Booking Holdings 3Q25 Earnings: The Market Missed the Merchant Model Inflection

Why a fintech transformation disguised as a travel report is rewriting Booking’s economics — and why Wall Street still hasn’t noticed.

TL;DR:

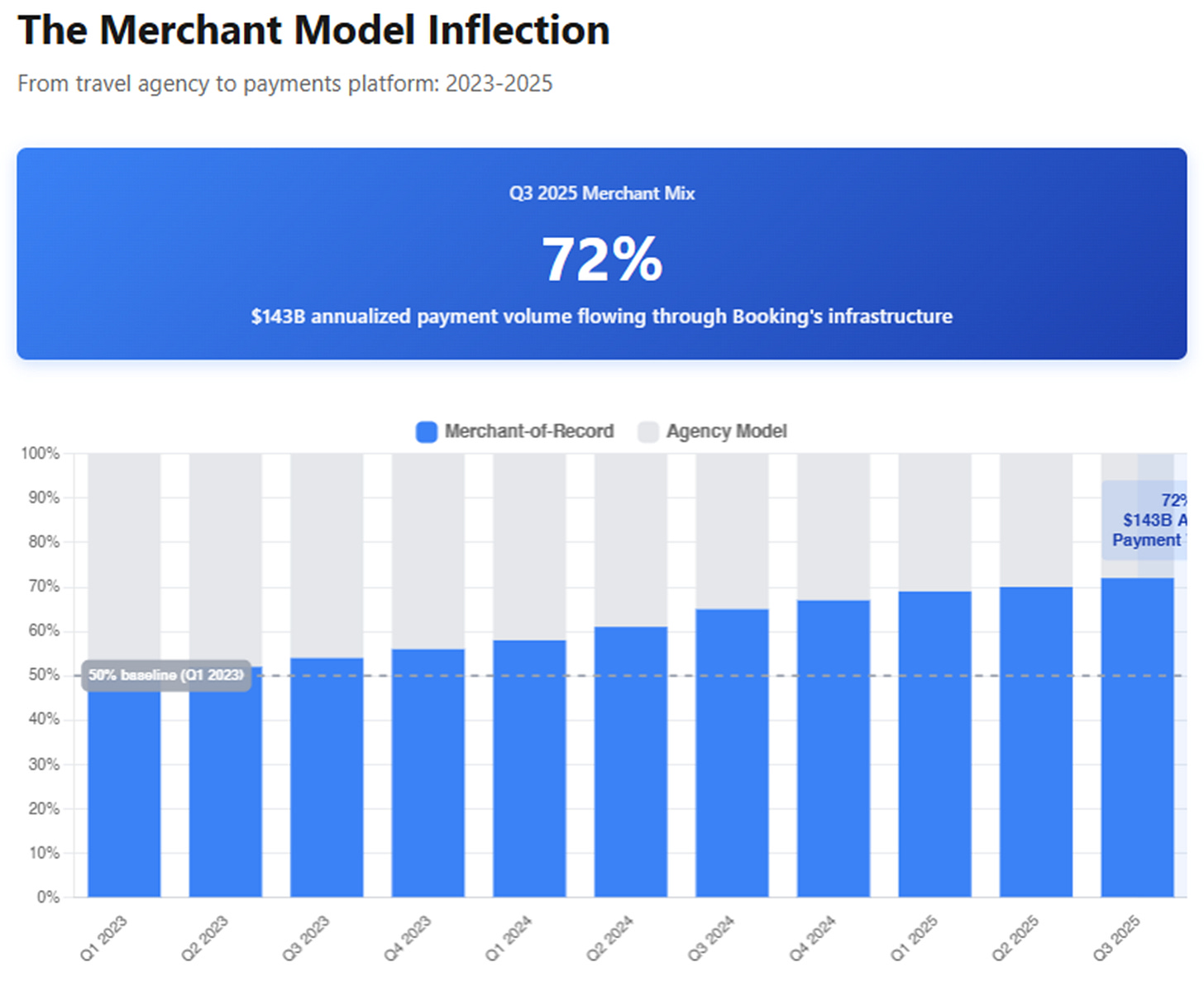

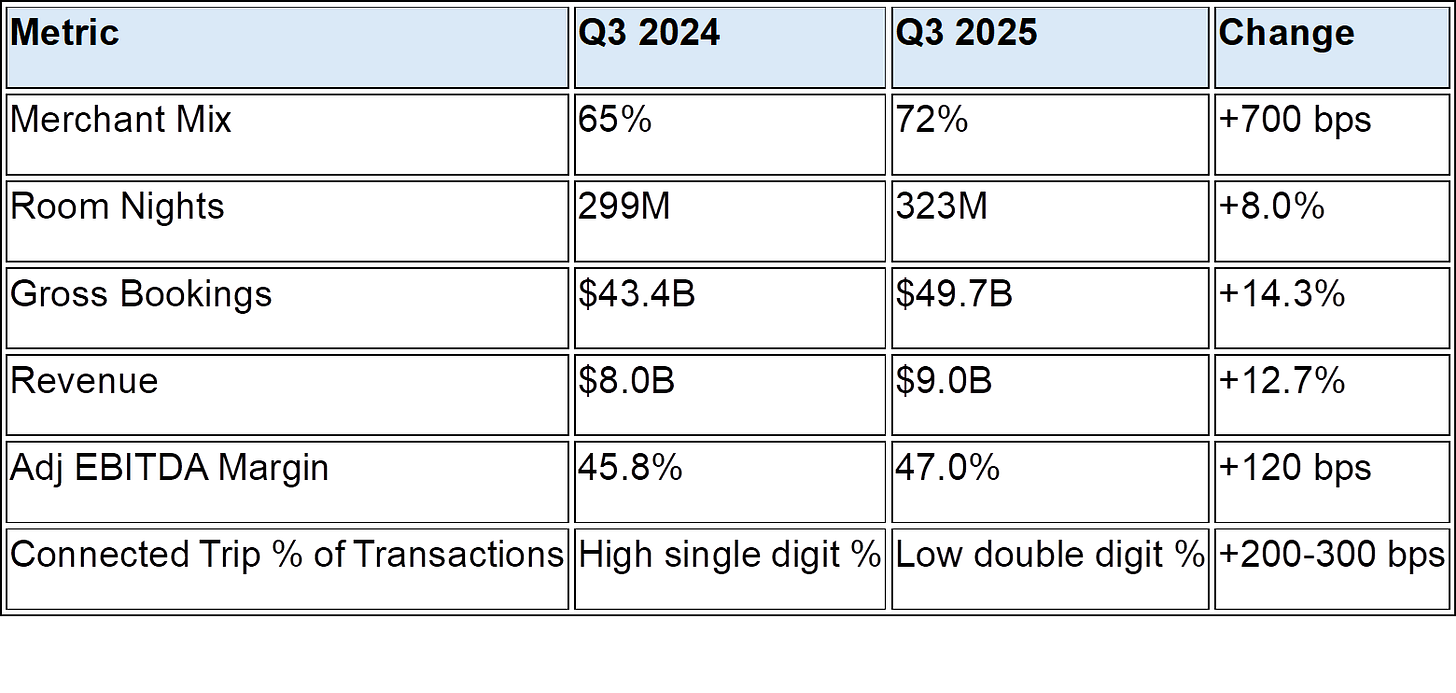

From travel agency to payments platform: 72% of Booking’s transactions now run through its merchant-of-record model — a structural shift that gives it payment float, margin leverage, and working capital advantages.

Fintech margins emerging: Facilitating payments now generates incremental revenue faster than associated costs — turning Booking’s P&L into a fintech profile with expanding EBITDA margins (47% this quarter).

Flywheel in motion: The merchant model powers Genius loyalty and Connected Trip bundling — increasing customer lifetime value, reducing churn, and positioning Booking as the infrastructure layer for global travel transactions.

