MongoDB's 3QFY26: The Binary Bet on AI and Modernization

AI is pulling forward cloud migrations even as enterprise logos quietly shrink, leaving MongoDB priced for a winner-takes-most outcome rather than a steady compounder.

TL;DR:

AI is speeding up modernization, not replacing it: Q3 suggests AI teams are forcing enterprises to modernize faster, turning Atlas into the early beneficiary even before AI revenue shows up.

Enterprise weakness offsets the AI narrative: Direct sales customers fell 5% YoY, signaling funnel pressure and mindshare drift despite stronger large-account spend.

No middle outcome: MongoDB is priced for a winner-take-most AI architecture; the next 12–18 months decide whether it becomes the default stack — or gets pushed to the margins.

Three months ago, in MongoDB and the Memory of Machines, I argued that MongoDB’s future would be determined by whether “hybrid retrieval” — the ability to combine semantic search, structured queries, and governance in a single system — would become the default architecture for AI applications. The bull case was that MongoDB would become the memory layer for machine intelligence; the bear case was fragmentation, with Postgres, specialist vector databases, and hyperscaler offerings carving up the market.

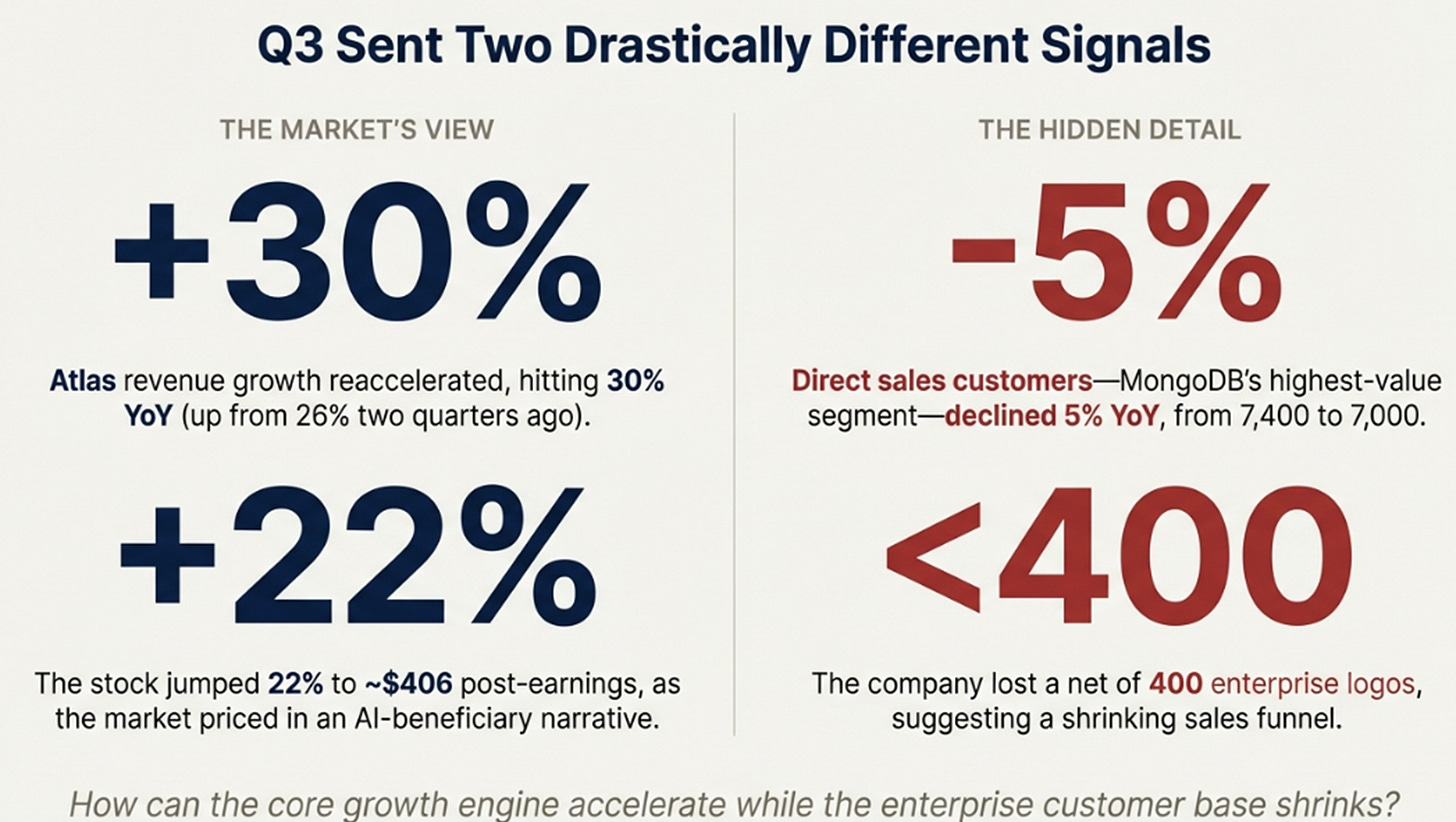

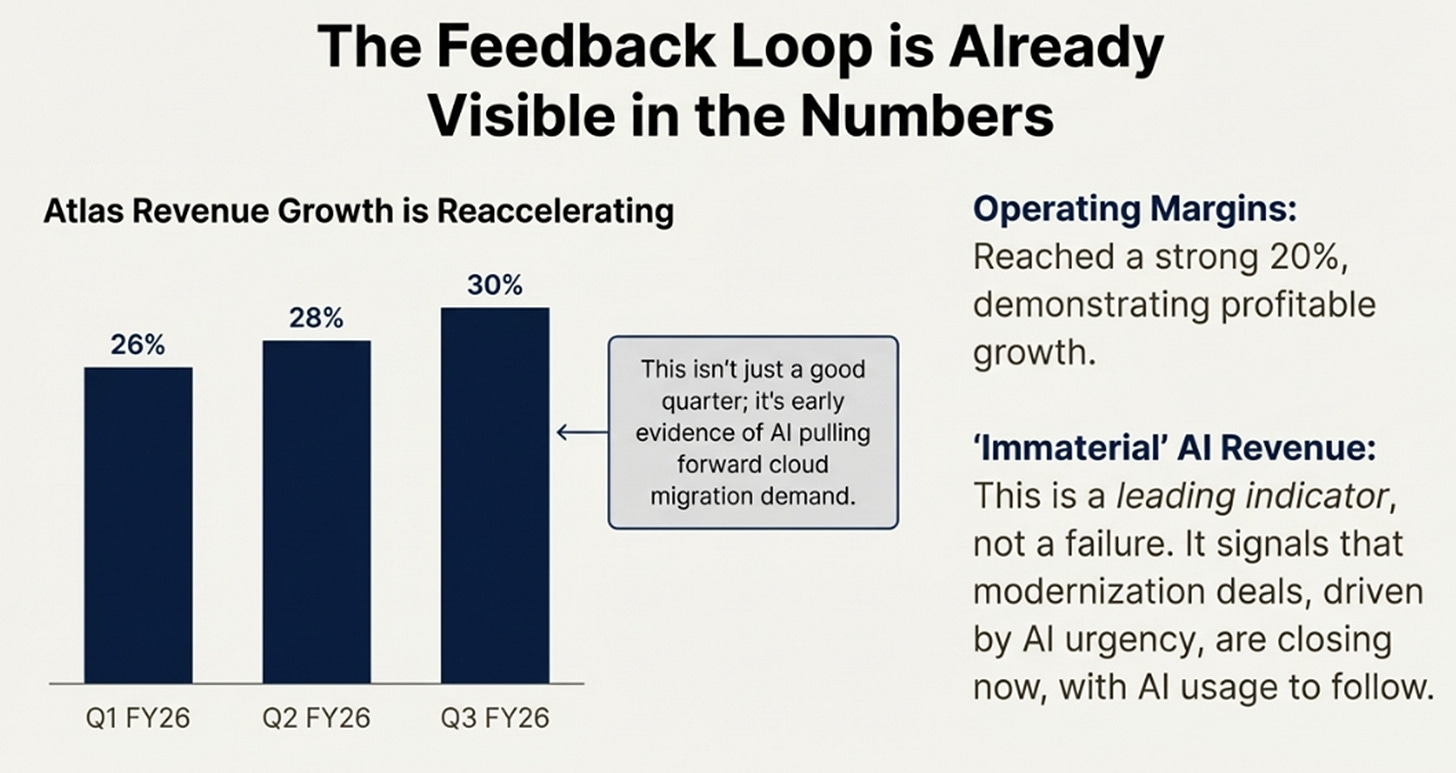

Last week’s Q3 earnings seemed to validate the bull case: Atlas revenue grew 30% year-over-year (accelerating from 26% two quarters ago), operating margins hit 20%, and the stock jumped 22% to around $406. MongoDB looked like exactly the kind of AI beneficiary that investors have been hunting for.

