PANW After Q1 FY26: The $13 Billion Assembly Test

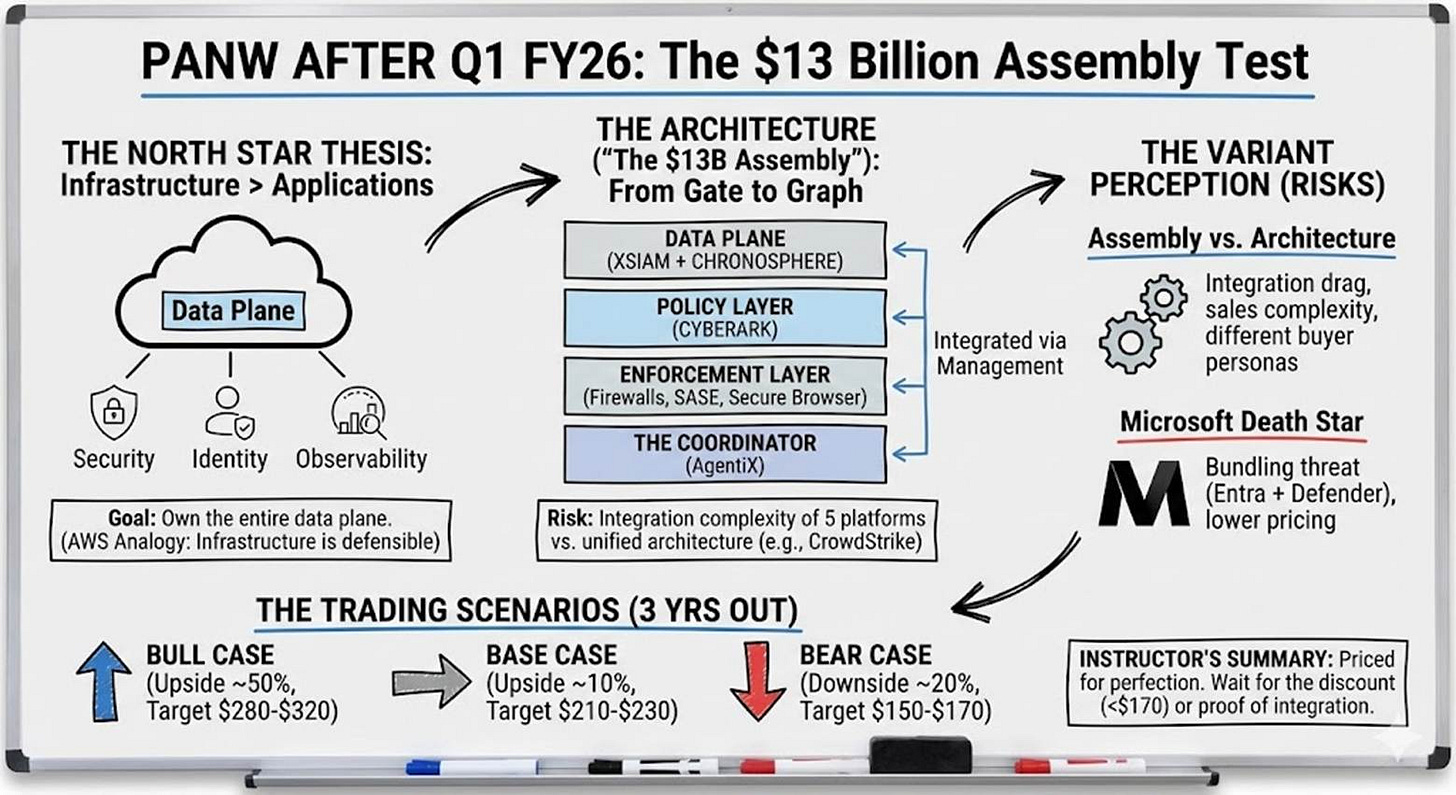

As AI reshapes telemetry, PANW is racing to unify five platforms into one data layer—before Microsoft bundles it all away

TL;DR

PANW is no longer just a cybersecurity vendor—it’s trying to build the infrastructure layer for security, identity, and observability, mirroring AWS’s 2006 playbook.