From Bloomberg:

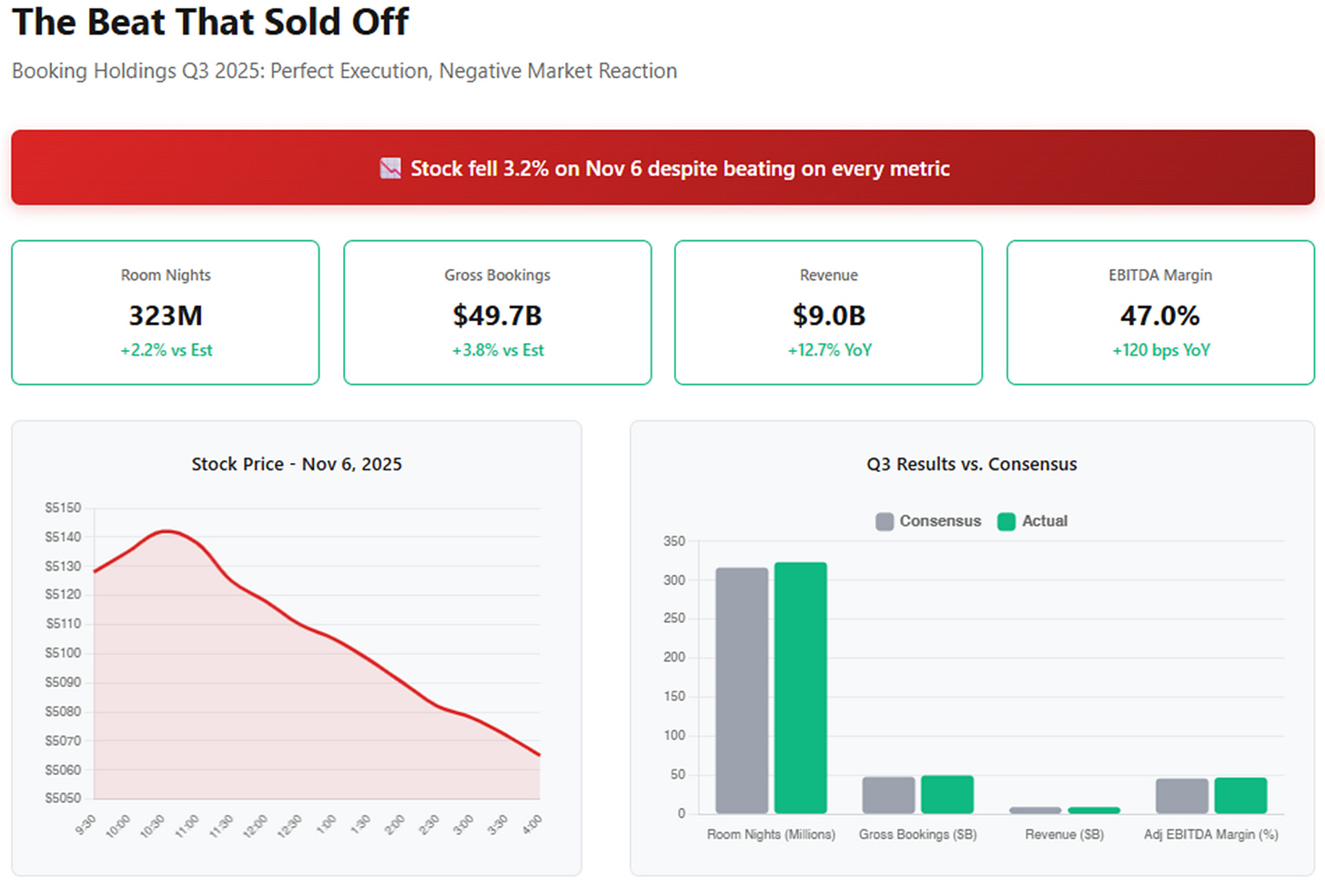

Booking Holdings Inc., the parent company to travel brands including Kayak and Priceline, reported a better-than-expected full-year reservations outlook, reassuring investors who have worried that broader economic concerns and a US government shutdown will stunt travel demand... Room nights sold grew 8% to 323 million for the three months ended Sept. 30, compared with analysts’ average estimate of 316 million. Gross bookings were $49.7 billion, ahead of the average projection of $47.9 billion.

