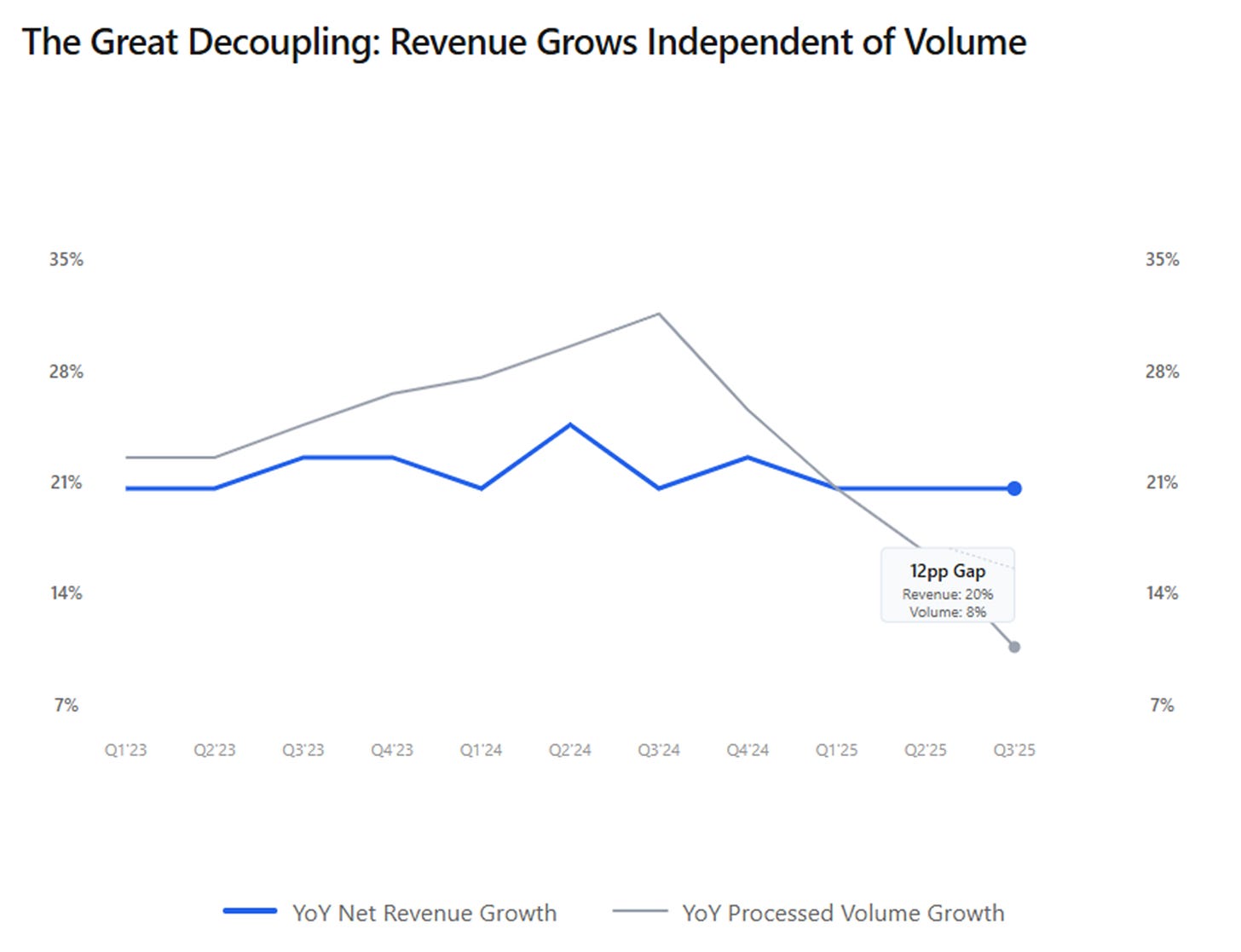

Revenue outpaces volume: Q3 2025 saw 20% revenue growth on 8% volume, proof that Adyen’s platform now monetizes complexity, not just transactions.

Single platform advantage: Adyen’s “one system, one codebase” lets it configure new markets and products in months, compounding data, efficiency, and take-rate power.

The architecture dividend: After years of invisible groundwork, Adyen’s unified design is now translating directly into pricing power, margin expansion, and investor confidence.

In the mid-2000s, the payments industry was pure chaos. A merchant wanting to accept payments globally needed a different gateway for Europe, another for the United States, a third for Asia. Online was separate from in-store. Fraud detection was bolted on from yet another vendor. Each integration took months. This wasn’t seen as a problem—it was just how payments worked.

