From Blackouts to Bulletproof: How Vistra Turned Power Into a Product

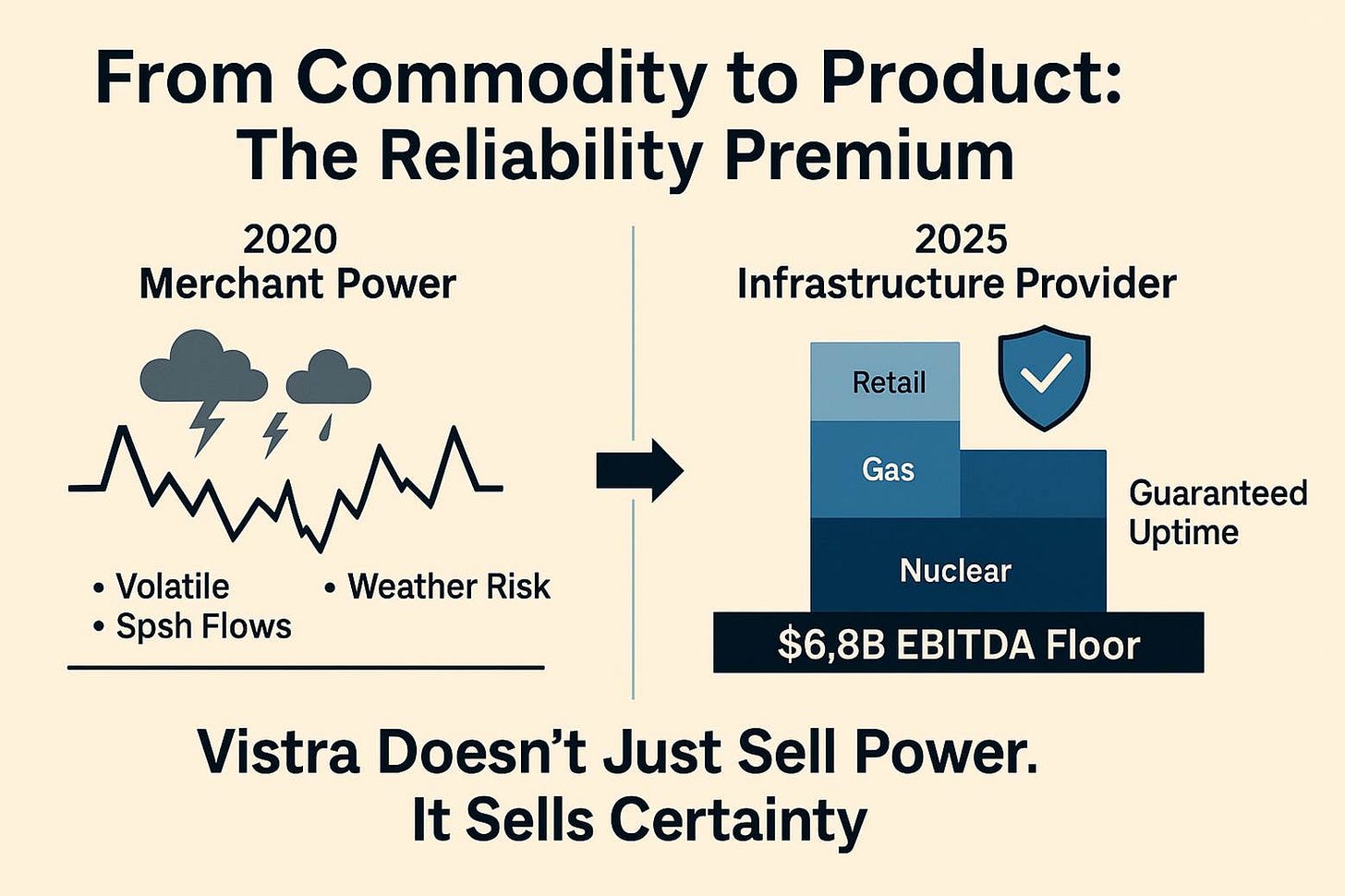

From a $2B crisis during Winter Storm Uri to a $6.8B EBITDA floor, Vistra has reinvented itself as the supplier of certainty in an AI-powered world.

TL;DR

AI flipped the power market: reliability, not price, is the new currency of electricity.

Vistra built a $6.8B EBITDA floor: nuclear baseload, gas flexibility, and retail integration de-risk cash flows while leaving upside optionality.

