NU Holdings Q2’25 — Trust, Priced In: What Mexico Just Proved

Rate cuts didn’t shake deposits, earnings quality stepped up, and the global platform clock sped up.

TL;DR

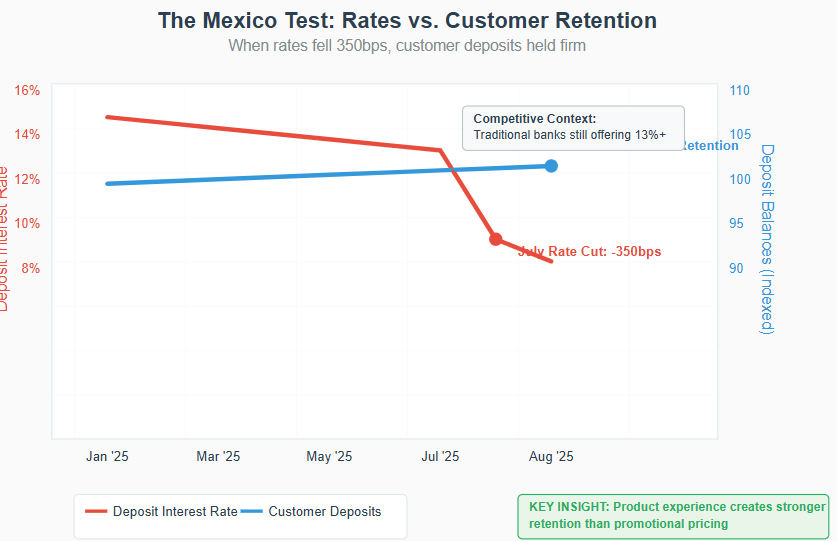

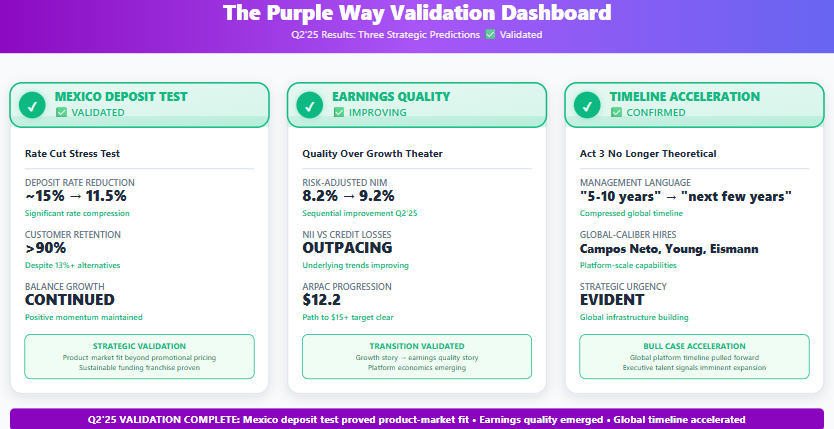

Mexico’s deposit beta passed: Cutting yields ~15% → 11.5% held >90% retention with continued balance growth despite 13%+ offers elsewhere—proof Nu can earn, not buy, funding.

