Alphabet 2Q25 Earnings: From Search Engine to AI Engine

Search Thrives, Cloud Surges, and CapEx Signals a New Era of Infrastructure-Scale Intelligence

TLDR

AI Didn't Disrupt Google — It Supercharged It: Alphabet’s Q2 2025 results obliterate the “ChatGPT threat” narrative, with search revenue up 12%, driven by AI Overviews expanding query volume. Google has weaponized its existing interface to deliver AI at internet scale, reinforcing its moat rather than eroding it.

Google Cloud’s Enterprise Inflection Point: With Cloud revenue up 32%, margins expanding to 20.7%, and $250M+ deals doubling, Google Cloud is no longer the underdog. It’s becoming the enterprise AI platform of choice — powered by unique model differentiation and supply-constrained demand.

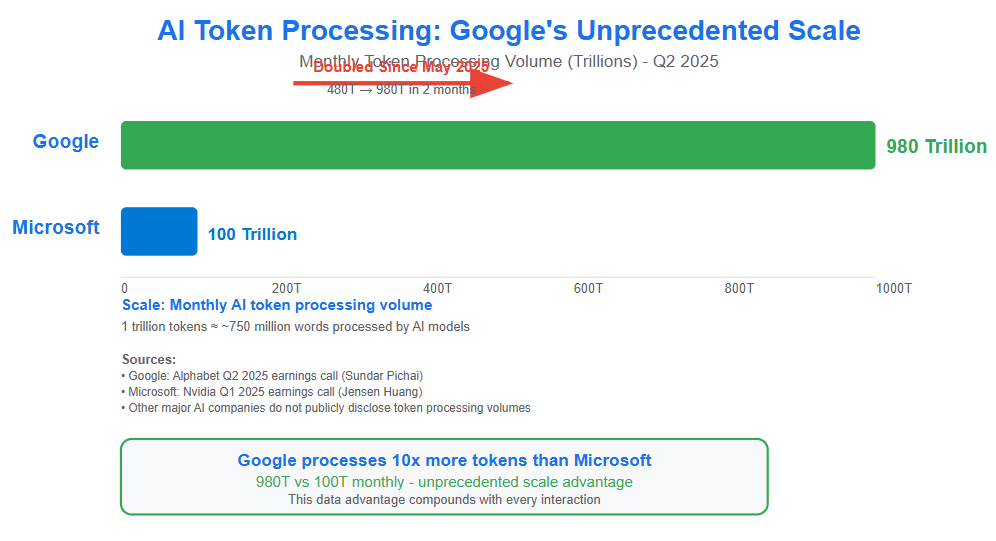

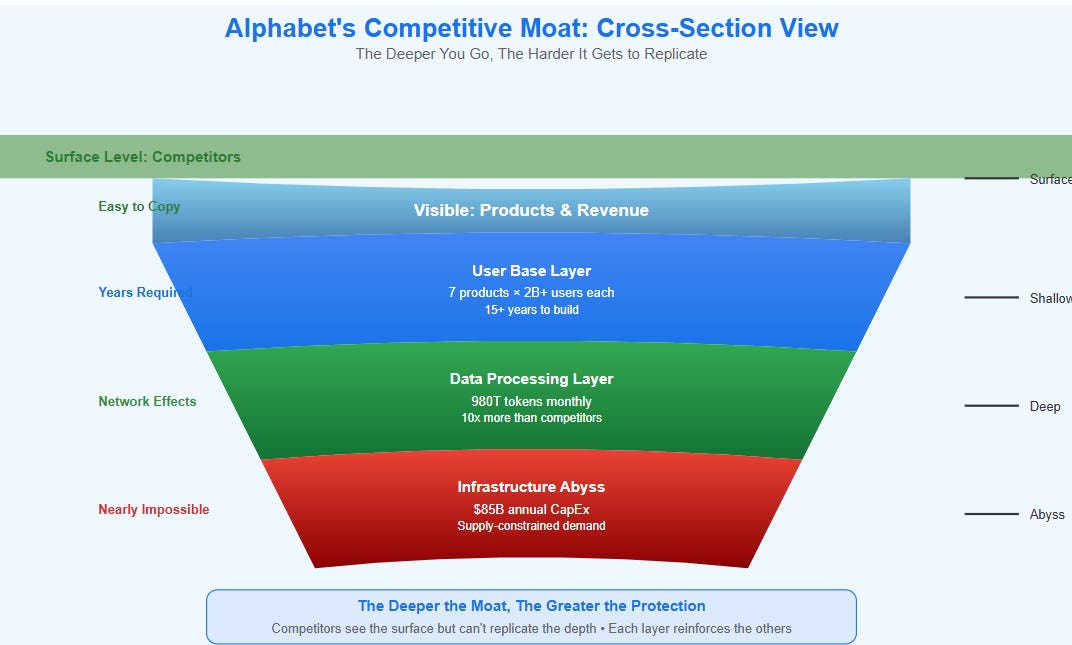

CapEx Surge Signals Platform Transformation: The surprise $85B CapEx guide isn't overspending — it's a signal that Alphabet is building the infrastructure layer of the global AI economy. With 980 trillion tokens processed monthly, Google’s intelligence flywheel is now a self-reinforcing system that competitors can’t match.

