Credo's 1QFY26: Moment Accelerates

Why AI’s router company may be repeating Cisco’s 1990s playbook

TLDR:

From Hardware to Platform: Credo is transforming from a cable/chip supplier into AI’s intelligence layer, with Pilot software turning deployments into self-optimizing infrastructure.

Network Effects in Action: Customer concentration shifts show hyperscalers locking in and spreading adoption, proving Credo’s platform is sticky, not commodity.

Universal Layer Advantage: Protocol-agnostic positioning, high margins, and rack-to-rack expansion create a moat with software-like economics and asymmetric upside.

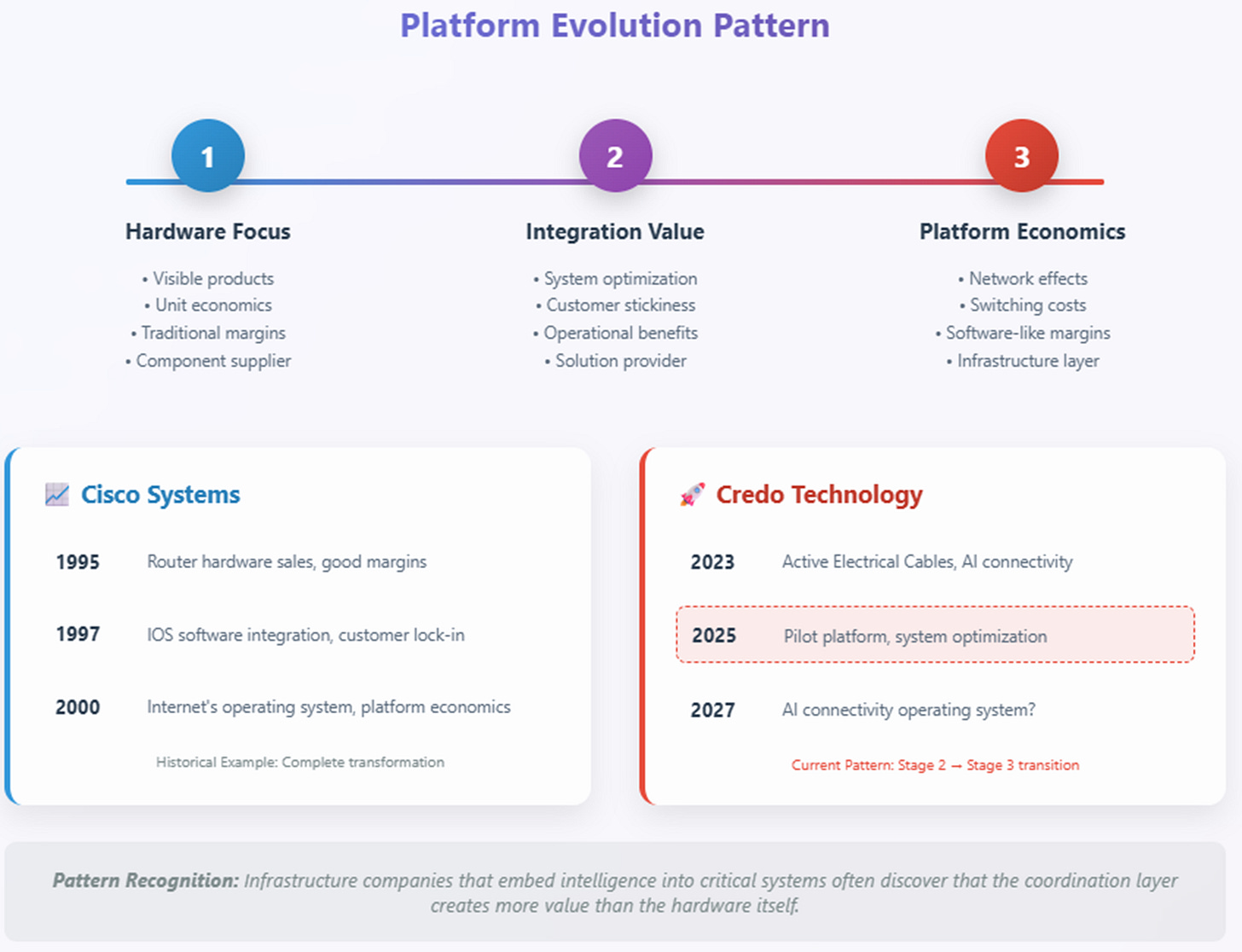

In 1995, Cisco Systems looked like a successful hardware company selling network routers to the rapidly expanding internet. Investors who understood the surface story did well. But those who recognized that Cisco was actually building the internet's operating system—that each router deployment made their IOS software more valuable and created operational dependencies that transcended hardware procurement—captured generational wealth as the company transformed from a box vendor into the coordination layer for digital infrastructure.

Think of it like the difference between selling individual traffic lights versus building the entire traffic management system for a city. The lights are visible and important, but the real value lies in the intelligent coordination system that makes the whole network function smoothly.

The pattern was subtle but powerful: what appeared to be hardware sales were actually platform deployments, creating network effects where each customer installation increased the value proposition for all others. Early adopters became reference architectures. Technical superiority evolved into operational lock-in. Hardware margins reflected software economics.

