Netflix Earnings: Why The Library Bet Works

Why an $82.7B bet on old content is actually a bet on engagement, algorithms, and survival against YouTube

TL;DR

The hit model is tapped out: Viewing hours grew just 2% while revenue rose 18%—price hikes and ads are masking an engagement ceiling.

Libraries fix the gap originals can’t: HBO, Friends, Harry Potter, and Discovery content create constant “keep reasons” between hit releases, reducing churn.

This isn’t AT&T 2.0: Netflix has the missing ingredient—algorithmic discovery—turning inert libraries into compounding engagement engines.

From Bloomberg, January 21, 2026:

Netflix Inc. beat Wall Street’s fourth-quarter earnings expectations but shares remained under pressure as the company announced it would pause stock buybacks to fund an $82.7 billion all-cash acquisition of Warner Bros. Discovery’s entertainment assets.

Reed Hastings spent fifteen years proving that software beats libraries. Now Netflix is spending $82.7 billion to buy the library anyway.

This will work. But to understand why requires understanding why AT&T’s nearly identical bet failed.

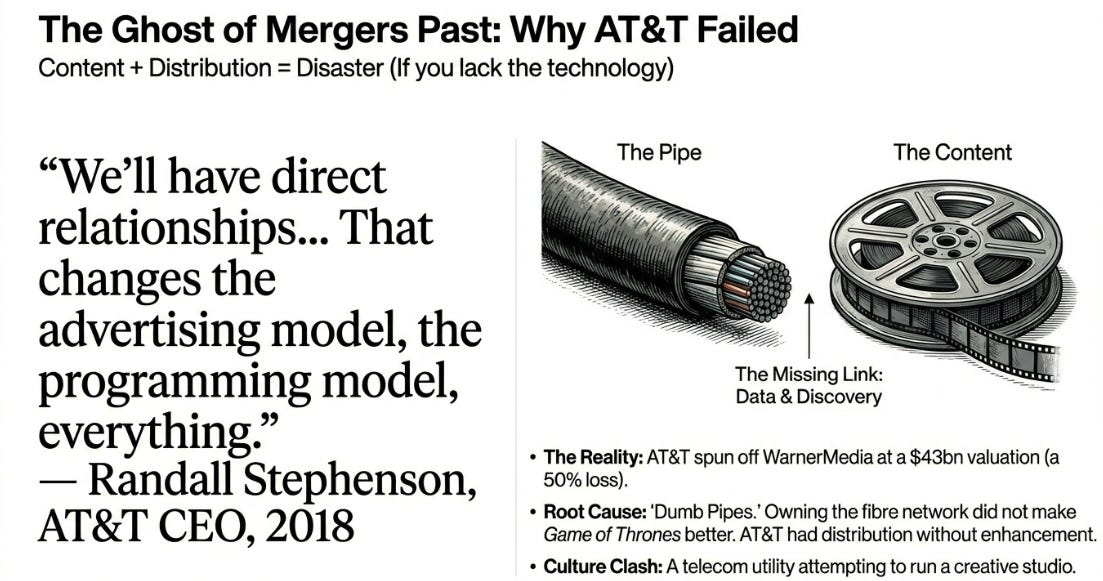

The AT&T Failure Nobody Understands

In June 2018, AT&T completed its $85 billion acquisition of Time Warner. The pitch was elegant: combine AT&T’s 170 million direct customer relationships (wireless, broadband, satellite TV) with Time Warner’s premium content assets (HBO, Warner Bros., Turner networks).

Randall Stephenson, then AT&T’s CEO, explained the logic: “We’ll have direct relationships with customers consuming content. That changes the advertising model, the programming model, everything.”

Three years later, AT&T spun off WarnerMedia to Discovery at a $43 billion valuation, a 50% loss. Wall Street concluded that content + distribution = disaster.

That’s the wrong lesson. AT&T didn’t fail because the combination was conceptually flawed. They failed because they had distribution without enhancement.

