Salesforce - The Complexity Trap: When the Disruptor Becomes the Disrupted

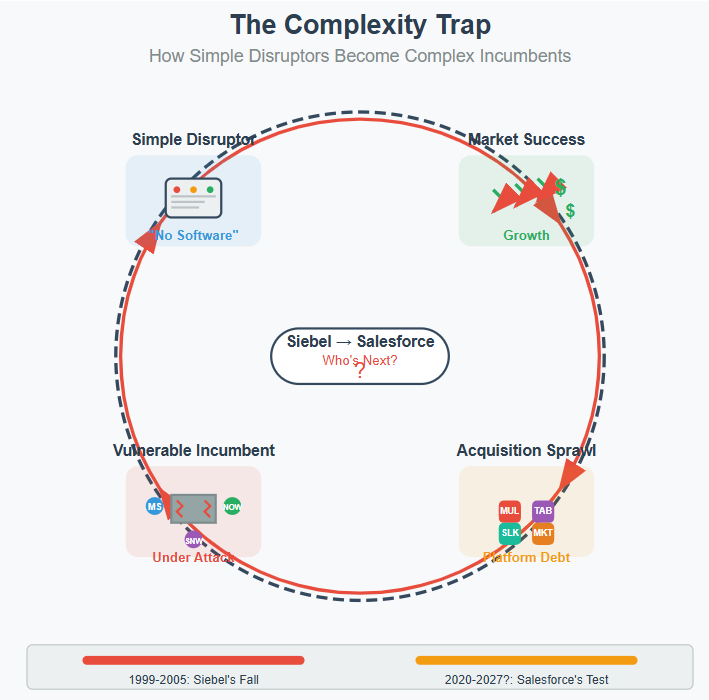

Salesforce killed Siebel by making CRM simple. Twenty years later, they face the same complexity problem that destroyed their predecessor.

The AI transition will reveal whether platform incumbents can escape the incumbent's paradox?

TLDR

The Complexity Paradox: Salesforce disrupted Siebel by making CRM simple, but their acquisition-driven growth strategy created the same platform fragmentation that destroyed their predecessor—now they must rebuild architecture while competitors with simpler systems capture AI market share

Competitive Timing Gap: While ServiceNow grows 20% with immediate AI monetization and Microsoft embeds Copilot in 400M+ daily users, Salesforce is stuck integrating fragmented systems requiring "forward-deployed engineers" for each AI deployment

FY27 Accountability: After six years of strategic pivots, management's promise that AI revenue becomes "meaningful in FY27" creates a binary moment—either they demonstrate measurable AI success or narrative credibility collapses

The Oracle OpenWorld conference in 1999 was Tom Siebel's stage. Standing before thousands of enterprise software executives, the Siebel Systems CEO radiated confidence about his company's dominance in customer relationship management. Complex on-premise deployments, million-dollar implementations, armies of consultants—this was serious enterprise software for serious enterprises. "Companies will never trust mission-critical customer data to browser-based applications," he declared, dismissing the nascent Software-as-a-Service movement as a toy for small businesses.

Four years later, a regional sales manager sat in a Marriott hotel room somewhere in Ohio, logging into Salesforce from her laptop browser. No IT department approval needed, no software installation, no consultant army. Just a username, password, and an internet connection. The "No Software" promise felt like magic—access trumped installation, simplicity conquered sophistication.

By 2005, Oracle acquired Siebel Systems at a fraction of its peak valuation. The platform advantages that had made Siebel dominant—deep customization capabilities, comprehensive feature sets, tight IT integration—became exactly what made them vulnerable to a simpler, faster alternative.

Today, in a twist of corporate irony, a customer support manager at a Fortune 500 company waits on a video call for Salesforce's "forward-deployed engineer" to configure AI agents for their service desk. The implementation timeline stretches across quarters, not weeks. Multiple systems require integration, data mappings need validation, and governance frameworks must be established before the first AI conversation can begin.

The circle is complete. Salesforce, the company that killed complexity through browser-based simplicity, now embodies the very complexity problem that destroyed its predecessor.

