Broadcom 3QFY25 Earnings — The Network Is (Still) the Computer

Shift from sustaining growth to accelerating it

TLDR

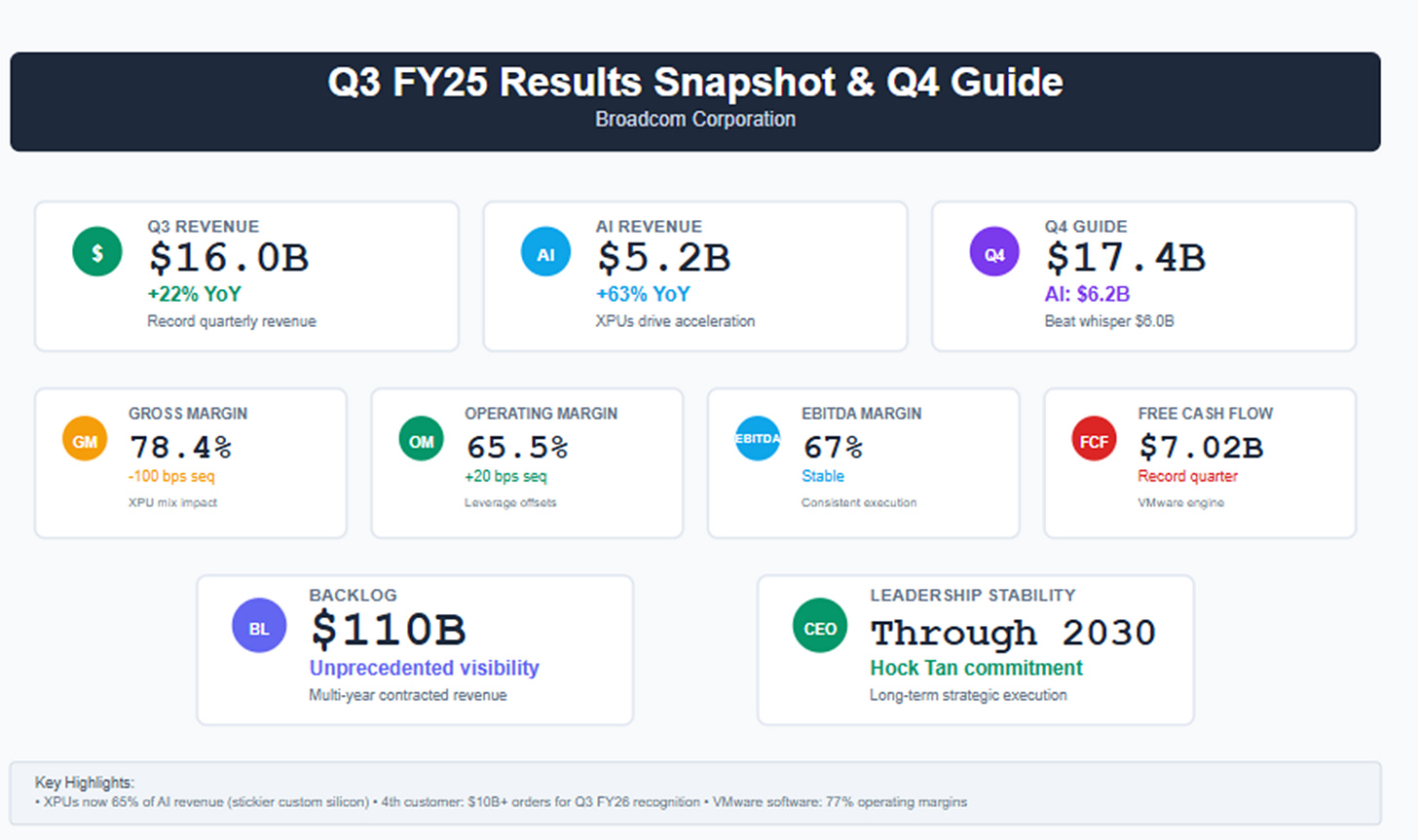

AI shifts from sustain → accelerate: XPUs are 65% of AI revenue, Q4 AI guide $6.2B, and a $10B+ 4th customer is slated to be recognized in Q3 FY26—reframing FY26 as acceleration (vs 50–60% growth in FY25).

Dual-moat flywheel: VMware’s cash engine (Op margin 77%, >90% top customers converted; Phase-2 upsell: security/DR) funds multi-year custom XPU + Ethernet R&D and hyperscaler programs.

