Oracle's 1QFY26 Earnings: Strategic Vindication

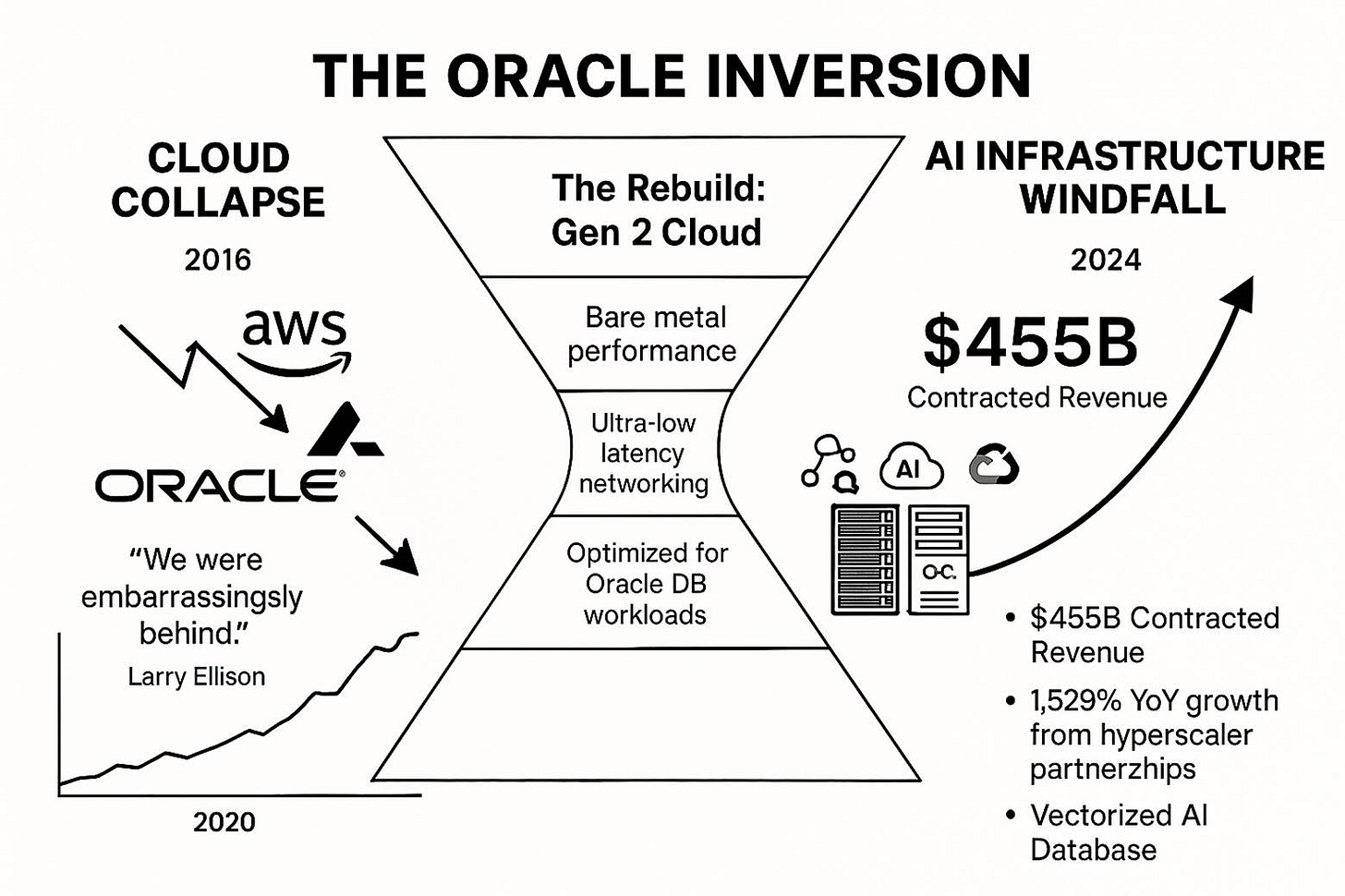

How Oracle's 2016 cloud failure forced a technical decision that positioned them to capture the $455 billion AI infrastructure windfall

TL;DR:

Oracle's 2016 cloud failure forced a radical rebuild that prioritized database performance over general-purpose cloud features—an architectural bet that looked like over-engineering at the time.

That “mistake” became a perfect fit for AI, as Oracle’s Gen 2 infrastructure turned out to be ideally suited for high-performance AI training and inference workloads.

Now sitting on $455B in contracted future revenue, Oracle has leapfrogged from cloud underdog to essential AI infrastructure provider—without needing to win the platform wars.

It was March 2016, and Oracle's first-generation cloud was dying a very public death. While AWS reported 64% revenue growth and Microsoft Azure was doubling year-over-year, Oracle's initial cloud offering was so technically inferior that major customers weren't just leaving—they were criticizing it openly. The database giant that had dominated enterprise computing for decades suddenly looked like a relic from another era.

Larry Ellison's admission on that quarter's earnings call was uncharacteristically humble: "We were embarrassingly behind." The company that had pioneered relational databases and built a $180 billion empire on enterprise data was being dismissed as too slow, too expensive, and too old-fashioned for the cloud era. Industry analysts wrote Oracle's cloud obituary with barely concealed satisfaction.

But in that moment of maximum embarrassment, Oracle made a decision that seemed counterintuitive to everyone watching: rather than copy AWS's general-purpose cloud architecture, they would scrap everything and build something completely different. Something specialized. Something that appeared to be expensive over-engineering for a niche market, but would turn out to be perfect preparation for a computing revolution nobody saw coming.

Seven years later, Oracle just reported $455 billion in contracted future revenue—more than the annual revenue of every technology company except Amazon. The company that appeared to have lost the cloud wars has positioned itself to win something far more valuable: the AI infrastructure era.

The Expensive Education (2014-2018)

Oracle's cloud humiliation was complete by any measure. Their first-generation offering, built hastily to compete with AWS, suffered from the classic enterprise software trap: they took existing on-premises architecture and tried to adapt it for cloud deployment. The result was a Frankenstein cloud that combined the worst aspects of both worlds—higher costs than on-premises with worse performance than AWS.

The market's verdict was swift and brutal. Oracle's cloud revenue growth stagnated in the single digits while competitors grew 50%+. Major customers publicly criticized the service. Industry conferences featured jokes about Oracle's cloud pretensions. The narrative crystallized: Oracle was a legacy database vendor being disrupted by cloud-native competitors who understood the future better.

Faced with this failure, most companies would have doubled down on copying the leaders. Oracle made a different choice: they would rebuild their cloud architecture from scratch, optimized exclusively for their most demanding workload—Oracle Database. This meant designing ultra-low latency networking, extreme compute density, and deployment models that seemed ridiculously over-engineered for typical cloud applications.

The industry's reaction ranged from skepticism to mockery. Why optimize for database workloads when the future clearly belonged to microservices and web applications? Oracle appeared to be building a Ferrari for a go-kart track, solving the wrong problem with expensive solutions nobody asked for.

Yet Oracle's leadership, particularly Larry Ellison and his engineering teams, pursued this specialized approach with single-minded determination. They weren't just building better infrastructure—they were building infrastructure optimized for the most performance-sensitive enterprise workloads imaginable. The decision seemed defensive, even desperate. In retrospect, it was visionary.