Here’s what actually happened: AT&T owned 100+ million customer billing relationships. They could bundle HBO Max with wireless plans and broadband packages. They could use customer data to target advertising. In theory, owning both the pipes (AT&T network) and the content (HBO) created advantages neither had alone.

In practice, none of this mattered.

AT&T’s network didn’t make HBO content more valuable to viewers. A subscriber watching Game of Thrones on AT&T fiber had the same experience as one watching on Comcast cable. The distribution advantage, direct billing, customer data, network priority, didn’t enhance the content itself.

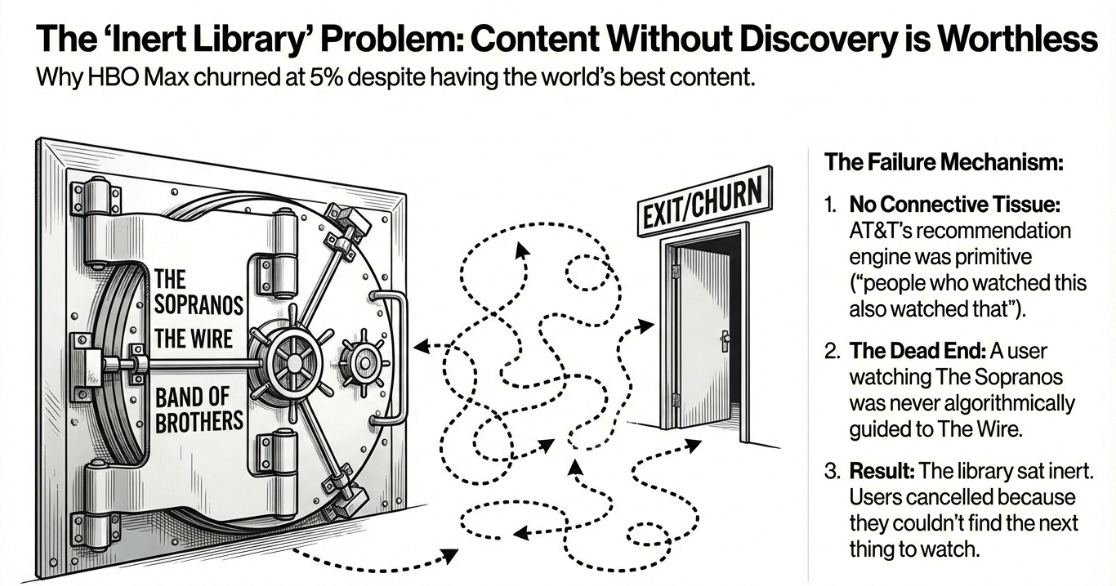

More critically, AT&T’s distribution didn’t solve HBO Max’s actual problem: content discovery. HBO had 50 years of prestige programming. The Sopranos, The Wire, Six Feet Under, Band of Brothers, critically acclaimed shows that had created HBO’s brand. But HBO Max had no mechanism to surface the right show to the right viewer at the right time.

Their recommendation engine was primitive. A viewer who loved The Sopranos might never discover The Wire because HBO’s algorithm couldn’t make the connection. The interface was clunky. The personalization was minimal. New subscribers churned at 5% monthly because after watching the one show they signed up for, they couldn’t find the next thing to watch.

So Time Warner’s library sat there, inert. HBO Max had the content. AT&T had the customer relationships. But there was no connective tissue, no technical mechanism to make the whole greater than the sum of parts.

John Stankey, who ran WarnerMedia for AT&T, kept talking about “direct-to-consumer relationships” and “data-driven programming.” But AT&T never built the technology to make that real. They were a telecom company trying to run a media business. The cultures were incompatible. The technical capabilities didn’t exist.

By 2021, it was clear the “synergies” were fiction. AT&T couldn’t make HBO Max competitive against Netflix and Disney+. They couldn’t reduce churn. They couldn’t improve content ROI through data. The distribution advantages they’d pitched were irrelevant to the actual challenge: making a vast content library navigable and valuable to subscribers.