Ethernet-led architecture + discipline = visibility: Tomahawk 6 (102.4 Tb/s, 3→2 tiers) and Jericho 4 (~100 km “scale-across”) cement the AI fabric moat; despite GM dip to 78.4%, OpM ~65.5%/EBITDA ~67% held, FCF ~$7.0B, backlog ~$110B, CEO through 2030.

In 1984, Sun Microsystems co-founder John Gage declared that "The network is the computer." At the time, this was a radical reimagining of computing architecture — instead of powerful standalone machines, the future would be distributed systems where processing power lived across interconnected nodes. Sun built their entire business model around this vision, from workstations to servers to the networking gear that tied it all together.

Fast-forward four decades, and Gage's prophecy feels almost quaint in its prescience. Today's AI training runs span tens of thousands of chips, each requiring unprecedented coordination across vast networks. The difference is that where Sun ultimately failed to capitalize on their architectural insight, Broadcom appears to have cracked the code on monetizing the distributed computing era — and they're doing it with a dual-moat strategy that would have been impossible in Sun's era.

From Broadcom's press release: "Broadcom posted record $16.0B (+22% YoY) revenue; AI semis $5.2B (+63% YoY); guided Q4 to $17.4B with AI $6.2B."

The surprise isn't the beat — it's what the numbers reveal about Broadcom's positioning across two seemingly disparate but increasingly synergistic markets. This quarter marked a fundamental shift from sustaining growth to accelerating it in AI, while simultaneously demonstrating how the VMware acquisition has evolved from cost-cutting exercise to growth engine. The combination creates something unprecedented: a company that can fund moonshot AI bets with the steady cash flow of enterprise software subscriptions.

The Delta That Matters

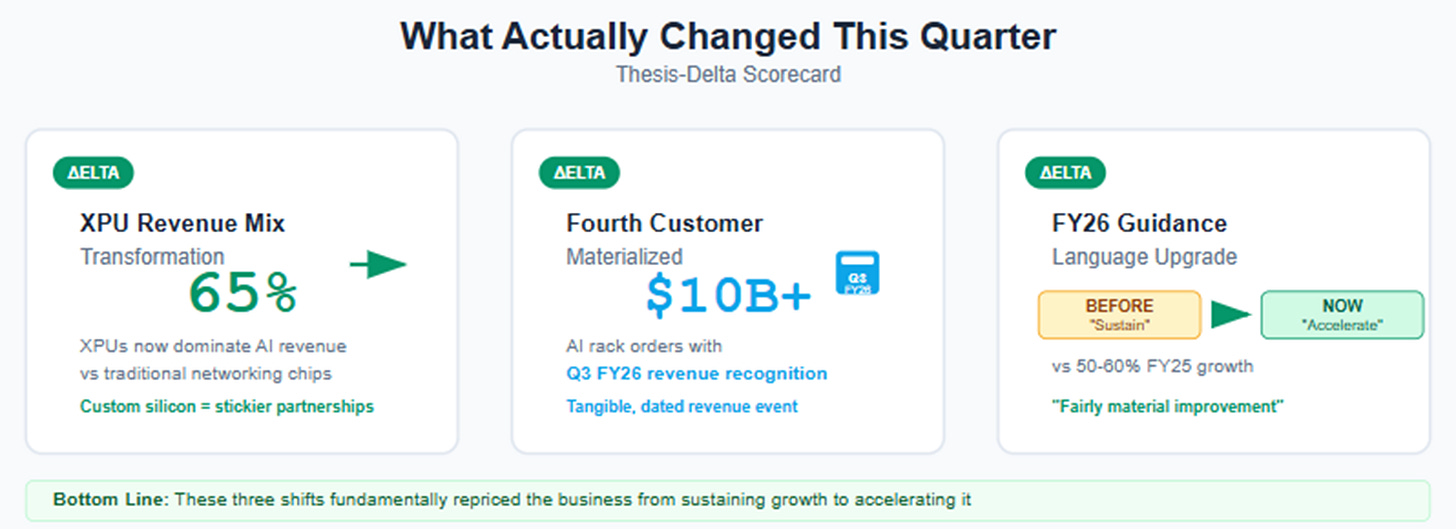

The most revealing aspect of any earnings analysis is isolating what actually changed. For Broadcom, several developments fundamentally altered the investment thesis, with AI acceleration taking center stage.

First, custom silicon (XPUs) now represents 65% of AI revenue, a dramatic mix shift that signals where the real value creation lies. While Broadcom's traditional networking chips continue growing in absolute terms, the custom compute business has taken the driver's seat. This matters because XPUs are built through multi-year co-development partnerships — the kind of deep technical collaboration that creates genuine switching costs rather than transactional relationships.