The Architectural Accident

Oracle's Gen 2 cloud architecture, launched in 2016-2017, made specific technical choices that seemed inexplicable to observers focused on general-purpose cloud competition. The company invested heavily in what Ellison called "bare metal" performance—eliminating virtualization overhead that other clouds accepted as necessary. They built networking infrastructure optimized for massive parallel processing and data movement. They created standardized deployment models that could deliver "the full Oracle Cloud in three racks for $6 million."

These weren't arbitrary engineering decisions. They were direct responses to Oracle Database's most demanding requirements: moving massive amounts of data between processing nodes, maintaining microsecond-level latency for transaction processing, and scaling parallel operations across hundreds or thousands of cores simultaneously. Oracle was essentially building cloud infrastructure that could satisfy their most performance-obsessed database customers.

The irony became apparent only years later: artificial intelligence training and inference workloads have identical technical requirements to Oracle's most demanding database applications. AI model training requires moving massive datasets between GPUs with extreme efficiency. AI inference demands low-latency responses at massive scale. Both workloads benefit from compute density and network optimization that seemed unnecessary for typical cloud applications but essential for Oracle's specialized use cases.

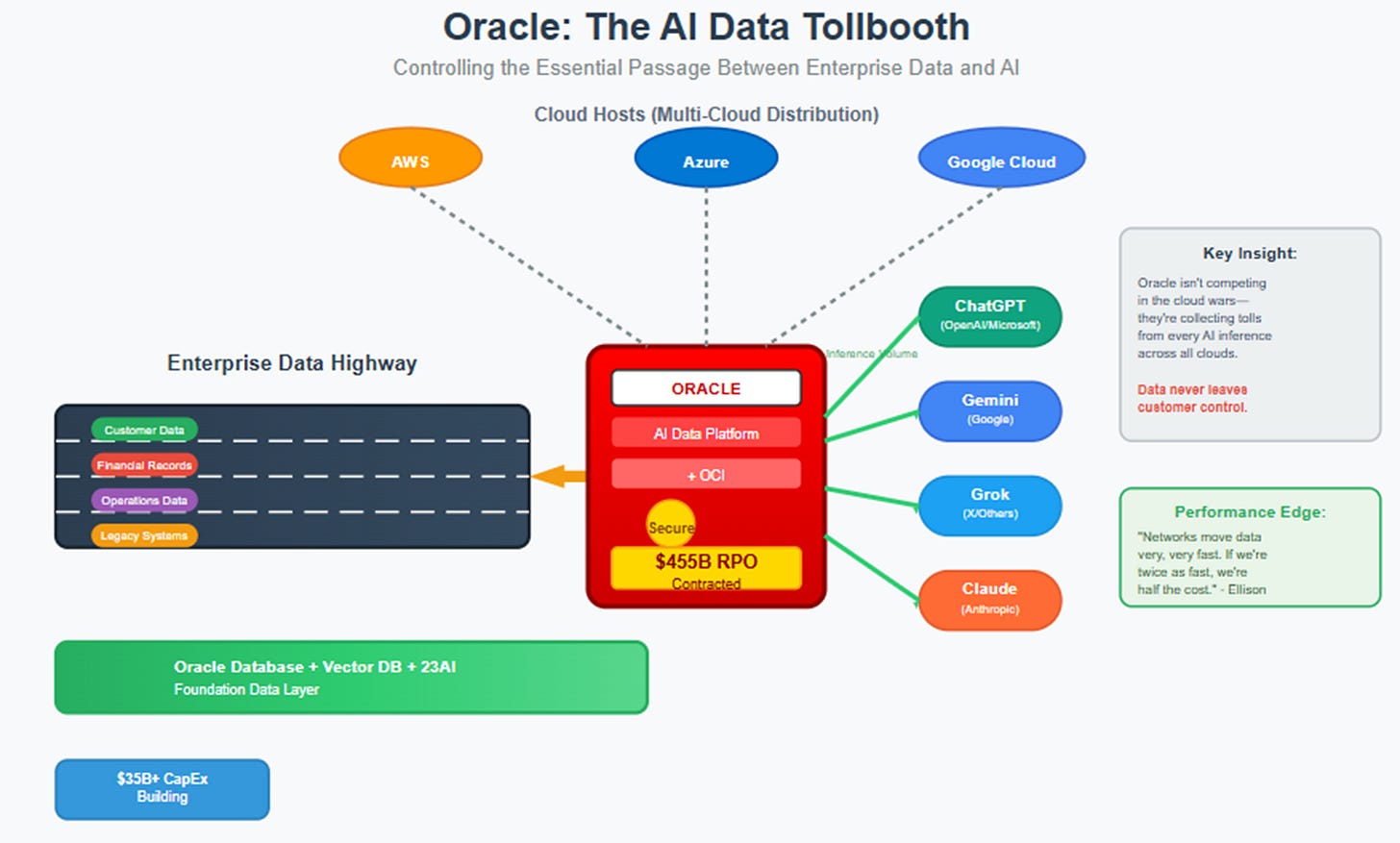

My June analysis of Oracle identified this positioning as an "AI Data Tollbooth"—a strategic chokepoint between enterprise data and AI capabilities. That thesis focused on Oracle's $138 billion remaining performance obligations as evidence of contracted future growth. Three months later, Oracle's Q1 FY26 results revealed that analysis was directionally correct but dramatically underscaled. The tollbooth had become a turnpike.

The Q1 FY26 Revelation: Numbers That Rewrite Assumptions

"I'm sort of blown away," said John DiFucci from Guggenheim Securities during Oracle's earnings call. "We're all kind of in shock, in a very good way," added Brad Zelnick from Deutsche Bank. These weren't typical earnings call pleasantries—they were expressions of genuine surprise from analysts who thought they understood Oracle's trajectory.

