China Mobile : Sovereign Cloud Mispricing

Why a “declining telco” is actually China’s state computational backbone—and why the market is wrong.

TL;DR

China Mobile runs two engines: a maturing but massive cash meter and a rapidly growing, state-backed cloud build.

Government and SOE cloud demand is governed by sovereignty, not price—creating a moat private providers can’t cross.

The stock prices the build at ~0.5x revenue, implying either the moat is worthless or the equity is cheap.

A Light in Sichuan

In 1955, a single light bulb flickered to life in a village in rural Sichuan province. For the farmers gathered around it, this was modernity arriving decades after it had transformed the coastal cities. The bulb connected to a wire, the wire to a pole, the pole to a network stretching back through mountains to a hydroelectric station that had taken years to build and would take decades more to pay for.

The electrification of China was not a business. It was a national project dressed in the language of enterprise. The entity responsible deployed capital with time horizons no private investor would tolerate, built capacity in regions that would never generate adequate returns, and priced its product to enable development rather than maximize profit.

This model worked. Within decades, China achieved near-universal electrification. The investors who funded it received stable income and participated in nation-building. Not spectacular returns—but durable ones, backed by an enterprise too important to fail.

Sixty years later, another state champion is building another national grid. The product is no longer electrons. It is computation.

The Paradox

China Mobile serves more than one billion mobile subscribers—a customer base larger than any company in any industry anywhere in the world.

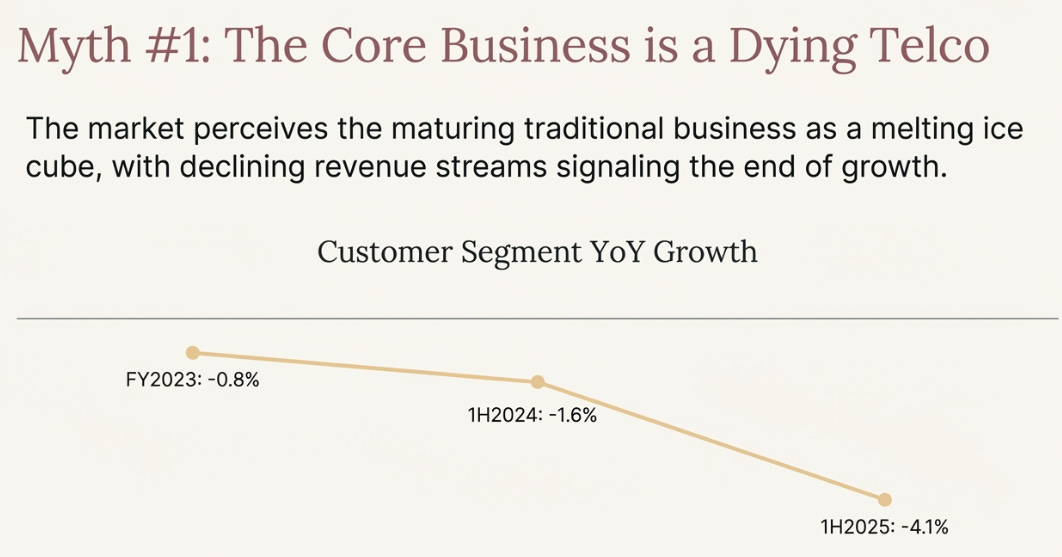

The core business is maturing. In the first half of 2025, the “Customer” segment declined 4.1% YoY. Traditional communications demand is saturating.

At the same time, China Mobile is returning more cash to shareholders than at any point in its history. The dividend payout ratio is rising toward 75%. The yield exceeds 6%.

And simultaneously, China Mobile is investing aggressively in cloud computing—which crossed 100 billion renminbi in 2024, growing more than 20% annually. Digital transformation services now represent over a third of total revenue.

The market sees contradiction: a declining telco trying to become a cloud company while paying out most of its earnings. The stock trades at 11 times earnings with a persistent discount to global peers.

The market is wrong. These capital allocation choices make perfect sense—because China Mobile is not a telco trying to become a cloud company. It is the state computational grid being built in plain sight.