Second, the mysterious fourth (Rumored to be OpenAI according to Financial Times) customer materialized into something concrete and massive. What CEO Hock Tan previously described as a "prospect" is now a committed customer with over $10 billion in AI rack orders. More importantly, Tan provided specific timing: these orders will ship and be recognized as revenue almost entirely within Q3 of fiscal 2026. This transforms the bull case from theoretical to tangible, with a specific date investors can model.

This customer win directly feeds into the third major shift: upgraded growth expectations for fiscal 2026. Last quarter's message centered on "sustaining" the strong pace of fiscal 2025. This quarter, Tan explicitly promised "acceleration," with a "fairly material improvement" over the current year's 50-60% growth rate. This isn't incremental guidance adjustment — it's a fundamental repricing of the business trajectory.

The Private Cloud Cash Engine

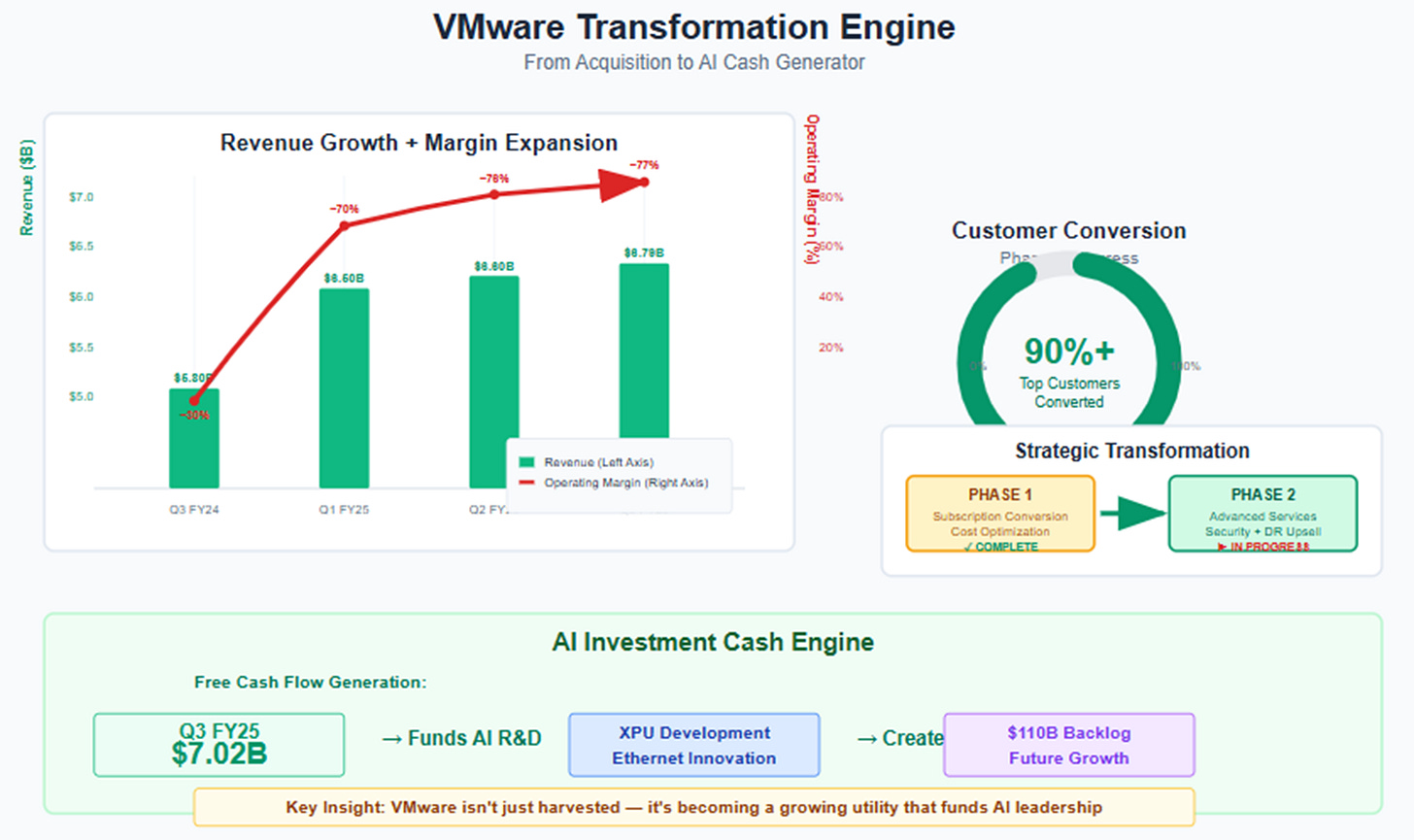

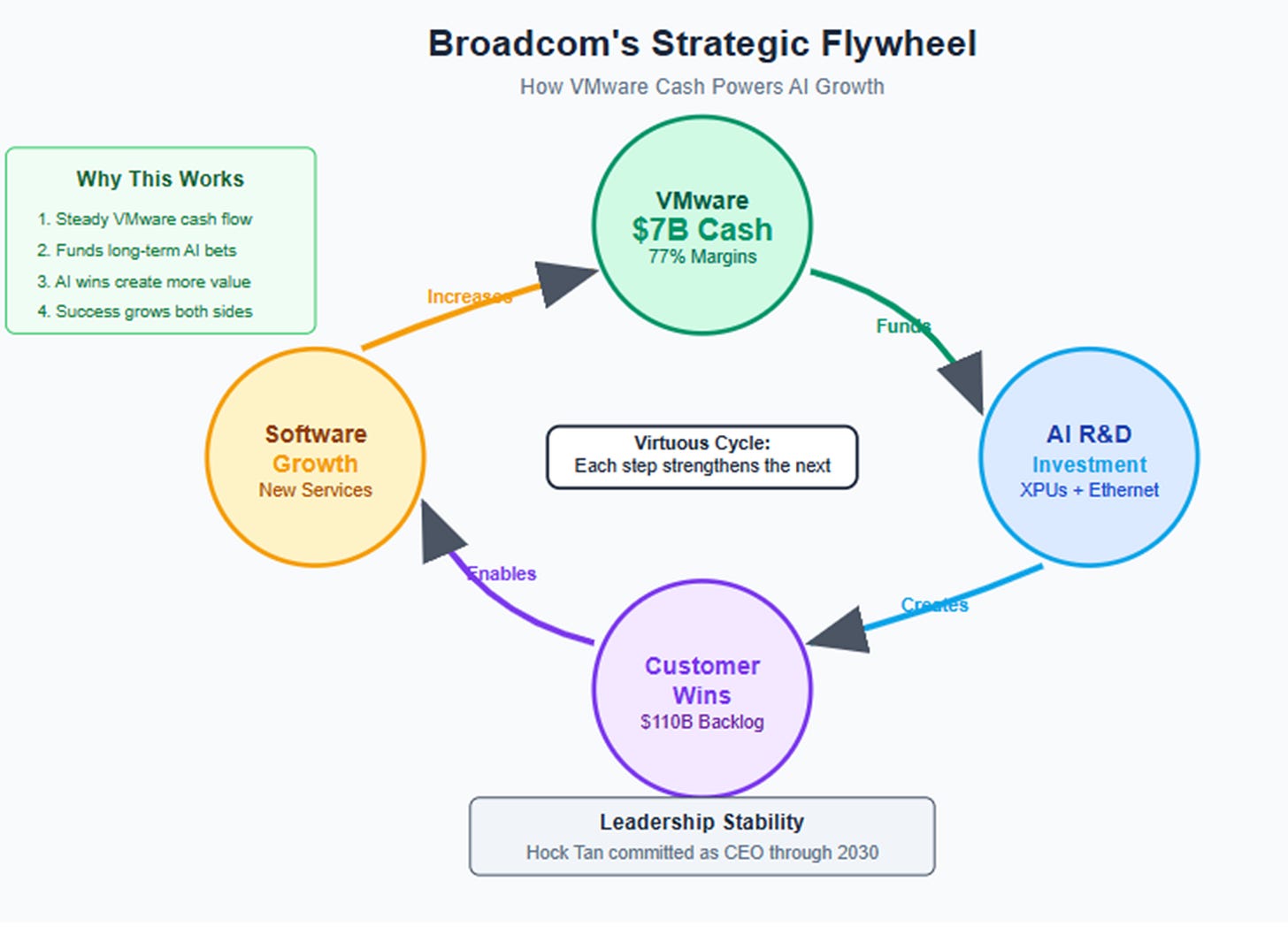

None of this AI ambition would be possible without the financial foundation Broadcom has built through its VMware transformation. What started as a controversial $69 billion acquisition has evolved into something more sophisticated than a simple cost-cutting exercise — it's become a private cloud utility that generates the cash flow to fund Broadcom's AI moonshots.

Broadcom Software Transformation

The margin expansion tells the story of a masterful operational transformation. Pre-acquisition VMware operated at roughly 30% operating margins. Under Broadcom's management, those margins have more than doubled to 77%, contributing to a record $7 billion in quarterly free cash flow.