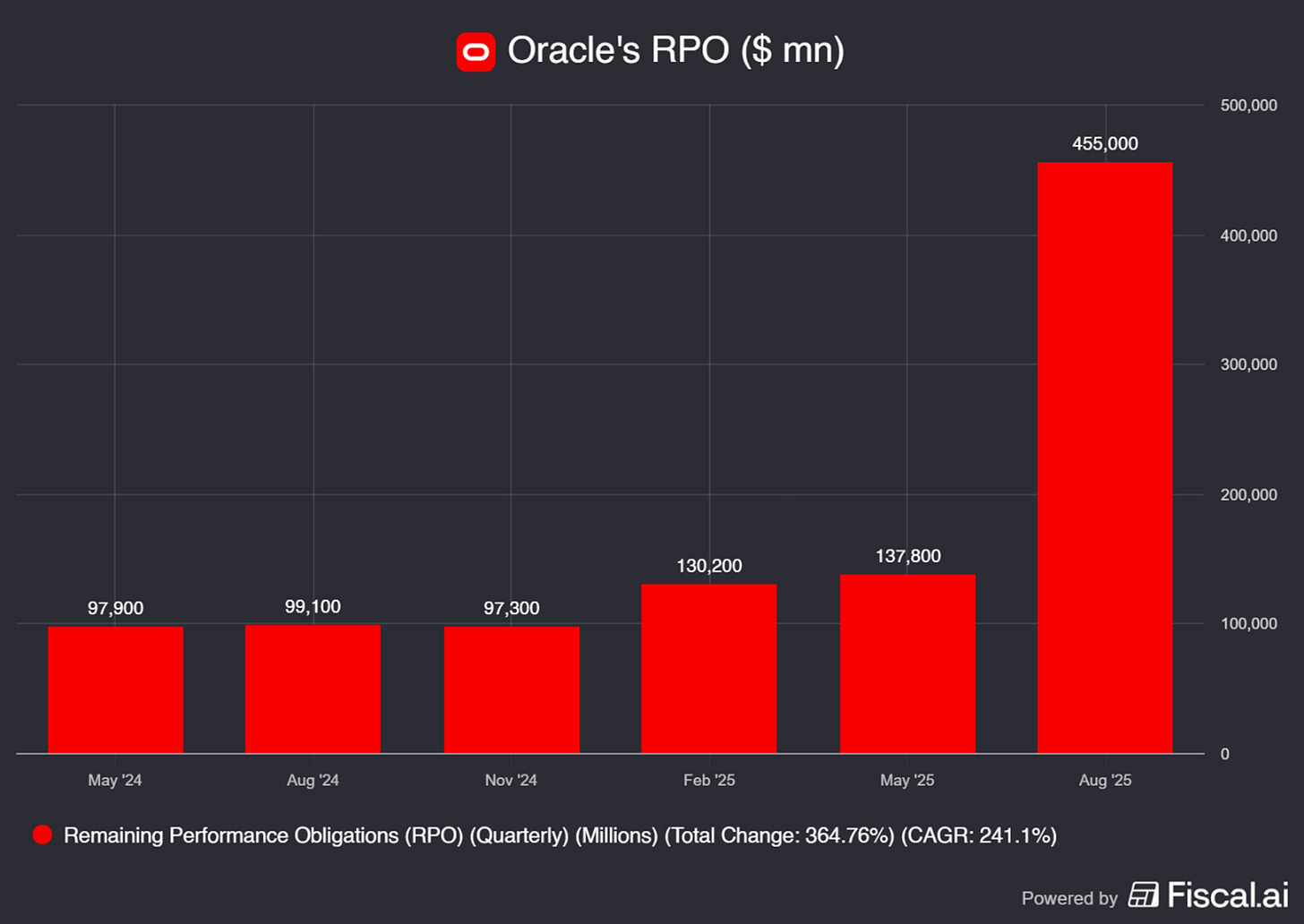

The company had technically missed revenue expectations ($14.9B vs $15.0B) and EPS guidance ($1.47 vs $1.481), but nobody cared about those numbers. Wall Street was focused on something unprecedented: Oracle's remaining performance obligations had exploded to $455 billion, representing contracted but unrecognized future revenue that dwarfed anything previously seen in enterprise technology.

That final jump represents Oracle signing what CEO Safra Catz described as "four multibillion-dollar contracts with three different customers" in a single quarter. The quarterly addition of $317 billion in contracted future revenue exceeds the annual revenue of every technology company except Amazon.

