ASML Q3 2025: The Service Company Hidden in Plain Sight

Forget €5B bookings and High-NA hype — the real story is in footnote three, where ASML’s Install Base quietly prints €8B at 60% margins.

TL;DR

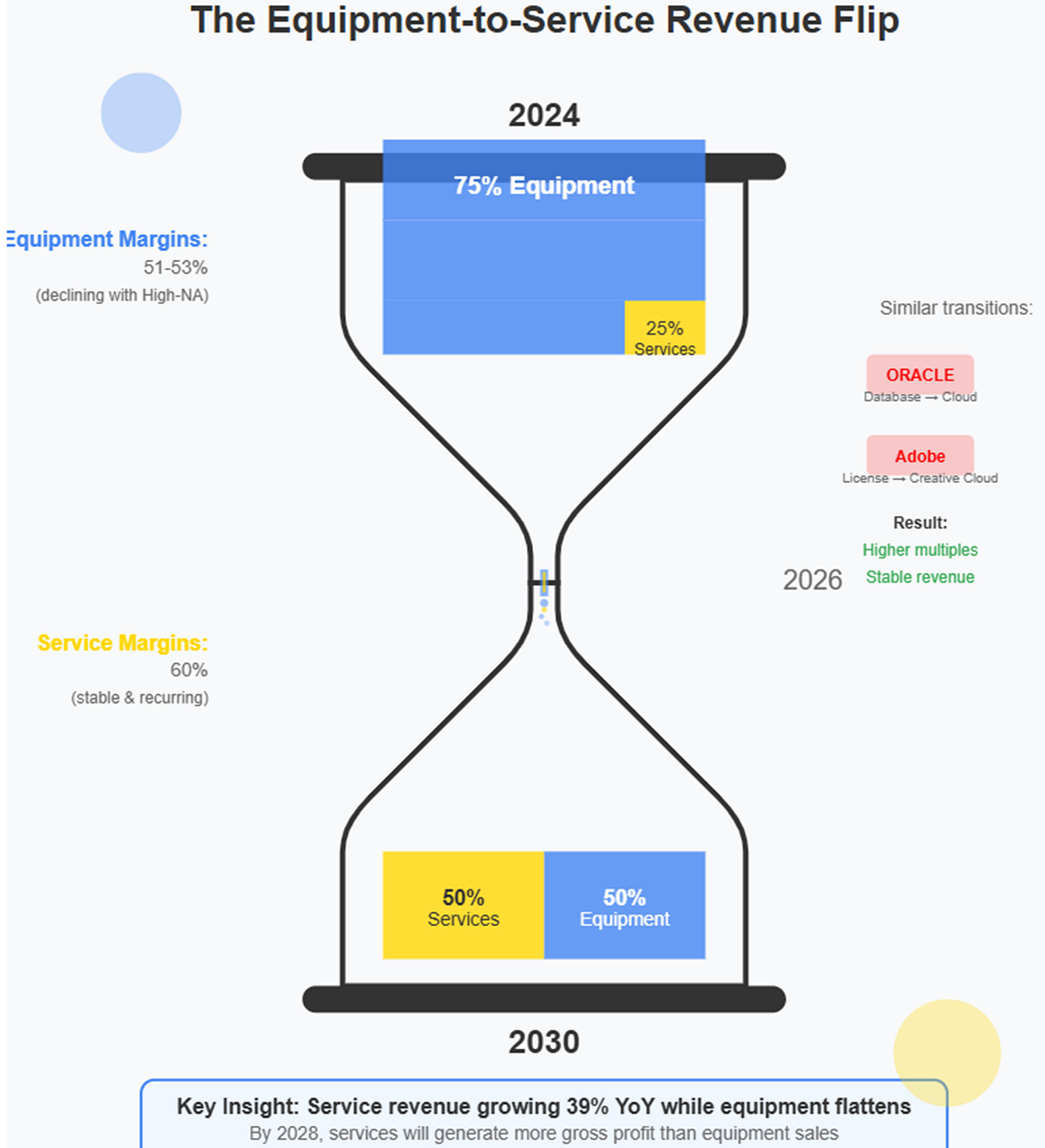

Services are stealing the show: ASML’s Install Base Management unit grew 39% YoY and now generates ~30% of total gross profit — with growth and margins that rival top SaaS businesses.

China’s exit, High-NA’s delay: Hardware sales are under pressure as China pulls back and TSMC delays High-NA adoption — but ASML’s service flywheel keeps spinning.

Short-term noise, long-term rerate: ASML is transitioning to a recurring revenue model, but the shift brings near-term turbulence that’s clouding the structural upside.

The Business Times celebrated ASML’s Q3 earnings with the enthusiasm typically reserved for a hot AI startup: “ASML Holding shares rose after it said the artificial intelligence boom is fueling demand for its cutting-edge chip-making machines.” The stock jumped 3.8%, everyone cheered the €5.4 billion in bookings, and analysts rushed to update their models.