But here's where the strategy gets interesting: Tan outlined the next phase of value creation beyond the initial subscription conversion. "First phase is convince these people to convert... Second phase now is make that purchase they made on VCF very create the value they look for in private cloud... on top of that, we'll start selling advanced services."

Phase 1 - converting perpetual licenses to subscriptions and eliminating duplicate products — is largely complete, with over 90% of top customers converted.

Phase 2 - represents the next multi-year opportunity: upselling high-margin services like security and disaster recovery into this captive customer base. This isn't just harvesting an acquired asset; it's turning a stagnant utility into a growing one.

The beauty of this model is its symbiotic relationship with Broadcom's AI ambitions. The software business provides predictable, high-margin cash flow that funds the long-term R&D investments required for custom silicon development. Meanwhile, the AI business offers explosive growth potential that justifies the company's premium valuation. It's a hedge fund strategy executed at semiconductor scale.

The Architecture of Distributed AI

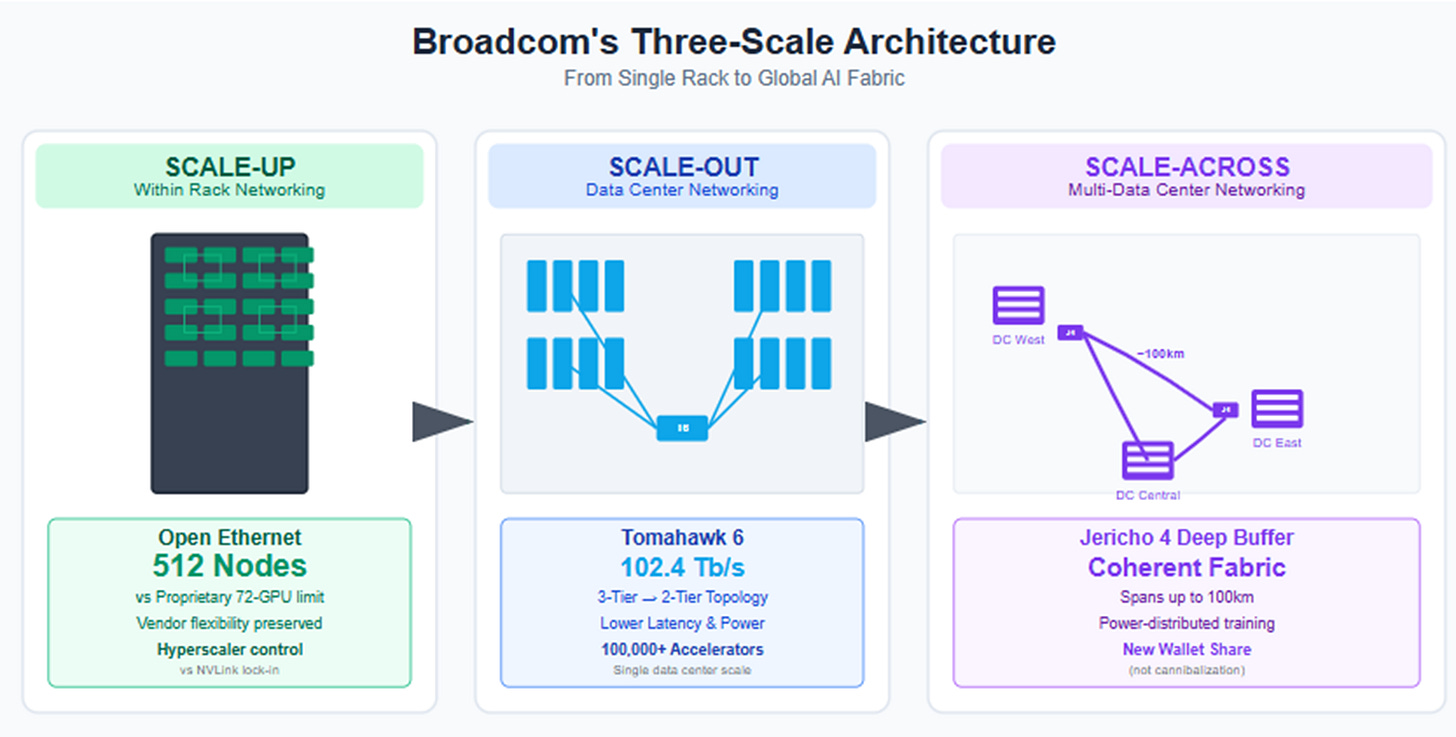

Broadcom's AI strategy rests on a simple but powerful insight: as AI training scales, the networking that connects compute becomes increasingly critical and complex. The company has positioned itself to solve this challenge at three distinct levels, each representing a different market opportunity.

