Rubrik's Q2 FY26 Earnings

Q2 FY26 proves the cyber resilience engine can fund AI ambitions, but can Rubrik build a control plane before cloud providers achieve 'good enough'

TL;DR:

Core business proven: Q2's 19% FCF margins and 44% clean growth (ex-one-time factors) demonstrate Rubrik's cyber resilience platform generates sustainable cash flow to fund AI expansion

AI strategy tangible but early: Predibase acquisition and Agent Rewind launch show real progress toward data governance for AI operations, but monetization timeline extends into FY27-28

Valuation hinges on execution: Updated price targets range $65-230 depending on whether AI products achieve meaningful attach rates (>15%) and platform cross-selling accelerates over next six months

Amazon's 1Q 2006 Problem

"Revenue rose 51% to $310M and free cash flow hit $57.5M (19%) as Rubrik raised its full-year outlook." — Bloomberg

In the spring of 2006, Amazon's CFO Tom Szkutak faced what seemed like a routine analyst question during the company's Q1 earnings call. Brian Pitz from Banc of America Securities wanted to know about something called "Other" revenue, which had jumped to $54 million from $14 million the previous year. Szkutak's response was deliberately vague: "Other is a combination of a lot of different things... it's hard to break out." Wall Street largely ignored this exchange, focusing instead on retail margins, fulfillment costs, and competition with Barnes & Noble.

What analysts didn't realize was that buried in that $54 million "Other" line item was the earliest revenue from Amazon Web Services—a business that would eventually dwarf Amazon's retail operations and transform enterprise computing. Jeff Bezos was using the profits and operational excellence of his established e-commerce engine to quietly build the infrastructure for an entirely different company. The market was measuring Amazon against traditional retailers when they should have been evaluating it as an emerging infrastructure platform.

The pattern was clear in retrospect: a profitable, well-understood "Act One" business generating cash flow to fund a speculative but potentially transformational "Act Two." Wall Street kept asking about book sales and shipping costs while Bezos was building the backbone of the cloud computing industry.

Rubrik's Q2 FY26 feels like Amazon's Q1 2006—a moment when the market is still measuring the old business while the company quietly builds the new one.

My Immediate Reaction

The cyber resilience business has proven it can generate serious cash. The question isn't whether Rubrik can build a profitable software company—Q2 settled that with 19% free cash flow margins and 1,800 basis points of contribution margin improvement over two years. The question is whether they can use those profits to build a control plane for enterprise AI operations before cloud providers make the category irrelevant.

What I'm watching isn't growth rates or margin expansion—those are backwards-looking metrics that confirm what already happened. I'm watching for proof that enterprises will pay for "policy over data" as a distinct layer in their AI infrastructure stack, and whether Rubrik can monetize that positioning before AWS, Azure, and Google achieve "good enough" data governance capabilities.

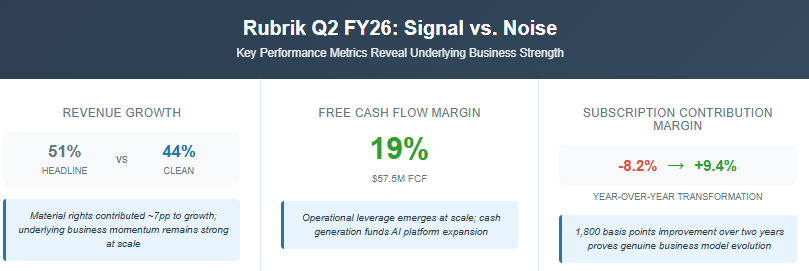

Separating Signal from Noise

Strip away the one-time factors and Q2 tells a cleaner story than the headline numbers suggest. Yes, revenue grew 51% to $309.9 million, but "material rights" related to cloud transformation contributed roughly 7 percentage points to that growth. The underlying business grew approximately 44%—still impressive at $1.2 billion scale, but more sustainable than the headline suggests.

