BAE : Too Strategic to Replace

Why BAE Systems Is Now the Irreplaceable Nerve Center of Western Military Integration

TLDR

BAE Systems has quietly transformed from a traditional defense contractor into the technological backbone of the Western alliance, integrating capabilities across land, sea, air, space, and cyber through programs like AUKUS and the Ball Aerospace acquisition.

Its enduring moat is built on trust, long-term institutional integration, and technological standardization, creating switching costs so high that replacing BAE would compromise allied interoperability and national security.

Investors are mispricing BAE as a cyclical contractor, when in fact it now operates with infrastructure-level economics, multi-decade visibility, and platform-like characteristics — offering asymmetric upside as the market catches up.

February 2022, a windowless conference room in Whitehall. Senior defense officials from the UK, US, and Australia surrender their phones into Faraday bags before entering. The conversation isn't about which company gets which contract - it's about which company can fuse three nations' defense ecosystems into a single technological spine.

"We're not just buying submarines," one official notes, reviewing classified briefing materials. "We're standardizing on an architecture."

BAE Systems isn't just winning the AUKUS submarine contract - they're being tasked with becoming the technological foundation that will connect allied defense capabilities for decades. The question that would reshape global defense markets was being answered in real-time: How did a British defense contractor become so essential that three governments are literally rebuilding their alliance around its capabilities?

Trust as Moat

The answer begins in 1940, on a factory floor in Yeovil where workers assembled Spitfires under blackout conditions. Britain's survival hung in the balance, and the company that would become BAE Systems was building the aircraft that would save it. Twenty-five years later, when Britain needed someone to build its nuclear deterrent submarines, they turned to the same company. When the Falklands War erupted in 1982, BAE's ships and aircraft were already in position.

This isn't a story about quarterly earnings calls or market share battles.

Trust in defense isn't built through PowerPoint presentations - it's built through decades of delivering when failure means national catastrophe.

BAE has been in the room for every existential Western defense decision since World War II, creating something far more valuable than customer relationships: institutional integration.

The institutional memory matters more than most investors realize.

When governments think "national security," they don't think about procurement processes or competitive bidding. They think about which companies have proven they can deliver when everything is on the line. BAE's advantage isn't just technical - it's testimonial.

“In defense, customer relationships aren't commercial partnerships - they're survival dependencies that create switching costs measured in decades, not dollars.”

The Quiet Rebuild

While the world watched the war in Ukraine unfold in 2022, BAE Systems was executing one of the most sophisticated corporate transformations in modern defense history. But unlike most strategic pivots, this one was designed to be invisible.

In 2020, facing the pandemic crisis, CEO Charles Woodburn told investors:

"Unless there is a significant resurgence in COVID-19, we see the financial impact has been largely contained to the first half."

It was classic crisis management speak - careful, measured, defensive.

Fast-forward to 2024, and Woodburn was reporting record results: £28.3 billion in revenue, £3.015 billion in EBIT, and a £78 billion backlog. The transformation was complete.

Everyone saw BAE getting bigger. Few noticed it was becoming something fundamentally different. The sleight of hand was masterful: while competitors focused on winning individual contracts, BAE was repositioning itself as the technological spine of the Western alliance.

What actually happened between 2020 and 2024 was a systematic evolution:

From hardware supplier to capability integrator

From defense contractor to allied infrastructure

From British company to the technological foundation of Western deterrence

The Ball Aerospace acquisition in February 2024 wasn't just the largest deal in BAE's history - it was the final piece of a strategic puzzle that had been years in the making.

While analysts debated integration risk and cost synergies, BAE was quietly building something unprecedented: a vertically integrated stack spanning land, sea, air, space, and cyber domains.

BAE executed a strategic transformation disguised as business-as-usual expansion.

Building the Layers

Understanding what BAE has become requires thinking in terms of technological layers, each building on the foundation below.

Industrial Bedrock

At the base layer sits the traditional moat: nuclear submarine shipyards, security clearances, and manufacturing infrastructure that took decades to build. Only four companies globally can build nuclear submarines. BAE controls two of those capabilities. Try to replicate BAE's Barrow shipyard, and you're looking at a 15-year, multi-billion-pound investment - assuming you can get the security clearances.

