The Re-Wiring of Computing: Zhen Ding's Second Act

A material-science moat, a geopolitical buildout, and a valuation that still reflects the past.

TL;DR

ZDT’s core edge isn’t “PCBs,” it’s manufacturing scale that turns exotic interconnect tech (M9, advanced substrates) into reliable volume production.

“One ZDT” makes hyperscaler procurement simpler and stickier — a single integrated supplier reduces execution risk in AI cluster design.

The market sees margin pressure; the bull case sees a re-rating once AI + substrate revenue crosses the credibility threshold (~25% mix).

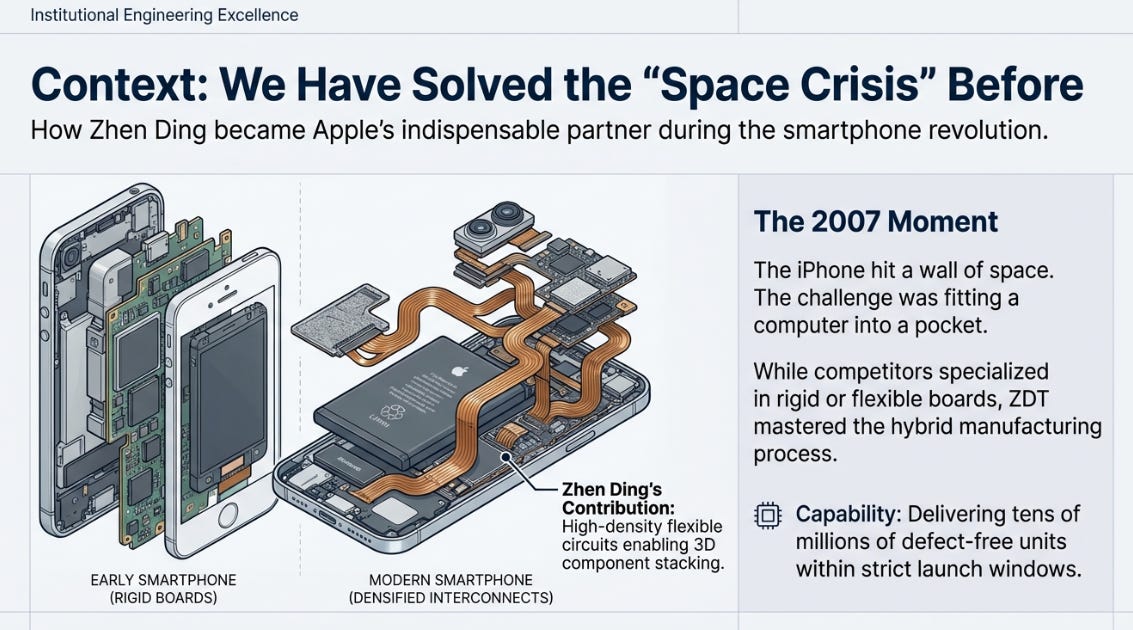

In 2007, the electronics industry hit a wall, not of performance, but of space. When Apple unveiled the iPhone that January, the engineering challenge wasn't just shrinking a computer to pocket size; it was fundamentally rethinking how components could occupy three-dimensional space. The circuit board, that green slab that had cradled chips for decades, had to become something else entirely: it had to bend, fold, and snake through a chassis where every millimeter was contested territory.

Zhen Ding solved this problem. While most PCB manufacturers specialized in either rigid boards or flexible circuits, Zhen Ding recognized that the future belonged to companies that could master both, and everything in between. They became Apple's indispensable partner not through a single breakthrough, but by building a manufacturing system that could deliver tens of millions of defect-free flexible circuits within the brutal launch windows of the smartphone era.