In Amsterdam, a startup called Adyen made what looked like an irrational choice. Instead of acquiring companies to quickly assemble capabilities, instead of integrating with existing payment rails to get to market faster, they would build everything themselves. One codebase. One platform. From scratch.

The bet was simple in concept, excruciating in execution: architectural integrity would compound faster than acquisition speed. For a decade, the payoff was invisible to outsiders—slightly better authorization rates, marginally higher uptime, customers who stayed longer. But Q3 2025 was when that patient, boring infrastructure work finally showed up in the income statement.

When Revenue Divorces Volume

Here’s the only number that matters: 20% revenue growth on 8% volume growth.

Adyen’s Q3 Business Update stated it plainly:

“In Q3 2025, net revenue reached €598.4 million, up 20% YoY (23% on a constant currency basis), primarily driven by wallet share expansion with existing customers. Growth was consistent across all regions, and supported in part by the timing of settlements in the quarter. Processed volume totaled €346.9 billion, up 8% YoY, or 19% YoY excluding a single large-volume customer.”

For any traditional payment processor, this divergence is mathematically impossible to sustain—revenue tracks volume because transactions are the product. But Adyen stopped being a transaction processor somewhere between 2020 and 2023. What they sell now is problem complexity. Unifying online with offline? Higher take rate. Embedding payments into a SaaS platform? Higher take rate. Optimizing cross-border routing with local acquiring? Higher take rate.

The single platform is what makes solving complex problems economically viable. And Q3 is when that architectural choice moved from operational advantage to financial inevitability.

