Rubrik Q3 FY26 Earnings: The Janitor Who Became the Bodyguard

From backup vendor to security platform, Rubrik’s quarter shows the business model—and the narrative—have fundamentally changed.

TL;DR:

The metadata moat emerges: Rubrik’s “master keys” data lets it do what endpoint vendors can’t—time-travel a compromised identity system.

Financial inflection: Contribution margins hit +10% while ARR growth stays above 30%, killing the “unprofitable storage vendor” bear case.

Security-led expansion: With 40% of NRR coming from security, Rubrik is repositioning itself into CrowdStrike/Datadog territory.

“Bad actors don’t break in. They log in.”

That line from CEO Bipul Sinha on Rubrik’s Q3 earnings call captures the strategic shift better than any metric in the release. For a decade, Rubrik was the digital janitor—storing old files, managing backups, cleaning up messes. Now they’re selling a different product entirely: the ability to survive when attackers are already inside.

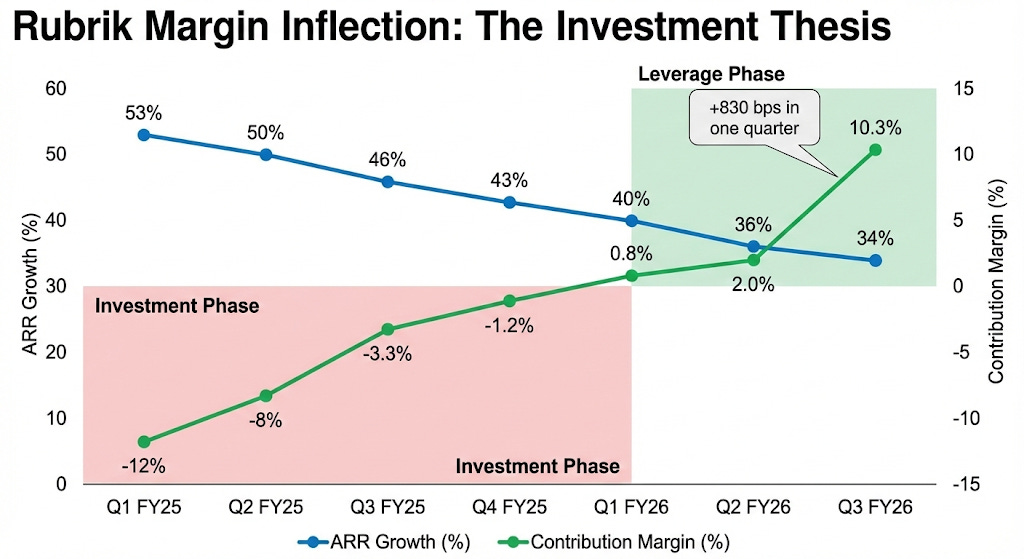

My immediate reaction to the quarter wasn’t the revenue beat—high-growth software companies are supposed to beat revenue estimates—but rather the metric Rubrik chose to emphasize: Subscription ARR Contribution Margin.

This is telling. Companies highlight what they want you to see. For two years, Rubrik buried this number because it was negative, fueling the narrative that growth was unprofitable. Now they’re leading with it. A year ago: negative 3%. Last quarter: positive 2%. This quarter: positive 10%. That’s a 1,400 basis point swing in twelve months.

When a company starts promoting a metric they previously hid, pay attention. The story is changing.