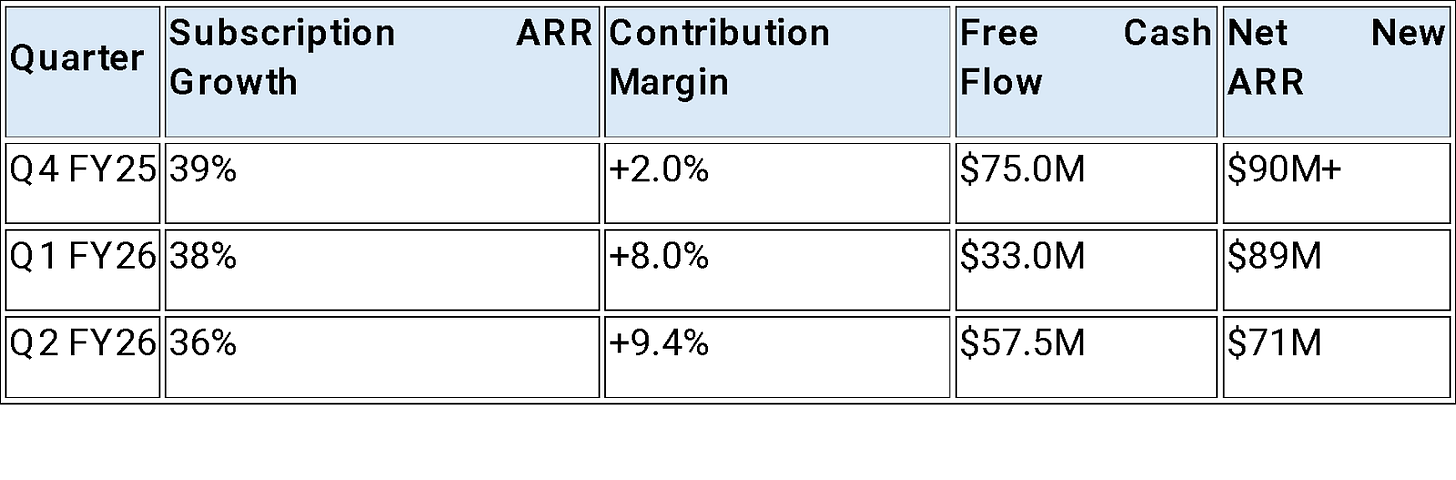

The more important signal is the 19% free cash flow margin ($57.5 million), driven by subscription ARR contribution margins expanding from -8.2% to +9.4% year-over-year. CFO Kiran Chaudhry helpfully detailed what drove this performance: stronger ARR, genuine margin improvement, capital structure optimization, favorable contract duration, and early renewals. Notice what's in that list—actual operational leverage, not just financial engineering.

The trajectory is real, but Q2 represents acceleration aided by timing factors. Chaudhry explicitly noted they're "not assuming the favorable compression continues" and are "modeling in a little bit more compression, I would say low to mid single digits." Translation: don't expect another 19% FCF quarter immediately.

The 1,800 basis point margin improvement over two years represents genuine business model transformation. You can't engineer that level of change through accounting tricks—this reflects fundamental operational leverage emerging at scale.

From Demos to Dollars

CEO Bipul Sinha's language during the earnings call reveals strategic repositioning rather than marketing speak. Three quotes stand out:

"We are a security and AI company."

This isn't the incremental product expansion you typically hear from software companies adding AI features. Sinha is explicitly repositioning Rubrik's identity around a convergence thesis.

"IT and security leaders now have assumed breach mindset... they are certain that cyber attacks are inevitable."

This captures perfect market timing. When prevention fails, recovery becomes the product. Rubrik's "preemptive recovery engine" that pre-calculates clean data states before attacks happen addresses this assumed-breach reality.

"We continue to build a portfolio of innovations at different stages... stack multiple S-curves to maintain maximal momentum."

