MercadoLibre Q3'25 Earnings: The Margin Compression Is the Strategy, Not the Problem

Why MercadoLibre’s falling margins and rising unit efficiency signal an offensive move—not a defensive stumble—against Amazon, Shopee, and Nubank.

TL;DR

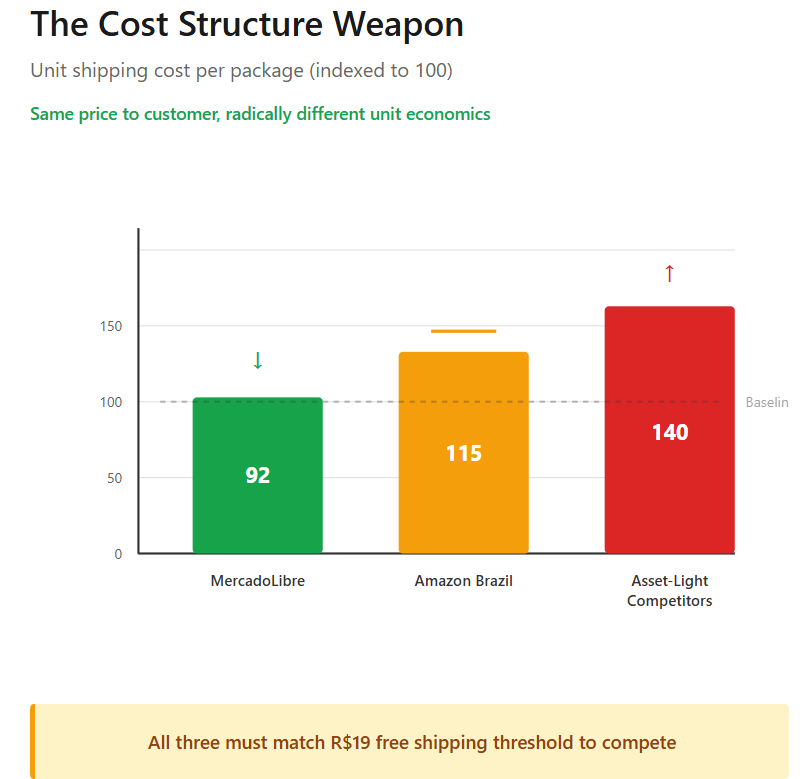

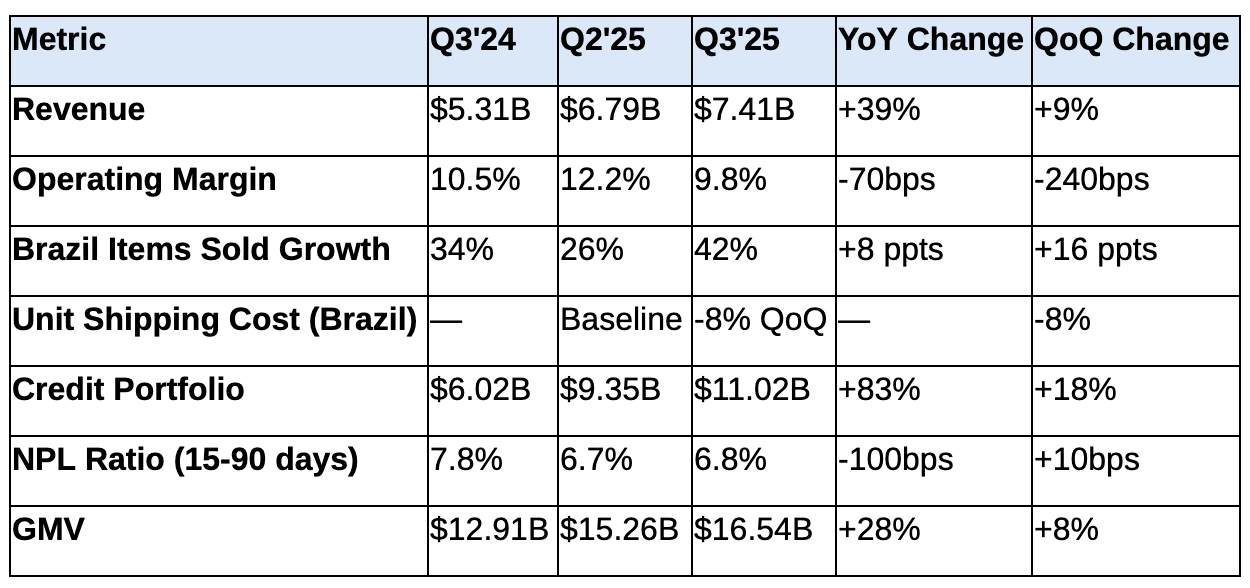

Margin compression as offense: Operating margin fell to 9.8%, but unit shipping costs dropped 8% as volume surged 28%—evidence of scale-driven efficiency, not panic spending.