The Acquisition Engine: Building Tomorrow's Technical Debt

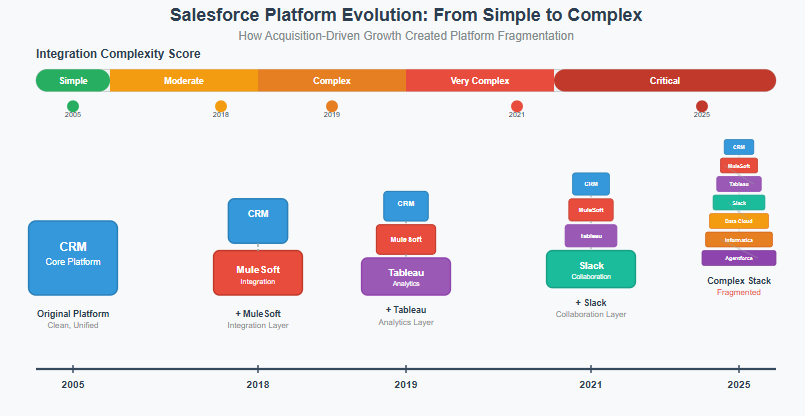

To understand how Salesforce arrived at this paradox, you have to appreciate the brilliance of Marc Benioff's original growth playbook. From 2005 to 2020, the strategy was elegantly simple: buy for breadth, bundle in pricing, and land-and-expand at scale. Each acquisition added new revenue streams and expanded the total addressable market. MuleSoft brought integration capabilities, Tableau delivered analytics, Slack provided collaboration, Marketing Cloud enabled campaign management. The portfolio approach allowed Salesforce to compete across the entire customer lifecycle rather than being confined to core CRM functionality.

But every acquisition also added architectural fragmentation. Each product came with its own data models, user interfaces, administrative frameworks, and integration requirements. What emerged wasn't a unified platform but a collection of powerful applications held together by marketing frameworks and pricing bundles. "Customer 360" became a brand promise rather than a technical reality.

This approach worked brilliantly in the cloud era because enterprises were primarily focused on escaping on-premise complexity. As long as each Salesforce product delivered value individually and the bundle pricing created economic incentives, customers accepted the integration friction as the cost of doing business. The portfolio breadth provided competitive moats—once a customer deployed Sales Cloud, Service Cloud, and Marketing Cloud, the switching costs and organizational disruption made competitive displacement extremely difficult.

The hidden liability was platform debt: accumulated architectural fragmentation that would become a critical vulnerability when the next technology transition arrived. And that transition—artificial intelligence—demands something Salesforce's acquisition-driven architecture struggles to provide: a single, unified context layer where customer data, interaction history, and business logic can be instantly accessed and acted upon.

The Governor's Dilemma: Forced to Slow the Flywheel

The market's message to Salesforce in late 2022 was unambiguous. Activist investors and institutional shareholders had lost patience with growth-at-all-costs expansion. Rising interest rates and economic uncertainty made profitable growth more valuable than revenue velocity. The growth flywheel that had driven Salesforce to $30 billion in annual revenue—hire more salespeople, expand into new products, acquire new capabilities, repeat—suddenly needed a governor.

The financial discipline that followed was dramatic. Operating margins expanded from the high teens to the mid-thirties. Headcount growth slowed, real estate footprints contracted, and capital allocation shifted toward dividends and share buybacks. Wall Street celebrated the transformation as evidence of operational maturity, but the real story was more complex. The margin expansion wasn't just financial optimization—it was creating the cash flow buffer necessary to fund a complete platform rebuild.

Behind the scenes, Salesforce launched what they internally called the "More Core" initiative: a massive re-platforming effort to consolidate acquired applications into coherent, AI-ready interfaces. Resources were redirected from building new features to the unglamorous work of rebuilding integration layers and establishing unified governance frameworks. Customer-facing innovation slowed as engineering capacity focused on paying down a decade of platform debt.

The $27.7 billion Informatica acquisition announced in 2024 represented the ultimate admission that organic solutions were taking too long. Rather than building data integration capabilities from scratch, Salesforce decided to buy the market leader and accelerate their timeline by years, not quarters. The acquisition wasn't about expanding addressable markets—it was about buying time in a competitive race where speed mattered more than cost efficiency.