The Master Keys

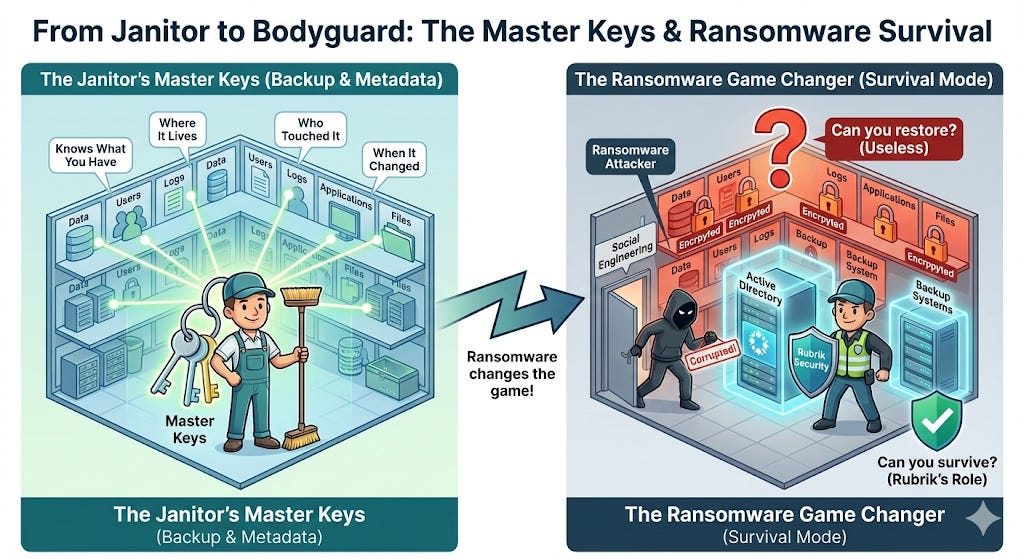

While being the janitor, Rubrik realized something important. They had the master keys to every room in the building. Because they back up everything, they know what data you have, where it lives, who touched it, and when it changed. That metadata—the time-series index of enterprise state—turns out to be more valuable than the backups themselves.

Then ransomware changed the game. Modern attackers don’t exploit software vulnerabilities—they exploit humans. They call help desks, impersonate employees, obtain legitimate credentials through social engineering. Once inside, they dwell for weeks, compromise the backup systems first, target Active Directory to lock administrators out, and only then execute the attack. By then, every backup is already corrupted.

Traditional backup is useless against this threat. The question is no longer “can you restore?” It’s “can you survive?”

When Margins Start Compounding

The contribution margin progression tells the real story:

Two things stand out. First, ARR growth is decelerating—from 53% to 34% over seven quarters. This is normal base effect math at scale. Second, and more important, profitability is accelerating far faster than growth is slowing. The company went from negative 12% contribution margin to positive 10% in less than two years. The margin jumped 830 basis points in Q3 alone.

This is the “Amazon AWS 2006” pattern. Heavy platform investment suppresses margins during the build phase. Once the platform scales, the marginal cost of adding the next ARR dollar drops precipitously. CFO Kiran Choudary explained: “The improvement in subscription ARR contribution margin was driven by higher sales, the benefits of scale, and improving efficiencies.”

I believe the bear case on Rubrik: that it was burning cash to buy revenue in a commoditized market, died this quarter. Management raised full-year FCF guidance by 32%, from $150 million to $198 million. That’s not fine-tuning; that’s a structural break.

The Security Pivot

The second metric Rubrik emphasized was new: security products now contribute over 40% of net revenue retention, up from 32% a year ago.

This is deliberate reframing. NRR itself (above 120%) hasn’t changed much. But the composition has. When security contributes 40% of expansion, customers aren’t buying more storage capacity. They’re buying capabilities. They’re expanding from “backup vendor” to “security partner.”

The Identity product—launched just over three quarters ago—is already at ~$20 million ARR. More striking: 40% of new identity customers were net new to Rubrik. CISOs went looking for identity resilience and found Rubrik directly, bypassing the traditional IT storage buyer entirely.

