Sea Ltd 3Q25 Earnings: The Rice Field Advantage

Margins compress, but infrastructure compounds — why Sea’s “rice field” know-how could turn short-term pain into long-term moat.

TL;DR:

Integration over imitation: Sea’s ecosystem — ads, logistics, credit, gaming — functions as one adaptive stack; Brazil’s margin drag is strategic, not structural.

Two theaters, two realities: Asia remains profitable and stable while Brazil’s “infrastructure war” is strategic offensive.

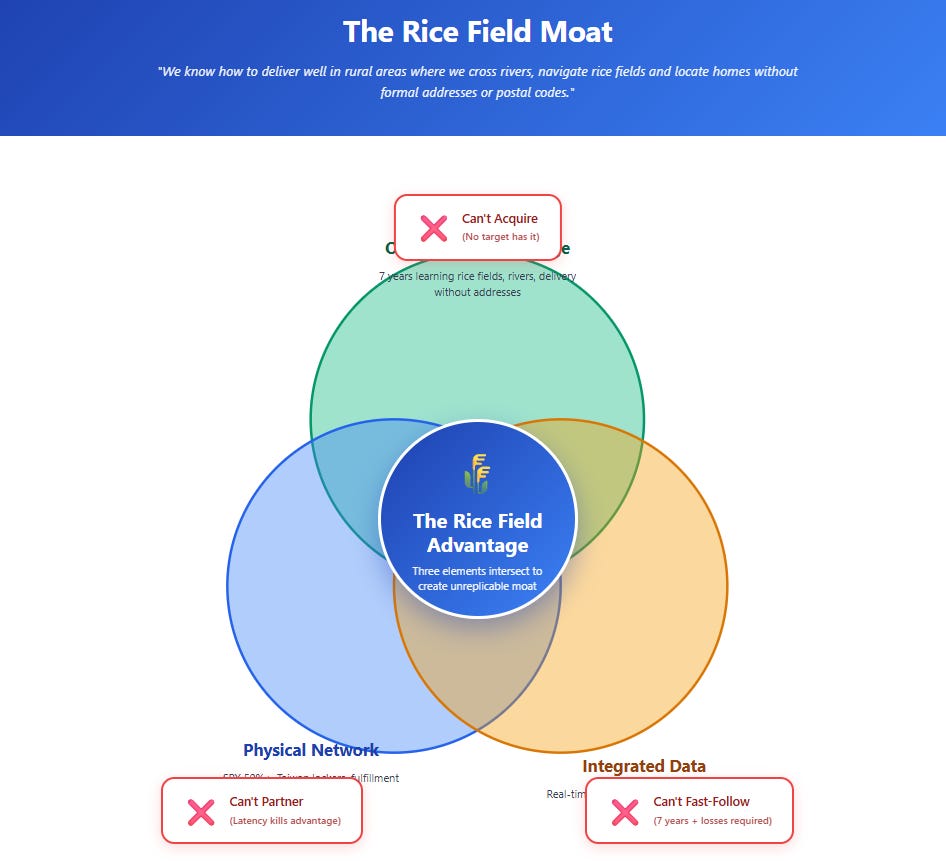

The rice field moat: Years of operational learning — crossing rivers, routing through rice fields — are the real defensible advantage that competitors can’t buy.

“We know how to deliver well in rural areas where we cross rivers, navigate rice fields and locate homes without formal addresses or postal codes.”

—Forrest Li, Sea Limited CEO, November 2025

Sea Limited’s stock fell following 3Q25 results that beat on revenue ($6.0 billion versus $5.65 billion expected) and EBITDA ($874 million versus $846 million expected). The problem: e-commerce operating margins compressed to 0.6% of GMV, down from 0.8% the prior quarter.

Weakness or strategy? Four datapoints from the same quarter:

Advertising revenue grew 70% YoY; ad take-rate rose 80 basis points while conversion improved 10%

Value-added services revenue (logistics) fell 5.7% from “subsidy net-offs”

Credit book grew 70% to $7.9 billion with NPLs stable at 1.1%

Garena gaming bookings jumped 51% to $841 million—best quarter since 2021

Revenue and monetization accelerating. Margins compressing. Li’s rice field quote explains why.

Two Theaters, Two Realities

Sea operates in two markets with different competitive dynamics.

