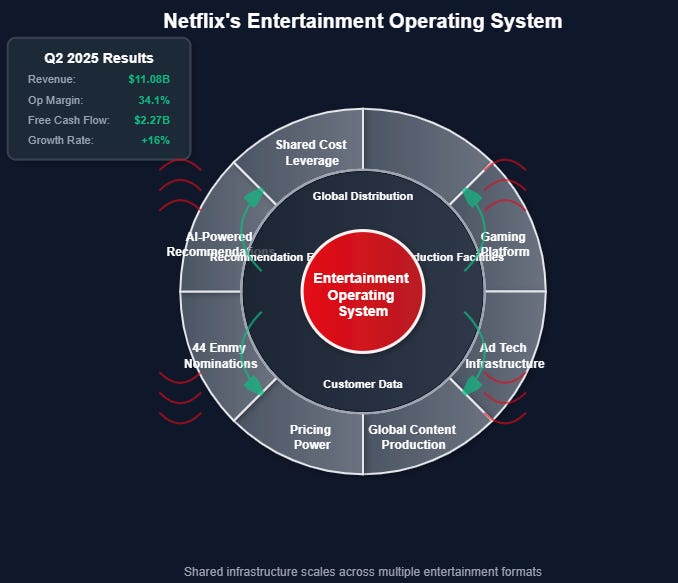

Netflix 2Q25 Earnings: Netflix’s Operating System Moment

Q2 results validate the platform thesis — scaling across formats, building ad tech in-house, and turning fixed costs into flywheel dominance.

Netflix raised its revenue and operating margin forecasts for the year, continuing a strong run that has propelled its shares to new highs.

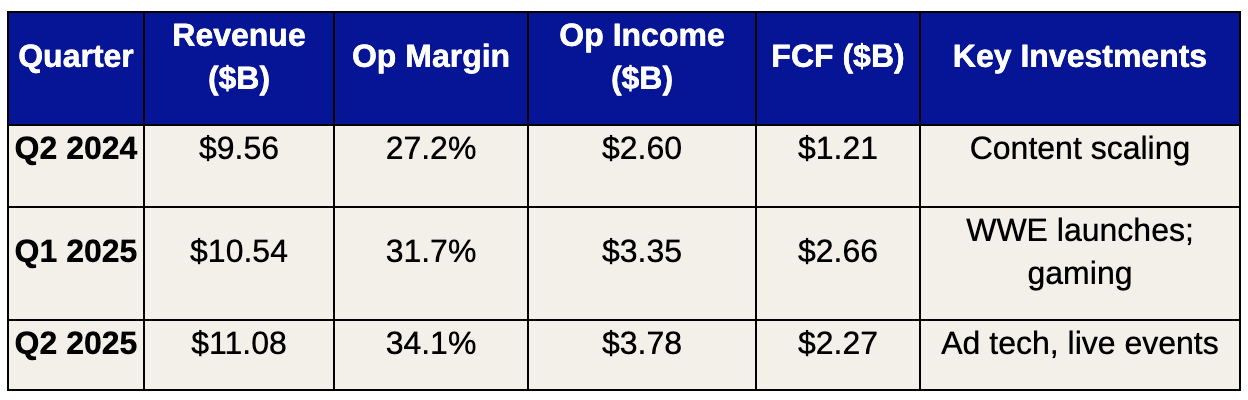

The streaming service said member additions, price increases and its growing ad business drove revenue in the second quarter. Netflix's revenue grew 16% to $11.08 billion in the second quarter. Net profit rose 46% to $3.1 billion. Those metrics slightly beat its guidance for the period.

From the Wall Street Journal:

My first thought after reading Netflix's Q2 results was that this wasn't just another strong quarter — it was validation of the Entertainment Operating System thesis I've been tracking. While Wall Street focused on the revenue beat and raised guidance, the real story is how Netflix achieved 34.1% operating margins while simultaneously expanding into live sports, gaming, and advertising. That combination should be impossible under traditional media economics, yet here we are.

The fact that Netflix can fund WWE programming 52 weeks a year, build proprietary ad tech, and expand gaming development while expanding margins reveals something fundamental: they've cracked the code on turning fixed entertainment costs into scaling advantages.

This isn't just good execution — it's architectural superiority. As one analyst put it, this was "close to perfection."

