ARM- Indispensable by Design

How ARM Outmaneuvered Giants by Becoming the Neutral Layer No One Can Ignore

On August 12, 1981, IBM held a press conference that would reshape the technology industry in ways its executives never imagined. The company unveiled the IBM Personal Computer, a machine that seemed to embody everything IBM stood for: reliable, business-focused, and built to IBM's exacting standards. But beneath the surface, IBM had made a decision that would prove to be one of the most consequential strategic errors in business history.

Facing intense pressure to rush a personal computer to market, IBM's management chose to abandon the company's traditional practice of building everything in-house. Instead, they outsourced two critical components: the microprocessor went to a small Intel, and the operating system to an even smaller Microsoft. The logic seemed sound—why waste time developing commoditized components when specialized vendors could deliver faster and cheaper?

IBM's executives believed they understood where value would reside. The brand, the distribution channels, the enterprise relationships, the systems integration—these would remain firmly under IBM's control. The processor and operating system were mere components, interchangeable parts in a larger machine that IBM would own and orchestrate

History, of course, had other plans. Within a decade, Intel and Microsoft had become the most valuable companies in the technology industry, while IBM's PC business became a low-margin, commoditized struggle. The company that had tried to control everything ended up controlling almost nothing that mattered.

The lesson was profound, though it would take years for the industry to fully absorb it: in technology, control of abstraction layers defines long-term value, not physical ownership. IBM learned this the hard way. ARM Holdings, a company that wouldn't be founded for another nine years, would build an entire business model around this principle.

ARM's Counterintuitive Beginning

In 1990, while Intel basked in the glory of its 486 processor and the PC revolution it was powering, a small team of engineers in Cambridge, England, was working on something that seemed almost quaint by comparison. Acorn Computers, a British company best known for educational computers, was designing a processor that deliberately did less, not more.

The Advanced RISC Machine, as it was initially called, was born not from grand

strategic vision but from financial necessity. Acorn was running out of money

and couldn't afford to build and manufacture processors the traditional way.

The licensing model wasn't a master plan—it was a cash flow solution. Rather

than build chips, ARM would design them and license the intellectual property

to others. Rather than compete directly with Intel's integrated model, ARM

would enable others to build what they needed.

This seemed like a profound disadvantage. In an era defined by MHz races and

the relentless pursuit of raw computational power, ARM's chips were deliberately simple. Where Intel's x86 architecture included complex instructions that could perform multiple operations simultaneously, ARM embraced a minimalist approach: each instruction did one thing, and did it efficiently. The result was processors that were slower in absolute terms but consumed dramatically less power.

To most observers, this looked like a classic case of making virtue out of

necessity. ARM couldn't compete with Intel on performance, so it competed on

efficiency. The company couldn't afford to build its own fabs, so it licensed

designs instead. Every apparent weakness was reframed as a strategic choice.

But beneath these rationalizations lay a genuinely different philosophy about

how technology businesses should operate. ARM's bet was elegantly simple:

enable others, don't compete with them. Let customers build what they need,

and win when they succeed. Rather than trying to control the entire value

chain, ARM would position itself as the essential enabler that everyone could

build upon.

It was a patient approach that would require decades to validate. But ARM had

stumbled onto something profound:

in a rapidly evolving technology landscape, the companies that win aren't necessarily those that build the most impressive products, but those that create the platforms others can't afford to abandon.

Mobile Validates ARM's Bet

The first major validation of ARM's approach came from an unexpected source:

Nokia. In the early 2000s, as mobile phones evolved beyond simple voice

communication, Nokia was grappling with the same challenge that had once

faced IBM.

How do you build complex computing devices quickly and efficiently?

Nokia's answer was Symbian, an operating system designed specifically for mobile devices. But Symbian needed processors, and Intel's x86 chips were completely unsuitable for battery-powered devices. The power consumption was too high, the heat generation too problematic, the complexity unnecessary for mobile applications.

ARM's chips, meanwhile, were purpose-built for exactly these constraints.

The simplicity that made them seem inferior in desktop applications became a profound advantage in mobile.

Each ARM-based phone lasted longer on a single charge.

Each ARM-based device ran cooler and required less sophisticated

thermal management.Each ARM-based system was smaller, cheaper, and more reliable.

But the real breakthrough came when Apple decided to build the A4 processor for the original iPad. This wasn't simply a cost optimization play—it was a declaration of strategic independence.