My first thought when I saw the stock close down despite beating every metric: the market is still analyzing Booking Holdings as a travel company. It isn’t. Not anymore.

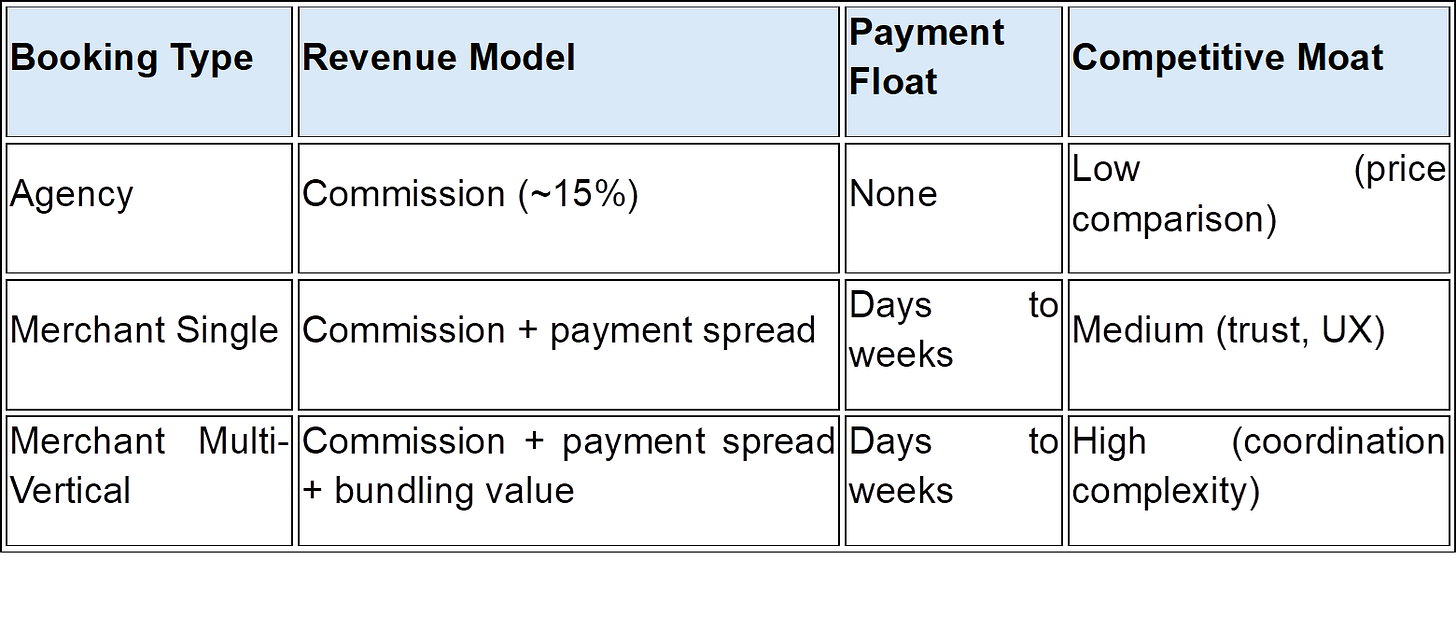

The numbers that matter aren’t room nights or even revenue growth—those are output metrics. The input metric that’s reshaping this business is hiding in plain sight: 72% of bookings are now processed as merchant-of-record, up from 65% a year ago and 50% two years ago.

This matters because Booking is no longer just connecting travelers with hotels and taking a commission. It’s becoming the payments infrastructure for global travel, collecting money upfront, holding it, and settling with suppliers later. That’s not an OTA business model. That’s a fintech business model that happens to have travel exposure.

The Transformation No One Is Pricing In

Let’s look at what’s actually changing underneath the surface:

Booking Holdings: Core Business Model Shift

The story Wall Street told itself: “Room night guidance for Q4 is 4-6%, down from 8% in Q3, therefore travel is slowing, sell the stock.”

