Saab 2Q25 Earnings: Europe’s First AI-Native Defense Platform

Blowout Q2 earnings showcase operational AI, sovereign backlog visibility, and structural NATO tailwinds — all at a valuation still priced for cyclicality, not transformation.

TLDR

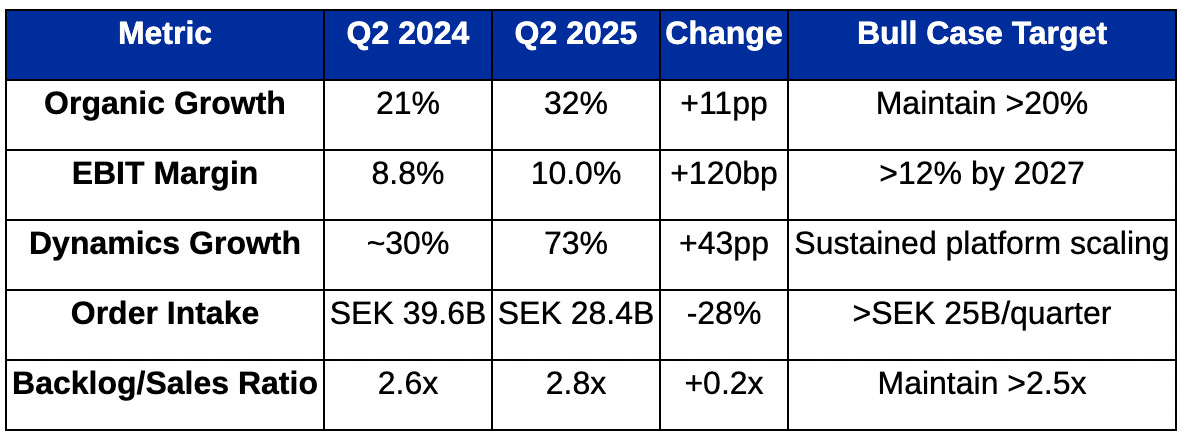

Platform Thesis Validated: Saab’s 32% organic growth, margin expansion, and upgraded guidance underscore its transformation from cyclical contractor to platform company, with Dynamics and Surveillance now comprising 71% of backlog — the engine of scalable, recurring-like growth.

AI & Sovereign Stack Advantage: The rapid deployment of an autonomous AI agent in Gripen E and France’s declaration of intent for GlobalEye aircraft signal Saab’s architectural lead in software-defined warfare and its embeddedness in Europe’s quest for strategic autonomy.

Asymmetric Upside at Platform Inflection: Despite a 130% YTD rally, Saab remains mispriced as a traditional defense stock. With potential software monetization, sovereign network effects, and NATO’s 5% GDP spending floor, the SEK 532 entry point offers a compelling platform-upside skew.

From the Bloomberg:

Saab shares jumped as much as 13% when trading started in the Swedish capital on Friday, taking gains so far this year to 130%. The Stockholm-based group posted organic sales growth of 22% during the first six months of the year while also boosting its guidance for the metric to 16% to 20%, from a previous range of 12% to 16%. The upbeat outlook comes as Saab negotiates Gripen orders with Thailand and Colombia, as well as the signing of a declaration of intent with France for the procurement of Globaleye aircraft.

My first thought after reading through Saab's Q2 results was that this wasn't just a good defense earnings report — it was validation of a fundamental thesis about the transformation of European defense.

The numbers themselves were impressive: 32% organic growth, 10% EBIT margins, and a guidance raise that suggests management sees structural rather than cyclical demand. But the real story is buried in CEO Micael Johansson's almost casual mention that Saab deployed an operational AI agent in a Gripen fighter aircraft in a matter of weeks.

"No other fighter aircraft could have added sort of a software in a few weeks time and have it flying doing what we did," he said on the call. That's not incremental improvement — that's architectural advantage.

The current price of SEK 532 represents a compelling entry point for investors willing to underwrite the platform transformation thesis. While the stock appears expensive at 43.3x forward P/E by traditional defense metrics, it trades at a reasonable 24.5x EV/EBITDA (NTM) for a company demonstrating platform economics and network effects with nascent software monetization potential.