The Canary in the Coal Mine: Why Benioff Won't Publish AI Metrics

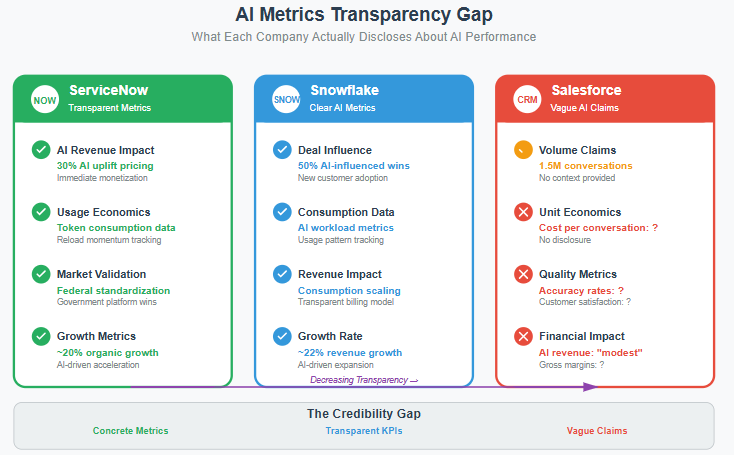

The most telling indicator of Salesforce's execution challenges isn't in their financial statements—it's in their earnings call transcripts. When analysts ask Marc Benioff about AI unit economics, something remarkable happens: the most metrics-obsessed CEO in enterprise software shifts into storytelling mode.

This represents a fundamental break from historical patterns. Benioff built his reputation on being first to market and loudest about results. Throughout Salesforce's growth phase, earnings calls were filled with specific KPIs: customer acquisition costs, lifetime value ratios, attach rates, expansion multiples. When the metrics were favorable, Benioff led with numbers. When competition emerged, he responded with data.

The AI evasion pattern is different. Asked about cost per conversation, AI gross margins, or consumption adoption curves, Benioff deflects to customer anecdotes and vision statements. The absence of unit-level AI KPIs after two years of "agentic enterprise" evangelism suggests the underlying economics aren't ready for public scrutiny.

Consider the competitive contrast. ServiceNow reports 30% AI uplift pricing with growing token consumption momentum—concrete metrics that analysts can model and investors can evaluate. Snowflake cites 50% of new wins being AI-influenced with transparent consumption growth patterns. Both companies provide the quantitative foundation that supports their growth narratives.

Salesforce offers "1.5 million agent conversations" without cost context, accuracy rates, or customer satisfaction deltas. The metric sounds impressive until you realize it reveals nothing about unit economics, deployment success, or competitive positioning. For a CEO who historically led with the strongest numbers available, the shift to qualitative storytelling signals underlying execution gaps.

