Rheinmetall Q3 2025 Earnings: When Industrial Physics Meets Strategic Narrative

Margins compress, cash burns, and Europe’s flagship defense prime discovers the limits of being indispensable.

TL;DR:

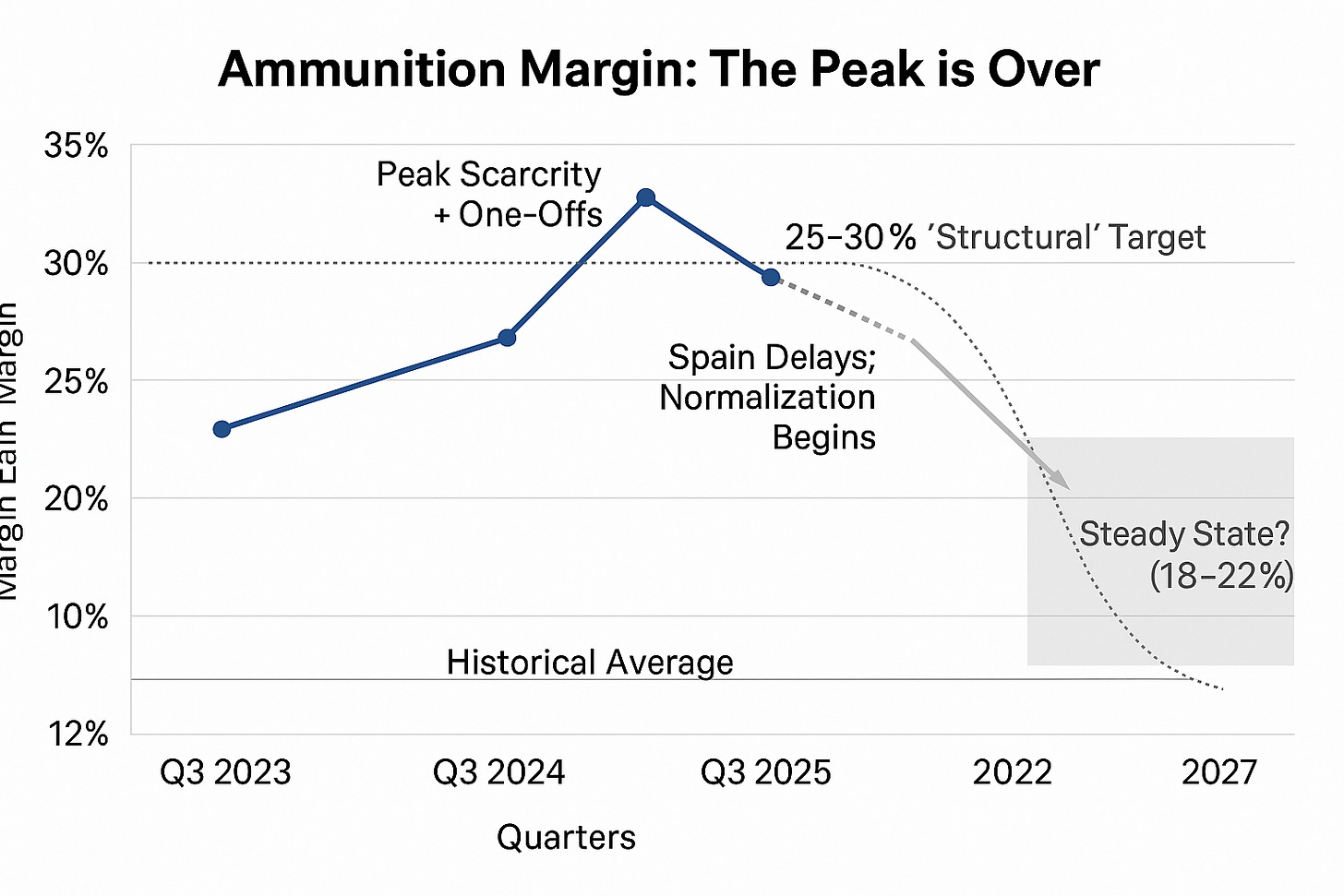

Margins signal the truth: 330 bps ammunition margin compression shows scarcity rents fading faster than management guidance admits.