They all missed the real story hiding in footnote three.

The Oracle Playbook

Here’s a thought experiment: What if I told you there was a company with a business unit growing 39% year-over-year, generating €8 billion annually at 60% margins, with virtually zero competition and decade-long customer contracts? You’d probably assume I was describing some SaaS unicorn.

You’d be wrong. I’m describing ASML’s “Install Base Management” business—essentially their service and upgrade division.

The market still prices ASML like they’re Applied Materials, a traditional equipment manufacturer subject to the brutal cycles of semiconductor capital spending. But look closer at those service numbers: IBM (yes, that’s what ASML calls their service business, not to be confused with the computer company) now generates €2 billion per quarter. At 60% margins, that’s €1.2 billion in quarterly gross profit.

To put this in perspective: ASML’s service business alone produces about 30% of the company’s total gross profit. By 2028, if current growth rates hold even partially, services will generate more gross profit than selling new machines.

This is the Oracle playbook in action—build an installed base of mission-critical systems, then monetize that base through high-margin recurring services. Larry Ellison would be proud.

The Perfect Storm of Transition

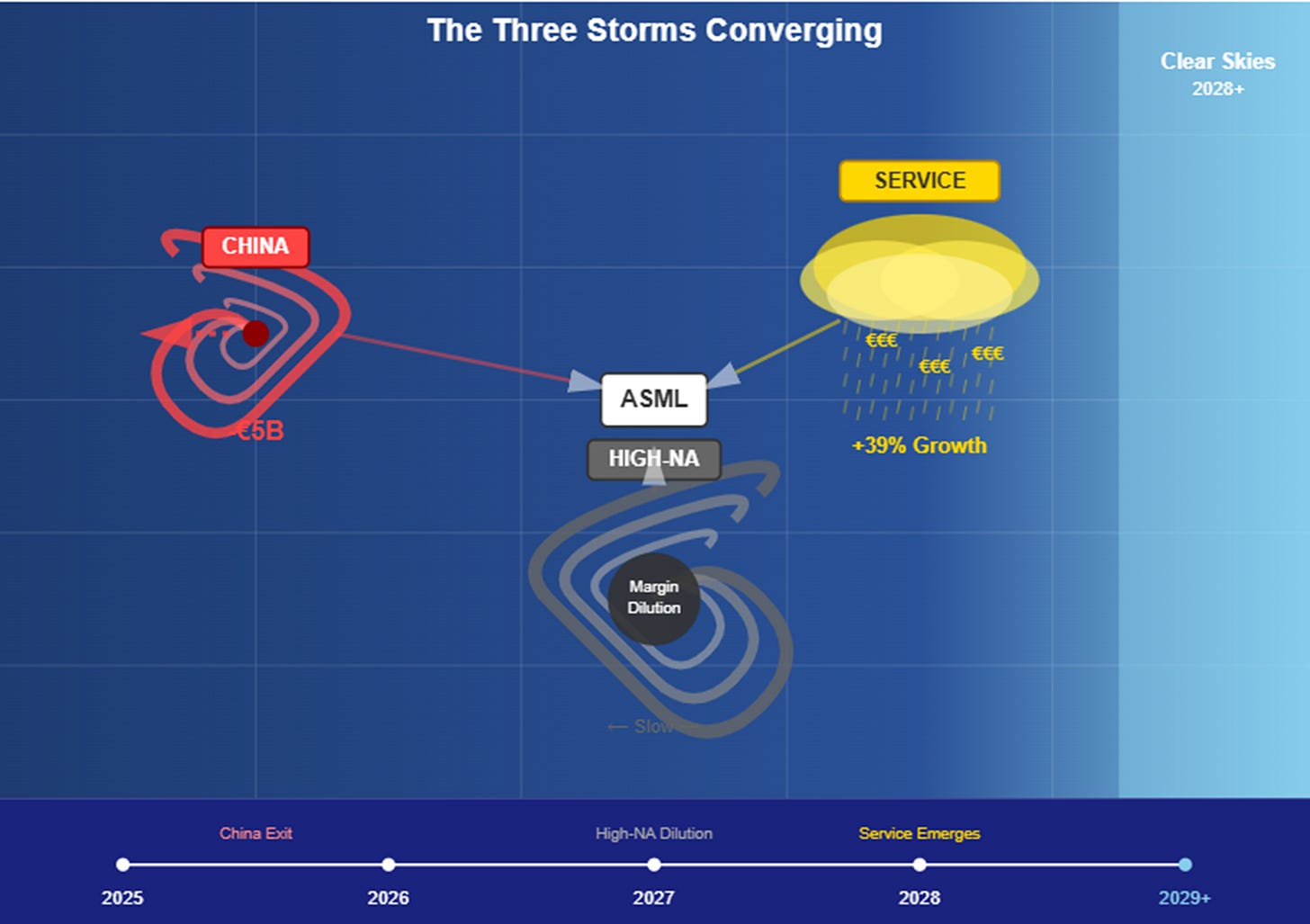

But here’s why the market can’t see it yet: ASML is caught in what I call a “transition trap.” Three massive shifts are happening simultaneously, each creating its own form of short-term turbulence that obscures the long-term value creation.