Apple realized that custom silicon could be a competitive weapon, not just a component choice. By licensing ARM's architecture and building their own chips, Apple could optimize for exactly the performance characteristics they wanted while maintaining control over their product roadmap.

The A4's success created a template that would be repeated across the industry.

Every ARM-based success created more ARM engineers,

more ARM development tools,

more ARM expertise, and more ARM momentum.

It was a compounding flywheel that accelerated with each design win.

More importantly, ARM had discovered something that Intel's integrated model couldn't replicate: the ability to enable rapid customization. While Intel had to design chips for the broadest possible market, ARM's licensees could optimize for specific applications. Apple could build for tablets, Qualcomm for smartphones, Texas Instruments for embedded applications—each getting exactly what they needed rather than settling for a general-purpose compromise.

By 2010, ARM had achieved something remarkable: it had become the de facto

standard for mobile computing without ever building a single chip. Th licensing model that had seemed like a disadvantage had become an insurmountable advantage. Every success by an ARM licensee strengthened the entire ecosystem, while Intel found itself locked out of the fastest-growing segment of the computing market.

The Cloud Learns to Customize

For years, data centers remained Intel's fortress. The x86 architecture's dominance in servers seemed unassailable, protected by decades of software optimization and enterprise inertia.

Why would anyone risk the complexity and cost of architectural migration when existing systems worked perfectly well?

The answer came from an unexpected source: efficiency economics.

As cloud computing matured, hyperscale operators like Amazon, Google, and Microsoft began measuring success not just in terms of performance, but in terms of performance per watt, performance per dollar, and performance per square foot of data center space.

In this new calculus, Intel's architectural advantages began to look like liabilities.

AWS's introduction of Graviton processors in 2018 marked an inflection point as significant as IBM's original PC decision. Amazon wasn't simply looking for cheaper chips—they were asserting architectural control over their infrastructure. By designing custom ARM-based processors optimized specifically for cloud workloads, AWS could deliver better price-performance ratios while reducing their dependence on Intel's roadmap and pricing.

The implications were profound. Intel's strength had always been its ability to design processors for the broadest possible market, amortizing development costs across millions of units. But hyperscale cloud operators didn't need broad compatibility—they needed specific optimization.

They controlled their own software stacks, their own deployment schedules, their own performance requirements.

ARM's licensing model suddenly looked prescient rather than merely practical. While Intel struggled to customize its monolithic architecture for diverse cloud workloads, ARM's licensees could rapidly iterate on designs optimized for specific applications. Machine learning inference required different optimization than database queries, which required different optimization than web serving.

More fundamentally, the cloud operators realized they couldn't achieve true infrastructure differentiation while dependent on commodity processors.

Custom silicon wasn't just about cost savings—it was about creating competitive advantages that couldn't be easily replicated. Amazon's Graviton chips gave AWS unique capabilities that Microsoft and Google couldn't simply purchase from Intel.

Intel's weakness wasn't performance—its processors remained technically excellent. The weakness was velocity and customization. In a world where cloud operators needed to iterate rapidly on infrastructure optimization, Intel's integrated model became a bottleneck rather than an advantage. ARM's licensing approach became a meta-platform for architectural innovation, enabling rapid experimentation and customization that Intel simply couldn't match.

AI Makes ARM the Default

The emergence of artificial intelligence as a dominant computing paradigm created exactly the kind of disruption that favored ARM's approach over Intel's.

Large language models, neural networks, and machine learning workloads didn't fit neatly into traditional computing categories. They required massive parallel processing, specialized memory architectures, and power efficiency at unprecedented scales.

More importantly, AI workloads were diverse and rapidly evolving. Training large language models required different optimization than running inference. Computer vision applications needed different architectures than natural language processing. Edge AI deployment had completely different constraints than data center training.

Intel's traditional approach—designing general-purpose processors for the broadest possible market—was fundamentally misaligned with AI's requirements. You couldn't optimize for everything simultaneously, and trying to do so resulted in chips that were adequate for many applications but optimal for none.

Every major AI company reached the same conclusion: custom silicon was essential for competitive advantage.

NVIDIA designed Grace processors for AI training clusters.

Google built Tensor Processing Units for search and cloud AI.

Amazon developed specialized Graviton variants for machine

learning workloads.Microsoft created custom chips for Azure AI services.

Apple designed Neural Engines for on-device AI processing.

Remarkably, every single one of these custom AI processors was built on ARM architecture.