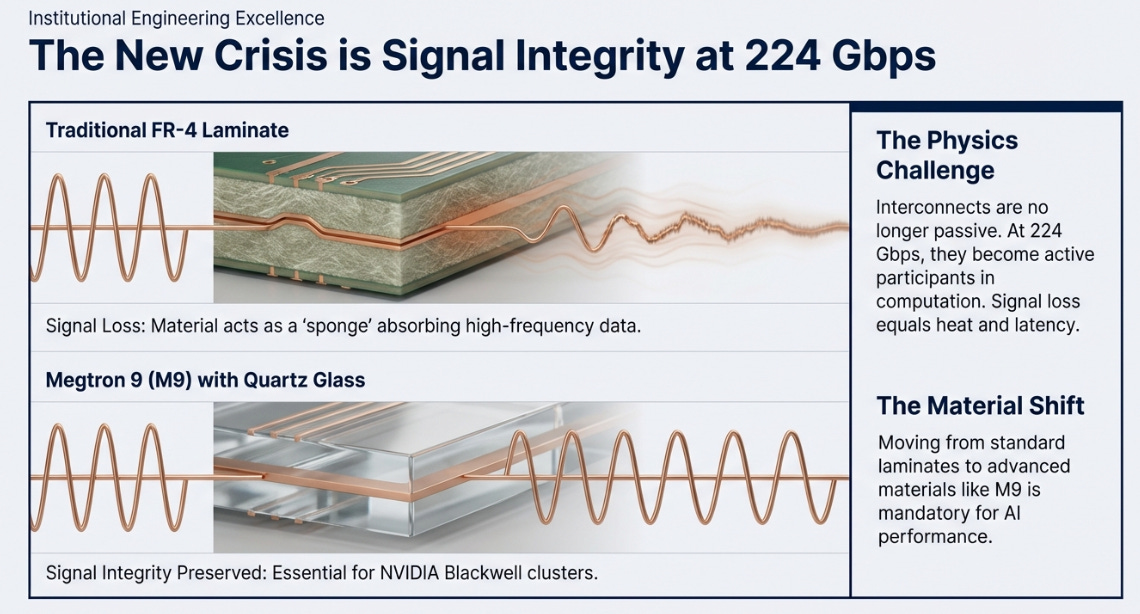

Today, the industry faces a different kind of space crisis. The challenge isn't fitting a computer into your pocket; it's moving unfathomable amounts of data through an AI cluster at 224 Gbps. The interconnects linking NVIDIA's Blackwell GPUs aren't just passive highways, they're active participants in computation, their material properties determining whether signals arrive intact or dissolve into heat. Once again, the physical foundation of computing is being rewritten. And once again, Zhen Ding is positioning itself as the architect.

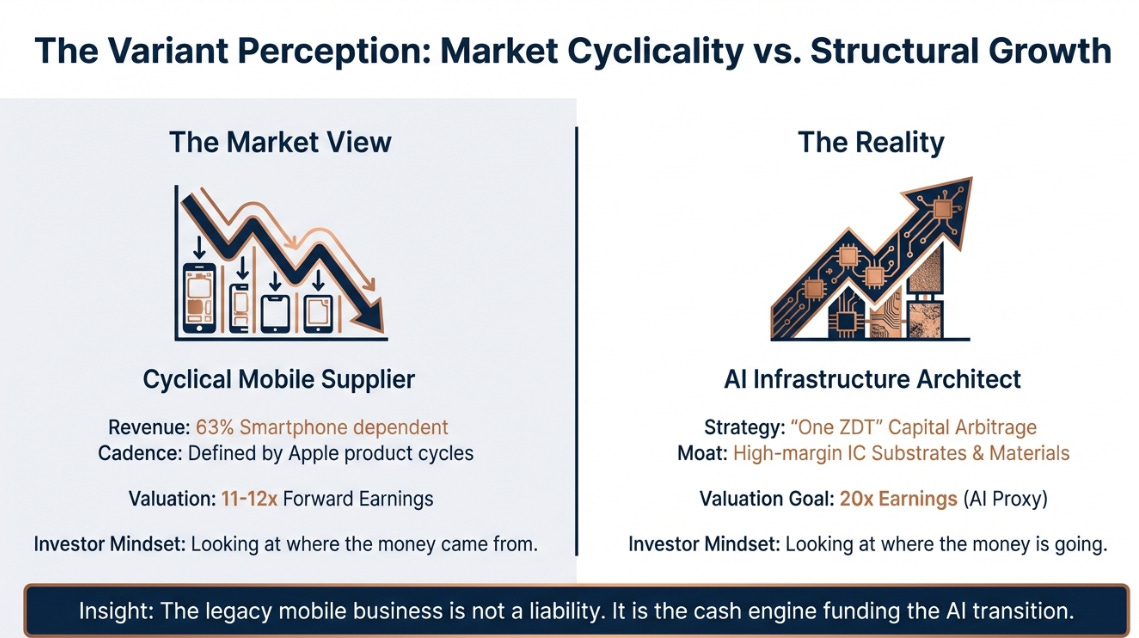

The Variant Perception

The market still sees Zhen Ding as a cyclical mobile component supplier, priced accordingly at 11-12x forward earnings. This isn’t entirely unfair, 63% of revenue still flows from smartphones, and the Apple relationship defines the company’s quarterly cadence. But this view captures where the money has come from, not where it’s going.