First, the China unwind. Second, the High-NA transition. Third, the service transformation itself. Any one of these would create quarterly noise. All three together? That’s a recipe for multiple years where the numbers look messy even as the business quality improves.

Let me explain why this matters.

The China Story Nobody Wants to Tell

China shipments dropped from 42% of system sales to 27% in a single quarter. That’s not a blip—that’s a collapse. CEO Christophe Fouquet tried to soften the blow with corporate speak: “we do not expect 2026 total net sales to be below 2025,” even as “China demand will decline significantly.”

Translation: We’re losing our second-biggest market, but we think we can make up for it elsewhere.

Here’s what’s really happening. For the past two years, Chinese chip manufacturers have been on a buying spree, grabbing every piece of advanced equipment they could before export restrictions tightened. Think of it like stockpiling toilet paper during early COVID, except each roll costs €200 million. That pantry-stuffing is ending, and ASML is staring at a €5 billion revenue hole over the next three years.

The fascinating part? Management seems remarkably calm about it. As one industry analyst noted in a recent report, “Chinese orders may decline from €8 billion annually to a €3 billion floor by 2028.” That’s a massive headwind, yet ASML guides for flat-to-up revenue.

Why? Because they’re playing a different game than the one Wall Street thinks they’re watching.

The High-NA Dilemma

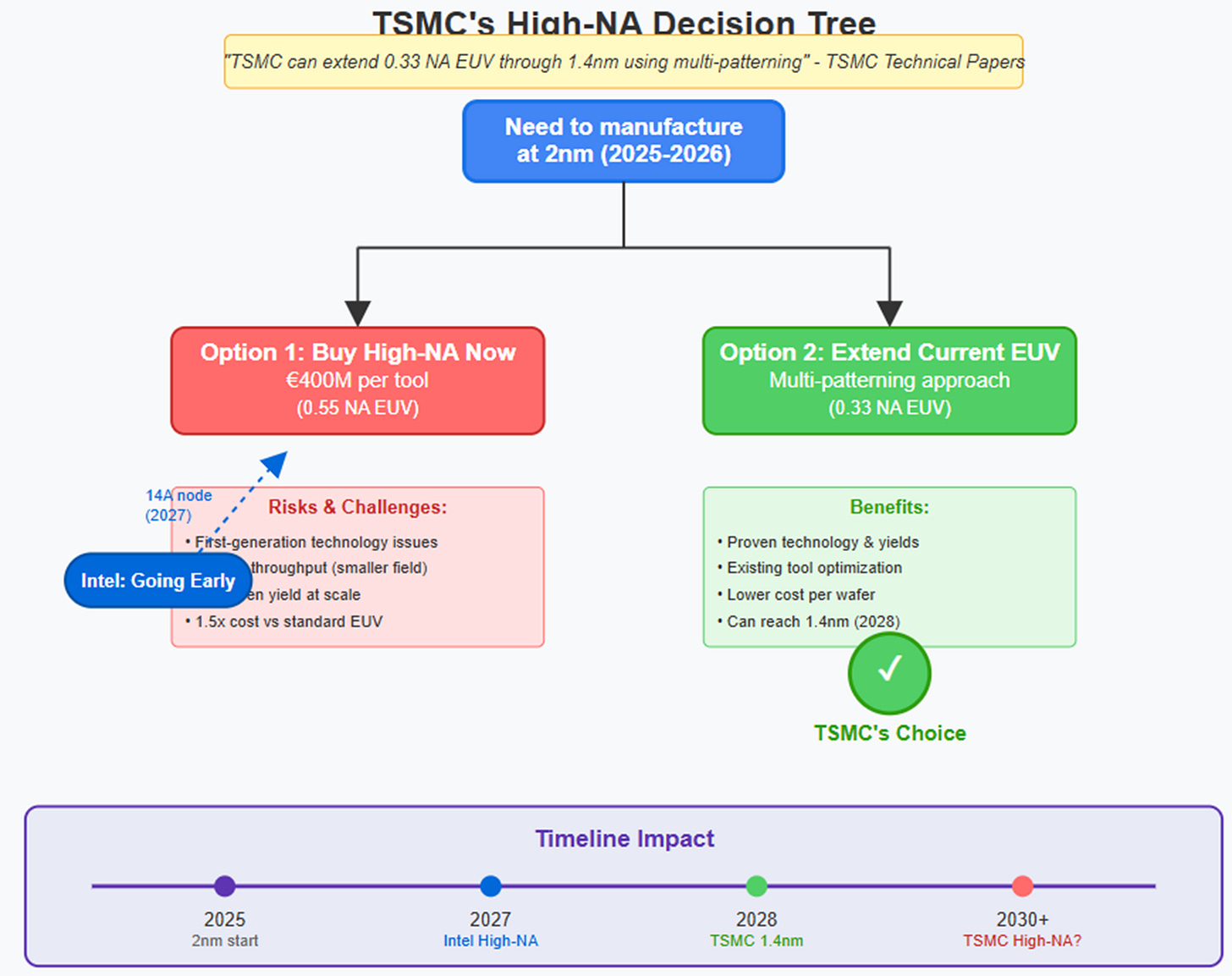

Silicon Valley has a saying: “The future is already here, it’s just not evenly distributed.” ASML’s High-NA EUV systems embody this perfectly. These machines, priced at €350-400 million each, represent the next generation of chip manufacturing. They work—Intel has already processed 300,000 wafers, and SK Hynix took delivery of the first production system.

But there’s a catch, and it’s a big one: TSMC isn’t buying yet.

Think about this from TSMC’s perspective. They’re the Tiger Woods of chip manufacturing—consistently excellent, methodically careful, never early to any technology party. Their engineers have figured out how to stretch current EUV systems through at least two more chip generations using clever techniques like multi-patterning. As TSMC explicitly stated, they won’t use High-NA EUV for their 1.4nm node in 2028, preferring to extend conventional EUV with multi-patterning innovations.

Why spend €400 million on a High-NA system when you can squeeze more life out of your €230 million low-NA machines?

This creates a timing problem for ASML. Every High-NA system shipped today is margin-dilutive—these early units are essentially very expensive beta tests. The company needs volume to drive down costs and improve margins, but they can’t get volume until TSMC commits, and TSMC won’t commit until they absolutely have to.

Intel’s betting the farm on High-NA for their 14A node in 2027, taking delivery of the first EXE:5200 tools. But one customer does not make a market. The bull case assumes 15+ High-NA tools shipping annually by 2030. The reality? More like 5-10, with Intel as the primary buyer through most of the decade.

It’s a classic adoption curve challenge, except each early adopter costs you margin points instead of generating them.

The Service Secret Multiplying in Plain Sight

Back to that footnote three—the one about Install Base Management hitting €8 billion annually.