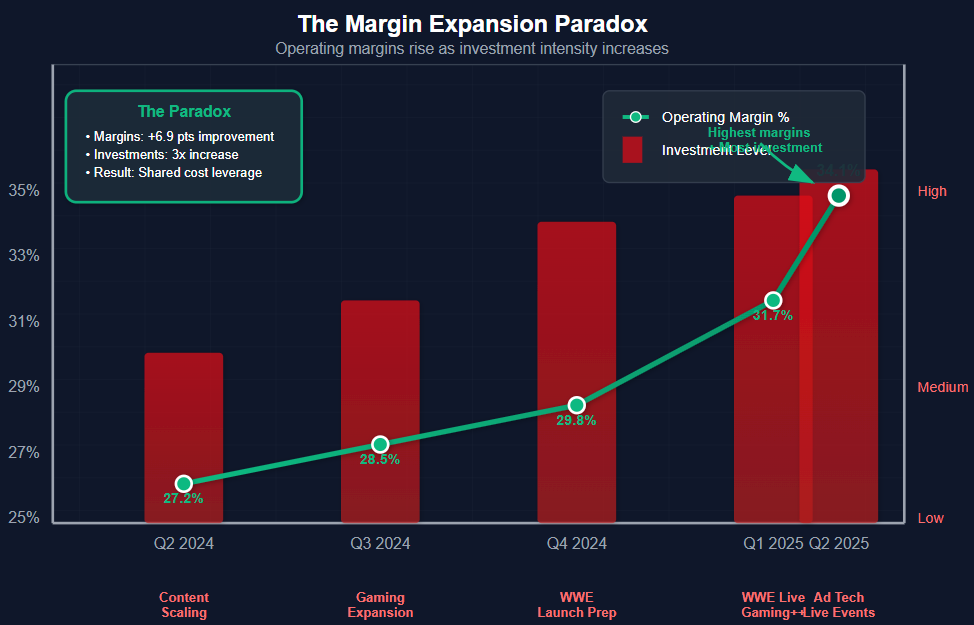

The Margin Expansion Paradox

The most striking aspect of Netflix's results is achieving 34.1% operating margins (up from 27.2% a year ago) while making their most aggressive multi-format investments ever. This defies basic business logic, where expanding into new verticals typically compresses margins as companies climb learning curves.

The explanation lies in what Netflix has built: shared cost infrastructure that leverages across entertainment formats.

Their recommendation engine works as effectively for suggesting games as films. Their production facilities support both scripted content and live events. Their customer acquisition costs amortize across an expanding entertainment portfolio.

This operating leverage is impressive, but it's worth noting the balance sheet strength that enables this strategy: Netflix ended the quarter with $8.2 billion in cash after paying off $1 billion in debt, with $12 billion remaining in buyback capacity.

They're not just achieving margins through financial engineering — they're generating real cash while investing aggressively.

CFO Spencer Neumann's guidance commentary was telling when he emphasized that the outperformance came from "favorable F/X impact, net of hedging, and the timing of expenses." But what he didn't say is more important: Netflix is flowing increased revenues directly to margins because their infrastructure scales without proportional cost increases.

The Global Scale Machine

Co-CEO Ted Sarandos made a comment on the earnings call that perfectly captures Netflix's structural advantage:

"We had 44 individual shows nominated for Emmys this year. So that's what quality at scale looks like."

This isn't just content bragging — it's a data point about Netflix's global production network creating competitive advantages that single-market competitors can't match.

The content ecosystem Netflix has built eliminates concentration risk: no single title represents more than 1% of total viewing hours, yet titles like "Lucifer" continue attracting significant interest two years after launching.

Consider the Q2 content performance:

UK-produced "Adolescence" reached 124 million global views

Korean "Squid Game S3" became the 6th biggest season in Netflix history

German "Exterritorial" became the 4th most popular non-English film ever

Animated "KPop Demon Hunters" from Japan is breaking K-pop records globally

Each piece of content benefits from Netflix's global distribution, recommendation algorithms, and production infrastructure. A show produced at their UK studios can utilize their Spanish post-production facilities, their global marketing expertise, and their worldwide customer base. This creates cost leverage that pure-play local producers simply cannot access.

The proof is in Netflix's expanding market share even in mature markets: they reached 9.0% of UK TV viewing time, up from 8.0% a year earlier, while Disney+ sits at just 2.8% despite massive IP investments. That gap isn't about content quality — it's about systematic advantages that scale creates.

