Cadence 2Q25 Earnings: The Infrastructure Inflection Point

When Export Controls Accidentally Reveal a Platform Monopoly

TLDR

Accidental Proof of Platform Dependency: Despite a one-month export restriction to China (9% of revenue), Cadence raised full-year guidance—revealing that global customers treated access to its tools as non-negotiable infrastructure, not discretionary software.

AI Workflow Lock-In & Margin Flywheel: With over 50% of advanced-node designs now using Cerebrus and SDA revenue growing 35% YoY, Cadence is transitioning from tool vendor to platform orchestrator, driving 270 bps margin expansion and setting up for long-term 60%+ operating margin potential.

Ecosystem Control through Foundry & Data Moats: Deep integration with all major foundries (TSMC, Samsung, Intel, Rapidus) and the growth of the JedAI platform create technical necessity and self-reinforcing data lock-in—building a choke point at the heart of AI-era silicon development.

"Cadence Design Systems Inc jumped 7% in recent afterhours trading following the report... Strength across all businesses, more than offsetting the impact of the temporary restrictions on exports to China imposed on May 23." - Investing.com

I've been analyzing enterprise software earnings for over a decade, and I can't recall seeing a more revealing quarter that so perfectly exposed a company's true strategic position. The headline story—20% revenue growth, margin expansion, raised guidance—is almost irrelevant compared to what the China export restrictions accidentally demonstrated about Cadence's transformation from cyclical EDA vendor to essential AI infrastructure.

The Accidental Monopoly Proof

The most important number in Cadence's Q2 isn't the $1.275 billion in revenue or the 42.8% operating margin—it's the mathematical impossibility hiding in plain sight. When temporary export restrictions prevented Cadence from serving China (roughly 9% of revenue) for approximately one month, the company didn't cut guidance. Instead, they raised full-year revenue guidance by $50 million.

This creates a paradox that reveals everything about Cadence's market position. In normal vendor relationships, constrained supply in one geography might shift demand patterns but wouldn't enable immediate global pricing power. What actually happened suggests something fundamentally different: customers elsewhere treating design schedule continuity as existential, willing to pay premiums and accelerate purchase timelines rather than accept any risk of delay.

CFO John Wall's understated comment that "strength in other regions more than offset the impact" actually describes customers exhibiting infrastructure dependency behavior—the kind of response you see when essential services become temporarily unavailable, not when optional software tools face supply constraints.

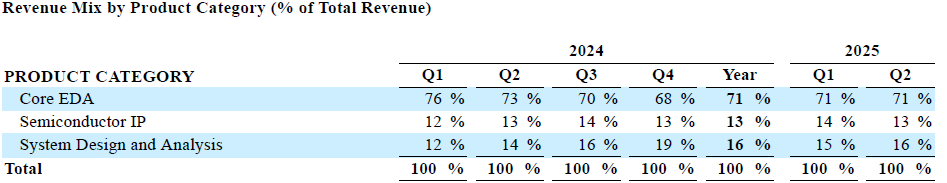

Multi-Quarter Revenue Trend Analysis:

The pattern reveals three critical insights: China diversification accelerating (from 12% to 9%), margin expansion trajectory steepening (270 bps improvement YoY), and growth rates remaining robust despite export headwinds. This isn't cyclical EDA performance—it's platform economics emerging.