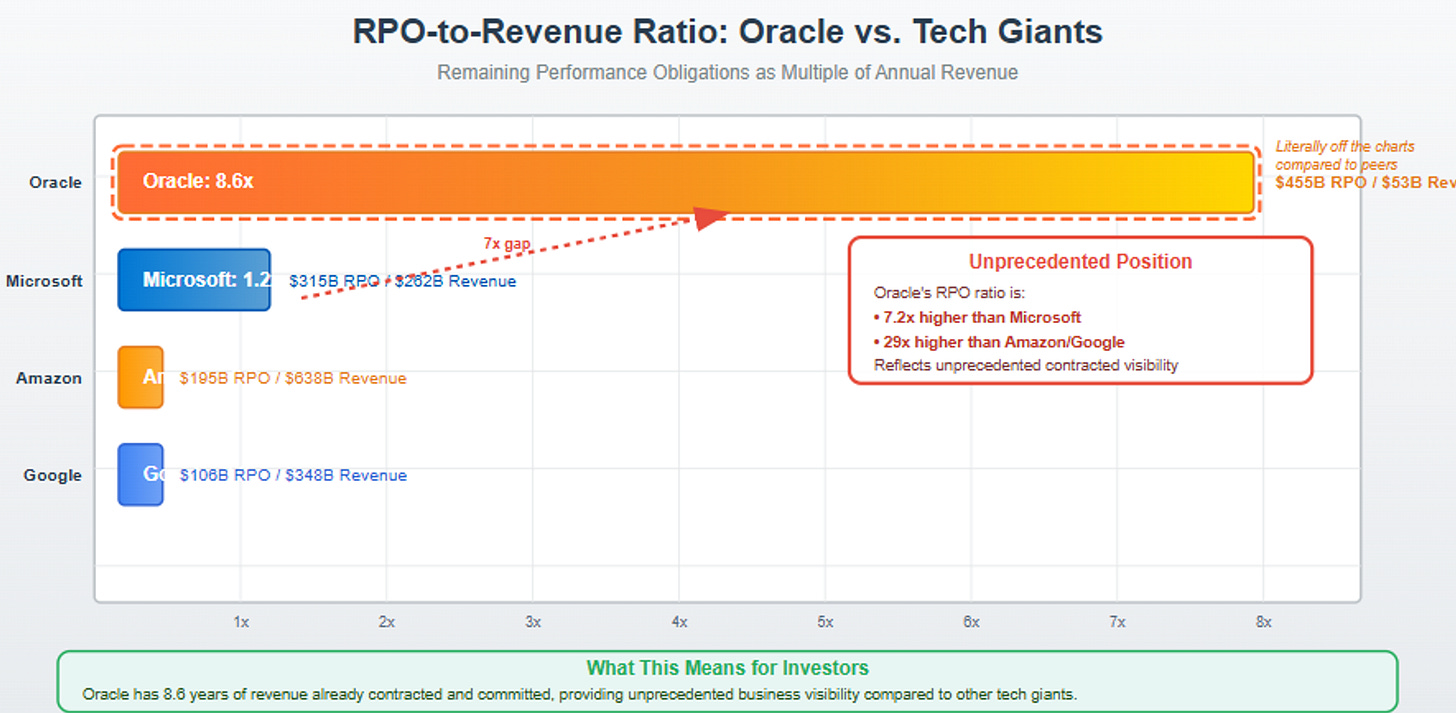

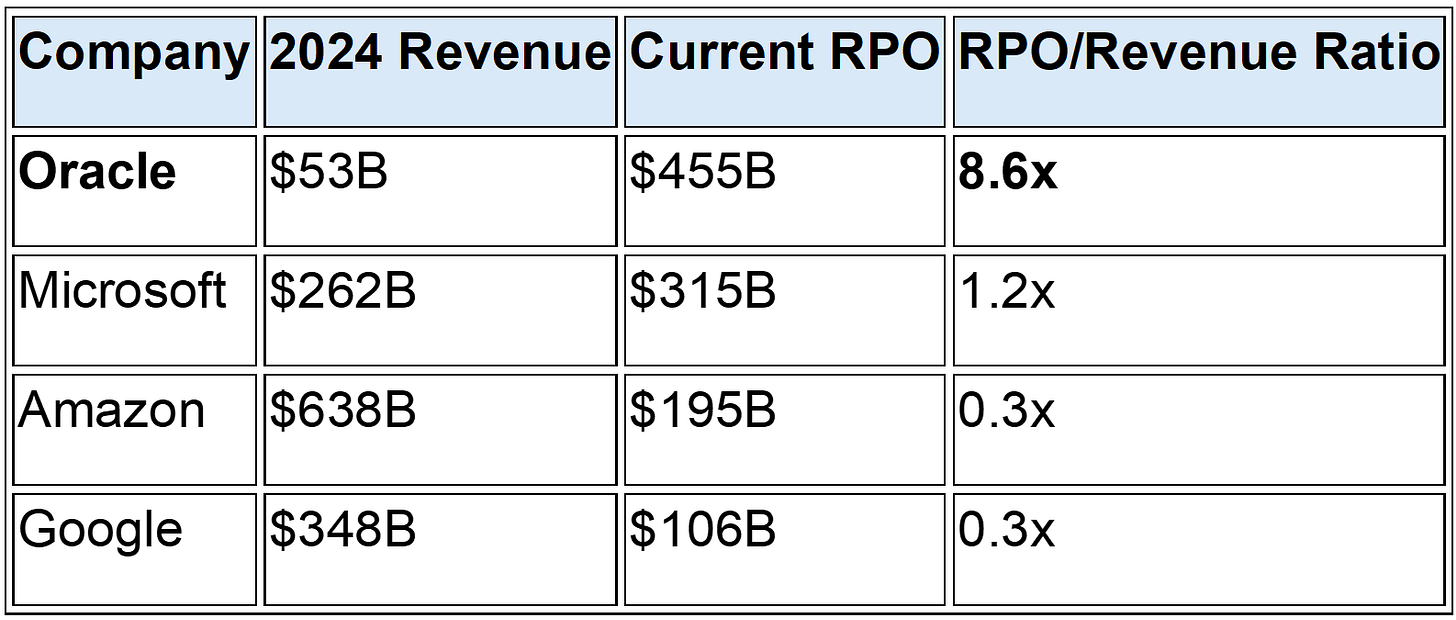

To understand the magnitude, consider Oracle's RPO relative to other technology giants:

Oracle's RPO-to-revenue ratio is completely unprecedented. This isn't just strong demand—it's evidence of enterprise customers making strategic, multi-year commitments to Oracle's AI infrastructure capabilities with legal enforceability.

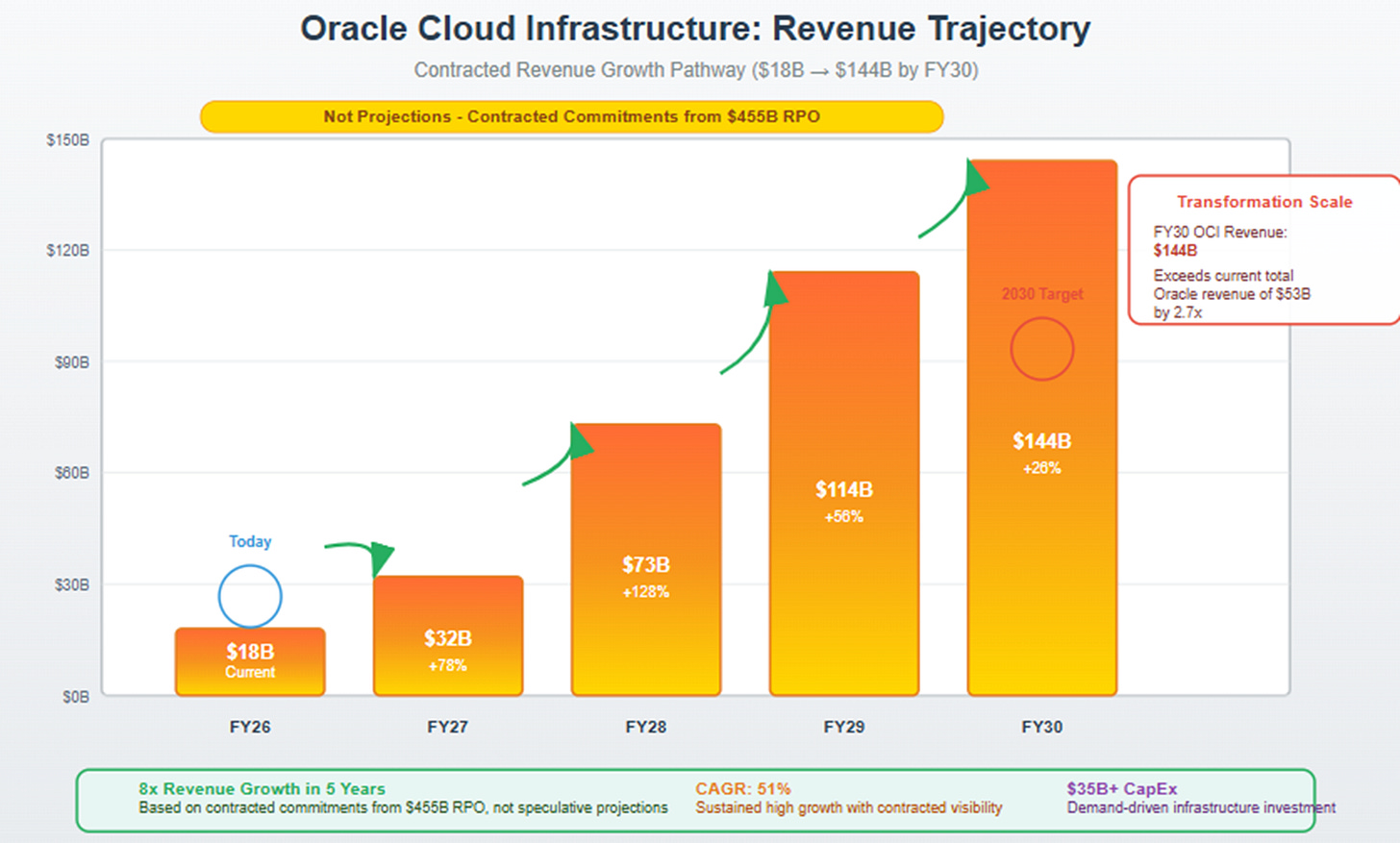

CEO Safra Catz's most revealing statement came when discussing Oracle's five-year cloud infrastructure projections: "Much of this revenue is already booked in our $455 billion RPO number." Oracle's management isn't making aspirational forecasts—they're describing contractually committed future revenue with unprecedented visibility.

The projected Oracle Cloud Infrastructure (OCI) revenue trajectory tells the story: $18 billion in FY26, growing to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. This isn't speculative growth—it's contracted delivery against signed customer commitments.

Platform Architecture vs. Infrastructure Commodity

Oracle's Q1 results reveal something more profound than strong quarterly performance: they demonstrate the completion of a platform transformation that positions Oracle as essential AI infrastructure rather than optional cloud vendor.