This wasn't coincidence—it was inevitability. ARM's licensing model enabled exactly the kind of rapid architectural experimentation that AI required. Companies could license ARM's instruction set architecture and modify it for their specific AI workloads without rebuilding fundamental computing infrastructure from scratch. They got the benefits of architectural customization without the risks of starting from zero.

More profoundly, the relationship between software and hardware was inverting. Instead of software adapting to whatever processors manufacturers decided to build, hardware was adapting to software requirements. AI researchers identified computational bottlenecks, which informed custom silicon requirements, which drove ARM architectural modifications, which enabled new AI capabilities.

ARM found itself at the center of this transformation, not as a participant but as an orchestrator. The company wasn't building AI chips—it was enabling everyone else to build exactly the AI chips they needed. ARM had evolved from a component provider to something more fundamental: the architectural foundation upon which the entire AI revolution was being built.

ARM's Business Model: Scale Without Friction

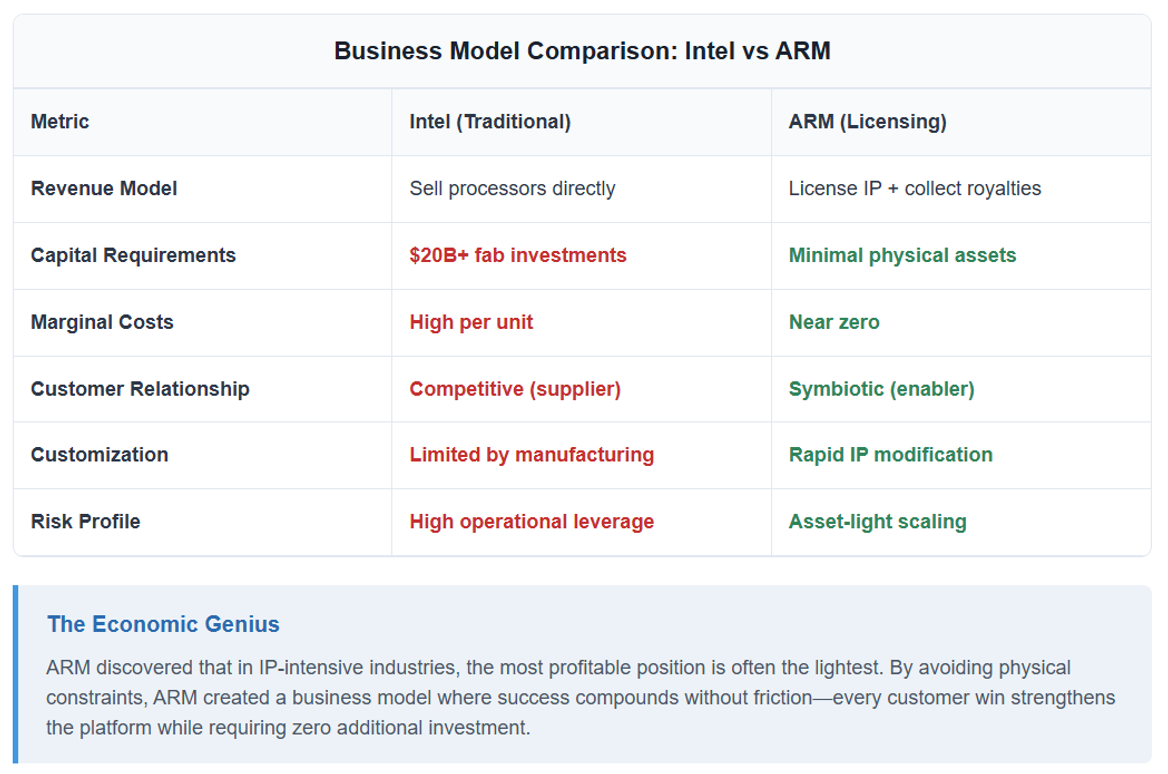

To understand why ARM became so central to computing's evolution, it's essential to understand the elegant mechanics of its business model. Unlike traditional semiconductor companies, ARM operates with almost zero physical constraints. No fabs to build or maintain, no inventory to manage, no manufacturing capacity to plan, no channel conflicts to navigate.

This creates pure intellectual leverage. Every ARM-based processor sold generates royalty revenue without any corresponding increase in ARM's costs. Every new licensee strengthens the ecosystem without diluting existing relationships. Every architectural improvement benefits all customers simultaneously without requiring individual customization.