This is classic platform playbook—using current cash flows to fund multiple bets on adjacent opportunities.

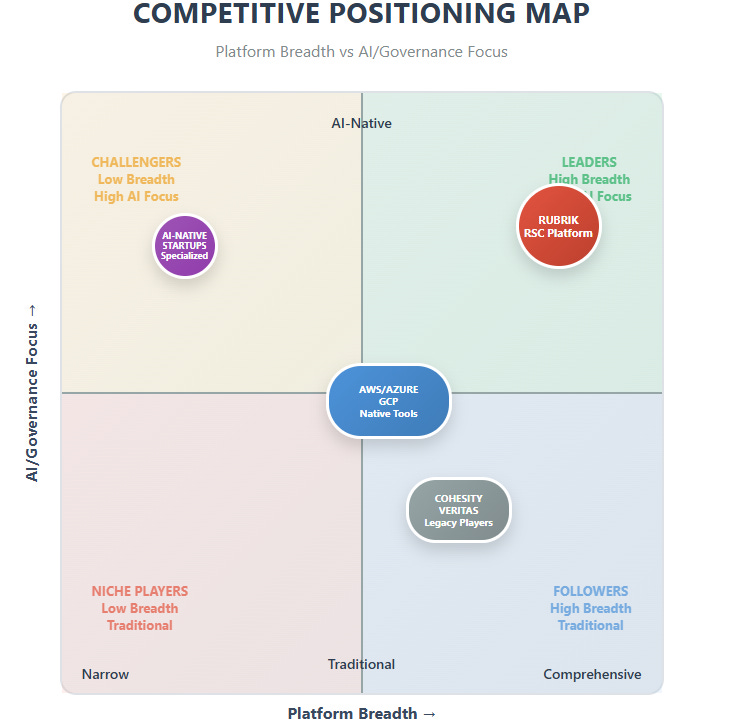

The competitive framing is subtle but important. Rubrik isn't competing against backup vendors anymore—they're betting that enterprises need vendor-neutral data governance as cloud sprawl and AI adoption accelerate. Cloud providers will inevitably build "good enough" backup and recovery capabilities, but the question is whether "good enough" data governance exists when you're managing AI workloads across multiple clouds while maintaining compliance and security postures.

The Predibase acquisition and Agent Rewind launch represent tangible progress toward this vision. Agent Rewind—which enables "undoing the mistakes of AI agents without full system rollbacks"—is genuinely innovative and addresses a problem enterprises are just beginning to encounter. But Sinha's repeated emphasis on being in "early stages of optimizing product fit" signals that AI monetization remains 12-18 months away.