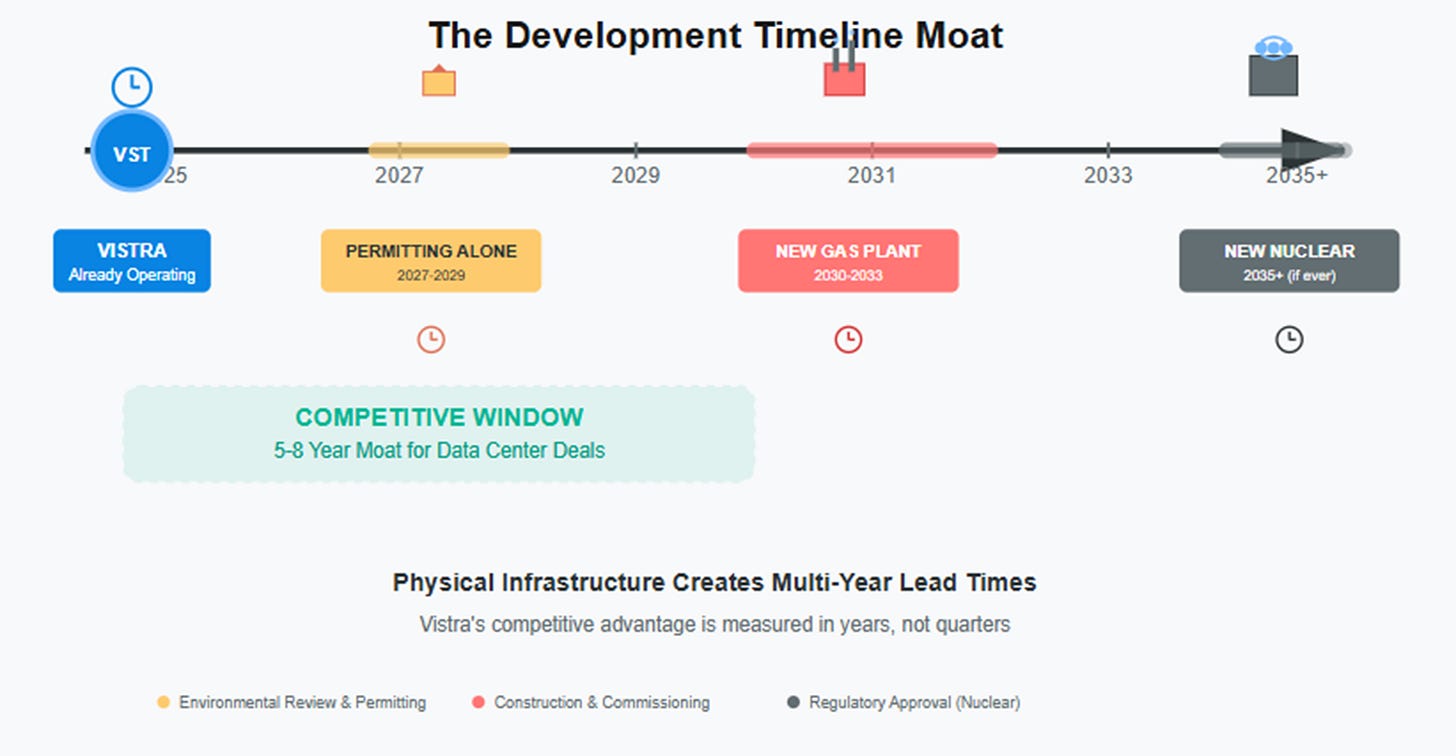

The moat is time: with new dispatchable capacity a decade away, Vistra has a rare multi-year window to lock in hyperscaler contracts at premium pricing.