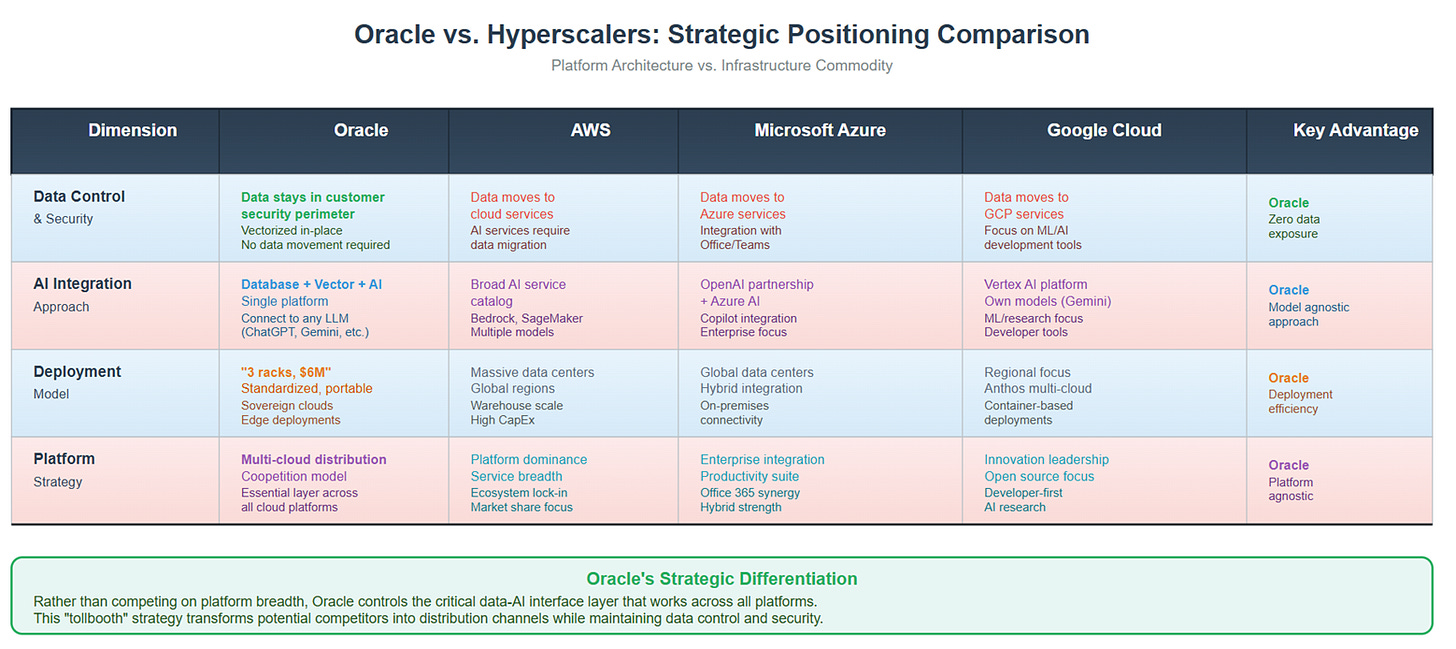

The key differentiator isn't just infrastructure performance but Oracle's approach to the fundamental enterprise AI challenge: how to leverage powerful AI models without exposing sensitive data. While hyperscalers offer AI services that typically require data to leave enterprise control, Oracle's architecture keeps data within customer security perimeters while enabling AI functionality.

Larry Ellison's explanation of the Oracle AI Database strategy during the earnings call revealed the technical sophistication: "We can take your private data, vectorize it in our database, and connect it directly to any large language model—ChatGPT, Grok, Gemini—without your proprietary information ever leaving your control."

This capability addresses what I identified in June as the core enterprise AI adoption challenge. Oracle isn't asking enterprises to migrate decades of existing data to new systems. Instead, they're making existing Oracle database deployments AI-ready instantly through vectorization and secure LLM integration. This is platform lock-in through AI enablement rather than AI infrastructure through platform migration.

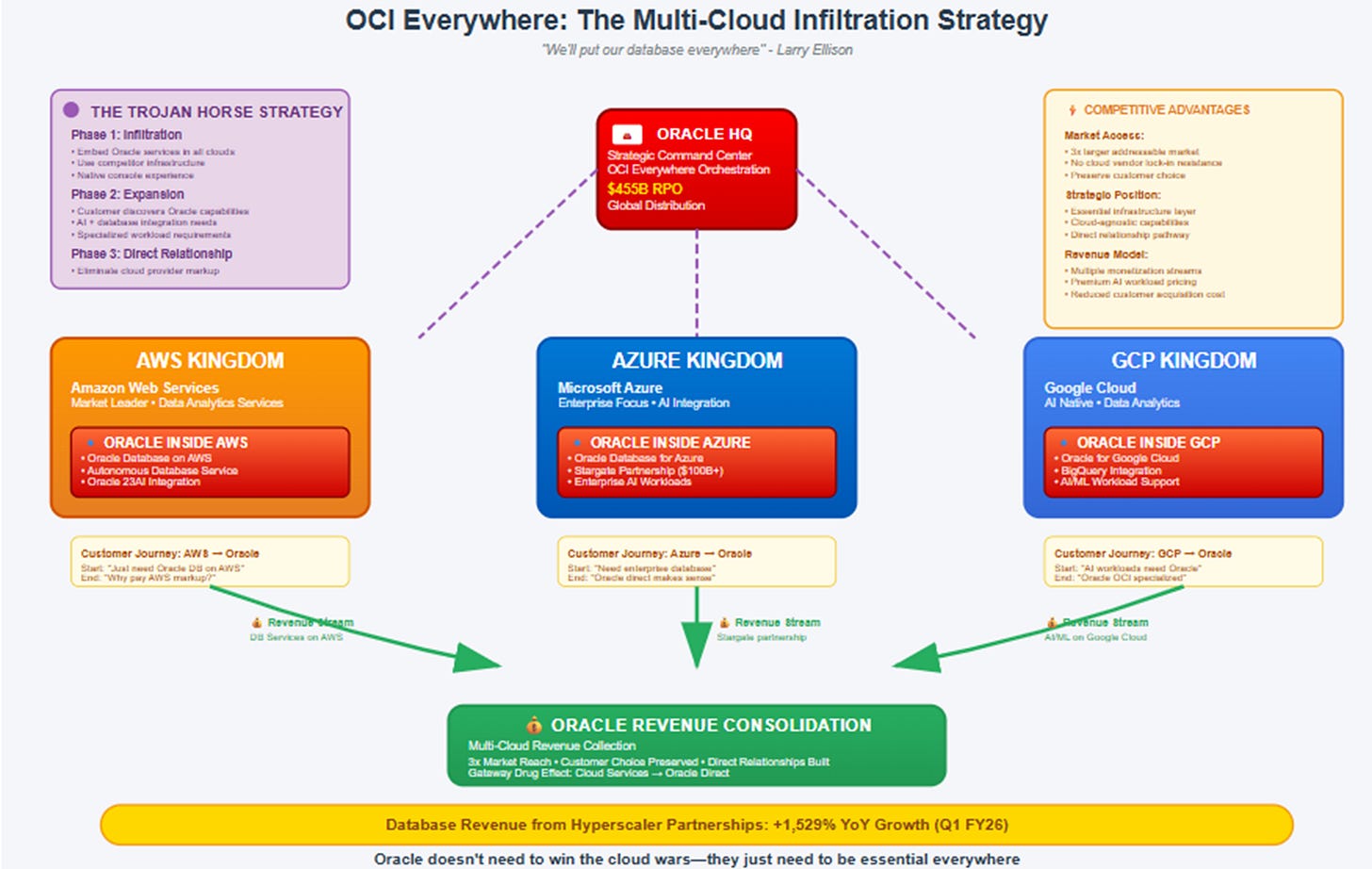

The multi-cloud database strategy provides additional validation of Oracle's platform approach. Database revenue from AWS, Azure, and Google Cloud partnerships grew 1,529% year-over-year in Q1, proving Oracle successfully transformed potential platform threats into distribution channels. Oracle gets paid while hyperscalers provide real estate, but Oracle maintains control over the data layer where AI value gets created.