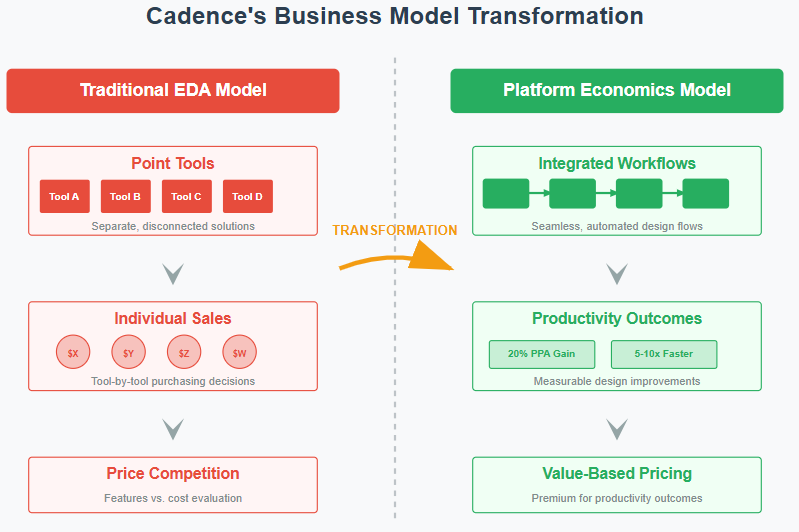

The Platform Metamorphosis

What I find most compelling about this quarter is the evidence of Cadence's business model transformation becoming mathematically inevitable. CEO Anirudh Devgan's comment about workload evolution reveals the core strategic insight: "By 2030, the chips will be... 1,000,000,000,000 transistors by 2030... So the workload will go up by thirty forty x in the next five years."

This creates an impossible equation. Chip companies cannot hire 30-40x more engineers (the talent doesn't exist) or accept 30-40x longer development cycles (AI competition is too intense). The only solution is automation-driven productivity improvements, and Cadence is uniquely positioned to deliver comprehensive workflow automation.

The evidence of platform economics is already visible in their AI tool adoption metrics. Devgan noted that "more than 50% of advanced nodes design using our implementation solutions are now using Cadence Cerebrus." But the breakthrough is Cerebrus AI Studio, which Samsung and STMicroelectronics endorsed at launch for delivering "20% PPA improvement and 5x to 10x faster chip delivery time."

This represents a fundamental shift from selling tools to selling productivity outcomes. More importantly, the JedAI platform that underpins these capabilities creates network effects—as Devgan explained, it's become "very essential" for AI deployment with flexible deployment options based on customer data sensitivity. The more design data flowing through JedAI, the stronger the AI models become, creating self-reinforcing advantages.

The strategic significance extends beyond automation.

Cadence is building what I'd characterize as "design workflow lock-in"—where the platform becomes so integral to chip development processes that switching becomes prohibitively complex and risky.

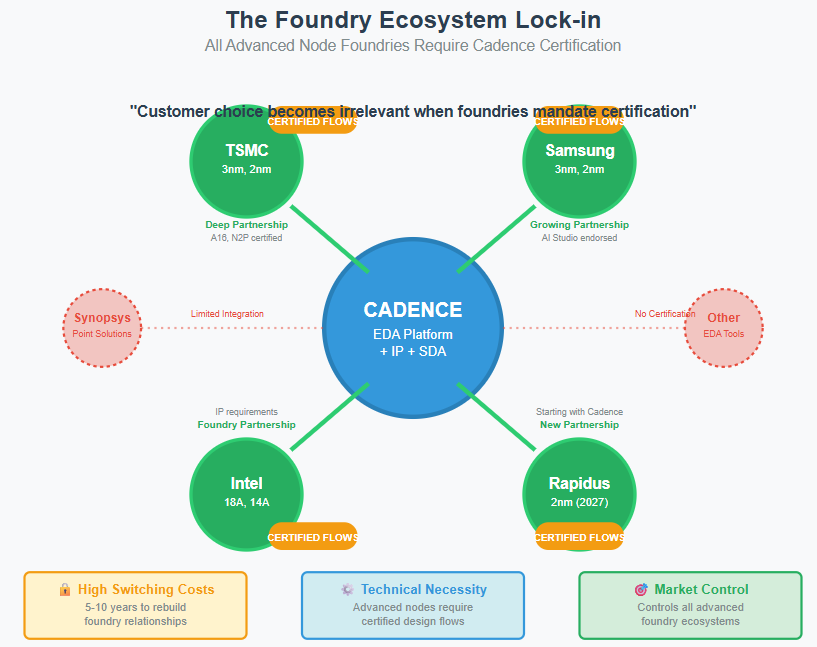

The Foundry Ecosystem Control

Perhaps the most underappreciated aspect of Cadence's competitive positioning is their control over foundry certification processes. When Devgan mentioned working with "all four major advanced foundries" (TSMC, Samsung, Intel, Rapidus), he's describing ecosystem control that creates mandatory adoption for the most valuable designs.

This foundry partnership strategy creates what I call "technical necessity" rather than vendor preference. Advanced node designs require foundry-certified flows, and Cadence's deep integration means competitors must rebuild these relationships from scratch—a process that typically takes 5-10 years and requires sustained foundry commitment.