Twenty-nine years later, a strikingly similar transformation appears to be accelerating in AI infrastructure connectivity.

The Thesis Evolution: Two Quarters of Platform Evidence

Six months ago, Credo Technology looked like an excellent semiconductor company riding the AI wave with their Active Electrical Cables. The platform thesis—that they were building the operational intelligence layer for AI connectivity through their Pilot software—was intriguing but largely theoretical.

The evolution from Q4FY25 to Q1FY26 has transformed theory into measurable evidence.

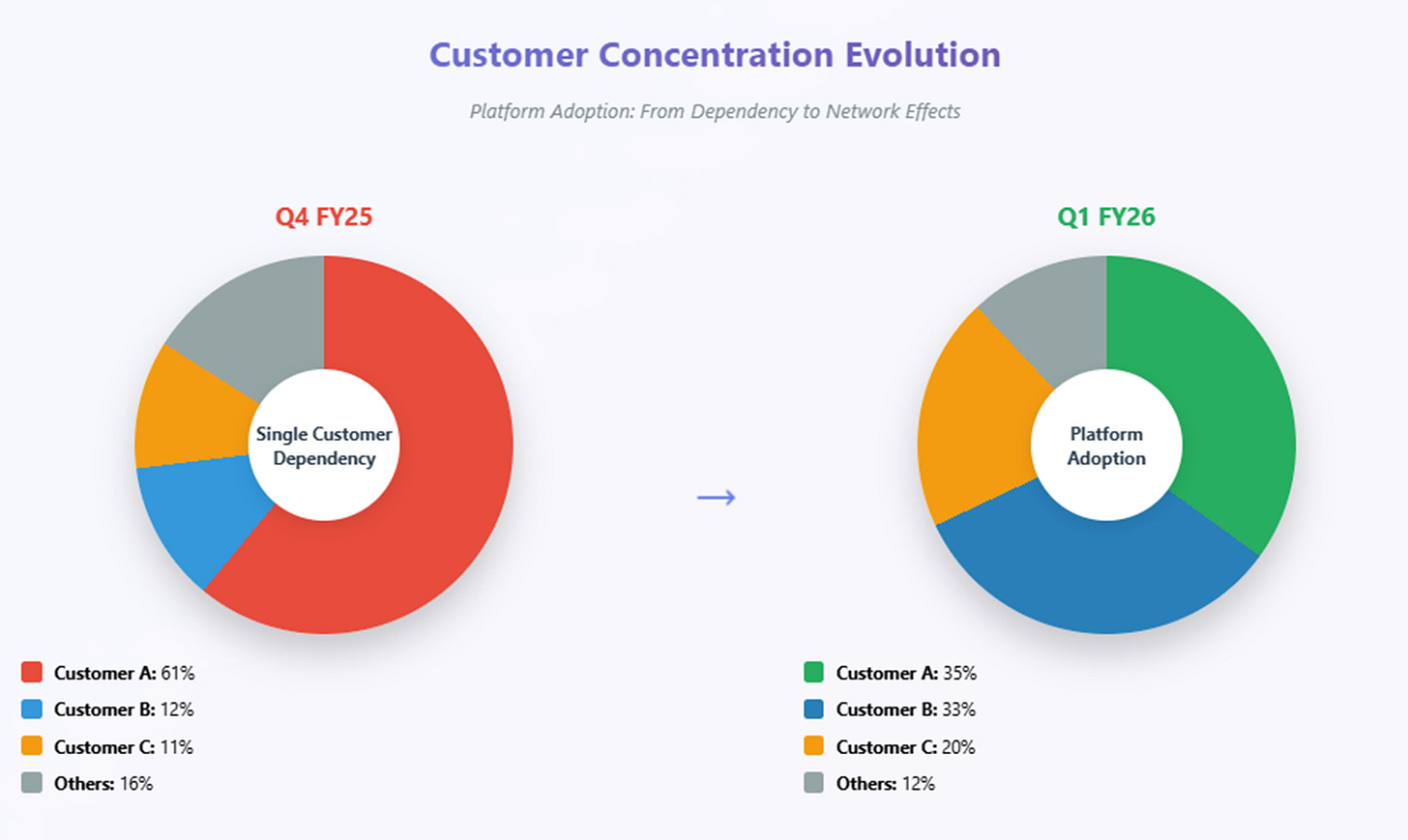

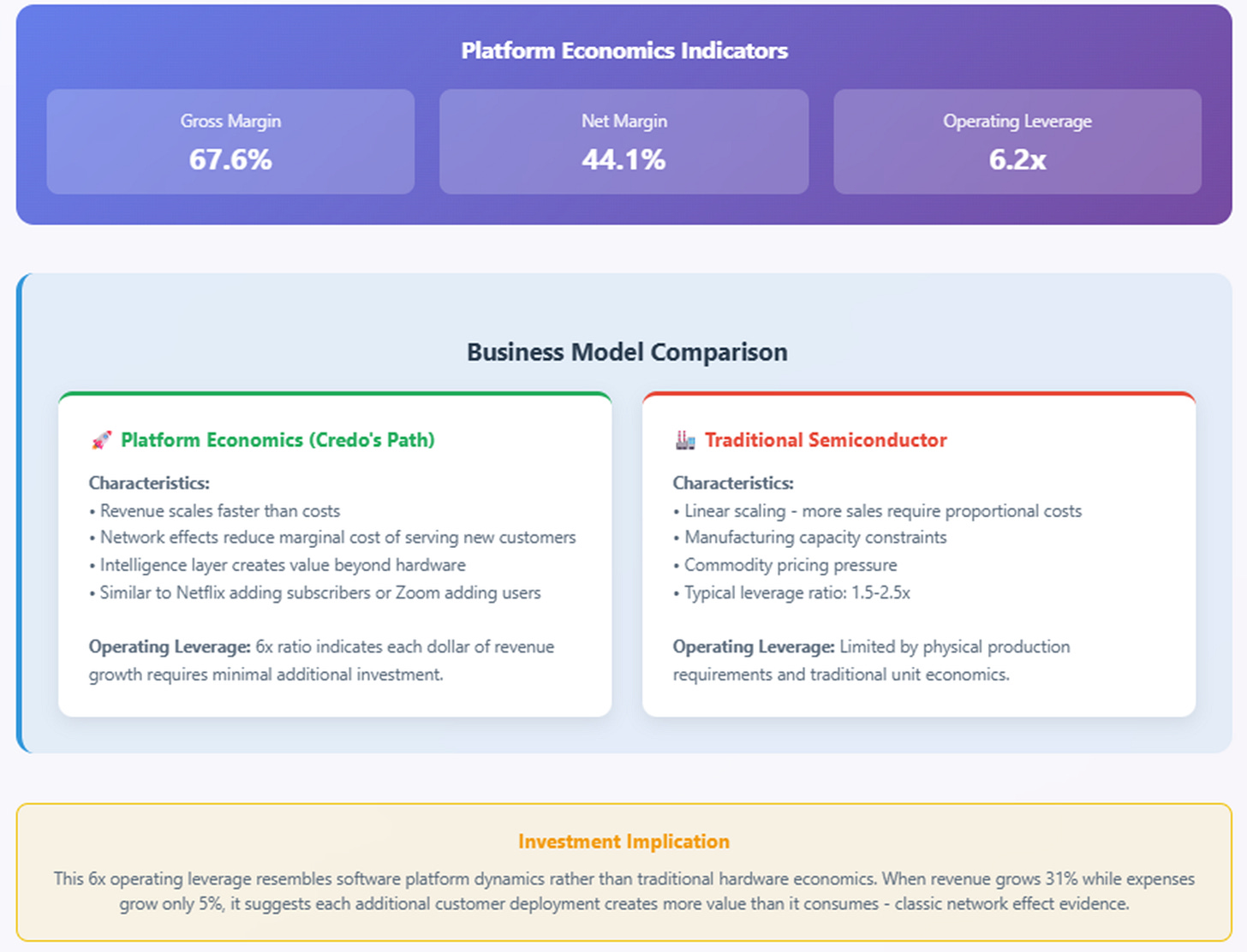

The most telling indicator isn't the impressive financial results, though those matter: revenue jumping from $170M to $223M while maintaining 67.6% gross margins and achieving 44.1% net margins. It's the customer concentration transformation that reveals network effects in action.

Q4FY25 showed one customer representing 61% of revenue, with two others at 12% and 11%. By Q1FY26, this had evolved into three customers at 35%, 33%, and 20% respectively. This isn't diversification for risk management—it's platform adoption spreading like a successful social media app where early adopters prove the value to their peers.