Netflix is making essentially the same bet AT&T made. The difference is Netflix has what AT&T lacked: the enhancement mechanism that makes libraries valuable.

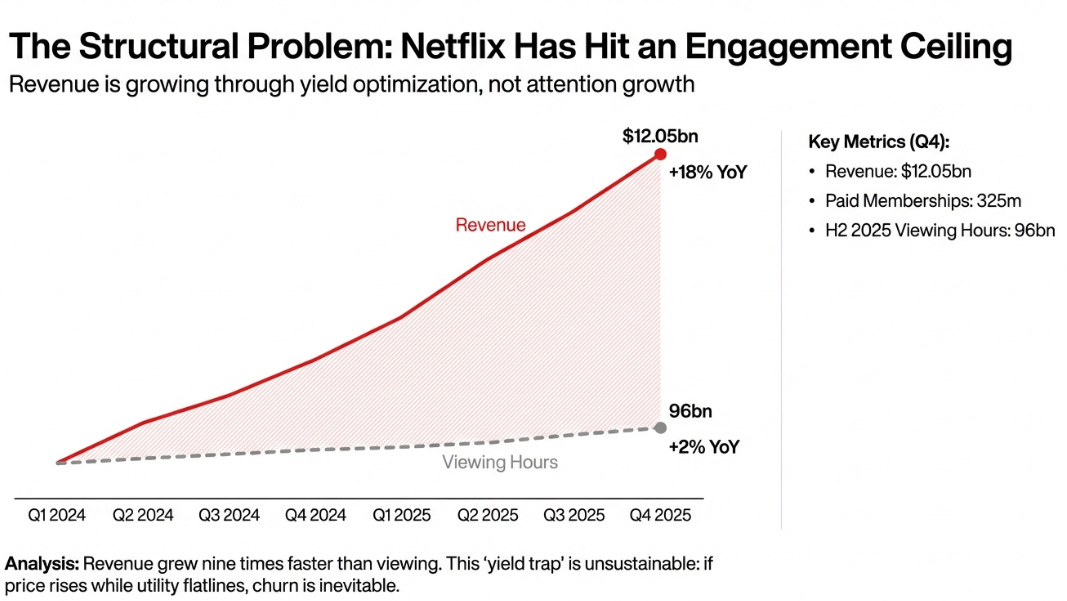

The Engagement Ceiling Netflix Hit

Netflix reported Q4 results that reveal a company at an inflection point:

Revenue: $12.05 billion (+18% YoY)

Full-year 2025: $45.2 billion revenue, 29.5% operating margin

Paid memberships: 325 million

H2 2025 viewing hours: 96 billion (+2% YoY)

Branded originals viewing: +9% YoY

Revenue grew nine times faster than viewing. Netflix is extracting more money from roughly the same amount of attention.

This works in the short term, raise prices, add advertising, optimize yield. But it’s unsustainable. If you keep charging more while delivering the same viewing experience, eventually subscribers leave.

Co-CEO Greg Peters was asked directly about hours per subscriber on the earnings call. His response: “Engagement remains healthy. We’re seeing strong performance in branded originals, which grew 9% year-over-year.”

He answered a different question. Total viewing grew 2%. Peters cited the subset that grew 9%. This deflection is more revealing than any metric Netflix reports.

The problem is structural, not cyclical. Netflix commissioned roughly 600 hours of major original content in 2025, spending over $17 billion. Those originals create engagement spikes, Squid Game drives massive viewing for 28 days after release. Then it declines.

Between those spikes, there’s not enough reason to open the app daily. YouTube uploads 500 hours of content per minute. TikTok has infinite scroll. Netflix has appointment viewing.

The hit-driven model worked brilliantly from 2013-2021 when Netflix was taking share from cable and establishing streaming as the default. It’s insufficient now that they’re competing for attention against free platforms with algorithmic feeds.