The first level is "scale-up" — networking within individual server racks. Here, Broadcom draws a stark contrast with proprietary solutions. NVIDIA's NVLink, for example, can connect 72 GPUs within a single system. Broadcom's open Ethernet approach enables connections across 512 compute nodes for their XPU customers, all while preserving vendor flexibility — a crucial consideration for hyperscale customers wary of single-vendor dependence.

The second level is "scale-out" — connecting thousands of accelerators across multiple racks within a data center. Broadcom's recently launched Tomahawk 6 switch, with 102.4 Tb/s of capacity, addresses this challenge by flattening network topology from three switch tiers to two. This seemingly technical optimization delivers practical benefits: lower latency, reduced power consumption, and simpler management for clusters exceeding 100,000 accelerators.

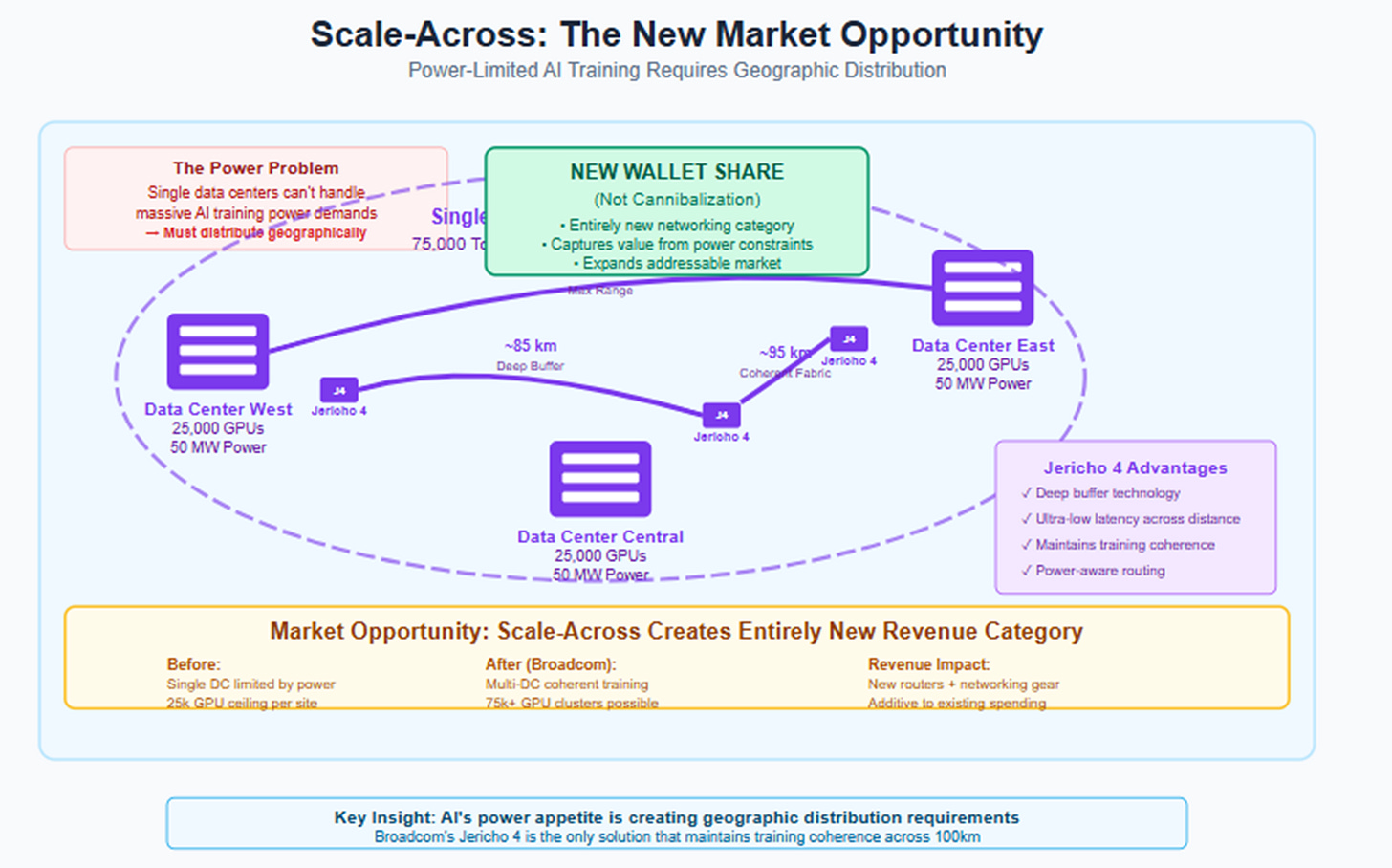

The most intriguing development is the third level: "scale-across," connecting massive clusters that span multiple data centers. This represents an entirely new market category born from AI's voracious power appetite. As individual data centers reach power limits, training runs must distribute across geographically separated sites. Broadcom's new Jericho 4 deep-buffer router creates coherent fabrics spanning up to 100 kilometers — not cannibalizing existing spending, but capturing entirely new wallet share.

