Sea's 2Q25 Earnings: Fortress and the Illogic of a Siloed View

Inside the fortress model that converts cross-segment synergies into competitive advantages competitors can’t match.

TLDR

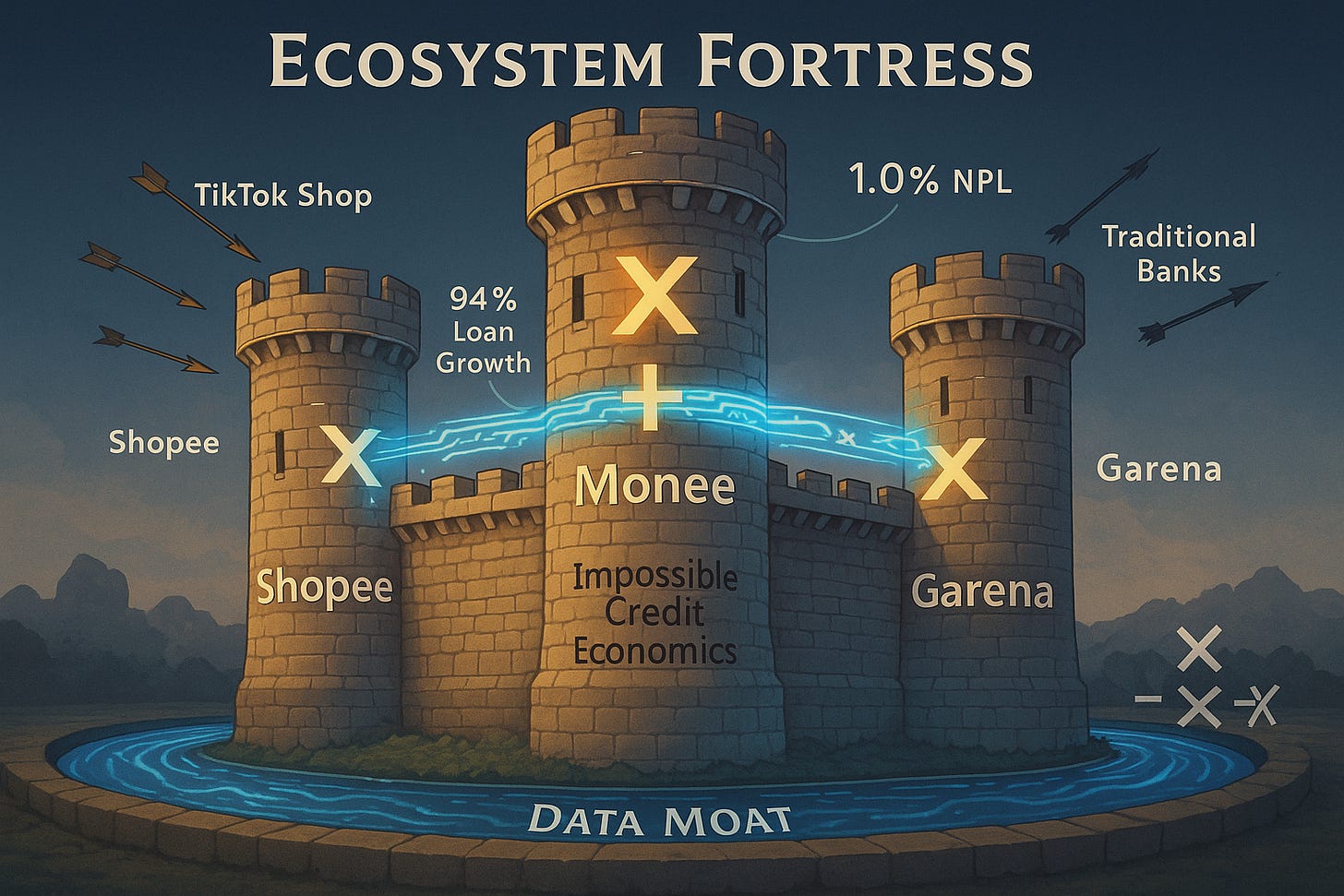

Ecosystem Fortress Proven – Q2 results confirm that Sea’s moat comes from the multiplicative integration of Shopee × Monee × Garena, not from their standalone performance.

