ASML 4Q25 Earnings: The Quarter That Ended The Demand Debate

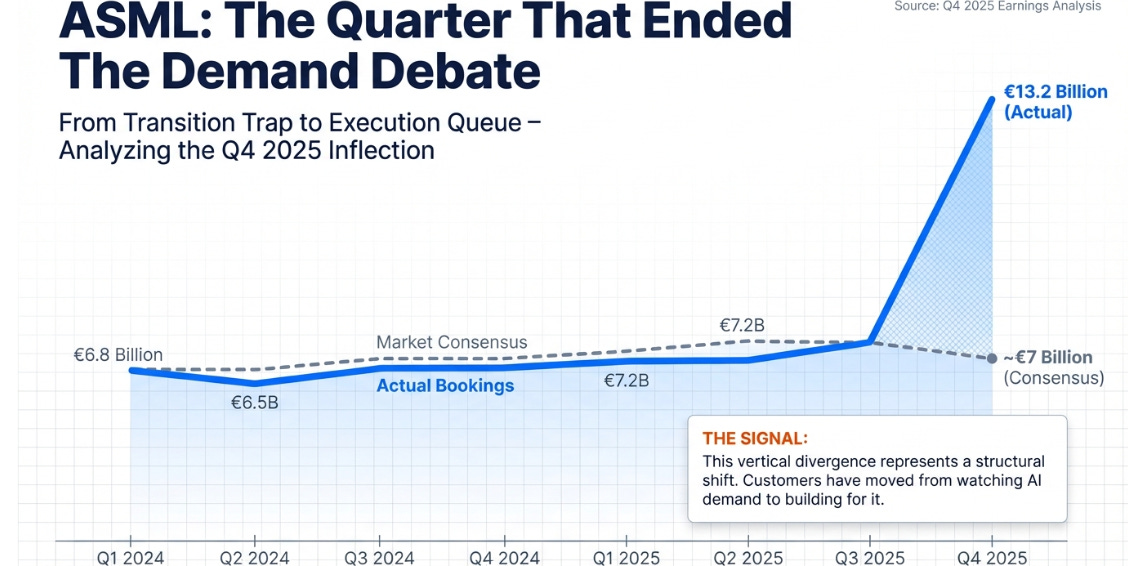

Record bookings didn’t just beat estimates, they collapsed the AI demand debate and reshaped ASML’s cycle

TL;DR

The transition trap never sprung. €13.2B in Q4 bookings and €38.8B in backlog mean ASML enters 2026 fully demand-covered, the risk has shifted from will orders come? to can ASML ship fast enough?

Memory flipped from cycle amplifier to anchor. DRAM makers are adopting EUV out of necessity for HBM, not inventory growth, structurally stabilizing ASML’s demand profile.

This looks less like a cycle, more like a queue. Multi-year capex commitments, rising lithography intensity, and a fast-compounding services annuity point to a genuine semiconductor super-cycle, not a one-year AI spike.

From Reuters, January 28, 2026:

ASML reported record fourth-quarter bookings of €13.2 billion, nearly double analyst expectations of roughly €7 billion, as chipmakers accelerated orders for extreme ultraviolet lithography machines to meet artificial intelligence demand. The Dutch company reported full-year revenue of €32.7 billion and guided 2026 sales of €34-39 billion with gross margins of 51-53%.