The IP business performance supports this thesis. Despite some quarter-to-quarter volatility, IP grew 25%+ YoY in Q2, driven by what Devgan described as AI infrastructure buildout and "at least four major companies doing advanced node foundries now." Each additional foundry partnership multiplies Cadence's addressable market while strengthening ecosystem lock-in.

System Design & Analysis Segment Analysis:

The 35% YoY growth in SDA deserves particular attention because it demonstrates platform pull-through effects. As Devgan explained, 3D IC adoption "naturally pulls in analysis tools," creating cross-selling momentum that didn't exist in traditional point-tool EDA sales.

This matters enormously for understanding Cadence's margin expansion potential. Traditional EDA companies face pricing pressure on individual tools; platform companies capture value through workflow integration and productivity improvements across multiple product categories.

The Margin Expansion Trajectory

Cadence's operating margin expansion from 40.1% to 42.8% YoY, with guidance pointing toward 44%+, reveals early-stage platform economics that I believe could reach 60%+ over the next five years.

The math becomes compelling when you consider the business model evolution. AI tools likely have 85%+ gross margins, customer acquisition costs are declining due to platform effects and foundry partnerships, and the hardware business (which constrains margins) is becoming a smaller percentage of total revenue despite record quarterly performance.

Management's aggressive share buyback strategy—over $700 million annually representing more than 50% of free cash flow—signals their view that the market is dramatically undervaluing this transformation. When you're generating 20%+ revenue growth with expanding margins and choosing buybacks over growth investments, you believe shares are trading at a significant discount to intrinsic value.

The strategic question becomes: what prevents Cadence from eventually achieving the 60%+ operating margins typical of scaled software platforms? Particularly as AI tool adoption creates pricing power and workflow integration reduces competitive pressure.

Executive Commentary: Reading Between the Lines

Two quotes from the earnings call reveal management's strategic thinking more clearly than the financial metrics:

On customer dependency: "The workload will go up by thirty forty x in the next five years. There's not even enough talent or headcount to hire to meet that requirement... You need AI to cope up with the 30 x."

On platform strategy: "JedAI has become a very essential part of our AI deployment to customers... some customers want JedAI to be on prem because their data is very sensitive."

The first quote reveals why Cadence's AI tools have become mathematical necessities rather than optional productivity enhancers. The second shows how platform strategy creates customer lock-in through data sensitivity and workflow integration.

What's particularly telling is the language shift from previous quarters. Management is no longer positioning Cadence as benefiting from AI trends—they're describing customers who have "no other choice" but automation. That's infrastructure language, not software vendor language.

Strategic Implications: The Recognition Gap

This quarter illuminates a fundamental market misunderstanding. Investors are evaluating Cadence as a software company with AI tailwinds, when the evidence suggests they're becoming essential infrastructure for AI chip development. The distinction matters enormously for valuation multiples and competitive dynamics.

Infrastructure businesses command premium valuations because they control chokepoints in essential processes. Cadence now controls multiple chokepoints: foundry certification flows, design workflow automation platforms, and the data that powers AI optimization. These aren't cyclical advantages—they're structural positions that strengthen over time.

The China export control episode accidentally demonstrated this infrastructure status. When essential infrastructure becomes unavailable, customers don't evaluate alternatives—they pay whatever necessary to restore access or secure alternative supply. That's exactly what happened globally when artificial scarcity created immediate pricing power.

Looking forward, three developments will determine whether this infrastructure thesis proves correct:

Physical AI Market Evolution: Cadence is positioning for autonomous vehicles, robotics, and edge devices to create additional design complexity beyond data center chips. Success here validates TAM expansion beyond traditional semiconductor markets.

Hyperscaler Integration Depth: The extent to which Google, Amazon, Microsoft, and Meta integrate Cadence workflows into their silicon development will determine long-term pricing power and competitive sustainability.

Regulatory Response Timing: As Cadence's infrastructure role becomes apparent, government attention to competition and technology dependency will likely increase. How they navigate this while maintaining technical leadership will significantly impact value creation.

The investment opportunity lies in the recognition gap. Cadence is demonstrating infrastructure characteristics while being valued as cyclical software. That disconnect won't persist indefinitely, but it creates exceptional opportunity for investors who understand the transformation occurring beneath the quarterly metrics.

This isn't just another AI beneficiary executing well—it's a company becoming indispensable to the most important technology transformation of our time while the market still prices it as if it sells optional productivity tools.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.