Palantir 4Q25 Earnings: The Coordination Premium

The Ontology, and the Most Valuable Real Estate in Software

TL;DR

Palantir isn’t an AI application company; it’s an operating system for enterprise coordination, monetizing the space between systems as intelligence commoditizes.

Q4 didn’t just validate the thesis, it blew past it: 137% U.S. commercial growth, 57% operating margins, and 139% net retention kill the “consulting” critique outright.

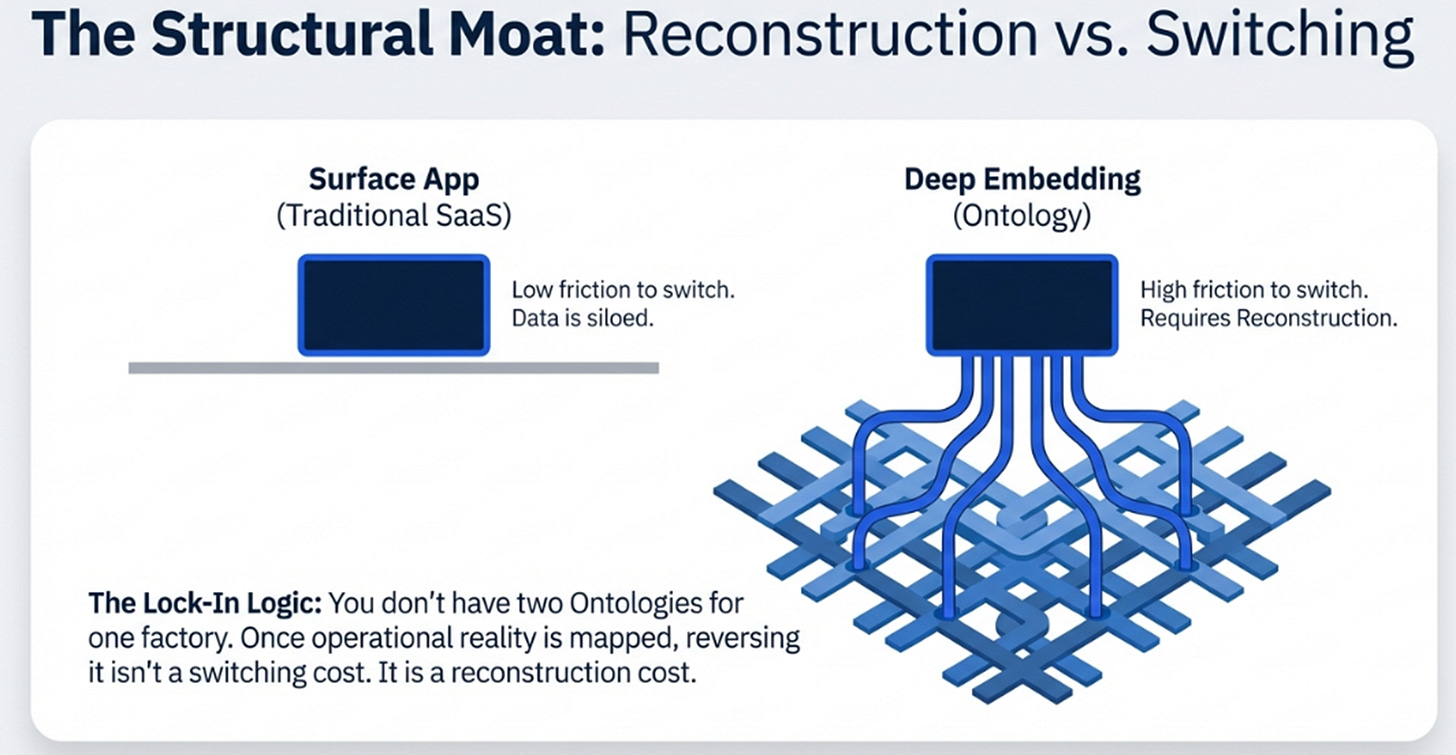

Once an Ontology is installed, there is no second one: switching costs become reconstruction costs, budgets consolidate, and Palantir captures the entire surface area of action.

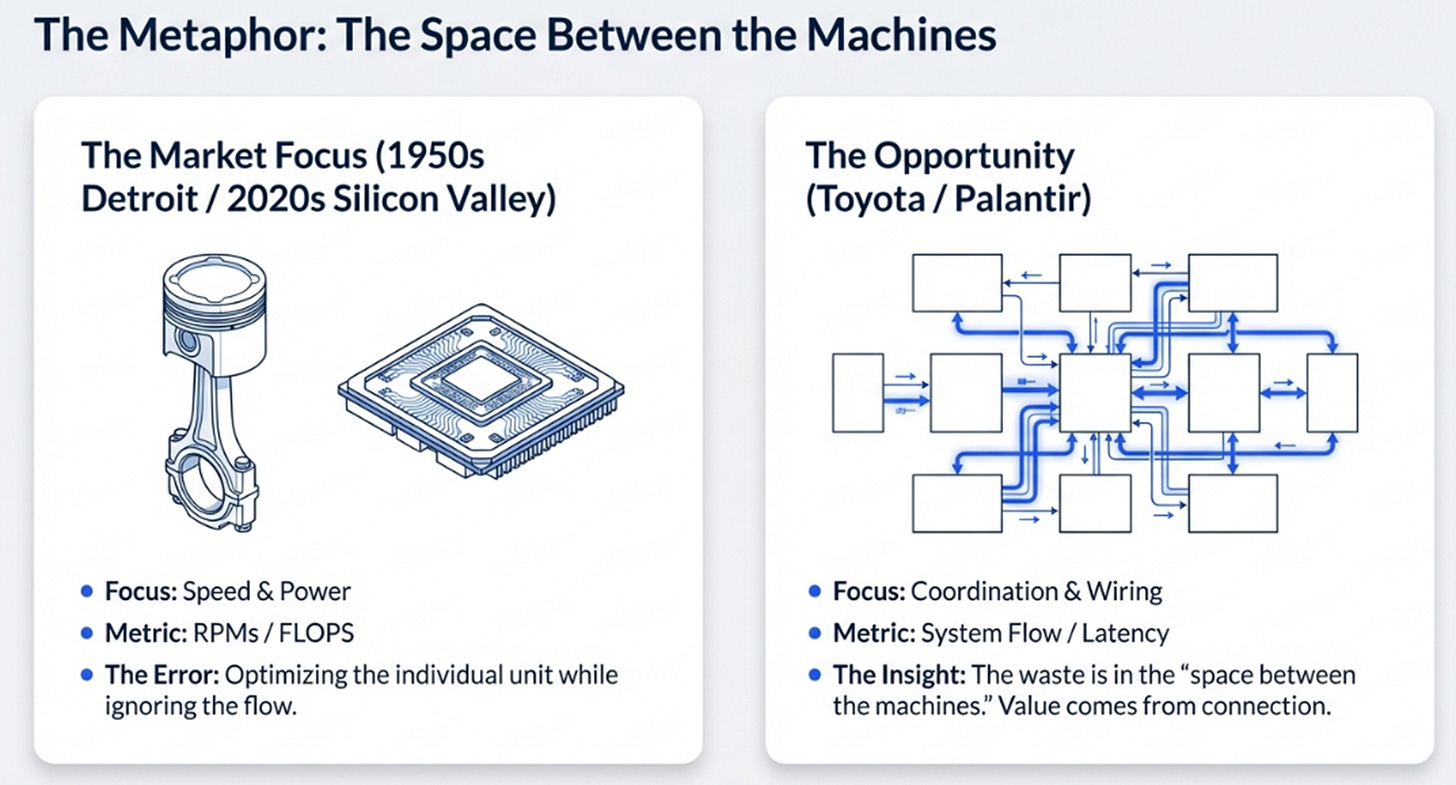

When Taiichi Ohno took over Toyota’s machine shop in the early 1950s, Western automakers were obsessed with speed, faster lathes, bigger presses, more powerful engines. Ohno looked at the same factory floor and saw a different problem entirely. The bottleneck wasn’t any individual machine. It was the space between the machines: parts arriving late, inventory piling up in the wrong place, information failing to flow between stations. The waste wasn’t in production. It was in coordination.

He built the Toyota Production System, not a better car, but a better system for making cars. American executives visited through the 1960s and 1970s, saw clean floors and kanban cards, and dismissed it as Japanese management culture. They literally could not see what they were looking at because it didn’t fit their model of what competitive advantage looked like. The value wasn’t in any step of production. It was in the connections between steps.