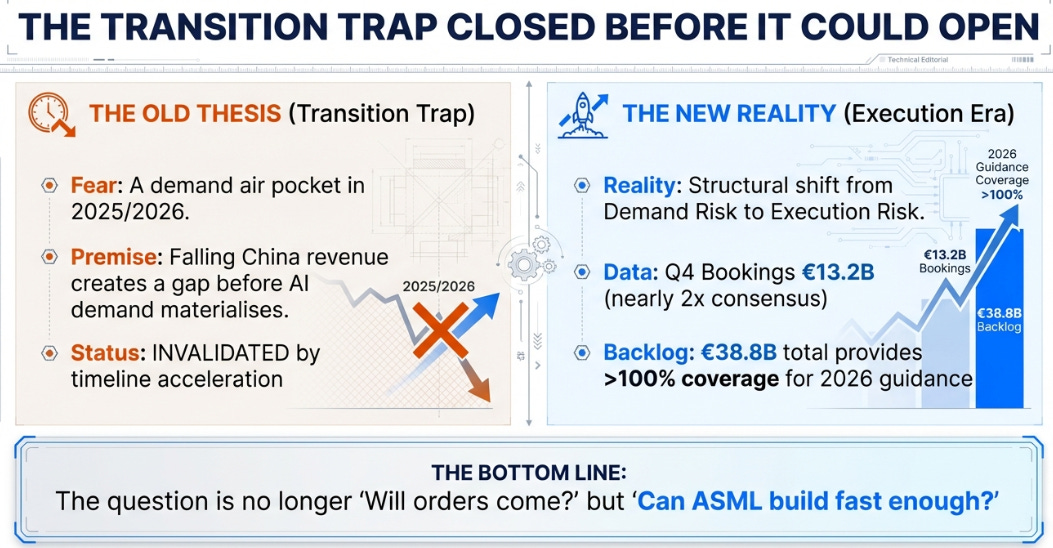

In October, I wrote about ASML’s “transition trap” , the risk that Chinese revenue would collapse before AI-driven demand could fill the gap. The thesis was that ASML remained a compelling long-term holding, but investors needed patience to navigate a potentially messy 2025-2026.

I was wrong about the timeline. The gap closed before it opened.

€13.2 billion in quarterly bookings , nearly double consensus , isn’t a beat in the traditional sense. It’s customers telling you they’ve moved from watching AI demand to building for AI demand. And that shift changes the analytical frame entirely.

From Transition Risk to Execution Queue

The most important thing that changed this quarter isn’t a number. It’s the risk profile.

ASML enters 2026 with €38.8 billion in backlog against revenue guidance of €34-39 billion. That’s 100%+ coverage at the low end. For a company that historically traded on quarterly booking volatility, this is a structural shift in how to think about the stock.

The question is no longer “will orders come?” The orders have arrived. The question is now “can ASML build and ship fast enough?”

That’s a fundamentally different bet. Demand risk has converted to execution risk. And execution risk, for a company with ASML’s manufacturing track record and supplier relationships, is a more manageable problem than demand uncertainty.

CEO Christophe Fouquet’s language on the call was notably direct:

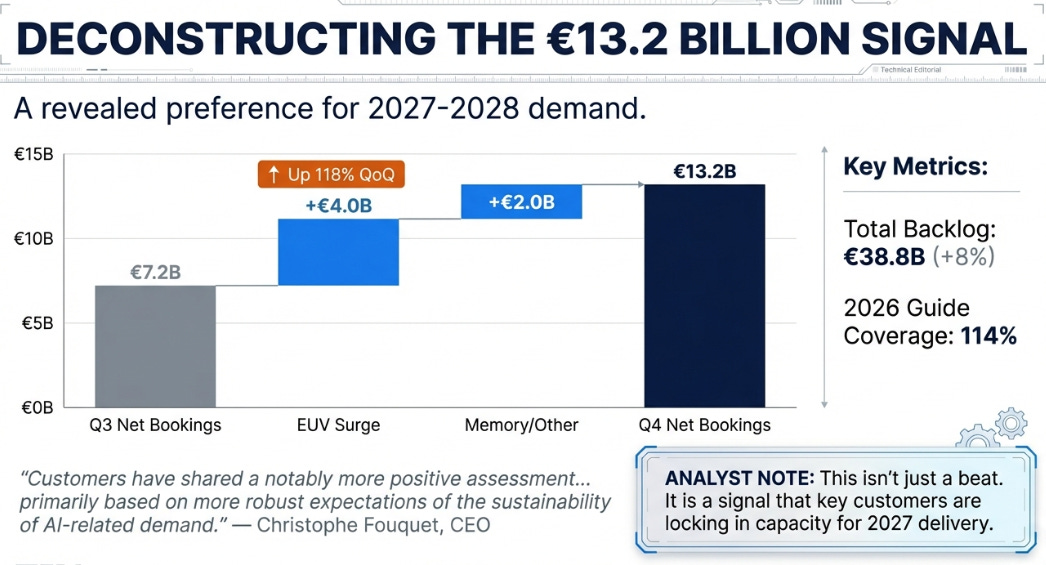

“In recent months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand.”