Infrastructure as a weapon: The R$19 free shipping threshold weaponizes logistics density, forcing competitors into uneconomic matching they can’t sustain.

The misunderstood war: Wall Street saw a profit miss; MercadoLibre declared a structural cost war that partnerships like Amazon–Nubank can’t replicate.

From Reuters:

“Latin American e-commerce giant MercadoLibre reported net income of $421 million for the quarter ending September 30, up 6% YoY but below the $596 million expected by analysts. Net revenue of $7.4 billion was up 39% YoY, beating estimates. Operating margin compressed to 9.8% from 12.2% in the prior quarter, as the company continued aggressive investments in shipping subsidies and logistics expansion.”

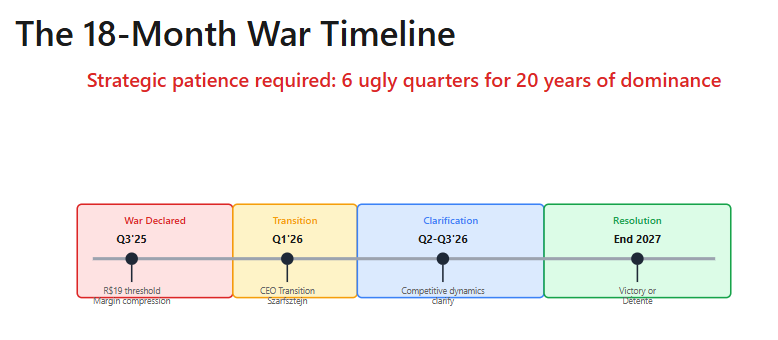

My first reaction to these results wasn’t about the profit “miss”—it was wondering how long it would take Wall Street to understand what’s actually happening. The answer, based on the initial -7.7% selloff following the Amazon-Nubank partnership announcement days later, is: not yet.

This quarter wasn’t disappointing. It was a declaration of war.

The Unit Cost Paradox

Here’s the number everyone missed: unit shipping costs in Brazil fell 8% QoQ while shipping volume surged 28%. Read that again. MercadoLibre’s operating margin compressed by 240 basis points, yet the cost of delivering each package decreased by 8%.

This is the exact opposite of what happens when you’re losing a competitive fight. When companies get forced into defensive spending, unit costs rise because they’re buying share with subsidies that don’t improve underlying economics. What MercadoLibre did is different: they achieved genuine efficiency gains from scale, then chose to reinvest those gains into lower prices and faster expansion rather than let them flow to the bottom line.

The R$19 free shipping threshold that went live in June represents the weaponization of infrastructure advantage. At the previous R$79 threshold, roughly 40% of purchases qualified for free shipping. At R$19, it’s effectively everything. The result shows in Brazil items sold: +42% YoY, accelerating from 26% growth in Q2.

Here’s the strategic logic: MercadoLibre can afford R$19 free shipping because its logistics density makes the marginal cost of each additional package approach zero on many routes. Amazon, with 200 logistics hubs in Brazil but far less density, must match the free shipping threshold while paying substantially higher unit costs. Shopee and other asset-light competitors face even worse economics—they’re paying full third-party freight plus subsidies.

CFO Martin de los Santos stated this explicitly on the earnings call: “Our strategic investments in free shipping, logistics, 1P, and credit cards continue to deliver strong top-line growth while putting some margin pressure...we are not managing the business for short-term margin. We are managing for long-term value creation.”

That’s not defensive language. That’s a company with falling costs choosing growth over profits.

What Management Is Really Saying

The leadership’s comments on the call deserve close reading. When asked about margin pressure from investments, de los Santos explained:

“The recent reduction in the free shipping threshold in Brazil has already delivered strong results with both GMV and items sold accelerating in the quarter. We also saw a strong growth in buyers with improved conversion rates, retention, and frequency of purchase... Higher transaction volumes helped us reduce unit shipping cost in Brazil by 8%.”

He is explicitly connecting the investment (margin pressure) to efficiency gains (lower unit costs) and market share gains (accelerating volume). This is a virtuous cycle, not a panic-spend.

More interesting was Commerce President Ariel Szarfsztejn’s framing of the Q2 results, which set the stage for this quarter:

“Particularly, items sold in Brazil accelerated to 34% growth year over year in June [after the threshold change]... We have proven over and over since 2017 that that offering more free shipping to our buyers has a direct impact in customer satisfaction, in customer retention, in frequency, and that creates long term value for us.”