The variant perception is this: Zhen Ding isn’t pivoting away from mobile; it’s leveraging mobile’s massive cash flows to build a moat in AI infrastructure that pure-play competitors cannot match. The “One ZDT” strategy, offering every interconnect solution from flex circuits to advanced IC substrates, isn’t just a bundling tactic; it’s a capital arbitrage play. The company uses its high-volume, lower-margin FPC business to subsidize entry into capital-intensive, high-margin markets where Japanese incumbents have historically dominated.

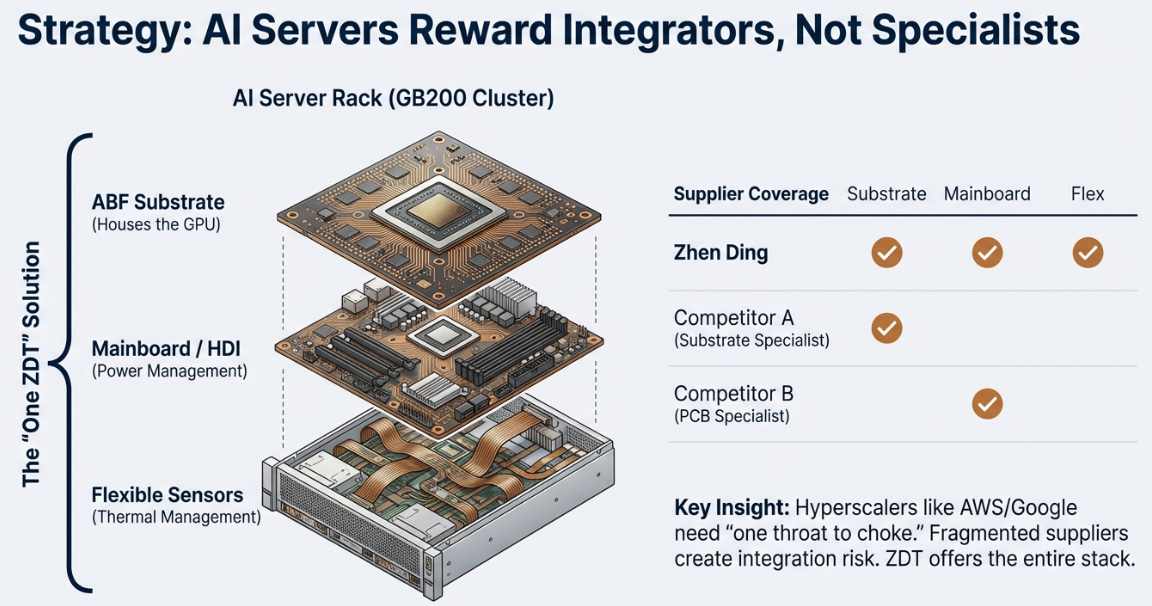

This matters because the AI server market doesn't reward specialists, it rewards integrators. When a hyperscaler like AWS designs a GB200 cluster, they need more than just a 78-layer server board. They need the ABF substrate that houses the GPU, the HDI boards for power management, and the flexible circuits for thermal sensors. Fragmented suppliers create fragmented risk. Zhen Ding offers a single throat to choke, and that's sticky in a way specialized competitors can't replicate.