It took Western automakers thirty years to understand this. By the time they did, Toyota had compounded its invisible advantage into the most valuable car company in the world.

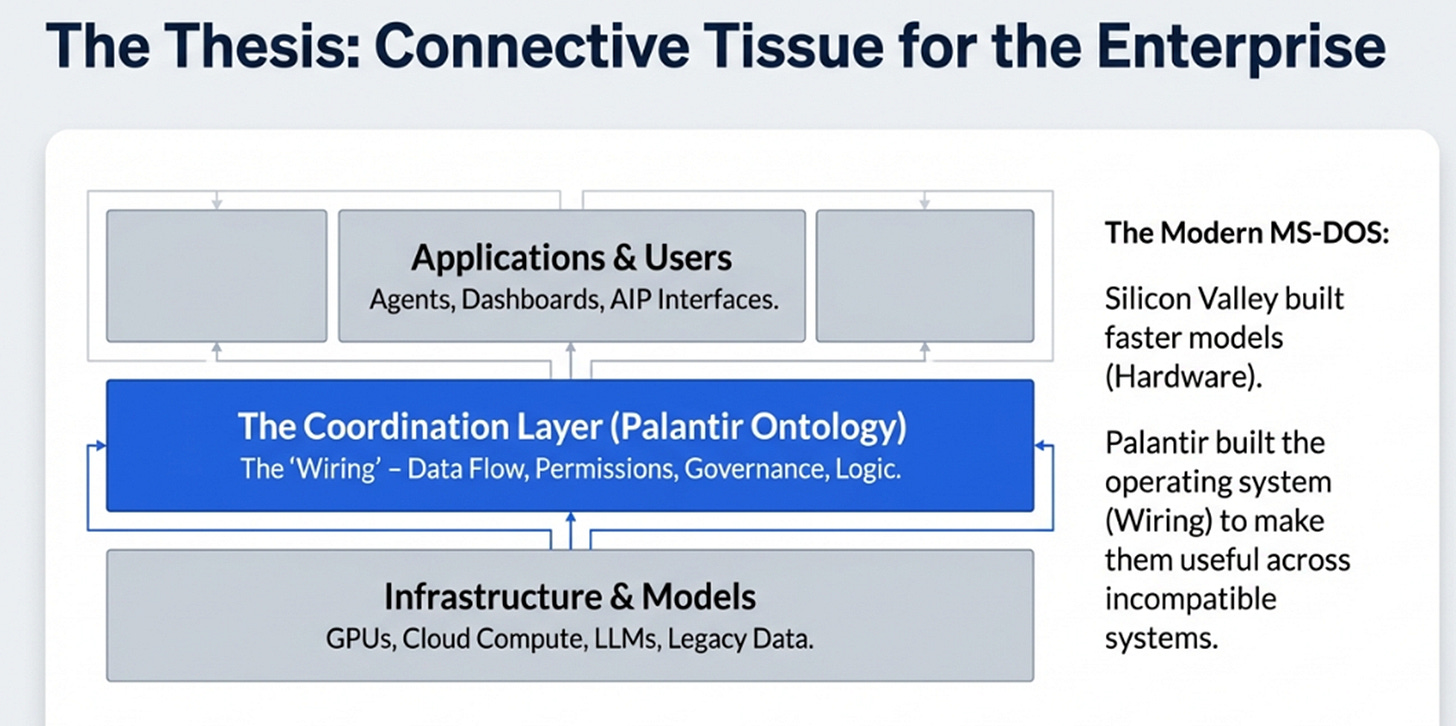

I keep returning to this story because the same pattern is playing out in enterprise software. Silicon Valley has spent the last decade building faster machines, better models, bigger GPUs, cheaper storage. Palantir has been building the wiring between the machines. And just as Toyota’s competitors dismissed the production system as too manual and too culturally specific to matter, Palantir’s critics have spent twenty years dismissing the Ontology as consulting.

Three months ago I argued that this misunderstanding was the central analytical error the market was making about Palantir. The thesis: Palantir isn’t an AI application company. It’s building the connective tissue for enterprise operations, the modern equivalent of MS-DOS, which won not through technical elegance but by solving the coordination problem across incompatible hardware. Forward Deployed Engineers weren’t consultants; they were installing the drivers. AIP was the GUI moment, natural language as the interface to the substrate underneath.

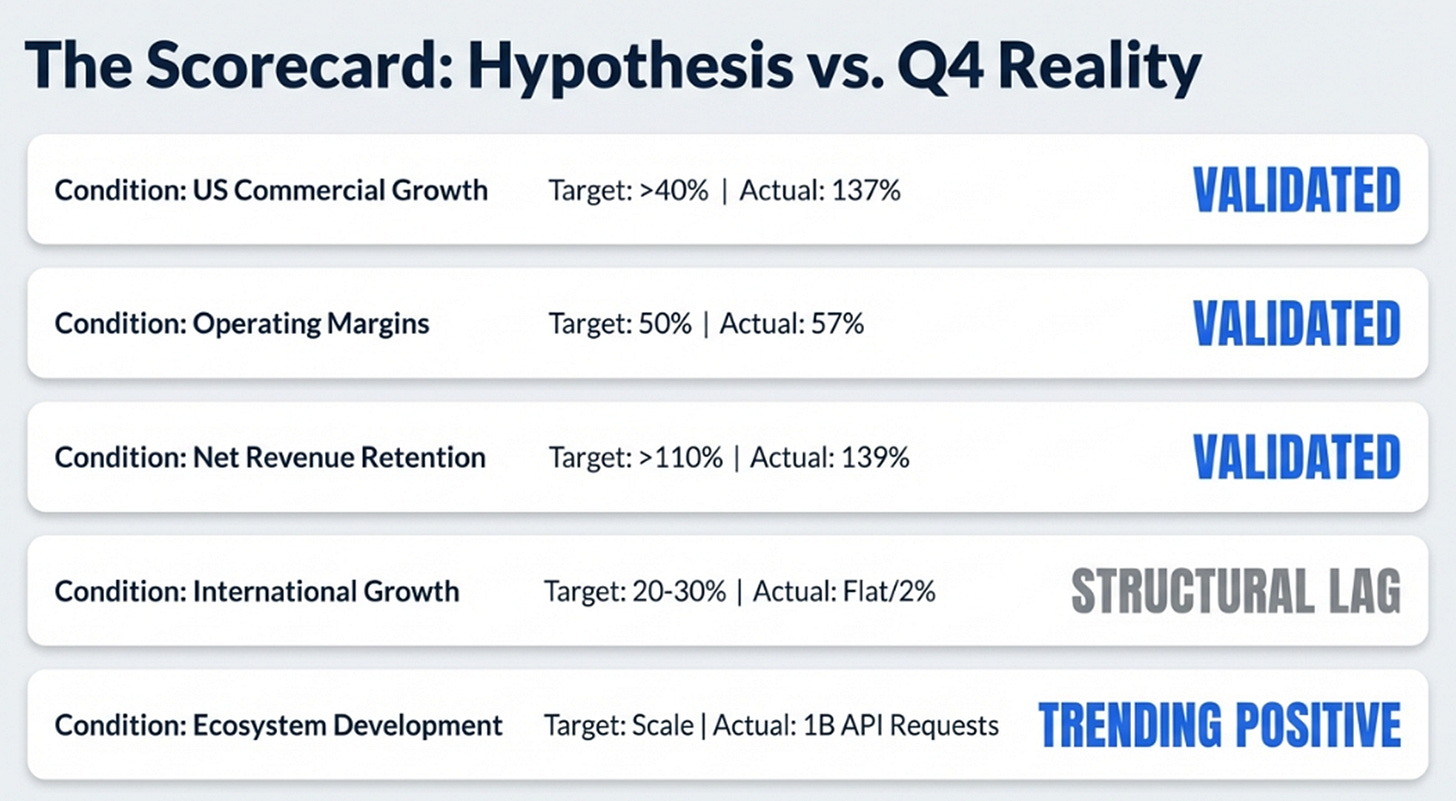

I identified five conditions that would validate or falsify this framework. Then Q4 happened, and the numbers didn’t just validate the thesis, they outran it.

The Scorecard

I made specific predictions. Here’s what happened.

