ServiceNow 4Q25: The Control Plane Shift

ServiceNow’s Quiet Bet to Become the FAA of Enterprise AI

TL;DR

Autonomous agents now operate at machine speed, bypassing interfaces, licenses, and human oversight.

Value shifts from applications to permissioned execution, governance, audit, and routing become the bottleneck.

ServiceNow’s M&A and AI strategy signal a category jump, not a growth slowdown.

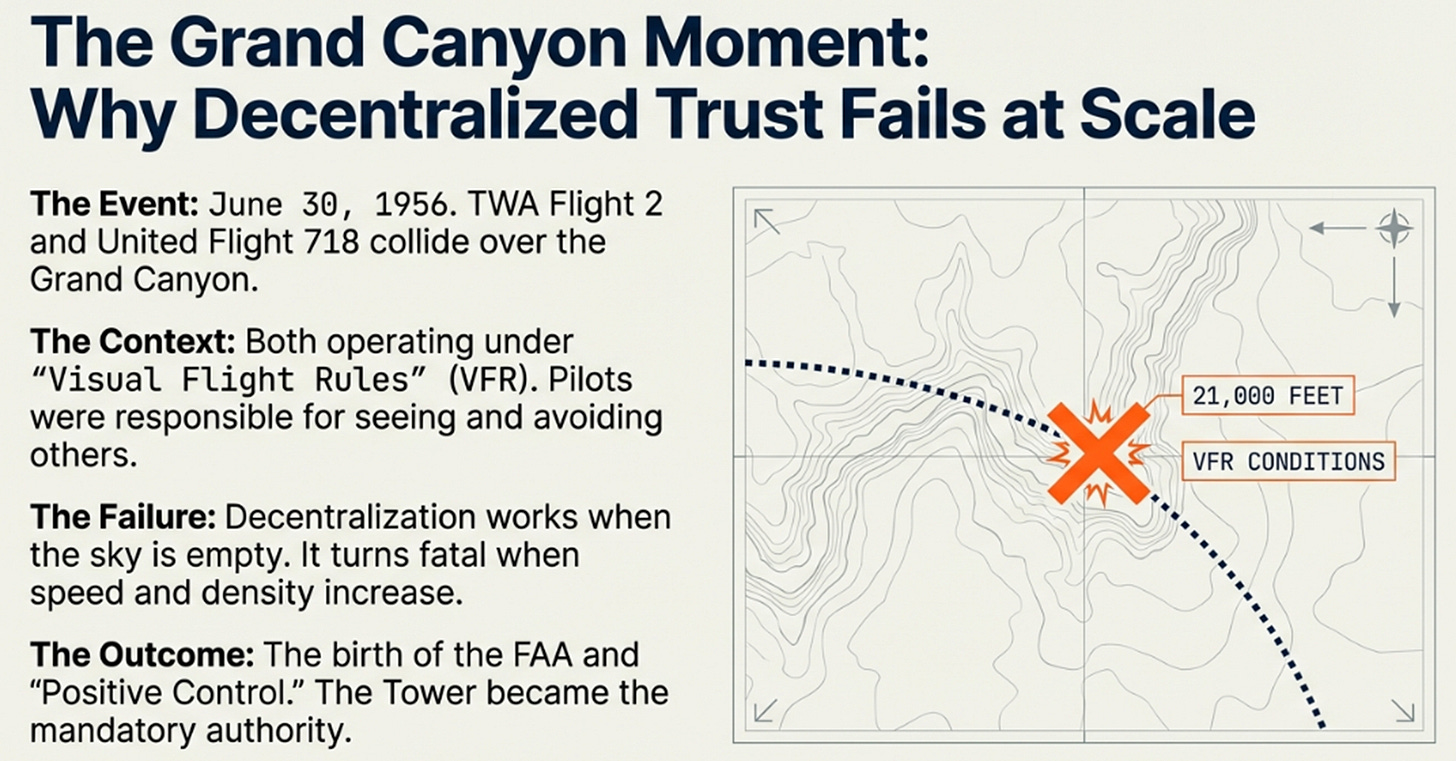

On June 30, 1956, two aircraft collided over the Grand Canyon. TWA Flight 2 and United Airlines Flight 718 met at 21,000 feet. All 128 people aboard died. The two planes had been operating under Visual Flight Rules, pilots responsible for seeing and avoiding other aircraft. It was decentralized, high-trust, and worked perfectly when the sky was empty and planes were slow.

The crash shattered that model. As density increased and speed accelerated, decentralized autonomy became fatal. The disaster birthed the Federal Aviation Administration and “Positive Control”, the pilot was no longer sole authority. The tower became mandatory.