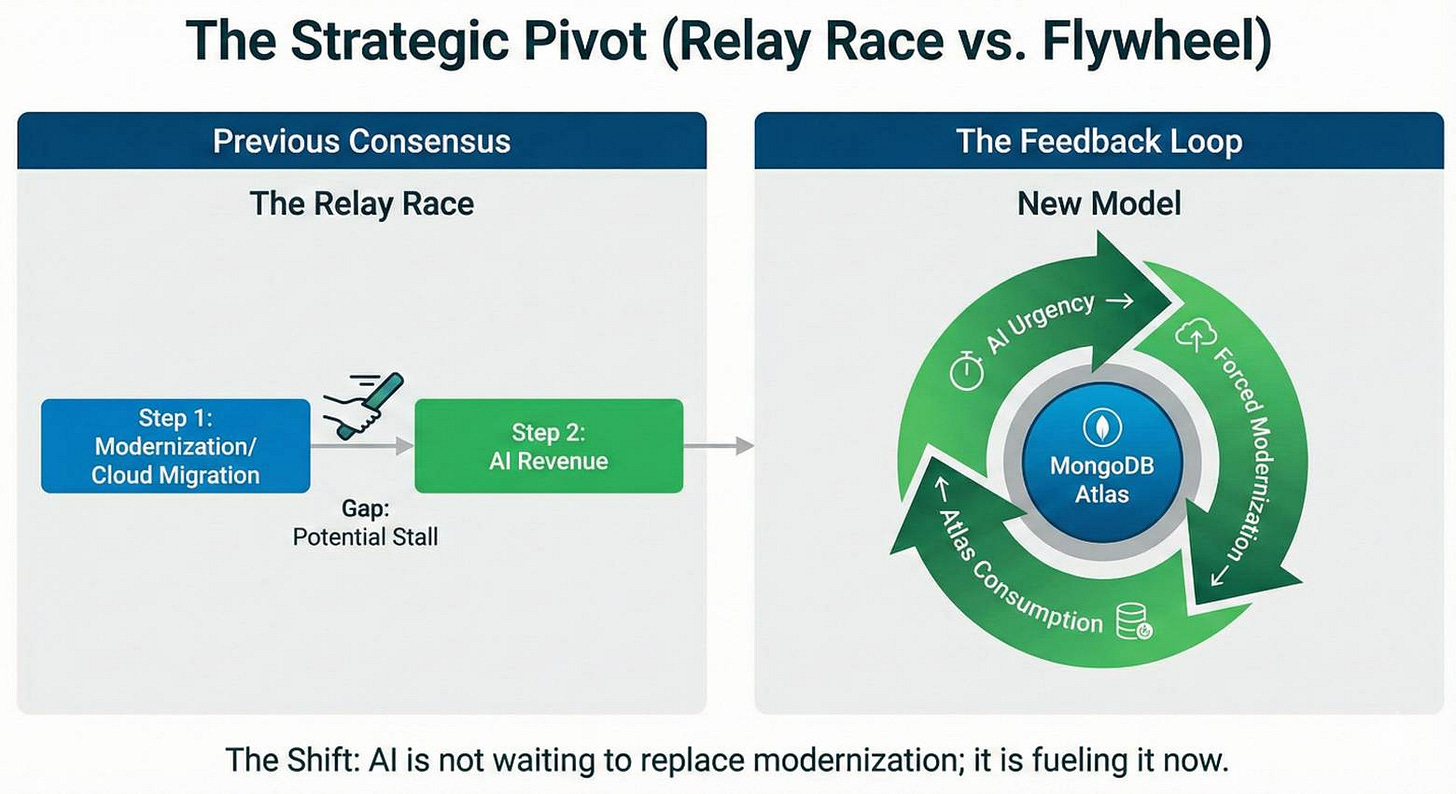

But here’s what I got wrong in my original framing: I treated MongoDB’s “modernization business” and its “AI business” as two separate engines in a relay race — with the risk being a gap between them where growth would stall. The better model, I now think, is that they’re the same engine. And understanding why changes everything about how to think about this stock.

The Feedback Loop

The conventional view of MongoDB’s business goes something like this: the company has a mature, high-quality modernization business helping enterprises migrate from legacy databases to the cloud. Separately, it’s building AI capabilities — vector search, Atlas Search, Voyage AI embeddings — that might become a meaningful growth driver in two to three years. The question is whether the AI business can scale up before the modernization business slows down.

This framing is wrong.

What Q3 revealed — buried in the prepared remarks rather than the headline numbers — is that AI ambitions are accelerating modernization, not waiting to replace it. New CEO CJ Desai made the point explicitly: “When the core team is not agile, their schemas are not flexible, it actually slows AI down.”