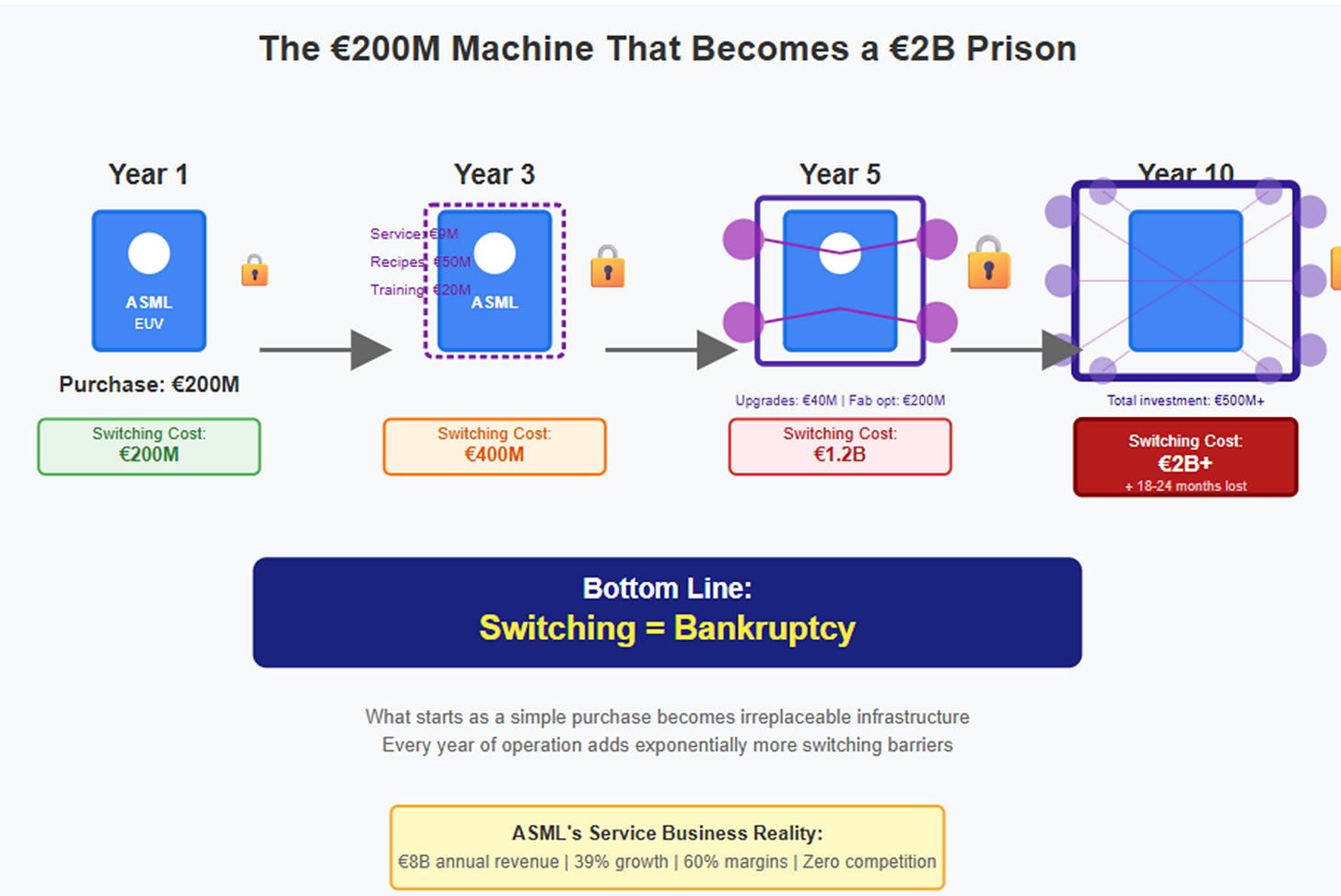

Every ASML EUV system is like a Formula 1 car: insanely complex, requires constant tuning, and becomes obsolete without continuous upgrades. ASML has brilliantly turned this complexity into a business model. Those 600+ EUV systems in the field each generate €2-3 million in annual service revenue, plus periodic €15-20 million upgrades that boost throughput by 30%.

Here’s the kicker: these aren’t optional services. If you’re TSMC or Samsung, and your competitor upgrades their ASML machines to run 30% faster, you have exactly two choices: upgrade or lose. There is no third option.

Remember when Microsoft moved Office to a subscription model? Same playbook, except ASML’s customers can’t switch to Google Docs. The switching costs approach infinity when your entire fab is built around ASML’s specifications.

CFO Roger Dassen mentioned almost in passing that the service business “benefited from strong service revenue on a growing installed base and higher upgrade revenue, notably the NXE:3800E productivity upgrade to 220 wafers per hour.” That’s like saying the iPhone “benefited from strong app store revenue.” It’s technically true but misses the transformative nature of the business model shift.