This isn't just about manufacturing capacity. BAE's security clearances span 40+ government customers across five continents. The company maintains classified facilities from Scotland to South Australia, each one representing years of security reviews and relationship building. Competitors can't simply acquire these capabilities - they have to earn them over decades.

Sensor Nervous System

The Ball Aerospace acquisition added the hidden moat: space-based sensors that create the "eyes and ears" of modern warfare. Ball's satellites don't just take pictures - they create the information architecture that enables everything else. Electronic warfare systems, AI-driven decision making, multi-domain integration - all of it depends on having the right sensors in the right places.

This is where BAE's transformation becomes visible. Traditional defense companies sell products.

BAE is building the nervous system that connects products into capabilities. The $3.7 billion Ball Aerospace backlog, growing 25% annually, represents more than revenue - it represents information superiority.

Alliance Protocol

At the top layer sits the strategic moat: technological standardization across allied nations. AUKUS isn't just a submarine program - it's technological integration across three nuclear powers. GCAP extends similar integration to Japan and Italy. Each alliance integration makes BAE more valuable to all allies, creating network effects that would make a Silicon Valley platform company jealous.

Consider the switching costs. If Australia wanted to replace BAE on AUKUS, they wouldn't just be changing suppliers - they'd be breaking technological compatibility with the UK and US nuclear submarines. The submarines BAE builds for all three nations will share common systems, training protocols, and operational procedures. Lock-in doesn't get more complete than this.

BAE isn't just selling weapons - it's building the technological infrastructure that defines how allied nations fight together.

Defense Operating Layer Hidden in Plain Sight

Here's what investors miss: BAE's business model has fundamentally changed, but it's hidden in plain sight.

Traditional defense contracting works like this: Government needs a tank, company builds a tank, contract ends.

BAE's model works differently: Government needs capability, BAE provides integrated solution across domains, capability evolves continuously. The difference isn't just commercial - it's existential.

Evidence is everywhere once you know what to look for. BAE's £78 billion backlog represents more than three years of revenue visibility, with 87% under multi-year framework agreements. These aren't discrete contracts for specific hardware - they're capability partnerships with built-in upgrade cycles. The UK's Dreadnought submarine program runs to the 2040s. AUKUS extends even further.

The revenue model transformation is subtle but profound:

Old model: Discrete contracts for specific hardware

New model: Multi-decade capability partnerships with continuous upgrades

The result: Switching costs that are national security risks, not sourcing decisions