Q1 FY26 metrics were strong, but the real story is the $13B bet on CyberArk + Chronosphere and the rising integration risk of stitching together five billion-dollar platforms.

At ~$200/share, investors are already paying for the bull case; without flawless integration and a benign Microsoft, there’s little margin of safety.

When Infrastructure Beats Applications

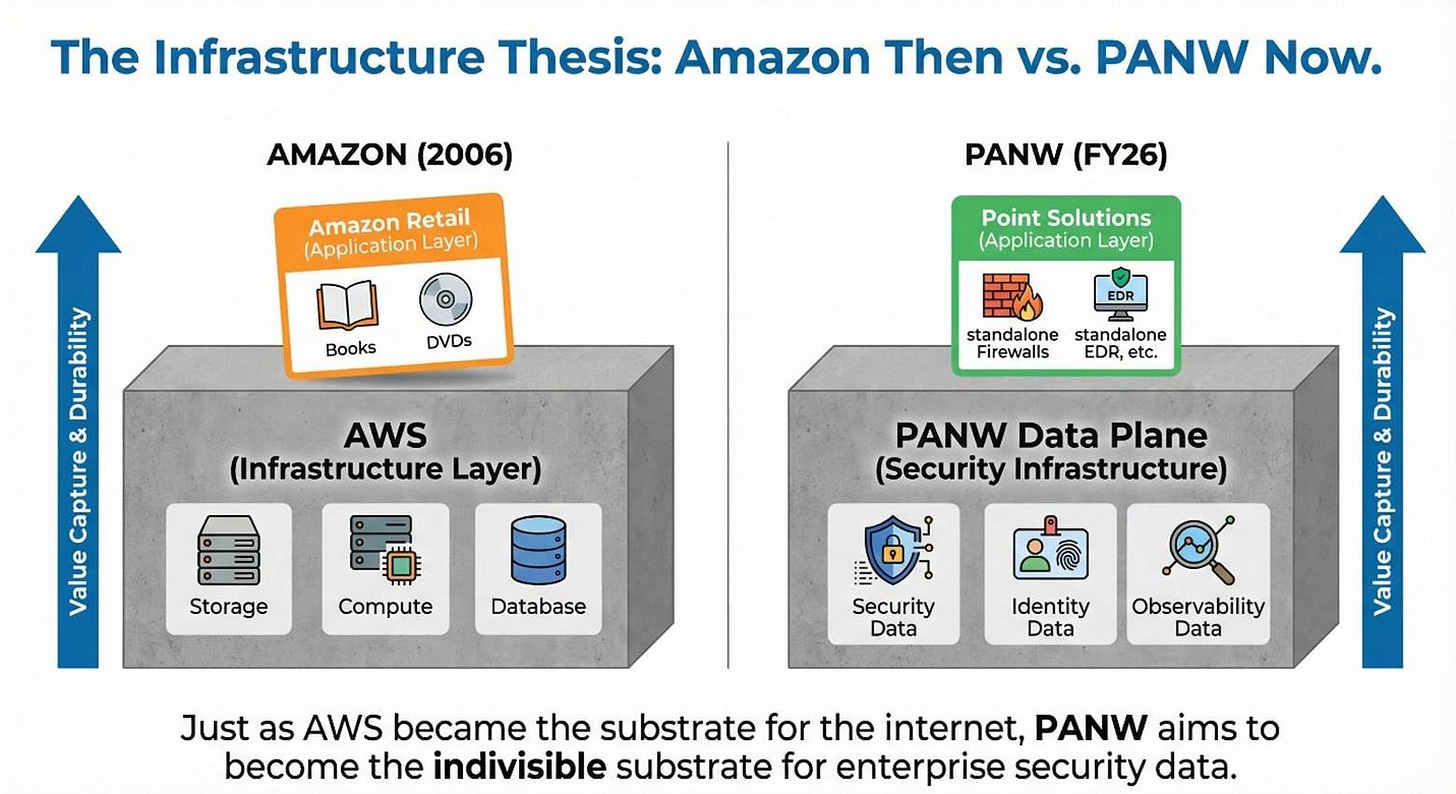

In the summer of 2006, Amazon made a decision that seemed puzzling to most observers. The company launched Amazon Web Services, offering basic computing infrastructure—storage, compute, databases—as a service. Wall Street analysts were skeptical. Why would the world’s largest online retailer want to become a data center operator? Amazon sold books and DVDs; infrastructure was a cost center, not a business.