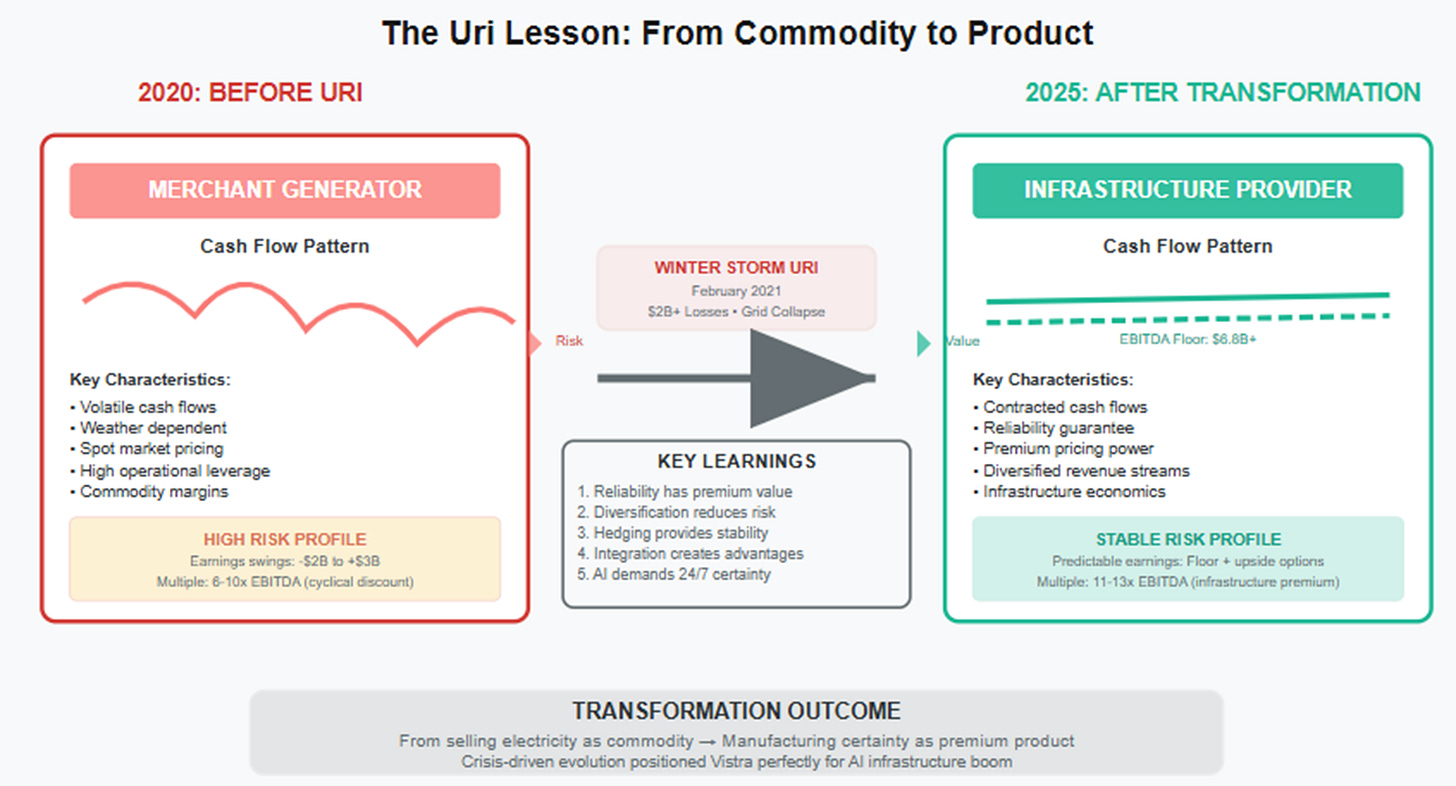

On February 15, 2021, the phones at Vistra Corp's command center in Irving, Texas, wouldn't stop ringing. Outside, temperatures had plummeted to -19°F. Natural gas pipelines were freezing. Power plants across the state were going offline one by one. The Electric Reliability Council of Texas (ERCOT) had just issued the unthinkable: controlled blackouts to prevent total grid collapse.

For Vistra, Winter Storm Uri wasn't just a weather event—it was an existential crisis that would ultimately cost the company over $2 billion in losses. But as executives watched their carefully hedged positions evaporate and their power plants struggle against conditions they'd never been designed to handle, something fundamental broke that week: the assumption that electricity would always be there, always be cheap, and always be predictable.

Fast-forward to today. Vistra's management no longer talks in the wide ranges typical of merchant power companies. Instead, they speak with unusual precision about "floors"—specifically, a 2026 EBITDA floor of at least $6.8 billion. The company that nearly buckled under Uri's assault has transformed into something different: a manufacturer of certainty in an uncertain world.

This transformation matters because the digital revolution has hit a physical wall.