The first condition was U.S. commercial growth sustaining above 40%. I called that the bull case. Palantir delivered 137% year-over-year in Q4 and guided for 115% or higher in fiscal 2026. The bull case was conservative by a factor of three. A healthcare company did two bootcamps last summer and signed a $96 million deal before year-end. An engineering services firm saw demonstrations in the fall and signed $80 million before December. The adoption cycle I described has compressed beyond what the most optimistic version of the thesis contemplated.

The second condition was operating margins holding or expanding toward 50%. Palantir delivered 57% adjusted operating margins in Q4 with 86% gross margins, and guided for approximately the same in fiscal 2026. You cannot run a consulting business at these economics. The services critique isn’t weakened. It’s empirically dead.

The third condition was international growth inflecting to 20-30%. International commercial grew 2% for the full year, essentially flat. Karp described this as structural, not a timing issue. This is the one condition that failed.

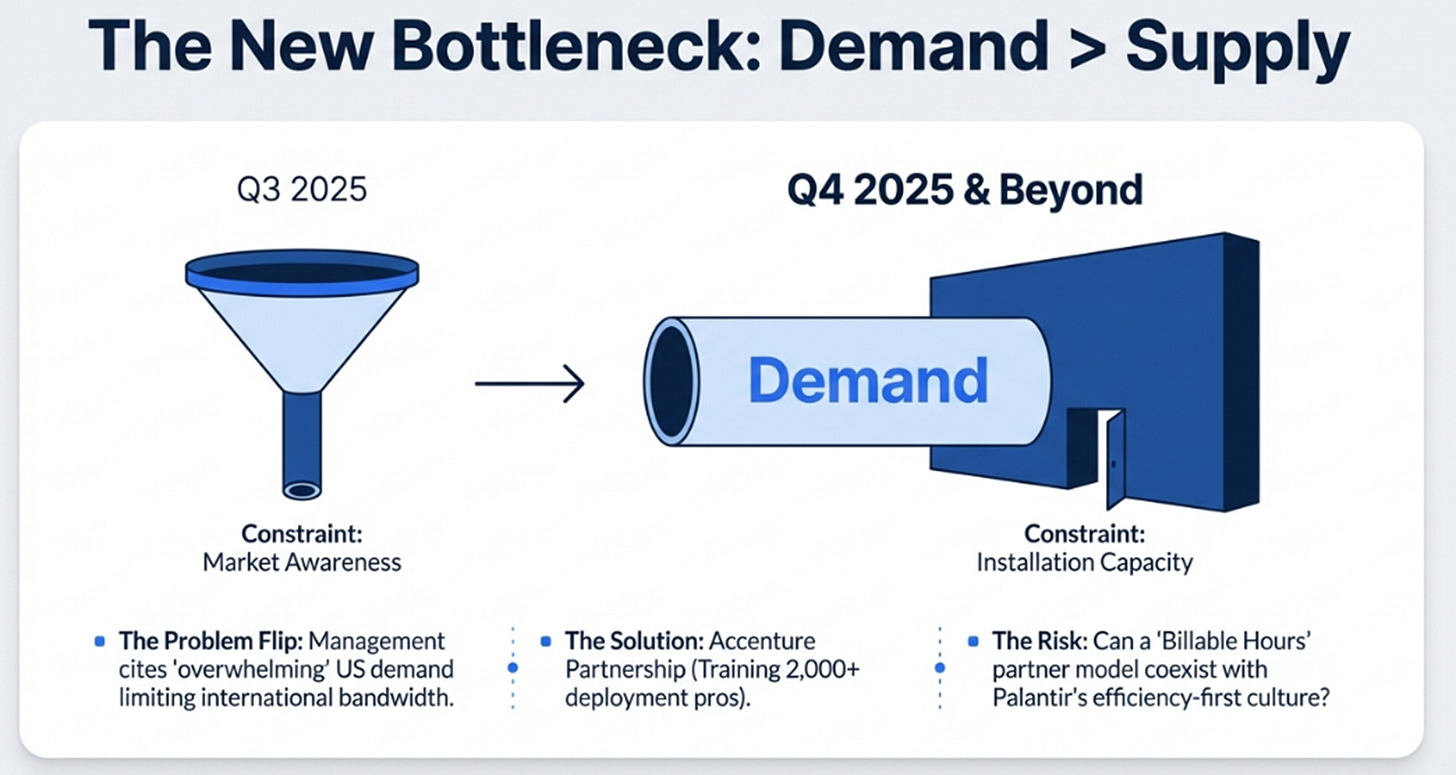

The fourth condition was ecosystem development, other companies building on Palantir rather than just with it. The evidence is mixed but trending positive. One billion API Gateway requests per week from customer-built applications. Enlisted service members building their own AI agent swarms on Palantir’s systems. A new partnership with Accenture to train over two thousand deployment professionals. Progressing, not proven.

The fifth condition was net revenue retention staying above 110%. Palantir reported 139%, up five hundred basis points sequentially, explicitly excluding customers acquired in the past twelve months. Pre-AI cohorts are expanding at this rate, which proves the compounding thesis: once the operating system is installed, the surface area for new use cases keeps growing.

Four of five conditions met or exceeded. The one that failed, international, is offset by U.S. performance so strong that the three-year math may not require international at all.

What the Quarter Revealed

Validating prior predictions is useful. But the more interesting question is what the quarter taught that the original framework didn’t anticipate.

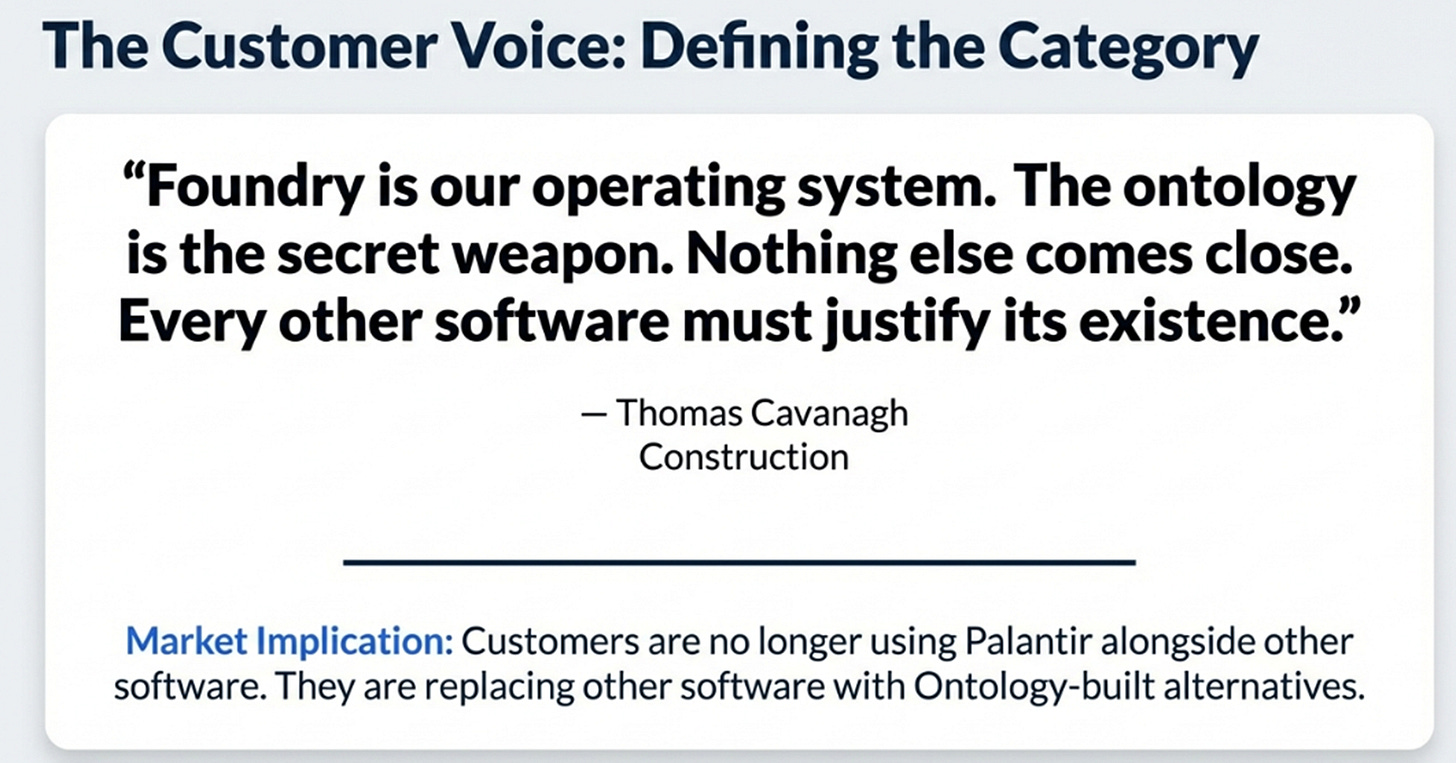

The most striking moment in the earnings call wasn’t a financial metric. It was a customer quote. The Ontology, Palantir’s living map that translates a company’s messy reality of legacy systems, sensor data, and human approvals into a single, governable digital structure, has always been difficult to explain on a slide. Thomas Cavanagh Construction made it concrete, unprompted: “Foundry is our operating system. The ontology is the secret weapon. Nothing else comes close. Every other software must justify its existence.“ When your analytical framework starts coming out of customers’ mouths, that isn’t confirmation bias. That’s the market adopting the category you described.