The Dynamics Explosion: Platform Economics in Action

The headline grabber was Dynamics growing 73% YoY, what Johansson called "unusually many deliveries." But this wasn't just about quarterly volatility — it's evidence that Saab's capacity investments are finally paying off, and more importantly, it validates the platform thesis. This segment now represents the scalable, recurring-revenue-like portion of Saab's business that justifies premium valuations.

What's remarkable is how Johansson described the transformation:

"We just opened a facility in Linköping, which is a completely autonomous facility when it comes to manufacturing parts of the support weapons, which we did completely manual before."

The company is simultaneously expanding globally (new facilities in India and the US coming online in 2026) while automating domestically. This isn't just scaling — it's leveraging technology to create what I call "mini-Saabs" with redundant capacity and local political embedding.

The backlog composition tells the story of platform economics emerging: 71% now comes from Dynamics and Surveillance, up from 65% last year. At SEK 198B (2.8x TTM sales), this represents the kind of visibility that traditional defense contractors can only dream of. These are the segments with shorter lead times but continuous refill cycles — exactly the kind of recurring characteristics that separate platform providers from project-based contractors.

The NATO 5% Catalyst: Structural Demand Inflection

Johansson spent considerable time on the call discussing the NATO summit's commitment to 5% GDP defense spending (3.5% pure defense capabilities, 1.5% infrastructure). This wasn't just context-setting — it was the CEO explaining why his confidence in raising guidance was justified. "Defense industries have to step up, you have to invest for capacity. We will need more," he said.

The strategic implication is profound: this isn't a cyclical defense upturn driven by Ukraine fears. It's a structural realignment of European priorities that creates a spending floor, not a ceiling. Sweden's commitment to reach 3.5% by 2030 versus others targeting 2035 gives Saab a near-term advantage in its home market while validating the multi-year demand visibility that underpins current capacity investments.

More importantly, the "European Defence industrial base" messaging from the summit validates Saab's sovereign embedding strategy. When politicians talk about reducing dependence on American defense systems, Saab — with its neutral country credentials and multi-domestic production — becomes the obvious beneficiary. This is the "sovereign network effect" in action: each new country that adopts Saab's systems makes the entire network more valuable while creating political switching costs that traditional defense contractors cannot replicate.

The AI Architecture Advantage: Software-Defined Warfare

The most telling moment in the earnings call came when Johansson described the Gripen E's AI capabilities. The aircraft can now conduct "beyond visual range" air-to-air combat missions with an AI agent that's "trained like you had a pilot training for 30 years around the clock." This isn't just impressive technology — it's evidence of the software-defined architecture that differentiates Saab from legacy defense contractors.

Johansson's confidence was palpable:

"No other fighter aircraft could have added sort of a software in a few weeks time and have it flying doing what we did."

This is the platform thesis made manifest — continuous capability upgrades via software deployment rather than hardware replacement cycles. The partnership with NVIDIA through the Sweden AI Factory consortium, combined with acquisitions like BlueBear and CrowdAI, creates a path to recurring SaaS/upgrade revenue that remains largely undisclosed in current financials.

The Street under-appreciates this software IP revenue potential. While currently opaque, I expect first explicit disclosure by Q4-25 CMD, with software revenue potentially exceeding 15% of sales by 2028. This would warrant platform-peer multiples (30-35x P/E) rather than traditional defense contractor valuations.

The Three Scenarios: Platform vs. Cyclical Outcomes

Looking at the current price of SEK 532, I see three distinct scenarios playing out over the next 5 years, each with different return profiles based on the platform transformation thesis:

Bull Case: Platform Recognition & Software Monetization (25% probability)

5-Year IRR: 20%+ annualized

The market recognizes Saab as Europe's sovereign defense platform. NATO spending reaches 5% GDP targets, multiple megadeals materialize, and software-defined capabilities drive recurring revenue streams. EBIT margins expand to 12.5% as platform economics kick in, and AI/software revenue disclosure reveals >15% of sales by 2028. The stock re-rates to 18x EV/EBITDA exit multiple.

Key triggers: Thailand/Colombia contracts (>SEK 30B), software revenue disclosure >5% of sales, Aeronautics EBIT margin >8%, AI-pilot external customer wins

Base Case: Guided Execution with Modest Platform Premium (60% probability)

5-Year IRR: 13% annualized

Saab delivers on raised guidance with 10% revenue CAGR through 2029, EBIT margins stabilize around 10%, and major campaigns close successfully. The company proves execution capability while maintaining operational discipline. FCF conversion exceeds 60% of EBIT as capacity utilization normalizes post-2026. Stock trades at 15x EV/EBITDA exit, reflecting growth premium over traditional defense.