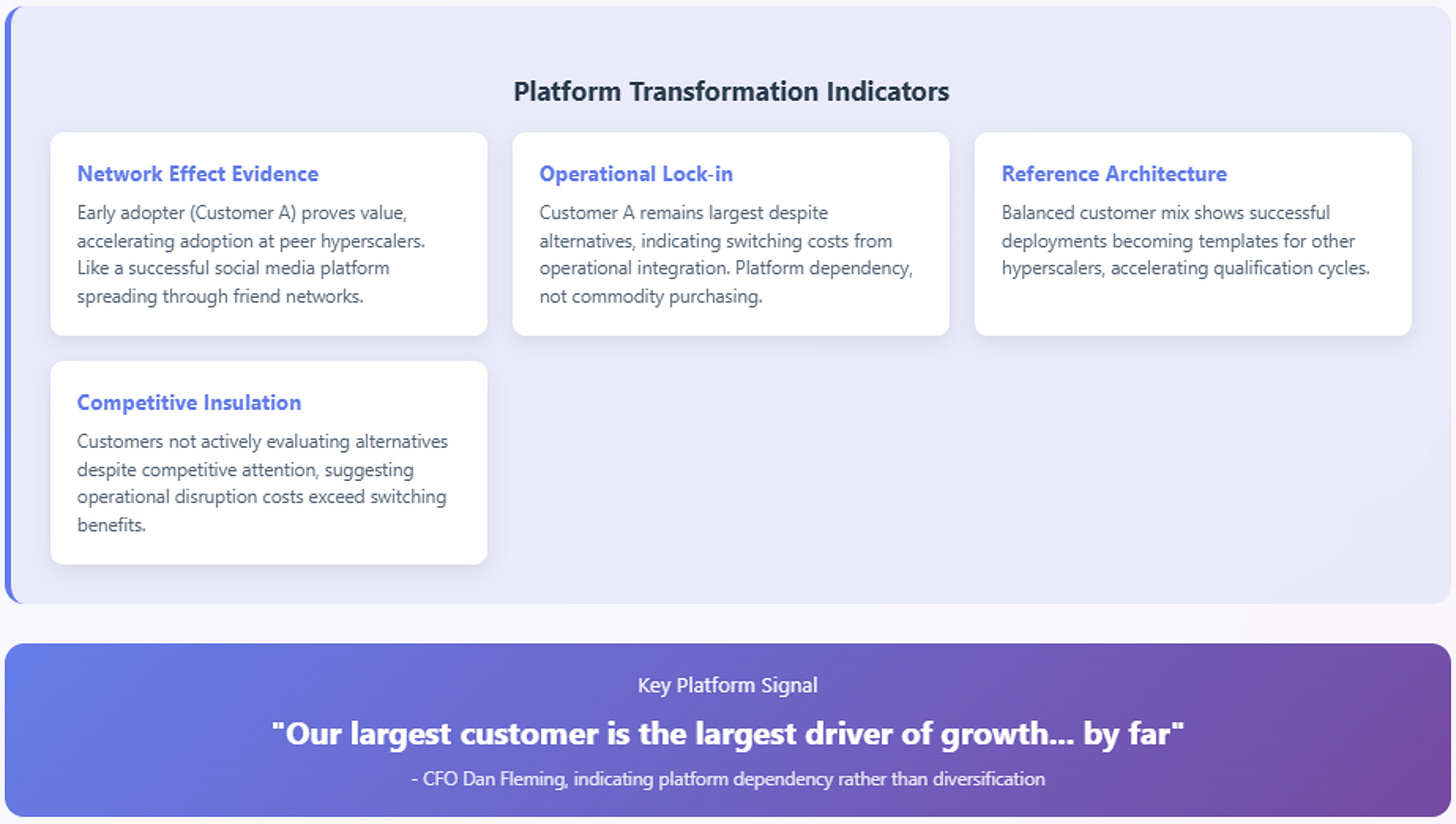

When CFO Dan Fleming noted that "our largest customer for fiscal 'twenty five is the largest driver of our growth in fiscal 'twenty six... by far, actually," he described platform dependency, not commodity purchasing. The customer remains Credo's largest not despite having alternatives, but because operational integration creates switching costs. It's like switching from iPhone to Android after years of using iMessage, iCloud, and the App Store—technically possible, but operationally disruptive.

The operating leverage tells the same story: 31% sequential revenue growth accompanied by just 5% operating expense growth. This resembles Netflix's economics where adding more subscribers costs very little once the platform infrastructure exists, rather than traditional manufacturing where more sales require proportionally more costs.

The Intelligence Layer Emerges

Credo's Q1 earnings call revealed platform development in real time. CEO Bill Brennan's discussion of their "system level approach" where they "own the entire solution stack, including SerDes IP, retimer ICs, system level design, qualification and production" sounds technical, but describes end-to-end control that enables optimization across traditional component boundaries.

To understand what this means, imagine the difference between buying individual plumbing parts versus hiring a company that designs, installs, and maintains your entire water system. The latter can optimize the whole system's performance in ways that individual component suppliers cannot.