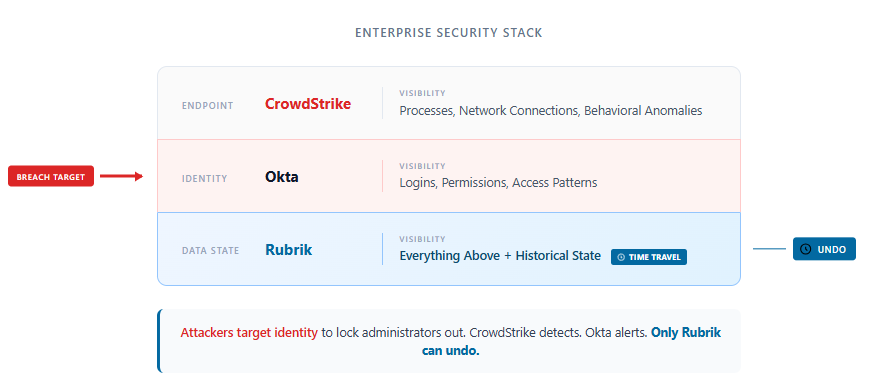

This is where a competitive deep-cut matters. Consider CrowdStrike, the dominant endpoint security vendor. CrowdStrike’s Falcon platform excels at detecting intrusions—it sees processes, network connections, and behavioral anomalies across endpoints. But when Scattered Spider compromises Active Directory and creates rogue admin accounts, CrowdStrike can alert you that something suspicious happened. It cannot restore Active Directory to its pre-attack state. It cannot tell you which of your 50,000 user accounts were modified three weeks ago by an attacker dwelling in your network.

Why? Because CrowdStrike doesn’t have the data. Endpoint telemetry doesn’t include the historical state of directory services, database contents, or file system snapshots. Rubrik does. The competitive moat isn’t feature functionality—it’s the underlying data architecture. You cannot bolt on time-travel capabilities to an endpoint agent.

Sinha described a customer win that illustrates this: “A European customer was really worried about Scattered Spider because one of their suppliers got hit. They bought Identity Resilience to protect their Active Directory.” That’s not a storage sale. That’s a security sale to a CISO responding to a specific threat that CrowdStrike cannot address.

The FY27 Accounting Trap

Here’s where the metrics detective work gets interesting. Management spent unusual time on the call pre-explaining why FY27 revenue growth will look weak.

Choudary was explicit: “In fiscal 2027, we anticipate that revenue growth on a reported basis will lag Subscription ARR growth by a few percentage points, primarily due to headwinds from material rights.”

The accounting mechanics matter. During Rubrik’s cloud transition, they incentivized customers to switch from on-premise appliances to cloud subscriptions. Under ASC 606, when a customer converts and receives “material rights” to future services as part of the deal, Rubrik must recognize some revenue upfront—about $68 million in FY26. As the conversion cohort matures, this front-loaded revenue disappears from the compare. The underlying subscription business keeps growing; the reported revenue number temporarily lags.

Why flag this now, during a blowout quarter? I think management is pre-establishing the narrative because they know algorithms will sell the headline. Sometime in mid-2025, Rubrik will report revenue growth decelerating from the mid-40s to the mid-20s. The actual subscription ARR will still be growing above 30%. But the stock will drop anyway.

This is smart investor relations from a management team with credibility to spend. They’ve beaten revenue estimates by 7-10% every quarter since IPO—a suspiciously consistent range that suggests deliberate sandbagging. When management who consistently under-promises tells you “next year’s revenue will look bad due to accounting,” believe them.

The AI Narrative (And Its Purpose)

Sinha made an aggressive claim: “Our mission is to lead Rubrik into our next era as, let me repeat—the security and AI operations company.”

The “let me repeat” is doing work here. Sinha is trying to force a narrative change, to make analysts and investors update their mental model of what Rubrik is. Currently, Rubrik sits in “storage and data protection” coverage universes, compared to Commvault and Cohesity. Sinha wants it in “security and AI infrastructure,” compared to CrowdStrike and Datadog.

But here’s the honest assessment: Rubrik’s AI revenue is zero. The product, Rubrik Agent Cloud, is in beta. The addressable market—enterprises deploying autonomous AI agents that need governance and rollback capabilities—barely exists today.

What would need to be true for this to matter? First, enterprises would need to actually deploy agentic AI at scale, not just copilots and chatbots. Second, those agents would need to modify critical systems—databases, file shares, identity directories—in ways that create real rollback requirements. Third, Rubrik would need to build agent-specific monitoring and remediation capabilities, not just repurpose existing backup infrastructure. None of these conditions are met today.