And the implications go further than a single customer testimony. Thomas Cavanagh isn’t using Palantir alongside their other software, they’re replacing other software with Foundry-built alternatives and, in their words, “beating them to new features within the year, because of the ontology.” Lear went from four use cases to 280. The connective tissue is absorbing functionality that used to belong to standalone applications. My original MS-DOS analogy may have understated the dynamic: MS-DOS coordinated between applications. The Ontology is eating them.

One structural observation explains why. You don’t have two Ontologies for one submarine factory. You have one. Once an enterprise maps its operational reality into the system, its data flows, permissions, dependencies, governance rules, there is no second mapping. That isn’t a switching cost in the traditional software sense. It’s a reconstruction cost. The winner in any given enterprise takes the entire budget. This is why revenue per customer is exploding while customer count grows modestly.

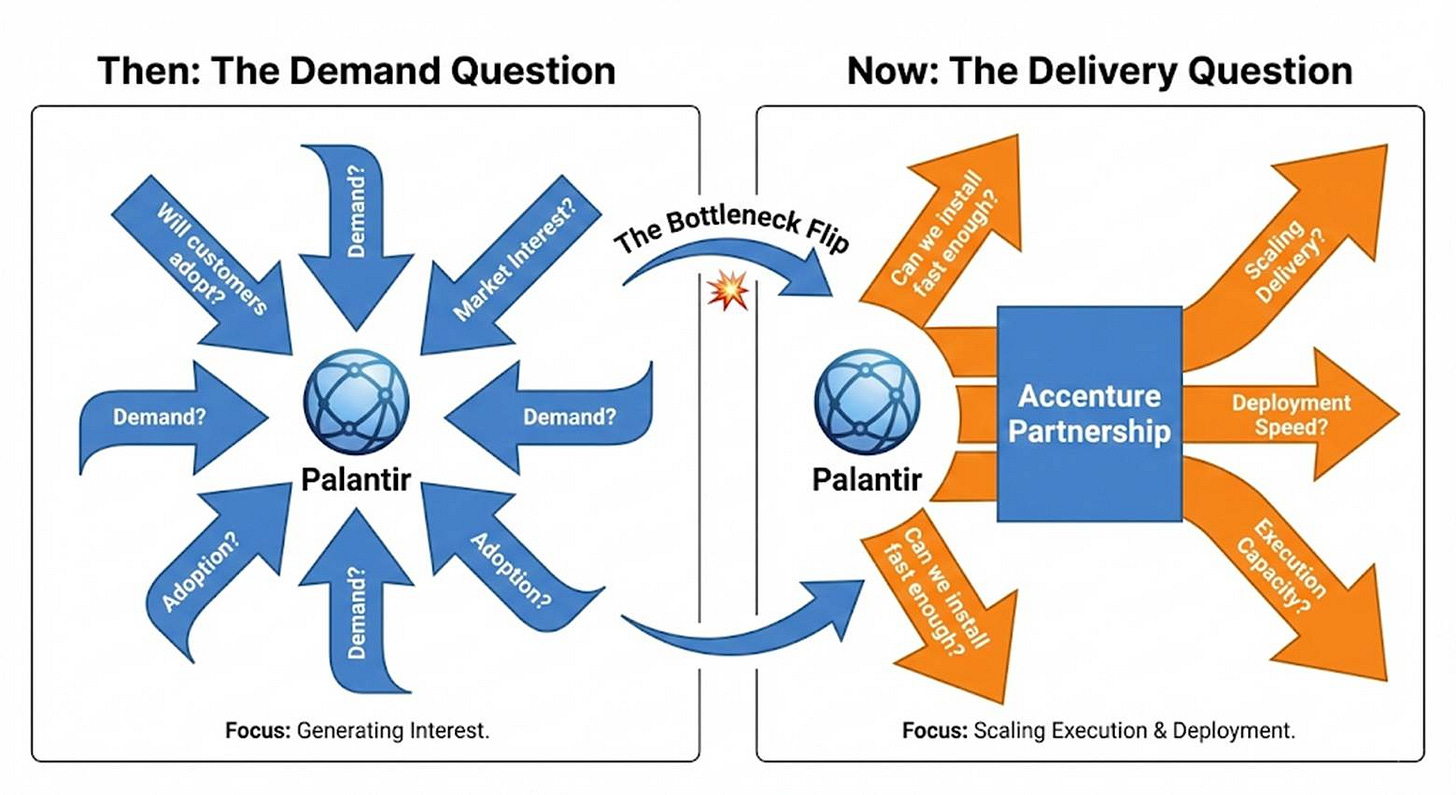

The original article focused on demand-side questions, will customers adopt? Will growth sustain? Q4 reframes the question entirely. The bottleneck has flipped. Karp essentially told investors that Palantir lacks bandwidth to serve international markets because U.S. demand is overwhelming. The Accenture partnership, training over two thousand professionals to scale deployments, is the clearest signal that the constraint has moved from “do people want this?” to “can we install it fast enough?” This is a better class of problem. It’s also a new condition to track, and it carries a specific tension: Accenture’s economics reward billable hours while Palantir’s reward efficient deployment. Whether those incentives can coexist without degrading quality will determine if the scaling constraint actually breaks.