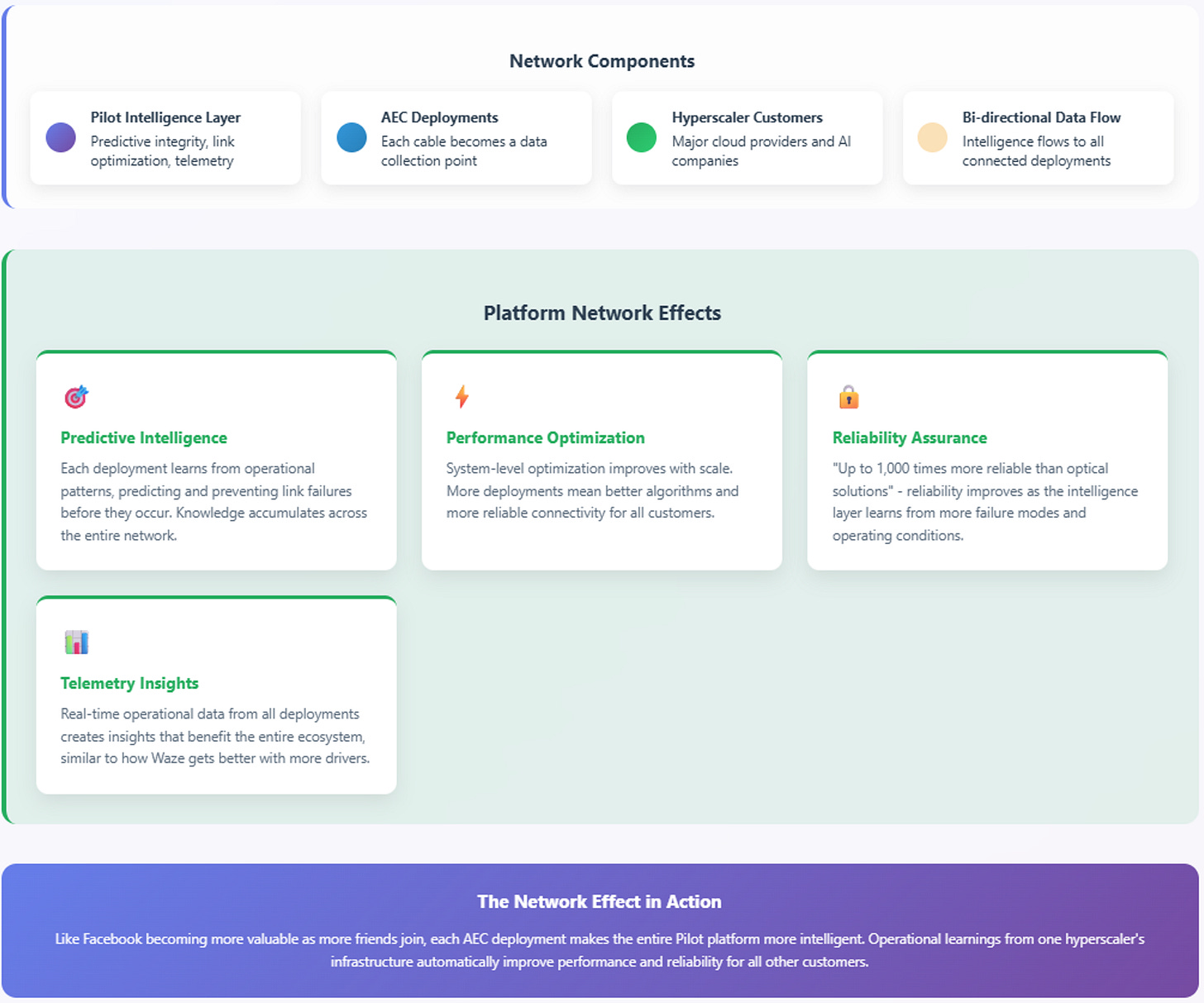

The Pilot platform—"predictive integrity, link optimization, and telemetry"—transforms every hardware deployment into a data collection point. Think of it like a smart thermostat that doesn't just control temperature but learns your patterns and optimizes your entire home's energy usage. When Brennan claims AECs are "up to 1,000 times more reliable" than optical solutions and "virtually eliminate link flaps," he's addressing a critical problem.

To grasp why this matters, imagine you're on the most important video call of your career—a final job interview or crucial business negotiation—and your connection keeps dropping for split seconds. In AI training, those brief interruptions (called "link flaps") can halt computation runs that cost hundreds of thousands of dollars per hour. It's like having a manufacturing assembly line where one unreliable robot stops the entire production facility.

Each successful deployment generates operational intelligence that improves performance for all other customers. This is classic platform dynamics: Facebook became more valuable as more friends joined, Uber improved as more drivers and riders used the network, and Credo's connectivity solutions become more intelligent as more hyperscalers deploy them.

The patent settlements with Amphenol and Volex, rather than weakening Credo's position, demonstrate sophisticated platform strategy. By licensing technology while maintaining control of the optimization intelligence, Credo enables ecosystem participation while preserving competitive advantages. It's like Apple allowing other companies to make iPhone accessories while controlling iOS—the ecosystem grows but Apple maintains the valuable control layer.