The Three Paths: Why Competitors Grow 20% While Salesforce Stagnates

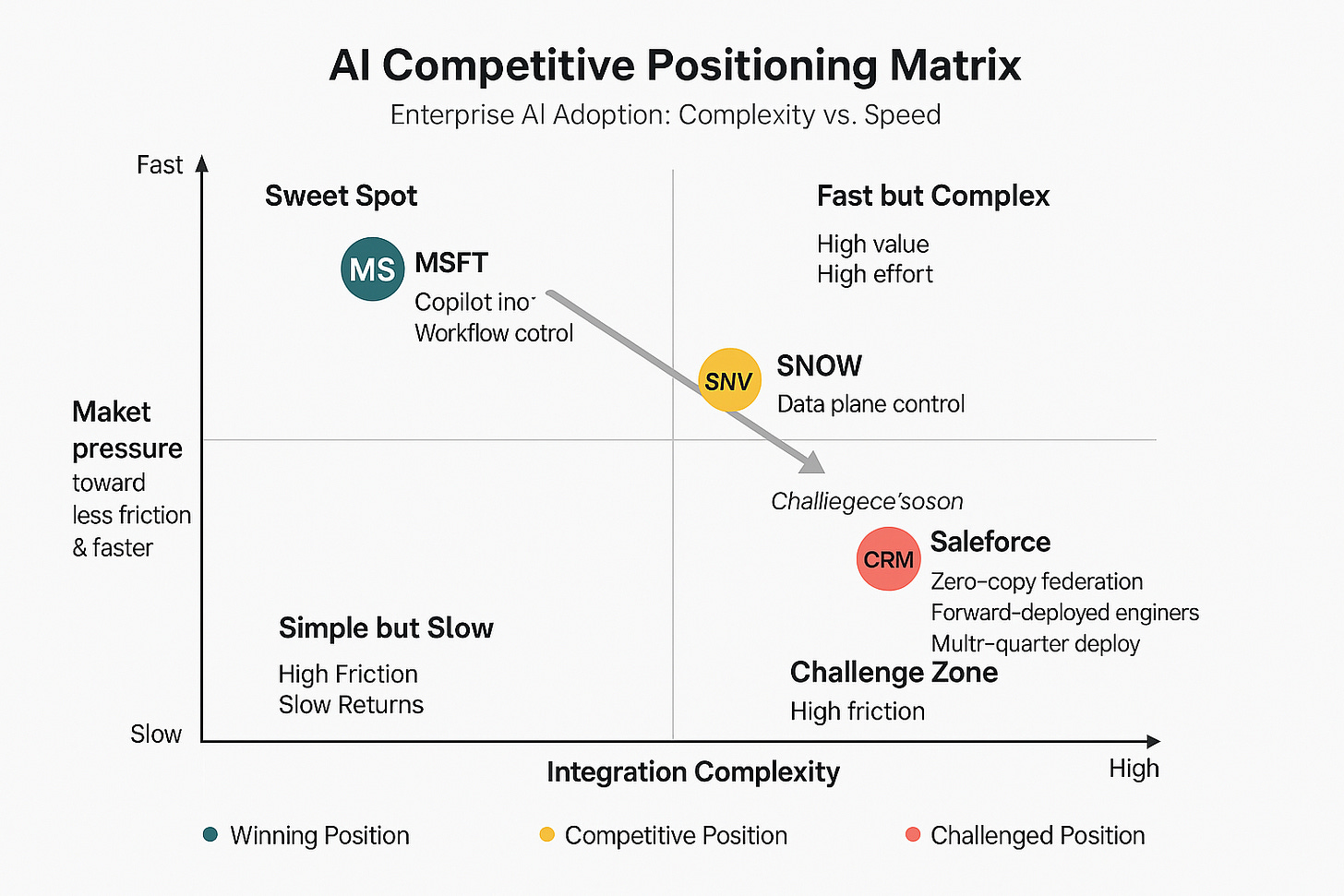

The most damaging aspect of Salesforce's platform complexity isn't the technical challenge—it's the competitive timing disadvantage. While Salesforce struggles to integrate AI across fragmented systems, competitors with more focused architectures are capturing immediate market value.

Microsoft's advantage isn't just about product capabilities—it's about distribution friction. Copilot embedded within 400 million daily Office users requires no new software deployment, no behavioral change training, and no integration complexity. Every Teams meeting, Excel spreadsheet, and Outlook email becomes an AI interaction point. Salesforce requires customers to adopt new workflows; Microsoft enhances existing habits.

The productivity suite integration creates a reinforcing flywheel. As Copilot usage increases within M365, the switching cost for competitive productivity tools rises exponentially. Salesforce's Slack-first agent strategy fights this entrenchment directly, requiring enterprises to change default collaboration behaviors in environments where Microsoft Teams is often mandated by IT policy.

ServiceNow's competitive advantage stems from workflow clarity rather than distribution reach. The 30% AI uplift pricing they command isn't just confidence—it's evidence that workflow automation delivers clearer ROI than CRM automation. IT tickets and HR processes have defined inputs, predictable outputs, and measurable efficiency gains. Customer conversations are messier, more contextual, and harder to automate reliably.

ServiceNow's single platform focus also eliminates the integration complexity that constrains Salesforce. When AI capabilities are native to the workflow engine rather than retrofitted across multiple acquired systems, time-to-value accelerates dramatically. The federal government's designation of ServiceNow as a "standard platform" for workflow automation provides both credibility and contract vehicles that are difficult for fragmented competitors to match.

Snowflake represents perhaps the most fundamental competitive threat because they own the data layer where AI workloads naturally gravitate. The principle of data gravity—applications move to data, not vice versa—gives Snowflake structural advantages as AI adoption scales. Their consumption model aligns pricing with usage patterns that enterprise customers understand, and their AI capabilities are native to the platform rather than bolted on through acquisition.

The consumption economics are transparent: customers pay for what they use, usage can scale exponentially with business value, and the billing model creates positive feedback loops between AI adoption and revenue growth. Salesforce's hybrid pricing approach—seats plus consumption plus multi-year agreements—creates complexity that obscures unit economics and slows adoption decisions.