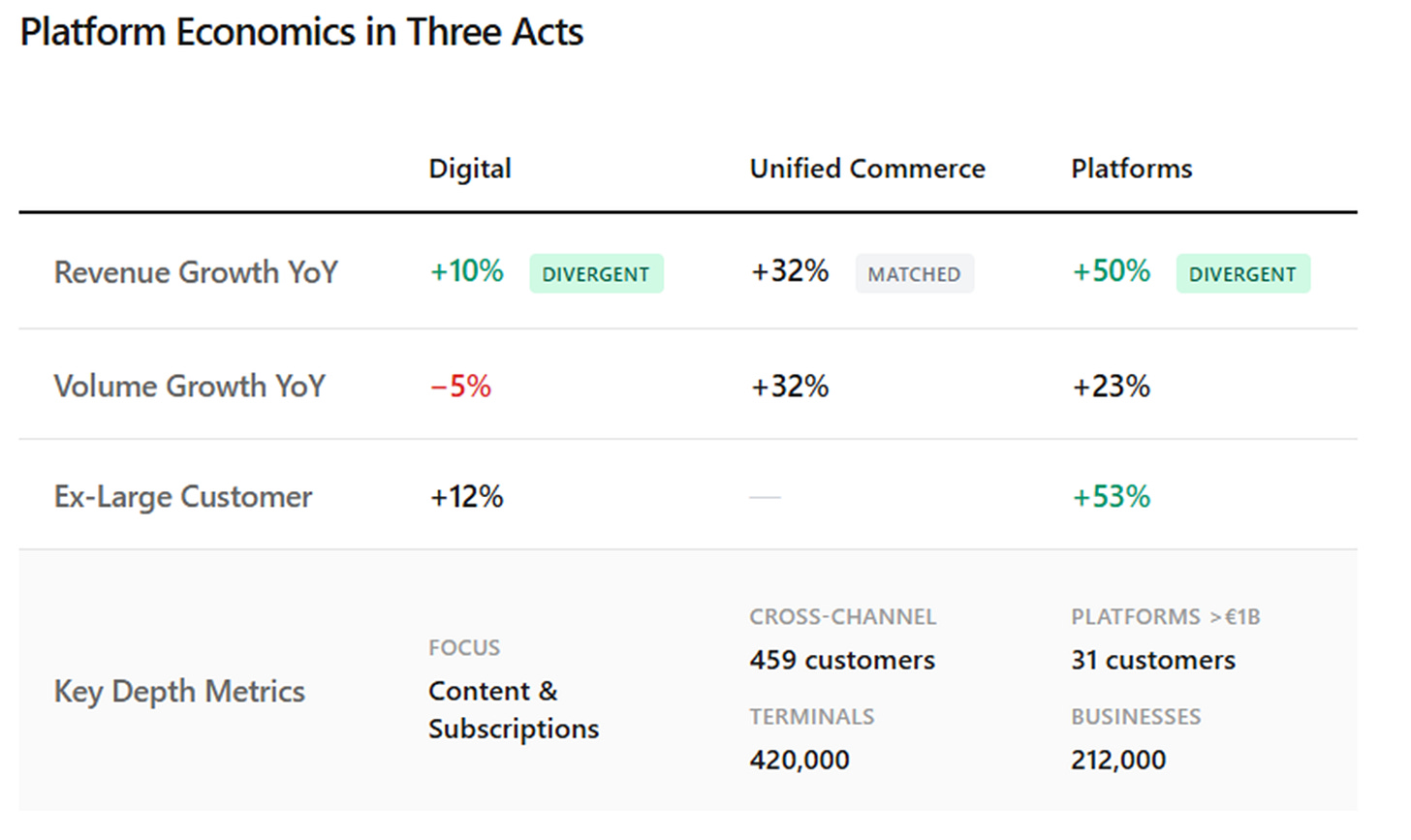

Digital, Adyen’s original e-commerce business, posted the starkest proof. Processed volume declined 5% year-over-year. Revenue grew 10%. Strip out one large, low-take-rate customer and Digital volume actually grew 12%—but focus on what happened when volume declined: revenue still grew. The platform was optimizing shrinking throughput through better authorization rates, fraud detection, and intelligent routing. This only works if every transaction flows through the same data layer, the same models, the same risk engines.

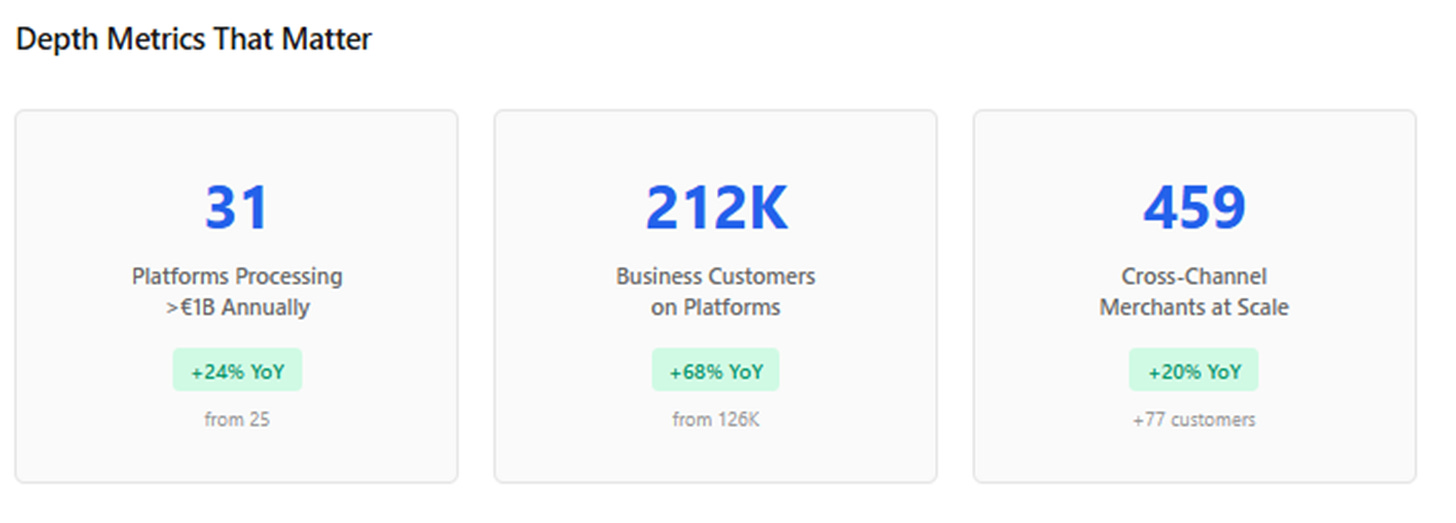

Unified Commerce—merchants processing both online and in physical stores—grew 32% in revenue and 32% in volume. The company now counts 459 customers “processing across channels at scale” (minimum €10 million on both POS and e-commerce, €50 million total), up 77 from a year ago. Terminal count hit 420,000, up 121,000 year-over-year.

This is channel expansion as configuration, not integration. A digital customer adds physical retail in weeks because it’s the same platform—same data, same settlement, same reconciliation. The alternative is what the rest of the industry does: hire systems integrators, spend six months connecting disparate vendors, and hope nothing breaks when regulations change.

Platforms is where the architecture shows its final form. Revenue grew 50% to €68.6 million. Volume grew 23%, or 53% excluding eBay. Adyen now has 31 platform customers processing over €1 billion annually (up from 25), with 212,000 business customers on those platforms (up from 126,000).