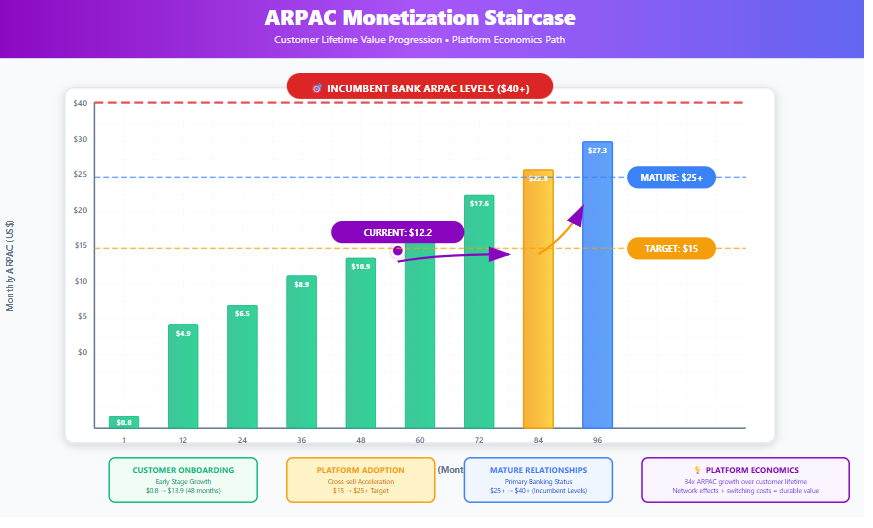

Earnings quality > growth theater: Risk-adjusted NIM improved; NII outpaced credit losses; Mexico deposit costs fell while ARPAC hit ~$12.2; low-40s LDR preserves option value.

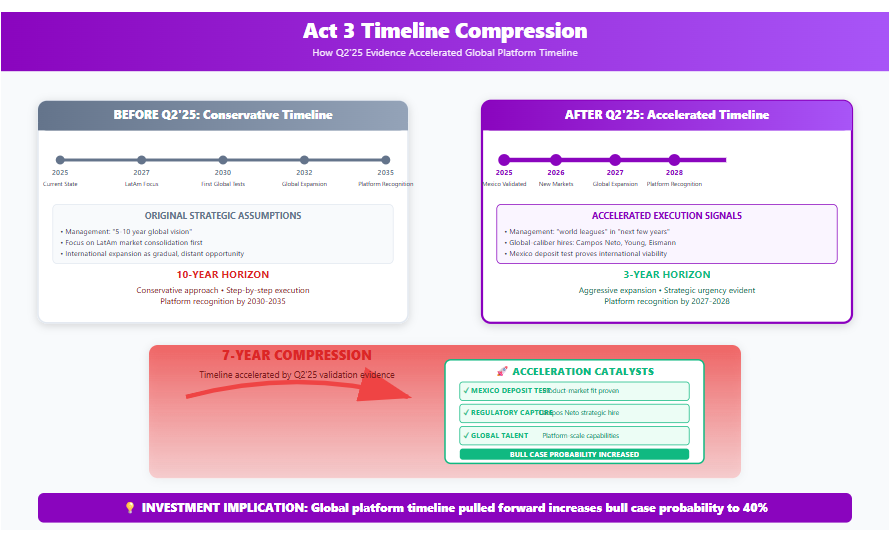

Timeline pulled forward: Shift from “5–10 years” to “next few years” plus global-caliber hires (Campos Neto, Eric Young, Ethan Eismann) raises bull-case odds—PW expected return ~22% IRR from ~$13.30.

A July evening in Mexico City: Maria opens the Nu app to check her savings balance. The notification is waiting—her yield has dropped from 15% to 11.5%. She pauses, considers the BBVA branch down the street offering 13%, maybe Banorte's new digital promotion at 12.8%. Her thumb hovers over the transfer button.

Then she remembers last week's rent payment—instant, free, no forms. The seamless credit line that appeared when she needed it. The investment options that actually make sense. The customer service that responds in minutes, not hours. She closes the app without moving a peso.

This micro-decision, repeated across millions of Mexican customers, just validated the most important assumption in Nubank's global expansion thesis. The question was never whether Nu could buy deposits with promotional rates. The question was whether they could earn them with product superiority.

Six months ago, I outlined Nubank's three-act strategic evolution in "The Purple Way." Q2'25 wasn't about changing that story—it was about stress-testing it under real-world conditions. The results exceeded even optimistic expectations.

What Changed: The Delta Since "The Purple Way"

I won't rehash the foundation laid in my previous analysis. Assume you know the three-act framework, the Brazilian cash engine, and the cohort monetization model. This piece is about what's genuinely new.

Three developments fundamentally altered the investment calculus:

Mexico's Deposit Beta Test: Rate cuts met with stable balances, proving product-market fit beyond promotional pricing.

Earnings Quality Emergence: Risk-adjusted net interest margin improved while headline metrics created noise, revealing a transition from growth theater to sustainable profitability.