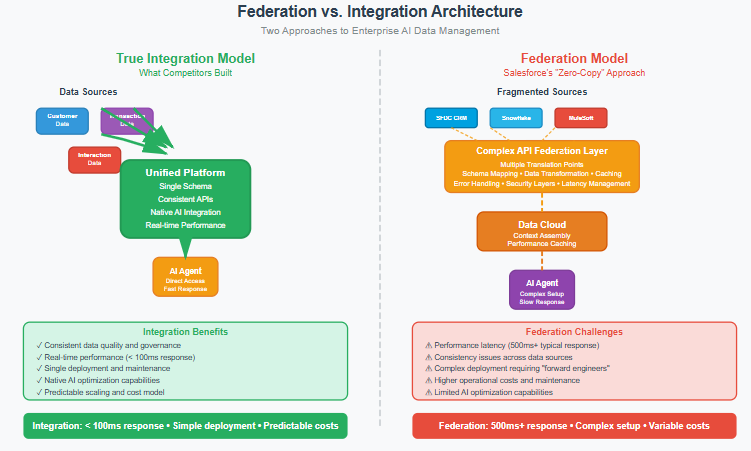

The Architecture Reality: Federation as Surrender

Salesforce's strategic response to their platform fragmentation challenge reveals both the scope of the problem and the limitations of their solution. The "zero-copy federation" approach they've embraced sounds technically sophisticated, but it represents a fundamental concession: Salesforce cannot effectively unify customer data across their acquired systems.

True platform integration would mean migrating customer data into unified schemas, establishing consistent governance policies, and providing seamless user experiences across all applications. Instead, zero-copy federation allows data to remain in existing systems while providing API-based access for AI applications. This approach reduces migration complexity but sacrifices the performance and consistency advantages of integrated platforms.

The federation strategy also reveals Salesforce's acknowledgment that they've lost the platform integration battle. Rather than forcing customers to restructure their data around Salesforce's requirements, they're adapting to customer data architectures that increasingly center on cloud data warehouses like Snowflake, Databricks, and BigQuery. This positions Salesforce as a consumer of customer data rather than the system of record.

The operational complexity of the federation approach becomes evident in customer deployments. The "forward-deployed engineers" that Salesforce assigns to major AI implementations aren't product managers or solution consultants—they're integration specialists working to connect fragmented systems in real-time. This isn't scalable software deployment; it's consulting-intensive systems integration disguised as platform adoption.

The services dependency creates margin pressure and scaling constraints that don't affect competitors with more integrated architectures. ServiceNow's workflow-native AI doesn't require extensive integration work. Snowflake's data-plane intelligence runs where customer data already resides. Microsoft's productivity AI leverages existing application contexts without requiring new data mappings.

Variant Perception: Managed Decline vs. Strategic Transformation

The investment community's interpretation of Salesforce's current trajectory reflects a fundamental disagreement about whether the company is managing decline or executing transformation. The consensus view treats Salesforce as a mature SaaS company with modest AI upside, constrained by platform complexity and intensifying competitive pressure. High single-digit revenue growth, expanding margins, and conservative AI guidance support this narrative of graceful maturation.

The contrarian perspective interprets current deceleration as strategic choice rather than competitive weakness. Under this framework, Salesforce is deliberately applying a governor to their growth flywheel to create the time and resources necessary for platform reconstruction. The financial discipline that Wall Street celebrates isn't just operational excellence—it's building the cash flow buffer required to fund a multi-year technical rebuild while maintaining competitive positioning.

This variant perception rests on several key assumptions.

First, that enterprise AI adoption will follow traditional enterprise software timelines—measured in years rather than quarters—giving Salesforce time to complete their platform integration.

Second, that the "patient capital" advantages of $15 billion annual cash flow will prove decisive against competitors optimizing for immediate monetization.

Third, that the orchestration layer between fragmented enterprise systems represents a defensible competitive position rather than a temporary bridging solution.

The central question becomes whether Salesforce is building the enterprise AI orchestration layer that will define the next decade of business software, or whether they're managing a sophisticated decline while competitors capture the future. The answer depends largely on execution timelines and competitive developments that won't be fully visible until 2027.

The Accountability Timeline: FY27 as Make-or-Break

Salesforce has essentially given itself a two-year window to prove that their AI transformation is substantive rather than narrative. Management's repeated guidance that AI revenue will be "modest in FY26, more meaningful in FY27" creates a clear accountability timeline that investors and competitors will use to judge execution success.

This timeline carries enormous stakes because it represents the culmination of six years of strategic pivots. From Customer 360 to pandemic infrastructure to profitability focus to AI transformation, Salesforce has demonstrated remarkable narrative agility. But each pivot has borrowed credibility from future execution promises, and FY27 represents the moment when those promises must be redeemed with measurable results.