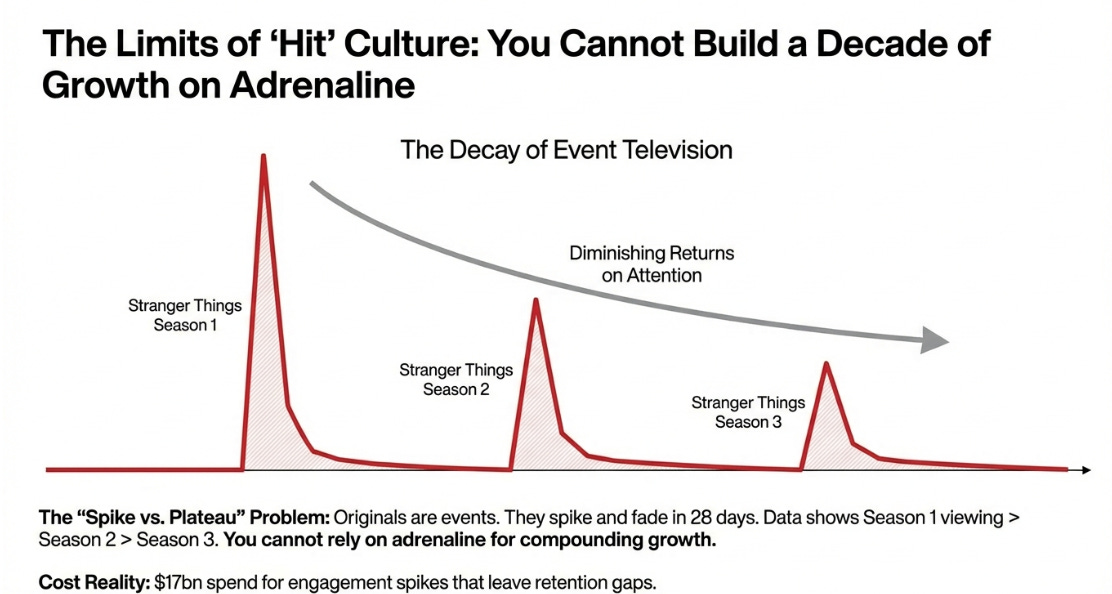

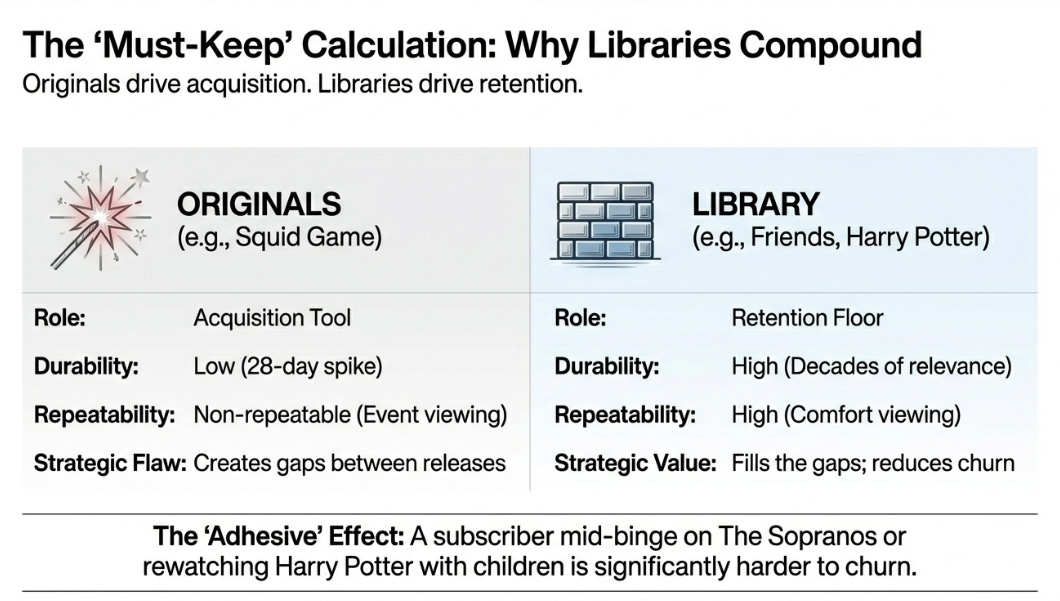

Why Libraries Compound and Originals Don’t

Netflix disclosed what they’re acquiring from Warner Bros. Discovery: HBO’s 50+ years of prestige programming, the Harry Potter franchise, DC Comics’ film library, Friends, and Discovery’s unscripted catalog.

Library content has a different durability curve than originals. Friends generates more viewing on streaming platforms than it did during its original NBC run. The Office drove Peacock’s early subscriber growth despite being 15+ years old. HBO’s The Sopranos creates binge marathons two decades after its finale.

Netflix originals follow the opposite pattern. They peak at launch and decline. Stranger Things Season 1 generated more total viewing than Season 2. Season 2 did more than Season 3. Each iteration captures less attention.

This isn’t a quality issue, Stranger Things remains excellent television. It’s that originals are events, and events by definition don’t repeat. You watch the new season when it drops. You don’t rewatch it the way you rewatch The Office or Friends or Seinfeld.