But Jeff Bezos understood something that became obvious only in retrospect: in technology, whoever owns the infrastructure layer ultimately captures more value than whoever builds the applications on top of it. Applications come and go, driven by taste and innovation cycles. Infrastructure, once established, becomes the substrate that everything else depends on. It’s not that applications don’t matter—it’s that infrastructure is structurally more defensible and economically more durable.

Twenty years later, AWS generates more operating profit than Amazon’s entire retail operation. The applications layer (e-commerce, streaming, devices) gets the headlines, but the infrastructure layer pays the bills. That same pattern has repeated across technology: iOS and Android captured more value than any individual app; Stripe captured more than most fintech apps built on top of it; Shopify’s platform eclipsed individual stores.

Palo Alto Networks is making a similar bet in cybersecurity. The question their Q1 fiscal 2026 earnings really answer isn’t whether they can grow 16% or maintain 30% operating margins—those are impressive but beside the point. The question is whether they can become the infrastructure layer for security, identity, and observability in the AI era, or whether they’ll remain—however successful—an applications vendor selling best-of-breed tools.

From Gate to Graph: The Experiment Continues

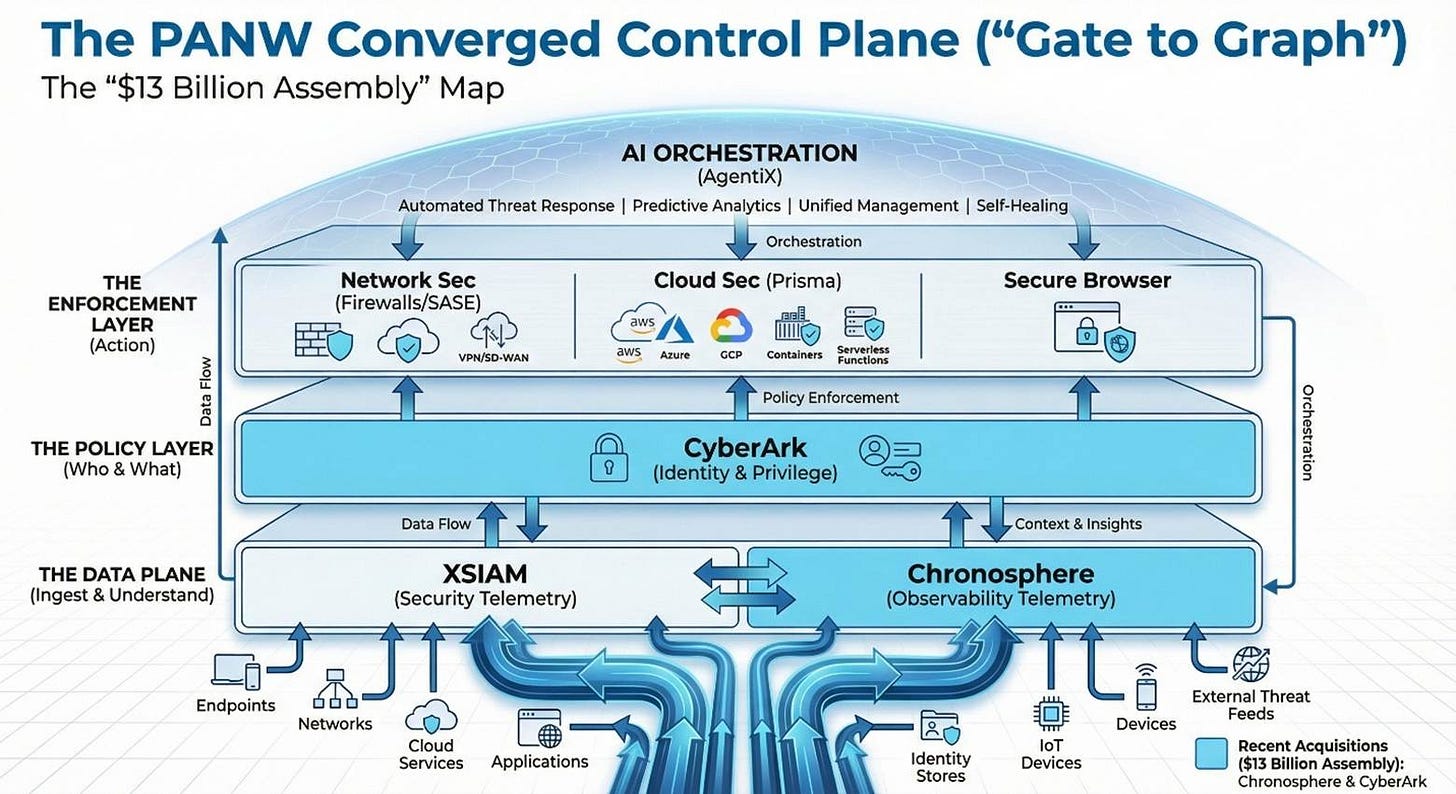

In August, I argued that Palo Alto Networks was executing a fundamental strategic shift I called “gate to graph.” The traditional model of cybersecurity—guarding a network perimeter like a medieval gate—has given way to governing a distributed graph of users, applications, data, and increasingly, AI agents. PANW’s response was to build a unified control plane across three layers: an enforcement layer (firewalls, SASE, secure browser), an understanding layer (XSIAM ingesting 15 petabytes of telemetry daily), and a policy layer (CyberArk for identity, soon to close in Q3 fiscal 2026).