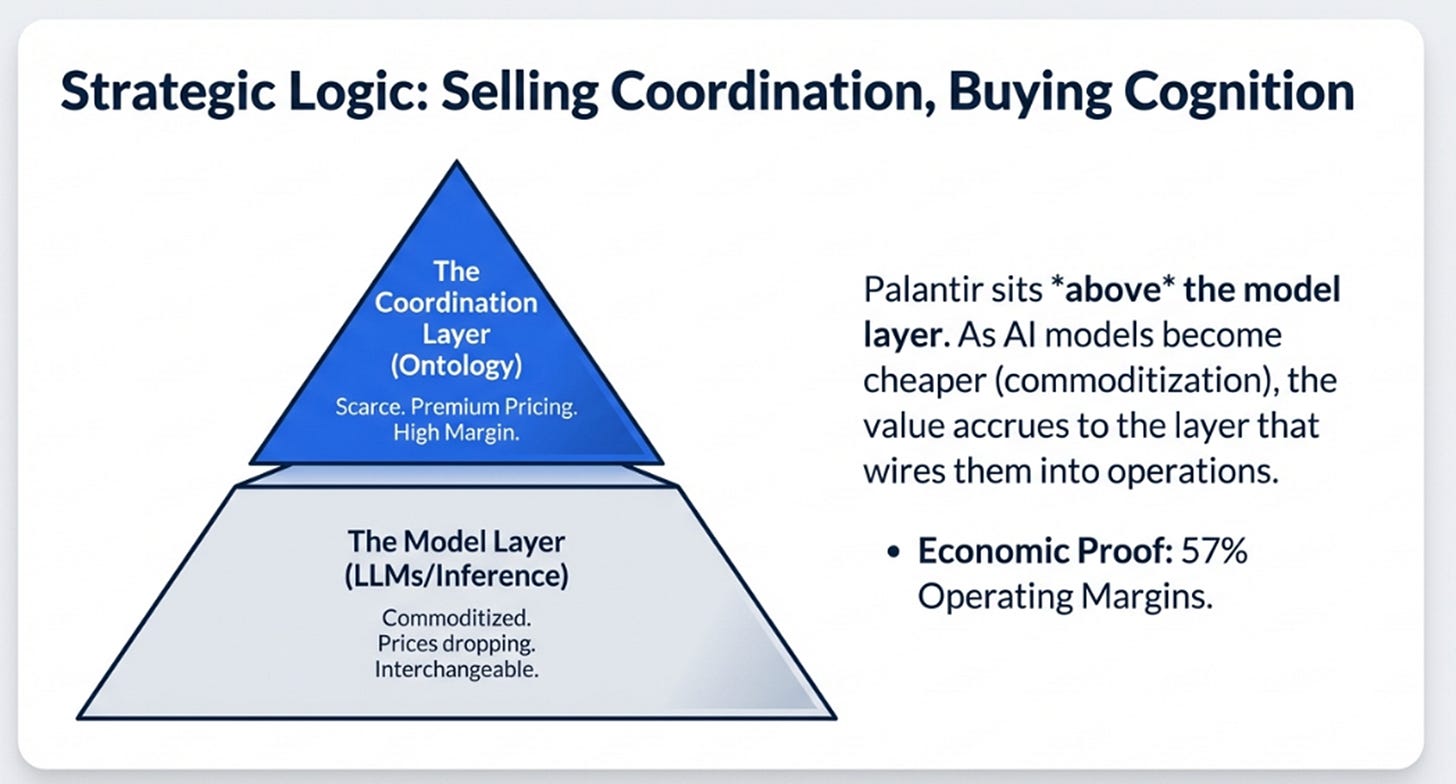

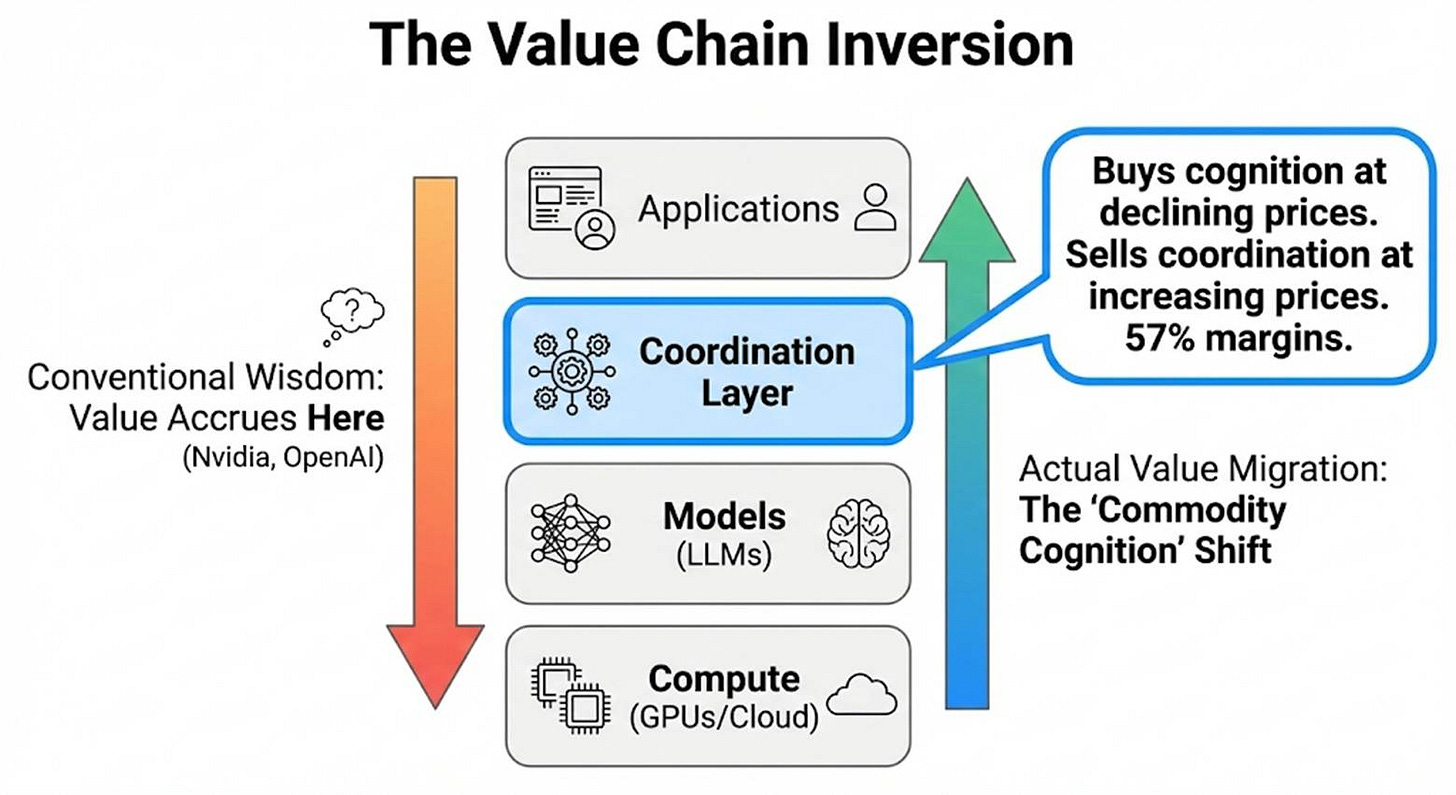

There’s also a strategic logic underneath the financials that my original piece underweighted. Palantir’s position only makes sense if large language models become cheap and interchangeable, and they are. Inference costs have dropped by orders of magnitude. Open-source models proliferate. Every hyperscaler offers competitive model APIs. Palantir doesn’t train models. They don’t care which model wins. They sit above the model layer, buying cognition at declining prices and selling coordination at increasing prices. The 57% operating margin during 70% revenue growth is the economic proof. As the complement commoditizes, the scarce layer captures more value, not less. This is the inverse of what most AI investors believe.

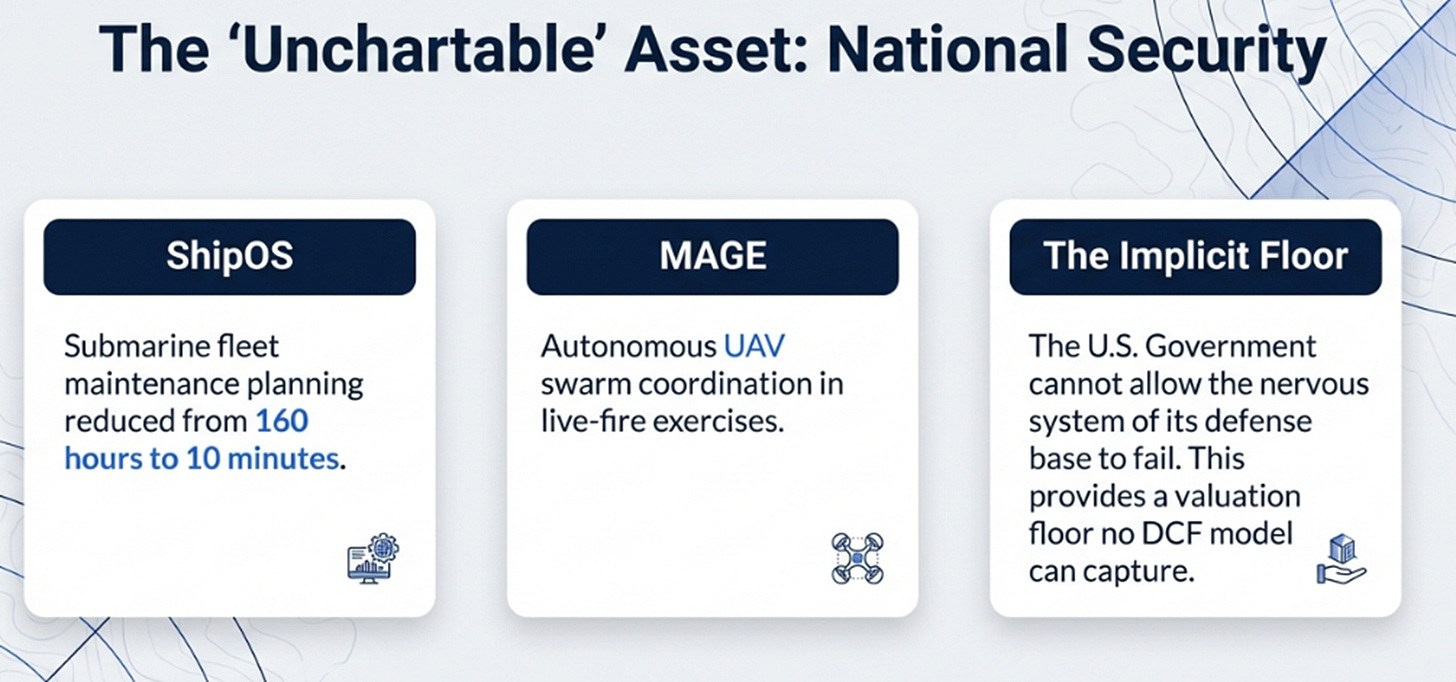

And then there’s the dimension that may matter most and is hardest to model. MAGE, autonomous UAV coordination in a live-fire exercise. ShipOS, reindustrialization of the submarine fleet, planning reduced from 160 hours to ten minutes. Gotham suite integrating battlefield planning, command relationships, and battle damage assessment. Enlisted personnel, E4s in Hawaii, E8s in South Carolina, building their own agent swarms. This is bottom-up institutional adoption of the kind that no procurement decision can reverse.