Impossible Credit Economics – Monee’s loan book grew 94% YoY to $6.9B while NPL90+ fell to 1.0%, leveraging Shopee’s behavioral data to underwrite with unmatched precision.

Profitability as a Weapon – Shopee’s slight margin dip reflects strategic reinvestment from a position of strength, funding user experience and market consolidation competitors can’t afford.

Sea Limited reported on Tuesday (Aug 12) a 418.3 per cent increase in its second-quarter earnings to US$414.2 million, a jump from the US$79.9 million in the year-ago period. Revenue for the group grew 38.2 per cent to US$5.3 billion for Q2 2025, powered by the performance of its e-commerce and digital financial services arms.

From Bloomberg

The market's reaction to Sea's Q2 results—an 19% jump —suggests investors finally recognized something significant. I believe what they witnessed was not merely strong quarterly execution, but definitive proof that Sea's three businesses now constitute what I call an "Ecosystem Fortress"—a self-funding economic structure whose primary competitive advantage lies not in any individual segment, but in their multiplicative integration.

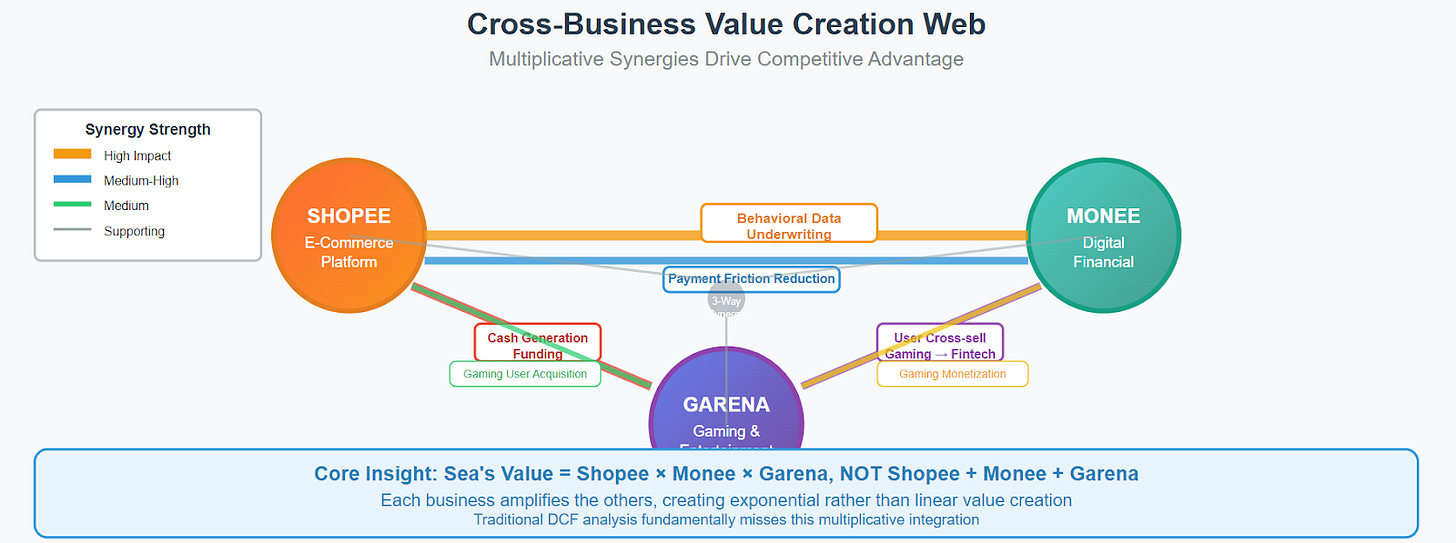

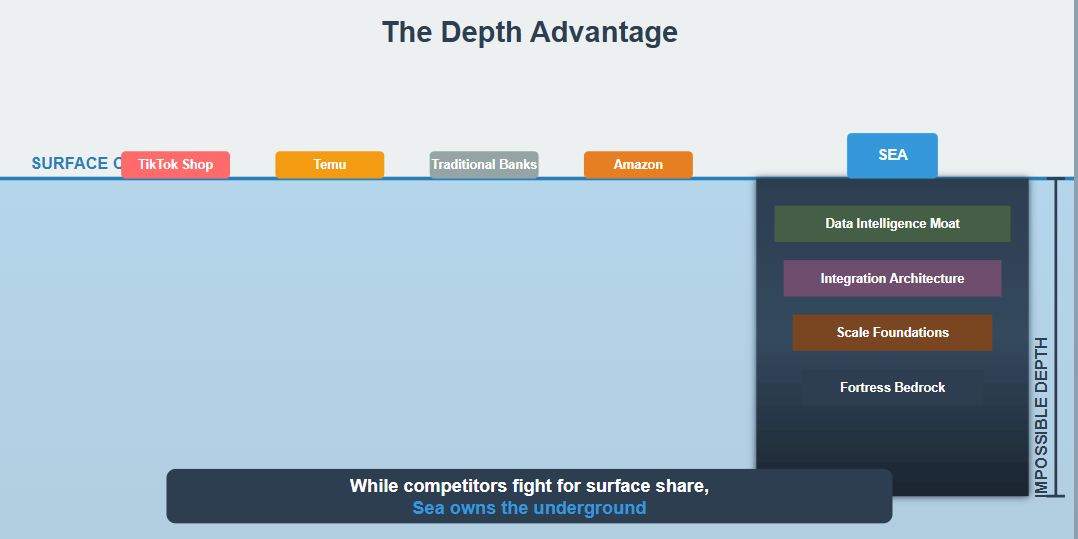

The persistent analytical error is treating Sea as the sum of its parts: an e-commerce platform plus a fintech plus a gaming company. This siloed view fundamentally misreads a business whose core moat derives from the synergy between those segments. The Q2 results provide overwhelming evidence that Sea's true value proposition is Shopee × Monee × Garena, not Shopee + Monee + Garena.

The Data Moat: Underwriting with Perfect Information

