Amazon Q3 2025 Earnings: The Engine Room

From Retail to AI: The Economic Flywheel Behind Amazon's CapEx Surge

TL;DR:

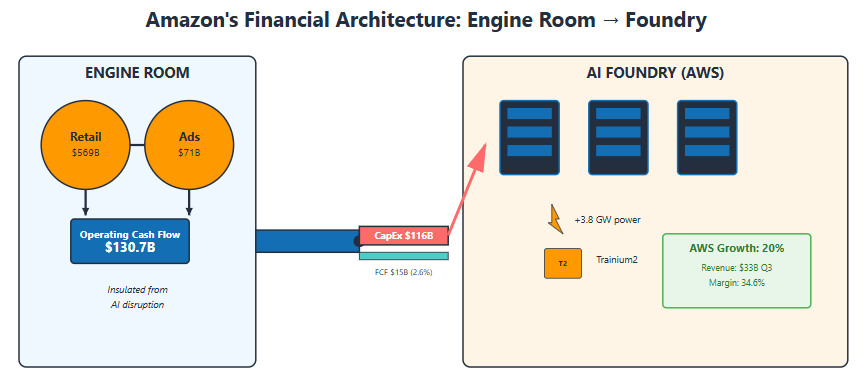

The Engine Room Funds the Foundry: Amazon’s Q3 results prove its core strategic advantage: the ~640B retail and advertising “Engine Room” generates massive, insulated cash flow (130.7B TTM OCF) to fund a record $115.9B CapEx cycle, building out an AI “Foundry” that competitors must fund from their core, disruptable businesses.

A Supply-Led Resurgence: AWS’s re-acceleration to 20% growth was not driven by discounts but by converting pent-up demand as new capacity (+3.8 GW of power, Trainium2 chips) came online. With October bookings already exceeding the entire Q3, this supply-led growth cycle is just beginning.

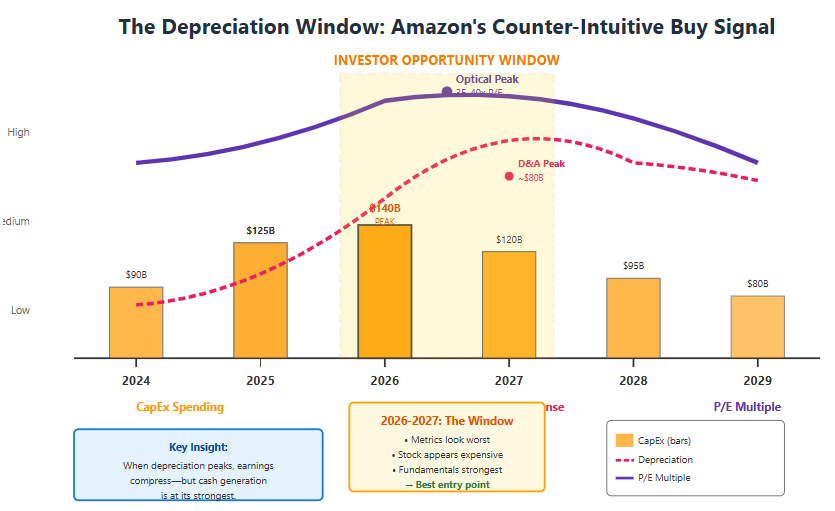

The Investor’s Edge is the Depreciation Window: The massive CapEx spend will suppress GAAP earnings in 2026–2027, making the stock look optically expensive. This creates a predictable entry point for investors who understand the accounting distortion, just as the business hits its strongest cash generation period.

From Bloomberg, October 30, 2025: “Amazon.com Inc. reported third-quarter revenue of $159.3 billion, beating analyst estimates, as its cloud-computing unit posted the fastest growth in nearly three years. Amazon Web Services sales rose 20% to $33 billion, accelerating from the prior quarter’s 19% pace.”

My first reaction wasn’t about the AWS re-acceleration—it was about the $34.2 billion Amazon spent on capital expenditures in a single quarter while free cash flow collapsed 69% year-over-year. The stock jumped 6% after hours anyway. Either investors understand something profound about Amazon’s structure, or they’re confusing “spending the most” with “winning.”

I think it’s the former, and Q3 2025 is the first quarter where you can see the entire machine working in concert.