The AI Accelerant Nobody’s Quantifying

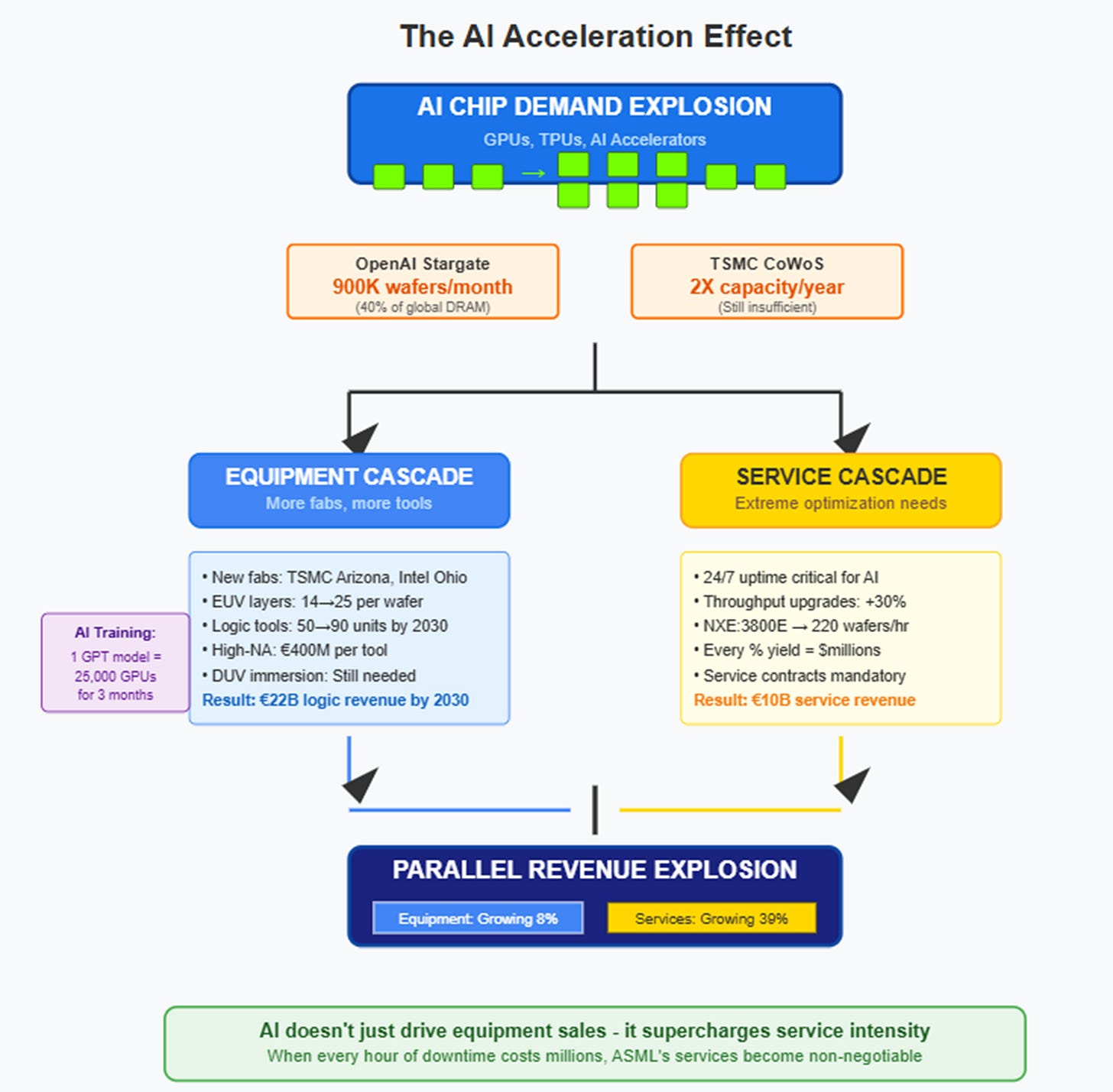

Here’s where it gets interesting. The AI boom isn’t just driving demand for new tools—it’s accelerating the service transformation in ways nobody’s modeling correctly.

Consider the math: TSMC’s CoWoS advanced packaging capacity is doubling in both 2024 and 2025, yet still can’t meet demand. OpenAI’s “Stargate” project could consume up to 900,000 DRAM wafers per month—that’s 40% of global output. These aren’t normal capacity expansions; they’re paradigm shifts that require extreme optimization of existing equipment.

When your customers are racing to squeeze every possible wafer out of their fabs, guess what becomes non-negotiable? Service contracts. Upgrades. Optimization packages. The same AI hunger that drives equipment sales also supercharges the service business.

SK Hynix projects the HBM market will grow 30% annually through 2030, reaching “tens of billions” in revenue. Every one of those HBM chips requires multiple passes through ASML’s most advanced tools. More complexity means more service revenue.