Two Engines

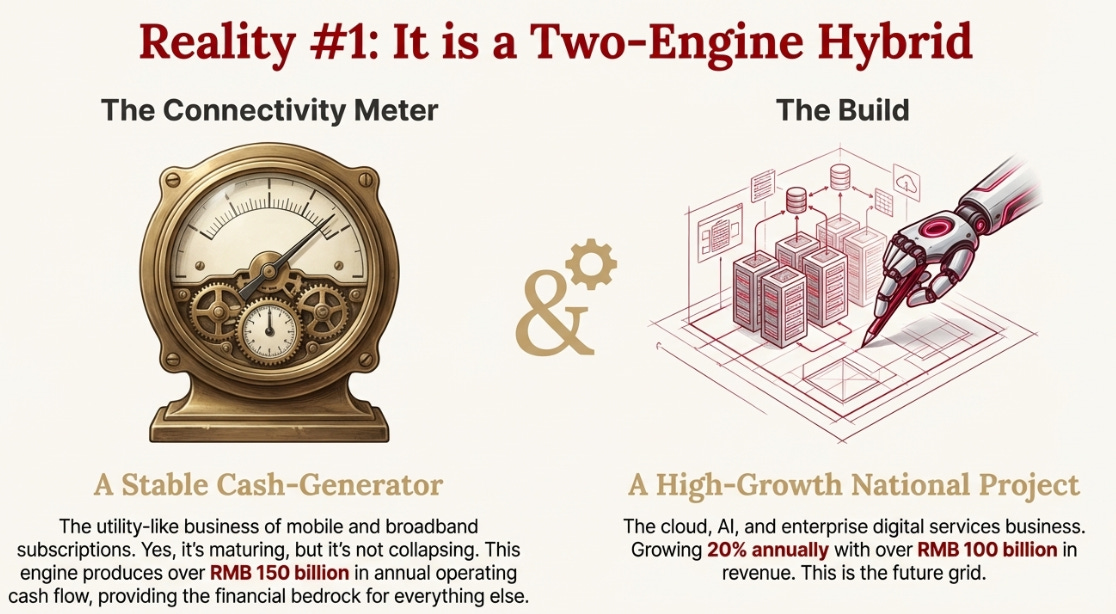

China Mobile has two economic engines.

The Connectivity Meter: mobile subscriptions, broadband connections, recurring revenue from a billion customers. Utility-like, high-margin, extraordinarily cash-generative. Yes, it is maturing:

But “maturing” is not “collapsing.” The Meter still produces over 150 billion renminbi in annual operating cash flow. This is the financial bedrock.

The Build: cloud computing, enterprise digital services, AI applications. Growing 20% annually into a market that barely existed five years ago. Cloud revenue of 100 billion renminbi. Government tender win rate of 16%—the highest in the industry. 700+ large-scale 5G enterprise projects deployed.

The market assumes the Build is worthless. It is not. A business growing 20% with captive government customers is not a cost center. It is an asset. And it trades at 0.5x revenue because investors still think China Mobile is a phone company.

The Sovereign Moat

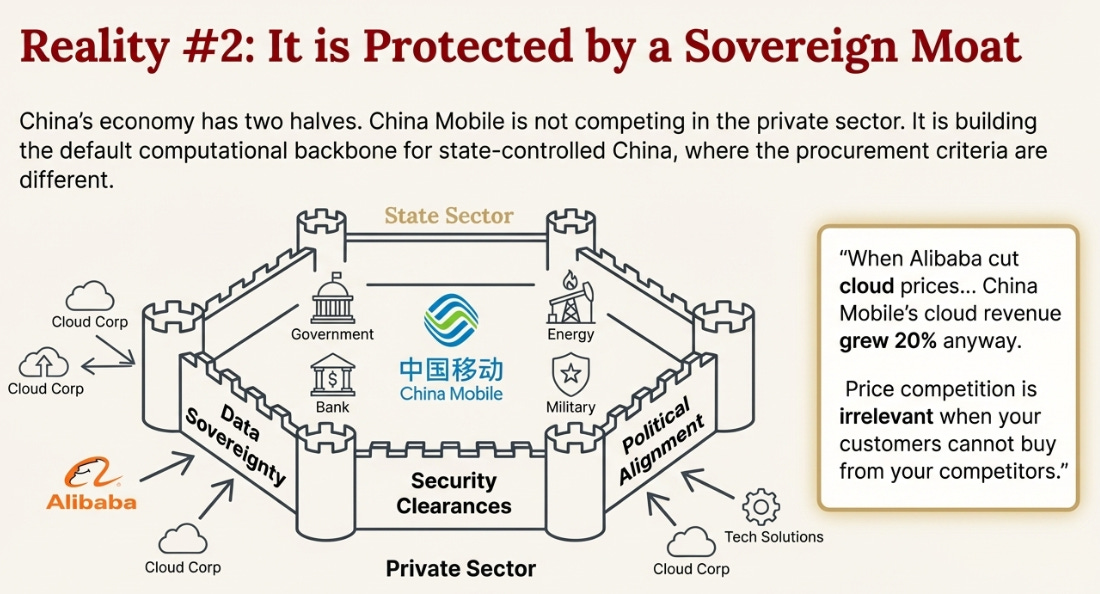

China’s economy divides into two halves operating by different rules.