But look at what this actually means: Palantir may be building the most important company in the Western defense industrial base, and the market is pricing it as a software company. If U.S.-China tensions continue escalating, Palantir’s defense position becomes not just a business but a strategic national asset. That’s unchartable on a DCF model. The U.S. government doesn’t allow the nervous system of its submarine production and battlefield coordination to go bankrupt, lose relevance, or fall into foreign hands. That’s an implicit floor that no financial model captures, and it could ultimately matter more than the commercial story.

Updating the Framework

If the evidence changed, the framework should change with it. Here’s what I’m revising.

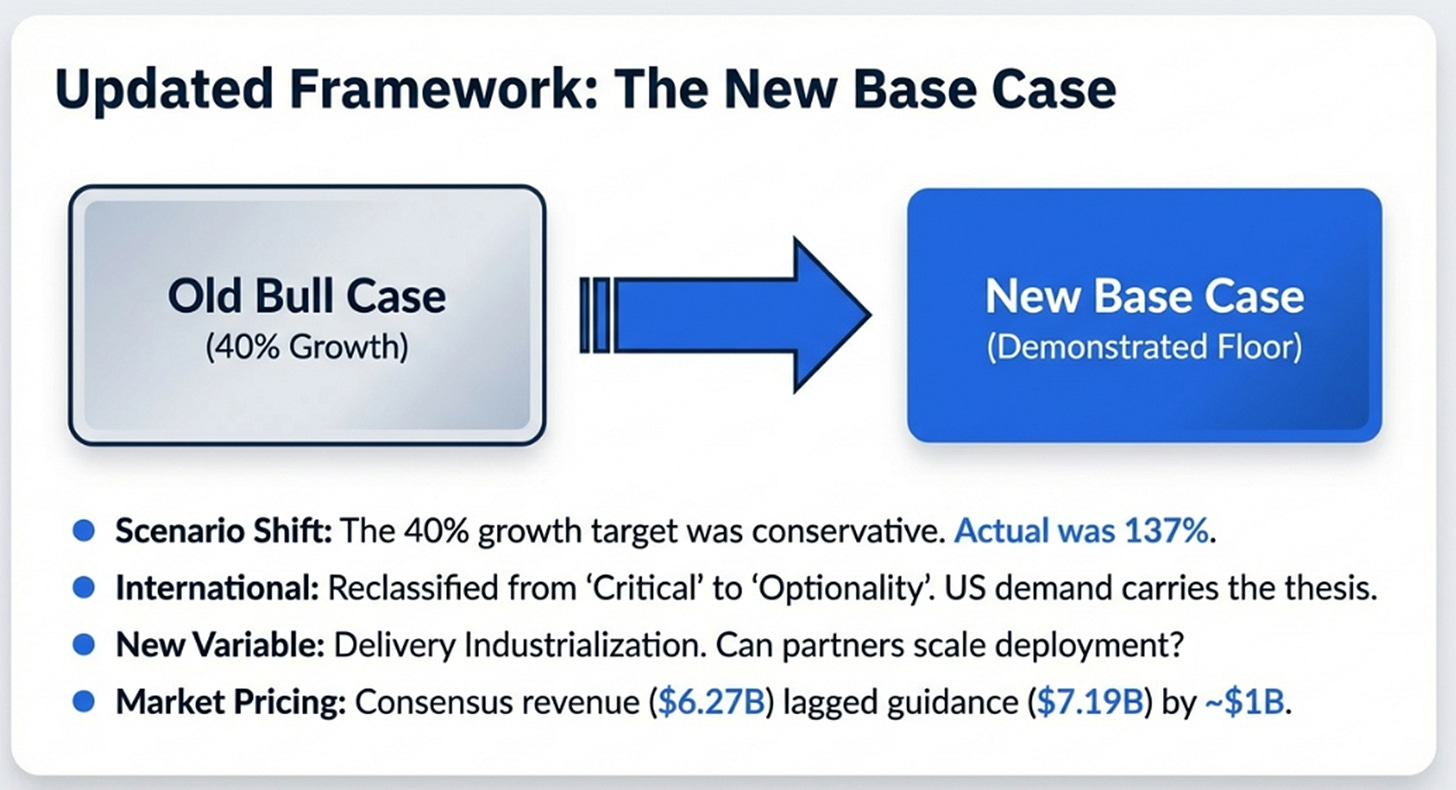

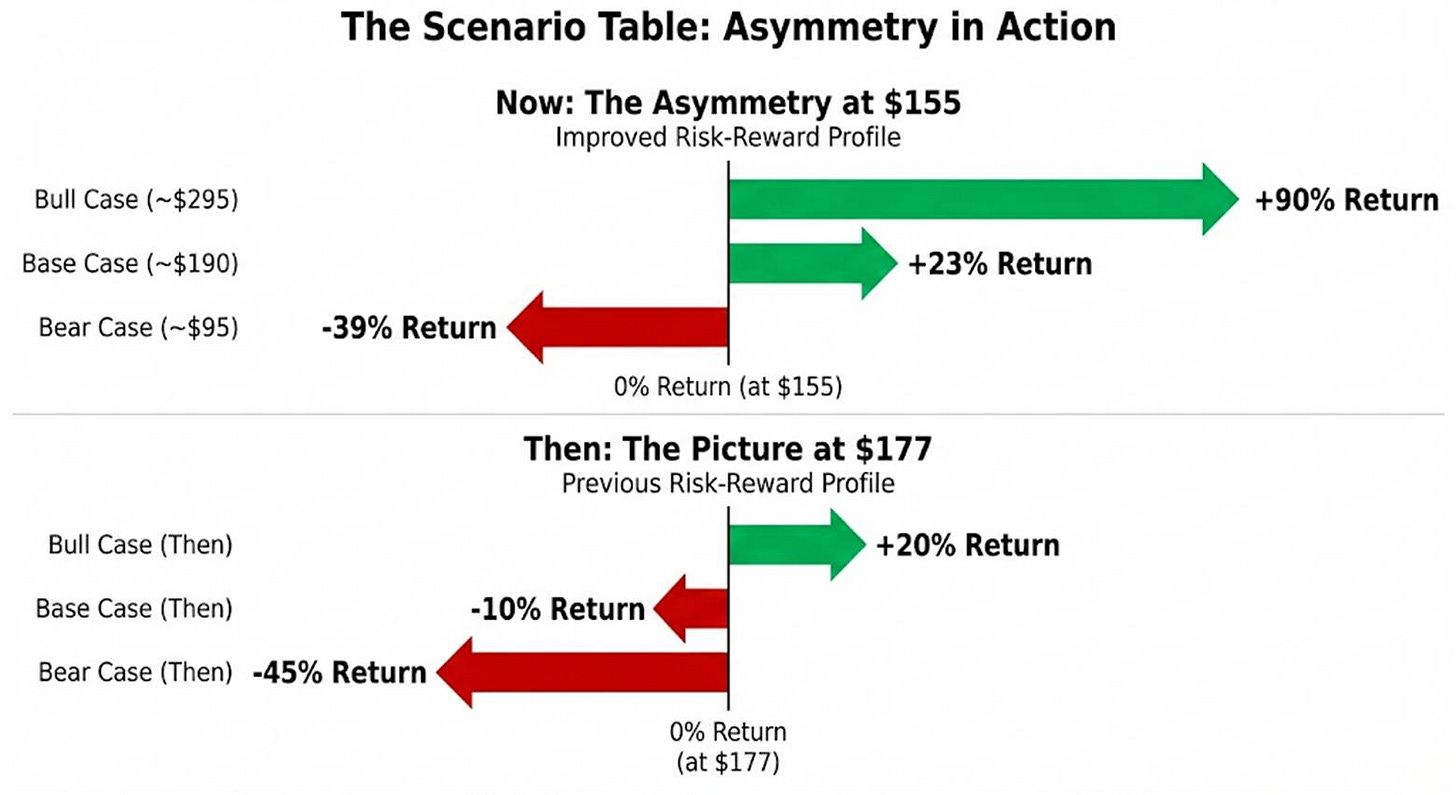

First, the old bull case is the new base case. My original bull case assumed 40%+ U.S. commercial growth and margins approaching 50%. The company delivered 137% growth and 57% margins and guided for 61% overall growth. The old optimistic ceiling is now the demonstrated floor. Each scenario shifts up one tier. This isn’t bullishness. It’s arithmetic.

