Meituan - The Cook, the Courier, and the Corner Store

Why Meituan’s network effects, cash war chest, and math—not subsidies—will decide China’s food delivery future

TL;DR

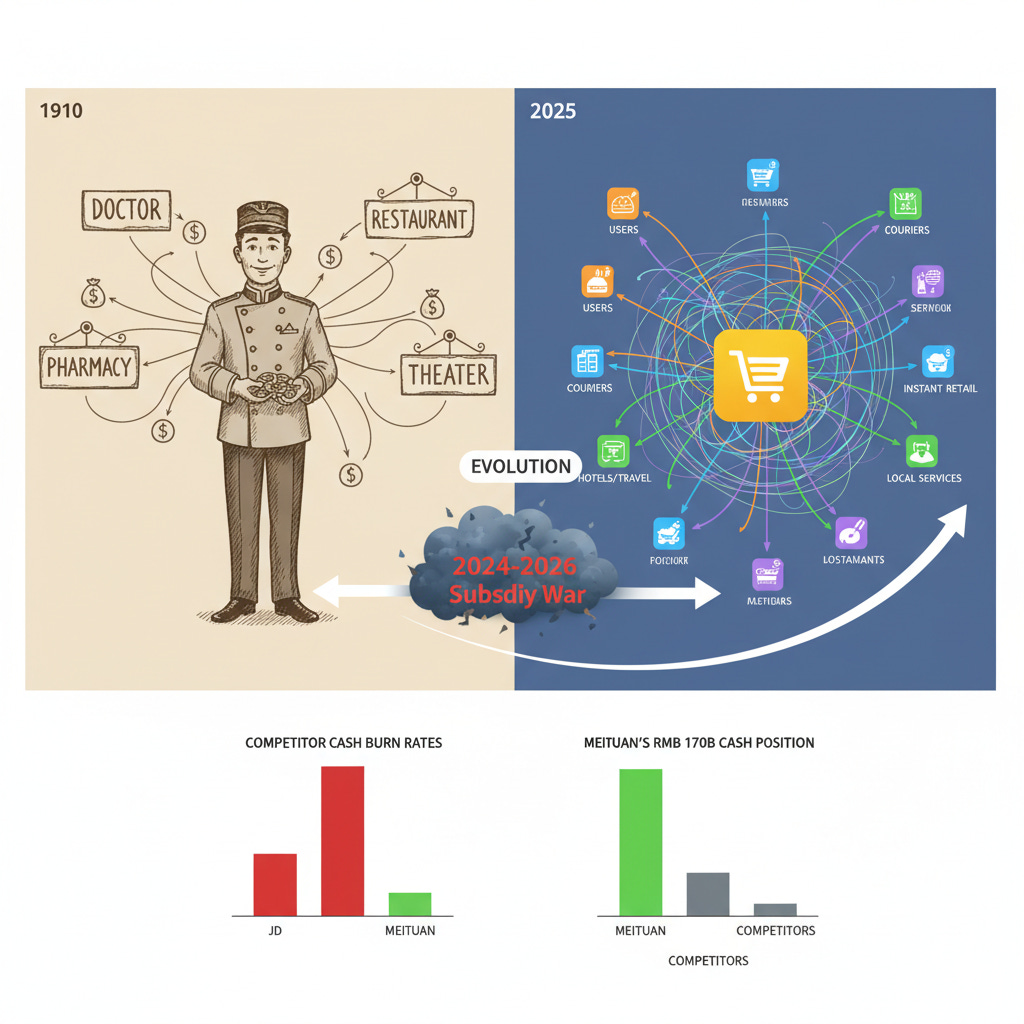

Meituan as the “digital bellhop”: By mastering urban complexity—reliable 30-minute delivery, dense courier networks, and trusted discovery—Meituan became indispensable to millions of daily users in China.

Subsidy war is temporary, math is permanent: Competitors’ deep-pocketed discount strategies strain their finances, but Meituan’s positive unit economics and RMB 170B cash position give it endurance and strategic flexibility.

