Lam Research Earnings: The Toll Booth Reprices

Lam Research Earnings: The Toll Booth Reprices

TL;DR

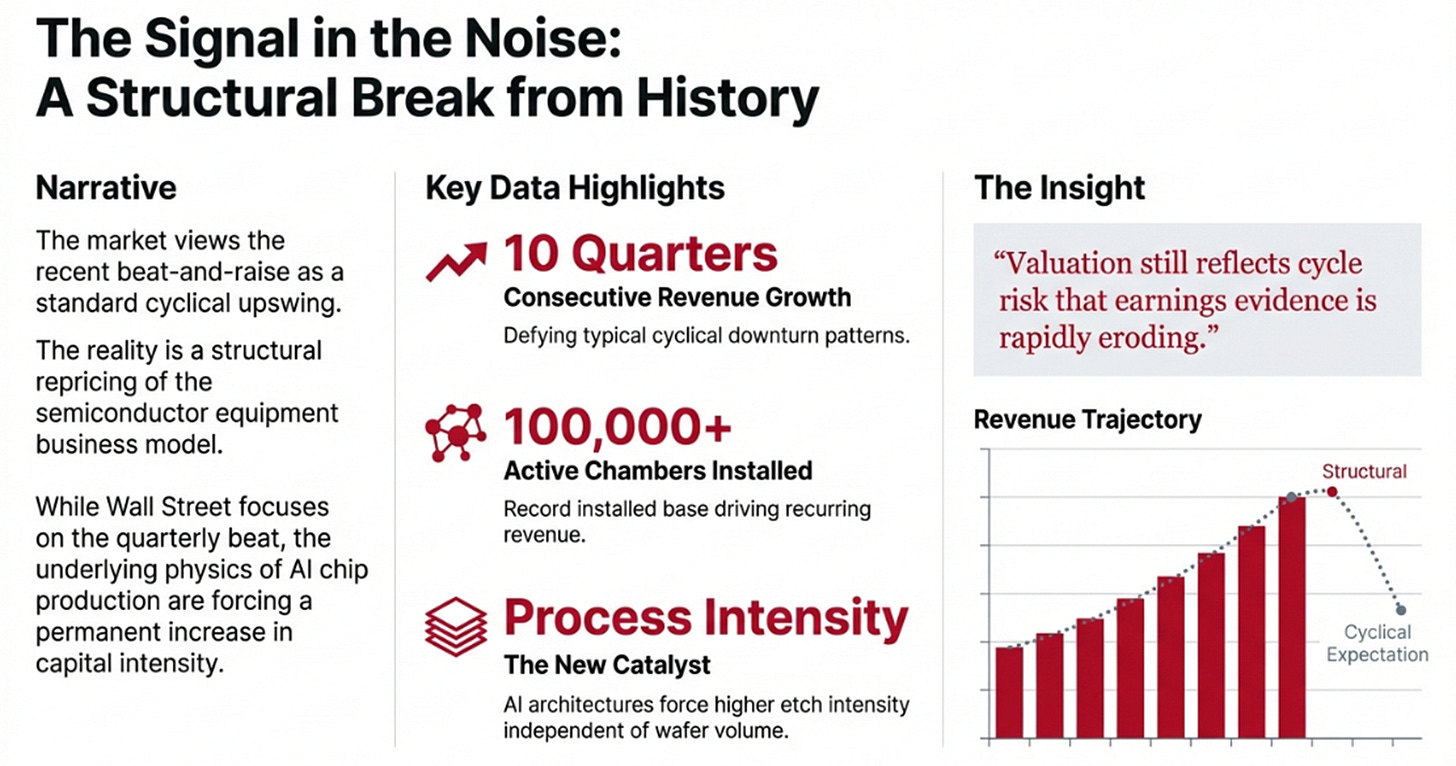

Ten quarters of growth and record installed base point to durability.

AI-driven architectures are forcing more etch per node, independent of wafer demand.

Valuation still reflects cycle risk that earnings evidence is eroding.

Bloomberg, January 29, 2026:

“Lam Research shares rise as much as 6.2% in premarket trading after the chip-tool maker forecast adjusted earnings per share for the third quarter that beat the average analyst estimate.”

I’ve been waiting for this quarter. Not because Lam’s results were uncertain—the committed capex from TSMC, Samsung, and SK Hynix made a beat-and-raise almost inevitable—but because of what it would reveal about how Wall Street thinks about semiconductor equipment companies. The answer: they still don’t get it.