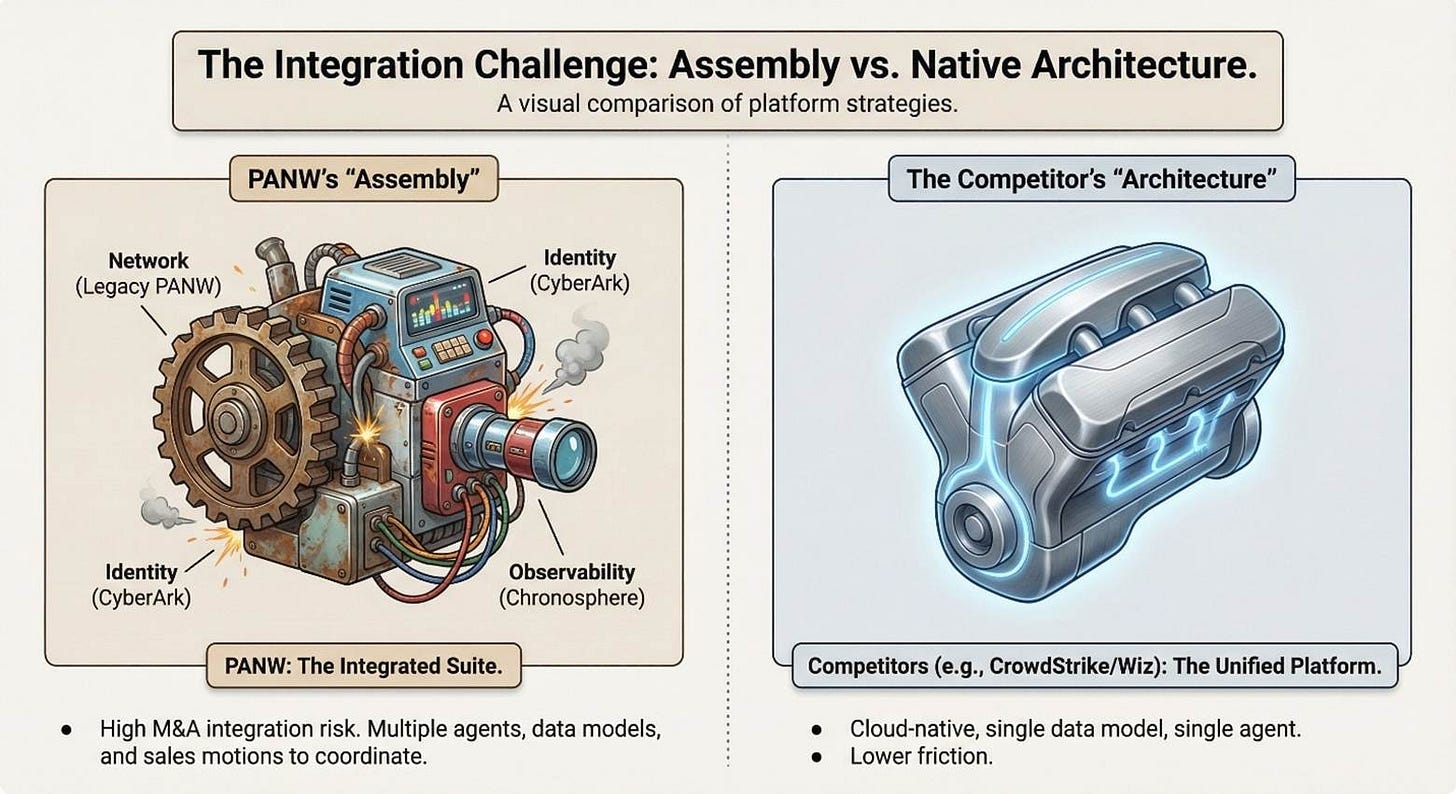

The strategic logic was clear. The execution risk was equally clear: PANW was attempting to coordinate multiple billion-dollar platforms—network security, cloud security, security operations, and identity—through management and process, not through a single unified architecture like CrowdStrike’s Falcon agent or Wiz’s cloud-native platform. I called this the “assembly versus architecture” tension, and suggested the market was underpricing the integration complexity while overpricing the upside at roughly 50x forward earnings.

Q1 fiscal 2026 and the announcement of the Chronosphere acquisition represent Chapter 2 of that experiment. The thesis hasn’t changed; the stakes have gotten higher.

What Q1 Actually Showed

The quarter itself was clean across every metric that matters. Revenue grew 16% YoY to $2.47 billion, at the top end of guidance. Next-Generation Security ARR, the company’s preferred growth metric, reached $5.85 billion with 29% YoY growth, again above the high end of expectations. Remaining Performance Obligation, the forward-looking contract backlog, hit $15.5 billion, up 24%. For the second consecutive quarter, non-GAAP operating margins exceeded 30%, while trailing twelve-month adjusted free cash flow margins touched 39.3%.

The product momentum underneath those numbers tells a more interesting story than the aggregate growth rate suggests. Software firewalls now represent 44% of trailing product revenue, up from 38% a year ago, signaling that the AI data center build-out is happening on virtualized infrastructure, not physical appliances. SASE annual recurring revenue surpassed $1.3 billion growing 34% YoY with roughly 6,800 customers including a third of the Fortune 500. Secure Browser, positioned as “the future operating system of the AI-driven enterprise,” now has over 7 million licensed seats across 1,200 customers, both up more than sevenfold YoY.

But the headline from Q1 wasn’t the quarter itself—it was the $3.35 billion acquisition of Chronosphere, an observability platform with roughly $160 million in annual recurring revenue growing at triple-digit rates. Combined with the pending $5.5 billion CyberArk acquisition expected to close in Q3, PANW has now committed over $13 billion in M&A capital in less than 18 months, dramatically expanding the scope of what “platformization” means.

This is where the AWS parallel becomes precise. PANW isn’t just trying to own security anymore; they’re trying to own the entire data plane where security, identity, and observability intersect.

The Variant Perception: Integration Risk Versus Microsoft Bundling

The consensus view on Wall Street treats Q1 as validation. Analysts point to 1,450 platformizations growing more than 30% YoY, 169 customers spending over $5 million in NGS ARR growing 54% YoY, and management’s reiteration of 40%+ adjusted free cash flow margins by fiscal 2028 despite $13 billion in acquisitions. The bull case writes itself: expand total addressable market from roughly $200 billion to $300 billion through identity and observability, sustain mid-teens revenue growth and 30%+ operating margins through the combination, reach $20 billion in NGS ARR by fiscal 2030, and maintain premium multiples befitting a platform winner in the AI era.

My view is different, and it hinges on two risks the market is systematically underweighting.

