Baidu: The Elephant's Dance

Baidu’s Journey from Search Dominance to Full-Stack AI — and the Strategy That Echoes IBM’s Comeback

TL;DR:

Baidu is intentionally dismantling its search business — once its cash cow — to build a vertically integrated AI stack, echoing IBM’s radical pivot under Lou Gerstner in the 1990s.

The transformation is already underway: AI-generated results now power 22% of Baidu searches, inference costs have dropped 99%, and ERNIE API calls are growing exponentially — all signs of strategic execution.

Investors misunderstand the shift: While markets see revenue cannibalization, the real value lies in Baidu’s full-stack AI infrastructure, which could position it as China’s foundational AI platform — if it completes the dance.

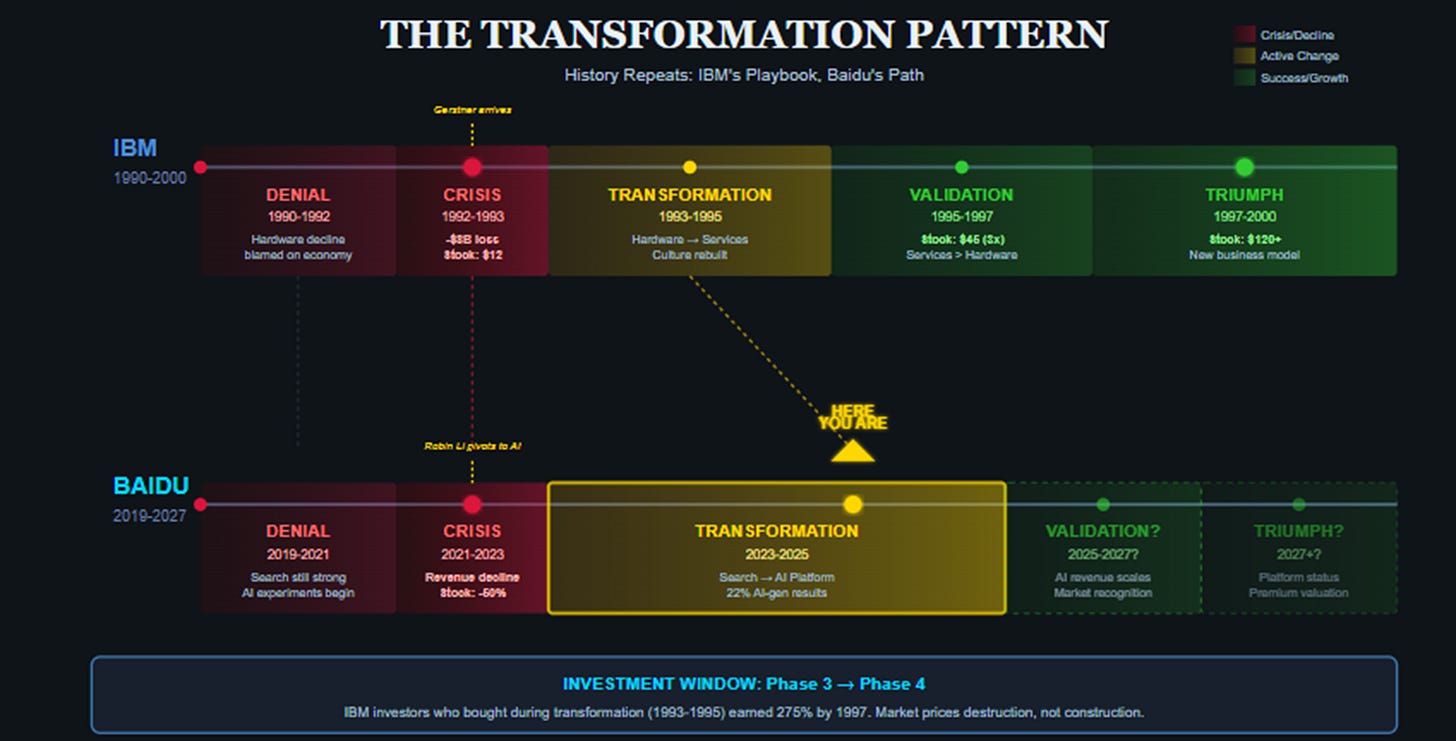

How IBM’s Playbook Predicts Baidu’s Future

In March 1993, Lou Gerstner walked into IBM’s Armonk headquarters as the company’s new CEO, carrying the weight of an impossible task. IBM — once the undisputed king of corporate computing — was bleeding $8 billion annually. The stock had collapsed 75% from its peak, trading at just $12 per share. The board was days away from approving a breakup plan that would have scattered Big Blue into a dozen irrelevant pieces.

The problem was fundamental: IBM’s identity was inseparable from hardware excellence. For eight decades, the company that Thomas Watson built had defined enterprise computing through beautiful, expensive machines. The System/360 mainframe, launched in 1964, remained the gold standard of corporate computing. IBM’s dress code — dark suits, white shirts, conservative ties — reflected the precision and reliability of their hardware. When those machines became commodities, IBM kept building them anyway, watching gross margins collapse from 55% to 35% while clinging to a business model that no longer worked.

Gerstner, an outsider from American Express and RJR Nabisco, saw what insiders couldn’t: IBM’s value wasn’t in the boxes they shipped but in the problems they solved. The relationships with every Fortune 500 company. The deep technical expertise accumulated over decades. The trust earned through millions of mission-critical implementations. These assets could anchor a completely different business — if IBM had the courage to cannibalize itself.

The resistance was fierce. IBM’s hardware division heads, who controlled the company’s power structure, saw services as beneath them — the domain of consultants and contractors, not serious technologists. When Gerstner proposed making services the center of IBM’s strategy, one executive reportedly said, “We’re engineers, not janitors.”

“The hardest thing was not the strategy,” Gerstner would later write in his memoir. “It was getting an organization to abandon the very thing that made it successful.”

By 1997, IBM’s stock had tripled to $45. Services revenue exceeded hardware for the first time. The company that almost died became more valuable than at its hardware peak. The transformation worked because Gerstner understood a fundamental truth: sometimes you must destroy what you built to create what you need.

Three decades later, another technology giant faces the same existential choice.

The Parallel Crisis

Baidu in 2024 looks remarkably like IBM in 1993. The numbers tell a story of slow-motion crisis. Search advertising revenue, which represents roughly 60% of total revenue, declined 2% year-over-year in Q2 2024. The stock trades at 14 times forward earnings — a valuation that screams terminal decline when U.S. tech giants command multiples twice as high. The sacred cow of 70% Chinese search market share provides less milk each quarter as users shift to in-app search, social commerce, and AI assistants.

But the parallels run deeper than financial metrics. Like IBM’s hardware in 1993, Baidu’s search in 2024 faces commoditization by fundamental technological shifts. The open web that search was built to organize is disappearing. ByteDance’s Douyin, Alibaba’s Taobao, Tencent’s WeChat — each creates a walled garden where Baidu’s crawlers cannot reach. The Chinese internet is becoming a collection of super-apps, not websites.

More fundamentally, user behavior has evolved beyond the search box paradigm. A new generation doesn’t “search” for restaurants — they browse Meituan. They don’t “search” for products — they scroll Douyin’s recommendation feed. They don’t even conceptualize “searching” as a distinct activity. Intelligence should be embedded everywhere, not accessed through a dedicated interface.