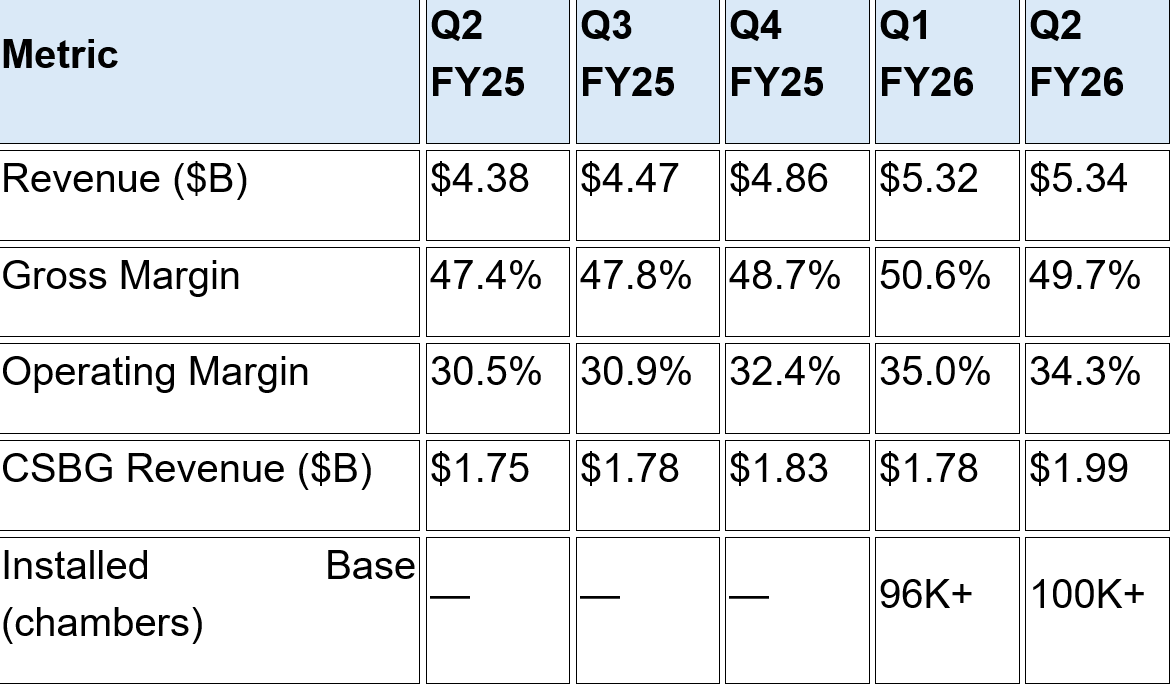

Lam delivered $5.34 billion in revenue (beat), 49.7% gross margins (beat), and $1.27 EPS (beat). They guided Q3 to $5.7 billion at the midpoint with margins holding at 49%. The stock popped to $252. And yet the most important thing Tim Archer said wasn’t about any of these numbers:

“All indications are that we are still in the early stages of the AI build out.”

This is a company telling you, in plain language, that the market is pricing them as a mid-cycle equipment vendor when they’re actually operating an infrastructure toll booth on a multi-year buildout. The question isn’t whether Lam had a good quarter. It’s whether the market’s mental model for semiconductor equipment is fundamentally wrong.

The Metrics They Want You to See (And The Ones They Don’t)

Let me start with what Lam chose to emphasize:

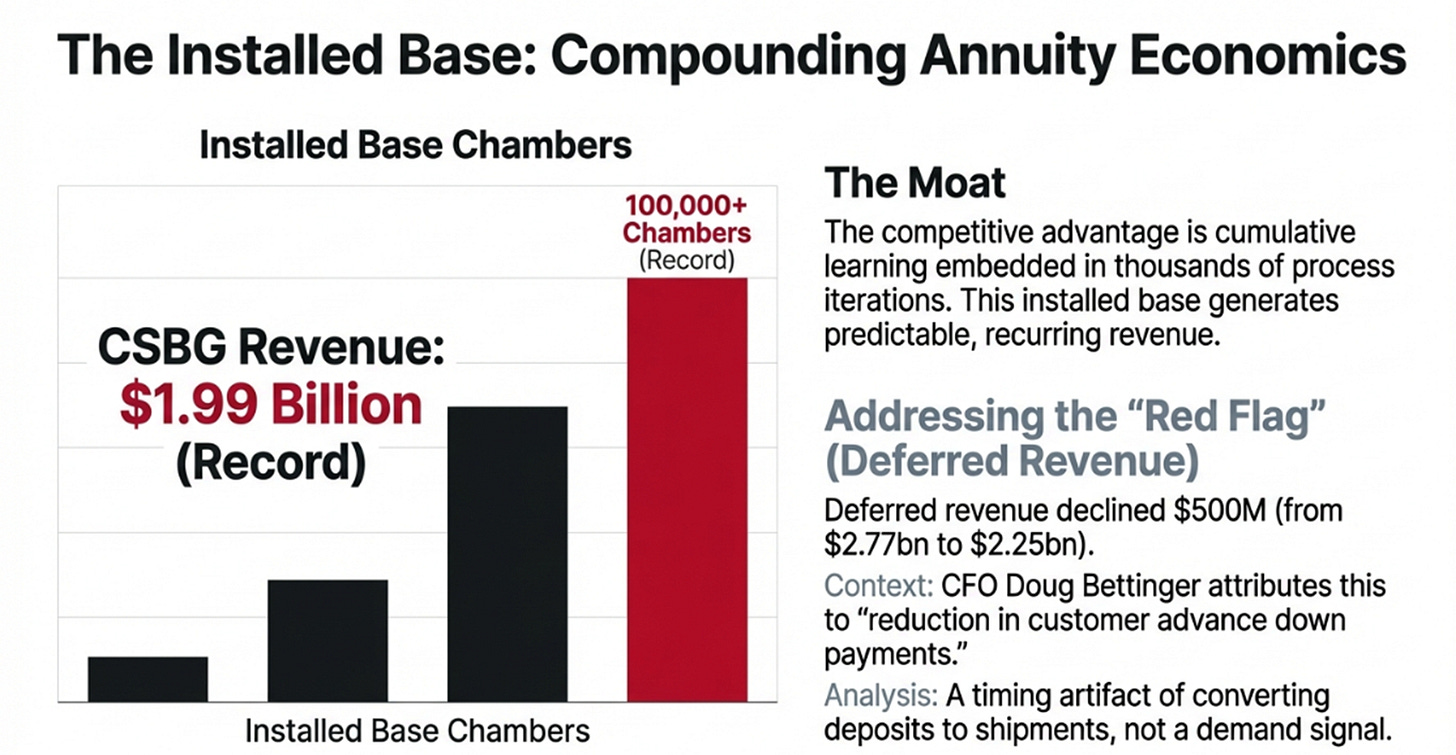

Ten consecutive quarters of revenue growth. Record CSBG revenue. Installed base crossing 100,000 chambers for the first time. These are the numbers Lam wants you to focus on, and they’re genuinely impressive.

But notice what they didn’t emphasize: deferred revenue dropped from $2.77 billion to $2.25 billion—a $500 million sequential decline that CFO Doug Bettinger attributed to “reduction in customer advance down payments.” That’s not a demand signal; it’s a timing artifact as customers convert deposits to shipments. Still, in a less favorable environment, that number would be a red flag.

The more interesting omission is any quantification of their 2026 WFE outlook breakdown by segment. Lam said $135 billion total, up from $110 billion in 2025. But when asked about the relative growth rates of foundry/logic, DRAM, and NAND, Tim Archer declined to provide specifics for 2027: “I’m not ready to rank order it quite yet.” That’s management-speak for “we see something shifting but aren’t ready to commit to it publicly.”