Path to sustainable dominance: Through membership programs, advertising monetization, satellite kitchens, and instant retail, Meituan is engineering value beyond subsidies, securing long-term network effects and profitability.

In 1910, the most valuable employee at New York’s grand hotels wasn’t found in the executive offices or the kitchen—he worked the lobby. The bellhop’s value had little to do with carrying luggage. His real worth lay in what he knew: which doctor would make house calls at 3am, which restaurant would open its kitchen after hours, which pharmacist worked Sundays. He wasn’t selling his labor; he was selling access to the city’s hidden operating system.

The economics were revealing. Guests might need help with bags once, but they needed dinner recommendations nightly, theater tickets weekly, urgent solutions constantly. The bellhop who grasped this—who cultivated relationships rather than completed tasks—built wealth not from wages but from becoming indispensable. When prohibition arrived, the best bellhops didn’t just know where to find a doctor; they knew where to find a drink. Trust, frequency, and local knowledge compounded into surprising fortunes.

This same principle—that value accrues to whoever makes urban complexity navigable—explains Meituan’s dominance in China. It also explains why the market has fundamentally misunderstood what’s happening as the company’s margins compress from 25% to 6% amid a vicious subsidy war. The question isn’t whether Meituan will survive—it’s how completely it will dominate when mathematics forces competitors to face reality.

Act I: Building the Digital Bellhop (2010-2018)

When Wang Xing launched Meituan in 2010, urban China faced a problem of overwhelming choice. In Beijing alone, over 100,000 restaurants served 20 million residents. Shanghai’s restaurant density exceeded Manhattan’s. The simple question “where should I eat?” had become computationally impossible for individuals to answer well. Discovery was fragmented across word-of-mouth, physical exploration, and primitive online forums. Transaction friction was enormous—cash only, phone calls to place orders, uncertain delivery times.

Meituan’s initial solution was elegant: aggregate information, enable group buying, make the city searchable. But this was merely digitizing the Yellow Pages. The real innovation came from understanding that information without execution had limited value. Users didn’t just want to know which restaurant had good dumplings; they wanted those dumplings delivered hot within 30 minutes.

The transition from information to transaction to fulfillment followed a clear logic. First, Meituan built trust through reviews and ratings—social proof at scale. The group-buying model created initial transaction velocity while educating both merchants and consumers about digital commerce. Then came integrated payments and order management, removing friction from the purchase process.

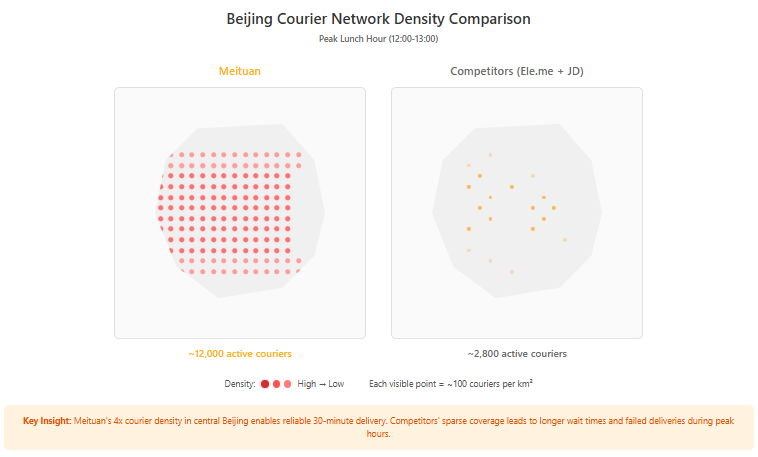

But the decisive move was building physical infrastructure to guarantee fulfillment. While competitors remained marketplaces connecting consumers to merchant delivery, Meituan built its own courier network. This wasn’t obviously correct—it required massive capital, operational complexity, and ongoing management challenges. The payoff only became clear over time.