The Reliability Premium

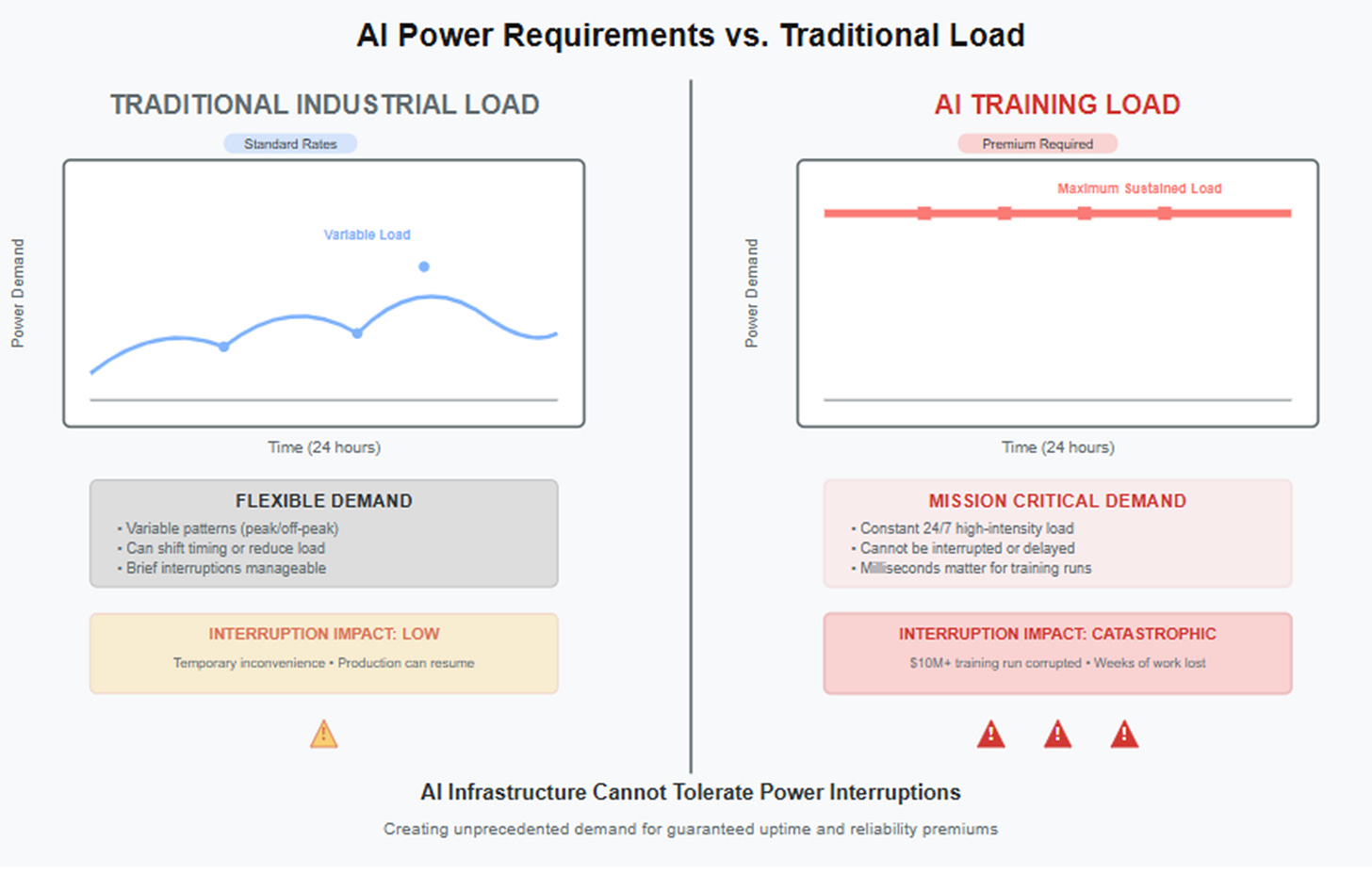

Artificial intelligence represents the first major software boom constrained not by code or capital, but by physics. Training a large language model requires massive computational clusters running continuously for weeks or months. A single power interruption—even for milliseconds—can corrupt a training run worth millions of dollars and months of work.

This creates what might be called the "Reliability Premium." In a world where a single GPU cluster can cost $100 million and a single training run can consume $10 million in compute resources, the most valuable kilowatt-hour isn't the cheapest one—it's the one that never fails.

For hyperscalers building AI infrastructure, power has transformed from a commodity input to a critical product requirement. They don't just need electricity; they need guaranteed, uninterruptible, 24/7 power with contractual certainty extending years into the future. Traditional utility arrangements, with their spot market exposure and weather-dependent reliability, simply won't suffice.

This shift from power-as-commodity to power-as-product has created an entirely new market dynamic. Companies that can deliver guaranteed uptime can command premium pricing. Those that can't are relegated to commodity rates.

Vistra's Product: Manufactured Certainty

Vistra's response to Uri wasn't just to rebuild—it was to fundamentally redesign what they sell. The company now offers something no competitor can fully replicate: a single contract that bundles nuclear baseload, natural gas flexibility, and retail integration into guaranteed, clean, always-on power.

The nuclear backbone provides zero-carbon baseload generation at scale. Vistra's 6,400 MW nuclear fleet, acquired through the Energy Harbor purchase, operates with 95%+ availability even during extreme weather. Nuclear plants don't freeze. They don't run out of fuel. They simply run, day and night, season after season.

The natural gas flexibility serves as dispatchable insurance. When demand spikes or other generators fail, Vistra's gas fleet can ramp up within minutes. This isn't just about peak shaving—it's about providing the backup guarantee that makes the entire system reliable enough for mission-critical AI workloads.

The retail integration completes the package. Vistra doesn't just generate power; it also sells directly to end customers through its retail arm. This provides natural hedging and creates a complete solution where the same company that generates your power also manages your billing, customer service, and grid interconnection.

For a hyperscaler planning a massive data center, this integrated offering is transformative. Instead of negotiating separate contracts with generators, transmission companies, and retail providers—each with their own risks and counterparty concerns—they can sign a single agreement with Vistra for firm, clean power with guaranteed uptime.

The Moat is Time, Not Cleverness

Why can't competitors simply replicate this offering? The answer lies not in proprietary technology or clever business models, but in the brutal realities of physics and regulatory timelines.

Building new nuclear capacity is effectively impossible in the current regulatory environment. Even if someone wanted to construct a new nuclear plant, the process would take 10-15 years and cost $30+ billion, as the troubled Vogtle project in Georgia demonstrated. The regulatory approval process alone can consume half a decade.

Natural gas plants are faster to build but still require 5-8 years from conception to commercial operation. Environmental permitting takes 12-24 months. Interconnection studies with grid operators can stretch 12-36 months. Construction of a modern combined-cycle plant takes 24-36 months even under ideal conditions.

Meanwhile, suitable sites near major load centers are increasingly scarce. Data centers need to be located near population centers and fiber infrastructure, which limits where new power plants can be built. Environmental opposition to new fossil fuel generation is intensifying. Grid interconnection rights, once viewed as administrative paperwork, have become scarce and valuable assets in their own right.

This creates a genuine time-based moat. Incumbent generators with assets already in place, already permitted, and already interconnected to the grid possess a multi-year head start that no amount of capital can quickly overcome.