What they are willing to commit to: outperforming WFE growth through SAM expansion and share gains. That’s the key metric—not whether Lam grows 20% or 25%, but whether they grow faster than the market they serve.

The Real Story: Process Intensity as Structural Moat

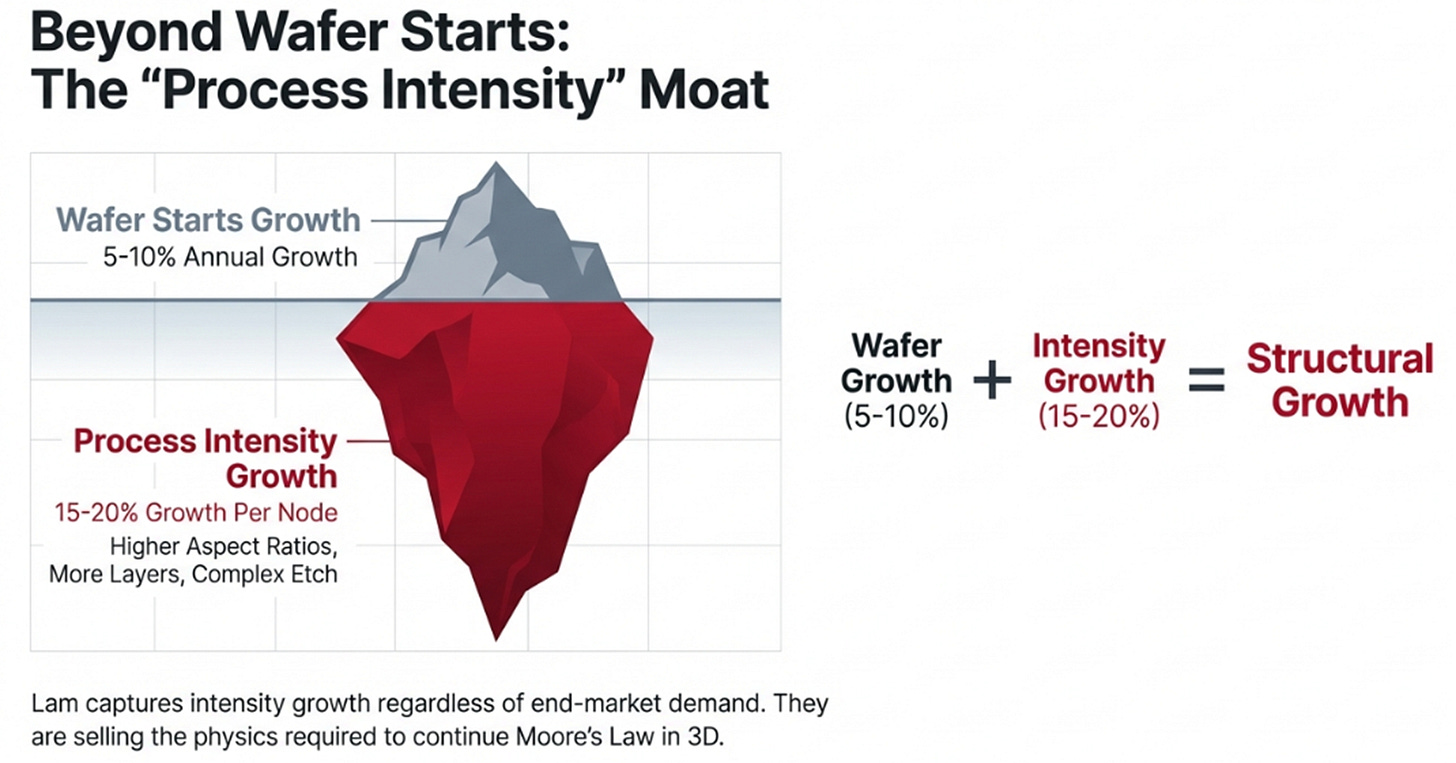

Here’s the analytical frame that most coverage misses: Lam isn’t selling tools. They’re selling the physical capability to continue Moore’s Law in three dimensions.