The tracking framework for thesis validation is becoming clearer through quarterly disclosures. Data Cloud attach rates need to exceed 50% of large enterprise deals to demonstrate platform consolidation. Published usage economics—even ranges—are necessary to enable investor modeling and competitive positioning. Slack-first ITSM customer wins must be demonstrated against ServiceNow to validate the surface strategy. Gross margin stability as AI volumes scale will prove whether the federation approach controls cost-to-serve effectively.

The competitive timeline pressure intensifies the accountability dynamic. If Microsoft's Copilot integration accelerates faster than Salesforce's platform rebuilding, or if ServiceNow's workflow automation captures more enterprise AI spending than anticipated, the window for Salesforce's orchestration strategy could close before FY27 results are measurable.

The Informatica acquisition represents both an acceleration attempt and a complexity multiplier. If the integration proceeds smoothly and delivers unified data governance capabilities ahead of schedule, it could provide the platform foundation necessary for AI scale. If integration challenges slow deployment timelines or create customer disruption, it could delay the very outcomes it was acquired to accelerate.

What History Teaches: The Incumbent's Paradox

Platform transitions in enterprise software follow predictable patterns that illuminate both the opportunities and constraints facing Salesforce. The most instructive parallel isn't necessarily other CRM companies, but rather how platform leaders in previous technology transitions navigated architectural challenges while maintaining competitive relevance.

IBM's transformation from hardware manufacturer to services company provides one template for reinvention. When client-server computing threatened mainframe dominance in the 1990s, IBM chose patient capital investment in consulting and services capabilities rather than immediate profit optimization. The strategy required accepting short-term margin pressure and revenue volatility while building new competitive moats. Lou Gerstner's leadership during this transition demonstrated that platform companies could successfully navigate paradigm shifts, but only through sustained commitment to architectural change rather than defensive optimization.

Microsoft's evolution from desktop software to cloud services offers a more recent example of successful platform transformation. The transition from Windows and Office licensing to Office 365 subscriptions required cannibalizing existing revenue streams and investing heavily in cloud infrastructure before customer adoption justified the costs. Satya Nadella's willingness to accelerate this transition rather than protecting existing business models enabled Microsoft to maintain platform leadership across technological generations.

The unsuccessful examples are equally instructive. Oracle's response to cloud computing focused on defending database licensing revenue rather than embracing subscription models and cloud-native architectures. While Oracle eventually developed cloud capabilities, the defensive approach allowed Amazon, Microsoft, and Google to establish dominant positions in cloud infrastructure and platform services.

The common thread across successful transitions is the willingness to accept present-period disruption in service of future competitive positioning. Platform companies that optimize for current-period metrics during technological transitions typically sacrifice the architectural flexibility necessary for long-term relevance.

Three-Year Scenarios: The Range of Outcomes

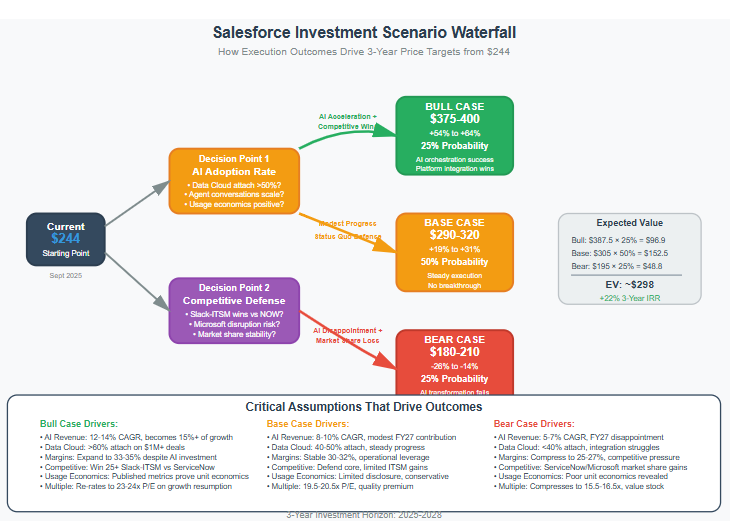

The investment framework for Salesforce necessarily accounts for the binary nature of platform transitions. Success scenarios involve multiple expansion as growth re-accelerates and competitive positioning strengthens. Failure scenarios involve valuation compression as the company transitions from growth stock to value stock with mature software multiples.