The economics become more compelling as designs grow more complex. ARM's royalty rates scale with chip sophistication—more advanced processors like those using Armv9 architecture generate higher royalties than simpler embedded controllers. As customers build more powerful, more capable processors, ARM's revenue per chip increases automatically.

ARM's Compute Subsystems (CSS) offering exemplifies this model's potential. Rather than just licensing raw intellectual property, ARM provides complete, pre-validated processor designs that customers can integrate directly into their chips. This reduces customer time-to-market by 40-50% while commanding premium licensing fees that

traditional IP licensing couldn't support.

The model creates compound leverage. Initial licensing fees provide upfront revenue, ongoing royalties create recurring income streams, and support services generate additional margin without scaling costs. Customers pay ARM to enable their success, then pay ARM again as that success scales.

More subtly, ARM's model aligns perfectly with customer incentives. Unlike Intel, which profits by selling more expensive processors, ARM profits when customers sell more of whatever processors they choose to build. ARM succeeds when customers succeed, regardless of the specific market segments or applications they pursue.

This alignment creates trust and partnership rather than competition. Customers don't worry about ARM becoming a competitor because ARM has no interest in building finished products. They don't worry about ARM extracting excessive rents because ARM's success depends entirely on customer success. The relationship is genuinely symbiotic rather than zero-sum.

The New Stack Hierarchy

ARM's rise reflects a broader transformation in how technology value is created and captured. The traditional computing stack—with processors at the bottom, operating systems in the middle, and applications at the top—is being restructured around new principles of control and optimization.

In this new hierarchy, ARM occupies a unique position: it sits between foundries like TSMC and hyperscalers like Amazon, Google, and Microsoft. It's below the software layer but above the manufacturing layer, providing the architectural standard that enables both custom optimization and ecosystem compatibility.

This positioning captures value that neither pure manufacturing nor pure software can address. TSMC can build whatever chips customers design, but can't provide the architectural expertise to design them effectively. Software companies can optimize for whatever processors exist, but can't influence the fundamental architectural decisions that determine what's possible.

ARM bridges this gap by providing architectural standards that are both flexible enough for customization and stable enough for ecosystem development. Customers can build exactly the processors they need while remaining compatible with the tools, software, and expertise that make ARM-based development practical.

The result is ecosystem depth that becomes increasingly difficult to replicate. ARM-compatible development tools, trained engineers, optimized software libraries, and validated design patterns create switching costs that compound over time.

New entrants don't just need to build better processors—they need to recreate entire ecosystems.

More importantly, ARM's position in the stack makes it largely immune to

disruption from adjacent layers. Cloud software optimization doesn't threaten

ARM because optimized software still needs processors to run on.

Manufacturing improvements don't threaten ARM because better

manufacturing makes ARM-based chips more competitive, not less. Even

breakthrough technologies like quantum computing complement rather than

replace ARM's role in classical computing.

ARM wins not by controlling the stack but by being the layer no one can avoid. It's the architectural lingua franca that enables innovation at every other level while remaining essential to the entire system's operation.

Enabling, Not Extracting

What makes ARM's position particularly defensible is how it creates value for customers rather than extracting value from them. This might seem like a subtle distinction, but it's fundamental to understanding why ARM's business model is so durable.

Traditional platform businesses often succeed by creating bottlenecks and extracting rents. App stores charge developers for access to customers. Operating systems charge users for software compatibility. Cloud platforms charge customers for avoiding vendor lock-in. Success comes from controlling access to something valuable and charging for that access.

ARM operates on exactly the opposite principle. Rather than creating bottlenecks, ARM removes them. Rather than extracting rents, ARM enables rent creation by others. Rather than controlling access to customers, ARM helps customers

reach their own markets more effectively.

Customers don't succeed despite ARM—they succeed because of ARM. Apple's chip design capabilities, Amazon's cloud infrastructure optimization, NVIDIA's AI processing leadership—all of these competitive advantages are enhanced rather than constrained by their relationship with ARM.

This creates what might be called the "Switzerland effect"—ARM becomes too valuable to displace and too neutral to threaten. Customers don't worry about ARM becoming a competitor because ARM's business model precludes direct competition. They don't worry about ARM restricting their strategic options because ARM profits from enabling rather than constraining those options.

Even the emergence of RISC-V, an open-source alternative to ARM's proprietary architecture, validates rather than threatens ARM's approach. RISC-V's growing popularity demonstrates that the industry values architectural flexibility and customization—exactly the principles ARM has championed for decades. The existence of an open-source alternative highlights the value ARM provides through its mature ecosystem, comprehensive support, and proven design methodologies.

