Alphabet 4Q25: The Grid Builder's Advantage

Why Alphabet isn’t winning AI by building the best chatbot, but by owning the economic grid that delivers intelligence at scale

TL;DR

AI didn’t kill search, it expanded it. Longer, more frequent, and more complex queries are growing Google’s cash engine.

Custom silicon + cloud scale turn AI into a margin game competitors can’t afford. Google captures the margin others pay to NVIDIA.

$175B+ in CapEx is offensive, self-funded, and backed by demand, building a grid others must rent.

The War of the Currents

In 1893, the Chicago World’s Fair became the battlefield for electricity’s future. Edison’s direct current had powered the first lightbulbs and captured imaginations, but Tesla and Westinghouse’s alternating current won the contract to illuminate the fair, and the war. The lesson wasn’t about who invented the lightbulb. It was about who built the system to deliver power at scale.

For two years, technology’s conventional wisdom held that ChatGPT was the lightbulb and Google was Edison, brilliant but about to be leapfrogged. Alphabet’s Q4 2025 earnings revealed everyone was watching the wrong competition. The question was never who built the best chatbot. It was who could build the economic and technical grid to deliver intelligence at scale, profitably, to billions.

Google wasn’t Edison. Google was Westinghouse.

Search Didn’t Die, It Expanded

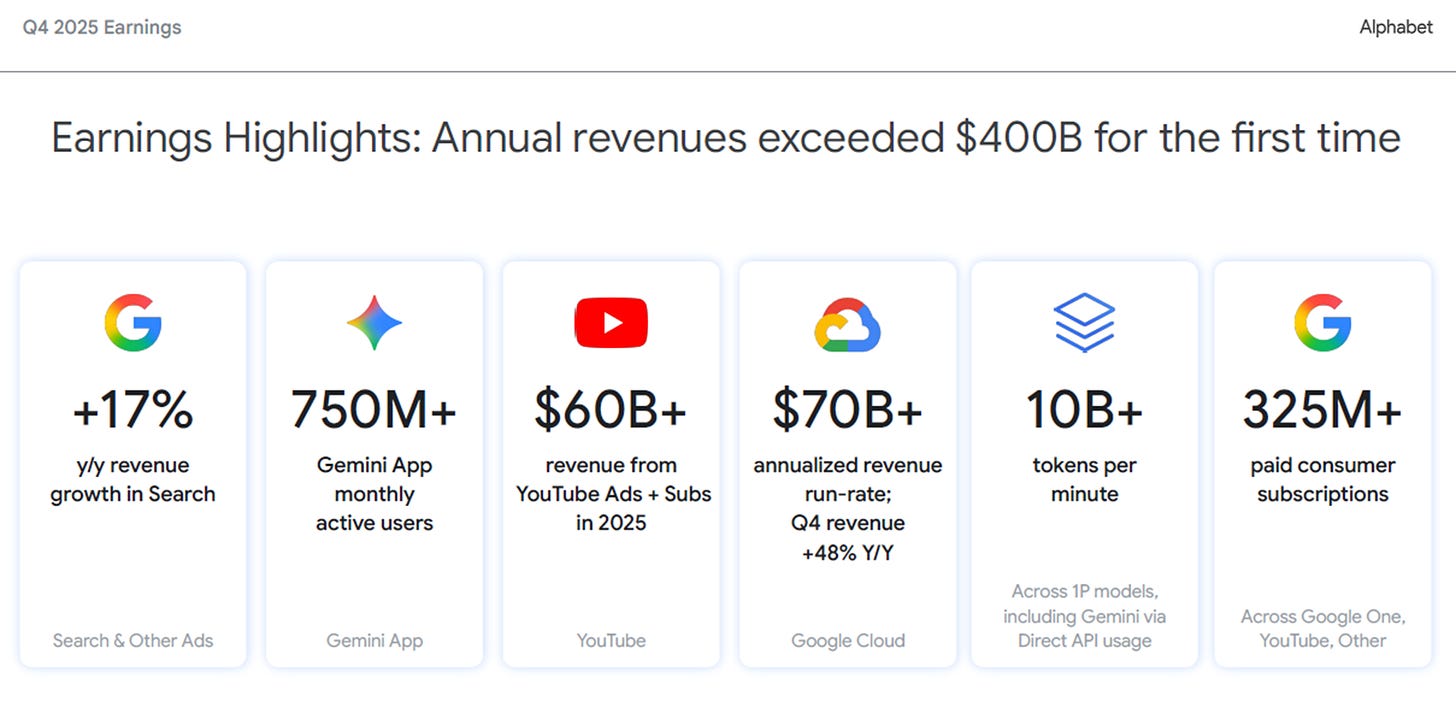

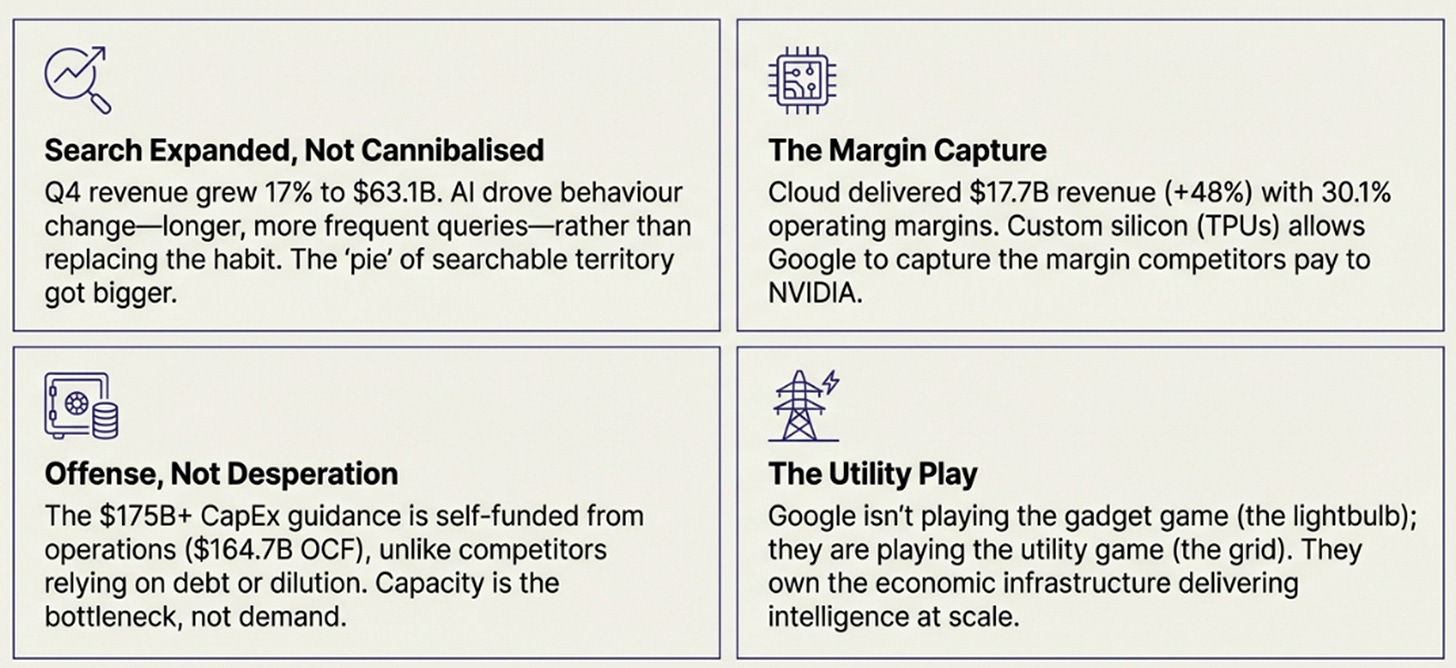

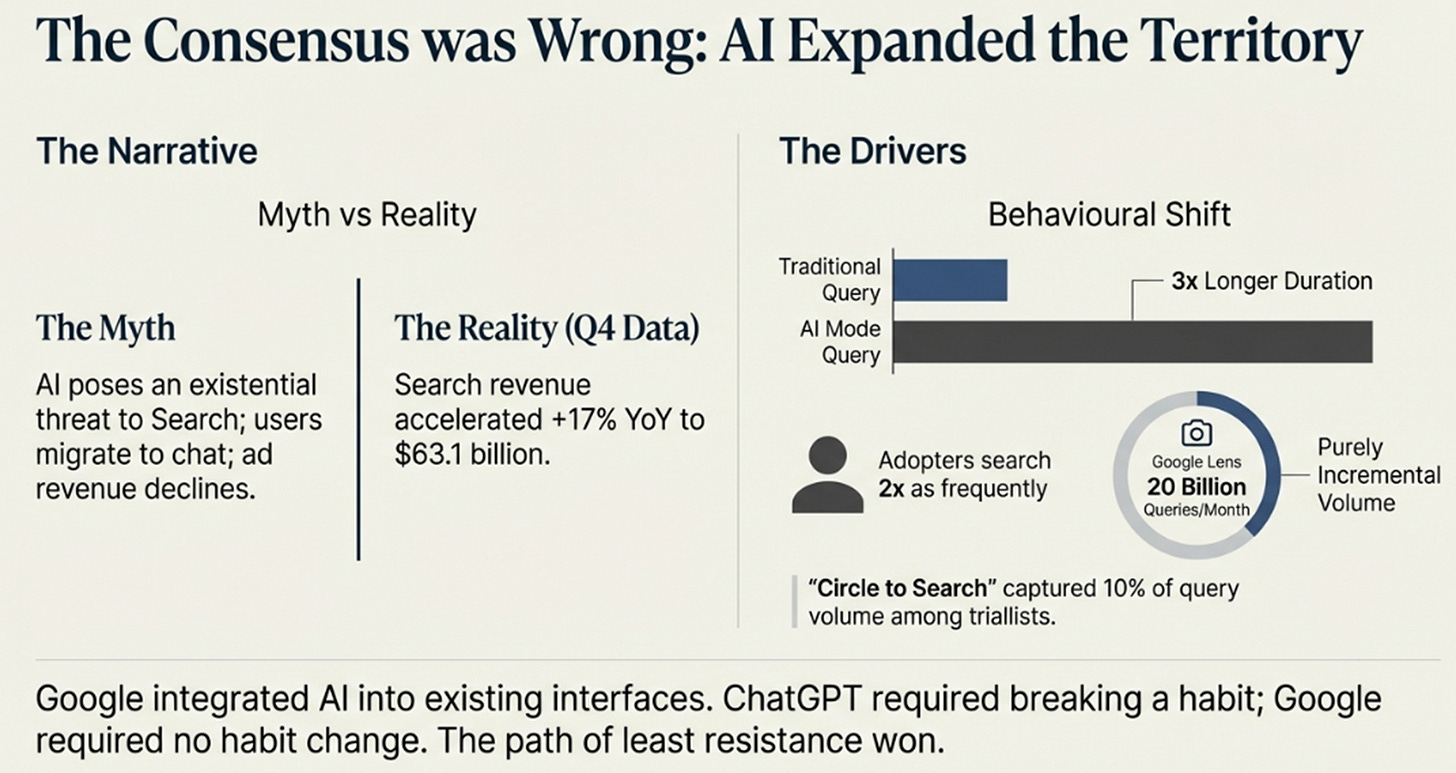

The consensus entering 2025 was that AI posed an existential threat to search. Users would migrate to conversational interfaces. Ad-supported search would yield to subscriptions. Google’s $250B+ revenue engine would sputter. Q4 told a different story. Search revenue grew 17% YoY to $63.1 billion, accelerating.

The behavioral data explains why: AI Mode queries run three times longer than traditional searches, and adopters search twice as frequently. Circle to Search captured 10% of query volume among those who tried it. Google Lens processes 20 billion visual searches monthly, most “purely incremental” per management.

This is the variant perception the market missed.

