MELI’s 2Q25 Wasn’t a Miss—It Was a Moat-Expansion Playbook

Shipping “subsidies” as competitive weapons, credit scale inflection, and platform LTV flywheels in full force.

TLDR

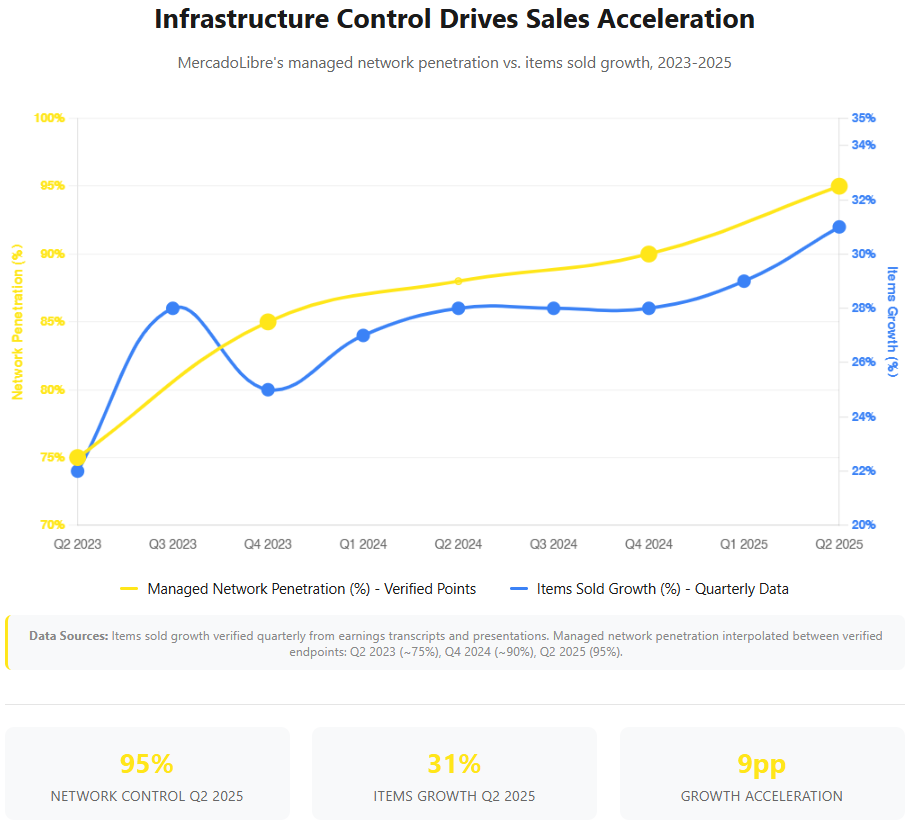

Logistics Moat Now a Weapon, Not a Cost Center: With 95% of shipments now running through MELI’s owned logistics network, the company slashed Brazil’s free shipping threshold—triggering 34% items sold growth in June and forcing rivals like Shopee into unsustainable subsidy responses.

Credit Arm Reaches Profitability Inflection Point: MELI’s credit card business in Brazil hit breakeven (NIMAL) with 51% of the portfolio profitable and $9.3B in total loans, powered by ecosystem data unavailable to traditional banks—validating the structural underwriting edge of its integrated platform.

Platform Economics Power a Long-Term LTV Flywheel: MELI is using low-margin e-commerce to acquire users for high-margin fintech and ad products, with multi-service customers generating up to 7x more value. This quarter marks a pivot from infrastructure building to full moat deployment.

"Latin American e-commerce giant MercadoLibre reported net income of $523 million for the quarter through the end of June, down 1.5% year-on-year and below the $596 million expected by analysts in an LSEG poll. Net revenue of $6.8 billion was up 34% year-on-year, beating the estimate of $6.7 billion." — Reuters, August 5, 2025

My immediate reaction wasn't about the earnings miss—it was about what MercadoLibre chose to emphasize. The company spent more time discussing infrastructure metrics and long-term customer acquisition than quarterly profitability.

This wasn't a quarter where MercadoLibre competed for market share. It was the quarter they demonstrated that 25 years of infrastructure investment had created an unassailable moat.

The Infrastructure Advantage Finally Weaponized

The key data point everyone missed: MercadoLibre's managed network now handles 95% of shipments, up from around 60% just two years ago. When they dropped free shipping thresholds from R$79 to R$19 in Brazil, they weren't changing pricing—they were leveraging infrastructure density that competitors cannot replicate.

This is the pay-off to a logistics build-out that began with Envios in 2013 and the first free-shipping gamble in 2017.

The competitive response validated MELI's thesis perfectly. Shopee immediately countered with R$10 cash coupons—paying money on top of third-party shipping costs to compete with MELI's infrastructure-enabled free shipping. That's not strategy; that's surrender disguised as marketing spend.

Incoming CEO Ariel Szarfsztejn explicitly connected current investments to historical success: "We would not be a $50+ billion GMV company today if it were not because of building our logistics infrastructure." When companies reference their winning formula while making expensive moves, pay attention.

The results came immediately: items sold growth accelerated from 26% for the full quarter to 34% in June alone. The acceleration came specifically from lower ASP purchases, demonstrating MELI is successfully bringing offline retail online.

Credit Business Reaches Strategic Inflection

Here's what the market completely missed: MercadoLibre's credit business just reached the inflection point that transforms it from supporting infrastructure into a primary profit driver.

The Brazil credit card business achieved NIMAL breakeven in Q2, with 51% of the portfolio now profitable. MELI now has 2% market share in Brazilian credit cards with proven unit economics and superior data advantages that traditional banks cannot match.