The most important revelation in Sea's Q2 report was not a revenue beat or margin expansion—it was the demonstration that Monee has achieved something that should be financially impossible. The consumer and SME loan book grew 94% year-over-year to $6.9 billion while the NPL90+ ratio improved to 1.0%.

Growth vs. Quality: The Impossibility Trend

The data is unambiguous. As the loan book nearly doubled, credit quality has actually improved—a dynamic that defies the laws of traditional finance.

What the market sees: A high-growth, high-risk emerging market lender expanding aggressively during favorable economic conditions.

What is actually happening: A data science operation monetizing a proprietary, real-time dataset of commercial behavior to eliminate traditional underwriting uncertainty. Monee is not competing with traditional banks or fintech lenders; it is operating with information asymmetries they cannot access or replicate.

The Shopee integration is not a "synergy" in the typical corporate sense—it is a fundamental risk-mitigation architecture. Every transaction on Shopee provides behavioral data: payment timing, purchase categories, merchant relationships, seasonal patterns, dispute resolution history. Traditional credit scores, where they exist in Sea's markets, are backward-looking snapshots. Sea's dataset is forward-looking behavioral prediction.

Consider the competitive impossibility: A standalone fintech like GrabPay can acquire Shopee customers, but it cannot acquire three years of their transaction history. A traditional bank like DBS has regulatory advantages and deep capital, but it lacks the high-frequency commercial activity data. Sea is the only entity operating with this level of underwriting information density.