Robin Li, Baidu’s founder and CEO, faces Gerstner’s dilemma with Chinese characteristics. Unlike Gerstner, Li built the company he must now transform. He wrote the original algorithms, hired the first engineers, and defined the culture that made Baidu synonymous with Chinese search. Asking him to destroy search is like asking a parent to demolish their child’s accomplishments.

Yet the evidence suggests Li has made the hardest choice. Baidu isn’t trying to save search. They’re using it to fund its replacement.

The Wrecking Ball

Every earnings call tells the same story through carefully buried metrics. Management never headlines these numbers — you have to dig through transcripts and piece together the narrative. In May 2024, buried on page 15 of the earnings call transcript, management mentioned that 11% of search results now include AI-generated content. Not enhanced or augmented — generated. Created from nothing by ERNIE, Baidu’s large language model.

By August 2024, that number reached 18%. By November: “over 20%.” By February 2025: 22%. Plot these points on a graph and the trajectory becomes clear. Within 18 months, half of all Baidu searches will bypass the traditional ten blue links entirely.

Each percentage point represents millions of traditional search queries that will never happen. When ERNIE directly answers “What’s the weather in Beijing?” or “How do I cook Kung Pao chicken?” or “Explain quantum computing simply,” users get their answer and leave. No clicking through results. No browsing multiple sites. No ad impressions on subsequent pages.

The economic impact is staggering. Baidu’s search advertising operates on a cost-per-click (CPC) model. No clicks means no revenue. A search that previously generated three page views and five ad impressions now generates zero. Multiply this by hundreds of millions of daily queries, and you’re watching a business model commit suicide in real-time.

This isn’t optimization or enhancement. This is controlled demolition.

The bear case writes itself, and sell-side analysts repeat it with increasing alarm. Bernstein’s latest note calculates that every 10% increase in AI-generated answers reduces search revenue by 3-4%. At current trajectory, that’s a 15% revenue headwind by 2026. “Baidu is cannibalizing high-margin search revenue for uncertain AI monetization,” their analyst writes. “Management provides no clear timeline for when AI revenues will offset search declines.”

The market agrees. While the Nasdaq climbs to record highs and U.S. AI stocks command premium valuations, Baidu stock declined 30% year-over-year. At HKD 139.70, it trades at valuation multiples typically reserved for dying businesses, not AI leaders.

But markets consistently misprice transformations in progress. They excel at pricing steady-state businesses but struggle with companies deliberately destroying one model to build another. The market sees destruction. It doesn’t yet see what’s being built in the rubble.

The Hidden Foundation

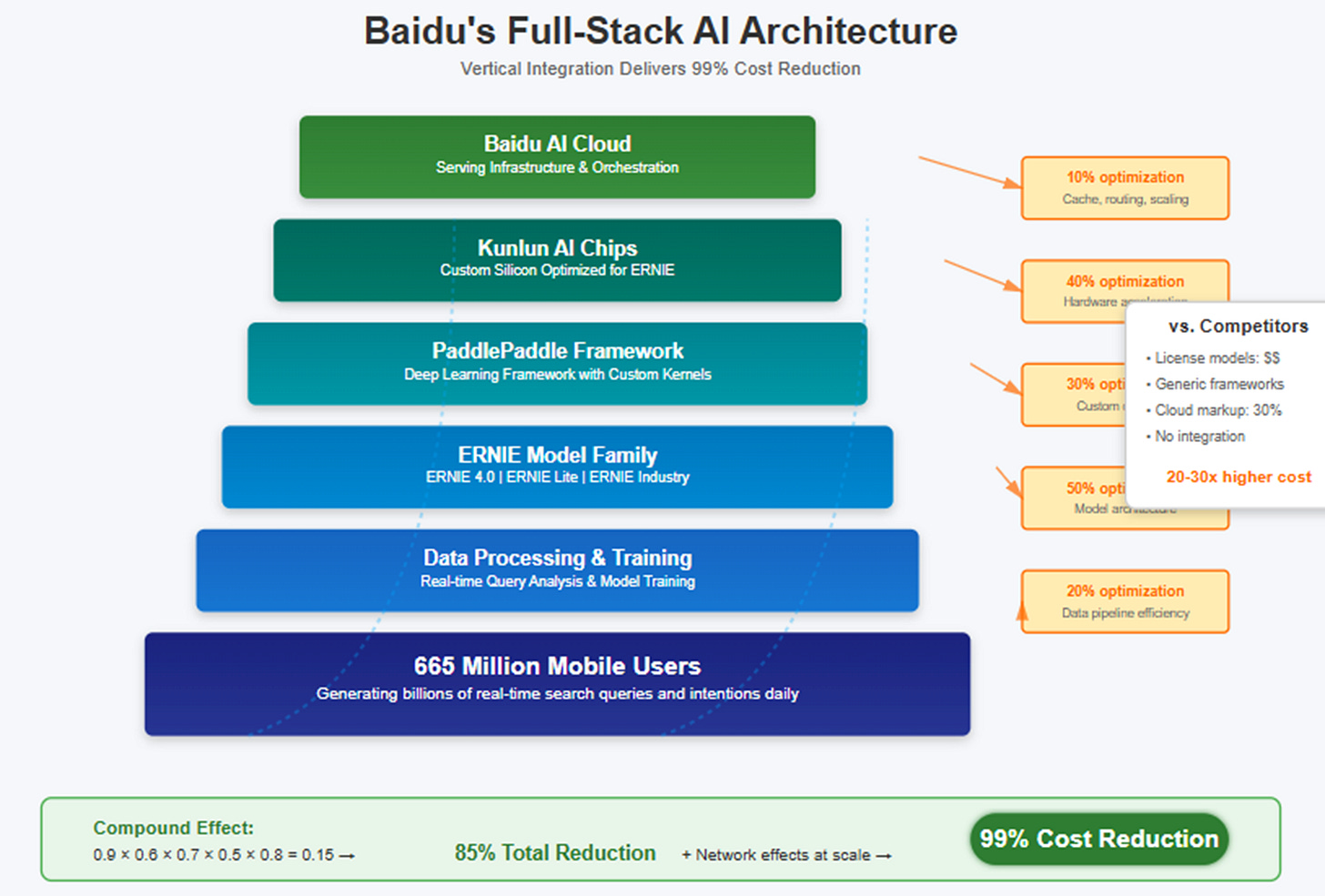

Beneath the demolition, Baidu constructs something unprecedented in Chinese technology: a fully integrated AI stack that compounds advantages at every layer. This isn’t visible in financial statements or press releases. You have to piece it together from technical papers, developer documentation, and scattered management comments across multiple quarters.

Start with the foundation: 665 million mobile users generating billions of daily intentions. Not just queries — intentions. When someone searches “stomach pain midnight Beijing,” they’re not looking for information. They’re seeking help. When they search “divorce lawyer Shenzhen fees,” they’re contemplating life changes. This real-time stream of human need, desire, and curiosity trains models that no competitor can replicate.

ByteDance knows what videos you watch. Alibaba knows what products you buy. But Baidu knows what you’re thinking about before you act. That’s irreplaceable training data for artificial intelligence.