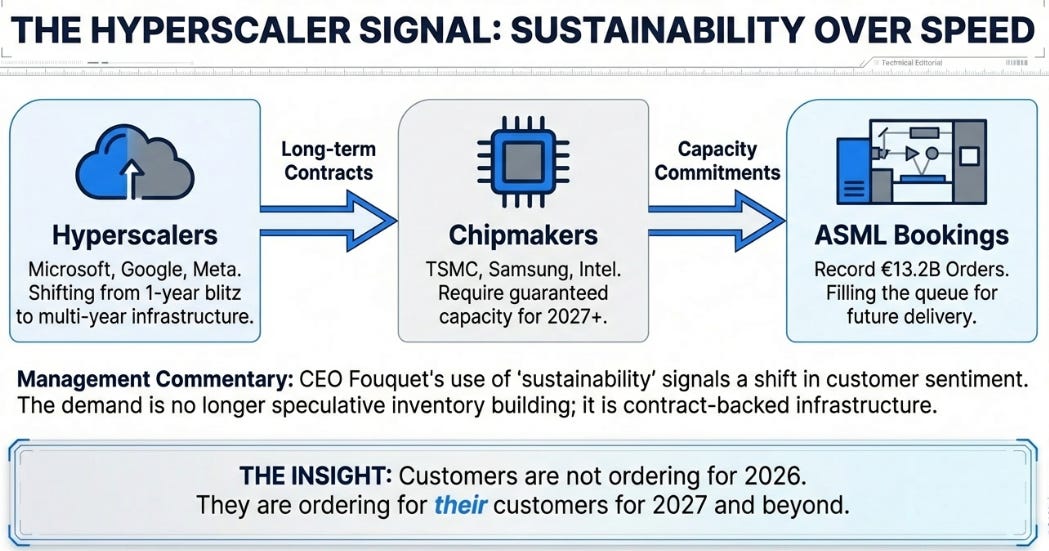

I want to highlight “notably more positive” and “sustainability.” ASML executives are methodical and measured. When Fouquet uses emphatic language about customer sentiment shifting, he’s signaling something specific: the hyperscalers are communicating to their chip suppliers that this isn’t a one-year spending blitz. It’s structural.

CFO Roger Dassen reinforced this:

“That recognition has led some of our customers to really invest in capacity and gear up their plans for medium-term capacity expansion.”

Translation: customers aren’t placing orders for 2026. They’re committing to multi-year capacity buildouts because their own customers , Microsoft, Google, Meta, Amazon , are signing contracts that require that capacity.

The Memory Inflection Nobody’s Modeling

The composition of Q4 bookings reveals something important that I haven’t seen adequately discussed elsewhere.

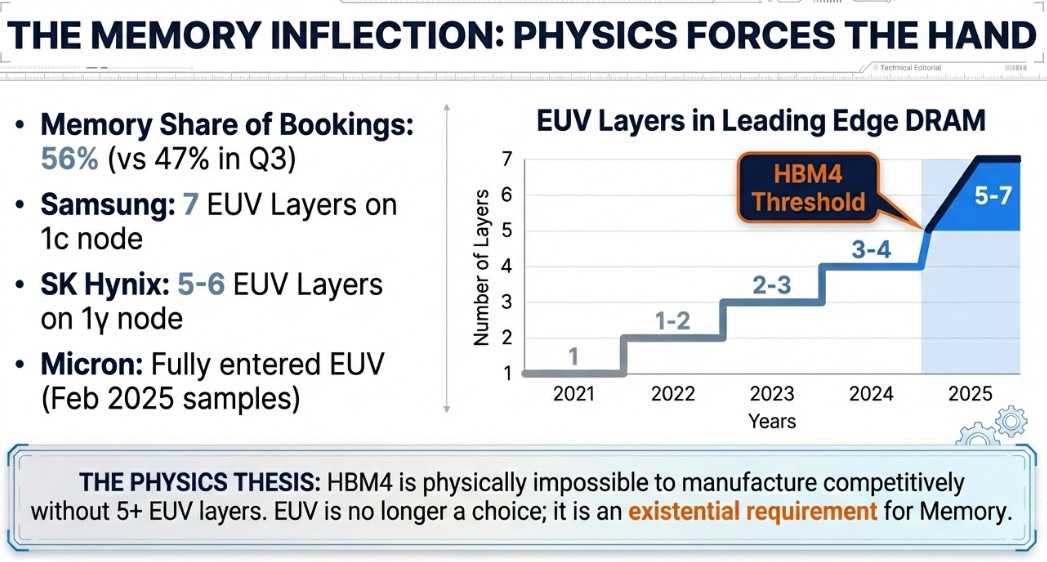

Memory customers represented 56% of Q4 bookings, up from 47% in Q3. Within that, EUV bookings were €7.4 billion. This isn’t logic customers ordering incrementally more tools. This is DRAM makers going all-in on EUV.

This is a technology adoption curve inflecting. SK Hynix is now running 5-6 EUV layers on their 1γ node. Samsung is at 7 layers on 1c. Micron shipped their first EUV samples in February 2025 , they were the last holdout, and now they’re in.

Here’s why this matters: historically, memory was the source of ASML’s cyclicality. Memory capex was inventory-driven , boom when demand exceeded supply, bust when inventory accumulated. DRAM makers would overbuild, prices would crash, and equipment orders would collapse.

This cycle has inverted that logic.

DRAM makers aren’t buying EUV tools to build inventory. They’re buying them because the architecture of AI memory , specifically HBM4 , is physically impossible to manufacture without EUV. You cannot make competitive high-bandwidth memory at leading-edge density without 5+ EUV layers. The choice isn’t “EUV or cheaper alternatives.” The choice is “EUV or exit the HBM market.”