AI didn’t cannibalize search, it expanded what could be searched. Complex multi-step questions, visual queries, voice inputs: these created new territory rather than redistributing existing demand. Google’s strategic choice was to integrate AI into the existing search interface rather than force new behavior. ChatGPT required breaking the Google habit. Google required no habit change at all. The path of least resistance won.

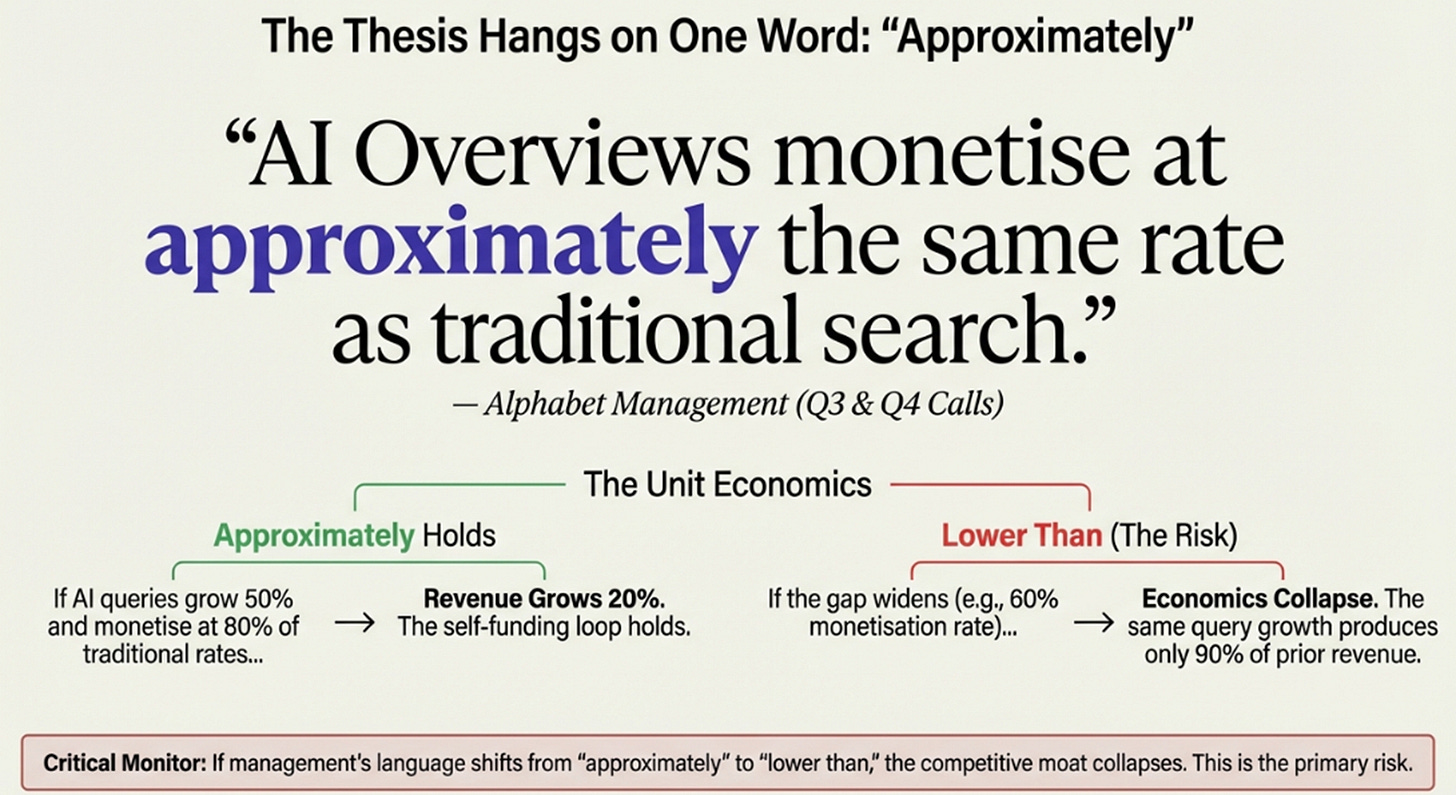

But here’s the critical risk. On both the Q3 and Q4 calls, management used identical language: “AI Overviews monetize at approximately the same rate as traditional search.” That word “approximately” is the linchpin of the entire thesis.

The math: if AI queries grow 50% but monetize at 80% of traditional rates, revenue grows 20% , Google wins. If the gap widens to 60%, the same query growth produces only 90% of prior revenue. The economics break. If this language ever shifts from “approximately the same” to “lower than,” the self-funding advantage that enables everything else disappears. Search generates the cash flow that funds the grid. Without it, the competitive moat collapses.