Key triggers: Consistent order intake >SEK 25B/quarter, successful facility ramp-up, backlog/sales ratio >2.5x maintained

Bear Case: Execution Stumble & Traditional Defense Reversion (15% probability)

5-Year IRR: <3% annualized

The scaling effort proves too complex, with delays in facility construction, supply chain bottlenecks, or major contract disappointments. T-7 losses worsen beyond expectations, Aeronautics margins fall <6%, and software monetization disappoints. The market reverts to cyclical defense valuations at 11x EV/EBITDA exit.

Key triggers: Aeronautics EBIT margin <7% for two consecutive quarters, order intake <SEK 18B, FCF conversion <40% of EBIT

The Capacity Investment Cycle: Today's Pain, Tomorrow's Gain

CFO Anna Wijkander's careful explanation of the cash flow situation revealed the strategic nature of current investments: "We have to keep some sort of high inventory levels to be sure that we can deliver to our customers... because of the supply chain perspective of old ecosystem suppliers that need to support the primes in growing in this market."

This isn't working capital inefficiency — it's strategic positioning for the recurring delivery capability that platform economics require.

The current FCF dip masks the "time-arbitrage" CapEx cycle. While FCF yield sits at just 1.9% TTM, the massive capacity build across US, UK, and India creates operating leverage that should drive FCF conversion >80% of EBIT once utilization normalizes in 2026-27. The company's net-cash balance sheet (SEK 211M) provides flexibility for bolt-on tech M&A without equity dilution — a stark contrast to leveraged peers like Leonardo and Rheinmetall.

The Sovereign Stack in Action: European Validation

What struck me most about the call was how Johansson casually mentioned the French declaration of intent for GlobalEye aircraft. This isn't just another export win — it's validation of the "sovereign stack" thesis. European countries want advanced capabilities, but they also want strategic autonomy. Saab's neutral country status and multi-domestic production strategy makes it the natural choice for countries caught between American dependence and Chinese alternatives.

The company's approach to scaling — partnerships with Sabiana Techniques in France for GlobalEye installations, collaboration with General Atomics for autonomous systems — shows how platform thinking creates network effects. Each partnership strengthens the ecosystem while reducing Saab's direct investment requirements. This vertically integrated stack (sensors → C2 → effectors) with common digital backbone creates switching costs and cross-segment pull-through that traditional contractors cannot replicate.

The Entry Point Assessment: Platform Premium Justified

At SEK 532, the current valuation embeds high expectations but offers asymmetric upside if the platform thesis plays out. Trading at 24.5x EV/EBITDA (NTM), Saab commands a premium that reflects its transformation trajectory. However, compared to pure-play software/platform companies at 30-50x, the valuation appears reasonable given the emerging software monetization potential.

The base case alone justifies the investment, offering 13% annualized returns over 5 years. The bull case delivers exceptional 20%+ returns for investors willing to underwrite the platform transformation thesis. Even the bear case, while painful, reflects execution risk rather than fundamental business deterioration.

The Variant Perception: Platform vs. Cyclical

The market is still pricing Saab as a cyclical beneficiary rather than a platform transformation story. Street models bake in sub-10% margins and conservative AI monetization, while missing the post-capacity operating leverage potential. The evidence is mounting that this is wrong: margin expansion during explosive growth, software-defined capabilities enabling rapid iteration, sovereign embedding creating political switching costs, and NATO interoperability requirements making alternative suppliers prohibitively expensive.

The fundamental transformation is undeniable. Saab has evolved from a Swedish defense contractor into Europe's sovereign defense platform. At SEK 532, the current price offers an attractive entry point for investors willing to underwrite the platform transformation thesis. The AI capabilities, the multi-domestic embedding, the NATO interoperability — these create switching costs and network effects that traditional defense contractors cannot replicate.

Earnings like these make the gap between platform reality and cyclical pricing increasingly unsustainable. As with Microsoft's transformation from Windows to cloud, the companies that recognize and position for structural shifts while others cling to old models capture disproportionate value. Saab is writing that playbook for European defense, and the Q2 results suggest the strategy is working.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.