Ellison's assertion about deployment efficiency—"three racks for $6 million" versus competitors' "100x cost"—suggests genuine architectural advantages developed over years of specialization. If accurate, Oracle's infrastructure efficiency provides sustainable competitive moats that extend beyond temporary technology leads.

The strategic brilliance becomes clear: Oracle is betting that data gravity will overcome platform lock-in. If enterprises can access Oracle's AI database capabilities across any cloud while keeping their most valuable data secure, traditional cloud platform boundaries become less relevant.

Competitive Dynamics: Specialization vs. Scale

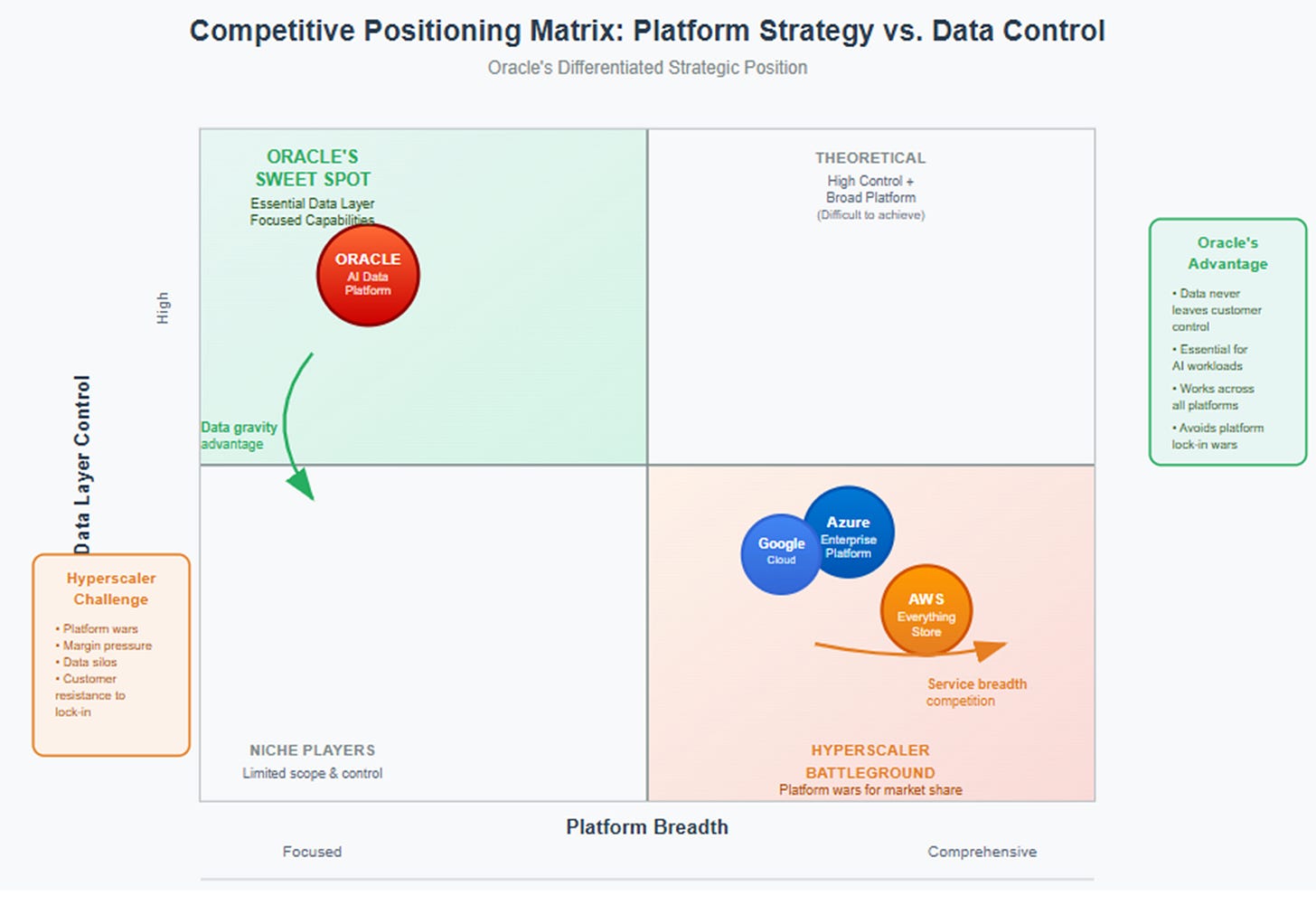

Oracle's transformation challenges fundamental assumptions about cloud platform competition. While AWS, Microsoft, and Google built comprehensive platforms designed to maximize customer lock-in through service breadth, Oracle focused on depth in specific high-value workloads.

The strategic differentiation is clearer when viewed through competitive positioning:

AWS: Dominance through ecosystem breadth and service catalog completeness. The "everything store" approach that captures customers through convenience and integration across hundreds of services.

Microsoft: Platform integration leveraging enterprise relationships and productivity software lock-in. Azure benefits from Office 365 adoption and Windows Server migration dynamics.

Google: Technical innovation and AI/ML capabilities, particularly around training infrastructure and model development. Strong in pure compute but weaker in enterprise data governance.

Oracle: Data layer control and specialized infrastructure performance. Rather than competing on platform breadth, Oracle positions itself as the essential data-AI interface layer that works across all platforms.

This represents a fundamental shift in cloud competition from scale games to specialization advantages. Oracle's success suggests that enterprise customers want choice at the infrastructure layer while accepting lock-in at the data and application layers where business logic resides.

The multi-cloud approach deserves particular attention because it inverts traditional platform strategy. Instead of building walls to trap customers, Oracle built bridges to reach customers wherever they operate. The 1,529% database revenue growth from hyperscaler partnerships proves this coopetition strategy works at scale.

Oracle's technical moat centers on what Ellison described as network performance advantages: "Our networks move data very, very fast. And if we can move data faster than the other people, if we have advantages in our GPU super clusters that are performance advantages, if you're paying by the hour, if we're twice as fast, we're half the cost."

This isn't marketing hyperbole but the direct result of architectural choices made during Oracle's cloud rebuilding phase. The specialized infrastructure optimized for database workloads translates directly into advantages for AI training and inference workloads that have similar technical requirements.

The Execution Imperative: From Demand to Delivery

Oracle's $455 billion RPO fundamentally changes the risk profile for investors and the strategic challenges for management. The investment question shifts from "will demand materialize?" to "can Oracle execute delivery at unprecedented scale?"

The capital deployment challenge is massive: Oracle projects $35 billion in CapEx for FY26, compared to $27.4 billion in FY25. This represents one of the largest infrastructure investment ramps in technology history, requiring operational excellence that few companies have demonstrated.