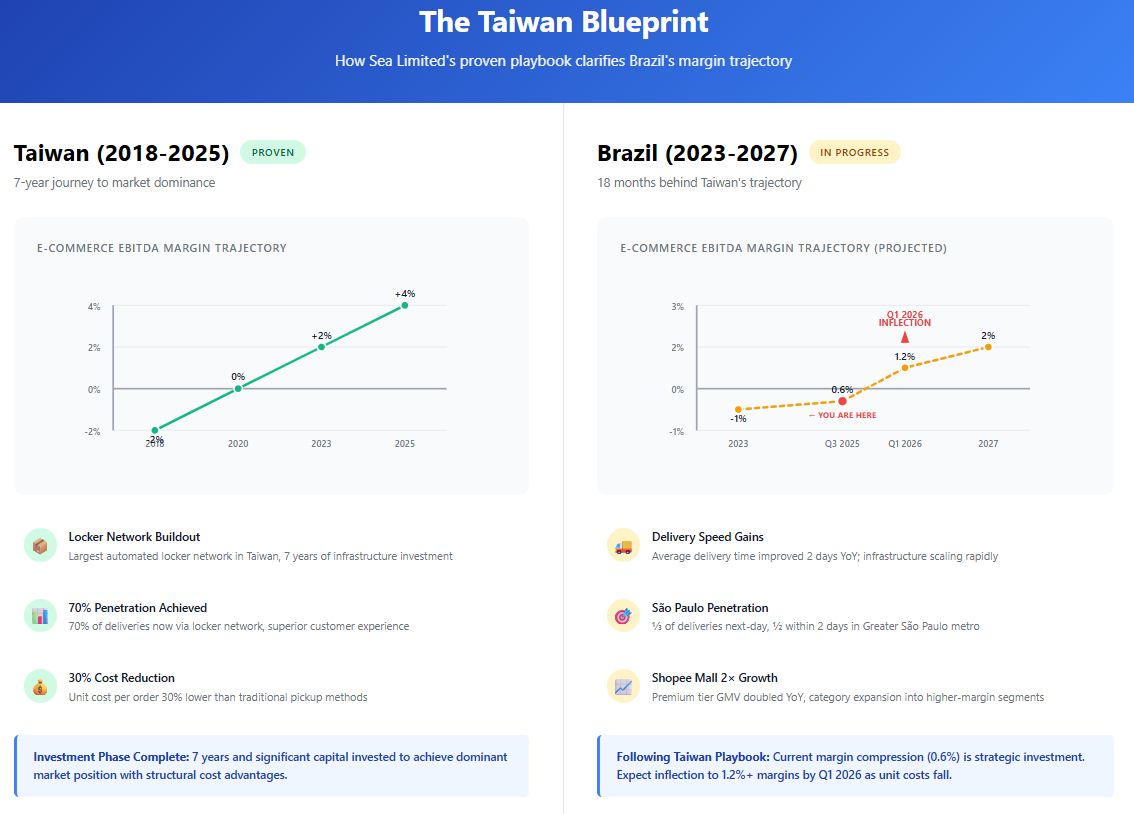

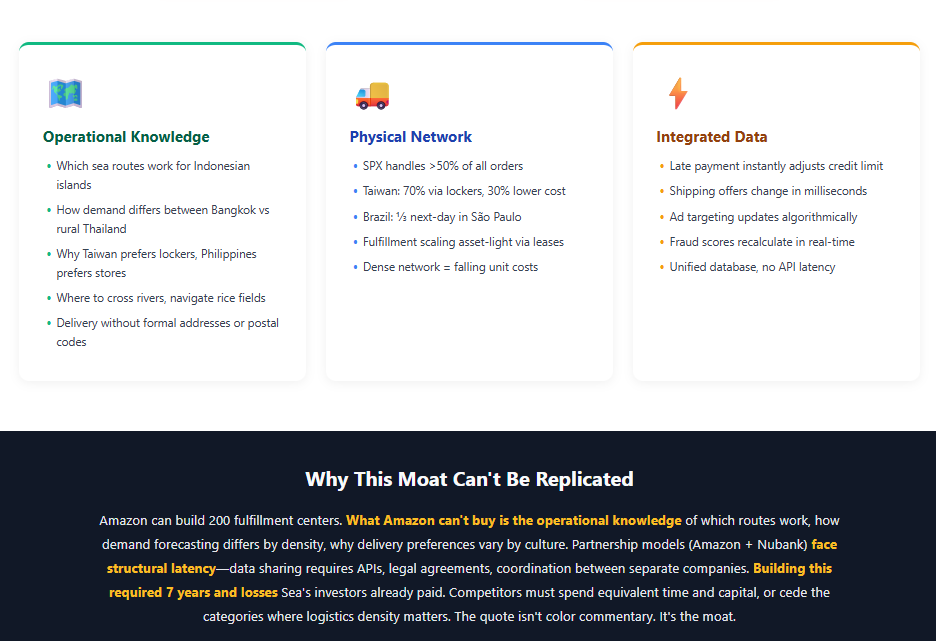

Southeast Asia (75% of e-commerce revenue): Sea holds 50-60% market share; competition is “relatively stable.” Taiwan’s automated locker network (seven years building) handles 70% of deliveries at 30% lower cost per