By 2018, Meituan had created a reinforcing loop: more consumers brought more merchants, which enabled better reviews and more choice, which attracted more consumers. The platform had become the trusted starting point for urban decisions. The map of the city had become queryable, bookable, and most importantly, reliably deliverable.

Act II: Mastering the 30-Minute Promise (2018-2023)

The courier network investment revealed its strategic brilliance gradually. Consider what “30-minute delivery” actually requires in a Chinese megacity. Orders arrive from high-rise apartments with specific elevator banks and security protocols. Restaurants have varying preparation times affected by kitchen size, time of day, and current orders. Traffic patterns shift hourly. Weather changes routing entirely. Solving this in real-time for millions of concurrent orders requires infrastructure that goes far beyond simple dispatch.

Meituan built this infrastructure courier by courier, order by order. Each delivery generated data: actual versus estimated preparation time, optimal routes under different conditions, building-specific delivery instructions. The learning system compounded its advantage with every transaction. A courier’s first delivery to a complex might take 40 minutes; by the hundredth, they knew which entrance to use, which elevator bank was fastest, which security guard was helpful.

The operational complexity was staggering. Managing millions of independent couriers required balancing supply and demand across geography and time. Too many couriers meant inefficiency and dissatisfaction; too few meant service failures. The solution involved sophisticated algorithms predicting demand, dynamic pricing to move supply, and careful courier relationship management.

The strategic brilliance lay in recognizing that mastering the hardest deliveries created defensibility. Anyone could deliver from the restaurant next door at lunch. Only Meituan could reliably get hot pot ingredients across the city at midnight in the rain. This reliability transformed usage from occasional convenience to daily habit.

Habit, in turn, created surface area for expansion. Once consumers trusted Meituan for dinner, they’d try it for groceries. Once it worked for groceries, why not pharmacy items? Electronics? The 30-minute promise became a distribution moat that enabled category after category expansion. Each new category strengthened the network effects—more orders meant denser courier networks, which enabled faster delivery, which attracted more users.

By 2023, the numbers reflected this dominance: 770 million annual transacting users, 150 million daily orders, 14.5 million active merchants. Food delivery had become merely the entry point to a broader ecosystem. Hotel bookings leveraged restaurant discovery. Movie tickets built on entertainment browsing. Local services extended the merchant relationships. Meituan had evolved from food delivery to the default interface for urban commercial activity.

Yet this same success created vulnerability. Consumer expectations ratcheted ever higher while willingness to pay remained stubbornly low. The mathematics of maintaining service quality while expanding selection at rock-bottom prices became increasingly challenging. Operating margins of 25% looked impressive but masked the delicate balance required to maintain them. This vulnerability would soon be tested.

Act III: Intent Versus Impulse (2024-2025)

The current warfare traces directly to China’s regulatory reconfiguration. As I documented in my analysis of Alibaba, when Beijing pushed tech giants away from winner-take-all platform dynamics toward “common prosperity” and real-world impact, it fundamentally rewired competitive incentives. Companies could no longer pursue monopolistic dominance; they had to demonstrate social value while competing vigorously.

Alibaba’s strategic response was revealing. Facing pressure in its core e-commerce business from Pinduoduo and live commerce, the company needed new narratives. The pivot toward “national-priority computing” addressed one requirement—supporting China’s AI ambitions. But this required massive capital expenditure without immediate returns. The company needed consumer-facing wins to balance the narrative.

Re-entering food delivery through Ele.me served multiple purposes. It provided genuine daily-frequency consumer touchpoints—essential for an e-commerce platform seeing engagement pressure. It leveraged existing merchant relationships from Taobao and Tmall. Most importantly, it offered a narrative of serving everyday needs rather than extracting platform rents.

When Daniel Zhang announced the RMB 10 billion subsidy program in early 2024, the amount seemed arbitrary. It wasn’t. Ten billion was enough to signal serious commitment without triggering immediate investor revolt. It was sufficient to force Meituan’s response but not so large as to imply desperation. The number itself was strategic communication.