The “complexity tax” I identified in my Applied Materials and Lam Research analyses has come for memory makers. Every new DRAM node requires more EUV layers, not fewer. Even if wafer starts stay flat, lithography intensity per wafer is rising.

Memory is no longer amplifying ASML’s cycle. It’s anchoring it.

The Services Thesis Validated

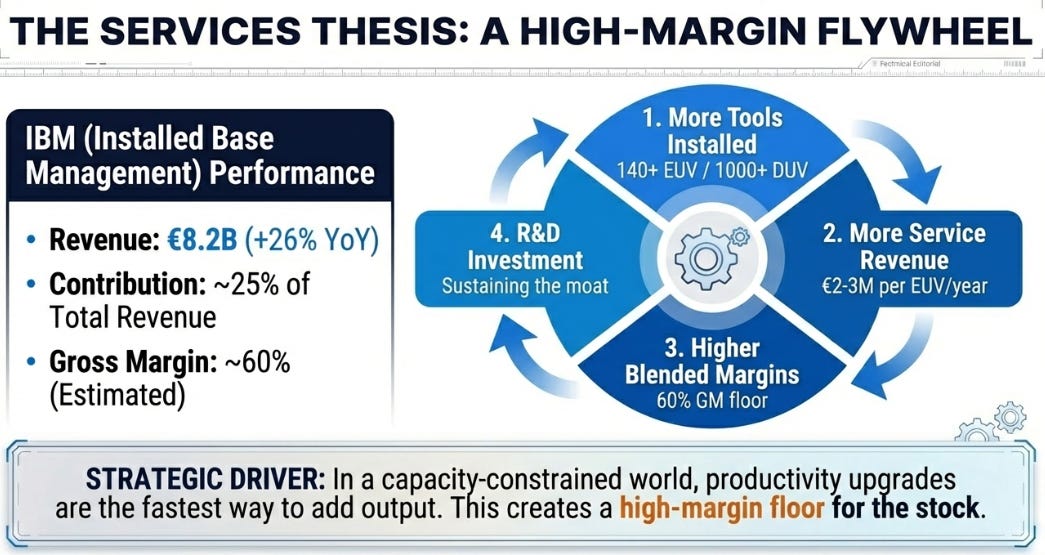

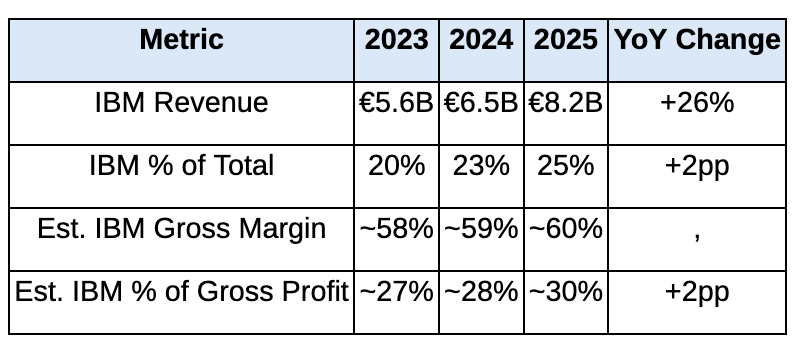

In October, I argued that ASML’s Installed Base Management (IBM) business was the “hidden story”, a high-margin services annuity that the market systematically undervalued. Q4 confirms the thesis is playing out faster than I expected.

€8.2 billion in services revenue, growing 26% year-over-year. Now 25% of total revenue at estimated 60% gross margins, meaning roughly 30% of gross profit. And Q1 2026 IBM is guided to approximately €2.4 billion, implying a €9.6 billion annual run rate.

The strategic mechanics are straightforward but powerful. Every EUV tool ASML ships adds to the installed base. The installed base now includes 140+ EUV systems and 1,000+ DUV systems. Each EUV tool generates approximately €2-3 million in annual service revenue for 15-20 years. As the EUV installed base expands, roughly 50-60 new units annually , the service revenue compounds.

But there’s a subtler point that management emphasized on the call: in a capacity-constrained world, upgrades are the fastest way for customers to add output.

Fouquet noted that the NXE:3800E has reached its 220 wafer-per-hour target and demonstrated 230 wph at some customer sites. That’s a 30% throughput improvement over tools from just a few years ago. For a customer trying to add wafer capacity without waiting 18 months for a new tool, buying a productivity upgrade is the rational choice.

This creates a flywheel. More tools in the field means more service revenue. More service revenue at higher margins means the trough of any future hardware cycle is structurally higher than the last. ASML’s downside is protected by a growing annuity that doesn’t depend on new tool shipments.