order. Indonesia scales two-hour delivery in Jakarta while rural areas get 20% cheaper shipping. This is the profit engine.

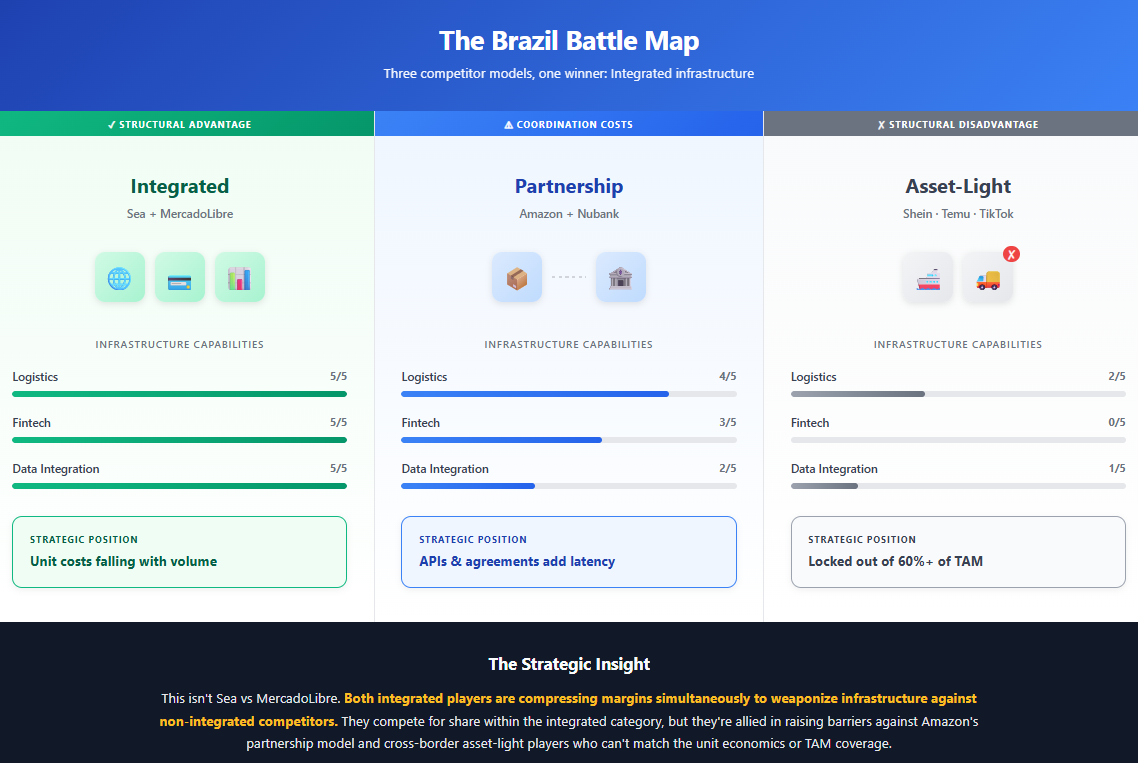

Brazil (25% of e-commerce revenue): The market frames this as Sea versus MercadoLibre. Wrong. It’s Integrated versus Everyone Else.