The Competitive Reality Check

That said, there are two warning signs worth monitoring.

First, Netflix's market share has been rangebound between 7.4%-8.4% since 2023, while YouTube jumped from 8.5% to 12.8% of total TV viewing. This stagnation suggests Netflix faces real competition for attention, even with their content quality and global reach.

Second, watch hours per viewer are declining year-over-year despite membership growth. Netflix attributes this to their back-half weighted content slate for 2025, with major releases like "Wednesday S2" and "Stranger Things" finale coming in Q3/Q4. If engagement doesn't recover with these releases, it could signal deeper competitive pressure.

Still, Netflix and YouTube appear to be the clear leaders with what one analyst described as "a mile between these two and 3rd place." Netflix's content breadth strategy — offering everything from Korean dramas to live sports — creates what they call "cancellation objectors" within households, making churn decisions more difficult.

Live Programming and the Platform Expansion

Netflix achieved a significant milestone this quarter by successfully hosting two concurrent live events: Taylor vs. Serrano globally alongside WWE SmackDown (delivered ex-US). Co-CEO Ted Sarandos noted the strategic importance:

"Not all view hours are equal, and what we've seen with live is that it has an outsized positive impact around conversation, around acquisition and we suspect around retention."

This validates Netflix's live strategy not as a defensive move against sports streaming competitors, but as another format that plugs into their Entertainment OS infrastructure. Live events leverage the same customer relationships, recommendation systems, and global distribution that serve their scripted content.

The new TV homepage rollout to ~50% of members is showing positive early results, with the redesigned interface better representing Netflix's expanded entertainment breadth. When roughly half of members come to Netflix with something specific in mind and half are looking for discovery, having superior recommendation and navigation becomes crucial competitive advantage.

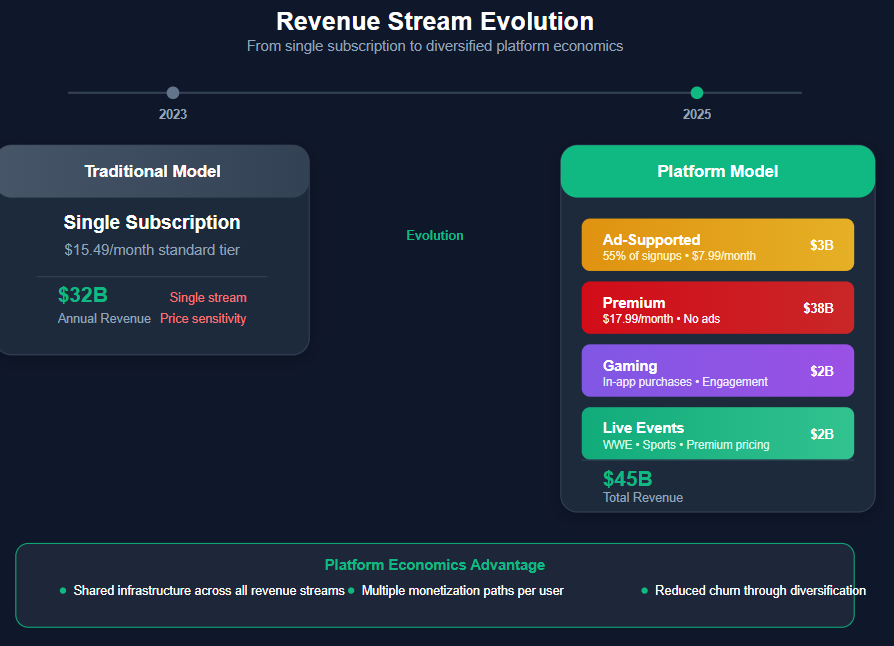

The Monetization Evolution

Note: FY25 are estimates

Perhaps the most underappreciated aspect of Netflix's results is their progress on tiered monetization. Co-CEO Greg Peters noted that their ad-supported tier now represents "over 55% of sign-ups in ad markets," while they're on track to roughly double ad revenue in 2025.

The Netflix Ads Suite rollout across all 12 advertising markets represents more than incremental revenue — it's a platform play. Peters explained:

"We believe our ad tech platform is foundational to our long-term ads strategy and, over time, will enable us to offer better measurement, enhanced targeting, innovative ad formats and expanded programmatic capabilities."