Why This Is A Super Cycle

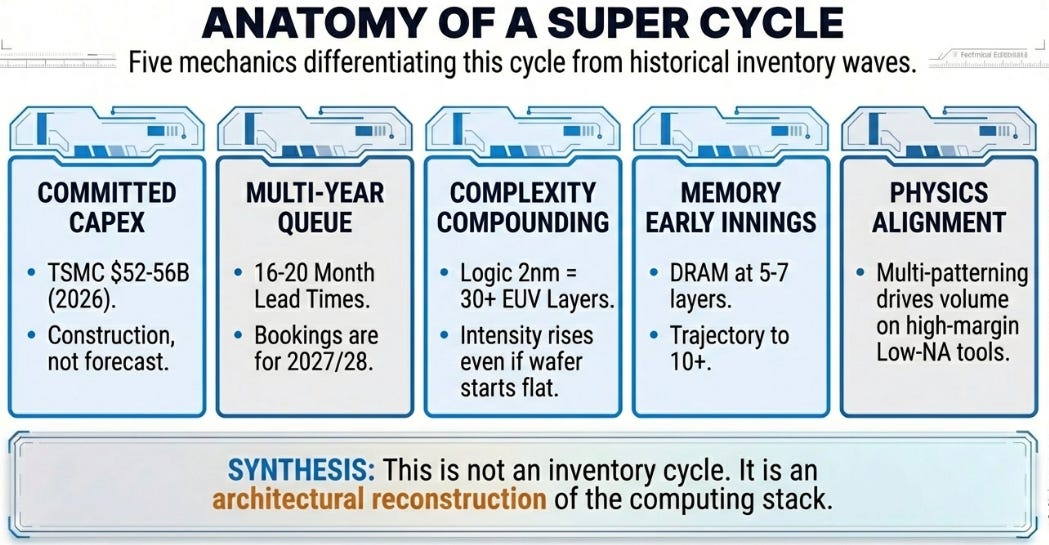

I use “super cycle” deliberately, knowing it invites skepticism. Every cycle gets called a super cycle by someone. But the mechanics of this one are genuinely different, and they’re worth laying out explicitly.

First: Committed, not forecast.

TSMC just guided $52-56 billion in 2026 capex , up 30% from 2025. SK Hynix is at $20+ billion, with HBM as the priority. Micron is pulling tool deliveries forward by four months because they can’t build HBM fast enough. These aren’t forecasts that might change if economic conditions deteriorate. The fabs are under construction. The purchase orders are signed.

Second: Multi-year queue.

€38.8 billion in backlog with 16-20 month lead times means customers are committing today for tools they won’t receive until 2027-2028. You don’t place orders that far out if you expect demand to evaporate. The backlog isn’t a snapshot of current demand , it’s a revealed preference about expected demand two years forward.

Third: Complexity compounding.

EUV layers per logic node: approximately 14 at 5nm, 25 at 3nm, 30+ at 2nm. Each node transition requires more lithography, not less. Even if wafer starts stayed flat , which they won’t , ASML’s content per wafer is structurally increasing.

Fourth: Memory adoption still early innings.

DRAM is at 5-7 EUV layers today. The trajectory suggests 10+ layers by late decade as nodes shrink and HBM architectures become more demanding. We’re not at the end of memory’s EUV adoption curve. We’re at the beginning.

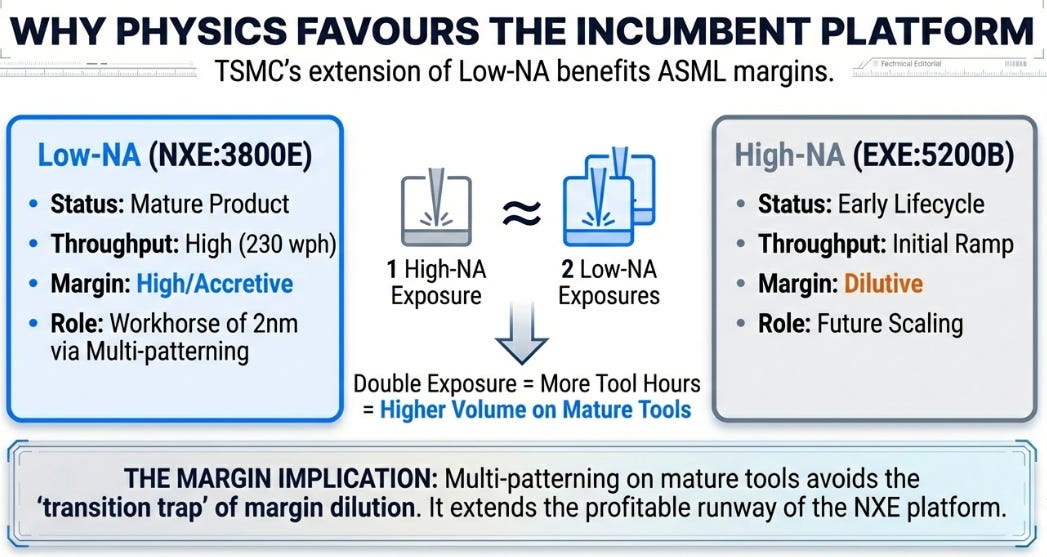

Fifth: The physics actually favor ASML right now.