First, the integration complexity is real and rising. PANW is now stitching together network security (firewalls, SASE), cloud security (Prisma Cloud), security operations (XSIAM), identity security (CyberArk), and observability (Chronosphere). These aren’t small tuck-ins; they’re multi-billion-dollar platforms with different technical architectures, different sales motions, and different buyer personas. A CISO buys firewalls and XSIAM. An identity and access management lead buys CyberArk. A DevOps or site reliability engineering team buys Chronosphere. Asking one sales force to coordinate across all five while maintaining the 29% NGS ARR growth rate and 30%+ operating margins is an organizational feat that has broken larger companies attempting less ambitious integrations.

Second, and more important, Microsoft represents an existential threat that’s not just competitive but structural. Microsoft now offers Entra for identity (with 400 million-plus users), Defender for endpoint and cloud security, Sentinel for security information and event management, Azure Monitor for observability, and Copilot for Security as an AI layer across the stack. The company can bundle this entire suite at 40-50% below best-of-breed alternatives because it’s monetizing through Microsoft 365 and Azure consumption, not standalone security pricing. When a CFO in a budget-constrained environment asks “Why are we paying Palo Alto Networks, CyberArk, and Datadog when Microsoft includes most of this?” the CISO’s answer of “best-of-breed performance” increasingly loses to “good enough plus bundled.”

PANW’s counterargument is multi-cloud positioning—only about 30% of enterprises are purely Azure-committed, leaving 70% of the market preferring vendor diversity across AWS, Google Cloud, and Azure. That’s true but insufficient. Even multi-cloud enterprises use Microsoft for identity and endpoints, giving Microsoft a wedge into the stack that compounds over time.