Think about what that means. An enterprise CIO who might have taken five years to migrate legacy applications to the cloud is now facing pressure from an AI team that can’t deploy agents on rigid, fragmented data infrastructure. The AI team doesn’t want to wait five years. They want to build now. That creates urgency around modernization that didn’t exist eighteen months ago.

If this feedback loop is real, then Atlas’s reacceleration from 26% to 30% isn’t just a good quarter — it’s early evidence of AI pulling forward cloud migration demand. And the fact that AI revenue is still “immaterial” isn’t a failure; it’s a leading indicator of modernization deals that haven’t fully converted yet. Enterprises are buying MongoDB to enable AI, even if the AI workloads themselves aren’t hitting the income statement.

This is the bull case, and it’s more compelling than I originally gave it credit for.

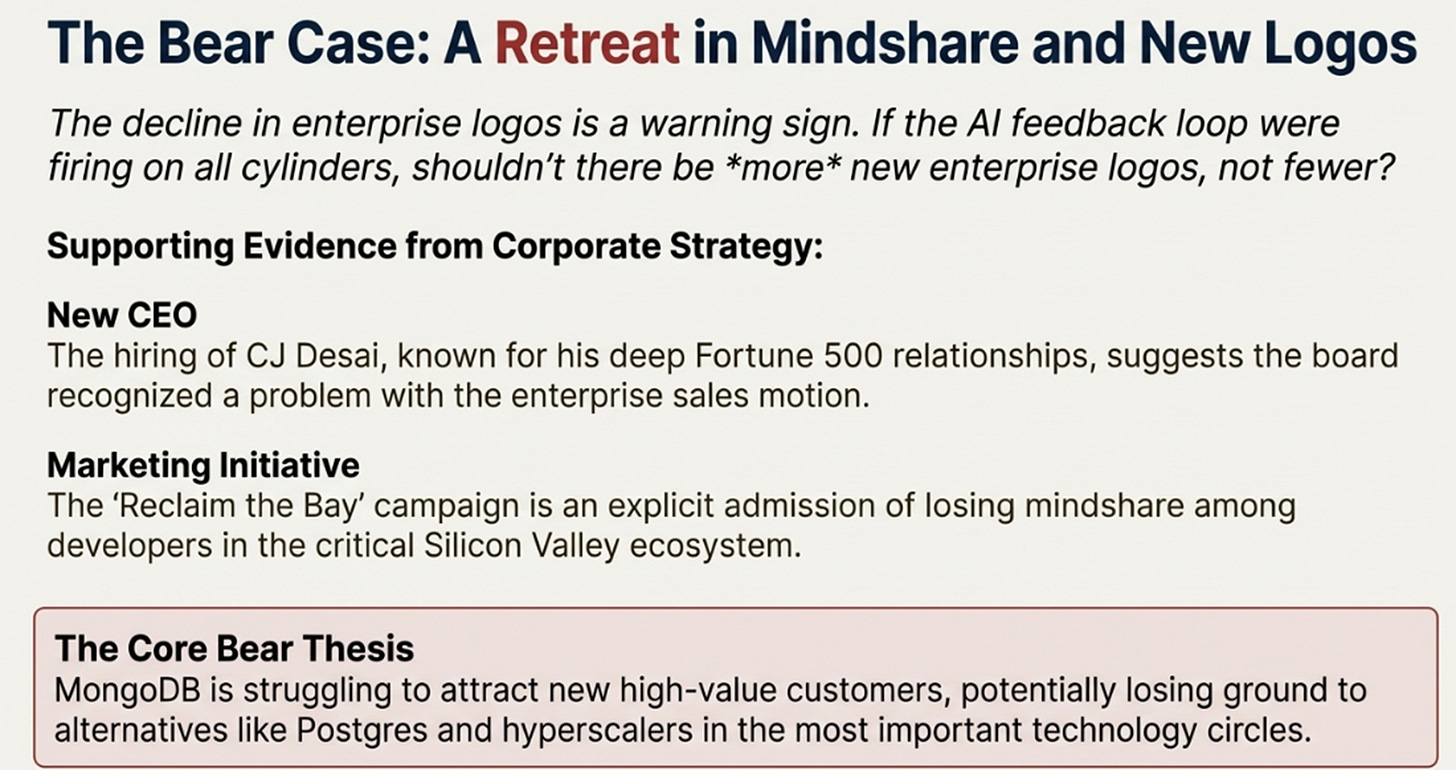

The Enterprise Retreat

But there’s a problem with the bull case, and it’s hiding in the supplemental data tables rather than the earnings release.