JD’s entry followed different logic but similar urgency. The company’s traditional moat—superior logistics for e-commerce—faced commoditization. Same-day delivery had become table stakes. The company needed new frontiers where logistics excellence created differentiation. Food delivery and instant retail offered that possibility, along with revenue growth to offset margin pressure in the core business.

But this isn’t merely a price war—it’s a fundamental clash between two models of demand formation. Understanding this distinction explains why current dynamics are unsustainable.

Meituan operates on what I call an “intent” model. Users open the app because they’re hungry, need groceries, or want services. The need exists independently; Meituan fulfills it efficiently. This creates predictable, high-frequency usage patterns. A user who orders lunch daily does so from habit, not promotion. The platform’s role is fulfillment excellence, not demand creation.

Competitors increasingly operate on an “impulse” model borrowed from short-video commerce. Users scrolling through Douyin encounter a flash deal for a local restaurant—50% off for the next hour. They weren’t planning to order food, but the deal creates demand. This model can drive significant volume but with fundamentally different economics.

The distinction determines sustainable unit economics. Intent-based orders have higher completion rates because users genuinely want the product. Refund rates stay low because expectations align with delivery. Predictable patterns enable efficient courier allocation. The platform serves existing demand efficiently.

Impulse orders spike unpredictably, straining logistics networks. Users attracted by deep discounts show higher price sensitivity and lower retention. Refund rates increase as impulse purchases lead to buyer’s remorse. The platform must create demand expensively then fulfill it inefficiently.

When JD and Alibaba launched their subsidy programs, they weren’t just compressing Meituan’s margins—they were attempting to transform how Chinese consumers think about local commerce. If successful, they’d shift the market from predictable intent-based ordering to volatile impulse-driven transactions. This would structurally disadvantage Meituan’s operational model while playing to competitors’ content and commerce strengths.

Engineering Value, Not Just Price

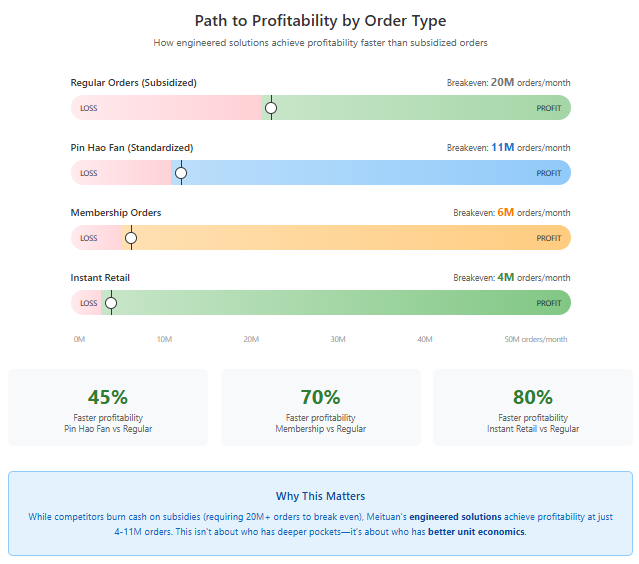

Meituan’s response reveals sophisticated thinking about long-term competitive dynamics. Rather than simply matching subsidies dollar-for-dollar—a game that favors whoever has the deepest pockets or highest pain tolerance—the company is systematically engineering new value propositions that work within permanently tighter margins.

Pin Hao Fan exemplifies this approach. These value-engineered meal sets aren’t just discounted food. They’re complete reimaginings of the restaurant-platform-consumer relationship. By standardizing ingredients across multiple restaurants, Meituan reduces procurement costs. Predictable preparation times improve courier efficiency. Consistent quality reduces refunds. Consumers get reliable value; restaurants get better margins even at lower prices; Meituan improves unit economics through operational efficiency rather than financial subsidy.