Floor Plus Options: The Business Model Reframed

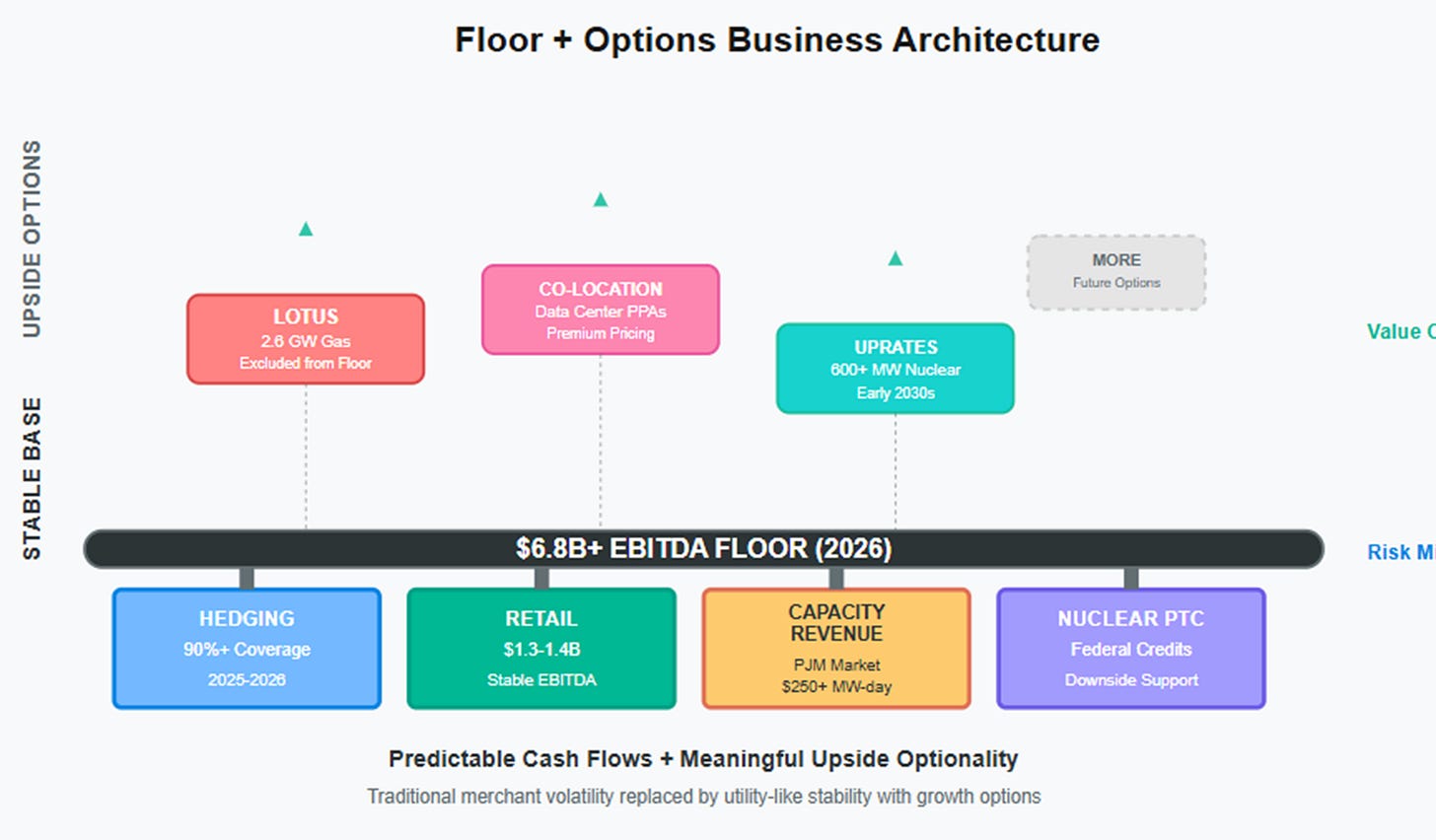

Understanding Vistra today requires abandoning traditional merchant power analysis. The company has engineered its business into two distinct components: a de-risked floor of cash flows and a portfolio of upside options.

The floor consists of predictable, contracted revenues:

Hedging Program: Vistra has locked in approximately 100% of expected 2025 generation and 90-95% of 2026 generation through forward sales contracts

Retail Run-Rate: The company's retail electricity business generates steady EBITDA of $1.3-1.4 billion annually

Capacity Revenues: PJM and other markets pay generators just for being available, providing base income regardless of actual generation

Nuclear Production Tax Credits: Federal policy provides downside support for nuclear generation

This foundation supports management's confidence in their 2026 EBITDA floor of at least $6.8 billion. Notice the precision: this isn't a range or a target, but a floor—a minimum level of earnings the company expects to achieve regardless of commodity price volatility.

The options represent sources of additional upside:

Lotus Acquisition: 2.6 GW of efficient natural gas generation, specifically excluded from the EBITDA floor calculations

Co-location Opportunities: Data center partnerships that could command premium pricing for dedicated power

Nuclear Uprates: Potential capacity expansions totaling 600+ MW at existing nuclear sites

This structure fundamentally changes the investment proposition. Traditional merchant power companies offer high returns with high volatility. Vistra now offers utility-like cash flow predictability with meaningful upside optionality—a combination rarely seen in the power sector.

What the Market Misses

The consensus view treats Vistra as a well-managed merchant generator benefiting from favorable market conditions and AI narrative hype. Analysts acknowledge the company's strong execution but worry that competition will eventually normalize pricing and compress margins. The current forward EV/EBITDA multiple of 12.6x seems full for a cyclical business.