The story Wall Street missed: Gross bookings are growing 600 basis points faster than room nights, merchant transactions are accelerating, and profitability is expanding. This is what happens when you shift from agency (take a cut of someone else’s transaction) to merchant (own the entire payment flow).

CFO Ewout Steenbergen was explicit about this on the call:

“Over the trailing twelve months, the incremental revenues from facilitating payments were greater than the associated incremental variable expenses.”

That’s fintech margin economics showing up in a “travel” company.

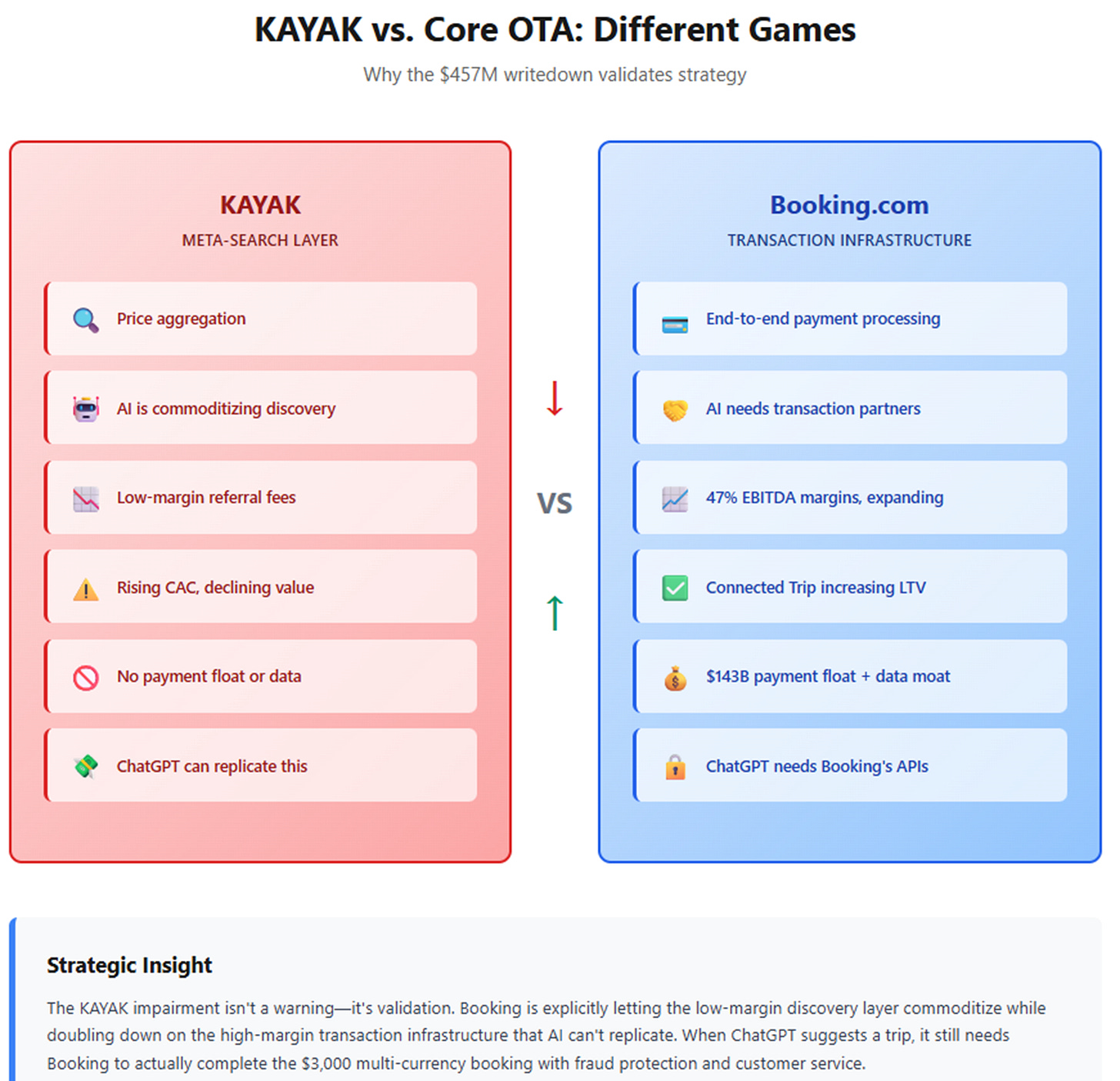

The KAYAK Writedown Is The Most Bullish Thing In The Report

Booking took a $457 million impairment on KAYAK’s goodwill and intangible assets. The reason cited: “expected increases in customer acquisition costs” for meta-search.

The market read this as a warning signal. I read it as strategy clarification.

Meta-search—the business model of aggregating everyone’s prices and sending users to the lowest bidder—is getting commoditized by AI. ChatGPT can do that. Google’s AI Overviews can do that. Perplexity can do that. The differentiation is gone.

But here’s what none of those AI tools can do: actually complete a multi-thousand-dollar international transaction involving hotel + flight + car rental across three currencies with customer service backup when something goes wrong.

Glenn Fogel addressed this directly when asked about competitive intensity:

“AI is actually a competitive advantage due to our scale, data, and engineering talent... This is the most exciting time for us ever. I see us in a much better position now than decades ago.”

That’s not CEO-speak deflection. That’s a clear articulation of where the value lies: not in discovery (which AI is commoditizing) but in transaction infrastructure (which AI needs to rely on).

The KAYAK impairment is Booking acknowledging that the low-margin meta-search layer is dying. Good. They should let it die. The high-margin payment infrastructure layer is what matters.