The Material Science Moat

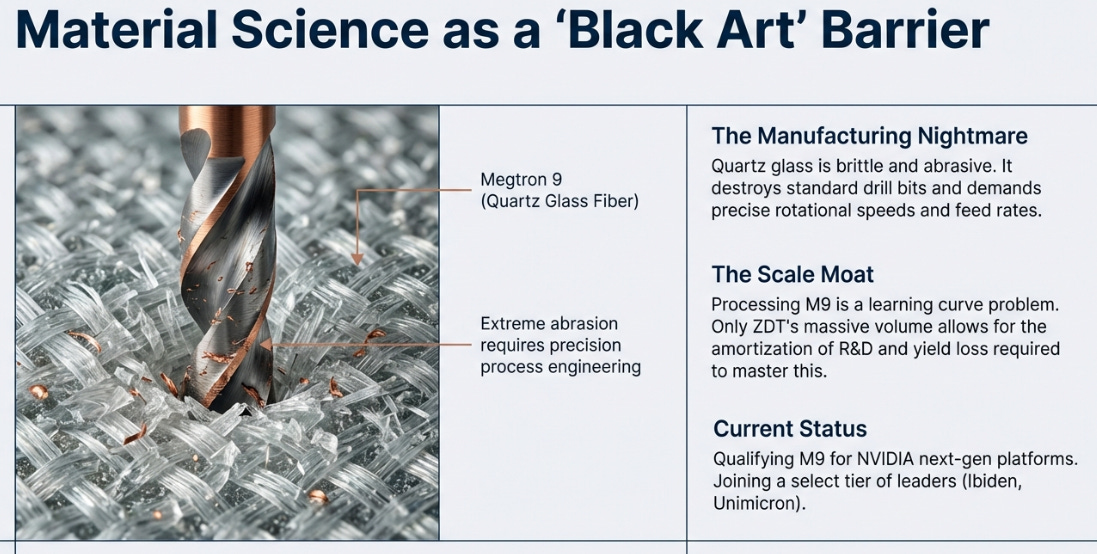

The transition to 224G signaling is fundamentally a material science problem. Traditional FR-4 laminate acts like a sponge at these frequencies, absorbing signals and converting them to heat. The solution is Megtron 9 (M9), a material using quartz glass fiber that maintains signal integrity but introduces a manufacturing nightmare. Quartz is brittle, abrasive, and destroys standard drill bits. Mastering its processing requires a different level of process engineering, what the industry calls “black art.”

This is where Zhen Ding’s scale becomes its technical barrier. Only companies running massive production volumes can amortize the R&D costs and yield learning curves associated with M9. The company is now qualifying M9 materials for NVIDIA’s next-generation platforms, joining a handful of Japanese and Taiwanese leaders who can realistically compete at this tier.

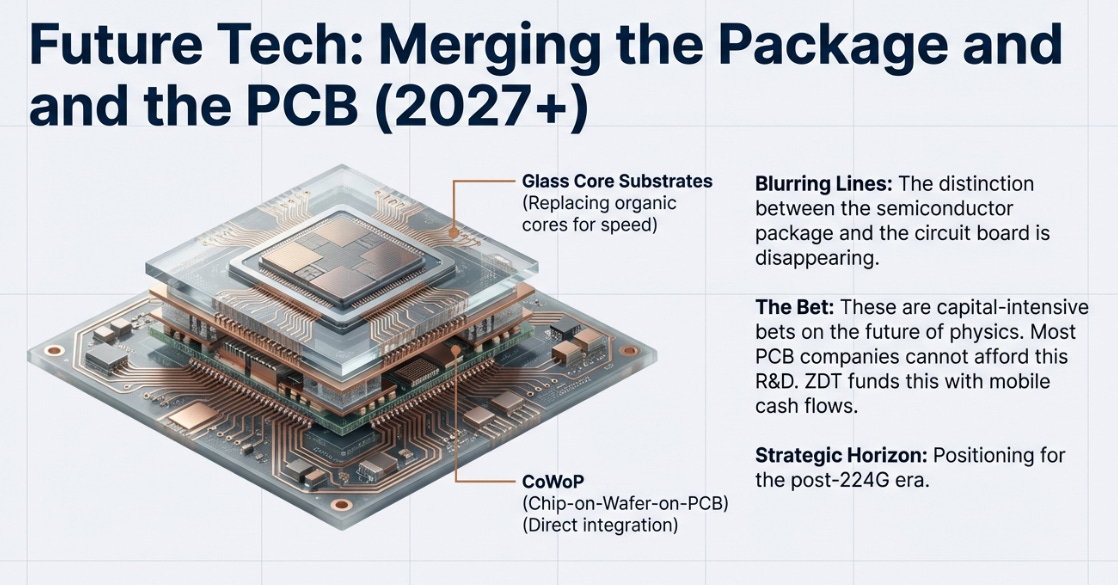

Looking further out, Zhen Ding is exploring Glass Core Substrates and CoWoP (Chip-on-Wafer-on-PCB), technologies that could merge the circuit board with the semiconductor package itself. These aren't incremental improvements, they're bets on a future where the distinction between substrate and board disappears. Most PCB companies can't afford these bets. Zhen Ding can, because its legacy business prints cash.