The bull case assumes successful platform integration and AI adoption acceleration. Revenue growth re-accelerates to 11-13% annually as consumption models scale and competitive positioning strengthens. Operating margins stabilize in the 33-35% range as automation benefits offset investment requirements. The stock re-rates toward 23-24x earnings on growth resumption, supporting price targets of $375-400 from current levels around $244.

This scenario requires several key developments: published AI usage economics that demonstrate competitive unit economics, Data Cloud attach rates exceeding 50% of large enterprise deals, successful Slack-first ITSM deployments against ServiceNow, and maintained gross margins despite scaling AI volumes. The probability of achieving all these conditions simultaneously appears relatively low given execution complexity and competitive timing pressures.

The base case reflects steady execution without breakthrough performance. Revenue growth continues in the 8-10% range with modest AI contribution scaling predictably. Operating margins improve to 30-32% through operational leverage rather than dramatic automation gains. The stock trades at 19.5-20.5x earnings reflecting quality business characteristics without growth premiums, supporting price targets of $290-320.

This scenario assumes continued customer retention and gradual AI adoption without competitive displacement or dramatic market share gains. It represents the most probable outcome given current execution trajectories and competitive dynamics, but offers limited upside potential for growth-oriented investors.

The bear case envisions platform complexity undermining AI adoption and competitive positioning. Revenue growth decelerates to 5-7% as competitors capture enterprise AI spending and customer retention weakens. Operating margins compress to 25-27% due to competitive pricing pressure and higher customer acquisition costs. The stock trades at mature software multiples of 15.5-16.5x earnings, supporting price targets of $180-210.

This scenario could develop if federation approaches prove insufficient for enterprise AI requirements, if Microsoft's distribution advantages accelerate Copilot adoption, or if ServiceNow's workflow automation captures larger AI spending than anticipated. The probability increases if FY27 AI revenue fails to meet guidance or if competitive customer losses accelerate.

Closing the Loop: The Complexity Circle

The irony of Salesforce's current position becomes most apparent when viewed through the lens of their original disruption of Siebel Systems. Twenty-five years ago, Tom Siebel built CRM market leadership through sophisticated on-premise platforms that delivered comprehensive functionality at the cost of implementation complexity. Salesforce killed that model by making CRM accessible through browser-based simplicity.

Today, Salesforce occupies Siebel's position in the complexity hierarchy. Their platform breadth and integration capabilities provide comprehensive customer management functionality, but at the cost of deployment complexity that newer, more focused competitors exploit. The acquisition-driven growth strategy that built market leadership also created the architectural fragmentation that constrains AI adoption speed.

The AI transition presents the same choice that faced Siebel during the cloud transition: defend platform sophistication or embrace disruptive simplicity. Siebel chose to protect existing complexity advantages and lost market leadership to simpler alternatives. Salesforce faces the parallel decision of whether to rebuild platform integration or accept federation complexity as competitive disadvantage.

The fundamental question isn't whether Salesforce can execute their AI strategy successfully—the technical capabilities and financial resources exist to build enterprise AI orchestration layers. The question is whether they can complete that transition faster than competitors can build alternative control points using simpler architectural approaches.

Just as cloud computing made on-premise complexity untenable regardless of functionality advantages, AI-native architectures may make retrofitted AI approaches obsolete regardless of platform breadth. The company that killed complexity through "No Software" now faces an existential challenge: can they kill their own complexity before someone else does it for them?

The next eighteen months will provide the answer. Either Salesforce will demonstrate that patient capital and platform breadth create durable advantages in enterprise AI orchestration, or they will validate that technological transitions favor architectural simplicity over incumbent sophistication. The complexity trap that destroyed their predecessor awaits the same resolution that made Salesforce successful: disruption through simplification.

For investors, the framework is clear. At current valuations around $244, you're buying optionality on successful platform transformation within a profitable, cash-generative business. The downside is protected by mature software fundamentals; the upside depends on whether the disruptor can avoid becoming the disrupted. History suggests that most incumbents fail this test, but the few that succeed create generational investment returns.

The meter that matters isn't quarterly growth rates or margin expansion—it's whether Salesforce can publish AI usage economics that prove their orchestration layer is working at scale. Until those metrics emerge, the complexity trap remains open, waiting to claim another platform leader that confused sophistication with competitive advantage.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

I’m bullish on Salesforce right now, which is why I’m trying to get a job there. I think having a lead in CRM makes them well positioned for folks to add on Agentforce. But we’ll see.