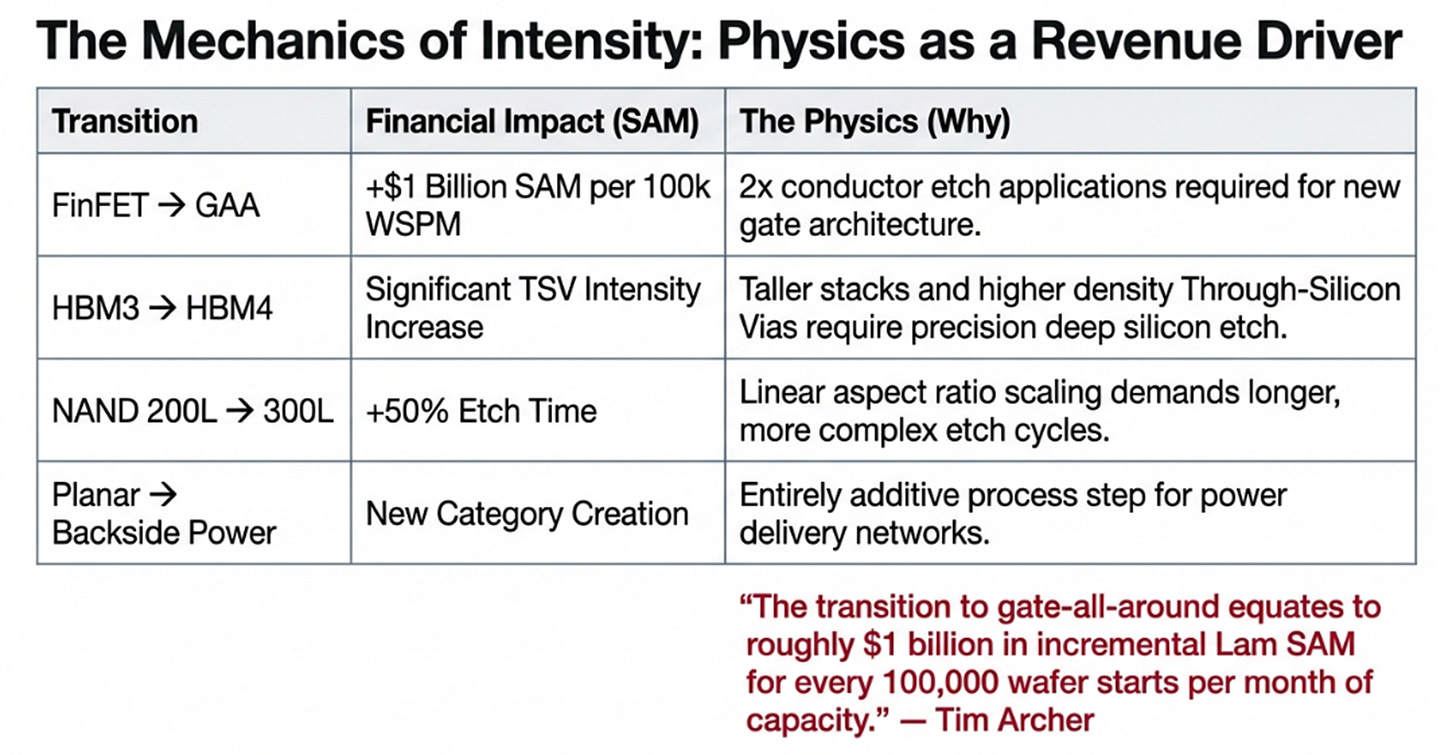

Consider what happens at each node transition:

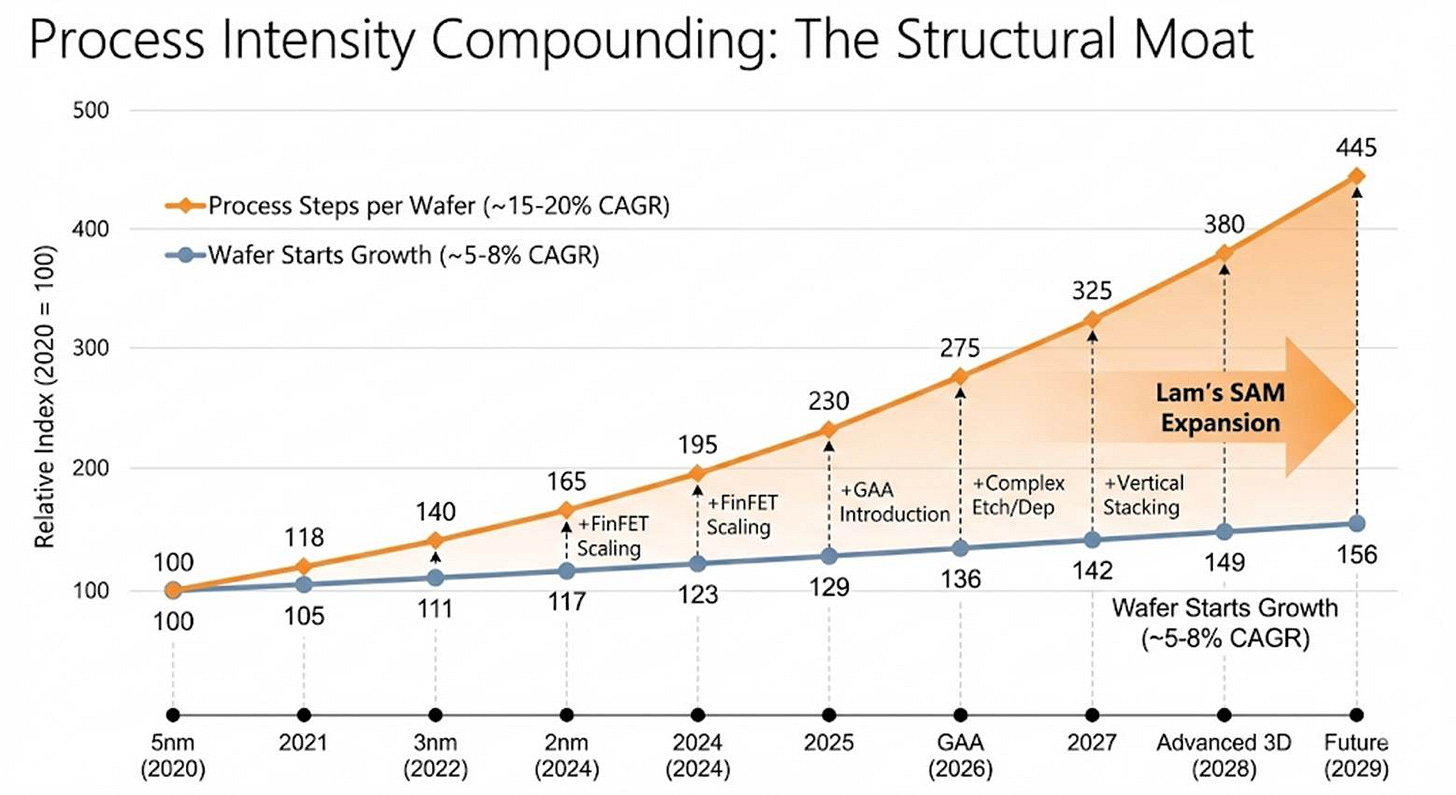

This is the compounding dynamic that the market underappreciates. Wafer starts might grow 5-10% annually. But process steps per wafer grow 15-20% at each node. Lam captures that intensity growth regardless of end-market demand.

Tim Archer on the GAA transition:

“The transition to gate-all-around equates to roughly $1 billion in incremental Lam SAM for every 100,000 wafer starts per month of capacity.”

That’s not a forecast—it’s physics. The structures require more etch steps. There’s no alternative. And Lam’s Akara conductor etch platform has “doubled its installed base over the past year” with “production tool of record wins for EUV and high aspect ratio etch applications.”