From Bloomberg:

Alphabet Inc. delivered robust second-quarter results that handily beat Wall Street expectations, with revenue reaching $96.4 billion and the company raising its full-year capital expenditure guidance to $85 billion. The Google parent said search revenue grew 12% to $54.2 billion while Google Cloud achieved 32% growth to $13.6 billion with operating margins expanding dramatically to 20.7%. AI Overviews now reach over 2 billion users globally, and the company processes 980 trillion tokens monthly across its services, up from 480 trillion in May.

My first reaction to these numbers was simple: everyone got the AI story wrong, including me at times. The narrative for the past year has been "Google playing defense against ChatGPT disruption." These results make clear that the opposite happened — Google turned AI from an existential threat into their biggest growth accelerant.

But as I dug deeper into the results and management commentary, what became clear is that this isn't just about one good quarter. Alphabet has pulled off something unprecedented: they've fundamentally transformed their business model while maintaining their cash cow, created multiple new revenue engines, and built what might be an insurmountable competitive moat — all while the market was focused on whether ChatGPT would kill search.

The Search "Disruption" That Never Was

The 12% search growth should end the "AI will kill Google" narrative once and for all. But what's remarkable isn't just that search survived — it's that AI made search dramatically more powerful.

CEO Sundar Pichai was explicit about this dynamic on the earnings call:

"We know how popular AI overviews are because they are now driving over 10% more queries globally for the types of queries that show them, and this growth continues to increase over time. Our new AI experiences significantly contributed to this increase in usage. We are also seeing that our AI features cause users to search more as they learn that search can meet more of their needs."

What Pichai is describing represents a complete inversion of the expected outcome. AI didn't cannibalize search queries — it expanded what could be searched. When you can point your phone at any object and get AI-powered information, when you can ask complex multi-step questions, when every pixel becomes a potential search interface through Circle to Search — you're not replacing searches, you're creating entirely new categories of searches.

The 980 trillion tokens processed monthly (doubled from 480 trillion in May) isn't just impressive scale — it represents Google processing more human-AI interactions than all other companies combined. This creates a data advantage that compounds with every interaction, making Google's AI systems smarter while simultaneously making competitors' systems relatively less capable.

Here's what I think happened: while everyone was debating whether AI would disrupt search, Google was quietly using search as the perfect AI delivery mechanism. Where else can you deploy AI capabilities to 8+ billion people instantly with zero adoption friction? The search box is the most successful user interface ever created, and AI makes it infinitely more powerful.

Google Cloud's Enterprise Legitimacy Moment

The cloud results were genuinely shocking, and represent what I think is Google Cloud's "enterprise legitimacy" breakthrough. This isn't just about growth rates — it's about achieving the combination of scale, profitability, and customer commitment that validates Google as a true enterprise player.

CFO Anat Ashkenazi revealed the scale of enterprise demand:

"The number of deals over $250 million doublingYoY. In the first half of 2025, we signed the same number of deals over $1 million that we did in all of 2024. The number of new GCP customers increased by nearly 28% quarter over quarter."

These aren't just big numbers — they're evidence of something structural happening in enterprise AI adoption. When deals are doubling in size, margins are expanding rapidly, and you're supply-constrained despite massive capacity investments, that suggests enterprise customers are essentially bidding for your capacity.

The margin expansion to 20.7% is particularly telling because it's happening during a period of massive infrastructure investment. This suggests Google's AI differentiation isn't just marketing — it's creating real pricing power in what's supposed to be a commoditized infrastructure market.

I'm starting to think Google Cloud will surpass AWS within three years. That sounds insane given AWS's current dominance, but the math is compelling: 32% growth at $54B annual run rate, with accelerating momentum, supply constraints, and expanding margins. AWS is selling compute; Google is selling intelligence. Those aren't even the same market.

YouTube's Quiet Television Takeover

Buried in the earnings was a stat that should terrify traditional media: YouTube captured 12.8% of total TV viewing time in June 2025. Not streaming time — total TV time.

This represents something profound that's happening largely under the radar. YouTube isn't just competing with Netflix for streaming attention; it's replacing television as the primary media consumption mechanism. The difference is crucial: Netflix pays billions for content that might or might not work, while YouTube gets content for free and shares revenue only when it's successful.