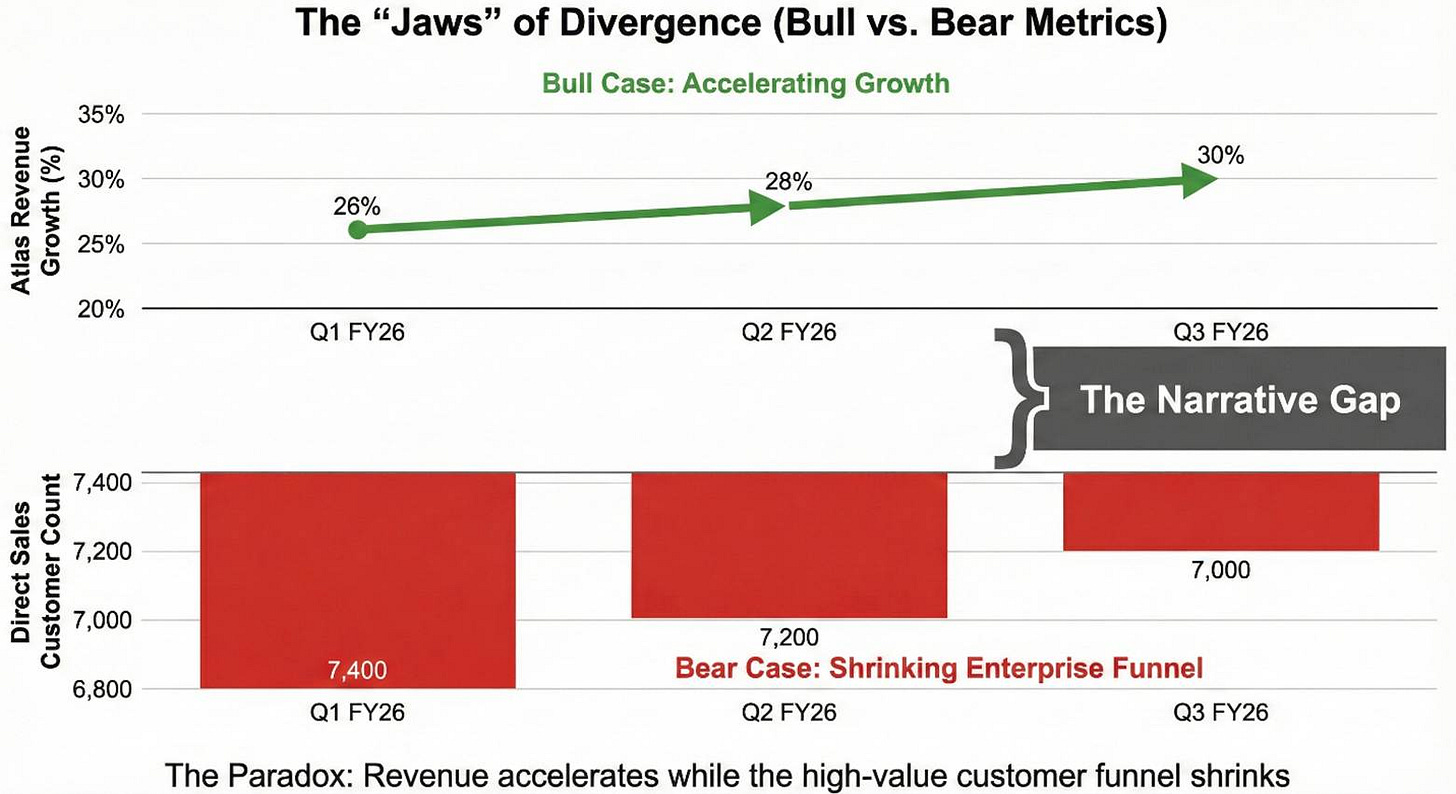

Direct sales customers — MongoDB’s highest-value segment, averaging $150-200K in annual revenue with 130% net retention — declined from 7,400 to 7,000 over the past twelve months. That’s a 5% decline in MongoDB’s enterprise customer count even as total customers grew 19% to 62,500.

All of the customer growth is coming from self-serve. The enterprise funnel is shrinking.

You could interpret this charitably: MongoDB is deliberately moving upmarket, focusing on larger deals rather than customer count. The 16% growth in customers spending more than $100K supports this view. Maybe losing 400 direct sales customers while growing large-account revenue is exactly the right trade.