Backlog ≠ cash: A €64B backlog masks an €813M cash burn and outsized reliance on Q4 prepayments.

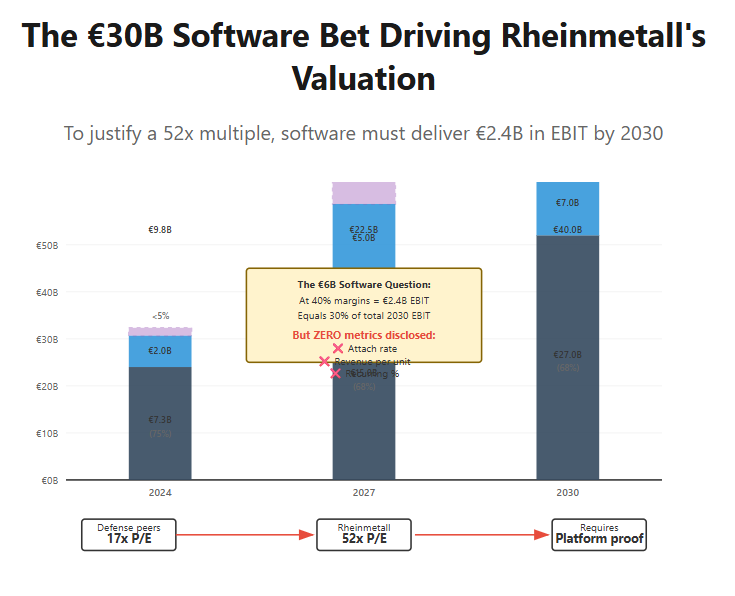

Valuation vs physics: At 52× earnings, flawless execution is priced in—execution strain is not.

Bloomberg reported on November 7th that Rheinmetall AG posted third-quarter defense sales of €2.3 billion, up 17% YoY, while reaffirming full-year guidance. Order intake fell 36% amid German election delays. The defense contractor’s backlog reached €63.8 billion, but operating cash flow was deeply negative at -€813 million through nine months.

This is the quarter where narrative met reality. The revenue growth is strong and the backlog represents a dream scenario for any defense contractor, yet the cash flow statement reveals a company straining against execution limits. Most telling is the 330 basis point margin compression in the ammunition segment during peak shortage conditions. That’s not merely start-up costs; that’s scarcity rent evaporating in real-time as competitive capacity begins to emerge.

The fundamental question facing Rheinmetall is whether it can manage the brutal complexity of rebuilding Europe’s defense industrial base almost single-handedly without buckling under its own success. The company has positioned itself at the center of European rearmament, but Q3 reveals the difference between winning contracts and converting them to cash.

The Margin Signal That Matters

The headline that should be leading every analyst report is the Weapon & Ammunition segment margin compression from 26.5% to 23.2%, a decline of 330 basis points. Management attributed this to Spain facility permit delays and new plant start-up costs, with CEO Armin Papperger assuring investors that “we are on a very good way in that area.”

What he’s really communicating is that this friction is temporary and investors should trust the 25-30% structural target. What the data actually reveals is scarcity rent evaporating. When you lose 330 basis points during peak demand shortage—before KNDS, BAE, and Hanwha bring competitive capacity online—the steady-state margin structure is revealing itself early.

Traditional ammunition manufacturers operate at 8-12% margins. Rheinmetall’s vertical integration through in-house propellants, energetics, and casings creates structural advantage, but “structural” in this context likely means 18-22%, not the 25-30% management targets. That’s still an excellent margin profile, but it fundamentally reprices the stock from 52x to 30-35x forward earnings.

Papperger emphasized the company’s shift toward “smart” ammunition with fuzes and guidance systems, as well as air defense systems that command higher margins. While this mix shift is real, these programs require 24-36 months to scale meaningfully. The Q3 margin is showing investors what 2027’s reality looks like today.

The Backlog Paradox

A €64 billion backlog sounds like an unmitigated asset, but Rheinmetall is learning that a backlog is actually a promise to deliver that consumes massive resources before generating cash. Through nine months, the company burned €813 million in operating cash while reporting record profits. As CFO Klaus Neumann explained, “As order intake was lower than previous year, we also did not see the large prepayments that we enjoyed in 2024.”