The private sector—consumer internet, export manufacturers, startups—purchases cloud services based on price and performance. Alibaba wins that market. China Mobile is not competing for it.

The state sector operates differently. Government agencies, state-owned enterprises, regulated industries like banking, energy, and defense have procurement criteria that never appear on feature comparisons: data sovereignty, security clearances, political alignment. For a ministry storing sensitive data, the question is not whether Alibaba’s cloud is faster. The question is whether they trust Alibaba at all.

They do not. They trust China Mobile.

China Mobile is building the default computational backbone for state-controlled China. Its customers are not choosing China Mobile despite alternatives—they are choosing it because there are no alternatives. When Alibaba cut cloud prices by 15-50% in 2023-24, China Mobile’s cloud revenue grew 20% anyway. Price competition is irrelevant when your customers cannot buy from your competitors.

State Grid Corporation built the electrical infrastructure for all of China and became one of the world’s largest companies. China Mobile is building the computational infrastructure for state-controlled China. The addressable market is smaller but still enormous—and growing at 20% annually.

The Accounting Reality

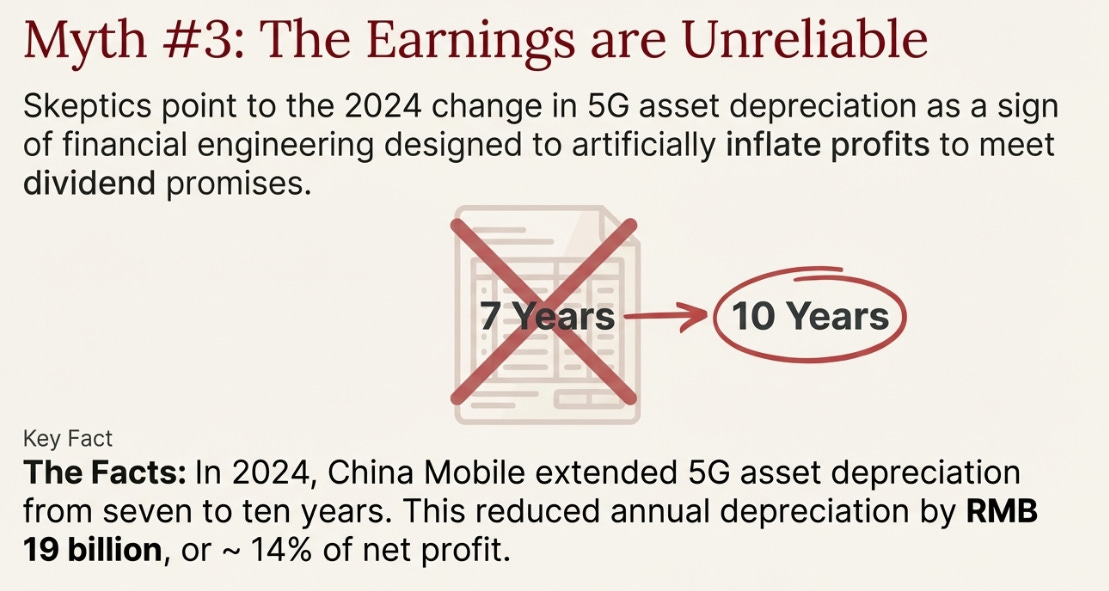

In 2024, China Mobile extended 5G asset depreciation from seven to ten years, reducing annual depreciation by 19 billion renminbi—roughly 14% of net profit.

Yes, the depreciation change was accounting-led. Yes, it created earnings headroom needed to fund the 75% dividend promise. This is not fraud; it is state-capitalism optimizing for stability over transparency. Management will choose accounting flexibility over capital discipline when the state demands both dividends and investment.