This echoes Amazon's evolution from retailer to AWS. What began as internal infrastructure to serve Netflix's core business is becoming a platform capability with entirely different economics and strategic optionality. Building proprietary ad technology rather than partnering with existing providers signals that Netflix views its data and customer relationships as assets too valuable to share.

Their US upfront was "nearly complete" with results meeting expectations for doubling ad revenue this year. The advertising business isn't just about incremental revenue — it's about creating another dimension of value capture from the same customer relationships and content investments.

AI Integration and Production Innovation

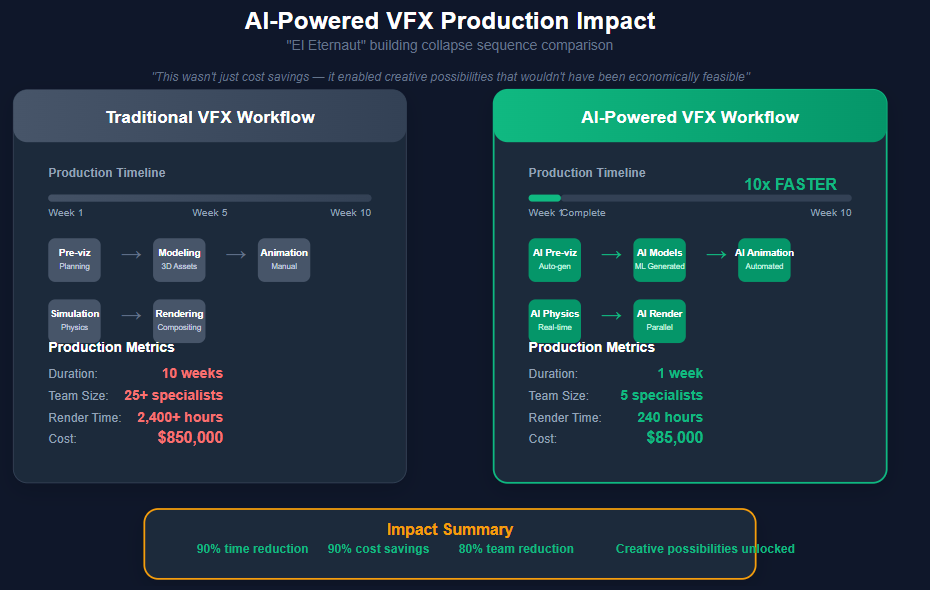

Netflix is also leveraging AI to improve both content production and user experience. They highlighted using AI-powered VFX tools for "El Eternaut," where a building collapse sequence in Buenos Aires was completed 10 times faster than traditional VFX workflows would allow. This wasn't just cost savings — it enabled creative possibilities that wouldn't have been economically feasible at that show's budget level.

The AI integration extends to their recommendation systems, with improvements to algorithms (including using LLMs for text-heavy Threads content) increasing engagement by 35% over the last six months. This represents Netflix applying their technology platform capabilities to enhance the core entertainment experience.

Strategic Implications

These results validate Netflix's transformation from streaming service to Entertainment Operating System.

While competitors like Disney+ struggle with traditional media economics (separate P&Ls for streaming, linear, and parks), Netflix has built unified infrastructure that treats different content formats as modules plugging into the same system.

The raised guidance to $44.8-45.2 billion revenue (from $43.5-44.5 billion) and 29.5% operating margins (from 29%) reflects this flywheel spinning faster. More importantly, Netflix's free cash flow generation of $2.27 billion this quarter gives them strategic flexibility that cash-strapped competitors lack.

Price increases have proceeded as expected without significant subscriber pushback, demonstrating pricing power in an entertainment offering that provides exceptional value. As one executive noted, Netflix represents "an incredible entertainment value" starting at $7.99 in the US compared to other streaming competitors.

Looking ahead, Netflix's ability to maintain margins while expanding into adjacent entertainment verticals suggests they're not just winning the streaming wars — they're defining the rules of future entertainment. The company that was supposedly "wrong" about the future three years ago is now demonstrating that properly architected entertainment platforms can generate both growth and profitability.

For investors, this isn't just about quarterly beats anymore. It's about recognizing that Netflix has built something unprecedented: an entertainment platform with technology company economics. The flywheel is now spinning fast enough to be largely unstoppable, even if some competitive pressure and engagement questions merit continued monitoring.NFLX 0.00%↑

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.