Cloud as the Economic Grid

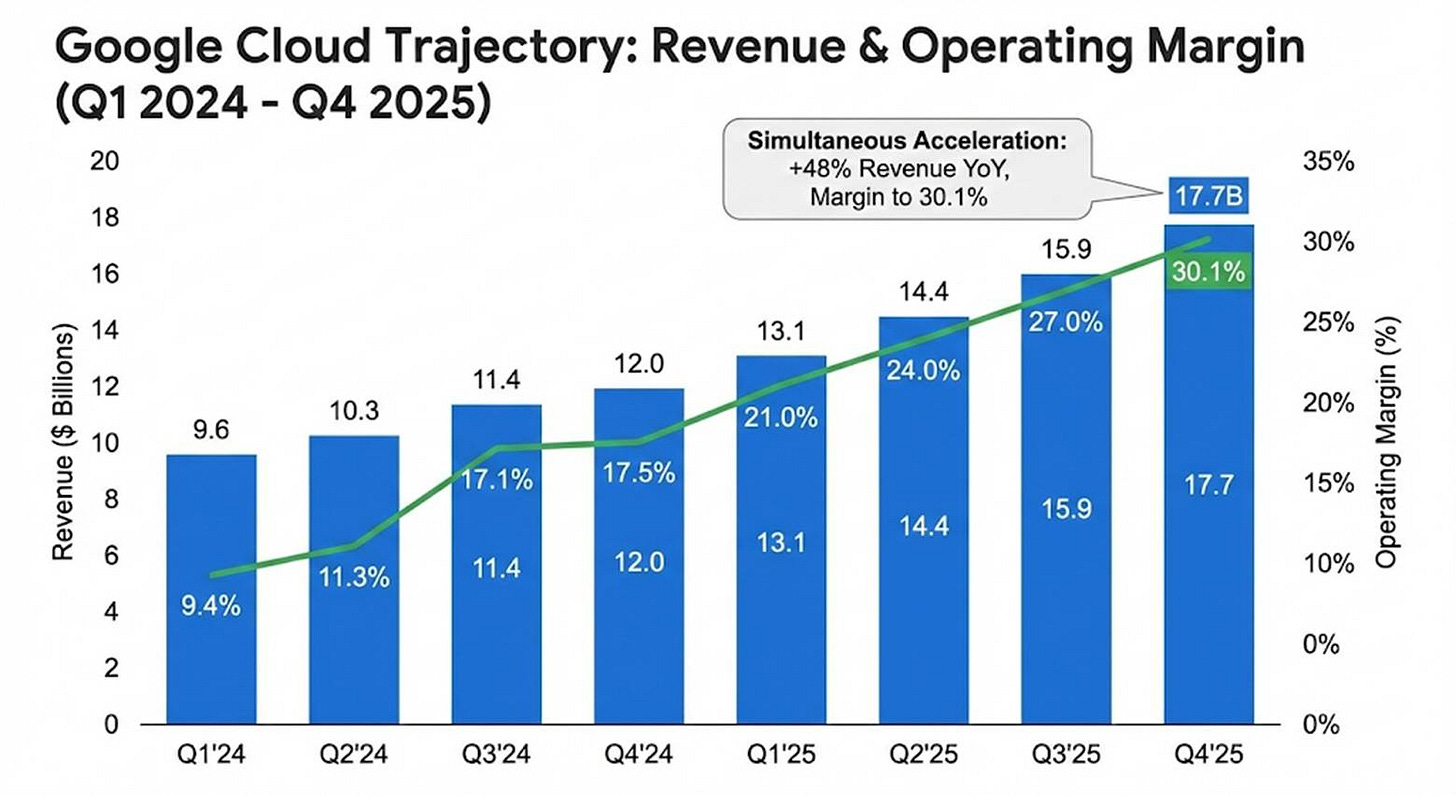

Google Cloud delivered the combination investors waited years to see: $17.7 billion in Q4 revenue (up 48%), with operating margins of 30.1% , up from 17.5% a year prior. Growth and margin expansion rarely coexist in enterprise businesses.

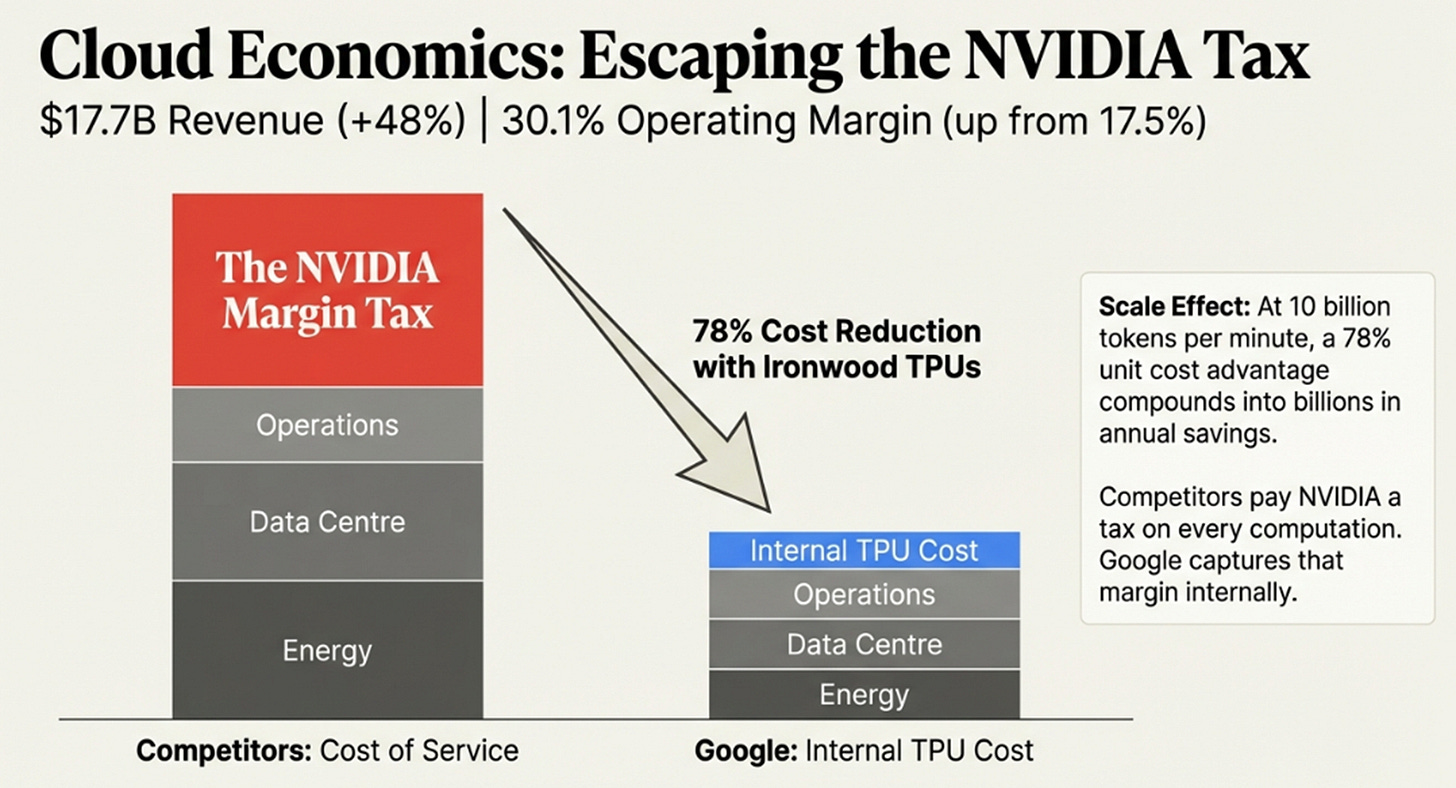

The reason Google pulled it off is custom silicon. Seventh-generation TPUs (Ironwood) cut Gemini serving costs by 78% in 2025. Every company building on NVIDIA pays NVIDIA’s margin, a tax on every computation. Google’s TPUs capture that margin instead. At 10 billion tokens per minute, a 78% unit cost advantage compounds into billions annually. Competitors paying the NVIDIA tax simply cannot match Google’s economics at scale.