But you could also interpret it as a warning sign. If the feedback loop were working — if AI urgency were driving enterprise modernization demand — why would enterprise customer count be declining? Shouldn’t there be more new logos, not fewer?

The fact that CJ Desai was hired specifically for his enterprise relationships suggests MongoDB’s board sees the funnel problem. You don’t bring in a CEO known for Fortune 500 relationships if your enterprise motion is working. The “Reclaim the Bay” initiative — a marketing campaign to win back Silicon Valley developers — is an even more explicit admission that MongoDB has lost mindshare in the most important startup ecosystem.

This is the bear case, and the evidence for it is just as real as the evidence for the bull case.

Why The Middle Ground Doesn’t Exist

Here’s where most analysis goes wrong: the temptation is to split the difference. Maybe MongoDB grows 18% instead of 25%, margins expand gradually, and the stock trades sideways while the market waits for clarity. Call it the “steady workhorse” scenario.

I don’t think this outcome is stable.

First, MongoDB’s shareholder base doesn’t tolerate steady workhorse outcomes. The stock is owned by fast money, and growth-focused crossover funds that need either (a) accelerating growth with AI narrative validation, or (b) an exit. These investors have twelve-to-eighteen month time horizons. They’re not sitting through a three-year “show me” period.

If the feedback loop validates and growth reaccelerates, these investors pile in and the stock becomes reflexively expensive. If growth disappoints or the AI narrative falters, they flee and the stock becomes reflexively cheap. The middle — a comfortable hold while waiting for clarity — isn’t an option the shareholder base will tolerate.

Second, the competitive outcome is binary. Either MongoDB’s integration thesis wins — one system for operational data, search, vector embeddings, and retrieval — and developers standardize on it, or the alternatives win — Postgres with pgvector, specialist databases like Pinecone, hyperscaler offerings — and MongoDB gets relegated to legacy modernization work.

There’s no stable equilibrium where MongoDB is “kind of winning.” Developer ecosystems have strong network effects. Once a stack becomes the default for AI applications, it’s very hard to displace. MongoDB is either going to be the default or it isn’t, and the next twelve to eighteen months will determine which.

The probability distribution isn’t a bell curve centered on “base case.” It’s bimodal, with mass at the tails:

At $406, the stock prices in roughly 40% odds of the bull case. If you believe it’s higher than that, the stock is cheap. If you believe it’s lower, the stock is expensive. But don’t fool yourself into thinking you’re buying a stable compounder — you’re making a bet on which tail materializes.