The competitive moat isn’t IP protection or brand loyalty. It’s cumulative learning embedded in thousands of process iterations with customers who can’t afford yield failures on $20 billion fabs.

The SK Hynix Confirmation

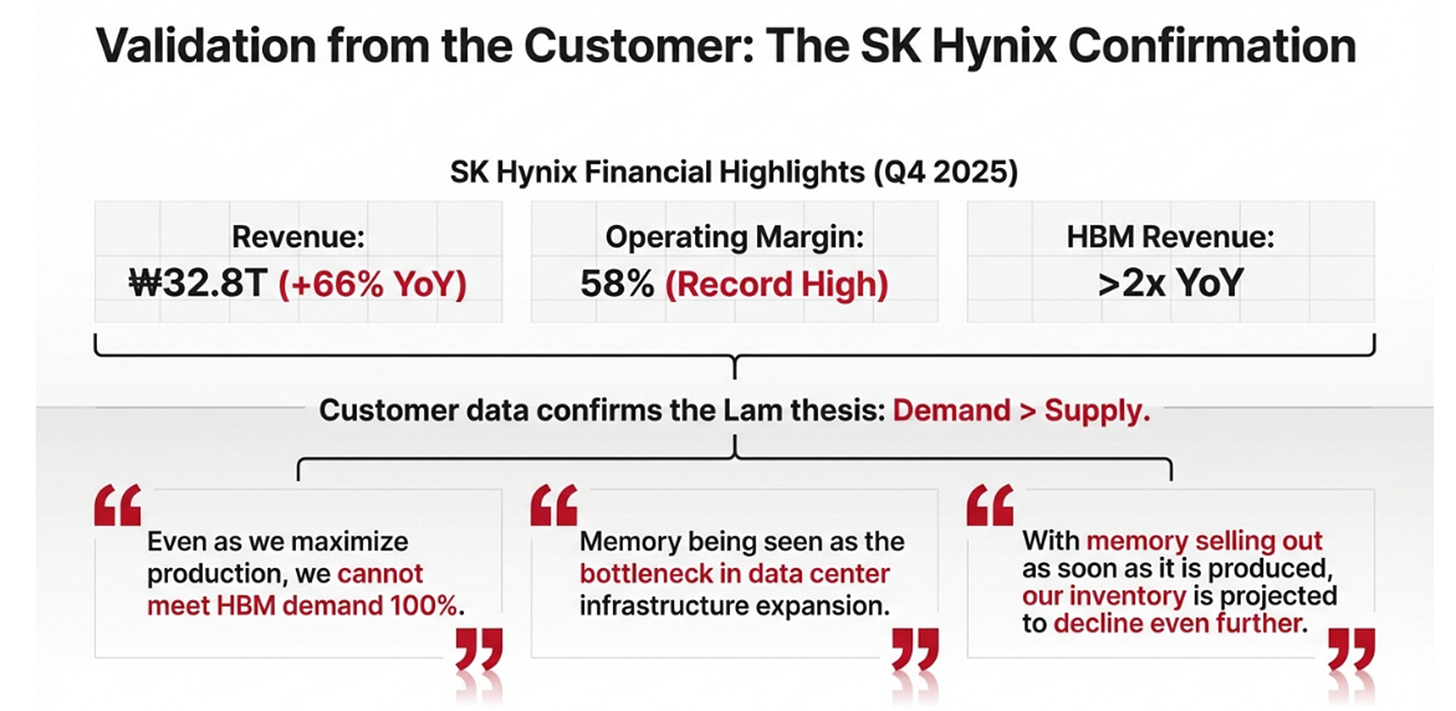

The same day Lam reported, SK Hynix released Q4 2025 results that read like a Lam investor presentation:

But the numbers aren’t the story. The commentary is:

“Even as we maximize production, we cannot meet HBM demand 100%.”

“Memory being seen as the bottleneck in data center infrastructure expansion.”

“With memory selling out as soon as it is produced, our inventory is projected to decline even further in the second half of the year.”

“LTAs being discussed today are expected to reflect strong mutual commitments... because production today requires cutting edge technology and far bigger investment.”

This is Lam’s largest memory customer confirming every element of the bull thesis: demand exceeds supply, inventory is declining not building, and long-term agreements are shifting from “loose contracts” to “strong mutual commitments.”

SK Hynix is accelerating M15X capacity “earlier than planned,” ramping 1nm DRAM and 321-layer NAND migration, and preparing both Cheongju Fab 7 and an Indiana advanced packaging facility. Each of these requires Lam equipment. The orders are locked.