Timeline Acceleration: Management language shifted from "5-10 year" global vision to preparing for "world leagues" in the "next few years," backed by world-class hiring.

Q2'25 was the quarter when strategic hypotheses became operational realities.

The Mexico Proof Point: Product-Led Funding Power

The Mexico deposit test represents the single most important validation in Nubank's short public company history. Here's why it matters more than any revenue beat or customer addition metric.

In Q1, Mexico's 70% customer growth was partially funded by high-yield deposits—a strategic investment that pressured consolidated margins. Critics questioned whether Nu was simply buying market share with unsustainable promotional rates. Q2 became the ultimate product-market fit test: cut rates significantly and observe customer behavior.

The results were unambiguous:

Deposit rates cut from ~15% to 11.5%

Customer retention exceeded 90% despite competitive alternatives

Balance growth continued with positive momentum

Competitive context: Traditional banks still offering 13%+ rates

This isn't just about Mexico—it's validation of the entire international expansion model. It proves that Nu's value proposition transcends promotional pricing. Product experience, trust, and ecosystem integration create genuine switching costs that traditional banks cannot replicate simply by matching interest rates.

The strategic implication is profound: Nu can now build sustainable, low-cost funding franchises internationally. They're not buying market share with expensive deposits—they're earning customer loyalty with superior products. This fundamentally de-risks every future geographic expansion and validates the core assumption that digital-native financial infrastructure creates durable competitive advantages.

As David Velez noted on the Q2 call, they've moved from proving they can acquire customers to proving they can retain them profitably. The cheapest capital isn't bought with basis points—it's earned with daily utility.

Earnings Quality Over Growth Theater

While markets fixated on revenue beats and EPS comparisons, the real story unfolded in metrics that sophisticated investors track: earnings quality and sustainability indicators.

The quality signals were unmistakable:

Risk-adjusted NIM improved sequentially while nominal NIM faced temporary pressure

Net interest income grew faster than credit losses, indicating improving underlying trends

Deposit costs declined in Mexico while balances held firm

ARPAC progression continued toward the $15+ target, reaching $12.2

This represents a fundamental transition in Nu's investment narrative. The company is evolving from a growth story dependent on customer additions to an earnings quality story driven by customer monetization and operational excellence.

Consider the sophistication of their approach: maintaining loan-to-deposit ratios in the low-40s isn't inefficiency—it's optionality. When risk conditions warrant expansion, they have the balance sheet capacity to deploy capital rapidly. When conditions favor caution, they can optimize existing relationships rather than chase growth.

This quarter didn't change the growth story; it changed the cost of telling it. Earnings are now coming from better funding and smarter risk management, not just more users. That's the hallmark of a platform transitioning from growth phase to mature competitive advantage.

Timeline Acceleration: Act 3 is No Longer Theoretical

Perhaps the most significant development was the acceleration of what I previously called "Act 3"—Nu's emergence as a global financial platform. The evidence suggests this timeline compressed dramatically.

The language shift in management commentary was subtle but significant:

Q1 tone: "5-10 year" global vision

Q2 tone: Preparing for "world leagues" in "next few years"

More importantly, the quality and timing of strategic hires signal imminent international expansion:

Roberto Campos Neto as Vice-Chairman: You don't hire a former Central Bank Governor for Latin American compliance. You hire him to navigate global regulatory frameworks and build relationships with policymakers worldwide.

Eric Young as CTO: Brought in for his experience scaling tech platforms to 900+ million users globally—capability far beyond current Latin American needs.

Ethan Eismann as Chief Design Officer: His background optimizing user experience for hundreds of millions of users suggests preparation for massive scale.

These aren't Latin American hires. They're global platform hires, made with urgency that suggests compressed timelines.

Even their discipline reinforces confidence in the strategy. Management's caution with private payroll lending—despite record profits and massive market opportunity—demonstrates that the "Purple Way" DNA remains intact. They're building for decades, not quarters, which actually increases the probability of successful international expansion.