Integration Over Modularization

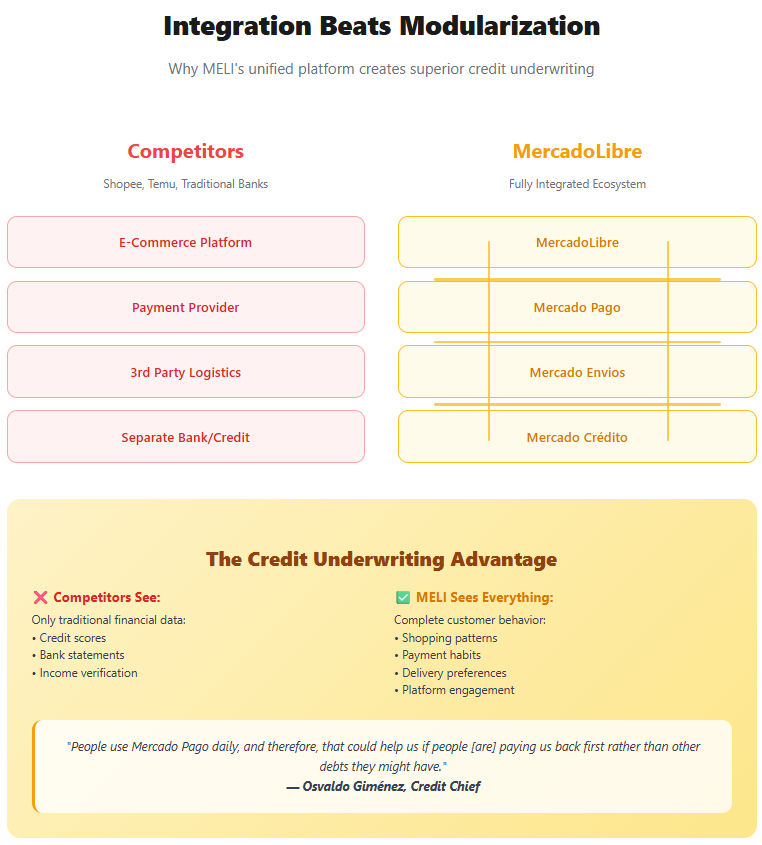

MELI's approach exemplifies integration creating competitive advantages. While competitors modularize e-commerce, payments, and logistics across separate providers, MELI's integrated platform generates compound data advantages that enable superior credit underwriting—something modular approaches cannot replicate.

Consider the competitive moat: banks underwrite credit based on financial statements and credit scores. MELI underwrites based on shopping behavior, payment patterns, delivery preferences, and engagement across commerce, logistics, and payments.

Credit chief Osvaldo Giménez revealed the ecosystem stickiness: "People use Mercado Pago daily, and therefore, that could help us if people [are] paying us back first rather than other debts." When your credit provider is your primary commerce platform, default incentives fundamentally change.

The portfolio grew 91% YoY to $9.3 billion while NPL ratios improved to 6.7%—the lowest since reporting began. That's unusual for rapidly scaling credit unless the underwriting model has structural advantages.

Platform Economics Justify Infrastructure Investment

The shipping subsidy narrative misses the fundamental business model transformation. MELI disclosed that customers using multiple services generate 3-4x the lifetime value of single-service users. Marketplace buyers who also use Mercado Pago off-platform spend 5-7x more annually.

This explains the infrastructure investment logic: e-commerce generates ~12% operating margins, fintech delivers 40%+ margins, advertising scales toward 80%+ margins. MELI uses the lowest-margin business to acquire customers for highest-margin businesses.

The advertising business demonstrated this leverage: revenue grew 38% year-over-year with display and video nearly doubling. The Google Ad Manager integration positions MELI to capture brand advertising that would otherwise go to Google or Facebook.

CFO Martin de los Santos framed the strategy explicitly: "We don't want to miss the growth opportunities ahead of us. That might generate some short-term margin pressure, but we are very optimistic about the long-term trajectory."

The Counter-Argument: Well-Funded Competitors

The bear case has merit: Asian competitors have demonstrated willingness to sustain massive losses for market share globally. If Shopee, Temu, or others view Latin America as strategically critical, they could force MELI into extended subsidy wars.

But this misunderstands the competitive dynamics. MELI's advantage isn't financial—it's structural. When your marginal shipping costs approach zero because you own the infrastructure, and competitors pay full freight plus subsidies, time works in your favor. The question isn't who can lose money longer, but who reaches sustainable unit economics first.

Moreover, MELI's platform effects are accelerating. The credit business provides switching costs that pure e-commerce players cannot match, while ecosystem revenue streams compound the value of each customer relationship.

The real risk isn't competitive spending—it's execution. If MELI's LTV/CAC ratios from shipping expansion don't exceed 2-3x within 18 months, the infrastructure thesis weakens significantly.

What This Quarter Changes

MercadoLibre's Q2 results represent a strategic inflection: the transition from infrastructure building to infrastructure weaponization. The company has reached sufficient scale and network density to use logistics as competitive weapon rather than operational capability.

What to watch:

Whether Asian competitors reduce Latin American investments as unit economics become clear

How quickly the credit business scales beyond $9.3 billion with proven profitability

Whether advertising revenue reaches 5% of GMV within three years

The earnings miss that spooked investors obscures the strategic positioning that should excite them. MELI just demonstrated that patient infrastructure investment creates competitive advantages venture capital cannot replicate.

If Q3 repeats June's 34% surge, the market's narrative will flip from "margin compression" to "pricing power"—and the stock price will follow. That Reuters quote about "intensifying competition" already looks dated. The competition ended this quarter—MercadoLibre won.

General Disclaimer: The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.