The eBay decline isn’t a problem management is desperately trying to solve—it’s a feature of strategy. Adyen would rather lose massive-volume, low-margin customers than dedicate engineering resources to servicing them at the expense of building higher-margin embedded finance products. They added six platforms at €1 billion scale while purging vanity volume. This is capital allocation, not churn.

On Platforms, Adyen isn’t serving customers—it’s becoming infrastructure for customers’ customers. When a SaaS platform embeds Adyen, every business on that platform inherits Adyen’s licensing, authentication, fraud detection, and optimization. The switching cost isn’t contractual; it’s architectural. Every feature built on Adyen’s primitives would need rebuilding.

What “Single Platform” Actually Means

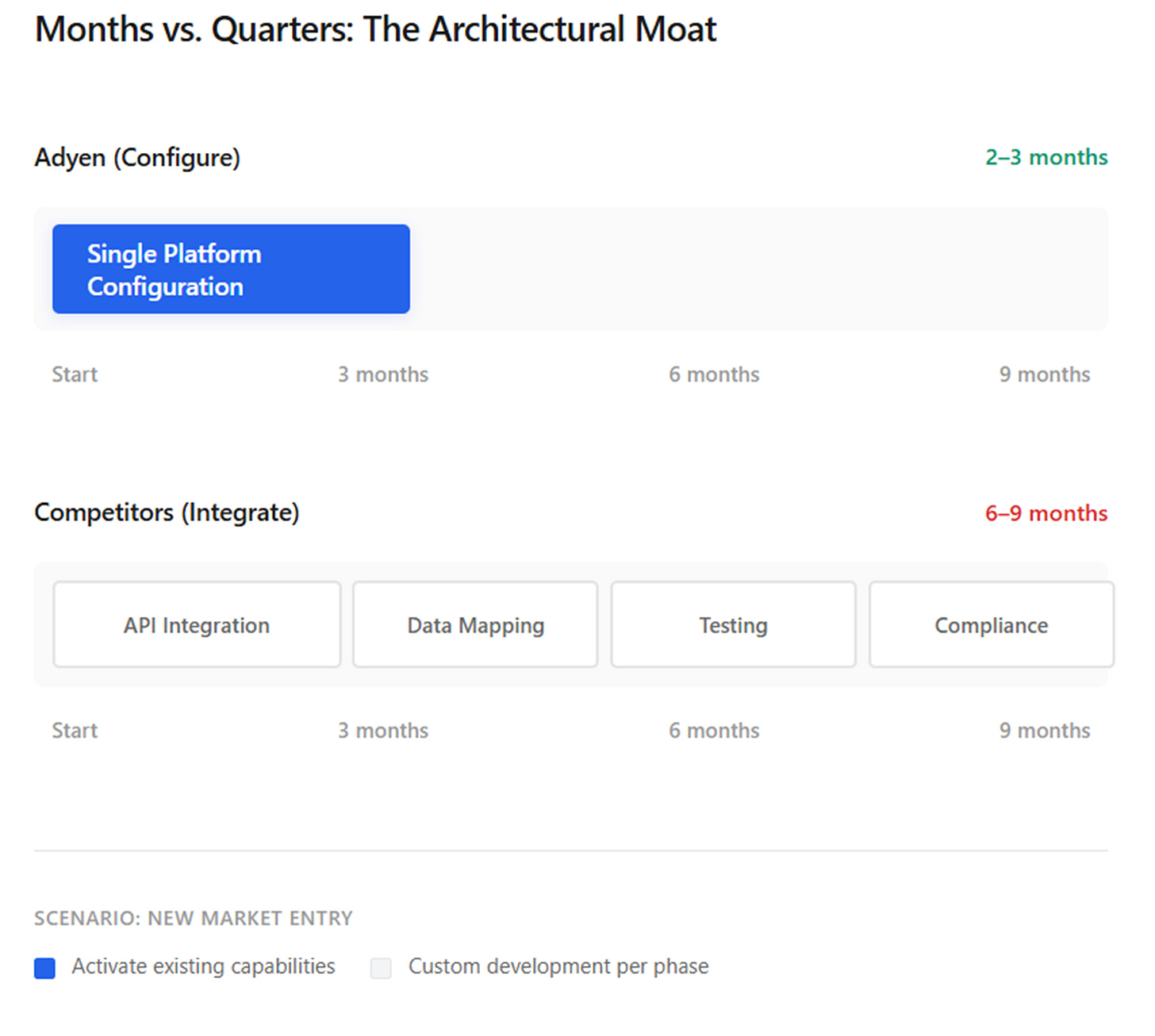

In Q2, discussing how Adyen helped Asia-Pacific merchants navigate U.S. tariff impacts by expanding into Brazil and Mexico, CFO Ethan Tandowsky said: “It’s a single platform. It’s a single integration. So it can be done in a couple of months.”