The Margin Mathematics

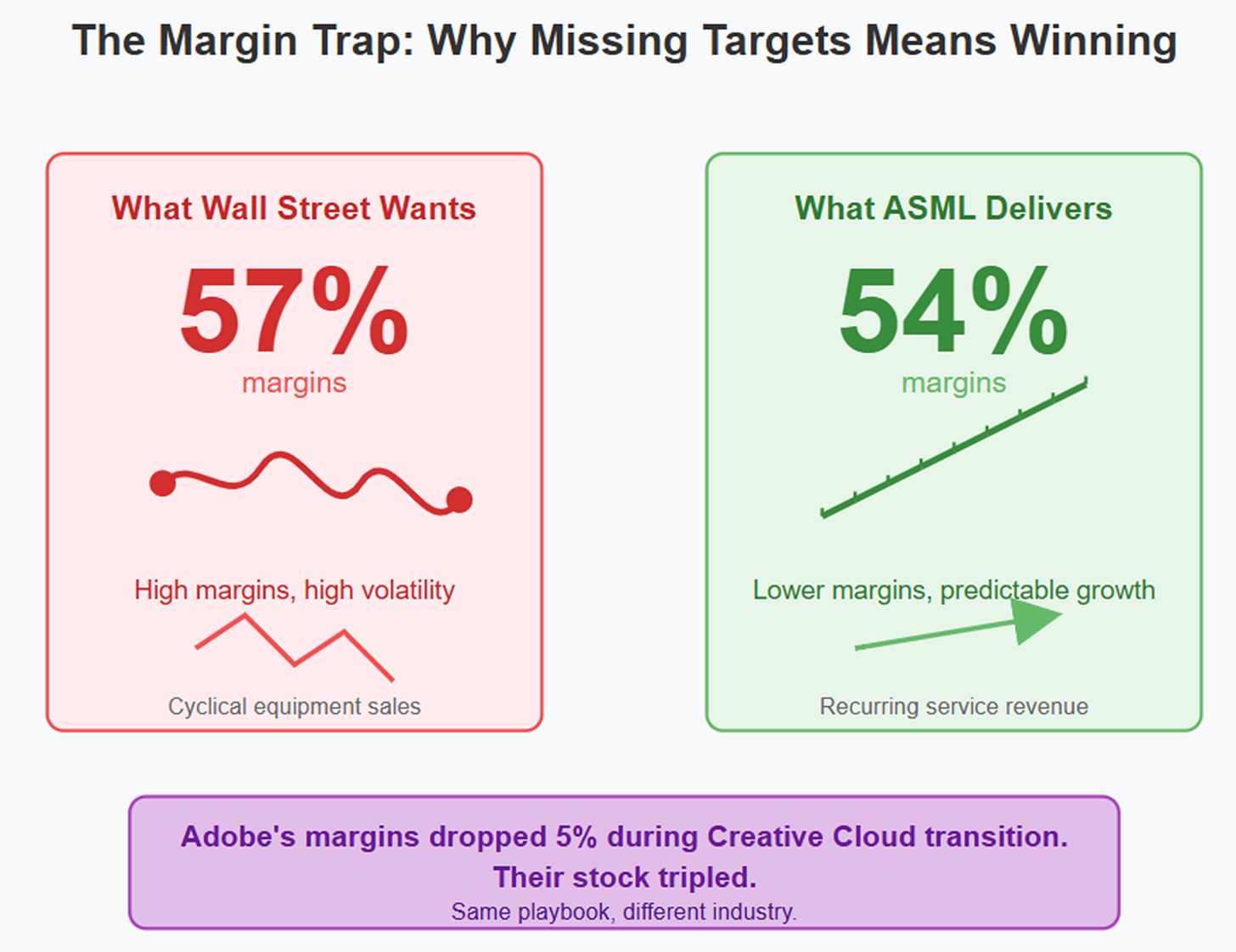

ASML’s management targets 56-60% gross margins by 2030. Let me save you the suspense: they won’t hit it. But that’s actually the good news.

Here’s why. Three forces are working against margin expansion:

First, the service business paradox. Yes, IBM generates 60% margins, which sounds great. But mature EUV equipment generates 58-60% margins too. As services grow from 25% to 35% of revenue, they’re actually slightly margin-dilutive. It’s profitable growth, but not margin-expanding growth.

Second, High-NA timing. These systems won’t hit profitable scale until 2028-29, not the 2026-27 that management hopes for. That’s two extra years of margin dilution from selling essentially prototype machines at production prices.

Third, the China mix shift. ASML is losing high-margin DUV sales to China (where they had pricing power due to limited competition) and replacing them with competitive EUV sales to Taiwan and Korea. Better customers, worse margins.

Add it up: realistic 2030 margins are 54%, not 57%+. On €50 billion in revenue, that three-point difference equals €1.5 billion in missing gross profit.

But here’s the twist: missing margin targets while building a recurring revenue business is exactly the pattern you want to see. Ask Adobe shareholders how they felt during the Creative Cloud transition.