The API Mandate Pays Off

There’s an apocryphal story from the early 2000s about Jeff Bezos issuing a mandate: all Amazon teams must expose their data through service interfaces and communicate via APIs. Anyone who didn’t comply would be fired. It wasn’t a technical directive—it was organizational surgery that forced Amazon to think in primitives and modular services.

That mandate, born from retail chaos, created the DNA for AWS. More importantly, it created a business structure where advertising could plug into retail traffic with minimal friction, and where cloud infrastructure could be funded by physical goods and ads rather than enterprise software margins.

Twenty years later, the payoff is visible in Q3’s results:

Amazon’s Q3 2025 Performance

The conventional narrative has been “AWS funds Amazon’s retail experiments.” Q3 proves it’s backwards. The $569.4B commerce business plus $71B advertising turbine generated $130.7B in trailing twelve-month operating cash flow. That’s what’s funding the $115.9B annual CapEx that’s building AWS’s AI infrastructure.

The Capacity Turn

Andy Jassy was explicit about what drove AWS’s 20% growth: “We added 3.8 gigawatts of power capacity in the past 12 months and will add over 1 gigawatt more in Q4.”

This is supply-led acceleration, not demand stimulation through discounting. CFO Brian Olsavsky reinforced this: “As fast as we’re adding capacity right now, we’re monetizing it.”

The evidence shows up in three ways:

First, the power infrastructure. 3.8 gigawatts added means Amazon doubled its global capacity since 2022 and is on track to double again by 2027. You don’t build this speculatively—power purchase agreements take 2-3 years to secure and represent multi-decade commitments.

Second, custom silicon adoption. Jassy noted Trainium2 is “fully subscribed” and “growing over 150% quarter-over-quarter” with Project Rainier—the nearly 500,000 chip cluster for Anthropic—now operational. The “fully subscribed” language is telling: it means demand exceeds Amazon’s ability to manufacture, not that they’re struggling to fill capacity.

Third, the bookings acceleration. Jassy dropped this casually: “Just in the month of October, we signed deals that exceeded the entire Q3.” That’s not normal. Even accounting for end-of-quarter deal-closing dynamics, October exceeding an entire quarter suggests the pipeline is overwhelming.

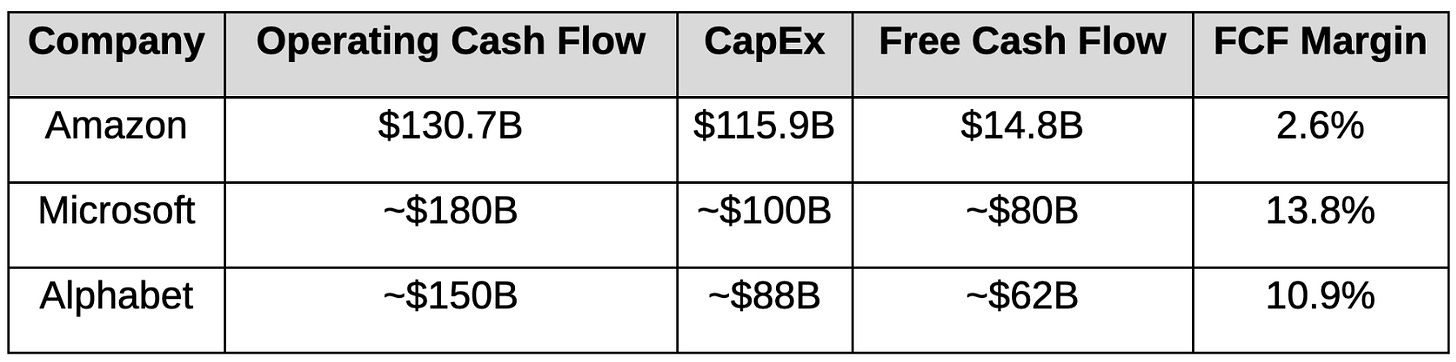

Yet here’s what concerns me: Amazon spent $115.9B over the trailing twelve months on CapEx while AWS grew 20%. Google spent roughly $88B to grow Cloud 34%. Microsoft spent ~$100B to grow Azure 40%. Amazon’s capital efficiency is 30-40% worse than competitors.

Either Amazon is building for 2027-2028 while competitors build for 2026, or something’s structurally less efficient in their approach.

The Twin Engines

To understand Amazon’s strategy, you need to see retail and advertising not as separate businesses but as an integrated system—the Engine Room that powers everything else.

