ARM Holdings 1QFY26 Earnings: The Transformation Hidden Behind Margin Compression

Q1 FY26 revealed the CSS strategy accelerating faster than expected—reshaping royalties, economics, and ARM’s moat in AI infrastructure.

· Platform shift validated, market mispriced: Q1 FY26 beat on revenue/EPS, yet stock -13% on margin optics. Behind the opex step-up, ARM’s CSS platform is scaling faster than expected—signaling a durable move from point-IP to integrated solutions with stronger economics.

· Royalty economics inflecting upward: CSS licenses doubled YoY (16 total). First-gen CSS royalties at ~10% of chip ASP (≈2× Armv9), with next-gen >10% and early customer upgrades in-cycle—evidence of a value ladder that improves time-to-market and raises ARM’s take rate.

· Strategic optionality expanding (AI + SoftBank): ACV growth accelerated (~28%) with SoftBank a meaningful contributor and hints of chiplets/full-end solutions tied to large AI buildouts. Combined with deepening data-center/edge wins, this sets up margin recovery later and setting up stellar growth.

ARM's stock fell 13% after an earnings report where the company's single most important strategic initiative—its platform transformation—was validated faster than even management expected. This is the kind of disconnect that creates opportunity.

ARM delivered Q1 FY26 revenue of $1.053B (up 12% YoY) and $0.35 non-GAAP EPS, yet investors fixated on operating expense acceleration and Q2 guidance rather than the extraordinary validation of ARM's business model evolution. While the market obsessed over quarterly margin dynamics, they missed the CSS (Compute Subsystems) strategy fundamentally redefining their economics from pure IP licensing to integrated solutions.

The CSS Revelation: Economics That Rewrite the Playbook

The most strategically significant development this quarter wasn't the 25% royalty revenue growth—impressive as that was—but the hidden economics emerging around ARM's Compute Subsystems strategy. Management's commentary revealed three critical data points that completely change ARM's value equation:

Rate expansion continuing beyond initial expectations

As CEO Rene Haas put it, what was once thought to be a potential ceiling at 10% is proving to be a new floor: "These subsequent generations of our CSS platforms... bring the highest royalty rates we have seen to date."

This isn't just incremental improvement—it's architectural revenue expansion that creates completely different unit economics. But the most telling detail? Three existing CSS customers immediately upgraded to next-generation platforms in Q1. This behavior pattern—immediate migration to premium platforms—suggests ARM has successfully created what platform companies dream of: a value ladder where customers willingly pay more for faster time-to-market and reduced engineering risk.

The Multi-Year Transformation Accelerating

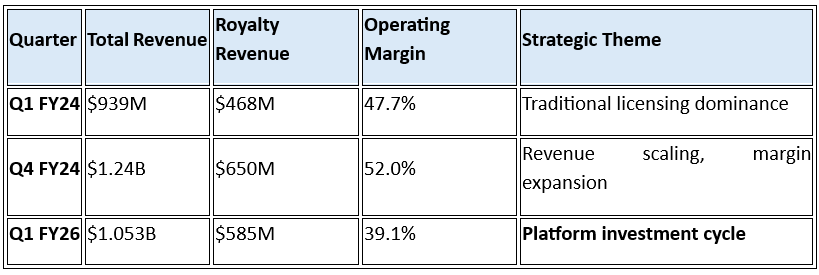

Looking at ARM's quarterly progression reveals a company executing a carefully orchestrated platform evolution:

Platform investment cycle

The margin compression from 47.7% to 39.1% year-over-year isn't operational weakness—it's strategic investment in what CFO Jason Child called "expanding engineering delivery across multiple levels". ARM is building capabilities for chiplets and potentially full-end solutions, essentially preparing to compete in adjacent markets while maintaining their core architectural dominance.

This investment timing is critical. As Child noted on the call: "ARM's revenues today come from technology developed years or even decades ago and our costs today are investments for future revenue streams." The CSS royalty rate increases are direct validation of this approach—previous R&D investments now generating 2x the revenue per design win.

Reading Between the Lines: The SoftBank Catalyst

The most strategically significant development may be ARM's expanded relationship with SoftBank around their AI infrastructure plans. Management was notably evasive about specifics, but several data points suggest something transformative:

Annualized Contract Value (ACV) jumped to 28% growth versus the normal mid-to-high single digits

SoftBank contributed approximately 11% of that ACV increase

References to "10 gigawatts" of compute capacity and ARM's "broader AI vision"

Management exploring "chiplets and potentially full-end solutions"

When Haas mentioned ARM's expansion beyond their current platform "in a way that no one else can," he wasn't just talking about technical capability—he was revealing ARM's unique position to provide full-stack solutions while maintaining their Switzerland-like neutrality.

This creates a fascinating strategic tension: ARM built their empire by enabling partners rather than competing with them. Now, customer demand is pulling them up the value stack into areas that could theoretically compete with partners—but in practice, addresses market needs those partners can't fulfill.

The AI Infrastructure Moat Deepening

ARM's positioning in AI infrastructure continues to strengthen in ways that aren't reflected in traditional metrics. The company now powers 70,000+ enterprises running AI workloads (40% YoY growth), with a clear path to ~50% market share with top hyperscalers in 2025.

But the more interesting dynamic is architectural: ARM claims to be "the only compute platform architected to deliver AI across the full spectrum of power and performance—from milliwatts to megawatts." This isn't marketing hyperbole—it reflects a fundamental architectural advantage as AI deployment shifts from centralized training to distributed inference.

· The NVIDIA Partnership Deepens: Grace Blackwell superchips deliver 25x better energy efficiency than x86 alternatives, validating ARM's power efficiency advantage in the most demanding AI workloads. As AI moves to edge deployment where power consumption matters most, this architectural advantage becomes even more pronounced.

· Geographic Diversification: China revenue jumped to 21% (from 15% last quarter), likely reflecting local companies accelerating ARM adoption to reduce dependence on US technology. Management's deliberate vagueness about this growth suggests they're benefiting from geopolitical dynamics while maintaining careful neutrality.

Forward-Looking Implications: Platform vs. Product Strategy

ARM's strategic evolution raises fundamental questions about sustainable competitive advantages in semiconductor IP. Traditional IP licensing becomes commoditized over time—but platform strategies can create compounding advantages through ecosystem lock-in and network effects.

The CSS success suggests ARM is successfully transitioning from product (IP licenses) to platform (integrated solutions). The immediate customer upgrades to next-generation CSS platforms demonstrate the kind of stickiness and recurring revenue characteristics typically associated with software platforms.

What to Watch Next Quarter:

CSS License Momentum: Watch for the type of customer. Is it another major automotive OEM or a second-tier smartphone maker? The former is far more significant.

Operating Margin Trajectory: The key isn't just recovery, but the rate of recovery. If margins don't show a clear path back above 40% in the Q3/Q4 guidance, the 'investment cycle' thesis weakens.

SoftBank/Stargate Development: Any formal announcement that ARM will supply a reference chiplet for this venture would be a major catalyst—and a test of the 'Switzerland' model.

Data Center Market Share: Progression toward the 50% target with specific customer wins beyond hyperscalers

The market sees a high-multiple growth stock hitting a margin wall. We see a platform company successfully executing a value-capture pivot, with the margin compression being the temporary and necessary cost of securing a much larger, more defensible revenue stream.

At current execution rates, ARM's CSS strategy alone could drive royalty rates to 15%+ of chip ASP in premium segments within 2-3 years, fundamentally changing their revenue quality and defensibility. The 13% stock decline after earnings may prove to be a rare opportunity to invest in a platform transformation that's validating faster than management's own expectations.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.