Three Scenarios for 2028

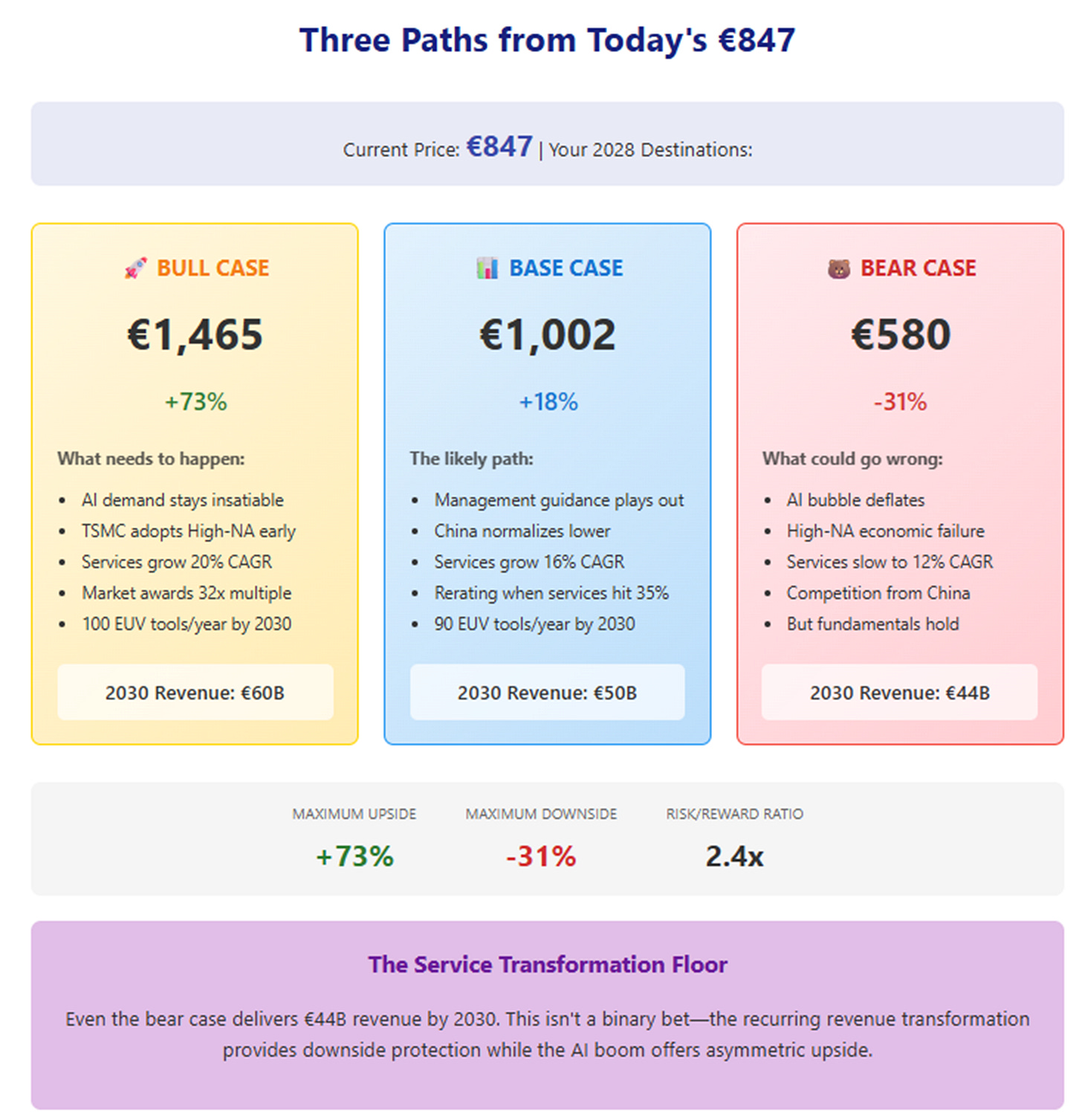

Let me paint three pictures of ASML’s future, with specific prices because precision matters in semiconductor equipment:

The Bull Case (€1,465/share): AI demand stays insatiable, High-NA takes off faster than expected, and the service business maintains 20% growth. TSMC decides they need High-NA for their 2027 nodes, triggering an industry-wide upgrade cycle. The market finally recognizes ASML as a services company and awards it a 32x multiple. Research shows logic customers could need 80-100 EUV tools annually by 2030, up from ~50 today.

The Base Case (€1,002/share): The next three years play out exactly as management is telegraphing. China normalizes lower, High-NA adoption is slow but steady, services grow at a merely excellent 16% annually. The stock muddles along until 2027, when services cross 35% of revenue and trigger a revaluation. EUV shipments rise to ~90 tools by 2030, with memory taking 15-20% as DRAM makers adopt 4-6 EUV layers per wafer. Classic “time arbitrage” opportunity.

The Bear Case (€580/share): AI infrastructure investment disappoints as companies realize their GPUs are sitting idle. High-NA proves to be a technical success but economic failure. Services growth slows to the merely good 12% range. But even here, the research suggests memory’s EUV adoption and 3D NAND scaling provide a floor—ASML still reaches €44 billion by 2030, just with a different mix.

The Standard Oil Parallel

John D. Rockefeller’s genius wasn’t in building oil refineries—lots of people could do that. His genius was recognizing that controlling oil transportation and distribution was more valuable than controlling production. Once Standard Oil owned the pipelines and distribution networks, it didn’t matter who pumped the oil.