Three competitor categories:

Integrated players (Sea and MercadoLibre) own logistics and fintech. Years building density. Unit costs fall as volume rises.

Partnership models (Amazon + Nubank) bolt separate companies together. Amazon has 200 hubs but coordinates with Nubank for credit. Data sharing requires APIs, legal agreements, compliance reviews. Integration points add latency.

Asset-light cross-border (Shein, Temu, TikTok Shop) ship from China in 2-3 weeks. Locked out of fresh food, heavy goods, returns-intensive categories. No fintech in a market where buy-now-pay-later represents 30%+ of mature-market transactions.

This isn’t Sea losing to MercadoLibre. Both integrated players are compressing margins simultaneously. MercadoLibre dropped free shipping to R$19 (from R$79); unit costs fell 8% quarter-over-quarter despite 28% volume growth. Sea improved delivery times by two days YoY; in São Paulo, one-third of deliveries arrive next-day, half within two days. Shopee Mall GMV doubled.

They’re weaponizing infrastructure to make Brazil uneconomic for competitors facing the same prices without the same unit costs.

Market mistake: extrapolating Brazil pressure to the whole company. Reality: Asia is fine. Only Brazil is a war.

The Compounding Stack

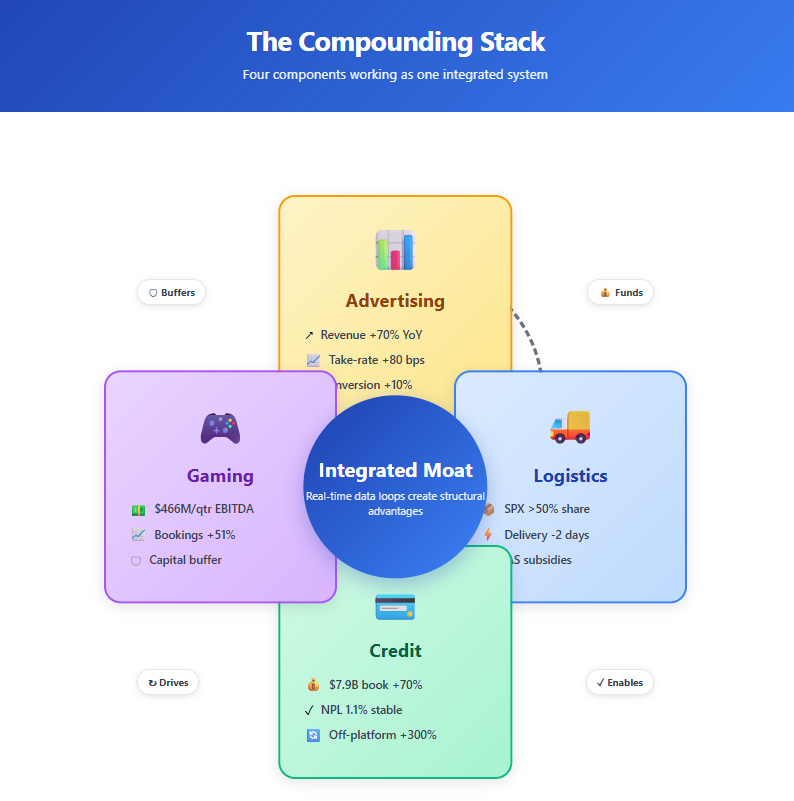

Not four businesses—a system where each component enables the next.

Advertising funds the build. Revenue grew 70%, take-rate rose 80 basis points. Conversion improved 10% YoY. This is AI-powered targeting that improves relevance, not ad-stuffing that degrades experience. Revenue funds logistics subsidies without permanent burn.

Logistics builds the barrier. SPX handles over 50% of orders. VAS revenue fell 5.7% because Sea subsidizes merchant shipping to buy density—Taiwan’s playbook. Faster delivery unlocks category expansion (fresh food, premium goods), increasing basket sizes and improving ad yield.

Credit accelerates conversion. The $7.9 billion book grew 70%; NPLs stayed at 1.1%. Brazil’s loan book tripled YoY with “improving portfolio quality.” Integrated shopping and payment data enables superior underwriting—Sea knows what customers buy, browsing patterns, return rates. BNPL penetration ranges from single digits (new markets) to 30%+ (mature), implying 3-5x runway.