The program’s sophistication extends beyond operations. Pin Hao Fan creates habituation—users who try value meals during competitive periods develop ordering patterns that persist after subsidies fade. It segments price-sensitive users from premium customers, enabling targeted monetization. Most importantly, it proves Meituan can compete on value through innovation rather than pure subsidy.

Branded satellite kitchens represent another strategic innovation. Traditional restaurant expansion requires significant capital—real estate, build-out, staffing, marketing. Satellite kitchens flip this model. Delivery-only locations in low-rent areas extend restaurant reach at a fraction of traditional costs. Meituan provides the technology stack, demand generation, and operational playbook. Restaurants provide the brand and recipes.

The economics are compelling. A popular restaurant can serve three times the geographic area with 30% of the capital investment. Kitchen utilization improves as delivery orders smooth peak/trough patterns. Customer acquisition costs drop as Meituan’s platform provides discovery. The model works because it aligns incentives—restaurants get growth, Meituan gets supply density, consumers get selection.

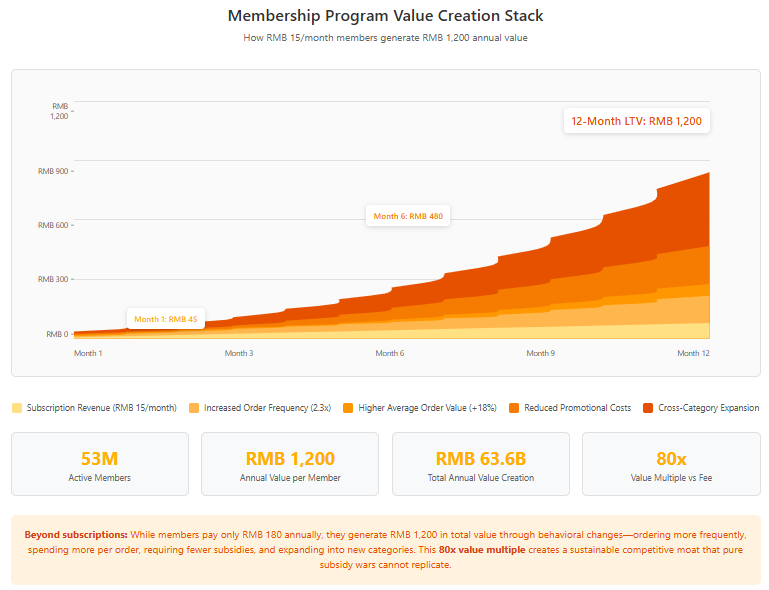

But the masterstroke is the membership program, now encompassing 53 million paying users. This fundamentally reframes the competitive battleground. Instead of fighting transaction-by-transaction with subsidies—where the deepest pockets win—membership creates a different game entirely.

Consider the consumer psychology. A RMB 15 monthly membership providing free delivery on orders over RMB 29 transforms the economic relationship. The upfront payment is a sunk cost, encouraging usage. The delivery threshold increases order values. The psychological ownership created by membership reduces price sensitivity. Users stop comparing delivery fees across platforms—they’ve already “paid” through membership.

The program’s sophistication extends beyond simple delivery benefits. Members receive priority customer service during peak times—crucial when orders go wrong. Exclusive restaurant access creates scarcity value—certain restaurants literally only accept member orders during busy periods. Cross-category perks link food delivery to hotel bookings, movie tickets, and local services. Each additional benefit increases switching costs while barely impacting marginal costs.

The financial impact compounds over time. Direct subscription revenue provides predictable cash flow—crucial during subsidy wars. Increased frequency drives platform revenue growth—members order 2.3x more than non-members. Reduced promotional intensity improves unit economics—members are less subsidy-sensitive. Higher retention reduces acquisition costs—annual member retention exceeds 70%.

Grocery operations demonstrate similar strategic discipline. While competitors chase growth at any cost, Meituan has systematically pruned unprofitable operations while doubling down on sustainable models. The community group-buying retreat wasn’t failure—it was recognition that tier 3-4 city economics would never support profitable operations given logistics costs and order densities.