This is the mechanism. Competitors integrate—connecting acquired systems, coordinating vendor relationships, managing data transformations. Adyen configures. A merchant adding a new geography or channel isn’t a custom development project; it’s activating capabilities already in the platform.

Time-to-reconfigure, measured in months versus quarters, compounds with every new market, regulation, and product. The company processed €1.3 trillion in volume over the past year. Every transaction trains the models that make the next transaction more valuable. Authorization rates improve. Fraud detection sharpens. Routing optimizes. This data flywheel requires one system—fragmented architectures can’t accumulate intelligence this way.

The North America hiring concentration—Chicago as the largest hub for Q3—isn’t evidence of struggle. It’s proof of scale. The 459 Unified Commerce customers processing cross-channel grew 77 year-over-year, with North American enterprise driving that growth. When you’re winning complex, multi-year deployments with global retailers, you need local engineering and commercial support. The continued investment signals expanding wallet share, not sunk costs.

Management’s Q3 language was precise. They disclosed that settlement timing benefited Q3 results, meaning Q4 faces the opposite effect. They narrowed 2026 revenue growth guidance from “low twenties to high twenties” to “low to mid-twenties,” while reaffirming EBITDA margin above 50%.

Tighter guidance isn’t weakness—it’s visibility. As Tandowsky explained: “It’s a single platform. It’s a single integration. So it can be done in a couple of months.” When you can see every customer’s deployment roadmap, every product attach rate, every expansion timeline through one system, you don’t need wide guidance ranges. The margin commitment is the tell: they’re not sacrificing profitability to chase growth.

The data also revealed that two-thirds of new enterprise customers adopt Adyen’s Protect module from day one. This isn’t a customer satisfaction metric—it’s pricing power. Value-added services carry higher margins than commodity processing. If customers buy them immediately rather than years later as upsells, the take-rate expansion is structural, not cyclical.

The single platform makes this possible. Each new feature—fraud optimization, intelligent routing, cost reduction—becomes available to every customer automatically. Competitors announce new capabilities that require custom integration work. Adyen ships updates that existing customers start using the next day.

Or, as Tandowsky put it: “It’s a single platform. It’s a single integration. So it can be done in a couple of months.”

The November Test

On November 11, Adyen will host an Investor Day in Amsterdam. After narrowing guidance eight weeks earlier, the timing is deliberate. Management needs to prove the platform transformation is real, not rhetorical.

Three questions matter:

· What percentage of revenue comes from value-added services versus base processing? If it’s 6-8% or higher, the platform thesis is validated. If management stays vague, the number is too small to disclose.

· What’s the actual eBay trajectory? The math suggests eBay volume is declining 20-30% annually. Is this a managed wind-down as Adyen reallocates capital to higher-margin products, or involuntary churn?

· What’s the return on North America investment? Years of Chicago hiring should translate to measurable enterprise traction. Is it working?

The thesis breaks if: day-one product attach rates fall below 60%; depth metrics plateau (31 platforms >€1B, 212K platform businesses, 459 cross-channel merchants); Digital revenue decelerates while volume stays negative; or time-to-configure slips from “months” to “quarters.”

At €1,337, the market prices base case plus modest bull. Base case: platform transformation is 50% complete, value-added services reach 10-12% of revenue by 2027. Bull case: genuine pricing power emerges, margins expand to 52-54% while growth sustains low-twenties. Bear case: maturing processor dressing up deceleration with margin improvement.

The Architecture Dividend

Twenty years ago, Adyen made a choice: build one system, even if it takes longer. The logic was simple. When you build one system, every new feature compounds everywhere. When you stitch together many systems, every new feature creates collision points and coordination costs.

Q3 2025 wasn’t a beat. It was the first dividend check from a bond Adyen wrote in the mid-2000s. Revenue growing 2.5x faster than volume isn’t financial engineering—it’s architectural advantage converting to economic reality.

The question isn’t whether the architecture is superior. It clearly is. The question is whether superior architecture translates to durable competitive advantage in a market where Stripe owns developer mindshare and platforms like Shopify build their own embedded payments.

The November 11 Investor Day will reveal whether Adyen’s patient infrastructure work created a compounding machine or merely an efficient utility. For investors with multi-year horizons, the difference matters more than any quarterly number ever will.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.