Layer up to ERNIE, the large language model family now processing 1.5 billion API calls daily. For context, that’s up from 200 million in April 2024 — a 650% increase in eight months. OpenAI, with global reach and first-mover advantage, reportedly handles about 3 billion daily API calls. Baidu, confined to Chinese language and China’s market, already operates at half that scale.

But explosive usage only tells part of the story. The real advantage comes from cost.

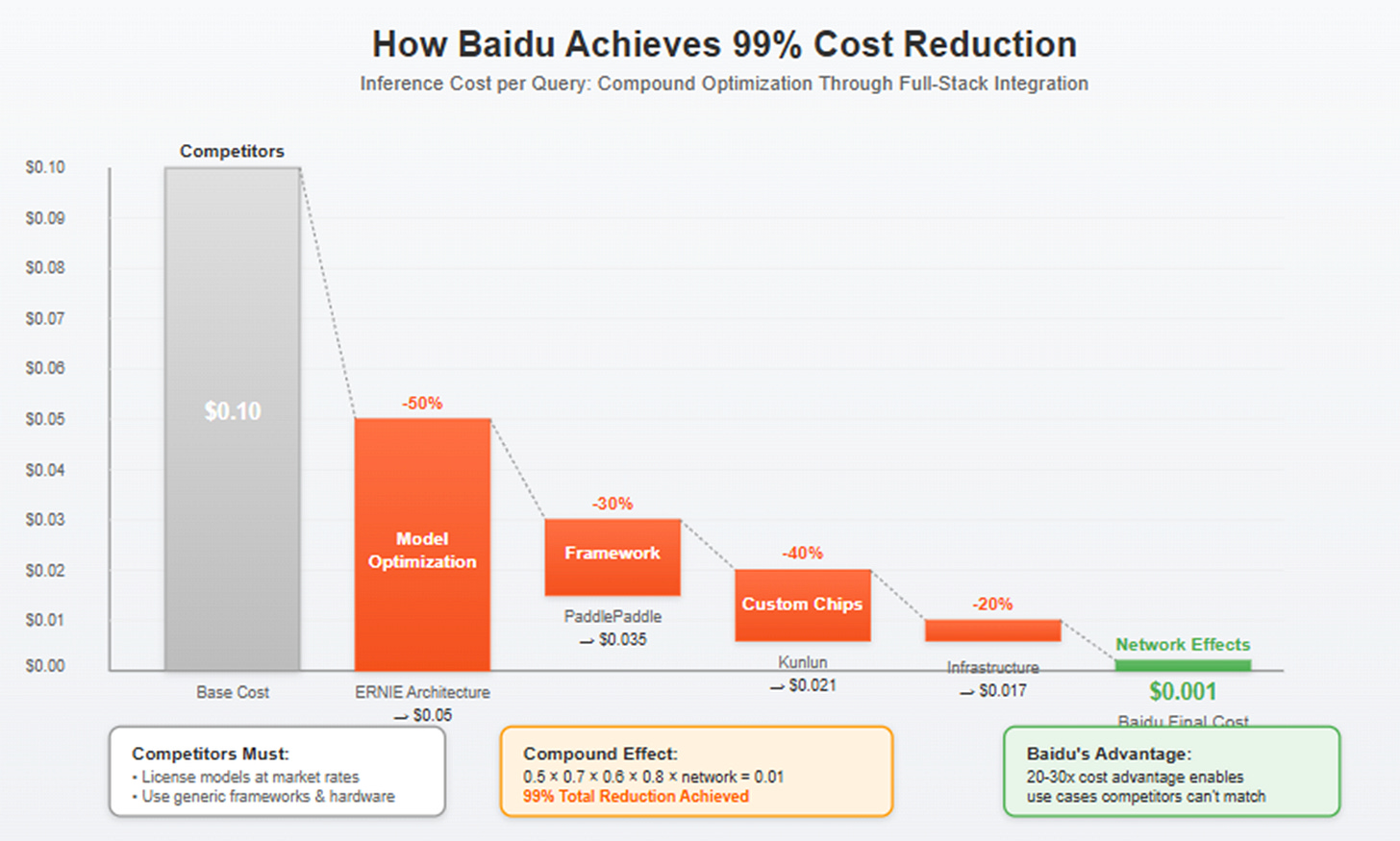

Since March 2023, Baidu has reduced inference costs by 99%.

This deserves repetition because it’s so extraordinary that readers might assume it’s marketing exaggeration. The cost to process an AI query has fallen from roughly 10 cents to 0.1 cents. At scale, this changes everything. AI interactions that were economically impossible at 10 cents become profitable at 0.1 cents. Use cases that required $100 in compute now cost $1.

How? Through the compound effect of owning every layer of the stack:

The Model Layer: ERNIE 4.0 isn’t just another large language model. It’s architected specifically for Chinese language, which requires different tokenization, different attention mechanisms, and different training approaches than English-optimized models. More importantly, it’s designed from the ground up for efficient inference rather than benchmark performance.

The Framework Layer: PaddlePaddle, Baidu’s deep learning framework, optimizes specifically for ERNIE’s architecture. While competitors must use general-purpose frameworks like PyTorch or TensorFlow, Baidu can optimize across the framework-model boundary. Specific optimizations include custom kernels for attention mechanisms, optimized memory allocation for Chinese token patterns, and hardware-specific acceleration.

The Hardware Layer: Kunlun chips, Baidu’s custom AI processors, are designed specifically for PaddlePaddle and ERNIE workloads. While not as powerful as Nvidia’s latest GPUs, they’re optimized for exactly what Baidu needs: high-throughput inference of Chinese language models.

The Infrastructure Layer: Baidu AI Cloud provides the serving infrastructure, with custom orchestration, caching, and routing optimized for ERNIE’s specific patterns.

When you control every layer, optimizations compound. A 10% improvement at each of four layers yields a 46% total improvement. A 50% improvement at each layer — which Baidu has exceeded — yields a 94% reduction. Add network effects from scale, and 99% becomes achievable.

ByteDance faces a completely different reality. To serve AI responses, they must:

License or train models at massive cost

Use general-purpose frameworks with overhead

Rent compute from cloud providers at market rates

Accept whatever optimization those providers offer

The same query that costs Baidu 0.1 cents might cost ByteDance 2-3 cents. At billions of queries daily, that 20-30x cost difference determines which use cases are economically viable.

The Management Carousel Signal

The human side of transformation tells through executive turnover. Since 2021, Baidu has cycled through CFOs at unusual speed: Herman Yu gave way to Rong Luo in 2021, who yielded to Junjie He in 2022, now succeeded by Haijian He in 2024. Each transition coincided with strategic pivots that required different financial leadership.

Herman Yu, CFO during the stable search monopoly years, excelled at margin optimization and capital returns. When strategic transformation began, Baidu needed someone comfortable with investment cycles and uncertain returns. Enter Rong Luo, who managed the initial AI investments and navigated regulatory uncertainty.

As AI investments scaled, Baidu needed a CFO who could articulate the transformation story to skeptical investors while managing the delicate balance between search decline and AI growth. Junjie He spoke the language of technology transformation, but perhaps too optimistically. The latest appointment of Haijian He suggests a focus on execution and credibility as the transformation enters its critical phase.

This revolving door might concern investors accustomed to stability. But transformation requires different skills at different stages. IBM cycled through several senior executives before Gerstner found his team. Microsoft saw significant turnover during its cloud transformation. The question isn’t whether executives change, but whether each change moves the company closer to its destination.