The closure of 1,500 warehouses in 2023 followed clear logic. Facilities in dense urban areas with strong order volumes remained open and saw investment. Rural and suburban locations with sub-scale density closed immediately. The remaining network achieved 20% better utilization with 60% less geographic coverage—a classic example of strategic focus creating more value than blind expansion.

Xiaoxiang Supermarket represents the future-focused approach. These smaller-format urban stores serve immediate-needs grocery with 30-minute delivery. The economics work because every variable aligns: average delivery distance under 2 kilometers, multiple orders per rider trip, higher basket values from planned purchases. Store-level contribution margins reached low single digits within 18 months—unprecedented in Chinese grocery delivery.

The Mathematics of Exhaustion

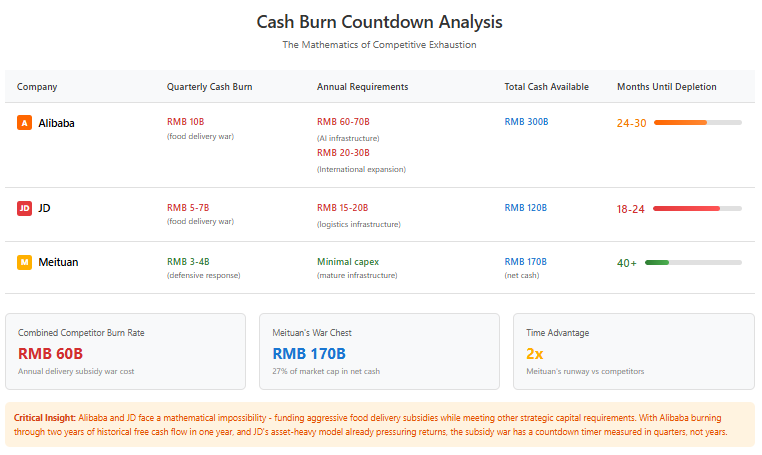

Note: Kristal.ai estimates

Here’s what the market fundamentally misunderstands: this subsidy war has a countdown timer visible in quarterly earnings reports. Unlike previous tech battles funded by patient venture capital with high risk tolerance, this involves public companies with quarterly reporting requirements, debt covenants, and diverse stakeholder demands.

Alibaba’s constraints are starkest. The company committed to investing RMB 200 billion in AI computing infrastructure over three years—a strategic necessity to remain competitive globally. The core e-commerce business faces margin pressure from live commerce and Pinduoduo requiring defensive investment. International expansion continues burning cash with uncertain returns. Against this backdrop, the company reported negative free cash flow for the first time in its public history.

The mathematics are unforgiving. Current burn rates in food delivery exceed RMB 10 billion quarterly. AI infrastructure requires RMB 60-70 billion annually. Core commerce defense needs continued investment. International expansion burns RMB 20-30 billion yearly. The company’s total annual free cash flow in good years barely exceeded RMB 150 billion. The current run rate implies burning through two years of cash flow in one year. This isn’t sustainable—it’s a financial physics experiment testing how long losses can defy gravity.

JD faces similar if less acute constraints. The company’s asset-heavy model already pressures returns on invested capital—warehouses and logistics infrastructure require continuous investment. Core e-commerce margins face structural pressure from competition and rising fulfillment costs. The delivery initiative adds billions in losses to an already strained P&L without clear path to profitability given inferior network density.

Meituan, by contrast, holds RMB 170 billion in net cash—equivalent to 27% of its market capitalization. The company generated positive operating cash flow even during peak subsidy intensity. Core unit economics remain positive when stripping out competitive responses. The operational density built over 14 years means every incremental order costs less to deliver than competitors’ first orders.

Based on current trajectories, the mathematical endpoint arrives within 12-18 months. This isn’t speculation—it’s arithmetic. Alibaba and JD cannot fund current burn rates while meeting other strategic requirements. Something must give, and quarterly earnings create forced transparency about what that will be.