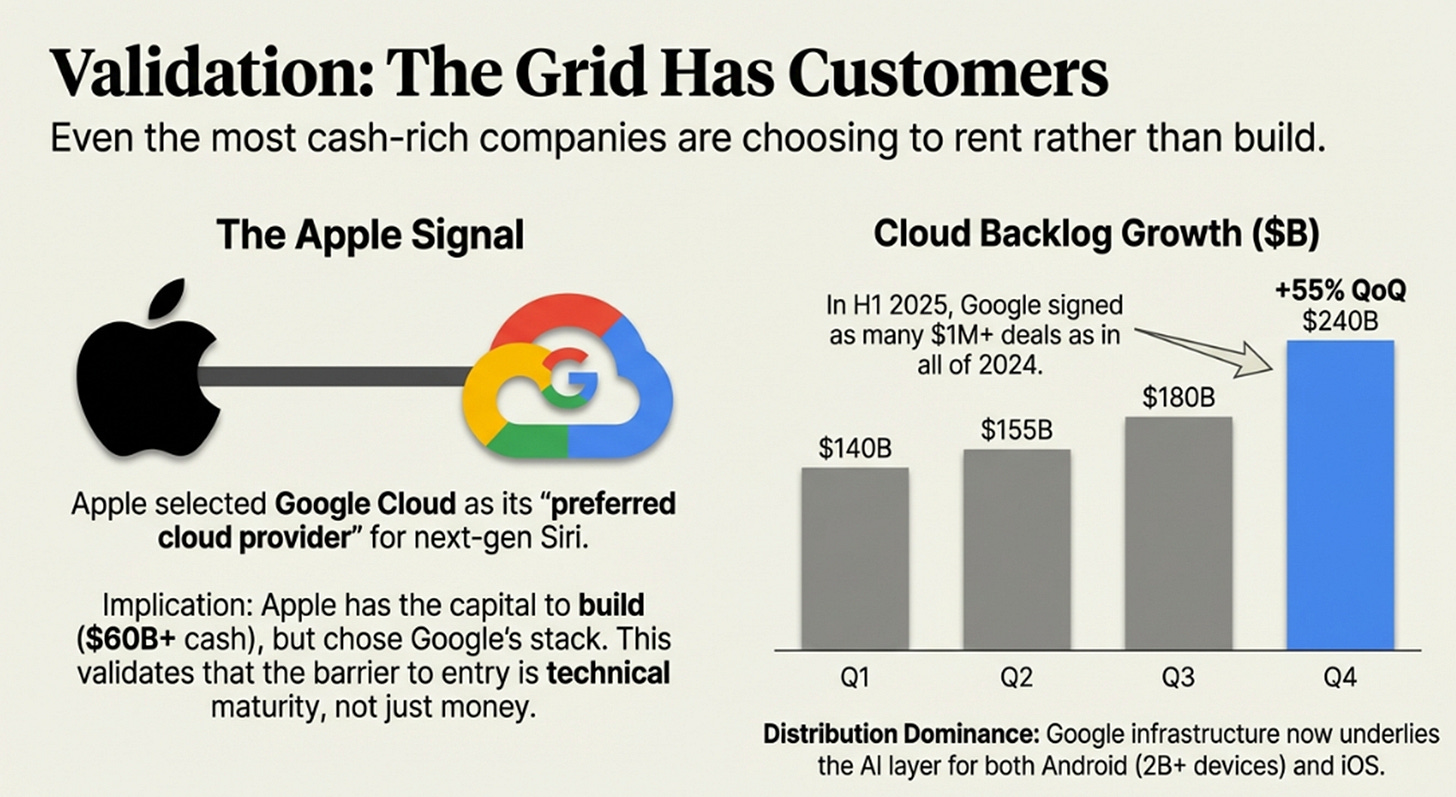

The $240 billion Cloud backlog, up 55% QoQ, more than doubling YoY, represents contracted demand. Multi-year enterprise commitments. In H1 2025 alone, Google signed as many $1M+ deals as all of 2024. Deals over $250 million doubled. This isn’t experimentation. This is enterprises making strategic bets.

The most significant signal, though, is Apple becoming Google’s “preferred cloud provider” and building next-generation Siri on Gemini. Apple has more cash than almost anyone. They could build their own AI infrastructure. Instead, they chose to rent Google’s grid, validation that competitive AI infrastructure requires more than capital. It requires the complete stack Google assembled over a decade.

Consider the distribution implications: Google owns Android (2B+ devices). With Apple adopting Google Cloud and Gemini for iOS, Google now underlies both major mobile platforms. Even if the interface shifts from search boxes to intelligent agents, those agents run on Google’s grid.