Updated Three-Lens Framework

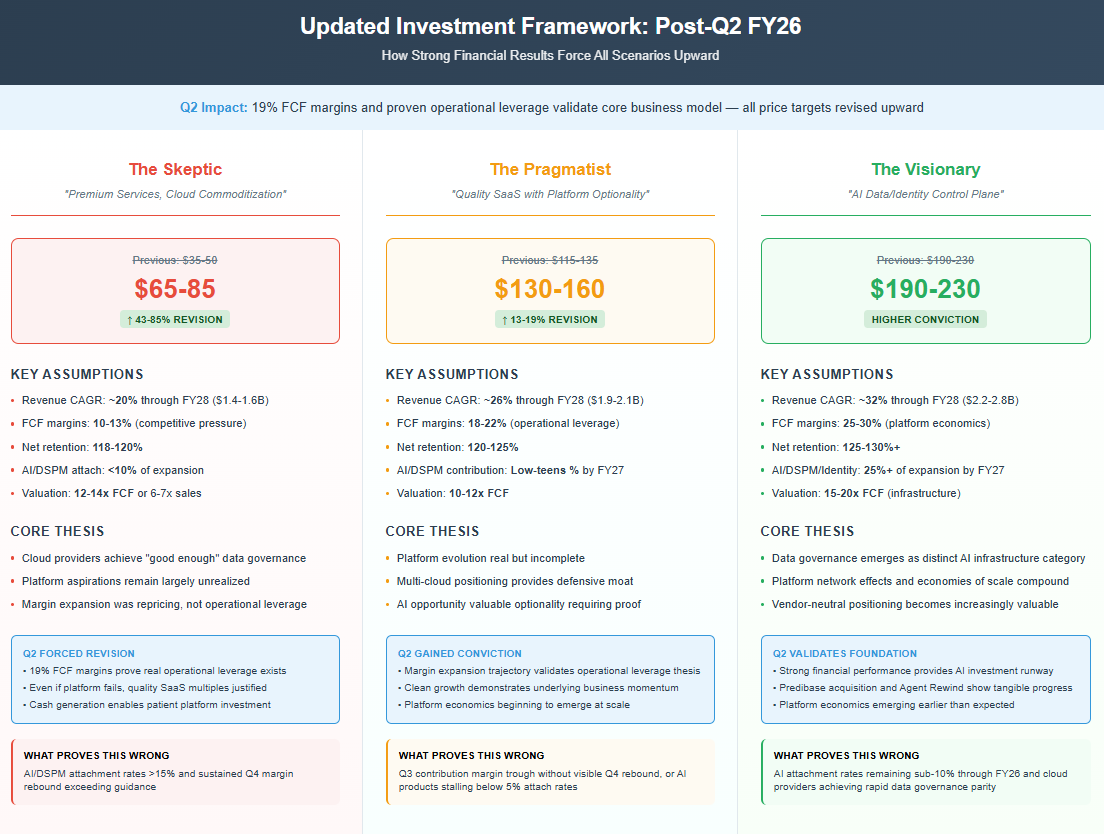

The Q2 results force a fundamental recalibration of all three investment scenarios. Every framework must now acknowledge that the core cyber resilience business is profitable, growing, and generating substantial cash flow. The debate has shifted from "can they build a sustainable business" to "how big can that business become."

The Skeptic: "Modern Backup, Premium Services"

Price Target: $65-85 (revised up from $35-50)

The skeptical case has been forced to retreat from questioning the business model to questioning the growth durability and competitive positioning. The core argument now centers on market saturation and cloud provider commoditization rather than unit economics.

Key assumptions: Revenue growth decelerates to ~20% CAGR through FY28 as the enterprise backup market matures, reaching approximately $1.4-1.6 billion. Free cash flow margins stabilize around 10-13% as competitive pressure and customer concentration create pricing headwinds. Net retention rates hover around 118-120% with AI/DSPM attachment remaining below 10% of expansion revenue.

Valuation framework: 12-14x free cash flow or 6-7x sales, reflecting quality software multiples but not platform premiums. With ~200 million shares and modest net cash position, this yields $65-85 per share.

What would prove this wrong: AI/DSPM/Identity products achieving 15%+ attach rates and Q4 contribution margin rebound exceeding guidance.

The Pragmatist: "Quality SaaS with Platform Optionality"

Price Target: $130-160 (revised up from $115-135)

The pragmatic view has gained significant conviction from Q2's margin expansion and execution consistency. This framework now leans closer to the visionary case while maintaining appropriate skepticism about timing and competitive dynamics.

Key assumptions: Revenue grows at ~26% CAGR through FY28, reaching $1.9-2.1 billion as platform cross-selling accelerates and international expansion contributes. Free cash flow margins expand to 18-22% through operational leverage and improved customer efficiency. Net retention rates consistently exceed 120-125% with AI/DSPM products contributing low-teens percentage of expansion revenue by FY27.

Valuation framework: 10-12x free cash flow, reflecting quality SaaS characteristics with platform optionality. The proven ability to generate cash while investing in growth justifies premium multiples.