The recent stabilization — Haijian He has now served for over a year — suggests Baidu may have found its footing. The experimental phase is ending. The execution phase has begun.

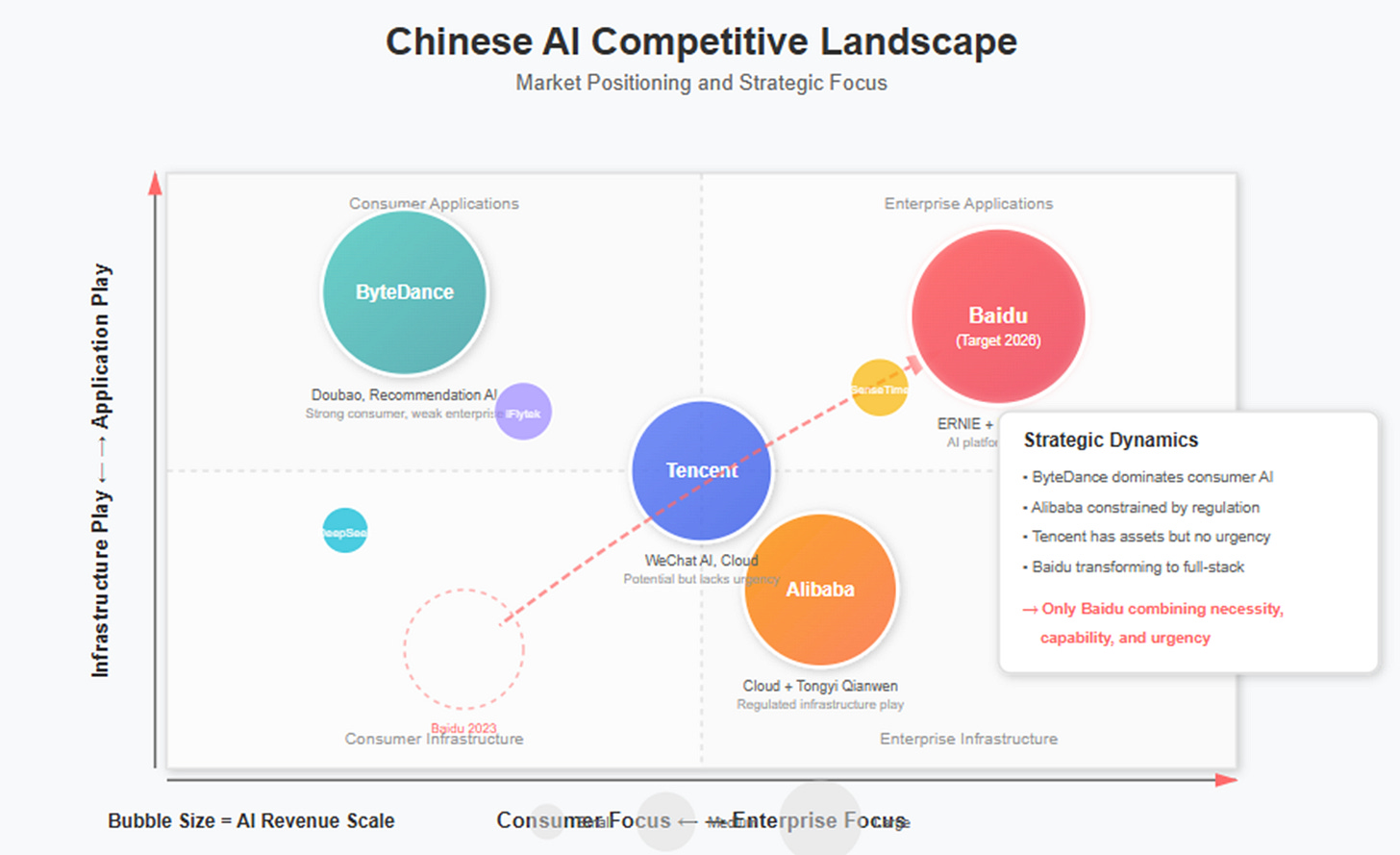

The Chinese Chess Board

Understanding Baidu’s transformation requires mapping the competitive landscape with precision. Each major player has different assets, constraints, and strategies:

ByteDance (The Consumer AI King): Douyin and Toutiao give ByteDance unmatched consumer attention. Their recommendation algorithms are arguably the world’s best at predicting what content users want. They’ve launched Doubao, their ChatGPT competitor, leveraging this consumer reach.

But ByteDance has a trust problem. Enterprises don’t want the company that runs TikTok handling their sensitive data. The consumer DNA that makes ByteDance brilliant at entertainment makes them suspect for business applications. They’re winning consumer AI but struggling to penetrate enterprise markets.

Alibaba (The Regulated Infrastructure): Alibaba’s transformation, which I documented previously, came through regulatory force rather than strategic choice. After Jack Ma’s fateful 2020 speech, the company was rebuilt as infrastructure serving state objectives. Alibaba Cloud is larger than Baidu’s, with more enterprise relationships.

But Alibaba assembled its AI capabilities reactively. Tongyi Qianwen (their LLM) was rushed to market. The cloud infrastructure wasn’t designed for AI workloads. They’re retrofitting rather than building natively. It’s the difference between renovating a house and building one from blueprints.

Tencent (The Sleeping Giant): Tencent has everything needed to win: technical capability, massive user base, enterprise relationships through WeChat Work, and patient capital. Their AI capabilities are strong, particularly in gaming and social applications.

But Tencent lacks urgency. As I analyzed in “The Patience Premium,” they systematically under-monetize assets to preserve optionality. Video Accounts runs at one-third the ad load of Douyin. WeChat Pay charges minimal fees. This patience is a luxury Baidu doesn’t have. While Tencent can wait for the perfect moment, Baidu must act now.

Smaller Players: Companies like iFlytek (voice AI), SenseTime (computer vision), and DeepSeek (pure-play LLM) have specific technical advantages. But they lack distribution, data, and capital to compete at platform level. They’re features, not products. Components, not systems.

Only Baidu combines necessity (search is declining), capability (full-stack AI), and urgency (no choice but to transform). Sometimes the best position in a race is having no alternative but to run.