$175-185B CapEx: Offense, Not Desperation

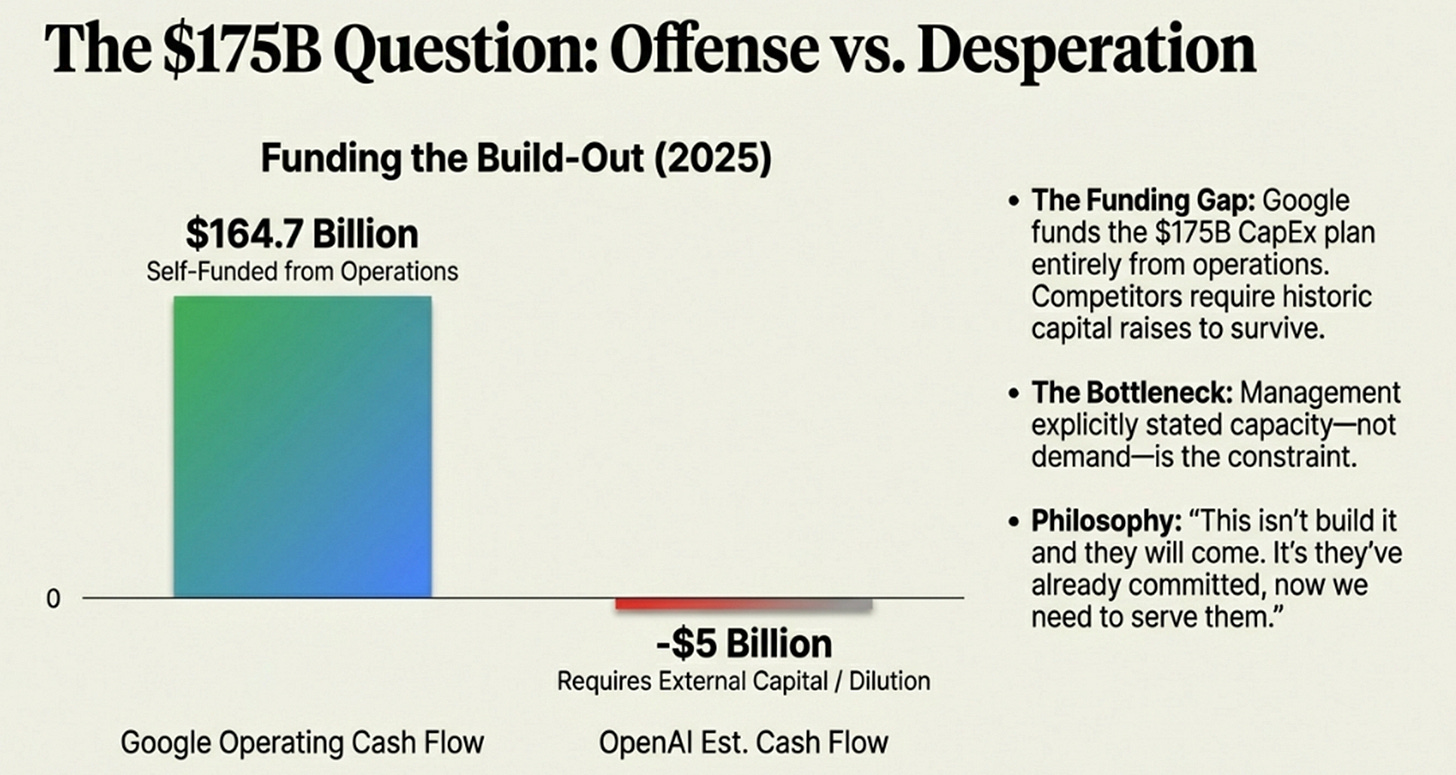

Google’s 2026 CapEx guidance , $175-185 billion, 55% above consensus, is the number that will generate the most controversy and the most misunderstanding.

Start with funding. Google generated $164.7 billion in operating cash flow in 2025. The entire CapEx plan funds from operations. Free cash flow drops from $73B to maybe $30-50B, but the company remains self-sufficient. Compare this to OpenAI, which per Reuters burns billions annually on $20 billion revenue and needs a “$60B to $1 trillion” IPO to continue. When one player funds the race from profits and another needs historically large capital raises, the sustainability equation is fundamentally different.

The spend is backed by $240 billion in contracted demand. Management said capacity, not demand, is the bottleneck , citing power availability and supply chain constraints. This isn’t “build it and they will come.” It’s “they’ve already committed, now we need to serve them.”