This analysis misses the fundamental shift in business model quality. Vistra has engineered a migration from high-variance merchant cash flows to predictable quasi-utility economics. The extensive hedging, capacity revenues, production tax credits, and retail integration have dramatically reduced earnings volatility compared to traditional merchant generators.

Screens focusing on next-twelve-months metrics miss this transformation. They see a power company trading at 12.6x EBITDA and conclude it looks expensive. They don't see a infrastructure company with contracted cash flows trading at a reasonable multiple of predictable earnings.

The market also underestimates the timeline advantages. Financial models assume competitors can respond quickly to Vistra's data center opportunities. The reality is that meaningful new dispatchable capacity won't come online until 2028-2030 at the earliest. This provides Vistra with a multi-year window to establish long-term contracts before significant competition arrives.

Industry Incentives Align

The transformation of power from commodity to product reflects deeper changes in industry incentives that favor Vistra's positioning.

Hyperscaler incentives have shifted dramatically. These companies now prefer to pay premium prices for long-term, take-or-pay contracts rather than accept spot market risks. The cost of power interruption has become so high that reliability premiums are easily justified. Amazon, Microsoft, and Google are increasingly willing to sign 10-20 year agreements for firm power delivery.

Vistra's incentives align perfectly with this demand. The company prefers brownfield development (faster, cheaper, higher returns) over greenfield projects. They favor share buybacks and disciplined capital allocation over growth for growth's sake. They want to maintain investment-grade credit metrics while maximizing returns to shareholders.

Regulatory incentives increasingly favor firm resources over intermittent ones. Capacity market rules reward generators that can provide guaranteed availability during peak demand periods. Nuclear production tax credits provide federal policy support for clean baseload generation. Grid reliability concerns are driving system operators to value dispatchable resources more highly.

These aligned incentives create a self-reinforcing dynamic. Customers want reliability, Vistra can provide it, and regulators support the underlying assets—a combination that supports sustainable premium pricing.

The Numbers That Matter

Evaluating Vistra requires focusing on the metrics that matter for cash-generating infrastructure rather than traditional utility or merchant power measures.

The key figures are EBITDA growth and free cash flow conversion. Vistra targets free cash flow conversion of at least 60% beginning in 2026, up from historical levels around 55%. This improvement comes from optimized maintenance capex, production tax credit benefits, and better working capital management.

Share count reduction amplifies per-share returns. The company has repurchased over 30% of outstanding shares since 2021, with additional buyback authorization supporting continued reduction. Even modest EBITDA growth translates into significant per-share gains when combined with aggressive share buybacks.

Revenue growth, while important, should be viewed as supportive rather than primary. Power company revenues can fluctuate significantly due to commodity price movements and weather patterns. The more meaningful question is whether the company can maintain its EBITDA floor while capturing upside from options like Lotus integration and data center partnerships.