The Geopolitical Admission Fee

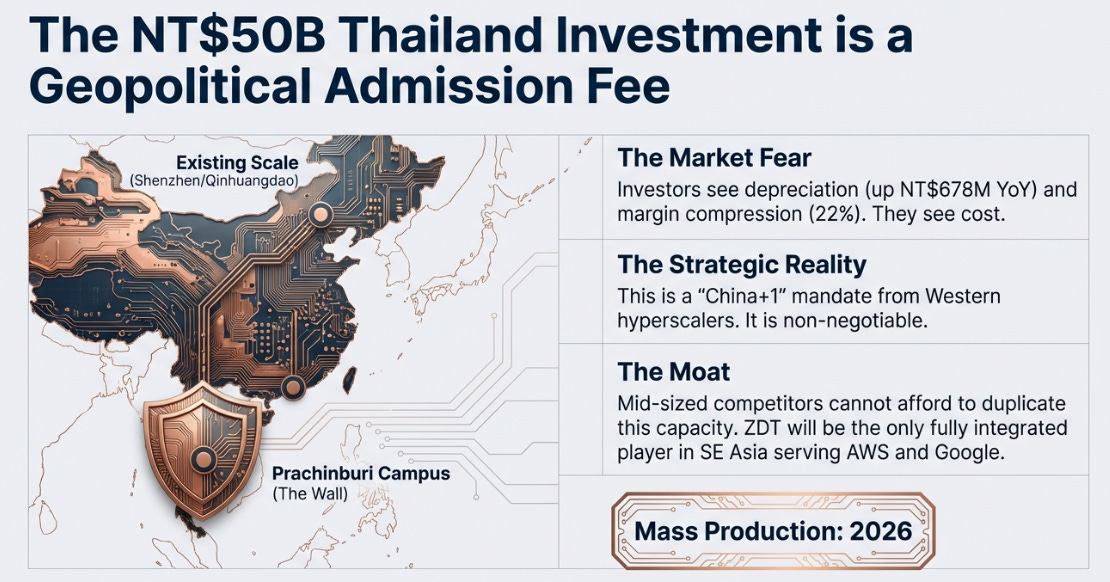

Technical brilliance alone isn’t sufficient in this decade. Success requires a geopolitical insurance policy, and that insurance isn’t cheap. Zhen Ding’s NT$50+ billion investment in its Thailand facility, scheduled for mass production in 2026, is the entry fee for remaining a global player. Western hyperscalers and automotive OEMs have made “China+1” sourcing mandates non-negotiable.

The market sees this investment cycle as margin compression. Depreciation already increased NT$678 million year-over-year in first-half 2025, dragging gross margins down to 22%. But this misunderstands the nature of the spending. Zhen Ding isn’t maintaining capacity; it’s building a wall. The Thailand plant replicates the scale and sophistication of its Chinese campuses, creating a geographic moat that midsize competitors simply cannot afford. While peers scramble to find partners in Southeast Asia, Zhen Ding will own a fully integrated facility serving AWS, Google, and Tesla directly.

Three-Year Valuation: Where the Story Meets Math

By January 2029, the market will have resolved its perception problem. Here’s how the scenarios could play out:

Bull Case: NT$250+ (70%+ upside)

Revenue CAGR: 15-20%, driven by AI server revenue doubling and IC substrates growing at 50% CAGR through 2027

Gross Margin: 25-28% as Thailand utilization hits 90%+ and ABF substrate yields reach 90%+

Re-rating: Market recognizes Zhen Ding as an “AI Pure-Play” proxy, awarding 20x P/E

Key Assumption: Zhen Ding displaces a Japanese incumbent for NVIDIA’s next-gen chip substrate, locking in a multi-year allocation

Base Case: NT$180-200 (25-30% upside)

Revenue CAGR: 8-10%, with “One ZDT” capturing 10% global PCB market share

Gross Margin: 22-24% as Thailand ramps smoothly and depreciation headwinds normalize

Re-rating: Multiple expands to 15x P/E as AI/Substrate revenue crosses 25% of total mix

Key Assumption: No major customer wins, but no share loss either; Apple relationship remains stable

Bear Case: NT$110-120 (20-30% downside)

Revenue CAGR: 0-3%, with weak iPhone 17 cycle and Thailand yield delays

Gross Margin: 15-17% as fixed costs overwhelm pricing power

De-rating: Multiple compresses to 8-10x P/E as market questions execution

Key Assumption: Geopolitical escalation forces premature China shutdown before Thailand is qualified