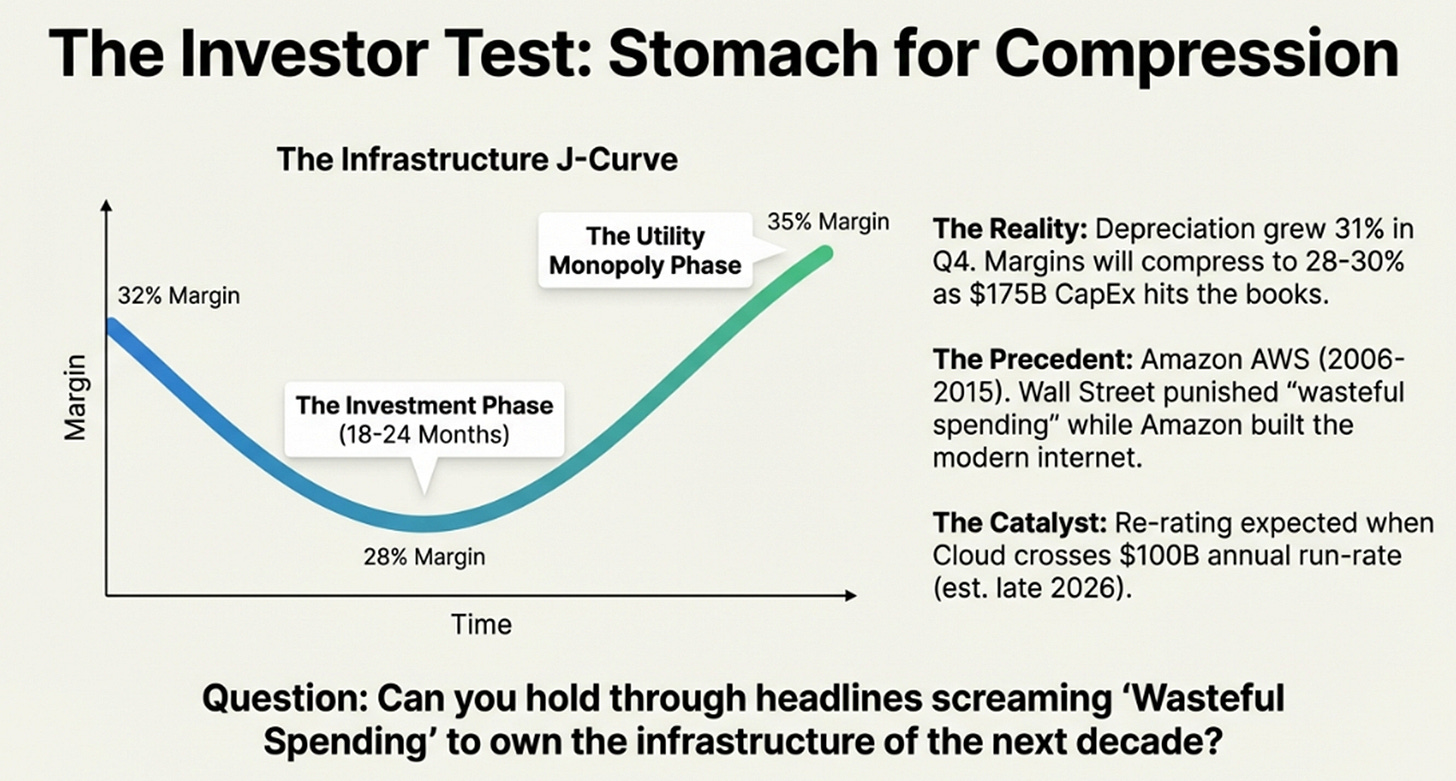

Google is deliberately accepting 18-24 months of margin compression , from 32% potentially to 28-30%, to build capacity competitors cannot replicate. This is the same bet Amazon made from 2006-2015 building AWS. Wall Street hated it. The stock languished. Those who understood what was being built made 20x+ returns over the following decade.

The Five-Layer Moat

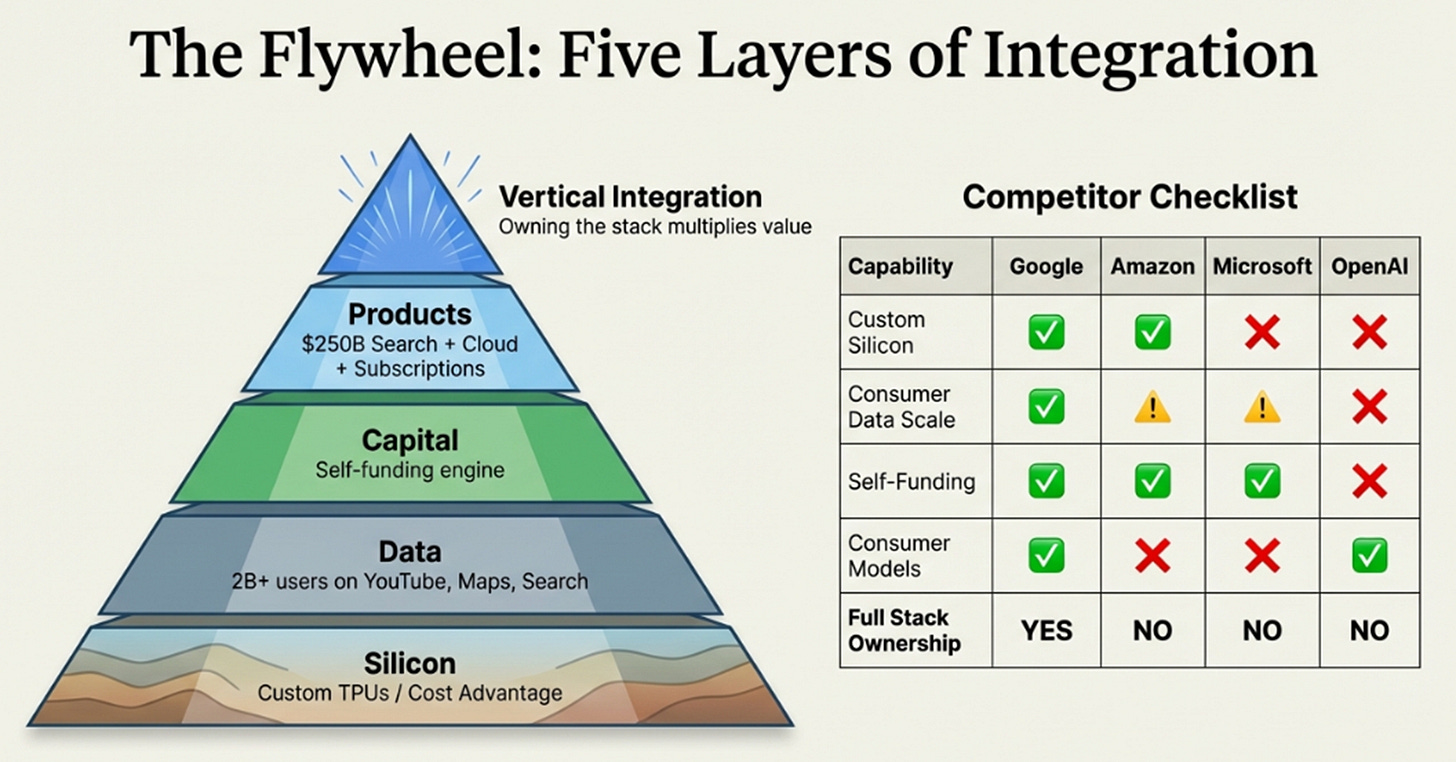

Google’s compounding advantage operates across five layers no competitor fully replicates:

1. Silicon, TPU cost advantages capturing margins competitors pay to NVIDIA.

2. Data, 2B+ daily users across Search, YouTube, Android, Chrome, and Maps generating training data across the full spectrum of digital behavior.

3. Capital, self-funding that enables sustained investment while competitors seek external financing.

4. Products, Search ($250B+), Cloud ($70B run-rate), Subscriptions ($54B) providing diversified revenue.

5. Vertical integration, owning silicon through distribution creates multiplicative, not additive, advantages.

Each layer reinforces the others. Distribution feeds data. Data improves models. Models improve products. Better products increase distribution. All require infrastructure only Google funds from operations.