So why make the claim now? I believe it serves two purposes. First, it’s genuine optionality—if agentic AI does proliferate, Rubrik’s architecture is well-positioned. Second, and more immediately, it’s a narrative shield. By positioning as “AI operations,” Rubrik justifies a premium multiple (12x revenue) versus storage peers (6x revenue). The AI story doesn’t need to generate revenue; it just needs to prevent multiple compression.

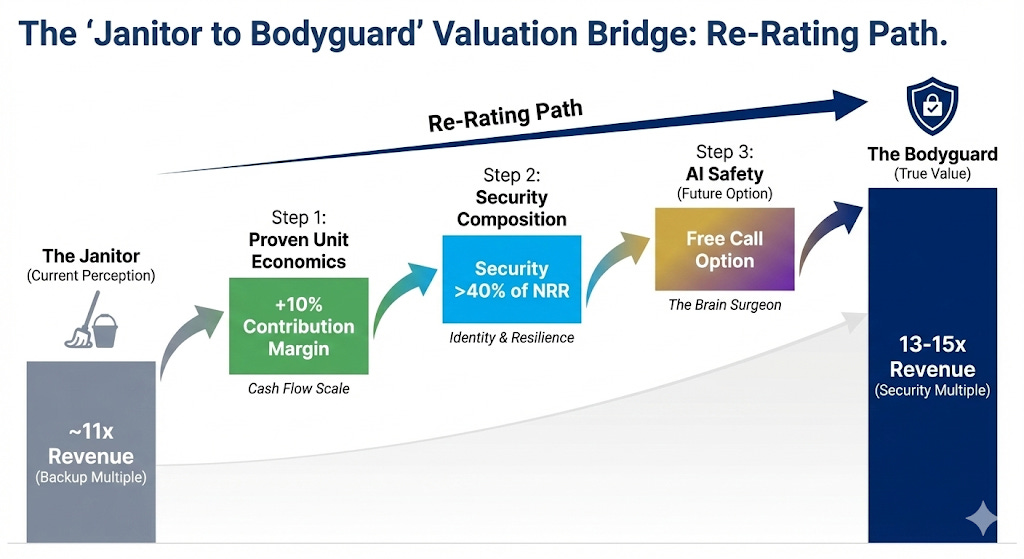

The valuation progression maps cleanly: Janitor (6x) → Bodyguard (12x) → Brain Surgeon (20x). The stock currently prices the bodyguard. The brain surgeon is free optionality—but investors should be clear-eyed that it’s optionality, not a base case.

Management’s Track Record

Revenue beats are remarkably consistent—always 7-10%. That’s not variance; that’s deliberate guidance-setting. EPS beats are accelerating. The swing to profitability wasn’t a surprise to anyone tracking the trend—it was the logical endpoint of four consecutive quarters of improvement.

Strategic Implications

Rubrik has crossed from “show me” to “prove it scales.” The unit economics are no longer in question. The security pivot is working—40% of NRR from security, identity landing new logos directly, competitive wins against native cloud tools.

The variant perception is straightforward: the market prices Rubrik as a backup company at 11x ARR. The financials increasingly show a security company, which would trade at 13-15x among peers. I believe the categorization will break when security contribution exceeds 50% of NRR, likely by mid-FY27.

Three years out, if the thesis plays out: subscription ARR approaching $3 billion, FCF margins in the mid-20s, and a stock price of $150-180.

The metrics to track: NRR composition (security should exceed 50% by FY27), identity ARR ($150M+ by FY28), and contribution margin (15%+ by FY28). If these trends hold, the re-rating is when, not if.

Rubrik spent a decade as the janitor, quietly collecting the master keys. Now it’s the bodyguard, and the market is slowly noticing.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

Brillant breakdown of the janitor-to-bodyguard reframing. The part about CrowdStrike not having the underlying data architecutre to restore compromised AD really cuts to the core of why Rubrik's metadata moat isn't just defensible but structuraly unique. What's underappreciated here is how the FY27 accounting headwind you flagged becomes a rare information asymmetry opportunity, since most algos will trigger on headline deceleration without parsing the material rights noise. The progression from storage peer pricing (6x) to security peer pricing (13-15x) feels like next year's obvious trade once security NRR contribution crosses 50%.