Strategic Conclusion: Monee's 1.0% NPL is not just impressive risk management—it is the "dividend" paid out by the Ecosystem Fortress's data integration. This advantage strengthens with every transaction and becomes mathematically harder for competitors to overcome.

Profitability as a Weapon

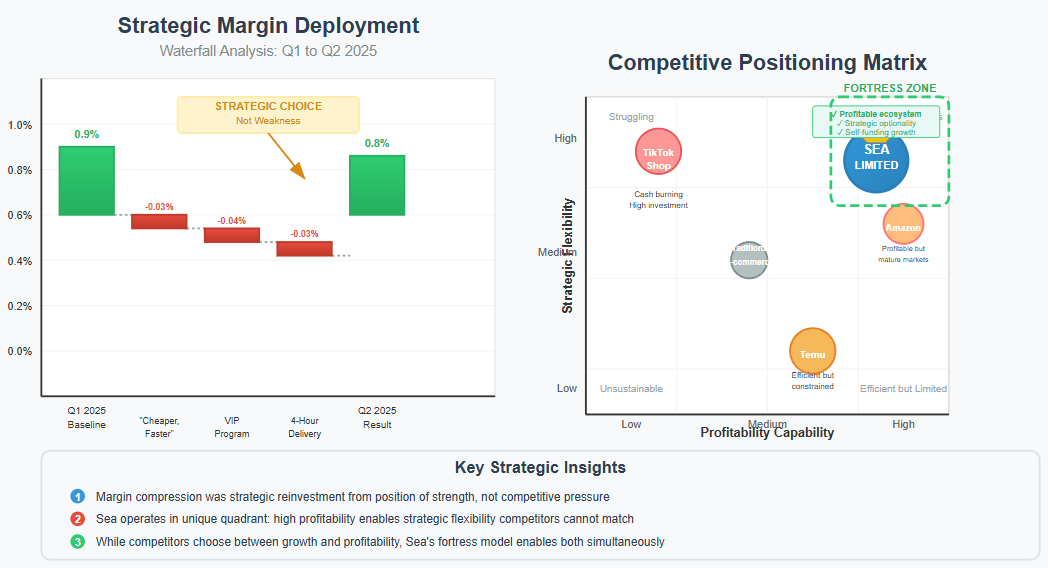

The second strategic insight emerges from what analysts initially interpreted as Shopee's only "weakness": the adjusted EBITDA margin slipping from 0.9% of GMV in Q1 to 0.8% in Q2. This narrow focus on sequential margin compression misses the broader strategic context entirely.

The Context of Margin: Strategic Reinvestment During Acceleration

The slight margin dip occurred during a period of accelerating growth, signaling a strategic reinvestment from a position of strength, not a deterioration of fundamentals.

CEO Forrest Li's commentary reveals the strategic sophistication: "Given the high potential of our markets and the stage we are at in our business now, we will continue to prioritize growth... At the same time, our company has reached a stage where we can pursue growth opportunities while improving profitability."

This statement is crucial. Li is not describing a choice between growth and profitability—he is declaring that Sea has achieved sufficient scale and competitive positioning to pursue both simultaneously. This is strategic flexibility that only profitable, dominant platforms possess.

The margin compression funded specific competitive moats: the "Cheaper, Faster at Shopee" campaign, VIP membership programs offering 50% higher GMV per user, and instant delivery services reaching 4-hour delivery windows. These are not desperate competitive responses—they are strategic investments in market consolidation.

Consider the competitive dynamic: While TikTok Shop struggles with logistics infrastructure development and regulatory compliance, and while Temu faces restrictions in financial services integration, Sea can afford to sacrifice short-term margins to widen its operational advantages. Cash-burning competitors cannot match this strategic patience.

Strategic Conclusion: This was not a margin miss; it was a demonstration of power. Sea is deploying its P&L as a competitive weapon, subsidizing user experience improvements that competitors cannot afford to match while maintaining profitability.