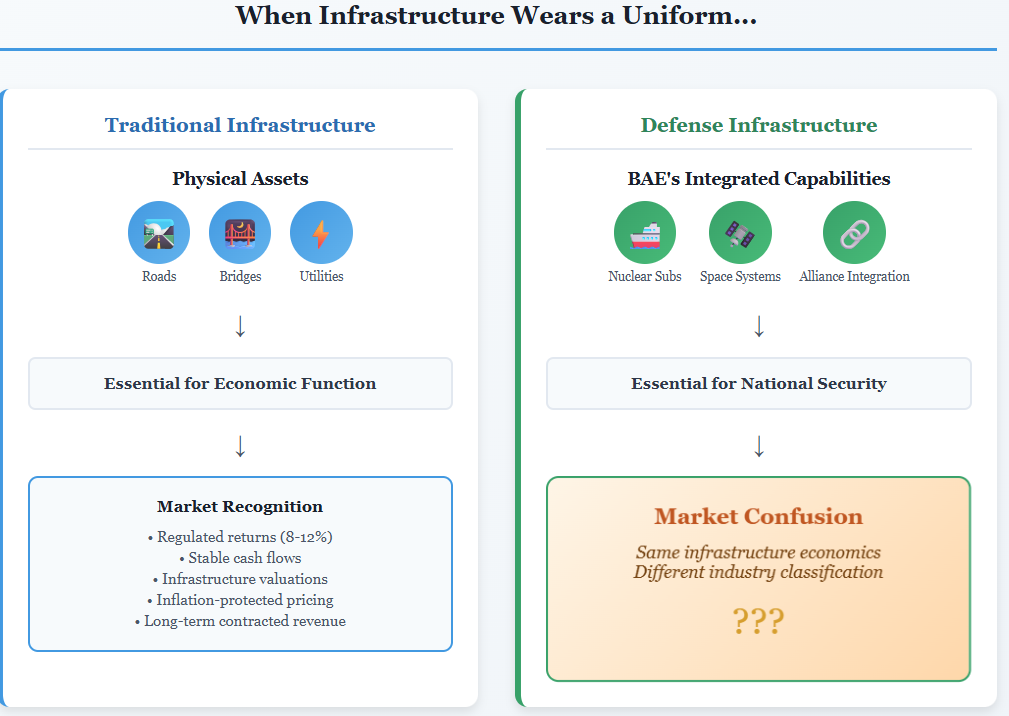

Traditional defense investors look at BAE and see a well-run contractor with good margins. Technology investors might recognize the platform dynamics if they squinted. Neither group fully grasps what BAE has become: a defense operating system with infrastructure characteristics.

Once governments standardize on a deterrence stack, churn is a national-security risk, not a sourcing decision.

The Contrarian Investment Thesis

The market sees a premium defense contractor trading at 25x P/E, benefiting from elevated defense spending. The valuation reflects quality execution and a diversified portfolio, but treats BAE as fundamentally cyclical - dependent on government spending cycles and geopolitical tensions.

What's actually happening is more interesting. BAE has achieved quasi-monopolistic positioning in critical defense infrastructure while developing technology platform characteristics. The government lock-in effects create switching costs that go far beyond normal customer relationships. When national security depends on your systems, you're not just a supplier - you're strategic infrastructure.

The asymmetric bet is compelling:

If the transformation thesis is right: Infrastructure valuations (35-40x P/E) justify £31-34 price targets, representing 65% upside

If we're wrong: BAE remains a high-quality defense contractor with strong cash flows, supporting £24-27 base case targets

The catalyst: Market recognition as technology integration becomes undeniable over the next 18-24 months

This isn't about defense spending cycles anymore. BAE has positioned itself as essential infrastructure for allied defense cooperation. The switching costs are existential, the competitive moats are multi-layered, and the growth runway extends decades into the future.

BAE offers infrastructure returns disguised as defense contractor risk.

Numbers That Matter

The financial metrics tell the story of transformation, but you have to know which numbers matter.

Infrastructure investors care about capital efficiency and cash generation: 19.4% ROE, 23.8% ROIC, and £2.5 billion in free cash flow on £28.3 billion revenue. These are exceptional returns for any business, let alone one managing multi-billion-pound government contracts. The 20 consecutive years of dividend increases signals management confidence in sustainable cash generation.

Technology investors focus on growth and reinvestment: 14% revenue growth, 14.4% EBIT growth in 2024, and a 30% increase in R&D investment targeting quantum computing, AI, and space systems. The Ball Aerospace integration is creating new revenue streams while the technology investments are building tomorrow's competitive advantages.

But the numbers that really matter are the ones other investors don't track: 87% of revenue under multi-year framework agreements, 40+ government customers creating geographic diversification, and program commitments extending to the 2040s. These metrics capture the lock-in effects and switching costs that define infrastructure businesses.

BAE generates infrastructure-quality cash flows with technology-level growth rates.

Risks That Keep You Honest

No investment thesis is complete without honest risk assessment, and BAE's transformation creates both traditional and novel risks.

The geopolitical dependency is real and unavoidable. The bull case requires sustained global tension, technological competition between great powers, and continued prioritization of defense spending. A genuine "peace dividend" - however unlikely it seems today - could crater the entire thesis. Geographic diversification and dual-use technology development provide some mitigation, but can't eliminate this fundamental dependency.

Execution risk compounds as BAE manages AUKUS, GCAP, and Ball Aerospace integration simultaneously. Defense programs are historically prone to cost overruns and schedule delays. BAE's proven track record and customer risk-sharing agreements provide confidence, but managing this level of complexity tests any organization's capabilities.