The market continues modeling a Latin American digital bank. Evidence suggests investors should start thinking about a global financial platform with significantly compressed execution timelines.

Scenario Analysis: What Mexico's Validation Changed

The Mexico deposit test fundamentally altered the probability weighting of future scenarios. Here's how the validation quarter reshapes the investment calculus:

Bull Case: Global Platform Recognition

Probability: 40% (increased from 35% pre-Q2)

Price Target (2028): $85-110 (6.5-8.5x return)

IRR: 28-34%

Key Assumptions:

International success in 4-5 new countries by 2028

Market recognition of infrastructure value (15-18x revenue multiples)

ARPAC achievement of $35-40 per customer

Regulatory capture advantages via Campos Neto strategy

What Changed: Mexico deposit retention despite rate cuts proves international replicability at sustainable funding costs. The hiring of global-caliber executives suggests accelerated timeline.

Base Case: LatAm Dominance + Selective Global

Probability: 45% (increased from 50% as bull case strengthened)

Price Target (2028): $45-65 (3.5-5x return)

IRR: 19-25%

Key Assumptions:

Regional leadership across Brazil, Mexico, Colombia

Successful entry into 1-2 additional markets

ARPAC progression to $25-30 per customer

Valuation multiple expansion to 10-12x revenue

What Changed: Deposit test reduces international execution risk, making base case more achievable while increasing bull case probability.

Bear Case: Growth Deceleration

Probability: 15% (unchanged)

Price Target (2028): $15-25 (1-2x return)

IRR: 2-10%

Key Assumptions:

International expansion fails beyond Mexico

Traditional banks successfully digitize

Major LatAm recession impacts fundamentals

Competitive pressure erodes cost advantages

Assessment: Mexico success makes this scenario less likely, but macro and competitive risks remain.

Probability-Weighted Expected Outcome

Expected Price Target: $62 (4.7x return)

Expected IRR: 22%

Mexico's deposit validation increased the probability of international success while demonstrating downside protection through product-led funding advantages. The risk-adjusted return profile became more attractive as execution risk declined.

What Could Still Derail the Thesis

While Mexico's validation strengthened the bull and base cases, several risks could still undermine the investment thesis:

Mexico Rate Sensitivity: If deposit repricing ultimately fails and balances flee over longer periods, it would question the sustainability of international expansion funding.

Brazil Credit Quality: Economic stress testing remains incomplete. Late-bucket deterioration during recession could reveal credit model weaknesses.

Execution Risk: International expansion beyond Mexico could stumble due to regulatory challenges or different market dynamics.

Competitive Response: Traditional banks might successfully digitize, or Big Tech could enter with regulatory advantages Nu cannot match.

Early Warning Signals: Mexico deposit outflows, Brazil NPL increases without economic explanation, ARPAC stagnation for multiple quarters, or market share reversals in core geographies.

These risks exist but have lower probability given Q2 evidence. The Mexico deposit test addressed the biggest concern about international expansion sustainability.

Epilogue: Trust Compounds

That Mexican user who didn't move her money despite lower rates? She represents millions of micro-decisions that collectively validate Nubank's most important strategic bet: that superior product experience creates switching costs more durable than any promotional interest rate.

The Mexico test revealed something profound about the nature of modern financial services. In a world where every bank can offer competitive rates, the sustainable advantage belongs to whoever creates the most utility in customers' daily financial lives. Nu didn't just pass this test—they defined a new standard for what product-market fit looks like in financial services.

The cheapest capital in Latin America isn't a teaser rate—it's habitual trust inside an app. Mexico just proved that trust, once earned, compounds faster than any promotional interest rate. Nu Holdings has moved from proving they can execute a strategy to proving that strategy creates sustainable competitive advantages.

The validation quarter is complete. The infrastructure quarter has begun.

From current price of $13.30, the probability-weighted expected return suggests 22% IRR over three years. The Mexico deposit test de-risked international expansion while demonstrating the quality of Nu's competitive positioning. For investors seeking asymmetric risk/reward profiles in emerging market platforms, the validation quarter strengthened an already compelling investment thesis.

General Disclaimer

The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.