The China Question Everyone’s Afraid to Answer

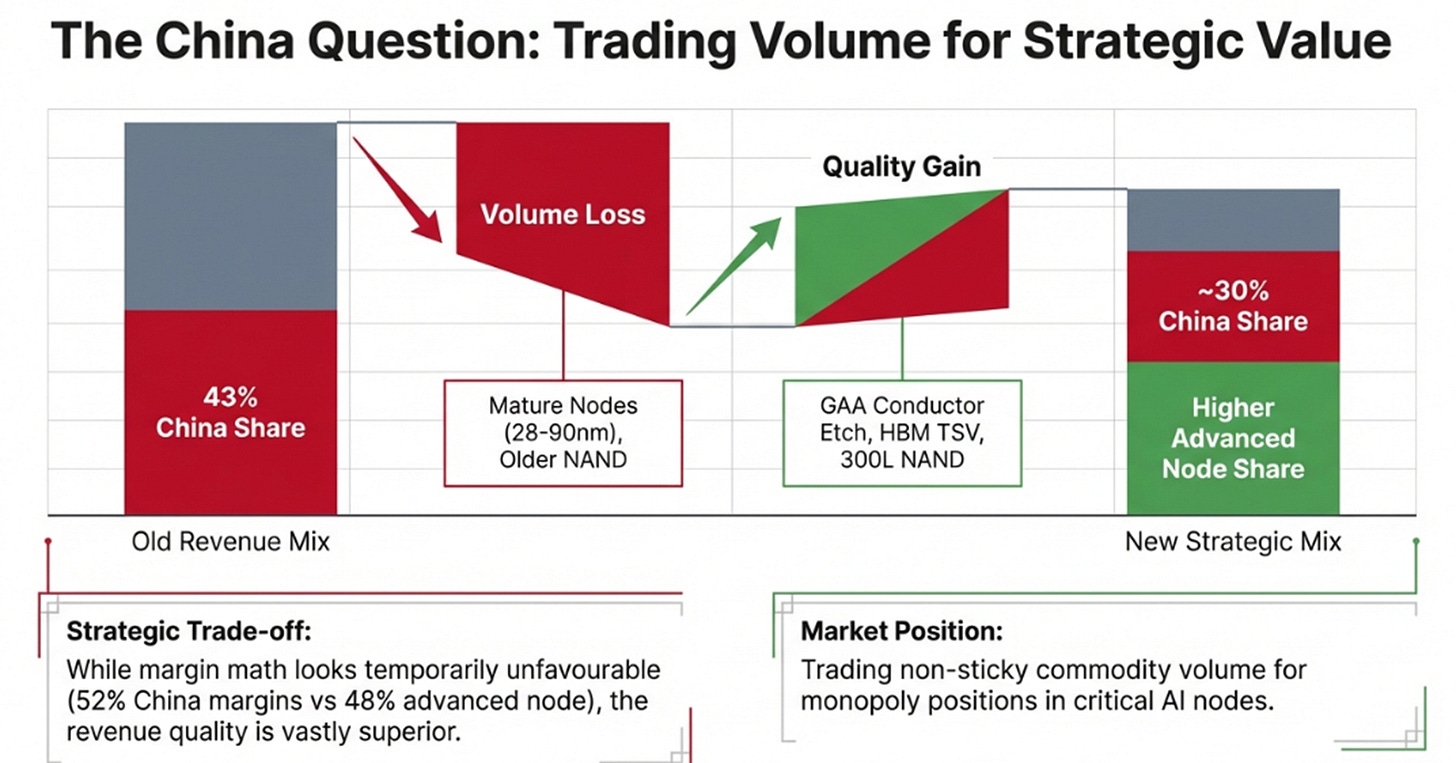

China revenue dropped from 43% to 35% of Lam’s total sequentially. Management attributed some of this to “affiliate rule” timing effects, but guided that China would be “flattish” year-over-year while everything else grows. The implication: China falls to low-30s or high-20s as a percentage of revenue by year-end.

Here’s what’s interesting: nobody seems worried about this.

Doug Bettinger on China margin impact:

“Yes, it’s customer mix. It’s going to be less rich in the March quarter.”

Translation: China revenue carried higher margins because Chinese customers had fewer alternatives. As China shrinks as a percentage and advanced-node customers (TSMC, Samsung) grow, margins face pressure from customer concentration, not operational issues.

But here’s the counter-narrative: Lam is effectively trading low-strategic-value revenue for high-strategic-value market position. China was mature nodes—28nm to 90nm logic, commodity DRAM, older NAND. The replacement revenue comes from GAA conductor etch, HBM TSV etch, and 300-layer NAND tools where Lam has near-monopoly positions.

The margin math looks unfavorable (52% China → 48% advanced node). The strategic math is overwhelmingly positive.