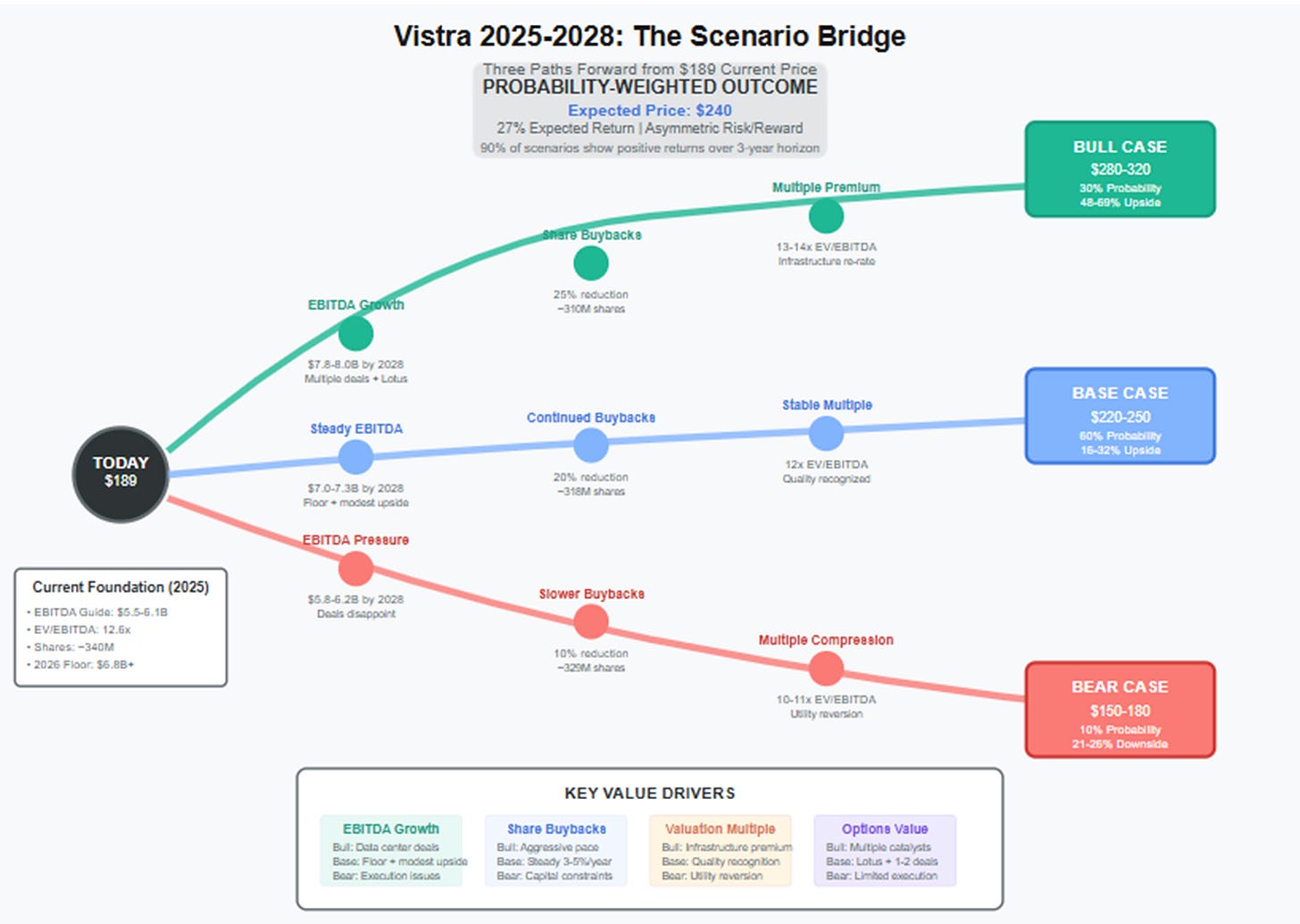

Three-Year Price Scenarios

Based on current business momentum and realistic execution scenarios, Vistra's stock price evolution over the next three years depends primarily on management's ability to convert their upside options into contracted cash flows.

Bull Case ($280-320): Perfect Execution

Revenue CAGR: 8-10%

2028 EBITDA: $7.8-8.0 billion

Exit EV/EBITDA: 13-14x

Implied price target: $280-320

This scenario assumes multiple large data center partnerships, successful Lotus integration, and continued strength in capacity markets. Share count reduction of 3-5% annually amplifies per-share gains. The premium exit multiple reflects successful transformation into predictable infrastructure cash flows.

Base Case ($220-250): Steady Execution

Revenue CAGR: 5-7%

2028 EBITDA: $7.0-7.3 billion

Exit EV/EBITDA: ~12x

Implied price target: $220-250

The base case assumes competent execution of current strategy without major surprises. One or two meaningful data center deals provide modest upside to the EBITDA floor. Capacity markets remain supportive but don't accelerate dramatically. Multiple stability reflects reduced variance from hedging and diversification.

Bear Case ($150-180): Execution Disappointment

Revenue CAGR: 2-4%

2028 EBITDA: $5.8-6.2 billion

Exit EV/EBITDA: 10-11x

Implied price target: $150-180

Bear case risks include data center partnerships failing to materialize, economic recession reducing power demand, persistent operational issues at key plants, or capacity market weakness. Even in this scenario, the company's diversified cash flow base provides some downside protection.

Shared assumptions across scenarios:

2026 EBITDA floor of at least $6.8 billion (management guidance)

Share count reduction of 3-5% annually through continued buybacks

Free cash flow conversion of 58-62% from 2026 forward

Modest deleveraging toward investment-grade credit metrics

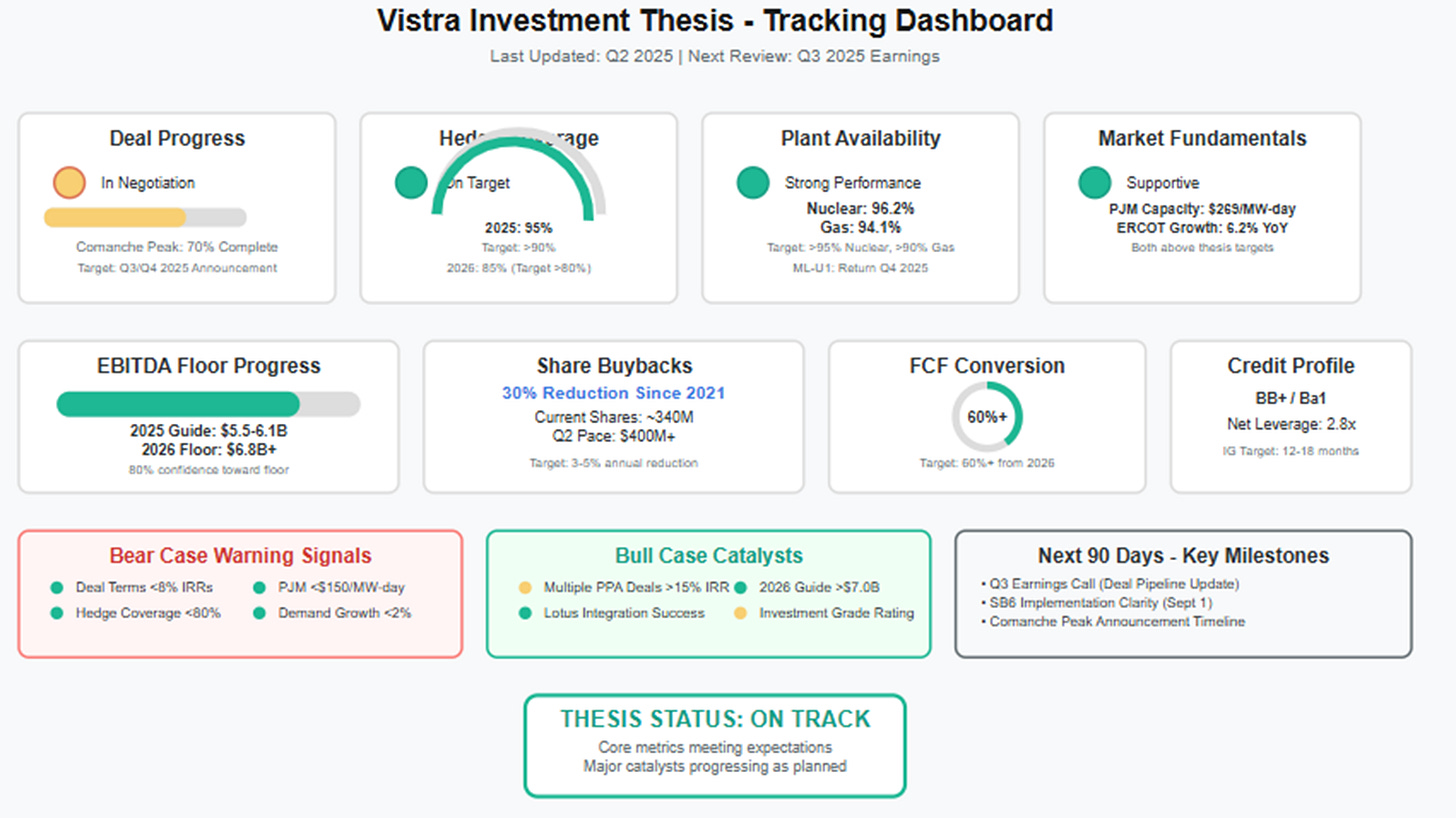

Tracking the Thesis

Several key indicators will validate or challenge the investment thesis over the next 18 months.

Bull case validation signals:

Formal 2026 guidance at or above $6.9-7.1 billion EBITDA with initial 2027 outlook

Successful restart of ML-U1 nuclear unit by late 2025/early 2026

Moss Landing battery project insurance settlement and construction restart

Lotus acquisition completion and integration progress

First credible data center co-location agreement with disclosed economics

Bear case warning signs:

Hedge discipline deterioration (forward year coverage below 80%)

Multiple capacity auction clearings below $200/MW-day

Persistent nuclear or gas plant operational issues

Retail customer losses or margin compression

Liquidity constraints affecting commodity risk management

Quarterly tracking priorities:

Hedge coverage percentages by delivery year

Retail business EBITDA run-rate sustainability

Nuclear and gas plant availability factors

Progress updates on Lotus, co-location, and uprate opportunities

Balance sheet metrics and credit facility availability

Steel-Manning the Counter-Arguments

The strongest counter-arguments deserve direct engagement rather than dismissal.

"Competition will arrive quickly once the opportunity is validated." This underestimates physical and regulatory constraints. New dispatchable generation requires 5-8 years minimum including permitting, environmental review, and construction. Interconnection queues are years long. By the time meaningful new supply arrives, incumbent generators will have locked up available load with long-term contracts.

"This is just another commodity cycle that will eventually normalize." The variance reduction is structural, not cyclical. Vistra's extensive hedging, production tax credits, capacity revenues, and retail integration provide earning stability independent of commodity cycles. The business model has fundamentally changed from high-variance merchant generation to predictable infrastructure cash flows.

"The current multiple already reflects fair value." Valuation analysis should focus on 2026+ earnings power and free cash flow yields rather than next-twelve-months GAAP optics. A 12x multiple on $7+ billion of predictable EBITDA with 60%+ cash conversion is reasonable for infrastructure assets. The market hasn't fully recognized the quality transformation.

Closing the Loop

The phones aren't ringing in crisis mode at Vistra's command center anymore. The company that nearly broke during Winter Storm Uri has rebuilt itself around a simple insight: in a world increasingly dependent on continuous digital infrastructure, certainty has become the scarce input.

What broke during that frozen week in February 2021 wasn't just equipment—it was assumptions about power as an unlimited, commoditized utility. What emerged was recognition that guaranteed, firm power represents a distinct product with distinct economics.

Vistra doesn't just generate electricity anymore. It manufactures certainty and sells it at scale to customers who literally cannot afford interruption. The AI revolution has created unprecedented demand for this product precisely when regulatory and physical constraints make it nearly impossible for competitors to create competing supply.

The company's transformation from merchant generator to infrastructure provider reflects a broader shift in how critical digital infrastructure relates to physical assets. Software may be eating the world, but it still runs on hardware, and hardware still needs power—reliable, predictable, guaranteed power.

The next two disclosure events will prove or disprove this thesis: formal 2026 guidance in early 2025 and the first credible data center co-location partnership announcement. These catalysts will determine whether Vistra has successfully productized certainty or merely benefited from favorable timing.

In a world where dropping a computation can cost millions and where the next breakthrough in AI depends on continuous, reliable power, the companies that can guarantee uptime aren't just selling electricity—they're selling the foundational input that makes the digital future possible.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.