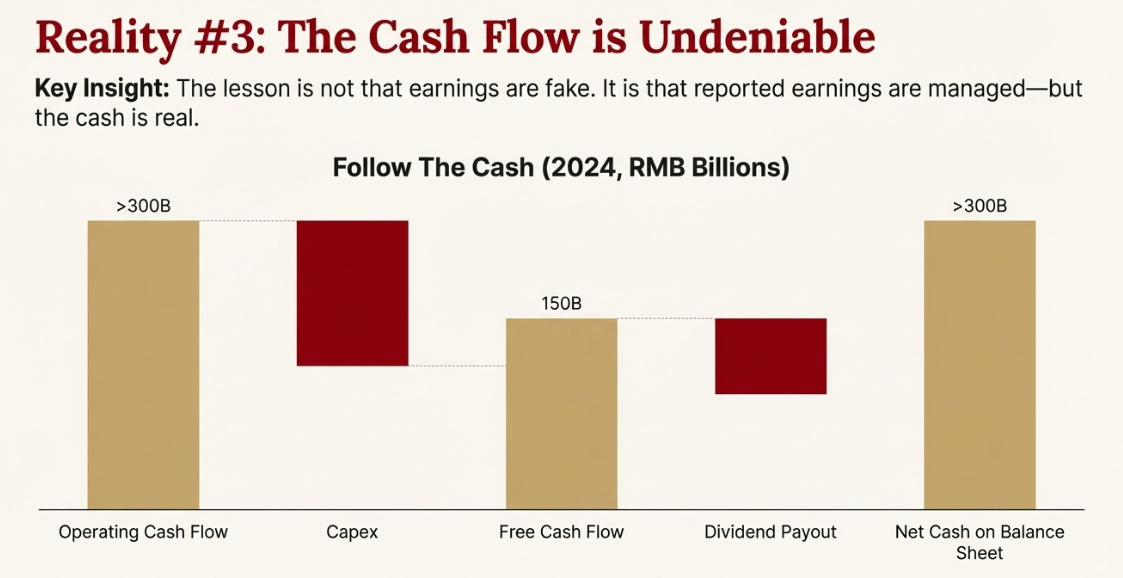

The lesson is not that earnings are fake. It is that reported earnings are managed—but the cash is real. Operating cash flow exceeded 300 billion renminbi in 2024. Free cash flow after capex was 150 billion. The dividend is covered. The balance sheet carries over 300 billion in net cash.

The accounting is what it is. The cash flow is what matters.

VI. The Valuation Gap

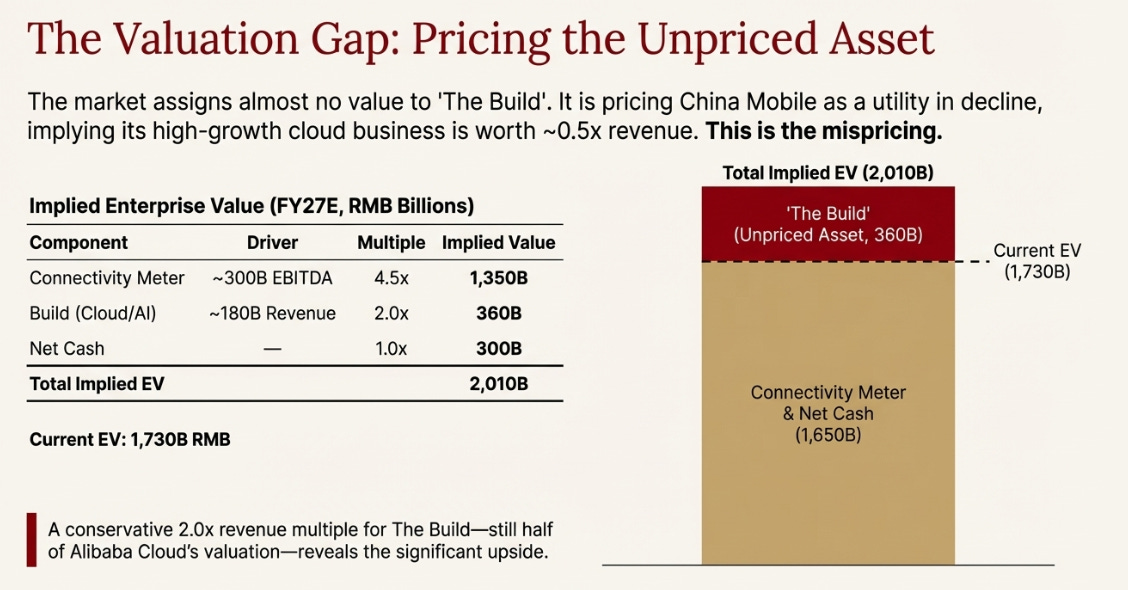

The market assigns almost no value to the Build. Here is what it should be worth:

At a 2x revenue multiple—still half of Alibaba Cloud’s valuation—the Build alone adds 360 billion renminbi. If it deserves 3x, the stock is worth HKD 95. If 4x, HKD 105+.

The market is pricing the Build at roughly 0.5x revenue. This is the mispricing. Either the sovereign moat is worthless, or the stock is cheap. I believe the sovereign moat is real.