Technology disruption represents a more subtle but potentially existential threat. Silicon Valley defense entrants like Anduril are winning contracts by bringing different approaches to traditional problems. Could BAE become the Nokia of defense - dominant until suddenly obsolete? Security clearance barriers, integration complexity, and government relationships provide protection, but technology evolution is inherently unpredictable.

BAE's moats are strong but not impenetrable - execution and geopolitical stability remain key dependencies.

Catalysts on the Horizon

Multiple catalysts over the next 18-24 months could validate the transformation thesis and drive market recognition.

Near-term catalysts (6-12 months) include AUKUS submarine production timeline announcements and share buyback acceleration as BAE completes its £1.5 billion program. These events would demonstrate both strategic progress and capital allocation confidence.

Medium-term catalysts (12-18 months) center on Ball Aerospace revenue synergies and the first integrated space-defense contract wins. Success here would prove that the acquisition created genuine technological advantages rather than just scale.

Longer-term catalysts (18-24 months) include technology breakthrough commercialization and potential additional strategic acquisitions. BAE's increased R&D spending should begin yielding tangible results, while continued industry consolidation could present new opportunities.

The meta-catalyst underlying everything else is market recognition that BAE has become strategic infrastructure disguised as a defense contractor. This realization could drive significant multiple expansion as investors apply infrastructure valuation frameworks rather than traditional defense metrics.

Multiple near-term catalysts create sustained re-rating opportunity over 18-month horizon.

Scenario Analysis: Returns from Current Price

At the current price of £19.08, BAE offers attractive risk-adjusted returns across multiple scenarios.

The bull case targets £31.00 (62% total return, 17.3% IRR) based on 2027 EPS of £1.15 and 27x P/E multiple expansion. This requires Ball Aerospace exceeding expectations, technology platform re-rating, and SMS margins exceeding 12%. The probability may be only 25%, but the magnitude creates significant upside optionality.

The base case targets £25.20 (32% total return, 9.6% IRR) assuming steady execution of current strategy, continued elevated defense spending, and maintained quality premium at 24x P/E. With 50% probability, this represents the most likely outcome and delivers attractive returns even without multiple expansion.

The bear case drops to £15.70 (-18% total return, -6.5% IRR) on geopolitical de-escalation, integration failures, and multiple compression to 16x P/E. While concerning, the downside magnitude is manageable compared to the upside potential.

Risk-adjusted expected return across all scenarios is approximately +27% total return (~8.1% annual IRR), with an asymmetric 3.4:1 upside/downside ratio. The key tracking metrics - book-to-bill ratio above 1.05x, SMS margins trending toward 12%, AUKUS milestone achievement, and EBIT margin expansion above 11% - provide clear validation points for thesis evolution.

When Infrastructure Wears a Uniform

That February 2022 meeting in Whitehall wasn't just about submarines. It was about creating a new kind of defense architecture - one where technological integration matters more than manufacturing capacity, where alliance interoperability trumps national industrial champions, and where the company that connects capabilities becomes more valuable than those that create individual components.

BAE didn't just win AUKUS. The allies redesigned their defense relationship around BAE's capabilities. From Spitfires to space sensors, BAE has always been in the room where allied defense decisions are made. The difference now is that they're not just implementing the decisions - they're providing the technological infrastructure that makes the decisions possible.

The investment insight is profound but subtle. Traditional defense investors see cyclical exposure to government spending. Technology investors might recognize platform dynamics. Neither fully grasps that BAE has achieved something unprecedented: strategic infrastructure status in an industry where infrastructure was supposed to be impossible.

The market will eventually recognize what BAE has become. The catalysts are in place, the metrics are measurable, and the competitive advantages are defensible. The only question is timing - and whether investors are positioned when the recognition occurs.

When infrastructure wears a uniform, how should markets value it? The answer, increasingly, is not as a defense contractor at all.

#DefenseTech #Geopolitics #BAESystems #AUKUS #AlliedDefense #Investing #PlatformEconomy #NationalSecurity #InfraInvesting #Substack #DefenseSpending #BAE #AUKUS #DefenseTech #Geopolitics #Investing #DefenseStocks #NATO #InfraTech #MilitaryTech

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.