Szarfsztejn is reminding investors that this isn’t a new strategy; it’s the same playbook that built their leadership position. The market worried that new leadership might pivot to profitability—this team is doubling down on the founder’s growth-first ethos, now backed by a cost structure that makes it more powerful than ever.

The most telling comment came in the Q4 2023 call when a similar question was asked about Asian competitors:

“We are confident that our competitive advantages, particularly logistics and payment, remain strong. We have a unique logistics network. We have a unique buy-now-pay-later and credit card offering... which we think will continue helping us drive our business and our market share gains.”

That’s carefully coded language. A “unique logistics network” that enables a “unique... offering” is MercadoLibre saying their unit economics are structurally superior. When they cut shipping thresholds, competitors have to match the customer offering but can’t match the underlying costs. It’s a cost-structure war disguised as a price war.

The Amazon-Nubank Non-Threat

The market’s panic over the Amazon-Nubank partnership reveals a fundamental misunderstanding of what makes MercadoLibre’s model work.

Amazon announced enhanced credit offerings for Nubank’s customers on Amazon.com.br—up to 24 monthly installments, extra credit lines, interest-free options. This superficially looks like Amazon adopting MercadoLibre’s playbook: combining commerce with fintech.

But partnerships aren’t integration. Here’s why it matters:

When a MercadoLibre user makes a late payment on their Mercado Pago credit card, the system instantly adjusts their credit line, modifies shipping offers, updates fraud scores, and changes ad targeting. It’s real-time, algorithmic, and seamless across the entire ecosystem.

When an Amazon customer with a Nubank card makes a late payment, what happens? Nubank knows. But getting that information to Amazon, in a format that Amazon’s systems can act on, at a speed that matters for customer experience, requires APIs, data-sharing agreements, privacy compliance reviews, and coordination between two companies with separate priorities and systems.

This isn’t a solvable technical problem—it’s structural. The partnership model introduces latency and coordination costs at every integration point. MercadoLibre’s 25-year unified data spine across search, purchase, payment, delivery, off-platform transactions, and credit behavior simply cannot be replicated through partnership, no matter how close.

The proof is in MercadoLibre’s credit metrics: “All-time low, first payment defaults,” as confirmed on the Q3 call, despite an incredible 83% YoY portfolio growth. That’s only possible with superior underwriting using data that exists nowhere else.

The Numbers Tell the Story

The pattern is clear: revenue and volume accelerating, margins compressing, but unit economics improving. This is the signature of offensive infrastructure leverage, not defensive spending.

The credit numbers deserve special attention. An $11 billion portfolio growing 83% with stable 6.8% NPLs is exceptional. For context, traditional consumer credit growing at 20% typically sees NPL deterioration. MercadoLibre is growing 4x faster with improving quality. That’s the data moat at work.

What This Means

MercadoLibre just told you their strategy for the next 18-24 months: compress margins to 9-10% while making Brazil economically unviable for competitors to match. The unit cost trajectory (-8% QoQ) proves this is sustainable. The items sold acceleration (+42% YoY) proves it’s working.

The Amazon-Nubank partnership isn’t a threat—it’s validation that Amazon can’t compete without bolting on the fintech piece they don’t have. But bolting via partnership introduces coordination costs and data latency that integrated systems don’t face.

Here’s my prediction: Q4 and Q1 earnings will produce similar “misses” as management keeps the investment dial at maximum. The stock will likely trade sideways or down as momentum investors exit. That volatility is the opportunity.

By Q2-Q3 2026, the competitive dynamics will clarify. Either Amazon’s Brazil market share stays below 10% (signaling their strategy failed to gain traction), or it reaches 15%+ (signaling the partnership is working and MercadoLibre needs to reassess). The unit cost trajectory will tell us which outcome is likely long before the market share data confirms it.

If unit costs keep falling through Q4 and Q1 while items sold growth sustains 35%+, MercadoLibre is winning the war. If unit costs flatten or rise, the thesis breaks.

The key insight is this: infrastructure at scale isn’t just a competitive advantage—it’s a weapon. MercadoLibre spent 25 years building unified commerce, payments, logistics, and credit systems. That infrastructure now enables margin compression that competitors literally cannot afford to match. The Pennsylvania Railroad achieved the same dynamic in the 1870s by cutting freight rates while expanding infrastructure, bankrupting competitors who faced the same low prices without the density to sustain them.

I think MercadoLibre’s leadership understands this historical parallel perfectly. The next six quarters will be ugly on the P&L by design. But if you believe integrated infrastructure creates unassailable market positions in emerging markets—and I do—this is exactly when you want to be paying attention.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.