Connected Trip: The Flywheel Everyone Is Ignoring

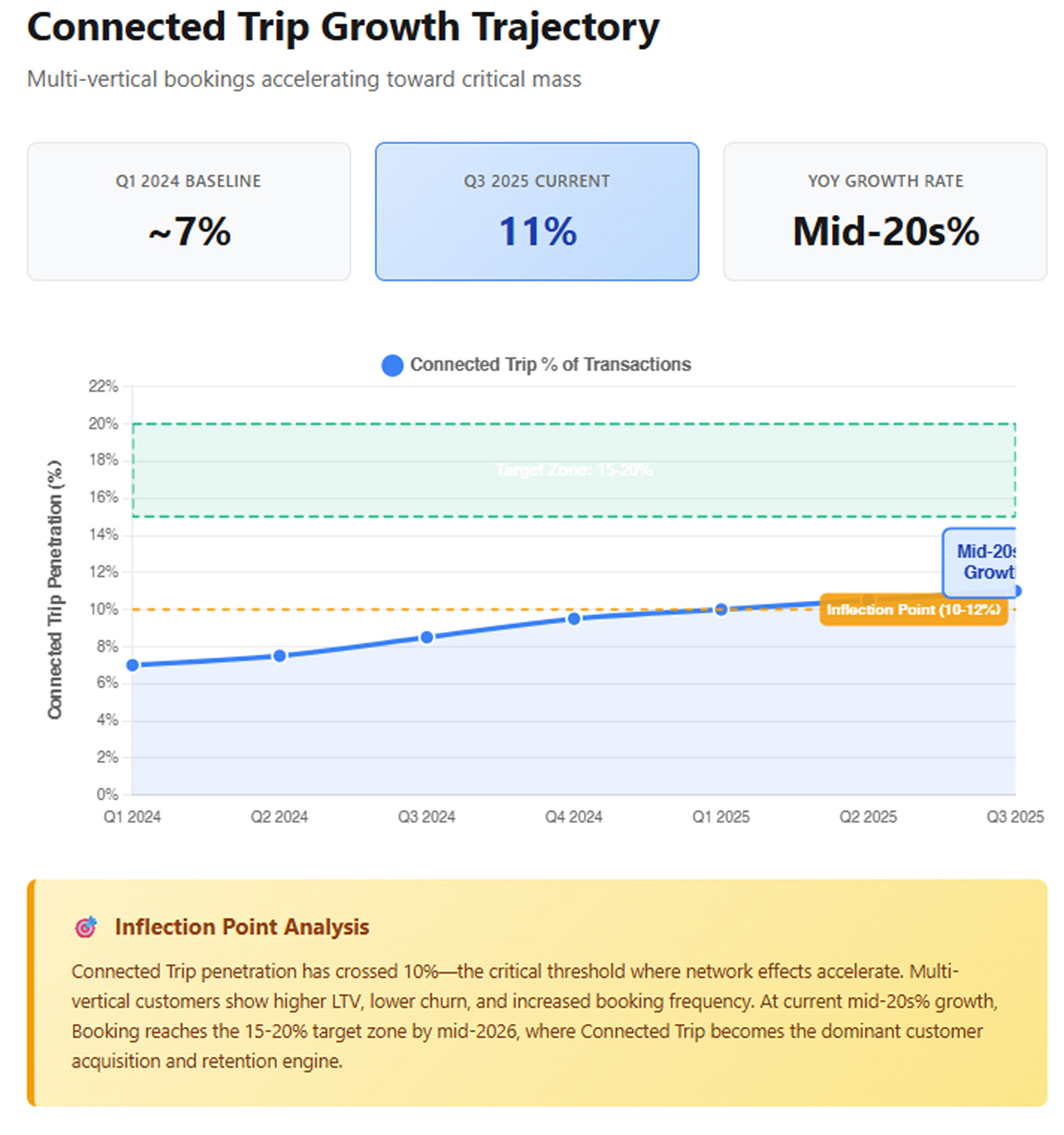

Connected Trip—Booking’s term for multi-vertical transactions where a customer books hotel + flight + car in a single session—grew mid-20s percent year-over-year and now represents “a low double-digit percentage” of total transactions.

Let’s assume that means 10-12%. That’s an inflection point.

Here’s why this matters more than any single quarter’s room night growth:

From the earnings call:

“Most importantly, travelers who choose to book multi-vertical trips with us also choose to come back to us for future bookings more often, which reinforces the long-term value proposition of the connected Trip vision.”

This is the Amazon Prime playbook. Multi-vertical customers have higher lifetime value. Higher LTV customers justify higher customer acquisition costs. Higher CAC tolerance creates competitive advantage. Competitive advantage enables margin expansion.

And unlike Amazon Prime, Booking doesn’t need to subsidize shipping or build warehouses. The infrastructure—flights, hotels, cars—already exists. Booking is just orchestrating the payment and fulfillment layer.

The economics get interesting when you layer in the merchant model:

Payment Float Dynamics:

A customer booking a hotel two months in advance, a flight one month out, and a rental car three weeks ahead through Booking’s merchant model means Booking collects ~$3,000 upfront, holds it for 4-8 weeks, settles with suppliers on different schedules, and captures payment spread on the entire flow.

That’s not just “better margins than agency.” That’s a fundamentally different business with working capital advantages, float income, and switching costs.

The Genius Program Nobody Understands

Genius—Booking.com’s loyalty program—now drives over 50% of room nights from its Level 2 and Level 3 members, who represent only 30% of the active customer base.

From the call:

“Genius members book more often, convert at higher rates, book further in advance, cancel less, and choose to come back more consistently than non-Genius customers.”

Over 850,000 properties voluntarily participate in Genius, meaning they pay for the discounts themselves. Why? Because Genius members leave more reviews (driving SEO visibility), book during off-peak times (helping occupancy optimization), and provide incremental demand.

This is the network effect that’s hardest to replicate: better customers attract better inventory, better inventory attracts better customers. The margin expands at both ends.

And here’s the strategic insight most people miss: Genius is expanding to flights, cars, and attractions. That means the loyalty benefits increasingly require Connected Trip infrastructure. You can’t give Genius perks on a flight if you’re not processing the flight payment directly.

The merchant model enables Genius. Genius drives Connected Trip adoption. Connected Trip increases LTV. Higher LTV justifies merchant transaction costs. It’s a flywheel, and it’s accelerating.