Amazon has silicon and data centers but weak consumer AI products and models. Microsoft has products and distribution but depends on OpenAI for frontier models and NVIDIA for chips. OpenAI has models but lacks silicon, data centers, sustainable economics, and distribution. Meta has improving models but no comparable search or enterprise cloud business.

The Investor Test

Depreciation grew 31% in Q4 and will accelerate significantly as the CapEx surge hits the books. Most server equipment depreciates over 3-4 years, meaning the 2026-2027 spending pressures margins through 2029-2030.

This creates a straightforward test: can you hold through four to six quarters where margins compress to 28-30%, free cash flow halves, and headlines scream about wasteful spending? The bet is that temporary compression builds capacity generating higher returns over five to ten years.

The market, at 29x forward earnings, still prices Google as an advertising company with a cloud side business. The market gives zero credit for the compounding value of owning all five layers simultaneously.

The re-rating catalyst arrives when Cloud crosses $100 billion annual run-rate , probably late 2026 or early 2027.

Three Paths to 2029

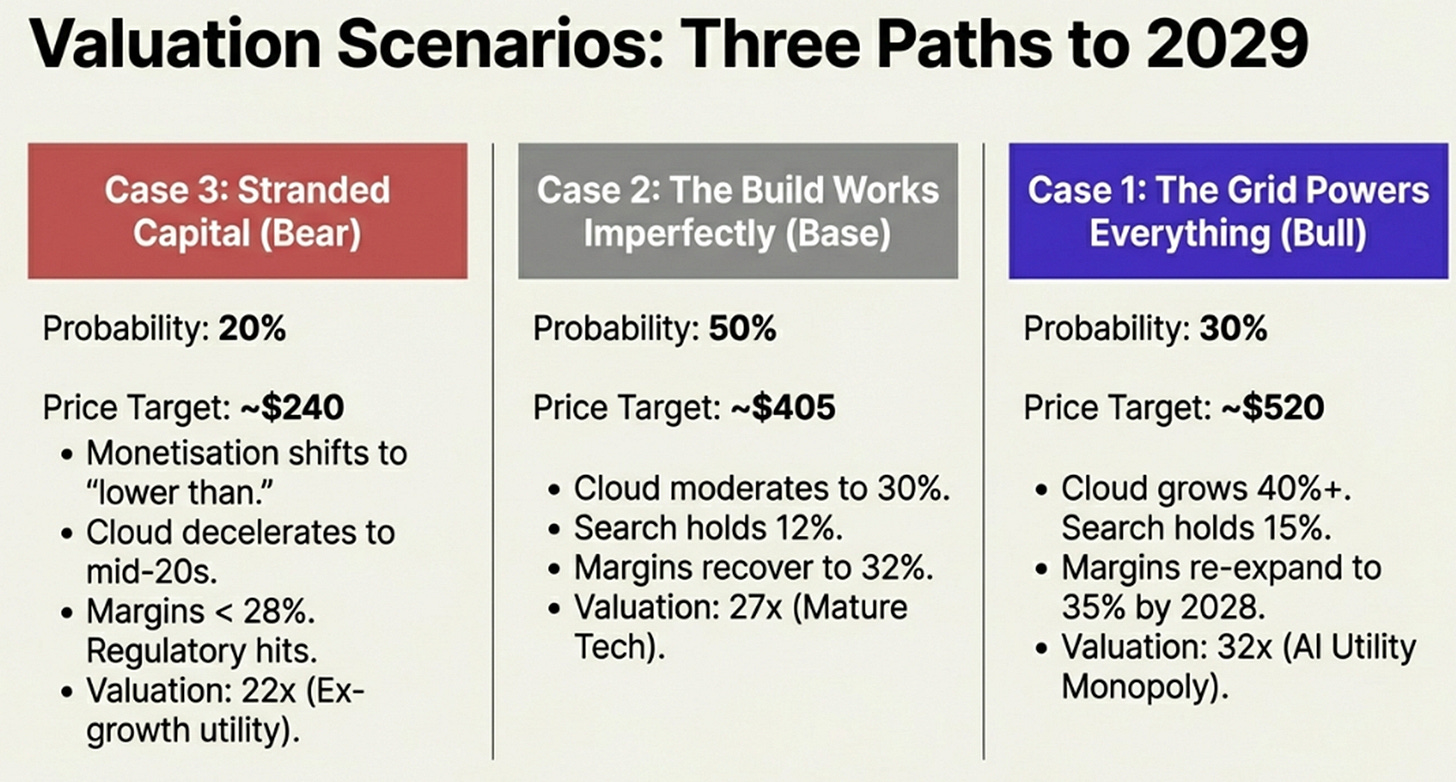

The Grid Powers Everything (30% probability, ~$520/share): Cloud sustains 40%+ growth. Search holds 15% growth as AI expands queries faster than monetization gaps widen. Margins compress then re-expand to 35% by 2028. Market re-rates to 32x as an “AI utility monopoly.”

The Build Works Imperfectly (50% probability, ~$405/share): Cloud moderates to 30% growth. Search holds 12% growth. Margins recover only to 32%. A powerful but mature company at 27x.

Stranded Capital (20% probability, ~$240/share): The monetization language changes to “lower than.” Cloud decelerates to mid-20s growth. Margins stay below 28%. Or: regulatory action forces divestitures. Priced as ex-growth utility at 22x.

Watch quarterly: search growth above 12%, cloud growth above 35%, margins above 29%. And most critically , any change in monetization language. “Better than” accelerates the bull case. “Lower than” breaks the thesis.

The Grid Is Live

Westinghouse didn’t win the war of the currents by building a better lightbulb. He won by building the grid that could power a nation.

Google spent two years under siege while everyone debated chatbots. Q4 2025 revealed they were building the grid the entire time , search expanding, cloud breaking out, infrastructure self-funded while competitors seek external capital. The five-layer advantage compounds in ways no single competitor can replicate.

The risk is execution through margin compression. The reward is owning the infrastructure layer of the AI era.

The battle was never about the chatbot. It was about the grid.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.