ASML is executing the same playbook with semiconductors. Yes, they make the machines—but increasingly, their value comes from being the irreplaceable service provider for those machines. Every EUV system sold locks in a decade-plus relationship generating predictable, high-margin revenue.

The market valued Standard Oil as a refinery business long after it had become an infrastructure business. The revaluation, when it came, was dramatic.

The Bottom Line

At €847 per share, ASML is priced for disappointment during an awkward transition. The next 12-18 months will likely be frustrating—China headwinds are real, High-NA margins will disappoint, and revenue growth will slow. The stock could easily trade down to €750-800 as momentum investors flee.

That’s your opportunity.

The service transformation is real, irreversible, and underappreciated. By 2027-28, when Install Base Management crosses 35% of revenue and High-NA finally achieves scale, the market will suddenly “discover” that ASML is actually a high-margin recurring revenue business that happens to sell equipment.

The precision paradox remains: slowing equipment sales mask accelerating economic value. The market sees a cyclical downturn. The reality is a business model transformation.

As CEO Fouquet said, “We do not expect 2026 total net sales to be below 2025.” That’s not guidance—that’s a confession that even management doesn’t want to talk about how good the service business really is.

The short-term noise is real: margin headwinds, China unwind, High-NA growing pains. But this turbulence is precisely what’s creating the opportunity. When a monopoly infrastructure business trades at equipment manufacturer multiples during a model transition, patient capital wins.

Sometimes the best stories are hiding in the footnotes. Sometimes the biggest opportunities come disguised as disappointing transitions.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.