This is the point Gemini raised that deserves expansion. TSMC is achieving 2nm through multi-patterning on Low-NA EUV tools rather than adopting High-NA. The market initially worried this would hurt ASML , that TSMC was delaying the High-NA transition.

The opposite is true.

Low-NA tools (NXE:3800E) are mature products with understood manufacturing costs and healthy margins. High-NA tools (EXE:5200B) are early in their lifecycle , complex to build, lower throughput, margin-dilutive until scale economics kick in.

TSMC’s choice to extend Low-NA means they need more Low-NA tools, not fewer, because multi-patterning requires multiple exposures per layer. A wafer that might need one High-NA exposure needs two Low-NA exposures. That’s two tool-hours instead of one.

For ASML, this is the best near-term outcome: volume revenue at mature margins now, with High-NA scaling gradually into 2027-2028 as the technology matures. The “transition trap” of margin compression from forced High-NA adoption didn’t materialize because TSMC’s engineering choices gave ASML more runway on their proven product line.

The traditional semiconductor cycle was driven by inventory dynamics: demand overshoots, customers overbuild, inventory accumulates, orders collapse. This cycle has different mechanics because AI demand is driven by hyperscaler compute buildout , multi-year contracts for training and inference capacity , not consumer device inventory that can swing quarter to quarter.

I could be wrong. If AI investment proves to be a bubble, we’ll see it in TSMC capex cuts first. But TSMC just guided the largest single-year capital expenditure in semiconductor history and said AI demand is “real” and will “continue for many years.”

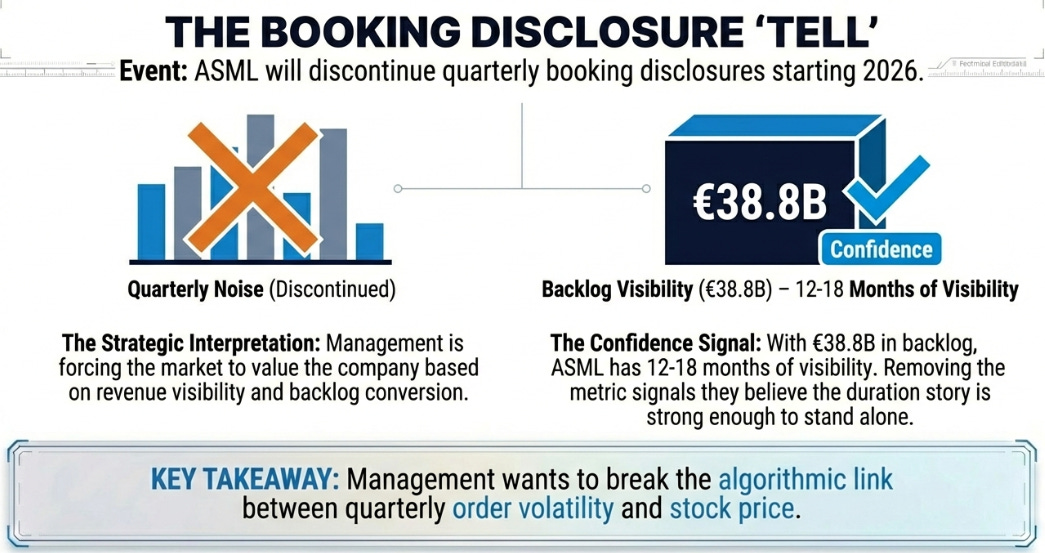

The Booking Disclosure Tell

There’s one more data point worth discussing, and it’s not a number. It’s a choice.

Starting in 2026, ASML will discontinue quarterly booking disclosures. They announced this at Investor Day in November 2024, framing it as reducing “short-term noise” in favor of focusing on “long-term value creation.”

This is worth interrogating. Why would a company stop reporting its most-watched metric right after that metric hits an all-time high?

The cynical interpretation: they expect bookings to normalize or decline from this peak, and they’d rather not report that.

The strategic interpretation: management is forcing the market to value them on revenue visibility and backlog conversion, not booking volatility. They’re telling investors to stop trading the quarterly noise and focus on the execution queue.

I lean toward the strategic interpretation for two reasons. First, the €38.8 billion backlog provides 12-18 months of visibility regardless of booking rates. Second, ASML’s management has been consistently conservative , they’ve beaten or met guidance in 7 of the last 8 quarters.