The translation is straightforward: Rheinmetall built over €2 billion in inventory for orders they expect in Q4. If German election timing causes these orders to slip, the company faces a significant working capital problem. This creates a binary event for Q4 that will determine the stock’s trajectory for the next six months.

Papperger detailed the expected Q4 German orders, including €3.4 billion for Jackal tactical vehicles (already signed), €1.4 billion for PUMA IFV upgrades, various international Lynx IFV contracts worth over €400 million, Leopard 2 upgrades at €500 million, a massive €6 billion 155mm ammunition framework, €3 billion for Skyranger and air defense systems, and a €2 billion ICEYE satellite program. The total approaches €15-17 billion.

More importantly, Papperger noted the company is in negotiations “to get between 20% and 30%” prepayments, suggesting a potential €3 billion cash influx. The math is straightforward: €15-17 billion in orders with 25% prepayment generates €3.75-4.25 billion in immediate cash. If this materializes in Q4 or early Q1, cash flow swings violently positive, validating the bull thesis and sustaining the premium multiple. If orders slip to Q1-Q2 2026, the market will question both liquidity and backlog quality, compressing the 52x multiple despite an unchanged strategic position.

The Missing Platform Metrics

Rheinmetall trades at technology company multiples: 52x next twelve months earnings versus a 17x defense peer median, based on a platform transformation thesis. The substance behind this narrative exists in the form of the TaWAN digitization program with its €7.5 billion 10-year framework, open architecture initiatives for vehicle digitization and battlefield management systems, and the ICEYE joint venture for space-based ISR with potential recurring data subscriptions.

To justify this valuation premium, however, the market needs three specific metrics in every quarterly report: attach rate showing the percentage of vehicles with digital subscriptions, revenue per node indicating recurring revenue per platform, and software/services as a percentage of total revenue, which currently sits below 5% with a target of 10-15% by 2027.

These economics are currently buried within the Electronics Solutions segment’s 11% margin rather than being broken out for investor analysis. If software and services reaches 10% of sales by 2027 at 40% or higher gross margins, that adds 100-200 basis points to group EBIT margin and justifies a premium multiple even as ammunition margins normalize. Until management publishes these KPIs, however, the “platform” story remains narrative rather than a demonstrable P&L reality.

Papperger acknowledged that “on the digitization side, we have to grow... this will be on the same level or higher than air defence” but provided no specifics on monetization mechanics or attach rates. This opacity around the very metrics that justify the valuation premium should concern investors.

Capital Allocation Concerns

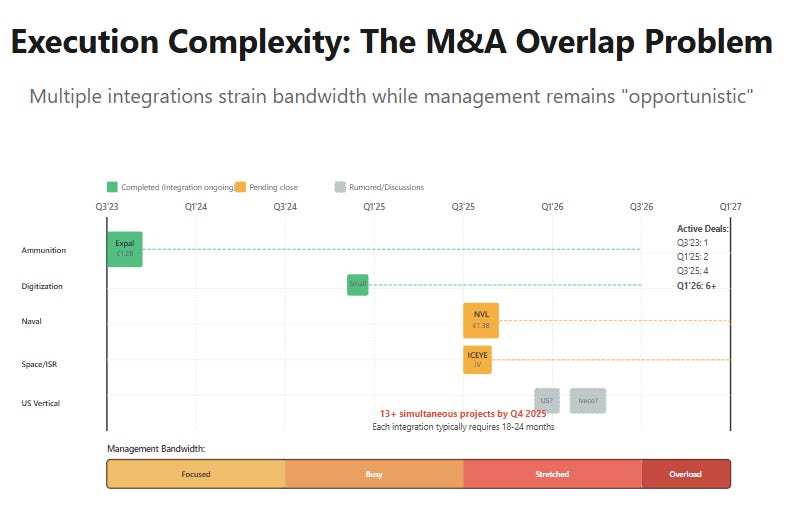

Over the past 18 months, Rheinmetall has announced a dizzying array of partnerships and acquisitions: a Lockheed Martin rocket motor joint venture, an Anduril autonomous systems partnership, the ICEYE space/ISR joint venture with a 40% stake targeting €2 billion in German contracts, and most recently the €1.3 billion acquisition of Lürssen Naval Vessels closing in Q1 2026, with ongoing discussions regarding Iveco defense trucks.