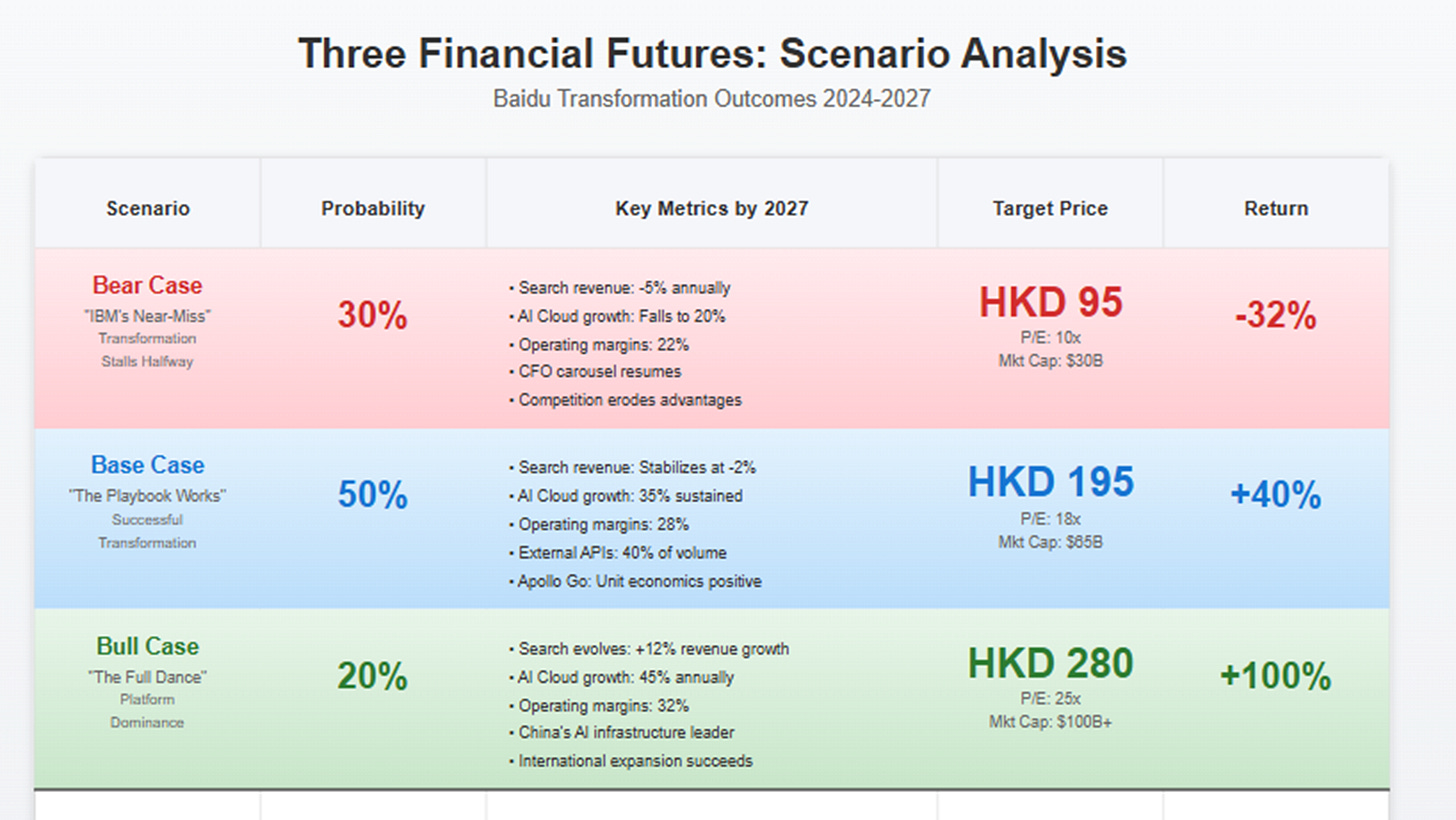

Three Financial Futures

The next three years offer three distinct scenarios, each with specific markers and measurable milestones:

The Bear Case: IBM’s Near-Miss (HKD 95, -32%)

In this scenario, Baidu’s transformation stalls halfway. The parallels to IBM’s near-death experience are instructive — even with the right strategy, execution can fail.

Search revenue declines accelerate beyond 5% annually as AI answers cannibalize faster than expected. Users appreciate getting direct answers but advertisers find no effective way to insert commercial messages into AI responses. The promised evolution from CPC (cost-per-click) to CPS (cost-per-sale) never materializes at scale.

Meanwhile, AI Cloud grows but disappoints. The 42% growth rate of Q2 2025 proves unsustainable, declining to 20% by 2026 as competition intensifies. ByteDance leverages its consumer scale to drive enterprise adoption. Alibaba uses pricing pressure to defend its cloud leadership. Tencent finally wakes up and leverages WeChat’s enterprise penetration.

Most critically, the inference cost advantage erodes. Open-source models improve efficiency. Competitors achieve their own stack integration. The 99% cost reduction that seemed insurmountable in 2024 becomes table stakes by 2027. Baidu’s first-mover advantage in Chinese AI infrastructure evaporates.

Operating margins compress to 22% as the company gets stuck between business models. Too dependent on declining search to abandon it, too invested in AI to retreat. The CFO carousel resumes as financial leadership struggles to articulate a coherent story.

The market prices this scenario at 10 times earnings — the multiple of a melting ice cube. Market cap shrinks to roughly $30 billion, valuing Baidu below its net cash and investments. The company survives but becomes irrelevant, a cautionary tale of incomplete transformation.

The Base Case: The Playbook Works (HKD 195, +40%)

The more likely scenario sees Baidu successfully executing the IBM playbook with Chinese characteristics.

Search revenue stabilizes by late 2025 as the AI integration reaches equilibrium. Revenue declines moderate to less than 5% annually, then flatten. The key: Baidu discovers effective AI-native monetization. Not traditional ad insertion, but new formats:

Agent interactions: When ERNIE helps users plan travel, book restaurants, or research purchases, merchants pay for qualified leads

Transaction completion: Moving beyond information to action, with Baidu taking a percentage of completed transactions

Subscription tiers: Premium ERNIE access for complex queries, professional research, or commercial use

AI Cloud sustains 35% annual growth, reaching $5 billion run rate by end-2025, $8 billion by 2027. The growth comes from three sources:

Enterprise ERNIE adoption: Companies integrate Baidu’s models for customer service, content generation, and internal knowledge management

Inference-as-a-Service: Startups and smaller companies use Baidu’s infrastructure for AI workloads

Industry solutions: Pre-trained models and applications for specific verticals like healthcare, finance, and education

External API usage exceeds 40% of total volume by mid-2025, proving real enterprise adoption beyond internal consumption. Each external API call generates revenue at attractive margins.

Operating margins expand to 28% despite the business mix shift. The key: AI services operate at 35-40% gross margins, offsetting search decline. Marketing expenses moderate as organic adoption accelerates. R&D spending becomes more efficient as the foundational models stabilize.

Apollo Go contributes meaningfully but not dramatically. The robotaxi service achieves unit economics in Wuhan, expands to five additional Chinese cities, and begins international pilots. While not yet profitable at corporate level, it demonstrates Baidu’s AI capabilities in physical world applications.

Management stabilizes. The CFO remains in place. Strategic communication becomes consistent and credible. The company pays modest dividends while maintaining growth investments, signaling confidence in cash generation.

At 18 times 2027 earnings, the market awards a modest transformation premium. Not the rich multiples of high-growth tech, but solid recognition of successful evolution. Market cap reaches roughly $65 billion, a respectable outcome for patient investors.

The Bull Case: The Full Dance (HKD 280, +100%)

In the optimistic scenario, Baidu doesn’t just transform — it defines the next era of Chinese technology.

Search doesn’t decline; it evolves into something more valuable. By 2026, “search” becomes a misnomer. Users engage in multi-turn conversations with AI agents that understand context, complete tasks, and learn preferences. A search for “dinner plans” evolves into ERNIE making reservations, ordering transportation, and suggesting wine pairings — each action generating transaction fees far exceeding traditional ad revenue.

Revenue grows 12% annually as both businesses thrive. Traditional search queries decline but high-value AI interactions more than compensate. The revenue per user doubles as Baidu moves up the value chain from information provider to task completion platform.