The Commerce Flywheel generates volume. North America retail at $414.8B TTM is growing paid units 11% while shipping costs only grew 8%. That spread—unit growth exceeding cost growth—is the definition of operating leverage finally showing up.

The fresh grocery expansion is the accelerant. Jassy: “Customers who purchase fresh grocery from us shop twice as often.” This isn’t just nice-to-have frequency—it’s the difference between a monthly and weekly shopping habit. That increased frequency compounds: more visits mean more ad impressions, more data for personalization, and more Prime subscription value.

Rufus, the shopping AI, already generates “$10 billion in incremental annualized sales” according to Jassy. But the strategic value isn’t the $10B—it’s that an AI layer can create that much GMV while the same AI infrastructure (AWS) requires $115B in annual capital to grow 20%. Retail AI is capital-light revenue acceleration; AWS AI is capital-intensive infrastructure monetization.

The Advertising Turbine generates profit. At $17.7B in Q3 (+24% YoY), advertising is a $71B annualized business growing faster than AWS with 40%+ operating margins. This is pure margin expansion—it requires no fulfillment centers, no delivery vans, no inventory risk. It’s monetizing traffic the retail business already generates.

The strategic moves are understated but significant: expanding the demand-side platform to Netflix, Spotify, and SiriusXM means Amazon’s advertising now extends beyond its own properties. Connected TV inventory is higher-margin and less saturated than e-commerce ads. The DSP effectively turns Amazon into a two-sided advertising marketplace.

Combined, these two engines produced $130.7B in TTM operating cash flow. That’s the fuel for the Foundry.

The Foundry Strategy

AWS’s strategy has two parts, and Jassy was unusually explicit about both:

Part 1: Serve all demand today. Amazon is deploying NVIDIA’s latest GB200 chips via EC2 P6e instances. Olsavsky: “We’re ordering very significant amounts from NVIDIA, as well as AMD and Intel.” Translation: Amazon will pay the NVIDIA tax to capture customer demand immediately rather than lose workloads to Azure or Google Cloud.

Part 2: Win on economics tomorrow. Trainium2, Amazon’s custom chip, offers what Jassy called “30-40% better price-performance for memory-intensive workloads.” This matters because inference (running deployed models) is 10-100x more frequent than training and is increasingly memory-bandwidth-bound rather than compute-bound.

But here’s where the language gets careful. Jassy: “Today with Trainium2, we have a small number of very large customers on it.”

“Small number” after 2+ years is the tell. Compare to Google’s TPU, launched in 2016, which now processes 1.3 quadrillion tokens monthly across all Google services. Amazon is where Google was in 2018—proving the concept with an anchor customer but not yet achieving broad adoption.

The Anthropic partnership—$13B invested, Project Rainier operational, Anthropic “heavily involved in Trainium design decisions”—creates bilateral lock-in. But it also creates concentration risk. If Anthropic is generating $2-3B of Trainium’s “multi-billion dollar” revenue, Amazon needs 5-10 more customers at that scale to prove Trainium is a platform, not a bespoke solution for one partner.

Jassy tried to address this: “We have a lot of customers, both very large and medium-size, who are quite interested in Trainium3.” “Interested” is the operative word. Until those customers deploy production workloads, Trainium’s success remains conditional.

The Agentic Flank

While everyone focuses on infrastructure, Amazon is building switching costs through applications. AgentCore, the orchestration framework, hit general availability in Q3. Kiro, the AI coding IDE, is in preview. Transform, the legacy application modernization tool, is showing traction. Connect, the AI-powered contact center, crossed $1B in annualized revenue.

These aren’t incidental products—they’re platform strategy. Provide both raw primitives (Bedrock model access) and value-added applications (AgentCore, Kiro) to capture developers at multiple layers. Once an enterprise deploys Connect for contact centers and Transform for migrations, switching away from AWS means rewriting operational systems.

Rufus is the consumer version of this strategy. Jassy: “Customers with Rufus are over 60% more likely to purchase.” With 250 million users, Rufus is becoming the front door to Amazon shopping for a meaningful cohort. That’s switching costs built into consumer behavior, not just enterprise contracts.

The Free Cash Flow Inversion

Here’s where Amazon’s strategy diverges completely from Microsoft and Google:

Free Cash Flow Comparison (TTM)

Amazon’s FCF collapsed from $47.7B a year ago to $14.8B despite operating cash flow growing 16%. The entire decline is CapEx acceleration—a choice, not a constraint.