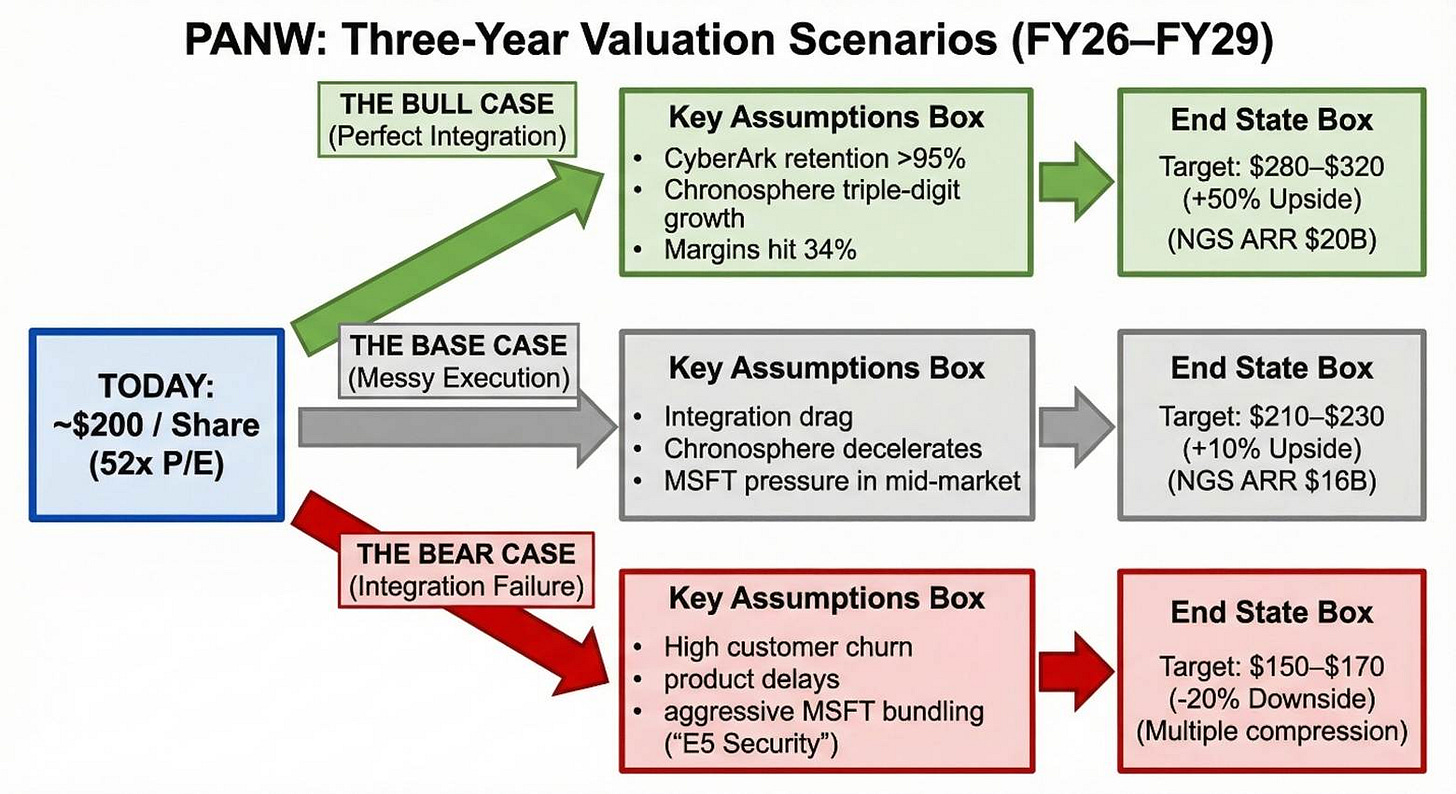

This leads to three scenarios for the next three years, each with different implications for returns from today’s price of roughly $200 per share trading at 52x forward fiscal 2026 earnings.

In the bull case, CyberArk integrates smoothly with customer retention above 95%, Chronosphere sustains triple-digit growth and becomes a genuine observability competitor to Datadog, core PANW maintains 25%+ NGS ARR growth through fiscal 2028, and Microsoft stays rational on security bundling. Operating margins reach 32-34% by fiscal 2028 as integration costs fade and scale benefits kick in, free cash flow margins exceed 42%, and the company reaches $18-20 billion in NGS ARR by fiscal 2030. Even with multiple compression to the low-30s price-to-earnings ratio befitting a slower-growth but higher-quality infrastructure business, the stock reaches $280-320 in three years for roughly 50% upside.

The base case assumes messier integration. CyberArk works but Chronosphere growth decelerates to 60-80% as the company scales, creating modest revenue synergies but limited margin expansion. Sales force complexity shows up as slightly elongated deal cycles. Microsoft bundles more aggressively in the sub-$5 million annual contract value segment, forcing PANW to focus on larger enterprise accounts. Revenue grows 13-14% compounded annually, operating margins stabilize at 30-31%, free cash flow margins hit the 40% target but don’t exceed it, and NGS ARR reaches $16-17 billion by fiscal 2030. Multiples drift to the high-20s to low-30s price-to-earnings, implying a stock price of $210-230 in three years for modest appreciation from today.