Second, international gets reclassified from swing variable to long-term optionality. The evidence suggests it’s architectural, the Ontology encodes assumptions about how institutions operate, and those assumptions are culturally specific. I’m assuming the U.S. plus select allies is the addressable market for the next three years. If international surprises, treat it as upside not yet in the model.

Third, I’m adding delivery industrialization as a new primary condition. The Accenture partnership replaces international as the swing variable. If partner-led deployments achieve similar expansion rates and retention as engineer-led ones, the scaling constraint breaks. If they don’t, there’s a human-capital ceiling regardless of demand.

Fourth, the variant perception itself has shifted. When I wrote the original article, the variant was categorical: Palantir is not consulting, it’s an operating system. The market has now largely accepted the business quality. The new variant is temporal: the old bull case assumptions are the demonstrated baseline, and the market hasn’t fully repriced for that reality. Most analysts were updating from a pre-earnings consensus of $6.27 billion, a number Palantir beat by nearly a billion dollars.

What the Market Still Misses

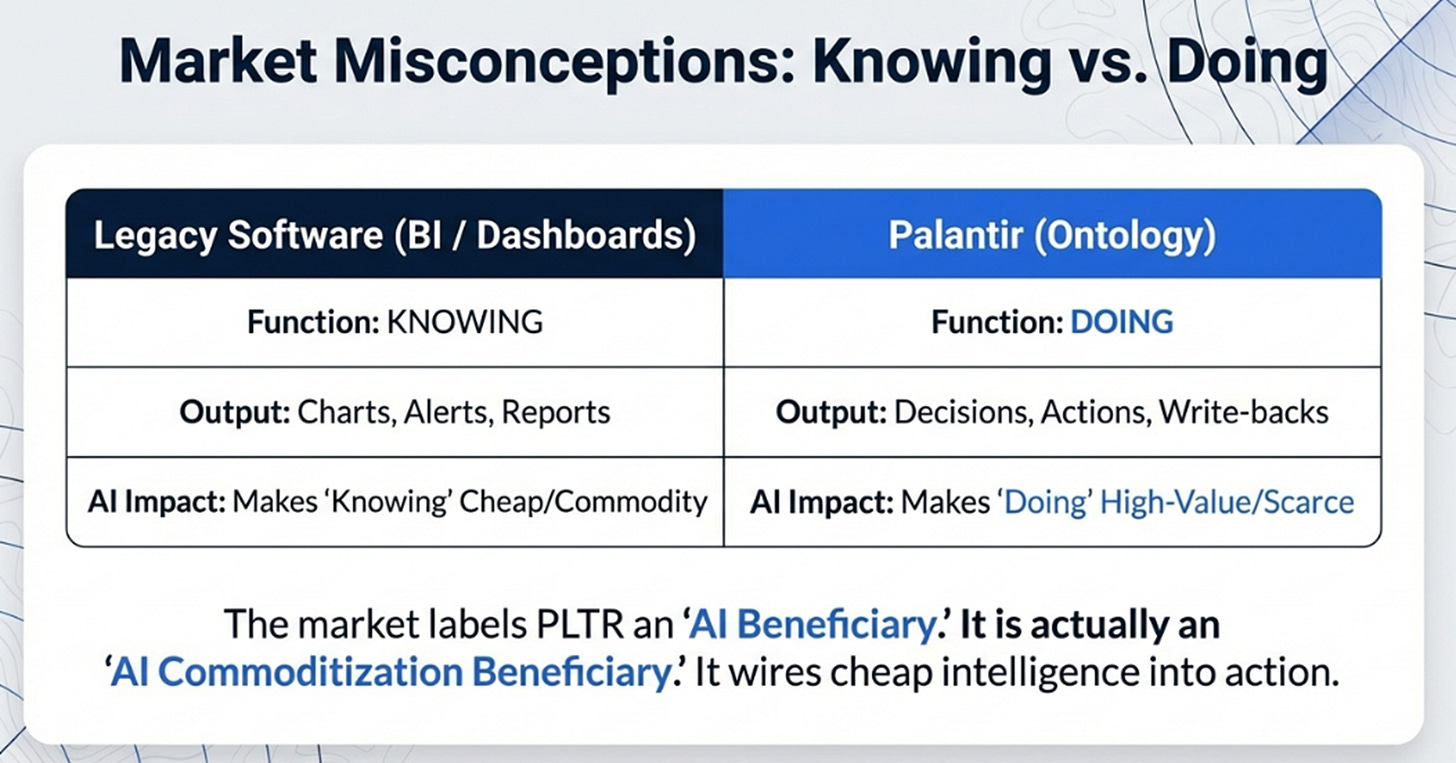

Every prior generation of enterprise software, BI tools, data warehouses, dashboards, was about knowing. AI makes knowing cheap. The scarce thing is now doing: turning a decision into a sequence of authorized actions across systems that were never designed to talk to each other. This shift from knowing to doing is the structural change that makes Palantir’s architecture suddenly essential rather than merely interesting.

The consensus view doesn’t reflect this. The market sees an expensive AI stock riding the enthusiasm cycle, roughly 130 times forward earnings, vulnerable to any disappointment. This framing contains several errors.

The first is categorical. “AI beneficiary” is the wrong label. Palantir benefits from AI commoditization, not AI advancement. If the AI bubble bursts and model companies implode, Palantir’s input costs decline while the operating system remains essential. The cheaper intelligence becomes, the more you need someone to wire it into operations.

The second is structural. The heaviness of implementation, the thing bears mocked for years, has inverted from weakness to moat. Every enterprise that maps its operational reality into the Ontology encodes something that cannot be easily replicated. Reversing it isn’t switching a vendor. It’s reconstructing the digital nervous system of your operations from scratch. That’s why net dollar retention is 139%.

The third is strategic. Revenue grew 70% while customer count grew 34%. This isn’t a failure to acquire new logos. It’s a deliberate strategy of density over volume, selecting customers who will restructure around the system and go deep. Revenue per customer is exploding. That’s the behavior of an operating system consolidating its installed base, not an application vendor chasing logos.

The fourth is mechanical. The market is anchoring to stale estimates. Pre-earnings consensus was $6.27 billion for fiscal 2026. Palantir guided $7.19 billion, a $920 million gap. Forward multiples will compress as analyst models catch up. The stock looks more expensive on trailing consensus than it is on the company’s own stated trajectory.

The Updated Math

A brief framing before the numbers. Better fundamentals don’t automatically produce higher price targets when starting multiples are elevated. But there is a meaningful difference between a business that improved modestly and one that exceeded its own bull case across four of five dimensions. When the prior optimistic scenario becomes demonstrated reality, the right move is to shift each scenario up one tier, not to anchor to old assumptions out of false prudence.