Olsavsky was direct: “We expect CapEx to increase year-over-year in 2026.” Not normalize or moderate—increase. From $125B in 2025.

The bet Amazon is making: accept 2-3 years of compressed FCF to build AI infrastructure at scale that competitors can’t match, funded by retail and advertising cash flows that don’t require capital returns.

This works if capacity gets monetized. Jassy’s statement—”as fast as we’re adding capacity, we’re monetizing it”—is the entire justification. If that’s true, Amazon is building the largest AI infrastructure in the world and filling it immediately. If it’s not—if capacity sits idle or fills only at distressed prices—this is value destruction at unprecedented scale.

The Depreciation Window

Here’s what almost nobody discussed on the call: depreciation expense.

Amazon’s TTM depreciation and amortization is already $61.9B. With $115.9B in CapEx being placed into service over 3-5 year depreciation schedules, D&A will step up significantly in 2026-2027.

The accounting impact: reported earnings will compress as depreciation accelerates, even if the underlying business strengthens. Amazon will look expensive on a P/E basis (potentially 35-40x) precisely when business fundamentals—utilization rates, revenue per watt, Trainium adoption—are proving out.

This creates an investor timing window. In 2026-2027, when Amazon reports compressed GAAP margins and elevated P/E multiples due to depreciation, the stock will look expensive to traditional value metrics. But if the capacity is monetizing and Trainium is gaining customers, the business will be approaching its strongest cash generation period (2027-2029) just as depreciation cycles complete.

What Could Break This

Three failure modes would invalidate the thesis:

First, utilization. If the multi-gigawatt capacity Amazon is building outpaces demand growth, or if Trainium fails to gain adoption beyond Anthropic, Amazon will have overbuilt. The 2027 scenario where capacity sits idle would force painful write-downs.

Second, execution. Bedrock’s rate limiting and SLA issues were mentioned tangentially on the call. If AWS can’t deliver enterprise-grade reliability for AI inference while Azure and Google Cloud can, developers will route workloads elsewhere despite Trainium’s economics.

Third, capital efficiency. If Amazon continues spending 30-40% more per dollar of incremental revenue than competitors, and that gap persists beyond 2026, it signals structural inefficiency rather than temporal mismatch.

What to Watch

Five metrics will validate or invalidate this strategy over the next 18 months:

AWS growth sustains ≥20% for at least two more quarters

Trainium customer announcements - need 2-3 major logos beyond Anthropic for Trainium3

Advertising growth stays ≥20% with increasing mix from CTV/DSP

Bedrock production wins - major enterprise customers deploying at scale with improved SLAs

FCF inflection signals - property & equipment not yet paid ($7.1B) begins declining as CapEx peak passes

The Engine Room Theory

What Q3 really demonstrated is that Amazon has built a financial structure none of its competitors can replicate.

Google and Microsoft fund AI infrastructure from their core profit engines—search advertising and enterprise software. If AI commoditizes those engines, they’re funding their own disruption.

Amazon funds AI infrastructure from physical goods (low margin, high volume) and advertising layered on top. The retail business doesn’t get disrupted by cheaper inference—it gets enhanced by better personalization and shopping AI. The advertising business doesn’t get disrupted by AI—it gets expanded by more ad inventory and better targeting.

This is the API mandate payoff at enterprise scale. The decision to re-architect retail around service primitives twenty years ago created the technical DNA for AWS. The decision to fund AWS’s AI build from retail and advertising cash flows is the financial equivalent—creating a capital structure where $130B in annual operating cash flow can be deployed entirely to infrastructure without shareholder capital return requirements.

The strategic question isn’t whether AWS is winning the AI infrastructure race—it’s whether Amazon is building winner-take-most infrastructure while competitors are forced to ration capital between growth and returns.

Jassy is betting yes. The $115B annual CapEx, the Trainium investments, the multi-gigawatt capacity buildout—these are all funded by an Engine Room that generates cash from selling consumer goods and serving ads, insulated from the AI disruption dynamics affecting competitors’ core businesses.

Q3 wasn’t just an AWS story. It was the moment you could see the entire Amazon empire—retail, advertising, and infrastructure—working as an integrated system to fund and operate what Jassy clearly believes will be the foundry for the AI economy.

Whether he’s right will be clear by 2027. But the structure he’s building is unique, and Q3 proved the Engine Room has the power to fund it.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.