The bear case is straightforward: integration fails. Either CyberArk or Chronosphere customer churn exceeds 10% in the first year post-close, product integration takes 30 months instead of 18, NGS ARR growth decelerates below 20%, and Microsoft launches an aggressive “E5 Security” bundle that undercuts PANW by half in the mid-market. Revenue growth slows to 9-10%, operating margins compress to 27-28% under integration costs and competitive pricing pressure, free cash flow margins fall short of 40%, and multiples normalize to the mid-20s for legacy security vendors. That puts the stock at $150-170 in three years.

At $200 today, you’re paying slightly above the midpoint of the base case three years forward. That’s not egregiously expensive for a business of this quality, but it offers no margin of safety for the integration and competitive risks you’re underwriting. You need the bull case, or at least the upper end of the base case, to generate attractive returns from here.

Why Chronosphere Matters More Than the Market Thinks

The strategic logic of the Chronosphere acquisition completes the data plane thesis in a way that CyberArk alone couldn’t. Modern enterprises generate three fundamental data streams: security telemetry (who accessed what, when, and whether it was allowed), identity telemetry (who has privilege to do what), and observability telemetry (is the infrastructure healthy and performing as expected). Legacy architectures treated these as separate domains with separate vendors, separate data lakes, and separate teams.

The AI era breaks that model. When you’re running millions of containers generating exponentially more telemetry than traditional three-tier architectures, observability costs become economically prohibitive with legacy vendors charging per gigabyte ingested. More important, separating security from observability creates blind spots—an application performance issue might actually be a security incident, or vice versa, but siloed data means delayed detection.