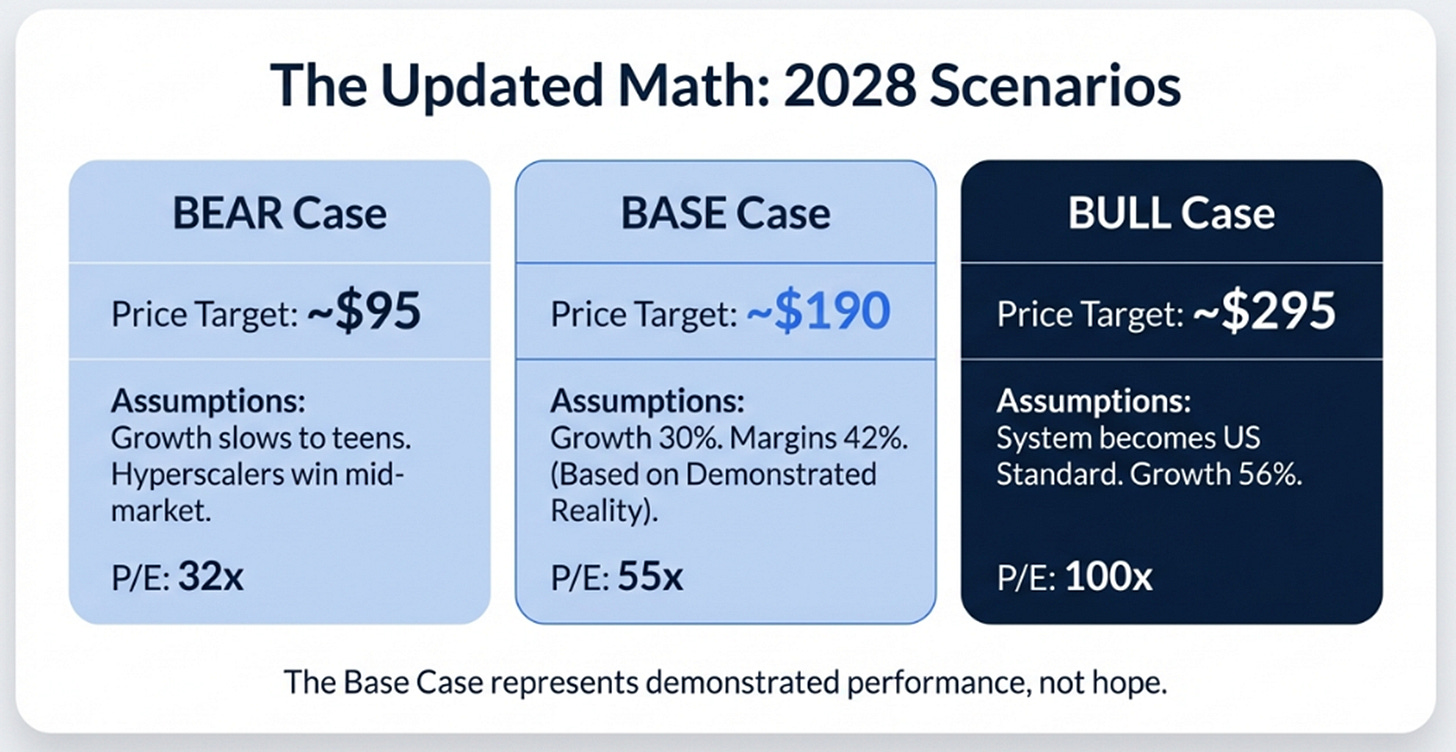

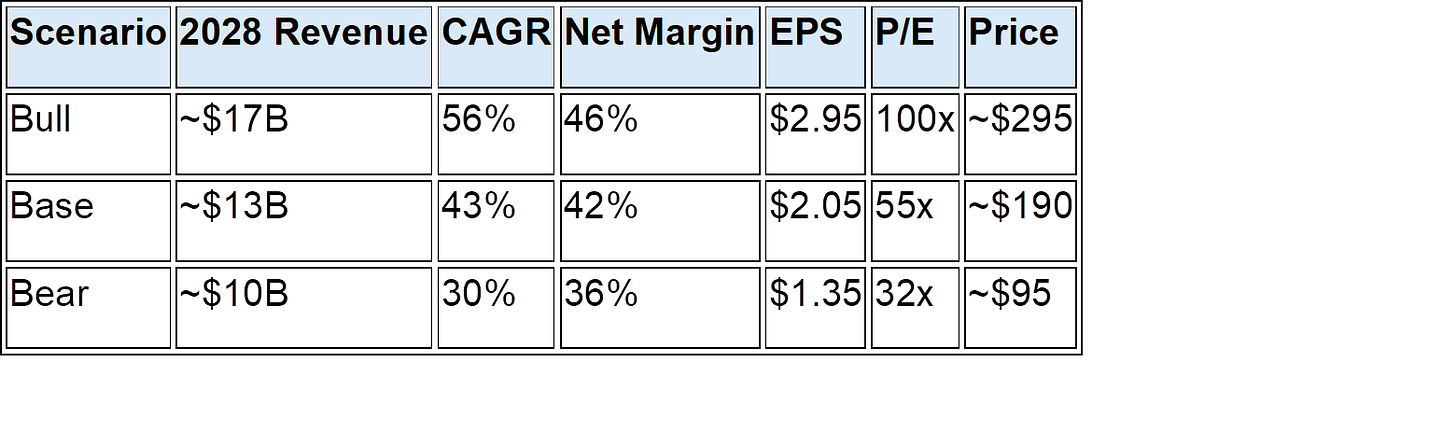

The bull case is approximately $300. This requires the system becoming the U.S. enterprise standard, Accenture successfully scaling delivery, and early ecosystem development. Revenue reaches roughly $17 billion by 2028, implying about 56% compounded growth. GAAP net margins of 46% produce approximately $2.95 in earnings per share. At 100 times earnings, roughly what the market pays today while the thesis is actively debated, and what it would sustain if the debate were settled, the stock reaches the mid-$290s.

The base case is approximately $190. This is the old bull case, now confirmed as realistic. Growth decelerates from 61% to roughly 30% by 2028. Margins hold. Revenue reaches approximately $13 billion. At 42% net margins and 55 times, appropriate for 30% growth with elite profitability, earnings of about $2.05 per share produce a price near $190.

The bear case is approximately $95. AI enthusiasm peaks. Growth normalizes to the high teens. Hyperscalers offer something good enough for mid-market. Revenue reaches $10 billion. Even here, $7 billion in current cash plus roughly $4 billion per year in free cash flow creates a meaningful valuation floor. At $1.35 in earnings and 32 times, the stock trades near $95, a loss from $155, but not catastrophic, and you still own a highly profitable business.

The asymmetry is what matters. Three months ago at $177, even the bull case offered only modest upside and the base case was a loss. Today at $155, the bull case offers roughly 90% upside and the base case, which represents what the company has already demonstrated, is positive at about 23%. You’re no longer paying for hope. You’re paying for demonstrated performance with meaningful optionality if the wiring compounds the way such systems historically have.

What to Track

Several conditions from the original article have been answered. U.S. commercial growth above 40%, answered at 137%. Margins toward 50%, answered at 57%. The operating system thesis gaining traction, answered by a customer on the record.

The questions that remain are different. The single most important metric is the revenue growth deceleration slope. Palantir guided 61% for fiscal 2026. If fiscal 2027 comes in above 40%, the adoption curve is long and the bull case holds. If it drops below 30%, the initial wave is peaking.

The new swing variable is the Accenture partnership. Track whether partner-led deployments achieve similar expansion and net dollar retention as direct deployments. If they do, the human-capital ceiling breaks. If they don’t, demand alone can’t solve the scaling problem.

Net dollar retention needs to stay above 130% through 2027. Below 120% would indicate expansion is slowing and the lock-in is weaker than the current numbers suggest. Stock-based compensation, currently about 15% of revenue, should trend below 10% by 2027 to confirm GAAP earnings quality is genuinely improving.

If you want to know what would make me wrong: revenue growth decelerating below 25% without macroeconomic cause, a hyperscaler launching a credible coordination product with real customer traction, net retention falling below 110%, or management’s tone shifting from “demand is overwhelming our capacity” to “competitive intensity is increasing.”

The Weight of the Wiring

When American executives visited Toyota in the 1960s, they saw nothing proprietary. No breakthrough machine. No secret component. Just clean flows, simple cards, and obsessive attention to the connections between things. They left confused because they were looking for a faster machine. Palantir’s critics have spent twenty years making the same mistake, searching for a better model instead of better wiring.

This quarter, the numbers stopped being debatable and a customer named what the market couldn’t see. The thesis got stronger. The price got better. At $155, you’re not paying for the market to discover something hidden. You’re paying for demonstrated reality to continue, with meaningful upside if the system compounds the way operating systems historically have.

Whether that becomes a generational outcome hinges on one mundane, unglamorous thing: can they scale delivery without losing what made it work in the first place? That’s not a question about AI. It’s a question about wiring. And it was always where the value lived.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.