Strategic Positioning: The Universal Layer

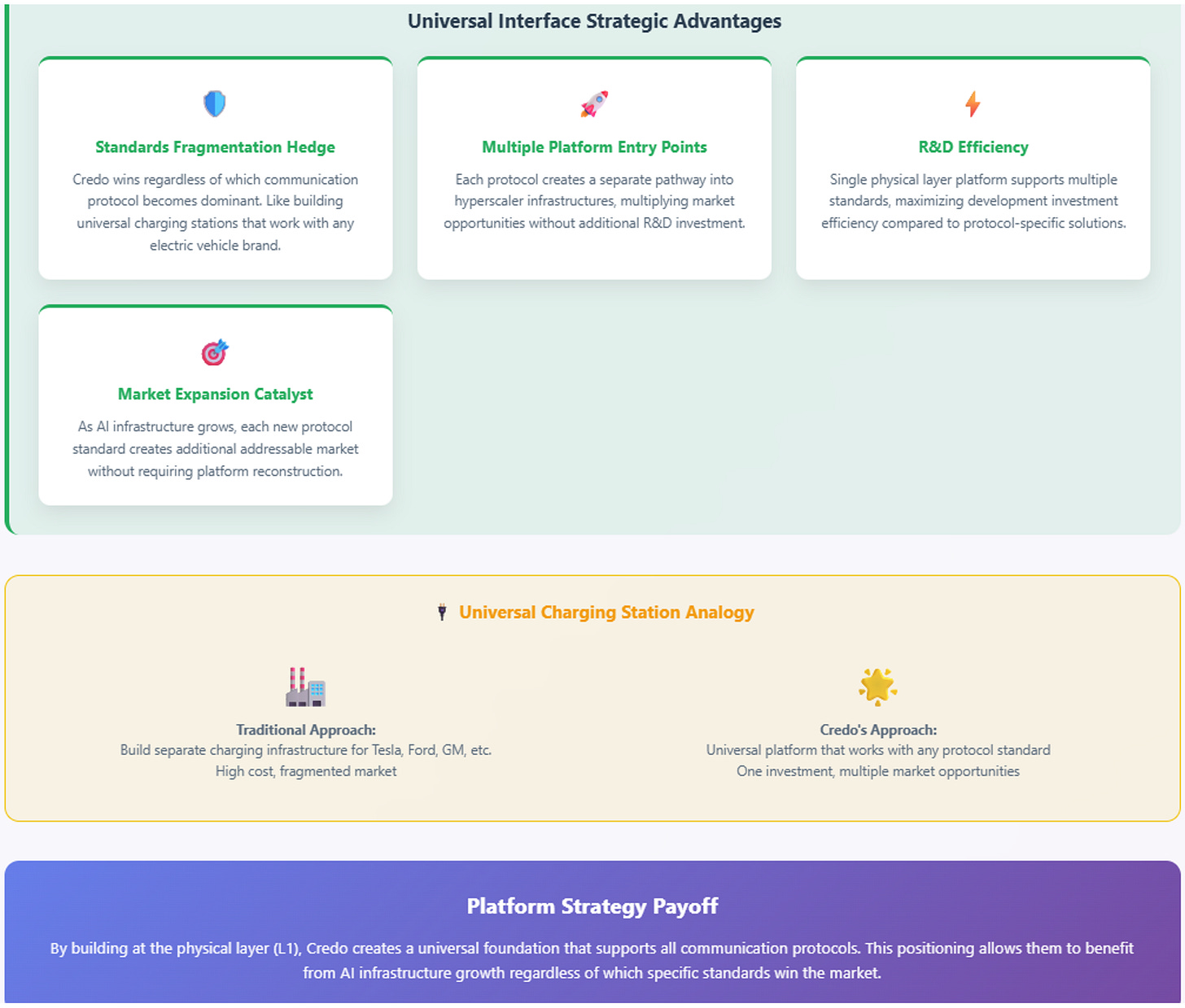

Credo's protocol-agnostic approach to the upcoming 200G/lane transition reveals platform thinking at scale. When Brennan explained that their "224G per lane AECs will be able to support Ethernet, SUE, UALINK, and also NVLink fusion" because "at the physical layer, layer one, these are all similar SerDes," he described a universal interface strategy.

Think of this like building universal charging stations that work with Tesla, Ford, GM, and any other electric vehicle rather than building separate infrastructure for each brand. This hedges against standards fragmentation while creating multiple platform entry points—Credo wins regardless of which communication protocol becomes dominant.

The expansion from intra-rack to rack-to-rack connections illustrates how platform effects create market expansion. As Brennan noted, liquid cooling and power improvements enable "a quadrupling of GPU density with one customer... to architect their entire scale up network with AECs." It's like how faster internet connections enabled Netflix streaming, which then enabled binge-watching, which created demand for even faster connections—each improvement expands the market opportunity.

The competitive response—or lack thereof—supports the switching cost thesis. Despite Credo's success attracting competitive attention, customers aren't actively evaluating alternatives. When asked about competition, Brennan noted that "the competitive environment has not changed meaningfully in the last ninety or one hundred and twenty days." This suggests customers find switching costly or risky, like how businesses stick with Microsoft Office despite alternatives because retraining employees and converting files creates operational friction.

Reading the Platform Signals: Investment Implications

The challenge facing investors isn't predicting Credo's future but interpreting what's already happening. The same evidence that suggests platform transformation to some appears as excellent hardware execution to others. The difference lies in how one reads the signals and what patterns they suggest.

Consider the customer concentration evolution. Traditional semiconductor analysis views this as positive diversification reducing business risk—like a restaurant getting more customers instead of depending on a few regulars. Platform analysis sees it as network effects validation—early adopters proving operational benefits that accelerate adoption among peers, like how early smartphone users convinced their friends to get smartphones too.

The margin sustainability question reveals similar interpretative differences. Credo's ability to maintain 67.6% gross margins while scaling rapidly could indicate pricing power in a supply-constrained market, like concert tickets during a popular tour. Or it could reflect software economics where additional deployments generate more value than they consume in costs, like how Zoom can add more users without proportional cost increases.

The protocol-agnostic positioning creates different risk-reward calculations depending on analytical framework. Traditional hardware analysis sees execution complexity—like a company trying to make products for multiple incompatible standards simultaneously. Platform analysis sees universal interface strategy that creates value regardless of which protocols succeed, like how Amazon Web Services works with any programming language or operating system.