Gaming buffers the system. Garena generates $466 million quarterly EBITDA ($1.9 billion annualized). This funds Brazil while Asia self-sustains. IP collaborations (Squid Game, Naruto) appear repeatable.

Why integration wins: Late payment instantly adjusts credit limits, shipping offers, ad targeting, fraud scores. Milliseconds, algorithmic, unified database.

Amazon + Nubank partnership: Nubank knows about late payment. Getting that to Amazon requires API calls, data agreements, compliance reviews, coordination between separate companies. Latency isn’t a bug—it’s structural.

What the Market Misses

At $142 (27× FY26 earnings), consensus assumes Brazil is a permanent margin drag. Implied forecast: $4.3-4.5 billion FY26 EBITDA, 25% growth—below the 68% growth Sea just printed.

Three errors:

Theater confusion. 75% of e-commerce operates in low-competition Asian markets. 25% faces Brazil war. Market prices Sea as if the entire company faces Brazilian intensity.

Multiple compression without cause. 27× P/E on 40% EPS growth = 0.67 PEG ratio. Bear case pricing while operating metrics strengthen.

Ignoring the buffer. Garena’s $1.9 billion annual EBITDA provides flexibility MercadoLibre lacks. MELI self-funds from marketplace profits. Sea sustains Brazil compression longer via gaming cash.

The market sees 0.6% margins as permanent. Management guides to “2-3% annual capability.” Prior quarter was 0.8%. The inflection is 6-9 months away.

This is offensive spending. Delivery improved 2 days YoY while São Paulo hit ⅓ next-day—unit costs falling, not flat. Taiwan took three years from subsidy phase to margin expansion. Brazil tracks that curve 18 months behind.