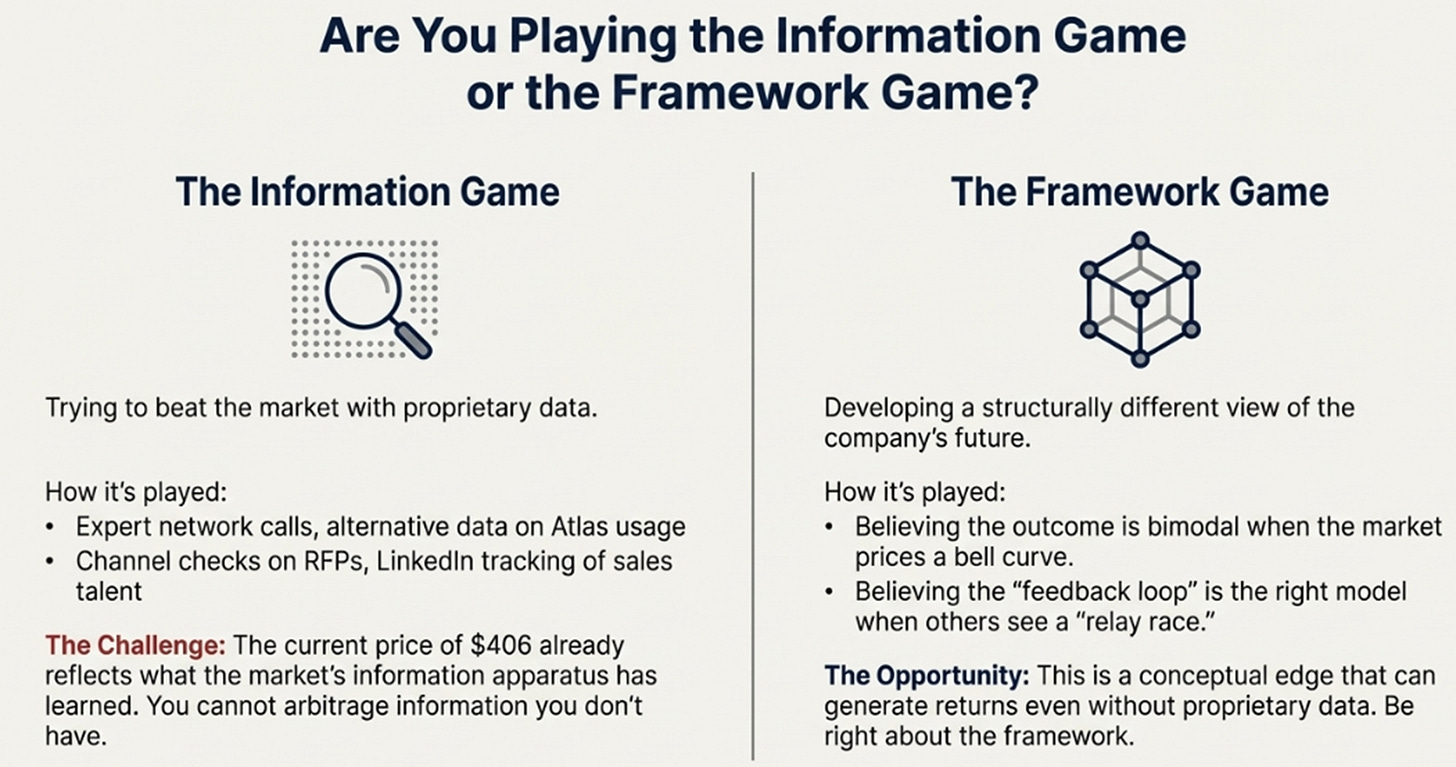

The Information Game

There’s one more dimension to this that matters for anyone actually trying to trade the stock: the market isn’t going to wait for earnings to reprice these probabilities.

The naive framework is “wait for management to disclose AI attach rates, then decide.” But that’s not how institutional investors operate. By the time Desai says “AI revenue is now material” on a quarterly call, the stock will already be at $500. The move will have happened three months earlier, driven by:

Expert network calls with MongoDB customers discussing deal pipelines

Alternative data on Atlas console traffic and usage patterns

Win/loss tracking in enterprise RFPs surfaced through channel checks

LinkedIn monitoring of MongoDB sales hiring and competitive departures

Developer sentiment analysis on Stack Overflow and GitHub

If you don’t have access to this information infrastructure, you’re not smarter than the current price. The $406 level already incorporates everything the market’s channel-checking apparatus has learned. You can’t arbitrage information you don’t have.

What you can do is have a differentiated framework. Believing that the distribution is bimodal when the market is pricing a bell curve is a structural view, not an information advantage. Believing that the feedback loop model is correct when the market is still thinking about relay races is a conceptual edge. These are the kinds of views that can generate returns even without proprietary data.

But be honest about which game you’re playing. If you’re betting on information, you’d better have information. If you’re betting on framework, you’d better be right about the framework.

What To Watch

Given the bimodal distribution, the question becomes: what signals would shift probability mass toward one tail or the other?

Signals that push bull case toward 50%+:

The single most important metric is direct sales customer count. If it stabilizes in Q4 — or better, returns to growth — it validates that the enterprise retreat was a deliberate move upmarket rather than a funnel failure. That would meaningfully increase bull case odds.

Beyond that: Atlas growth sustaining above 28%, gross margins holding above 73% despite mix shift, and any additional Elasticsearch displacement case studies would all be confirmation of the feedback loop thesis.

Signals that push bear case toward 50%+:

Direct sales decline accelerating to 10%+ would be a serious warning sign. AI revenue still described as “immaterial” through Q2 FY27 — four quarters from now — would suggest the feedback loop isn’t working. Gross margins breaking below 71% would indicate pricing pressure from hyperscaler competition. And any evidence of Postgres becoming the default in AI startup stacks would be existentially concerning.

The honest answer is that Q3 didn’t resolve the debate between these scenarios. It provided evidence for both. The Atlas reacceleration supports the bull case. The direct sales decline supports the bear case. Both are real.