Chronosphere, with roughly $160 million in ARR growing triple-digits and serving two of the top five frontier AI model providers, is purpose-built for this scale. The pitch is compelling: PANW can offer network security, cloud security, security operations, identity, and observability from one vendor with one agent fabric, one data model, and one set of AI-powered agents (AgentiX) orchestrating across all five domains.

But here’s where assembly versus architecture matters. CrowdStrike has a single Falcon agent with a unified data model. Wiz has cloud-native architecture built from the ground up. PANW is integrating five different platforms with five different technical foundations and hoping that management excellence and integration discipline can create something that behaves like a unified platform. That’s possible—Cisco pulled it off in networking, Salesforce in CRM—but it requires near-perfect execution and, critically, enough time before competitors close the gap.

The 18-24 month window starting now is decisive. Three specific failure modes could derail the thesis. First, sales force complexity where representatives struggle to carry quota across network security, security operations, identity, and observability while different buyer personas pull in different directions. Second, product integration timelines where unifying the data models and creating genuine cross-platform workflows takes longer than planned, allowing competitors to ship adjacent features faster. Third, customer confusion where enterprises bought “the PANW platform” but now face questions about whether to adopt CyberArk, whether to migrate observability from Datadog, and how much integration actually exists versus marketing promises.

If any of those failure modes materializes meaningfully, you migrate from the base case toward the bear case quickly. The margin for error is thin when you’re already priced at 52x forward earnings.

The Scorecard for the Next Year

Several metrics will clarify which scenario is unfolding well before three years elapse. Platformization momentum needs to sustain—watch for 50-60 net new platformizations per quarter and the mix shifting toward customers buying three or more platforms simultaneously, not just SASE or XSIAM individually. The count of customers spending over $5 million and over $10 million in NGS ARR needs to keep growing 40%+ YoY; if that decelerates sharply, it signals pricing pressure or competitive losses at the high end.

After CyberArk closes in Q3 fiscal 2026, retention and cross-sell metrics matter immediately. If CyberArk standalone retention drops below 90% in the first two quarters, something is breaking in customer confidence or product roadmap. If identity doesn’t start showing up in 20%+ of platformized deals within four quarters of close, the cross-sell thesis isn’t working.

Chronosphere’s post-close trajectory is equally telling. The company needs to sustain 80%+ growth through fiscal 2027 to justify the 21x ARR multiple paid. If growth decelerates to 40-50% within a year, PANW overpaid for a good but not exceptional asset.

Finally, watch the competition. If Microsoft announces an “E5 Security” bundle or CrowdStrike launches an observability module, those are tells about how seriously the market perceives PANW’s platform threat. And watch the margins—if non-GAAP operating margins dip below 28% or adjusted free cash flow margins fall below 37% during integration, management is either underinvesting to protect the numbers or discovering the deals are more dilutive than modeled.

What To Do At $200

Amazon’s 2006 bet on AWS worked because applications actually needed infrastructure, and Amazon built it better and faster than anyone expected. The analogy to Palo Alto Networks is precise: security, identity, and observability applications need data infrastructure, and PANW is betting it can own that layer.

Q1 fiscal 2026 confirmed the business quality is elite—16% growth at $10 billion scale with 30% operating margins and near-40% free cash flow margins is rare. The product traction is real, not vaporware—1,450 platformizations, 470 XSIAM customers cutting median time to respond to under 10 minutes, SASE growing 34% at over $1 billion scale. Management has earned credibility through consistent execution.

But the experiment is priced in. At $200 with 52x forward earnings, you’re paying for successful integration of $13 billion in acquisitions before that integration has been proven. You’re paying for CyberArk and Chronosphere to become genuine growth contributors, not just ARR acquired. You’re paying for Microsoft to stay rational on bundling when the company’s entire cloud strategy depends on winning security spend.

That doesn’t make this a short or even a clear avoid. The business quality is too high and the strategic positioning too compelling to dismiss. But it makes this a “wait for the discount” name, not a “pay any price” compounder.

The real answer comes in 18 months when we see whether PANW’s assembly bet creates a genuine control plane or just an expensive suite of excellent tools. Until then, respect the business, respect the ambition, but wait for the fear before paying for the success.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.