However, several factors distinguish Oracle's approach from traditional speculative cloud expansion:

Demand-Driven Investment: Unlike hyperscalers who build capacity hoping customers will come, Oracle's CapEx expansion directly responds to contracted customer commitments. The $455B RPO provides investment certainty that eliminates traditional cloud infrastructure demand risk.

Asset-Light Architecture: CEO Safra Catz emphasized Oracle's focus on equipment ownership versus property/building ownership: "We do not own the property. We do not own the buildings. What we do own and what we engineer is the equipment." This approach enables flexible deployment without geographical constraints that limit traditional data center expansion.

Standardized Deployment: Oracle's "three racks, $6 million" deployment model allows rapid capacity scaling using identical configurations. This standardization reduces operational complexity while enabling deployment in partner facilities, sovereign cloud requirements, and edge locations.

Proven Acceptance Timeline: Ellison's customer acceptance story demonstrates operational excellence: "We just turned over a giant data hall to one of our customers... It was one week from the time we officially owned the equipment and they were testing it to the time they started paying." Typically, massive infrastructure deployments require months of testing and validation.

The execution challenge remains substantial. Oracle must build and deploy infrastructure equivalent to becoming one of the world's largest technology companies within five years. The projected OCI revenue growth from $18B in FY26 to $144B by FY30 requires scaling at a pace few companies have achieved.

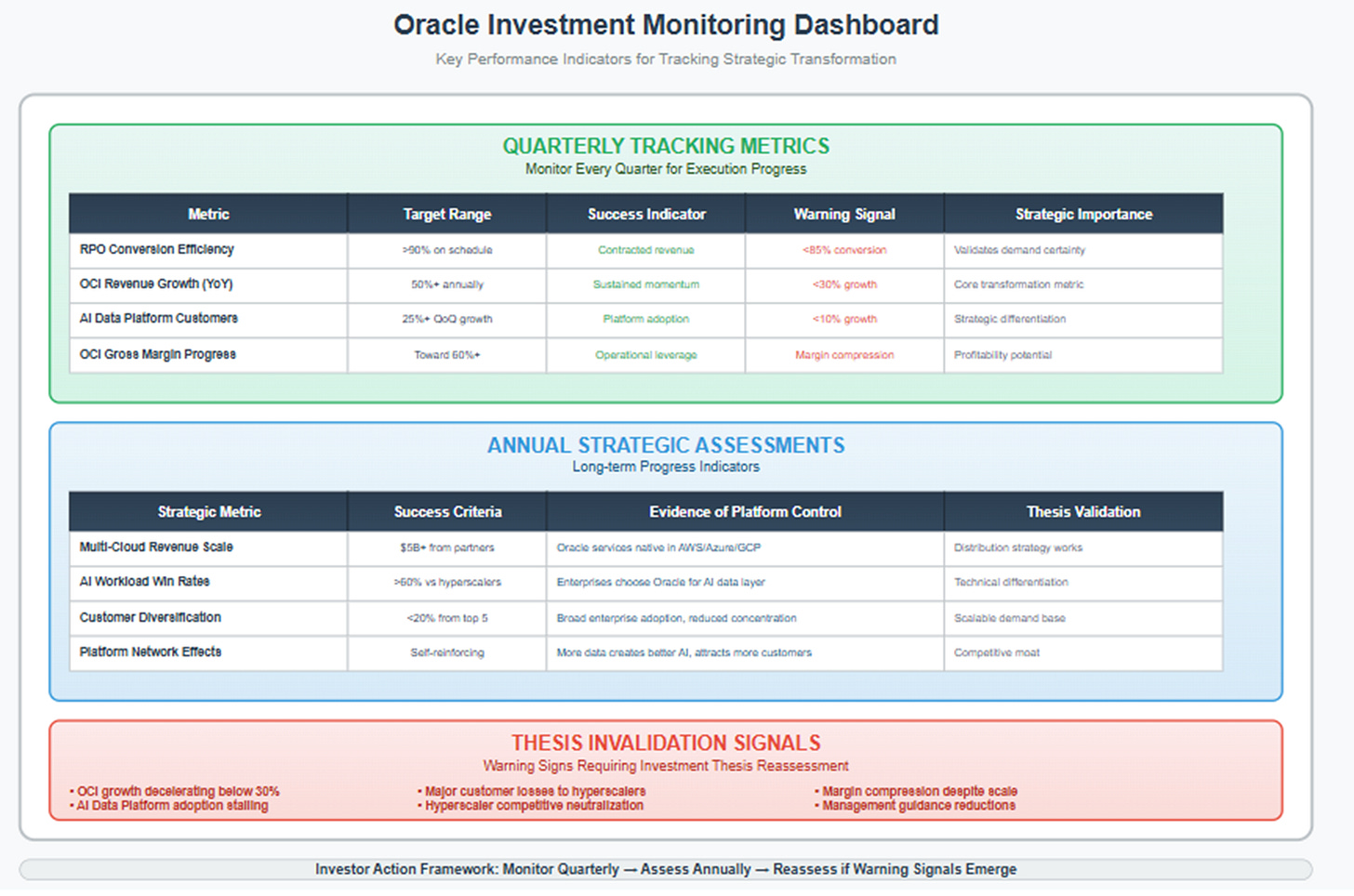

Key monitoring metrics for tracking execution success include:

RPO Conversion Efficiency: Target >90% of contracted revenue converting on schedule

Oracle AI Database Adoption: Customer acquisition rates and revenue contribution from the new platform

Multi-Cloud Partnership Revenue: Database revenue scaling from AWS/Azure/GCP partnerships

OCI Margin Progression: Evidence of operational leverage driving margins toward 60%+ targets

Customer Concentration: Ensuring growth diversification beyond initial mega-contracts

The broader execution risk centers on maintaining technical differentiation while scaling. Oracle's current advantages—networking performance, deployment efficiency, database integration—must remain superior as hyperscalers inevitably respond with competing offerings.