What to Watch

The thesis evolves on four key data points:

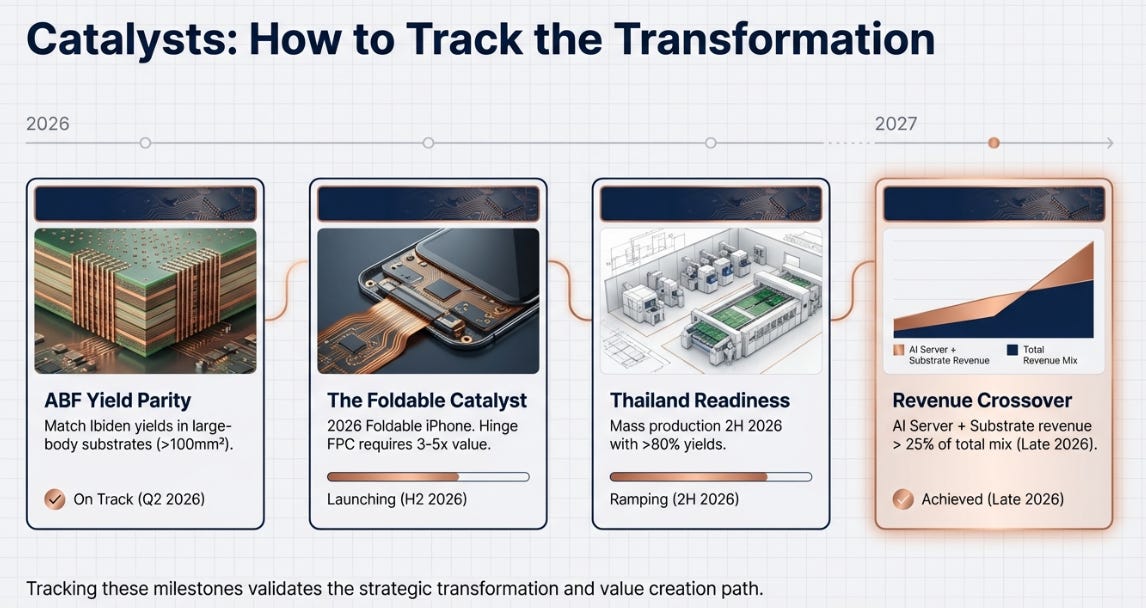

ABF Yield Parity: Confirmation that Zhen Ding’s Kaohsiung and Thailand sites have achieved yield parity with Ibiden in large-body substrates (>100mm²). This is binary, either they can compete at the highest tier or they can’t. Watch margin expansion in 2H 2026 for evidence.

The Foldable Catalyst: A 2026 foldable iPhone launch would be a content multiplier unlike anything in recent memory. The hinge alone requires 3-5x the FPC value of a standard phone. This would turbocharge the mature mobile business, funding even more aggressive AI investments.

Revenue Mix Crossover: The quarter when AI Server + IC Substrate revenue exceeds 25% of total will be the inflection point. At that moment, the narrative becomes undeniable. Current trajectory suggests this happens in late 2026 or early 2027.

Thailand Operational Readiness: Mass production must begin in 2H 2026 with yields above 80%. Any delay beyond Q4 2026 leaves the company exposed to geopolitical risk and risks losing design wins to competitors like Gold Circuit Electronics, which already has Thai capacity.

Conclusion

Zhen Ding is undergoing its second metamorphosis. The first transformed it from a regional PCB supplier into the backbone of the smartphone revolution. The second will transform it from a mobile component maker into a critical enabler of accelerated computing.

The market’s hesitation is understandable, the financial statements still look like a cyclical manufacturer navigating a heavy investment cycle. But the operational data tells a different story. Record revenue in Q4 2025, 70% growth in server/automotive, 90%+ utilization in BT substrates, these aren’t the metrics of a company in decline.

The current valuation essentially gives investors the mature, cash-generative mobile business at fair value, while throwing in the AI infrastructure and advanced packaging transformation for free. That’s the kind of asymmetric setup that appears when the market lags reality by 18-24 months.

For those willing to look past near-term margin friction, Zhen Ding offers something rare: a proven execution machine captureing a structural tailwind that its own scale makes possible. The company isn’t just riding the AI wave. It’s building the physical foundation upon which the entire industry will surf.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.