Library content fills the gaps between events. A subscriber waiting for the next Stranger Things season might cancel if that’s the only reason they keep Netflix. But if they’re mid-binge on The Wire or rewatching Harry Potter with their kids, canceling becomes harder.

This is the “must-keep” calculation. Every additional reason to keep Netflix makes churn more difficult. Library content isn’t flashy, it won’t dominate social media conversations or generate viral moments. But it’s adhesive.

Netflix guided 2026 revenue to $50.7-51.7 billion. At their current 29.5% operating margin, that’s $15+ billion in operating income. The company doesn’t have a profitability problem. They have an engagement growth problem that makes the next decade’s revenue trajectory uncertain.

The Algorithm Advantage

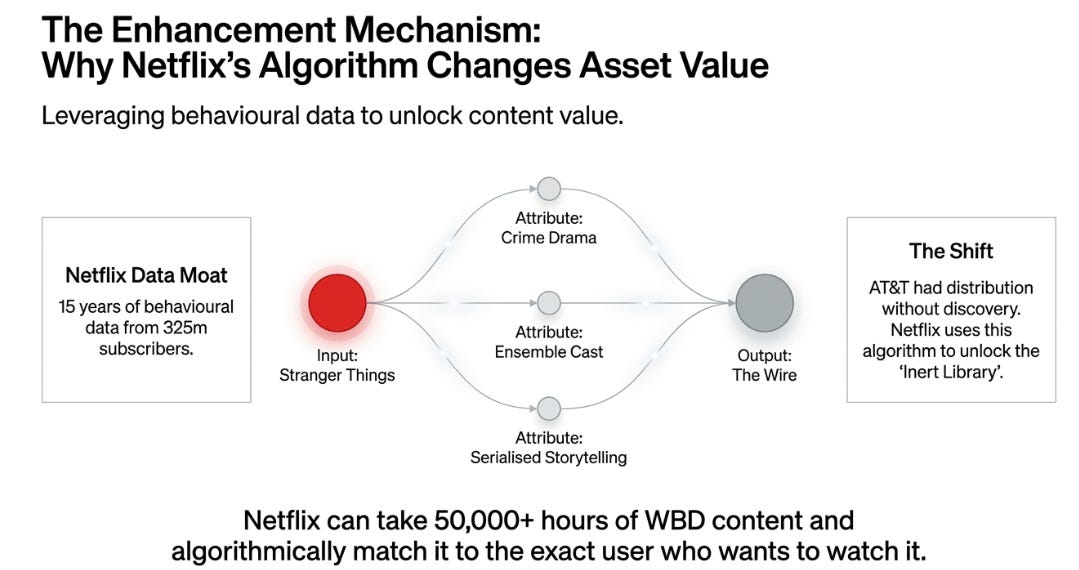

Netflix’s recommendation engine has been trained on 15 years of viewing data from 325 million subscribers. This is the technical capability that makes the Warner Bros. Discovery library valuable in a way it never was for AT&T.