Three Scenarios

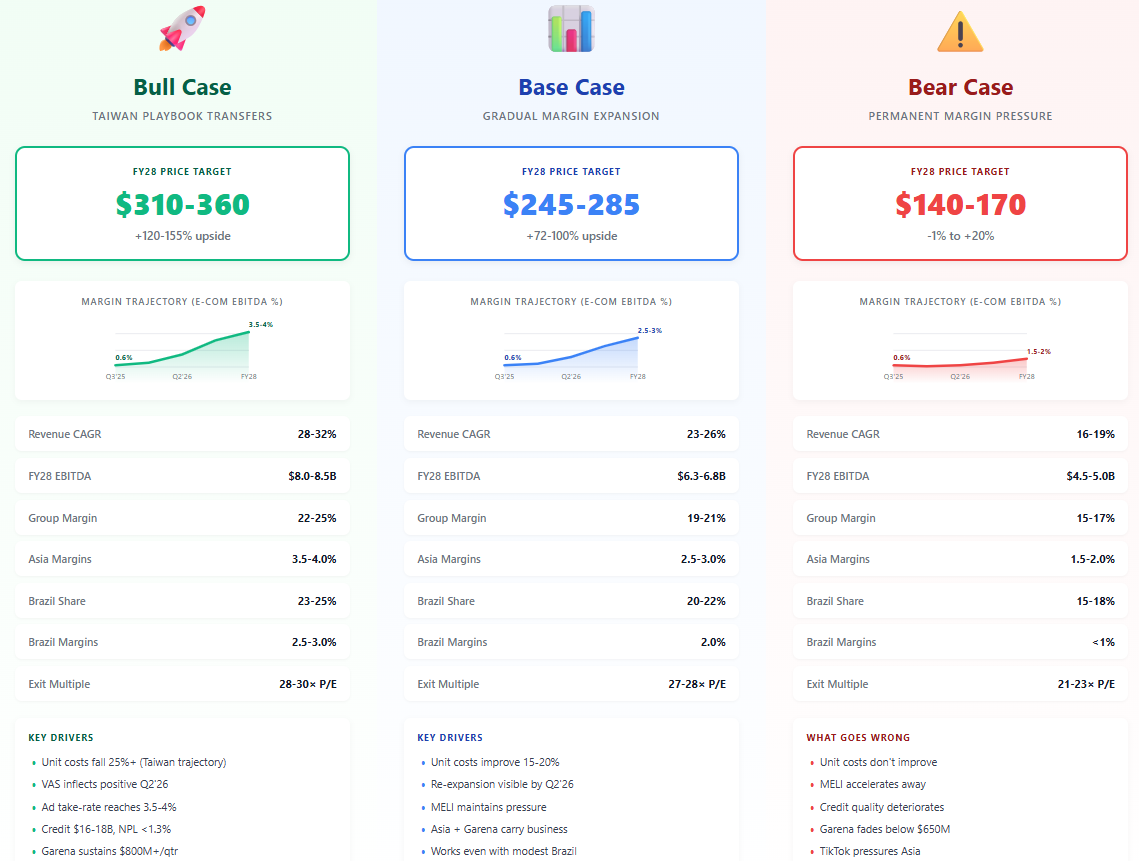

Bull (25% probability): Taiwan’s cost trajectory transfers to Brazil. Unit costs fall 25%+ over 18 months. VAS inflects positive by Q2 2026. Ad take-rate reaches 3.5-4%. Credit scales to $16-18 billion, NPL <1.3%. Revenue CAGR 28-32%. Worth $310-360.

Base (55% probability): Slower Brazil improvements—15-20% unit cost gains. Margin re-expansion by Q2 2026 but gradual. MELI maintains pressure. Critical insight: this works. Asia margins of 2.5-3% plus Garena cash carry the business even if Brazil achieves only 20% share at 2% margins. Revenue CAGR 23-26%. Worth $245-285.

Bear (20% probability): Unit costs don’t improve while subsidies persist. MELI accelerates beyond Sea’s ability to match. Credit deteriorates (NPL >1.5%). Garena fades below $650M quarterly. TikTok pressures Asia. Revenue CAGR 16-19%. Worth $140-170.

Key distinction: bull requires Brazil success. Base doesn’t. Probability-weighted outcome delivers strong returns even if Brazil achieves only distant second place.

Tracking Quarterly

Q4 2025 (February): EBITDA margin holds 0.6-0.7%. Garena sustains $750M+ bookings. Management quantifies Brazil unit costs or fulfillment ROI.

Q1 2026 (May)—Critical inflection: VAS turns positive YoY. EBITDA margin climbs to 0.8-0.9%. Credit provisions normalize to 70-75% of loan growth.

Q2 2026 (August)—Confirmation: Margins re-expand toward 1.0-1.2%. Ad take-rate gains of 70-80bps sustained. Off-book credit rises above 15%.

If these hit, Street estimates revise higher—FY26 EBITDA from $4.5B to $4.8-5.0B. Multiple re-rates from 27× to 32-35×. Stock moves toward $245-285.

Failure modes: EBITDA stuck <0.7% through Q2 2026 (unit costs not falling). VAS stays negative through Q2 2026 (merchants won’t pay). NPL >1.5% by Q1 2026 (data advantage overstated). Garena <$650M in Q4 2025 or Q1 2026 (Q3 was spike).

Q1 2026 earnings in May will matter more than any quarterly report in the next two years.

Back to the Rice Fields

“We know how to deliver well in rural areas where we cross rivers, navigate rice fields and locate homes without formal addresses or postal codes.”

Not color commentary. Accumulated operational specificity that can’t be acquired, partnered, or fast-followed. Competitors can’t buy knowing which sea routes work for Indonesian islands, how demand forecasting differs between dense Bangkok and rural Thailand, why Taiwanese prefer automated lockers while Filipinos prefer convenience stores.

Building that required seven years and losses Sea’s investors already paid. Competitors spend seven years and equivalent losses, or cede categories where logistics density matters.

The Brazil endgame isn’t beating MercadoLibre for first. It’s establishing profitable second at 20-25% share with 2% margins. That’s $1.5-2.0 billion annual EBITDA by FY28. Combined with Asia’s $4-5 billion (dominant) and Garena’s $2 billion, that’s $7-8 billion EBITDA—nearly double Street consensus.

At $142 and 27× forward earnings, you’re paying bear-case prices for base-case outcomes. The rice field advantage is worth $255-290 if real, $140-170 if not. Six to nine months clarifies which.

The margin compression everyone sees as weakness is the final stage of building what competitors can’t replicate. Even with capital, they lack time and operational learning from crossing rivers, navigating rice fields, finding homes without addresses.

The quote isn’t color. It’s the moat.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

Hey, great read as always. What if that adative stack became open source?