Three Roads

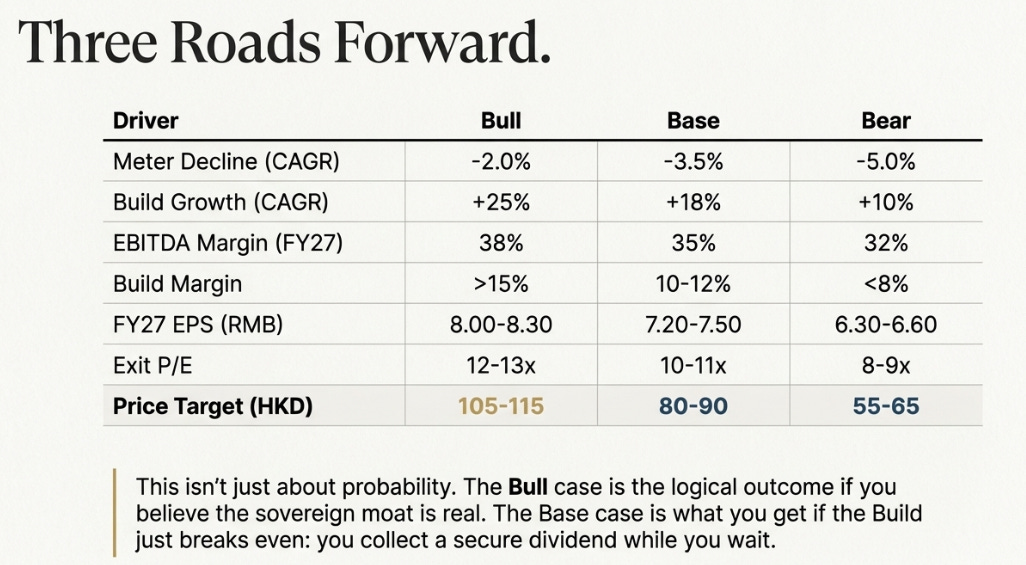

The probability-weighted return is approximately 10% annually. But this framing is misleading.

The bull case is not a tail event. It is the base case for anyone who believes the sovereign moat is real. The “base” scenario is what happens if the Build merely breaks even: you collect the dividend. The bear case is dilution risk—the state extracting value through margin compression and payment delays.

The options are: good, okay, and bad. Not: spectacular, mediocre, and terrible.

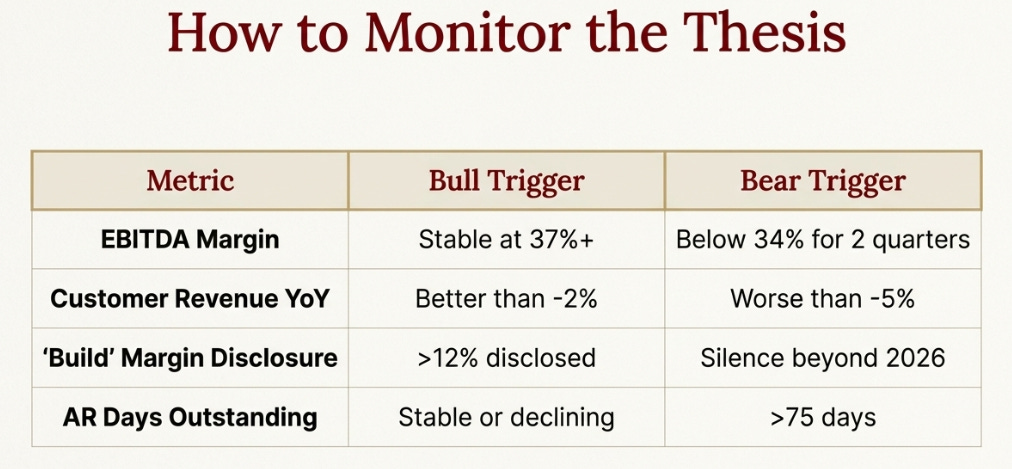

What to Watch:

The Second Grid

At HKD 80, you are buying State Grid’s cash flows with a free call option on the computational infrastructure of state-controlled China. The market sees a melting ice cube. I see the next regulated monopoly being built in plain sight. The dividend is not a bribe for patience—it is your dividend, backed by 300 billion in net cash and 150 billion in annual free cash flow. The Build is not a cost center—it is a business growing 20% annually with captive customers, valued at nearly zero. When the market cannot categorize something, it misprices it. China Mobile is not a telco, not a cloud company, and not a utility. It is the state computational grid. Once investors understand this, they will price it accordingly.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.