What distinguishes Broadcom from traditional component suppliers is their system-level approach. Rather than simply selling chips, they co-develop entire accelerator roadmaps with hyperscale customers, designing optimal Ethernet topologies for specific workloads. This positions Ethernet as the default fabric for distributed AI training.

The Economics of Dual Moats

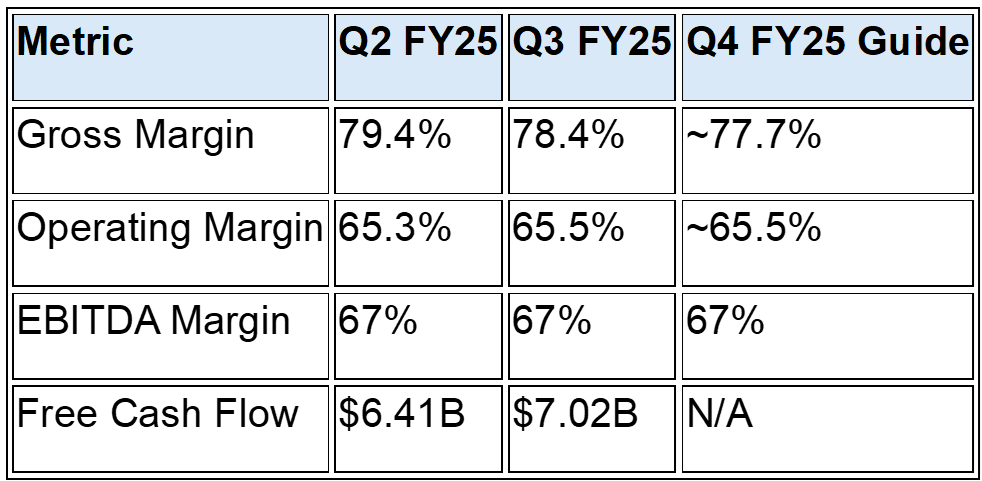

Critics will inevitably focus on gross margin compression — Q3 margins fell to 78.4% from 79.4% the previous quarter, with Q4 guidance suggesting another 70 basis point decline. However, examining operating leverage reveals the underlying business health:

Broadcom Financial Metrics

Despite gross margin pressure from higher XPU mix and seasonal wireless products, operating margins actually improved, with EBITDA margins holding steady at 67%. This demonstrates exceptional operational discipline and the protective power of having two distinct revenue streams with different margin profiles.

The margin dynamics reflect a deliberate trade-off: accepting near-term gross margin pressure to access a larger, stickier revenue pool. As XPU programs scale through fiscal 2026, margins should stabilize at higher absolute profit levels, while the software business continues generating consistent cash flow regardless of semiconductor cycles.

Perhaps the most underrated announcement was Tan's commitment to remain CEO through 2030, coupled with the company's $110 billion backlog. These provide unprecedented leadership stability and financial visibility — the kind of long-term foundation required to execute complex technical roadmaps across multiple market segments.