This is a company that believes its own duration story enough to remove the metric that used to drive its stock price. That’s a signal.

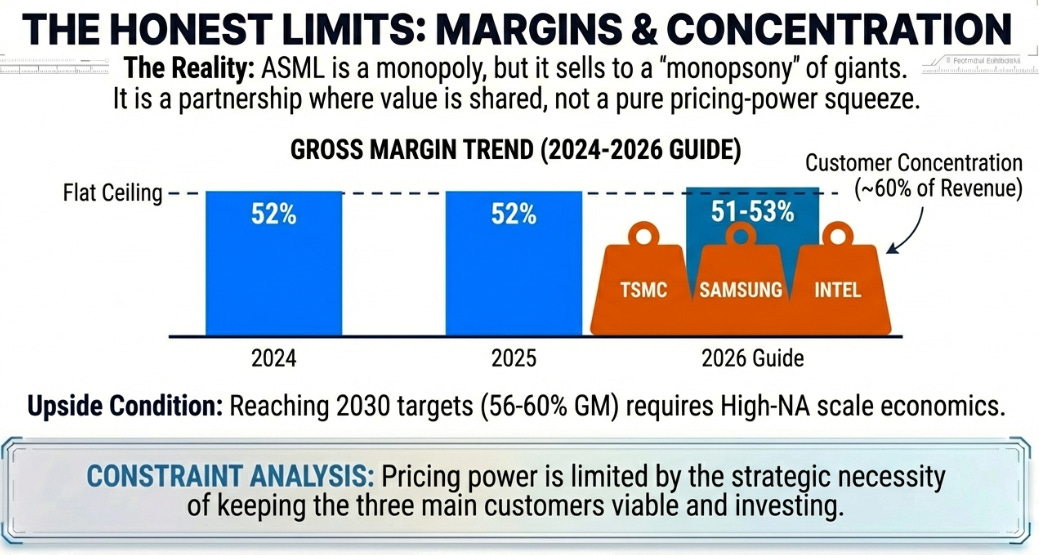

What Hasn’t Changed (The Honest Limits)

I don’t want to write a victory lap. The Q4 results were strong, but constraints remain.

The margin ceiling is real.

ASML guided 2026 gross margins to 51-53% , essentially flat with 2025’s 52.8%. Despite record bookings. Despite favorable mix shift toward EUV.

The reason is customer concentration. TSMC, Samsung, and Intel collectively represent approximately 60% of ASML’s revenue. ASML is a monopoly, but it’s a monopoly selling to three customers who negotiate hard and have the scale to extract concessions. This isn’t pricing power in the traditional sense , it’s a negotiated partnership where value gets shared.

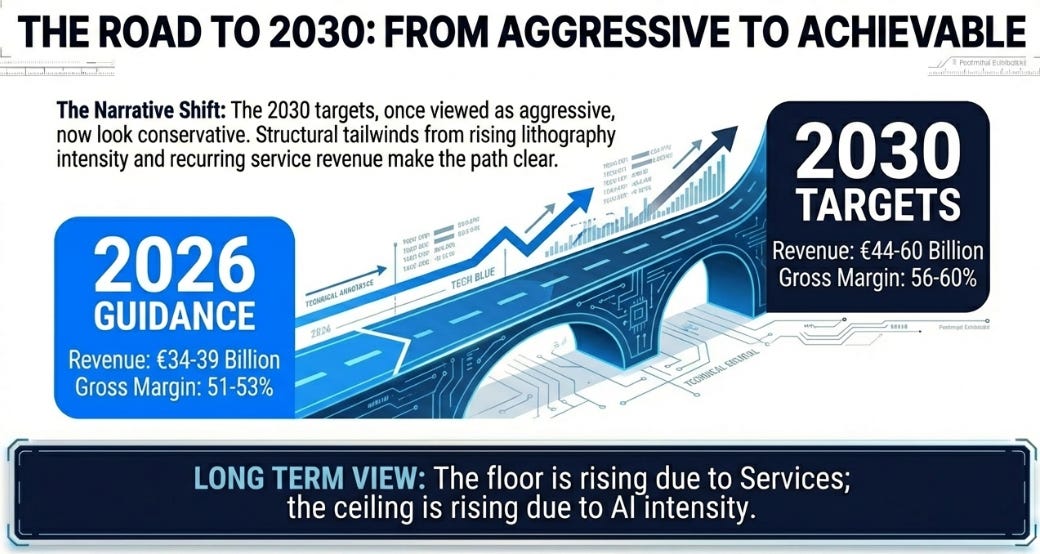

The 2030 targets , 56-60% gross margins at €44-60 billion revenue , require High-NA reaching scale economics and customer concentration easing through Intel’s foundry recovery or new entrants. Both are plausible but neither is guaranteed. Margins remain a “show me” story.