YouTube is becoming the new television network, except with better economics, global reach, and AI-powered personalization that traditional media can't match. The fact that this transformation is happening while YouTube ad revenue grew 13% to $9.8 billion suggests we're still in the early stages of this shift.

The $85 Billion Infrastructure Bet

The biggest surprise was management increasing 2025 CapEx guidance by $10 billion in a single quarter, from $75 billion to $85 billion, with explicit expectations for further increases in 2026. Wall Street's instinct was concern about overspending, but I think this completely misses what's actually happening.

Ashkenazi was crystal clear about the drivers:

"Given the strong demand for our cloud products and services, we now expect to invest approximately $85 billion in CapEx in 2025... Our updated outlook reflects additional investment in servers, the timing of delivery of servers and an acceleration in the pace of data center construction primarily to meet cloud customer demand."

Picture a restaurant so popular there's always a three-hour wait, and the owner decides to build a bigger kitchen. That's not risky - that's obvious.

This isn't speculative investment — it's Google responding to validated demand they literally cannot meet. The fact that they're supply-constrained in a supposedly competitive market tells you everything about their competitive position.

But here's what I think is really happening: Google is building the computational backbone of the AI economy. The $85 billion isn't just about meeting current demand — it's about establishing infrastructure advantages that will compound for decades.

Think about it: when every company needs AI capabilities, when every application becomes AI-native, when every business process gets augmented by intelligence — someone needs to provide that computational foundation. Google is betting they can be that foundation, and the early returns suggest they're right.

The Token Economics That Change Everything

The most important number in these earnings might be the least understood: 980 trillion tokens processed monthly. This represents something unprecedented in technology — Google has become the nervous system of human-machine interaction.

Every time someone uses AI, that interaction gets broken down into "tokens" that models process. Google is handling more of these interactions than all other companies combined, and it's growing exponentially. This creates what I call the "intelligence flywheel": more users generate more data, which trains better models, which attracts more users.

At Google's current scale, this flywheel is basically unstoppable. Each month, they process nearly a trillion trillion discrete interactions with AI systems. That's not just a big number — it's an unassailable competitive advantage that grows stronger with every interaction.

What Alphabet Really Is Now

Ben Thompson often asks what a company's "core capability" really is, and these results provide the clearest answer yet for Alphabet.

Google's core capability isn't search, advertising, or even AI — it's building platforms that become more valuable with scale.

The 980 trillion token processing illustrates this perfectly. Every interaction makes the system smarter, which attracts more users, which generates more data, which improves the system further. The seven products with over 2 billion users each create a compound flywheel effect that's unprecedented in scale and diversity.

This also explains why the enterprise AI market appears to be much larger than anyone estimated. When Cloud deals are doubling in size, margins are expanding while scaling rapidly, and supply constraints extend into 2026 despite massive investments — that's not normal SaaS growth. That's infrastructure-level adoption happening at software speeds.

Looking at the broader competitive landscape, I think we're witnessing something remarkable: the AI arms race is effectively over, and Google won. While competitors focused on demos and announcements, Google built actual production infrastructure at scale. Microsoft talks about AI; Google delivers AI to billions of users. OpenAI builds demos; Google builds products. Amazon sells compute; Google sells intelligence.

The 10-Year Compounding Story

What makes this particularly compelling as an investment thesis is that the advantages Google is building compound annually, not quarterly. The infrastructure investments, the AI model advantages, the data flywheel — these aren't cyclical dynamics. They're structural advantages that get stronger over time.

Think about what happens when agentic AI becomes mainstream (which Pichai predicted for 2026). Google won't just be serving those AI agents — they'll be the infrastructure those agents depend on to function. They're not just participating in the AI economy; they're building the foundation that the AI economy runs on.

My prediction: Alphabet in 2025 is what Microsoft was in 1995, Amazon was in 2005, and Apple was in 2010 — a company that has achieved such fundamental platform advantage that the next decade of growth is essentially inevitable.

The difference is that Alphabet's platform is intelligence itself — the most valuable resource in human history. The Q2 2025 results aren't just good earnings — they're evidence that Google has won the most important technology transition since the internet itself.

This isn't a search company that added AI features. This is an AI infrastructure company that happens to make most of its money from search. The distinction matters because infrastructure companies trade at very different multiples than advertising companies.

The market will eventually recognize this, but probably not until the stock price reflects the reality that Google has become the foundational layer of the AI economy. I expect Alphabet to be a $5 trillion company within five years, not because of financial engineering, but because they've built infrastructure that the global economy depends on.

The only question is whether investors will recognize this transformation before it becomes obvious to everyone else.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.