When you finish Stranger Things, Netflix’s algorithm might surface The Wire (crime drama, ensemble cast, serialized storytelling) or True Detective (mystery, dark tone, character-driven). The system makes connections between shows that human curators might miss.

This is what AT&T couldn’t do. HBO Max had The Sopranos but no way to algorithmically connect it to viewers who’d love it. Their recommendation engine was basic, mostly relying on editorial curation and rudimentary “people who watched this also watched that” logic.

Netflix can take Warner Bros.’ 50,000+ hours of content and surface the exact show each subscriber wants to watch next. That’s the enhancement mechanism AT&T lacked. Distribution doesn’t make content more valuable. But discovery, algorithmic matching between viewer preferences and vast content libraries, absolutely does.

The Warner Bros. library becomes more valuable on Netflix than it was on HBO Max for precisely this reason. The same content, same production quality, but vastly superior discovery infrastructure.

The All-Cash Signal

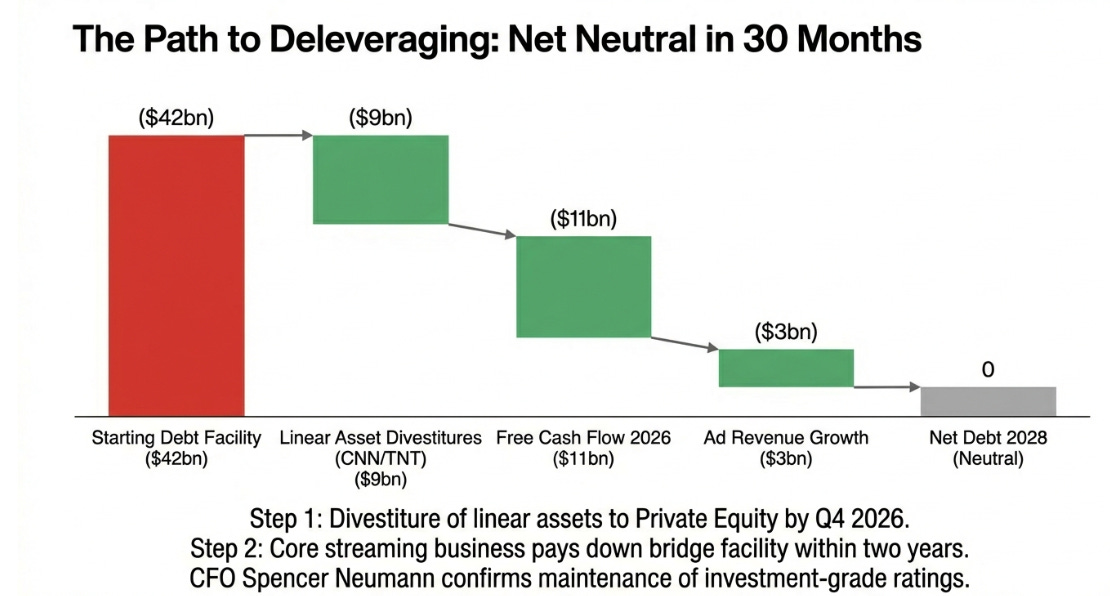

Netflix amended the deal structure to all-cash at $27.75 per Warner Bros. Discovery share. This required a $42.2 billion bridge facility and pausing buybacks.

Why lever up when your stock trades at $87, down 34% from highs?

Because management believes the equity is undervalued. If Netflix thought $87 fairly valued the business, they’d use stock as currency. The decision to borrow $42 billion instead signals conviction that the combined entity is worth substantially more than current prices.