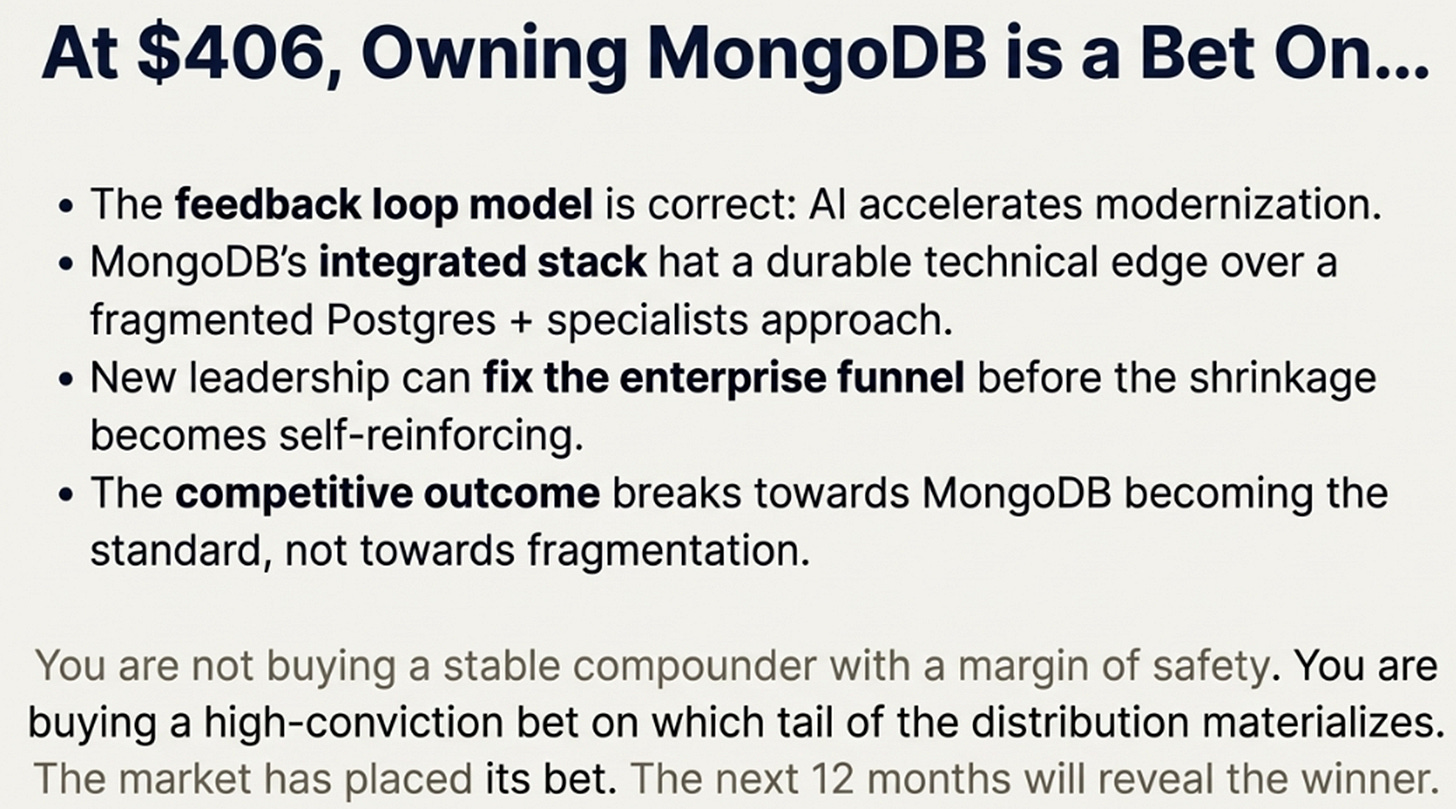

The Bet

At $406, owning MongoDB is a bet that:

The feedback loop model is correct — AI accelerates modernization rather than replacing it

MongoDB’s integrated stack has genuine technical edge over Postgres-plus-specialists

CJ Desai can fix the enterprise funnel before the shrinkage becomes self-reinforcing

The competitive outcome breaks toward MongoDB rather than toward fragmentation

The shareholder base dynamics resolve bullish rather than bearish

You are not betting on a comfortable 18% grower with steady margin expansion and time to wait for clarity. That outcome has maybe 20-25% probability, and even if it materializes, it implies a stock price 20-25% lower than today’s.

This is a stock for people with conviction, not for people looking for margin of safety. If you believe the feedback loop is real and MongoDB has product edge, the stock is reasonable — possibly cheap if you push bull odds above 45%. If you’re uncertain on either dimension, you’re paying a premium for a coin flip between outcomes that are 30-40% higher or 30-40% lower.

Q3 proved MongoDB can still deliver numbers worthy of a growth compounder. What it didn’t prove — and what the stock price assumes — is that the AI tailwind and the enterprise retreat will resolve in MongoDB’s favor. The market has already placed its bet. The next twelve months will reveal whether it was right.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.