AI Cloud explodes to 45% annual growth, reaching $12 billion by 2027. Baidu becomes China’s de facto AI infrastructure, the “AWS of AI.” Every enterprise needs AI capabilities, and Baidu provides the most complete, cost-effective solution. The network effects are powerful: more users generate more data, training better models, attracting more developers, creating better applications, drawing more users.

Critical breakthrough: Baidu cracks the code on AI-native advertising. Not banner ads or sponsored links, but intelligent commercial integration. When users plan vacations, ERNIE naturally includes sponsored options that match preferences. When researching products, it provides balanced comparisons that include paid placements. The ads don’t interrupt — they enhance.

International expansion succeeds through Apollo Go partnerships. While regulatory constraints limit Chinese companies’ global expansion, robotaxis provide a backdoor. Baidu’s autonomous driving technology, refined through billions of kilometers in China, powers fleets in Southeast Asia, Latin America, and eventually developed markets. Each deployment generates licensing revenue and showcases Baidu’s AI capabilities.

Margins reach 32% as the business model completes its evolution. Software economics emerge: high fixed costs but minimal marginal costs. The integrated stack advantage widens as scale enables further optimization. R&D spending as a percentage of revenue declines even as absolute investment increases.

The market finally sees what was hidden: Baidu has become an AI platform company that happens to do search, not a search company trying to do AI. At 25 times earnings — still below U.S. AI leaders but premium for Chinese tech — the stock reaches HKD 280. Market cap exceeds $100 billion, validating the transformation thesis.

Tracking the Transformation

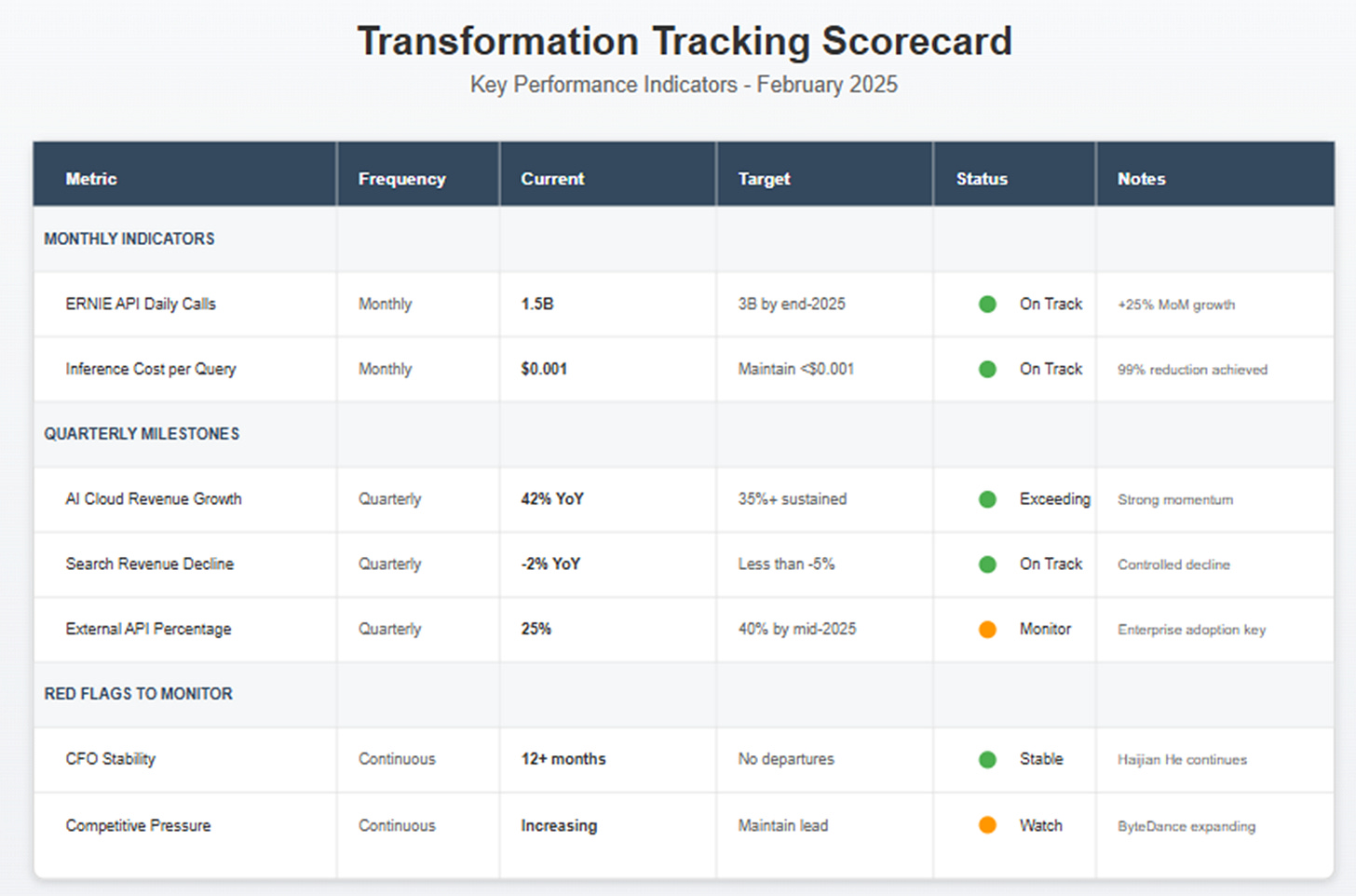

Unlike speculative bets on unproven technologies, Baidu’s transformation generates measurable signals. Investors can track progress through specific metrics:

Monthly Indicators:

ERNIE API Daily Calls: Must maintain 20%+ monthly growth to reach 3 billion by end-2025

Inference Cost per Query: Should decline 10% quarterly through optimization

Developer Ecosystem Activity: GitHub commits, API documentation updates, SDK downloads

Quarterly Milestones:

AI Cloud Revenue Run Rate:

Search Revenue Decline Rate:

Gross Margins:

External API Percentage: Currently ~25% → Target 40%+ by mid-2025

Annual Checkpoints:

2025: AI Cloud exceeds 20% of total revenue; search decline moderates

2026: New AI-native monetization contributes 10%+ of revenue

2027: Operating margins exceed historical 35% peak despite mix shift

Red Flags to Monitor:

CFO departure before 2026 suggests renewed strategic uncertainty

AI Cloud growth decelerating below 25% indicates competitive pressure

Search revenue declining faster than 8% annually breaks the model

Inference costs stop declining or competitors achieve similar optimization

Enterprise customer wins slow or concentrate in low-margin segments

The Integration Advantage Deepens

IBM won its services transformation not through superior offerings but through integration. When a bank needed new systems, competitors could provide pieces: servers from Compaq, software from Microsoft, databases from Oracle, consulting from Accenture. But only IBM could integrate across all layers, taking responsibility for the complete solution.

Baidu’s AI stack creates similar dynamics with multiplicative effects:

· Data Advantage: Every search query trains models. But unlike static training data, this is continuous, real-time feedback. When millions search “Shanghai COVID restrictions” or “Beijing flooding,” ERNIE learns about emerging events before news organizations report them. This temporal advantage — knowing what people care about right now — cannot be replicated with historical data.