What The Conservative Q4 Guidance Actually Tells Us

Q4 room night guidance of 4-6% growth looks slow compared to Q3’s 8%. But context matters:

Q4 2024 comps:

Room nights grew 13% (easiest comp of 2024)

Coming off holiday surge in travel demand

Booking window extended due to early-bird planning

Q4 2025 setup:

Cycling the 13% comp

Shorter booking window (holidays later in month)

Transformation Program creating ~$120M in quarterly savings being reinvested

Management using language about “geopolitical and macroeconomic uncertainty”

I think the 4-6% guide is classic sandbagging. If they deliver 5%, they’ll have grown room nights at a 5% CAGR over two years against the toughest comp of 2025 while expanding EBITDA margins by 240 basis points.

The key tell: management raised Transformation Program savings targets from $400-450M to $500-550M and raised full-year Adjusted EBITDA growth guidance from ~15% to ~17-18%. You don’t raise guidance and savings targets if you’re seeing real demand deterioration.

The Strategic Implications

The core capability driving Booking’s strategy is increasingly clear: payment infrastructure at scale across fragmented global travel supply.

This advantage compounds in three ways:

Network effects: More customers → more supplier participation → more payment volume → better unit economics

Data moat: 323 million quarterly transactions generate proprietary data on what travelers actually book (not just search), when they cancel, what they pay, and what makes them return. That data set becomes more valuable as AI tools proliferate—they can suggest destinations, but they need Booking’s data to close transactions.

Regulatory barriers: Payment processing across 220 countries with local tax compliance, fraud protection, multi-currency settlement, and consumer protection isn’t something a startup can replicate. It’s infrastructure that took decades to build.

Now layer in where AI development is heading. The narrative everyone bought: “ChatGPT will disintermediate OTAs by letting users book directly from chat.”

The reality emerging: ChatGPT and other AI agents are great at discovery and planning but terrible at transactions. They need APIs to services that can actually:

Process multi-currency payments

Handle supplier relationships and contracts

Manage customer service and cancellations

Coordinate complex multi-vertical trips

Provide payment flexibility (pay later, installments, etc.)

Booking is building those APIs. They were launch partners for OpenAI’s Operator platform, integrated into Microsoft Copilot, and joined ChatGPT’s App Store in the first wave.

The strategic positioning is brilliant: let AI tools commoditize discovery (where Booking was already spending billions on Google search ads), then capture transaction value when customers need to actually book.

What To Watch Next

The Q4 results (due early March 2026) will tell us whether this thesis is playing out:

Bull case validation:

Room nights at or above 5% (midpoint of guide)

Merchant mix crosses 75%

Connected Trip penetration disclosed as 15%+

Marketing as % of gross bookings stays under 4.8%

Bear case signals:

Room nights below 4%

Marketing efficiency deteriorates

Management reduces FY 2026 outlook

No disclosure of AI-agent-sourced bookings

My base case: Q4 comes in at 5-6% room night growth, merchant mix hits 74-75%, and management provides FY 2026 guidance showing low-double-digit revenue growth with continued EBITDA margin expansion.

The stock currently trades at 18.5x FY 2026 EPS of $265. If the market starts pricing this as a payments infrastructure company rather than a cyclical travel stock, a higher multiple isn’t unreasonable.

The longer-term story is even more compelling. If Connected Trip reaches 20% penetration, merchant mix hits 80%, and EBITDA margins expand to 40%, you’re looking at $300+ in EPS by FY 2027-2028. At 24x, that’s $7,200+.

But the market won’t wait for 2028 to re-rate the stock. It’ll happen the quarter where:

Merchant mix crossing 75% makes payment economics undeniable

Connected Trip growth staying at 20%+ makes LTV improvement obvious

AI agent partnerships show material booking volume (proving the infrastructure thesis)

My guess: That’s Q1 or Q2 2026. Until then, the market will keep treating this like a travel company that’s “slowing down” at 4-6% growth. Which creates the opportunity.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.