Companies evaluating RISC-V quickly discover that architectural licensing costs are a tiny fraction of total development expenses. The real costs lie in software optimization, tool development, engineer training, and ecosystem maturation—all areas where ARM maintains substantial advantages regardless of licensing fees.

Rather than competing on price, ARM competes on enablement. The question isn't whether customers can afford ARM's licensing fees, but whether they can afford to rebuild everything ARM provides if they choose an alternative architecture.

Present-Day Inflection

ARM's September 2023 initial public offering wasn't the beginning of a new phase—it was the market's recognition of a phase that had already begun. For years, ARM had been valued as a cyclical intellectual property company, with revenues tied to smartphone sales cycles and licensing deal timing. The IPO revealed something different: a technology infrastructure company whose value scales with the entire computing industry's growth and diversification.

This revaluation reflects ARM's evolution from component supplier to ecosystem orchestrator. The company no longer simply licenses processor designs—it provides the architectural foundation that enables rapid innovation across every computing segment simultaneously. Its success is no longer tied to any single product category or customer vertical.

The numbers tell the story clearly. ARM-based processors now power 95% of smartphones, increasingly dominate automotive computing, represent the fastest-growing segment in data centers, and serve as the foundation for virtually every custom AI chip being developed. This isn't market share in the traditional sense—it's infrastructure penetration.

But success at this scale creates new challenges. ARM's ubiquity means that problems compound across the entire computing ecosystem. Security vulnerabilities, architectural limitations, or licensing disruptions don't just affect individual products—they impact entire industries simultaneously.

Managing this level of systemic importance requires different capabilities than ARM needed as a smaller, more focused company. The company must balance the needs of competitors who increasingly depend on the same architectural foundation. It must navigate geopolitical tensions that didn't exist when its customers were primarily consumer electronics companies. It must maintain architectural leadership while ensuring backward compatibility across an enormous installed base.

Most importantly, ARM must resist the temptation to extract more value from its position. The licensing model that enabled ARM's success depends on customer trust that ARM will remain an enabler rather than becoming an extractor. Any shift toward more aggressive monetization could undermine the symbiotic relationships that make ARM's business model sustainable.

The risk now isn't obsolescence—it's overreach. ARM's greatest threat isn't a superior competitor but the possibility of damaging the ecosystem dynamics that created its success in the first place.

The Real Lesson: Patient Infrastructure Wins

ARM's thirty-year journey from Cambridge startup to computing infrastructure reveals something profound about how technology businesses create lasting value. The companies that ultimately win aren't necessarily those that build the most impressive products or dominate the most visible markets. They're the companies that become essential to everyone else's success.

This requires a fundamentally different approach to strategy than most technology companies pursue.

Instead of competing for market share, ARM focused on expanding

market opportunity.Instead of building proprietary advantages, ARM created shared

infrastructure that became more valuable as more people used it.Instead of extracting maximum value from each transaction, ARM

optimized for long-term ecosystem growth.

The patience required for this approach cannot be overstated. ARM spent decades avoiding the spotlight, building capabilities and relationships while more prominent companies captured headlines and market attention. The licensing revenue looked small compared to Intel's processor sales. The architectural influence seemed modest compared to Microsoft's software control. The strategic importance was invisible to most observers.

But ARM understood something that many technology companies miss: in rapidly evolving industries, the most defensible position is often not at the top of the value chain but at the foundation that everything else builds upon. Operating systems change, applications evolve, user interfaces transform—but architectural foundations persist for decades.

The future of computing will be increasingly fragmented, customized, and application-specific. Artificial intelligence, edge computing, autonomous systems, and quantum-classical hybrid architectures will all require different optimization approaches. No single company can anticipate or address all of these requirements simultaneously.

ARM's genius lies in recognizing this fragmentation as an opportunity rather than a problem. By providing the architectural foundation that enables rapid customization rather than trying to control the customization itself, ARM positioned itself to benefit from computing's diversification rather than being threatened by it.

Today, as every major technology company designs custom silicon and every AI breakthrough requires architectural innovation, ARM has become what it always aspired to be: not the most visible company in computing, but the most essential. It wins not by innovating the fastest or building the most impressive products, but by being what everyone builds upon.

In a decentralized world, ARM discovered the architecture of control—not through dominance, but through indispensability. That might be the most important strategic lesson in modern technology business.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.