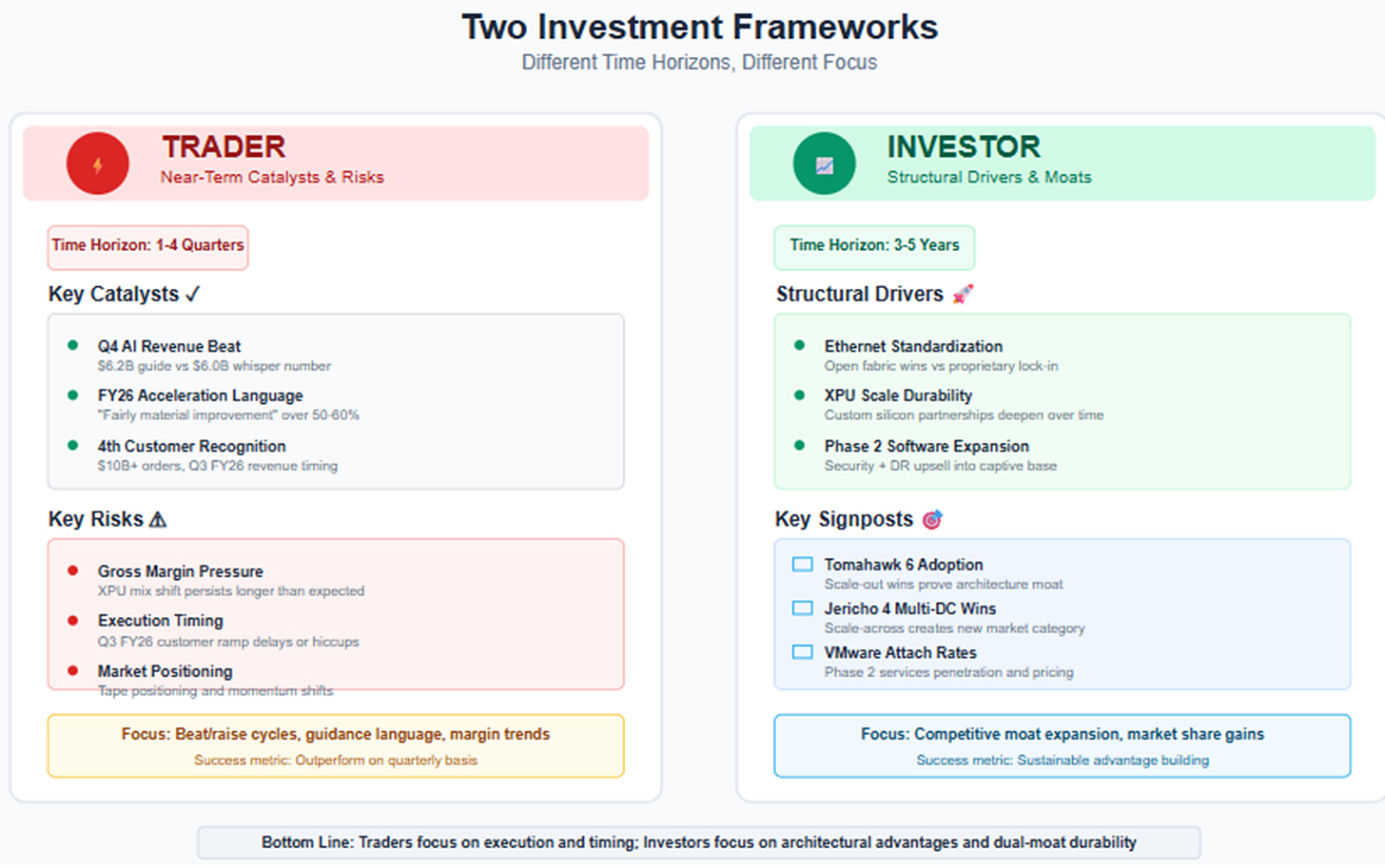

Two Investment Frameworks

For traders, the setup appears straightforward. The quarter delivered an in-line beat against buyside expectations, but Q4 AI guidance of $6.2 billion exceeded whisper numbers around $6.0 billion. The real catalyst lies in upgraded fiscal 2026 language and the tangible $10 billion customer commitment. The primary near-term risk centers on whether mix-driven margin pressure persists beyond a few quarters.

Long-term investors should view this quarter as validation of a more fundamental transformation. Broadcom is cementing its position as a dual-moat company: an AI connectivity utility funded by a private cloud cash engine. Wall Street still largely categorizes Broadcom as a networking semiconductor company with a software acquisition bolted on. The reality is a company that has achieved something rare in technology — two distinct competitive moats that reinforce rather than compete with each other.

The key signpost to monitor is continued adoption of Tomahawk 6 and Jericho 4 switches, which will demonstrate whether Broadcom's technical moat in AI networking is widening. Equally important is the software business's progression into Phase 2 upselling, which will determine whether VMware becomes a growth engine or merely a cash cow.

John Gage's 1984 prediction that "the network is the computer" proved both prescient and premature. Sun Microsystems grasped the architectural shift but failed to monetize it effectively, ultimately falling victim to the very cycles they hoped to transcend. Forty years later, as AI training transforms computing into truly distributed systems, Broadcom appears positioned to capture the economic value that Sun could only envision — with the added advantage of a software business that provides the financial stability Sun never achieved. The network has finally become the computer, and this time, someone figured out how to pay for it.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

https://open.substack.com/pub/techitalt/p/broadcom-just-landed-a-10b-ai-chip?r=5jmutn&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true