The NAND Sleeper

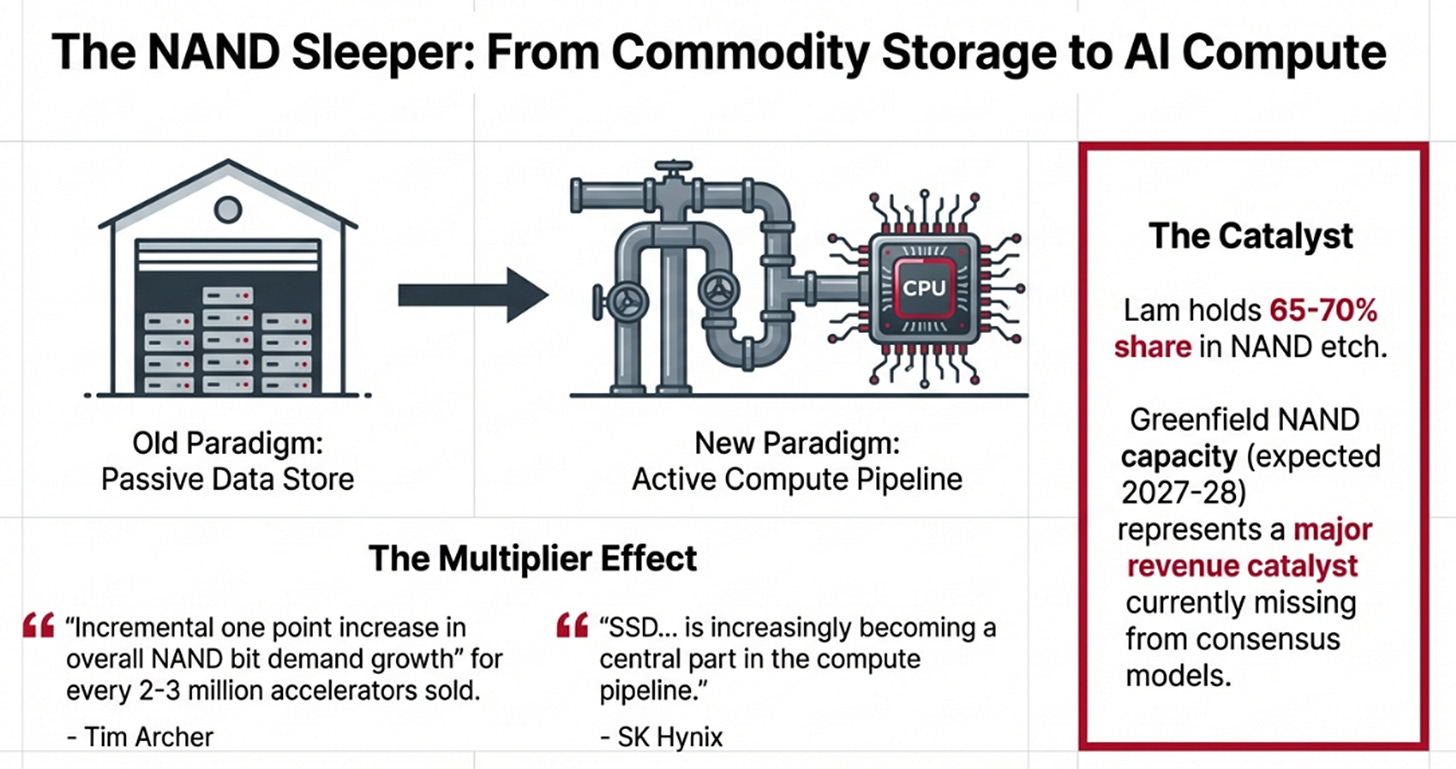

The most underappreciated element of both calls was the NAND repositioning.

Tim Archer:

“Non-volatile context memory layers that enable large scale inference have the potential to add incremental growth in NAND bit demand for every 2 to 3 million accelerators sold. We estimate an incremental one point increase in overall NAND bit demand growth.”

SK Hynix:

“NAND today is changing completely. Not only a data store, but becoming a storage solution that directly supports AI computation workflows... The SSD was a peripheral under the CPU centric architecture. In the recent context memory environment and GPU centric IO server architecture, it is increasingly becoming a central part in the compute pipeline.”

This is both companies coordinating a narrative shift: NAND isn’t commodity storage anymore. It’s AI infrastructure.

If the market accepts this reframing, the implications are significant. Lam has 65-70% share in NAND etch. The company has been talking about a “$40 billion upgrade opportunity over several years” but now says “that seems to be happening faster than expected.” Greenfield NAND capacity—the next leg after upgrades—is a 2027-28 catalyst that isn’t in most models.

What the Valuation Actually Implies

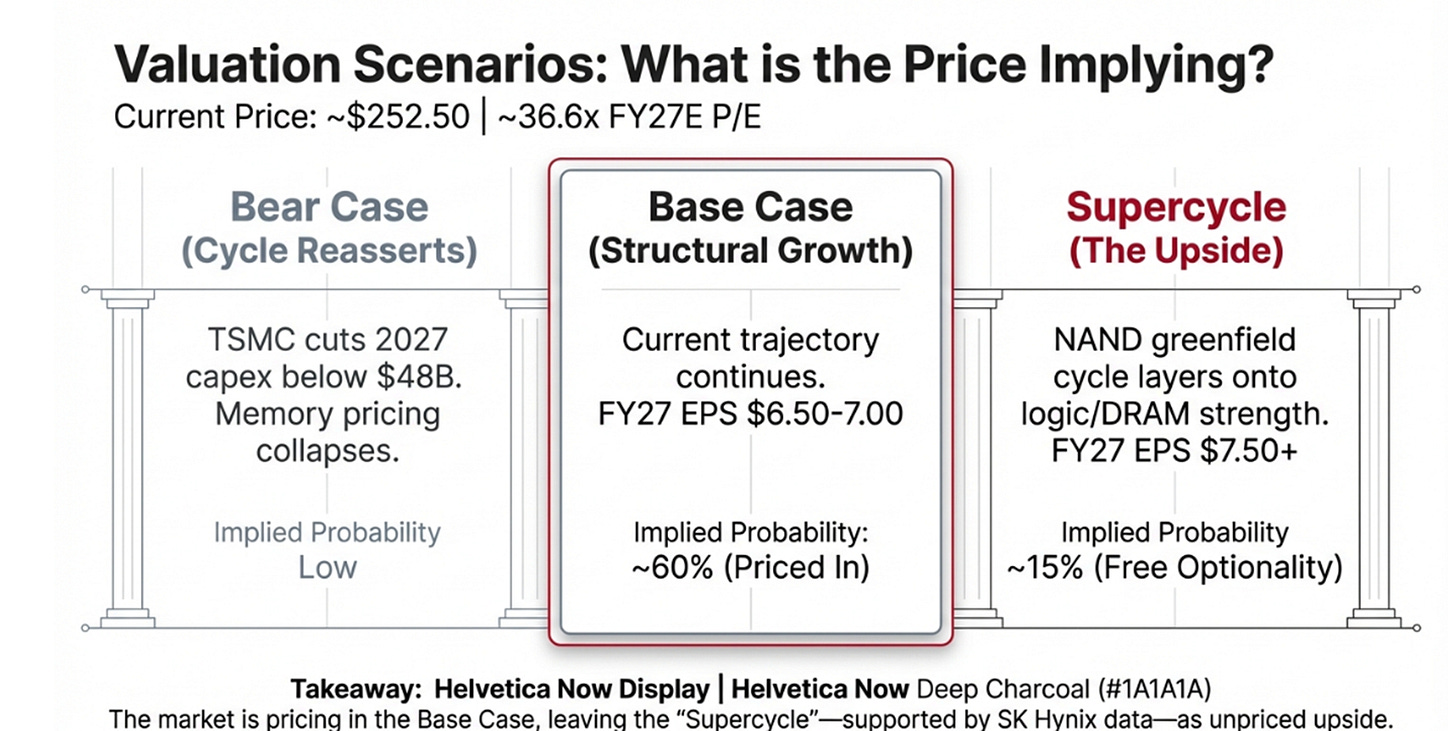

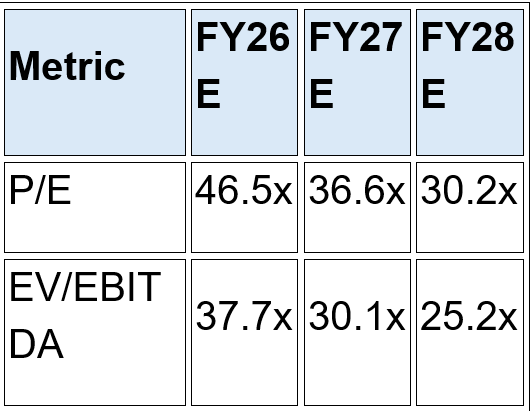

At $252.50, Lam trades at:

These are not “cheap” multiples. But they’re not crazy either, if you accept the infrastructure framing.