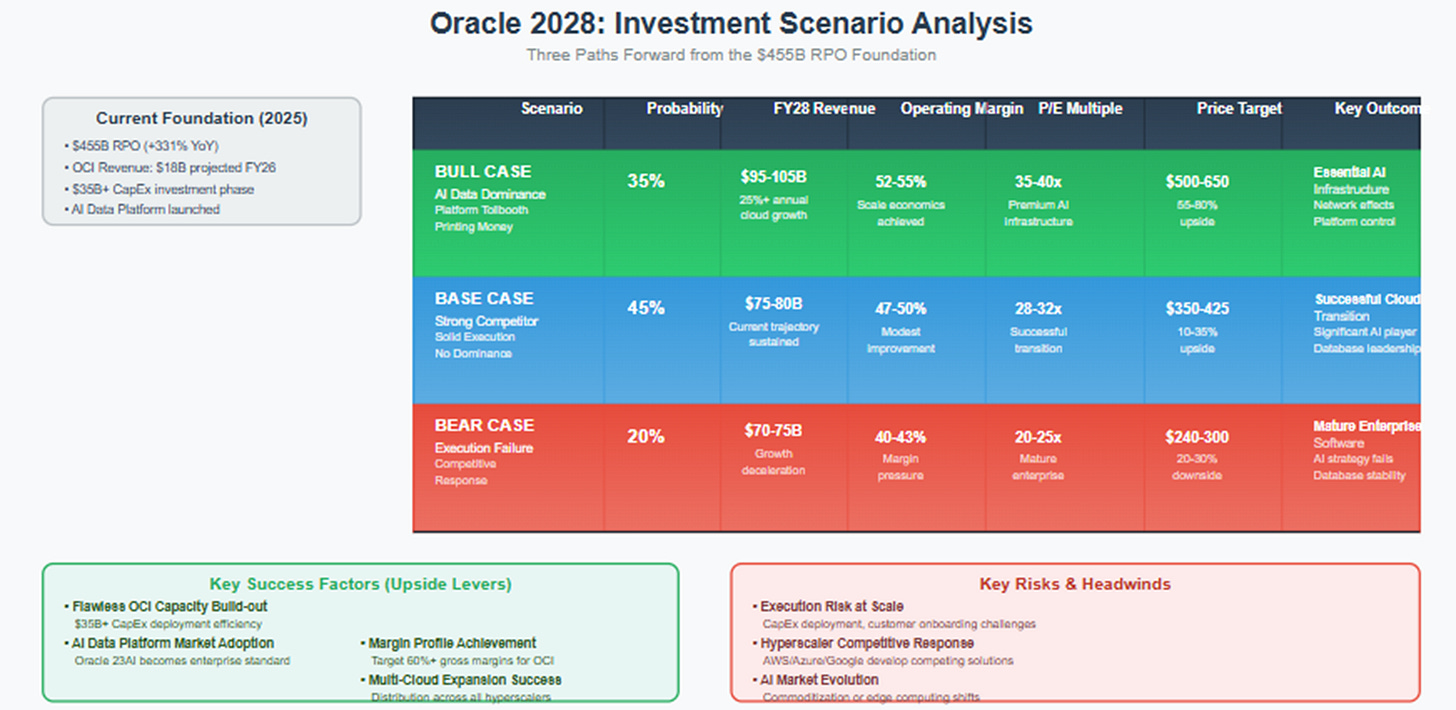

Scenario Analysis: Platform vs. Product Outcomes

Oracle's transformation creates a wide range of potential outcomes depending on execution success and competitive dynamics. The $455B RPO provides unprecedented downside protection while platform optionality creates significant upside potential.

Platform Dominance (50% probability): Oracle AI Database becomes the enterprise standard for AI deployment, creating network effects and pricing power. Multi-cloud database revenue scales to $15B+ annually. Operating margins expand to 52-55% as specialized infrastructure achieves scale economics and Oracle demonstrates platform characteristics rather than product competition.

Strong Competitor (40% probability): Oracle successfully executes on contracted commitments without achieving platform dominance. The company becomes a significant AI infrastructure provider while maintaining database leadership. Growth continues at attractive rates without the transformational scale or margin expansion of the platform scenario.

Execution Failure (10% probability): Major operational challenges in capacity deployment or service delivery damage customer relationships and competitive positioning. Hyperscaler competitive responses successfully counter Oracle's differentiation. The probability is low given contracted revenue providing execution certainty, but the outcome would significantly impact long-term positioning.

The scenario analysis reflects how contracted revenue has fundamentally improved Oracle's risk/reward profile. Traditional technology growth companies face both demand uncertainty and execution risk. Oracle's $455B RPO eliminates demand uncertainty while focusing risk on operational execution—a much more manageable and predictable challenge.

Key variables determining scenario outcomes include Oracle AI Database enterprise adoption rates, multi-cloud partnership revenue scaling, competitive response effectiveness, and Oracle's ability to demonstrate operational leverage through margin expansion.

Industry Implications: The Unbundling of Cloud

Oracle's success carries implications beyond a single company's revival. It suggests that cloud platform competition may be evolving from integrated platform dominance to specialized layer competition.

The historical parallel worth considering is the enterprise software market's evolution. Twenty years ago, integrated suites from Oracle, SAP, and Microsoft dominated enterprise software through comprehensive functionality and tight integration. Then Salesforce proved that specialized SaaS applications could compete effectively by focusing on specific business functions while integrating with existing systems.

Oracle's current strategy applies similar logic to cloud infrastructure. Rather than competing with hyperscalers on platform breadth, Oracle focused on the specific intersection of enterprise data and AI capabilities. By making Oracle services available across all major clouds, they positioned themselves as the specialized layer that enhances rather than replaces existing cloud investments.

This approach suggests successful cloud platforms don't require owning every technology layer. Specialized providers can build defensive moats by controlling critical junction points—in Oracle's case, the data-AI interface that enterprises need regardless of their underlying cloud infrastructure choices.

The broader industry implication centers on whether Oracle's success encourages other specialized infrastructure providers to challenge hyperscaler dominance in specific verticals. If enterprises value choice at the infrastructure layer while accepting lock-in at the data and application layers, it could fragment cloud competition from platform wars to layer-specific battles.

Oracle's contracted revenue approach could also become a template for enterprise AI deployment more broadly. Rather than consumption-based experimentation, enterprises might increasingly prefer long-term strategic partnerships that provide cost predictability and infrastructure certainty for mission-critical AI workloads.

The multi-cloud distribution strategy deserves particular attention as a potential model for other enterprise software companies. By making specialized capabilities available across competitor platforms, companies can expand addressable markets while reducing customer switching costs—a strategy that could prove valuable beyond Oracle's specific circumstances.

Conclusion: From Failure to Fortress

Oracle's Q1 FY26 results complete a remarkable strategic arc that began with public cloud humiliation and culminated in AI infrastructure validation. The company's 2016 decision to rebuild cloud architecture around specialized database workloads appeared defensive and expensive. Seven years later, that decision positioned Oracle perfectly for the AI infrastructure revolution.

The transformation represents more than operational execution—it demonstrates how architectural choices made during apparent failure can become foundations for future platform control. Oracle's specialized approach to cloud infrastructure, dismissed as niche over-engineering, proved to be perfect preparation for AI workloads that share identical technical requirements.

The $455 billion RPO transforms Oracle's investment profile from a "comeback story" to an essential infrastructure provider with contracted revenue visibility extending five years. This combination—downside protection through contracted commitments with upside potential through platform positioning—represents a rare risk/reward profile in technology investing.

Oracle's success validates a broader strategic insight about platform competition: sometimes the best approach isn't building the biggest platform but making yourself indispensable to every platform. By positioning itself as the essential data-AI interface layer, Oracle captured value across the entire cloud ecosystem rather than competing directly with platform owners.

The execution watch begins now. Oracle's future depends not on demand generation—that's contracted—but on delivery execution. The market will shift from questioning whether Oracle can compete to measuring how efficiently they convert contracted commitments into recognized revenue and sustainable margins.

For investors, Oracle offers something unusual in today's technology landscape: a fundamental transformation supported by contracted financial commitments rather than speculative growth projections. The company that appeared to have lost the cloud wars has positioned itself to win something far more valuable—control over how enterprises access and deploy AI capabilities.

Oracle's architectural vindication is complete. The question now is whether they can build what they've already sold.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

https://open.substack.com/pub/techitalt/p/is-oracle-having-its-nvidia-moment?r=5jmutn&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true