The naval acquisition deserves particular scrutiny. Papperger’s pitch centers on vertical integration opportunities: “The combat management system, the sensor and radar system, the weapon systems... are a huge amount of money where we can make in Rheinmetall some vertical integration.” The revenue bridge envisions growth from €1.3 billion in 2025 to €5 billion by 2030, with €3 billion coming organically and €2 billion from these integration “synergies.” The margin is expected to expand from 10-11% currently to 15% by 2030.

The playbook appears straightforward: acquire “dumb” capacity in hull fabrication, integrate high-margin systems including weapons, missiles, and combat management, then cross-utilize shipyard capacity for armored vehicle chassis. At approximately 4.5x EBITDA on €300 million run-rate EBITDA, the price seems reasonable in isolation.

Yet when pressed on how Rheinmetall will convince navies to replace proven Raytheon and Thales systems with their alternatives, Papperger deflected: “We are not at the moment in negotiations... first of all, we need closing.” This suggests the €2 billion synergy number remains entirely theoretical until proven with actual customer contracts.

More telling is the signal sent by the seller. The Lürssen family has built naval vessels for over 150 years. Their decision to sell at cycle peak to a buyer trading at 52x earnings tells you something about relative cycle-timing instincts.

When asked about M&A discipline, Papperger responded that “we remain opportunistic. With our stock price and strategic position, we’d consider larger deals if they make sense.” This isn’t a framework—it’s deal addiction. The appropriate response would establish clear boundaries: pausing M&A at 2.0x net debt/EBITDA or committing to no acquisitions until naval integration is complete and free cash flow normalized. Great acquirers often struggle most with knowing when to stop acquiring.

Reading Between the Lines

Management communication this quarter revealed as much through tone as content. Papperger’s assertion that “around €80 billion is a fair value” for year-end backlog signals confidence in direction while building in wiggle room on timing, particularly with his caveat “don’t hit me if it’s 78 or 82.” CFO Neumann’s explanation that cash flow negativity stemmed from “buildup of inventory and lower prepayments” frames the issue as timing rather than demand.

The emphasis on prepayment negotiations, with Papperger noting they’re working “to get between 20% and 30%,” reveals management’s awareness that contract structure drives stock performance more than headline order values. His comments on naval synergies, deferring customer negotiations until after closing, acknowledge that the €2 billion synergy projection remains entirely theoretical.

Perhaps most concerning was the response on M&A strategy. “We remain opportunistic” isn’t a capital allocation framework when you’re managing thirteen simultaneous integration projects.

The 2030 Bridge Requires Extraordinary Execution

Management’s €45-50 billion revenue target for 2030 requires threading multiple needles simultaneously. Germany must deliver sustained €15 billion or higher annual orders, international wins must materialize at scale, Naval must achieve its €5 billion target, ammunition margins must stabilize above 20%, and finally, the company must avoid major delays across its 13+ simultaneous projects.

Compound these probabilities and you get approximately stiff odds of perfect execution. The market’s current pricing implies high execution certainty. That gap represents the valuation disconnect.

The Reality Check Quarter

Rheinmetall is executing the most important industrial transformation in European defense since the end of the Cold War; rebuilding sovereign capacity that governments publicly committed to but privately doubted was achievable. The backlog is real, policy support appears durable, and the vertical integration strategy creates meaningful competitive moats.

At 52x next twelve months earnings, however, the stock price demands perfect execution across cash conversion, margin sustainability, M&A integration, and platform monetization. Successfully delivering on four of five dimensions might generate 15-20% returns. Missing on two could result in a 30-40% drawdown.

The path to €45-50 billion in revenue won’t follow a clean upward trajectory: it’s a messy, cash-intensive slog through industrial physics and execution complexity. Q3 provides the first concrete evidence of this reality through margin compression, cash burn, and visible execution strain.

The market priced a victory parade. The company is fighting in industrial trenches. The distinction matters enormously for forward returns.

Watch Q4 order announcements and—critically—the prepayment terms disclosed in the annual report. The backlog tells you what Rheinmetall will accomplish eventually. The cash flow tells you what it can accomplish now. At this valuation, that temporal distinction makes all the difference.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.