· Model Advantage: ERNIE isn’t one model but a family optimized for different tasks. ERNIE 4.0 for complex reasoning. ERNIE Lite for mobile inference. ERNIE Industry for vertical applications. Each model learns from others, creating compound improvements. When ERNIE Lite achieves breakthrough efficiency, those learnings propagate across the family.

· Infrastructure Advantage: Running your own models on your own framework on your own chips in your own data centers enables optimizations impossible for competitors. Cache common queries at edge nodes. Pre-compute likely follow-up questions. Dynamically route queries to optimal hardware. These micro-optimizations compound into macro advantages.

· Ecosystem Advantage: Developers building on Baidu’s platform create lock-in effects. An application optimized for ERNIE and PaddlePaddle won’t run efficiently on competing platforms. As more developers invest in Baidu-specific optimization, switching costs increase exponentially.

The 99% cost reduction proves this multiplication effect works. But cost is just the beginning. The same integration enables:

Latency reduction: Responses in milliseconds versus seconds

Quality improvement: Models trained on proprietary interaction data

Feature velocity: New capabilities deployed instantly across the stack

Security enhancement: Data never leaves Baidu’s controlled environment

Competitors must negotiate across organizational boundaries, technical interfaces, and commercial agreements. Baidu just builds.

The Historical Pattern

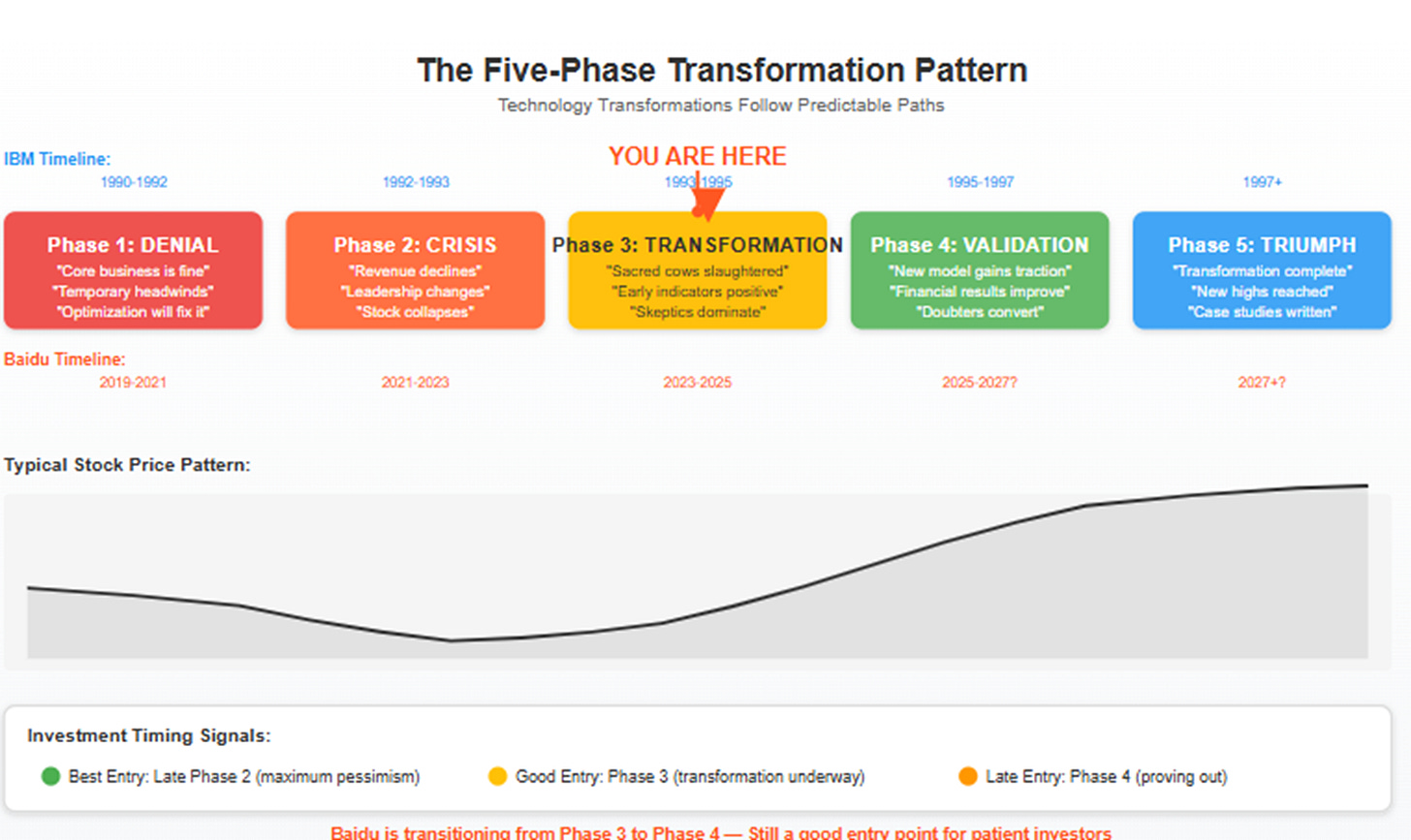

Technology history offers a clear lesson: successful transformations follow predictable patterns, and Baidu’s journey maps perfectly onto historical precedents.

Phase 1 - Denial (IBM 1990-1992, Baidu 2019-2021): The incumbent insists the core business remains healthy. Declining metrics are blamed on temporary factors: recession, competition, regulatory changes. Leadership focuses on optimization rather than transformation. The stock price drifts lower but catastrophe seems distant.

Phase 2 - Crisis (IBM 1992-1993, Baidu 2021-2023): Reality becomes undeniable. Revenue declines accelerate. Profits evaporate. Leadership changes (CEO or key executives). The board considers dramatic action: breakups, asset sales, strategic pivots. Stock price collapses as investors flee.

Phase 3 - Transformation (IBM 1993-1995, Baidu 2023-2025): New leadership commits to fundamental change. Sacred cows are slaughtered. The organization resists but gradually aligns. Early indicators show promise but financial results lag. Skeptics dominate narrative. Stock price stabilizes at depressed levels.

Phase 4 - Validation (IBM 1995-1997, Baidu 2025-2027?): New model gains traction. Financial results improve. Doubters convert to believers. Strategic logic becomes obvious in hindsight. Stock price begins sustained recovery.

Phase 5 - Triumph (IBM 1997+, Baidu 2027+?): Transformation complete. New business model dominates results. Company valued on future potential rather than past decline. Stock reaches new highs. Case studies are written.

Baidu sits squarely in Phase 3, with early signs of Phase 4 emerging. The pattern suggests maximum investment opportunity occurs during Phase 3, when transformation is underway but unproven. By Phase 4, the market recognizes success and prices accordingly.