The key question is what the FY27 P/E of 36.6x implies about probability-weighted outcomes:

Bear case (cycle reasserts): FY27 EPS of $5.50-6.00, stock at $180-200. Requires TSMC cutting 2027 capex below $48B and memory pricing collapsing.

Base case (structural growth): FY27 EPS of $6.50-7.00, stock at $240-280. Requires current trajectory continuing without acceleration.

Supercycle: FY27 EPS of $7.50+, stock at $300-350. Requires NAND greenfield cycle layering onto current logic/DRAM strength.

The current price suggests the market assigns roughly 60% to base case, 25% to bear, 15% to supercycle. If you believe the supercycle probability is higher—and SK Hynix’s 58% operating margin plus “cannot meet demand” commentary suggests it might be—there’s upside.

The Strategic Takeaway

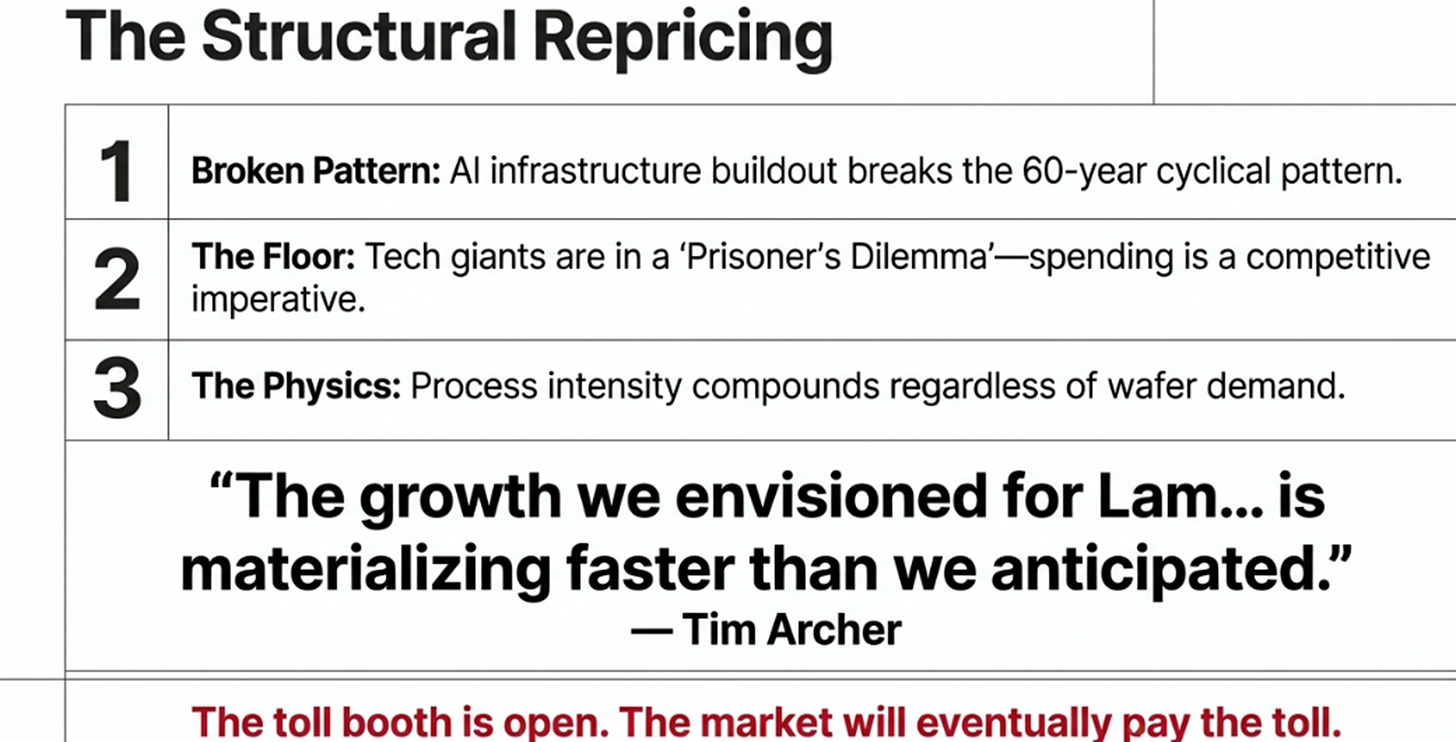

Here’s what I think is actually happening: the semiconductor equipment market is undergoing a structural repricing that most investors haven’t internalized.

For sixty years, equipment companies were cyclical because demand was cyclical. Fabs got built, capacity came online, oversupply crushed pricing, capex got cut, equipment orders collapsed. Rinse and repeat every 3-4 years.

The AI infrastructure buildout breaks this pattern in two ways:

Demand is competitive imperative, not discretionary. Microsoft, Google, Meta, and Amazon are in a prisoner’s dilemma where cutting AI infrastructure spending cedes competitive position. The demand floor is higher and more durable than in previous cycles.

Process intensity compounds regardless of wafer demand. Even if wafer starts flatten, Lam’s SAM grows 15-20% per node because 3D architectures require more process steps. This is structural, not cyclical.

Lam isn’t a better cyclical company. It’s a different kind of company than it was five years ago—one whose revenue is increasingly tied to the physical requirements of continued compute scaling rather than the vagaries of chip demand.

The market will figure this out eventually. The question is whether it happens gradually over eight quarters of beat-and-raise, or suddenly when the “cycle peak” everyone’s waiting for fails to materialize.

Tim Archer, closing the call:

“The growth we envisioned for Lam at our Investor Day one year ago is materializing faster than we anticipated.”

When management tells you their bull case is playing out faster than expected, and their largest customer says they literally cannot make enough product to meet demand, and the stock is up 13% but still trading at a discount to ASML’s multiple—that’s the setup.

The toll booth is repricing. The only question is how long it takes the market to pay up.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.