CFO Spencer Neumann: “We expect to maintain investment-grade ratings and delever within two years post-close.”

The math works:

2026 free cash flow guidance: approximately $11 billion

Interest expense on $42 billion at ~6%: $2.5 billion

Available for debt reduction and content: $8.5 billion

That deleverages to net neutral within 30 months. Netflix accepts capital constraints through 2028 in exchange for solving the engagement ceiling permanently.

The timing reveals urgency. The all-cash structure killed Paramount’s competing bid for Warner Bros. Discovery. Netflix worried they might lose this asset to a competitor. That fear reveals how strategically critical the library is.

The Advertising Inflection

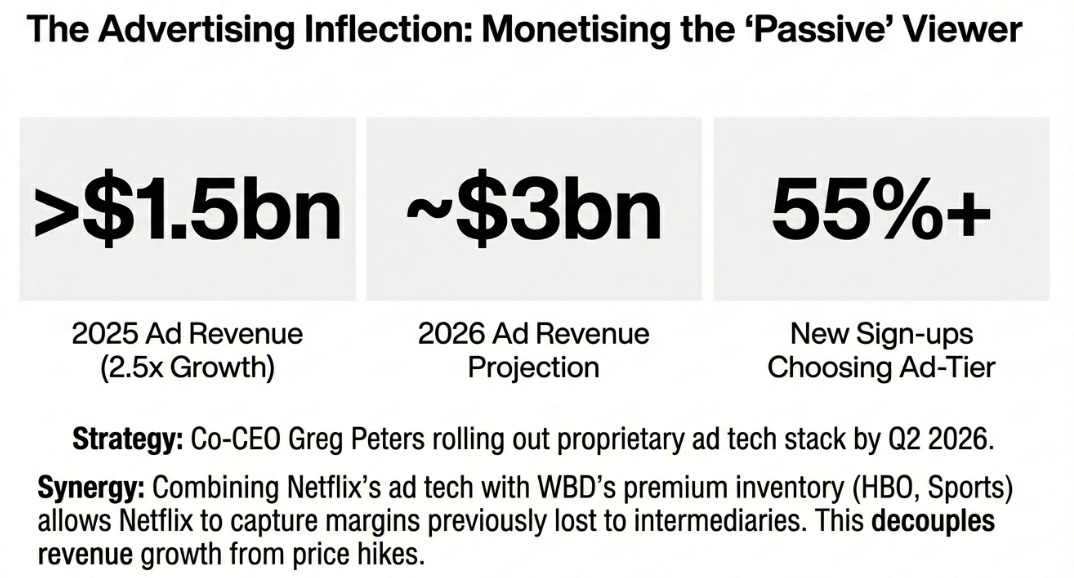

Netflix disclosed ad revenue exceeded $1.5 billion in 2025, growing 2.5x, and will roughly double to approximately $3 billion in 2026. More importantly, 55%+ of new sign-ups in ad markets now choose the ad-supported tier.

This matters because it changes the engagement ceiling calculation. If subscribers are watching the same amount but Netflix can monetize through both subscription and advertising, the revenue per hour improves without raising prices.

Co-CEO Greg Peters emphasized rolling out Netflix’s proprietary ad technology across all markets by Q2 2026. Owning the ad tech stack means Netflix captures margins that typically go to intermediaries. Combined with Warner Bros.’ premium inventory, HBO prestige content, CNN news programming, sports rights, this creates a top-tier streaming ad business.

At $3 billion, advertising represents roughly 6% of total revenue. That’s material and scaling.