The China Context

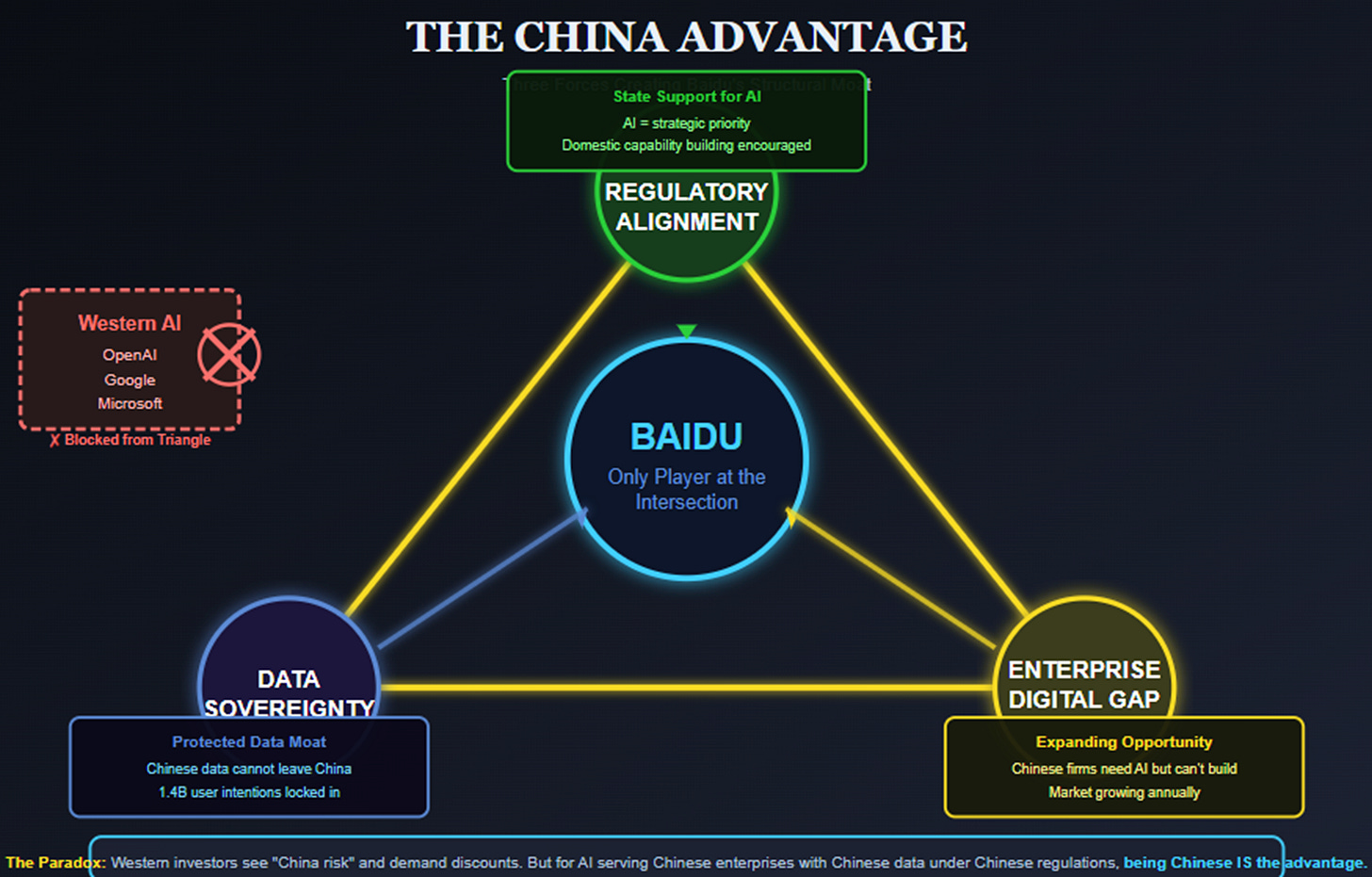

Baidu’s transformation cannot be understood without the broader Chinese technology context. Three forces shape the environment:

Regulatory Alignment: Unlike 2020-2021’s regulatory crackdown, current policy supports AI development. China views AI leadership as strategic necessity. Baidu’s infrastructure approach aligns with state objectives: building domestic capability, reducing foreign dependence, enabling Chinese enterprises. This alignment provides protection and support unavailable during previous tech cycles.

Data Sovereignty: Chinese data cannot leave China. Foreign AI models cannot train on Chinese data. This isn’t just regulation — it’s Baidu’s moat. While OpenAI builds globally competitive models, they cannot access the real-time intentions of 1.4 billion Chinese citizens. Geography becomes destiny.

Enterprise Digitalization: China’s enterprises lag developed markets in technology adoption. As they digitalize, they need AI capabilities but lack resources to build internally. Baidu provides the complete solution: models, tools, infrastructure, and expertise. The addressable market expands annually as digital transformation accelerates.

These forces create asymmetric opportunity. Western investors see “China risk” and demand discounts. But for AI infrastructure serving Chinese enterprises with Chinese data under Chinese regulations, being Chinese is the ultimate competitive advantage.

The Investment Lesson

Lou Gerstner’s IBM transformation generated spectacular returns for patient capital. An investor who bought IBM stock in 1993 at $12 and held through 1997 earned 275% returns while the S&P 500 returned 95%. More importantly, they owned a transformed company positioned for another decade of growth.

The investment lesson wasn’t about timing the exact bottom or selling at the peak. It was recognizing that transformations create discontinuous value. The market prices gradual change efficiently but struggles with fundamental business model shifts.

Baidu offers a similar opportunity with clearer signals. Unlike IBM in 1993, Baidu’s transformation is already underway with measurable progress:

AI revenue growing 40%+ annually

Inference costs down 99% with room for more

1.5 billion daily API calls proving real usage

Management committed to cannibalization

At 14 times forward earnings, the market prices Baidu like IBM in 1993 — a dying business with unclear future. But the early evidence suggests something different: a company successfully executing one of the most difficult transformations in technology.

The risk is real. Transformations can fail. Competition is fierce. Chinese markets carry unique challenges. But at current valuations, much bad news is already priced. The asymmetry favors patient capital willing to endure Phase 3 uncertainty for Phase 4 validation.

The Dance Accelerates

In his memoir “Who Says Elephants Can’t Dance?” Lou Gerstner reflected on IBM’s transformation: “The thing I have learned at IBM is that culture is everything. Transformation is impossible unless hundreds of thousands of people are willing to help. They have to believe in the new direction and want to help make it happen.”

Baidu faces the same cultural challenge magnified by Chinese characteristics. A company built on search excellence must embrace AI uncertainty. Engineers trained to optimize algorithms must learn to train models. Sales teams selling clicks must learn to sell solutions. The entire organization must forget what made them successful to learn what will make them relevant.

The early evidence suggests the cultural shift is happening:

AI mentions dominate earnings calls while search becomes secondary

New hires come from AI backgrounds rather than search optimization

R&D spending shifts from incremental search improvements to foundational model research

Management incentives align with AI metrics rather than search revenue

But the hardest part remains ahead. When search revenue declines accelerate — and they will — will Baidu maintain strategic courage? When AI investments pressure margins — and they must — will investors remain patient? When competitors achieve breakthroughs — and they shall — will Baidu’s advantages hold?

These questions lack certain answers. But the framework is clear. Baidu has chosen transformation over decline, destruction over preservation, uncertain future over certain decay. They’ve begun the elephant’s dance.

At current valuations, investors can buy a ticket to watch the performance. The music has started. The elephant has taken its first steps. Whether graceful ballet or awkward stumble, the dance itself creates value for those willing to watch it unfold.

Sometimes the best investments aren’t in companies doing well but in companies doing difficult things that matter. IBM’s transformation mattered because enterprises needed integrated solutions. Baidu’s transformation matters because China needs AI infrastructure.

The market prices the difficulty. Patient capital should price the importance.

The dance has just begun.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.