Key proof points: Q3's 6.5% contribution margin trough followed by visible Q4 rebound, FY26 free cash flow delivery in the $145-155 million range, and first disclosure of AI/DSPM attachment metrics.

The Visionary: "Data/Identity Control Plane"

Price Target: $190-230 (maintained with higher conviction)

The visionary thesis views Q2 as validation that platform economics are emerging and that Rubrik is successfully positioning for the AI infrastructure wave. The strong financial performance provides the foundation for aggressive expansion into adjacent categories.

Key assumptions: Revenue accelerates to ~32% CAGR through FY28, reaching $2.2-2.8 billion as data governance becomes mission-critical for AI operations. Free cash flow margins expand to 25-30% as platform network effects and economies of scale compound. Net retention rates exceed 125-130% with AI/DSPM/Identity products contributing 25%+ of expansion revenue by FY27, supplemented by early Predibase/Agent Rewind monetization.

Valuation framework: 15-20x free cash flow, reflecting infrastructure platform characteristics. The convergence of cyber resilience and AI operations creates a defensible control plane worth premium multiples.

Critical tells: Quantified attachment rate disclosure, named multi-cloud enterprise wins, and paid AI product launches gaining customer traction.

The Next 90 Days: Binary Questions

Q3 and Q4 will determine which scenario unfolds. The monitoring framework shifts from general growth metrics to specific proof points:

Margin sustainability: Does Q3's guided 6.5% contribution margin trough lead to meaningful Q4 rebound toward 7% full-year targets? This tests whether Q2's leverage was sustainable or peak performance.

AI monetization progress: Do AI/DSPM/Identity products show disclosed attachment rates above 10% of new/expansion ARR? Below 5% suggests platform cross-selling challenges; above 15% indicates genuine platform emergence.

Growth cadence validation: Does Q4 net new ARR exceed Q1 levels, proving the business can sustain momentum despite annual sales compensation changes and seasonal patterns?

Clean growth trajectory: Does guidance confirm minimal material rights contribution in FY27, allowing clean year-over-year comparisons and removing optical complications?

Predibase integration signals: Do Agent Rewind and AI infrastructure products show early paid customer traction or remain in pilot/proof-of-concept stages?

The Control Plane Bet

Rubrik is making the same fundamental bet Salesforce made in 2004—that a new category of enterprise infrastructure is emerging and whoever builds the best platform captures disproportionate value. But today's landscape is fundamentally more challenging than what Salesforce faced.

The risk is that cloud providers achieve "good enough" data governance before Rubrik achieves meaningful platform lock-in. AWS, Azure, and Google have vastly greater resources and direct customer relationships. They don't need feature parity—they need adequate functionality at marginal cost, bundled with existing services.

But Rubrik's bet on vendor-neutral, policy-driven data governance across hybrid environments could prove prescient. As enterprises deploy AI workloads across multiple clouds while maintaining strict compliance and security requirements, the complexity of managing data policies, access controls, and recovery procedures may exceed what cloud providers can effectively address through native tools.

My specific prediction: If AI product attachment rates exceed 15% by FY27 and cross-selling accelerates into double-digit revenue contributions, Rubrik trades like infrastructure (15-20x EV/S) rather than software (10-12x EV/S). If AI products remain sub-10% attach rates and competitive pressure intensifies, the stock settles into quality SaaS multiples regardless of absolute growth rates.

The timeline for this determination is compressed. Unlike Salesforce's gradual platform evolution over many years, Rubrik faces immediate competitive pressure from well-funded platform players. The next two quarters provide the critical data points to distinguish between genuine platform emergence and sophisticated software execution.

Amazon's "Other" revenue became AWS, the most valuable technology infrastructure ever built. Whether Rubrik's AI and data governance initiatives follow a similar trajectory—or remain interesting footnotes to a successful cyber resilience business—will determine which investment framework proves correct and whether today's stock price reflects opportunity or expectation.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.