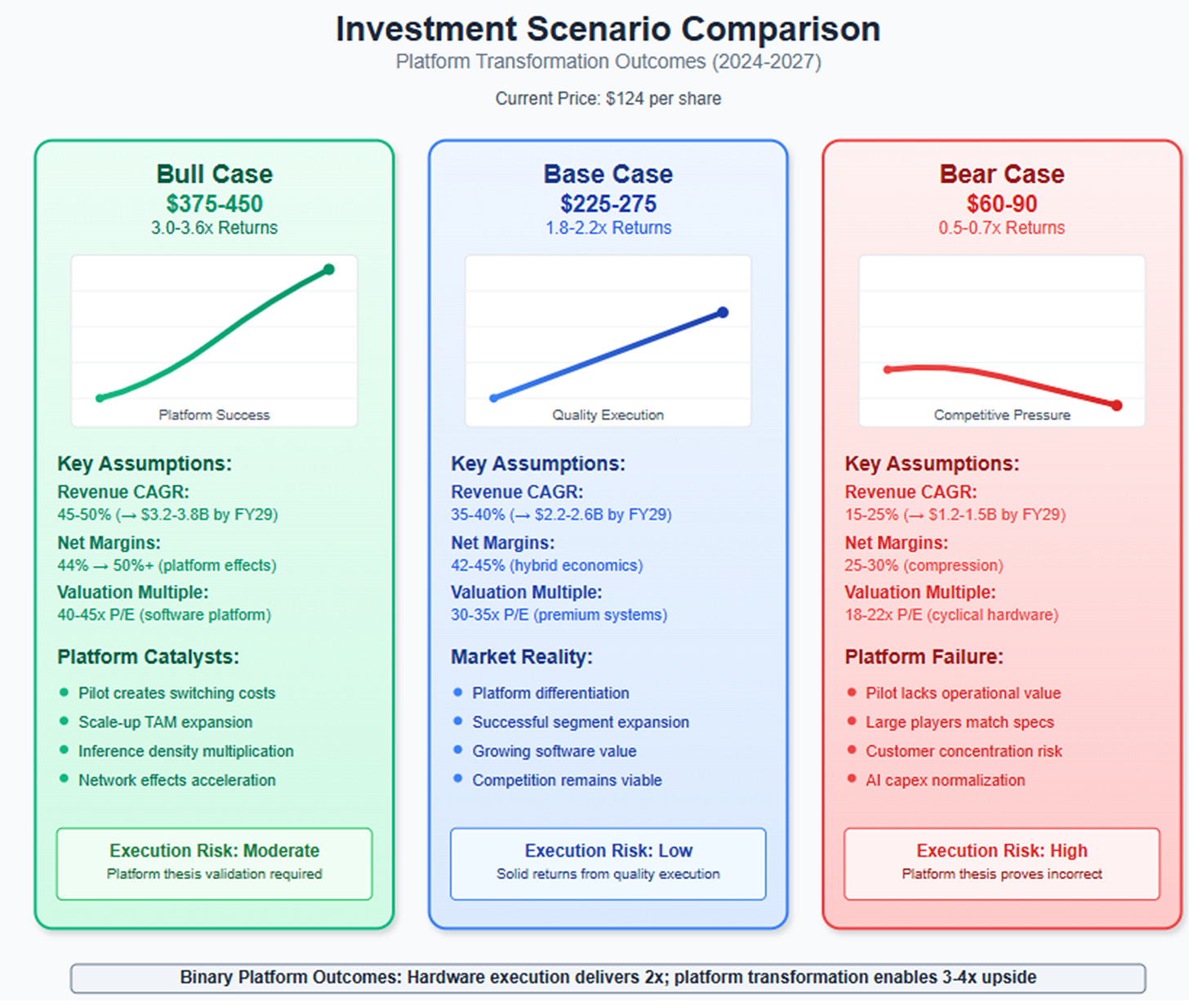

These interpretative differences lead to dramatically different investment outcomes. If Pilot evolves into genuine operational infrastructure that hyperscalers cannot replace without significant business disruption—like trying to replace Google's search algorithm with a different system—Credo's financial trajectory resembles software platform economics. This could support revenue growth of 45-50% annually with net margins expanding toward 50%, potentially driving the stock to $375-450 per share.

Alternatively, if platform elements provide competitive differentiation without full transformation—like having the best customer service in your industry but not changing the fundamental business model—Credo might achieve solid 35-40% revenue growth with stable margins around 42-45%. This would justify stock prices of $225-275 per share, reflecting quality execution without platform premiums.

The bear case assumes competitive pressure undermines platform aspirations, like how many companies claimed to be "the Uber of X" but failed to create lasting advantages. Revenue growth decelerating to 15-25% with margin compression would reflect traditional hardware economics, pointing toward $60-90 per share.