What Actually Happens

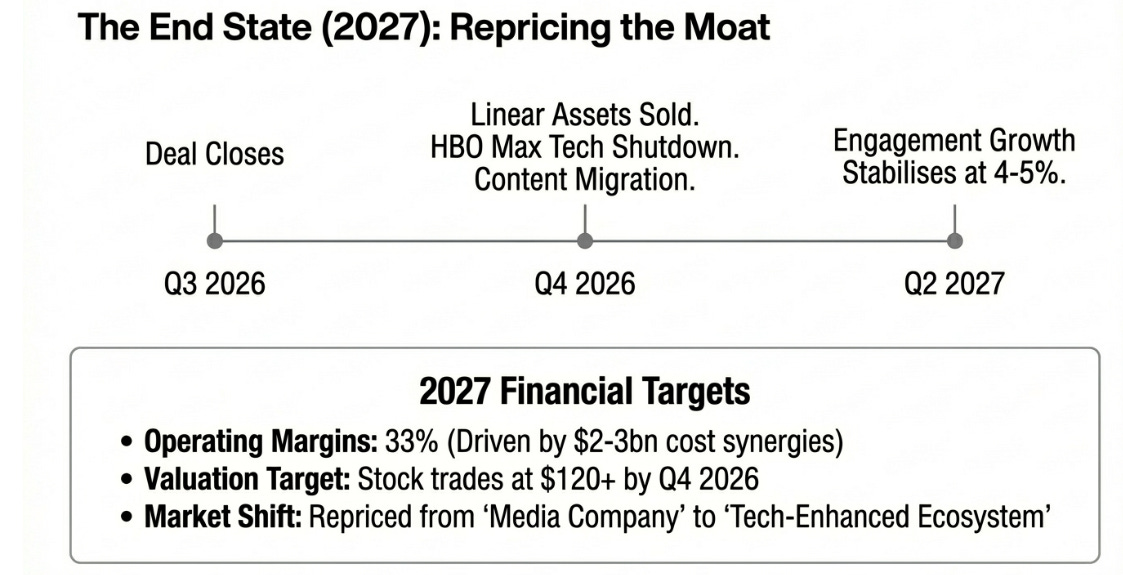

The deal closes in Q3 2026. Regulatory approval comes because the relevant market is attention, where YouTube dominates with more than 12% of TV screen time, not just streaming subscriptions where Netflix and Warner Bros. combined would be large but not monopolistic.

Netflix disposes of CNN, TNT, and TBS to private equity by Q4 2026. These linear assets generate cash flow but drag on valuation. The disposal reduces net debt by $8-10 billion immediately.

HBO Max technology shuts down within 90 days of close. All content migrates to Netflix’s interface where the recommendation engine starts surfacing Warner Bros.’ library to 325 million subscribers.

Engagement growth reaccelerates by Q2 2027. Not to the 8% rates of 2022, but to 4-5%, sustained by library depth filling the gaps between original programming releases. Churn improves as households accumulate more “cancellation objectors.”

Operating margins reach 33% by year-end 2027 as $2-3 billion in cost synergies, duplicate technology infrastructure, overlapping content licensing deals, consolidated corporate functions, flow through to results.

The stock trades at $120+ by Q4 2026 as the market reprices Netflix from “mature content company hitting engagement ceiling” to “technology-enhanced media entity with sustainable moat.”

Why This Works

Netflix hit an engagement ceiling that hit-driven original content cannot solve. The data is unambiguous: 2% viewing growth while revenue grows 18%. That’s optimization, not expansion.

The Warner Bros. Discovery library solves this by providing 50,000+ hours of proven content that generates consistent viewing between hit releases. This isn’t theory, library content demonstrably has longer durability than originals.

The AT&T precedent doesn’t apply because Netflix has the recommendation technology that makes libraries valuable. AT&T had distribution without discovery. Netflix has both.

The all-cash structure reveals management conviction. The deleveraging math is straightforward. The linear asset disposal is obvious and imminent.

This deal closes, executes cleanly, and works. Netflix at $87 is the opportunity. The stock hits $120 within twelve months as engagement reaccelerates and margins expand past 33%.

The market is pricing this like AT&T’s disaster. It’s not. Netflix actually has the technical capability to extract value from libraries that AT&T fundamentally lacked.

That difference is worth $82.7 billion.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.