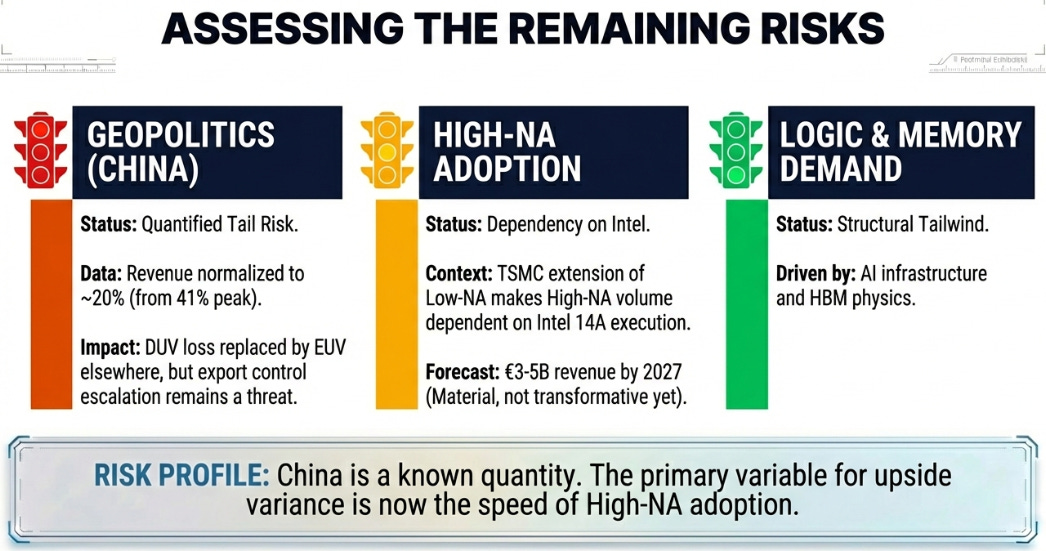

High-NA timing is uncertain.

Intel accepted their first EXE:5200B production tool. ASML recognized revenue on two High-NA systems in Q4. The technology works.

But TSMC’s decision to extend Low-NA for N2 and potentially A14 means High-NA volume depends heavily on Intel execution and Samsung adoption. If Intel 14A succeeds and wins external foundry customers, High-NA becomes a meaningful revenue driver by 2027-2028. If Intel struggles, High-NA remains a niche product for longer.

I expect €3-5 billion in High-NA revenue by 2027. That’s material but not transformative. The timing creates scenario dispersion that the market will price quarter by quarter.

China is quantified, not eliminated.

Management guided 2026 China revenue to approximately 20% of total , down from 41% at the 2024 peak but still significant. At €36.5 billion midpoint guidance, that’s roughly €7 billion annually.

The revenue being lost was primarily DUV (mature-node equipment). The revenue replacing it is primarily EUV (leading-edge equipment). The mix shift is margin-neutral to positive. But export control escalation remains a tail risk, and €7 billion from a geopolitically sensitive market is still €7 billion.

What To Watch

Five signals that will determine whether the super cycle thesis holds:

1. TSMC 2027 capex guidance. If TSMC sustains above $50 billion through 2027, the structural demand thesis is confirmed. If they guide materially lower, it’s the first crack.

2. DRAM EUV layer announcements. Watch Samsung and SK Hynix 2026-2027 node disclosures. If we see 8-10 layer announcements, memory becomes an even larger share of EUV demand.

3. High-NA customer expansion. Intel is the anchor. The question is who’s next and when. Watch for TSMC or Samsung tool acceptance announcements, which would signal faster adoption than base case.

4. IBM growth trajectory. Q1 2026 is guided to €2.4 billion. If that holds and grows through the year, the services flywheel is real. If it reverts toward €2 billion, Q4 included one-time items.

5. Backlog composition. With booking disclosures ending, watch backlog breakdowns in quarterly reports. Rising Memory % is bullish for EUV intensity. Stable China % above 20% might indicate license approvals.

The Bottom Line

In October, I asked whether ASML could navigate the transition without a stumble. In January, the customers answered with €13 billion.

The transition trap didn’t spring because AI demand arrived faster and stronger than anyone modeled. The backlog provides visibility. The services business provides stability. The memory inflection provides a growth driver beyond logic. And TSMC’s physics choices gave ASML more runway on mature, profitable products.

The risk has shifted from “will demand materialize?” to “can ASML execute?” That’s a better problem to have.

The market still prices ASML as a cyclical equipment company enjoying a strong upcycle. The data suggests something different: a monopoly with growing recurring revenue, multi-year demand visibility, and structural tailwinds from rising lithography intensity.

The 2030 targets , €44-60 billion at 56-60% margins , looked aggressive when announced. They now look achievable.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.