The Rails Strategy

The market’s deepest misunderstanding concerns recovery mechanics. Consensus assumes margins only improve when consumer prices rise—that Meituan must eventually charge more for delivery to restore profitability. This misses the sophisticated monetization rails being constructed that improve economics without touching consumer prices.

Advertising represents the most powerful rail. As subsidy intensity moderates, merchants need efficient customer acquisition. Meituan’s sponsored placement system offers something blanket subsidies cannot: measurable return on investment. A restaurant bidding RMB 3 for prominent placement during lunch rush knows exactly how many incremental orders result. This transparency drives adoption once merchants understand the superior economics.

The sophistication goes beyond simple pay-for-placement. Meituan’s system incorporates quality scores ensuring platform diversity. Targeting capabilities leverage unique data assets—not just what users ordered but when, where, in what combinations. Attribution models track the complete funnel from impression to order to satisfaction rating. Merchants see which campaigns drive profitable customers versus one-time discount seekers.

Early results demonstrate the model’s power. Merchants shifting budget from coupons to advertising report 20-30% improvement in customer acquisition costs. Return on ad spend averages 3-4x across categories, with sophisticated merchants achieving 6-8x. As more merchants see these results, the shift accelerates. In mature cities where competition has moderated, advertising penetration already exceeds 25% of orders.

Mix shift toward instant retail provides structural margin improvement invisible in aggregate metrics. Food delivery operates on razor-thin margins due to restaurant economics and consumer price sensitivity. But instant retail categories—beauty products, consumer electronics, pharmacy items—carry fundamentally different economics. These products have higher absolute margins, tap into brand marketing budgets rather than restaurant promotional funds, and face less direct price comparison.

The operational improvements compound these benefits. A delivery rider carrying multiple instant shopping orders achieves better utilization than one carrying a single meal. Predictable product dimensions enable better packaging and routing optimization. Longer shelf life reduces time pressure and enables batched fulfillment. Every operational improvement flows directly to bottom-line margins.

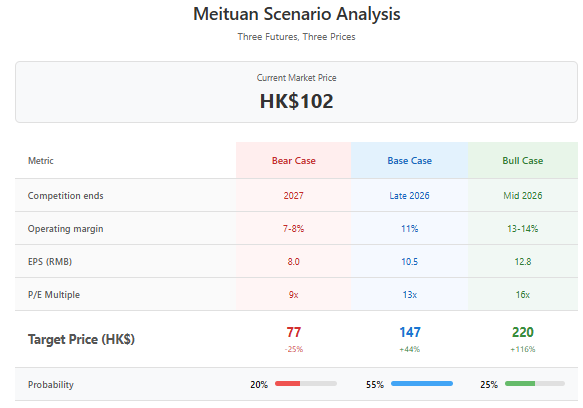

Three Futures, Three Prices

Let me paint three specific scenarios, each grounded in observable dynamics:

Bear Case (20% probability, HK$77): Competition extends through 2027 as Alibaba finds alternative funding—perhaps selling core assets or raising debt specifically for the food delivery fight. Margins remain compressed at 7-8% as Meituan balances share defense with profitability. Revenue grows only 6-7% annually as price competition limits monetization.

Even in this scenario, Meituan earns approximately RMB 8.0 per share by 2028. The market applies a distressed multiple of 9x reflecting the challenging environment, implying HK$77. But the RMB 170 billion cash position and fundamental network value—770 million users, established infrastructure—provide downside protection.

Base Case (55% probability, HK$147): Competition moderates by late 2026 as financial reality constrains competitors. Alibaba’s AI infrastructure needs force resource reallocation. JD focuses on core e-commerce defense. Market dynamics shift from share grab to margin restoration. Revenue grows 10-12% annually as monetization rails gain traction.