Monitoring the Transformation

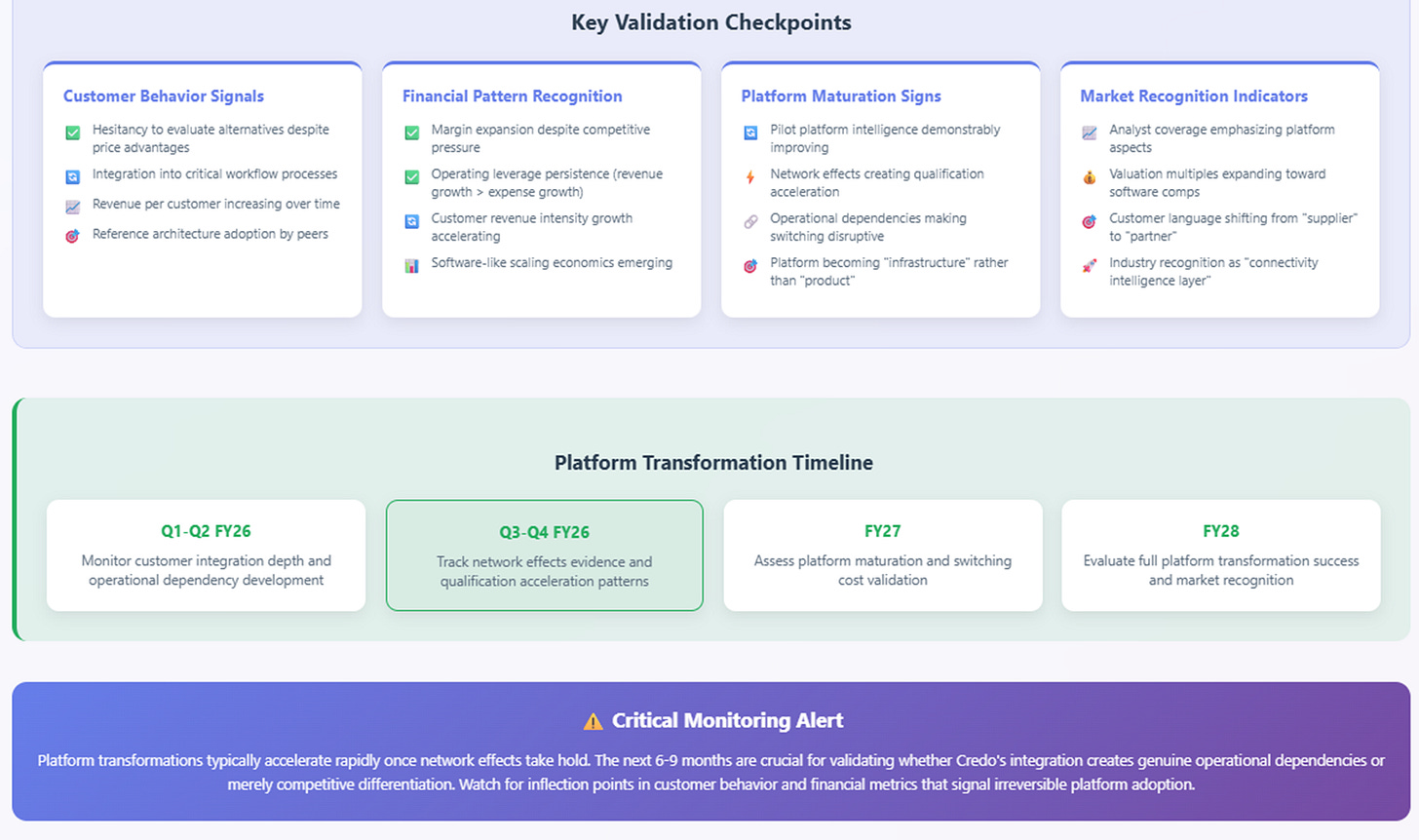

Platform transformations typically succeed dramatically or fail definitively—like social media platforms that either achieve massive scale or disappear entirely. This creates both opportunity and risk, requiring careful attention to early indicators that distinguish between outcomes.

Customer behavior provides the clearest signals. True platform adoption creates operational dependencies that make switching costly regardless of alternative product capabilities. It's like trying to convince a company to switch from Salesforce to a different CRM system—even if the alternative is cheaper or has better features, the disruption of changing workflows, retraining staff, and migrating data creates resistance.

Evidence includes customer hesitancy to evaluate competitive offerings despite price advantages, integration of Credo solutions into critical workflow processes, and reference architecture proliferation where successful deployments accelerate adoption at other hyperscalers. Think of how successful Zoom deployments at major companies during COVID convinced other organizations to adopt Zoom rather than alternatives.

Financial metrics offer validation but lag operational changes. Margin expansion despite competitive pressure suggests platform value creation rather than temporary pricing power. It's the difference between charging premium prices because you're the only supplier versus charging premium prices because switching away would be operationally disruptive.

Operating leverage persistence—revenue growth consistently outpacing expense growth—indicates network effects rather than linear business scaling. Customer revenue intensity growth, where relationships deepen faster than they broaden, suggests platform economics emerging, like how Apple makes more money from existing iPhone users through services and accessories rather than just selling more phones.

Completing the Arc: The Next Infrastructure Inflection

Cisco's investors who identified the platform inflection in 1995 achieved generational returns, while those analyzing router sales missed the IOS transformation that made the internet work reliably.

Today, Credo's transformation from hardware supplier to operational intelligence provider follows strikingly similar patterns. The cables and chips represent visible infrastructure, but the Pilot platform and system-level integration could become the coordination layer that makes AI connectivity work seamlessly at unprecedented scale—like the difference between selling individual traffic management devices versus controlling the entire smart city traffic system.

The investment decision reduces to pattern recognition: whether we're witnessing another infrastructure company discovering that intelligence embedded in critical systems creates more value than the systems themselves. The evidence increasingly suggests yes, but the market continues pricing the hardware story while the platform transformation accelerates.

For investors willing to bet on platform pattern repetition, the asymmetric opportunity resembles what Cisco offered in 1995—the chance to own the essential coordination layer for the next phase of technological infrastructure. The steel rails were impressive, but the wealth creation came from making them intelligent. Today, Credo's cables are impressive, but the real opportunity lies in the operational intelligence that makes AI connectivity work reliably at the scale the future demands.

Platform transformations reward patient capital but punish late recognition. The inflection appears to be accelerating.

General Disclaimer: The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.