The Garena Engine Upgrade

The most underappreciated development in Q2 was management's mid-year guidance raise for Garena, now expecting bookings to grow "more than 30% in 2025, year on year." This completely transforms the strategic narrative around Sea's gaming division.

Re-acceleration: From Decline to Growth Engine

The narrative of Garena as a declining asset is definitively broken. Both growth momentum and monetization efficiency are sustaining at elevated levels.

For eighteen months, the conventional wisdom held that Garena represented a mature, cash-generating asset whose primary value was funding Shopee and Monee expansion. The guidance revision suggests something far more strategic: a re-accelerating, high-margin engine that significantly de-risks the entire ecosystem.

Management's confidence in raising guidance mid-year, combined with their discussion of Free Fire as an "evergreen franchise" and successful IP collaborations (Netflix Squid Game, Naruto), indicates they have developed a repeatable playbook for lifecycle extension through systematic content innovation.

The strategic implications are profound:

Risk Reduction: Instead of one business funding two others, Sea now operates three self-sustaining profit centers, dramatically reducing execution risk across the platform.

Strategic Optionality: Garena's cash generation provides additional firepower for geographic expansion, competitive responses, and technology investments without requiring external capital or cross-subsidization.

Competitive Advantage: Most gaming companies face hit-driven volatility with unpredictable revenue cycles. Sea appears to have solved the "evergreen content" problem, creating predictable, high-margin cash flows that fund platform investments competitors cannot match.

Strategic Conclusion: The fortress's internal bank just received a massive, unexpected capital injection, making the entire ecosystem more self-sufficient and providing additional ammunition for market consolidation.

The Fallacy of the Sum-of-the-Parts

The market's analytical framework for Sea remains fundamentally flawed. Investors and analysts continue applying traditional DCF models to each segment individually, then adding the results together. This approach completely misses the multiplicative value creation occurring across the integrated platform.

The true value equation is not:

Shopee + Monee + Garena = Sea's Value

The reality is:

Shopee × Monee × Garena = Sea's Fortress Value

The multiplicative effects are evident in the Q2 results:

Shopee's transaction data enables Monee's impossible credit economics (1.0% NPL at 94% growth)

Monee's financial services integration reduces Shopee's payment friction (VIP members show 50% higher GMV)

Garena's cash generation funds both Shopee and Monee's market consolidation (strategic margin compression capability)

These cross-business advantages compound over time rather than diminish. Each additional user makes the platform more valuable across all segments simultaneously.

Pure-play competitors face what I call "single-dimension optimization"—they must excel in one area while Sea optimizes across multiple integrated dimensions. A standalone e-commerce platform must compete with Shopee's logistics while lacking financial services integration. A pure fintech must acquire customers expensively while Sea cross-sells through gaming and shopping touchpoints.

The Ecosystem Fortress is now built and fully funded. The next phase is about monetizing the territory within its walls through expanded financial services, geographic replication, and AI platform commercialization.

The Next Test of the Thesis

The primary question for Q3 and beyond is no longer whether Sea can achieve profitability—it is how management chooses to deploy that profitability for maximum competitive advantage.

The key metric to monitor is Core Marketplace Revenue growth within Shopee. This represents high-margin advertising and commission revenue directly correlated with ecosystem monetization effectiveness. If Core Marketplace Revenue continues outpacing overall GMV growth, it will confirm that the Q2 margin reinvestment successfully translated into higher ecosystem monetization.

Secondary validation metrics include:

Monee NPL maintenance below 1.5% despite continued rapid expansion

Geographic expansion announcements leveraging the proven Brazil playbook

Cross-selling acceleration between business segments

The Q2 results transformed Sea from "promising integrated platform" to "proven Ecosystem Fortress." The question is not whether this model works—it is whether investors will recognize the multiplicative value creation before it becomes obvious to everyone else.

The fortress walls are built, the economic moat is filled, and the internal funding engine is operating at full capacity. Sea has achieved something rare in business: sustainable competitive advantages that strengthen rather than weaken with scale.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.