Operating margins recover to 11% by 2028, driving earnings to RMB 10.5 per share. Advertising penetration reaches 25-30% of orders. Membership expands to 100 million users. Instant retail becomes 20% of volume. A market multiple of 13x reflects normalized growth, suggesting HK$147.

Bull Case (25% probability, HK$220): Rapid normalization occurs as one competitor exits and market dynamics shift decisively. Perhaps Alibaba faces a liquidity crisis forcing immediate withdrawal. Competition moderates by mid-2026, enabling accelerated recovery. Revenue grows 12-14% as all monetization efforts gain traction simultaneously.

Margins reach 13-14% by 2028, driving earnings to RMB 12.8. The market applies a quality multiple of 16x recognizing Meituan’s dominant position and growth trajectory. International operations contribute meaningfully. This implies HK$220.

The probability-weighted expected value is HK$151, offering 48% upside with approximately 14% IRR. More importantly, the risk-reward skews favorably—downside limited by tangible value while upside depends only on time and mathematics.

What to Watch

For investors tracking this thesis, certain indicators deserve particular attention:

Competitor cash burn rates provide the clearest countdown timer. When quarterly losses from food delivery exceed RMB 10 billion, the mathematical endpoint approaches. Watch segment reporting carefully—companies often bury these losses in broader categories. Cash flow statements reveal truth that income statements obscure.

Geographic subsidy patterns reveal normalization sequencing. Start monitoring tier 3-4 cities where economics are worst. When promotional intensity decreases 10-15% without major share shifts, broader moderation follows. City-level data requires work to obtain but provides months of advance warning.

Advertising metrics demonstrate monetization rail development. Focus on revenue per merchant rather than absolute advertising revenue. When average merchant advertising spend exceeds RMB 500 monthly, the model has achieved critical mass. Penetration rates matter too—30% of orders with sponsored elements indicates maturity.

Membership cohort behavior validates the subscription model. New member additions matter less than tier upgrades and retention rates. When 60%+ of members maintain subscriptions beyond 12 months, the model has proven sticky. Cross-category usage by members indicates ecosystem value creation.

Regulatory language evolution signals intervention probability. The progression follows predictable patterns: “disorderly competition” represents early concern, “harming consumer interests long-term” indicates growing alarm, “guidance for healthy development” immediately precedes action.

Back to the Bellhop

Those Manhattan bellhops understood something timeless about service businesses: value accrues not to whoever works hardest or charges least, but to whoever becomes indispensable to navigating complexity. The bellhop who cultivated relationships, who learned the city’s hidden systems, who made himself trusted and necessary—he built wealth that endured.

Meituan has achieved this position at the scale of urban China. Its 150 million daily orders aren’t just transactions but habits embedded in daily life. The current subsidy war, painful as it appears, is temporary. Mathematical constraints ensure it. Competitive dynamics demand it. Regulatory preferences support it.

At HK$102, the market prices Meituan as if this war continues indefinitely—as if Alibaba can fund endless losses while building AI infrastructure, as if JD can burn cash in delivery while defending e-commerce margins, as if consumers will forever expect services below cost, as if mathematics doesn’t ultimately govern corporate behavior.

This mispricing exists because markets are human constructs, subject to fear and greed, momentum and revision. In the short term, markets are voting machines. In the long term, they’re weighing machines. Today, the votes reflect pessimism. Tomorrow, the weight of Meituan’s network, operations, and economics will assert itself.

The opportunity isn’t complex. You’re not betting on technological breakthroughs or regulatory favoritism. You’re betting that companies cannot indefinitely fund losses while fighting multiple battles, that mathematics eventually constrains behavior, that essential services with network effects generate value over time.

The subsidy war will end. The habits will remain. The math is that simple. And sometimes, the best opportunities are also the simplest: when competitors burn cash they don’t have while you hold RMB 170 billion, patience becomes strategy. When time horizons diverge between market fears and mathematical certainties, conviction becomes alpha.

The bellhop’s secret wasn’t complicated. Neither is this.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.