Enterprise software ran on Visual Flight Rules for two decades. Humans opened applications, looked at screens, made decisions, clicked workflows. The interface was the control point. Security meant preventing unauthorized logins. Compliance meant auditing who did what inside which application.

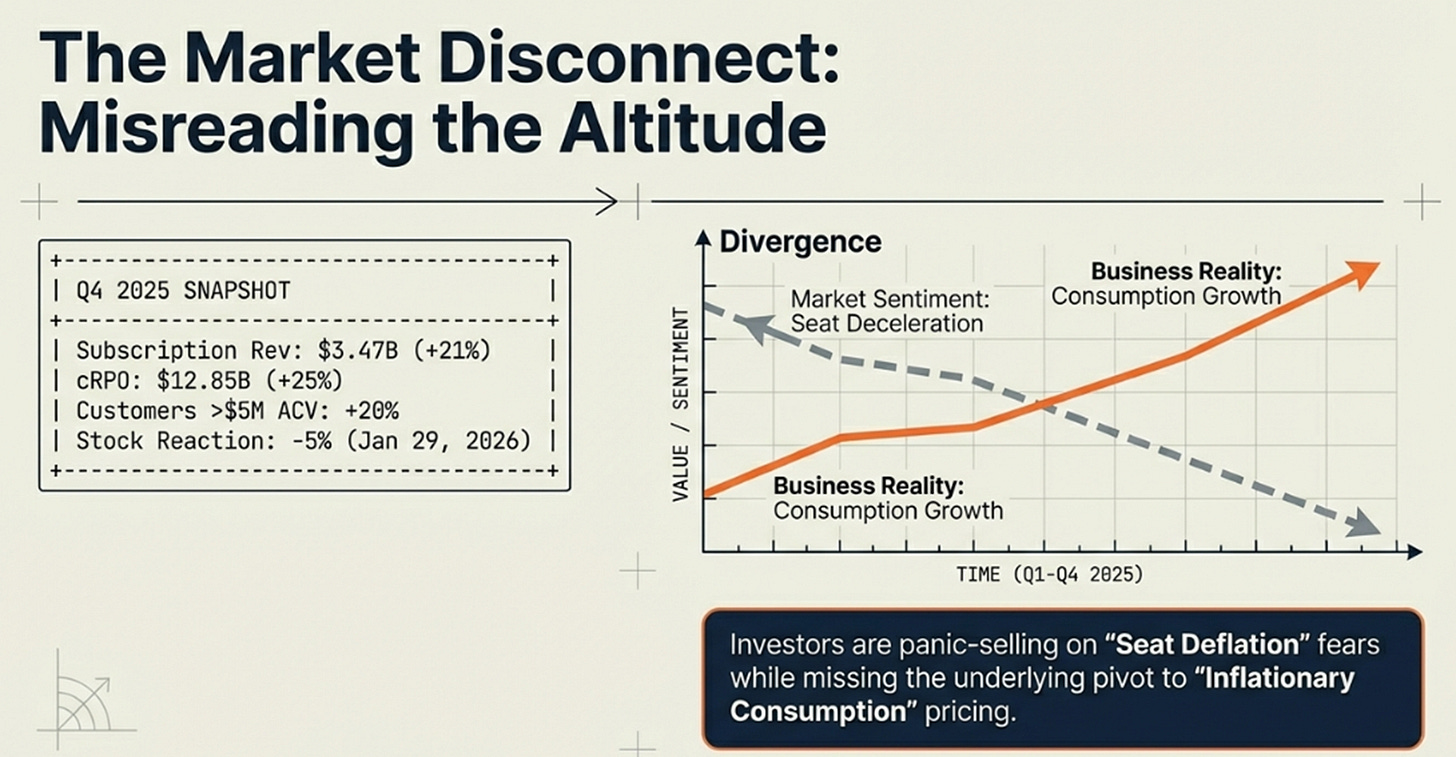

On January 29, 2026, ServiceNow reported fourth-quarter results beating every metric while guiding first-quarter organic growth to 17-18%. The stock fell 5% to $168. Investors saw deceleration. They missed the control tower being built.

Visual Flight Rules Are Breaking

Agentic AI has filled enterprise airspace with autonomous actors at machine speed. Claude Code, which reached $1 billion ARR in six months, doesn’t assist developers; it works autonomously. Point it at a task and it writes code, runs tests, debugs failures, commits to GitHub without supervision. Developers consume 200,000-300,000 tokens per minute during active sessions. That’s not autocomplete; that’s autonomous execution.

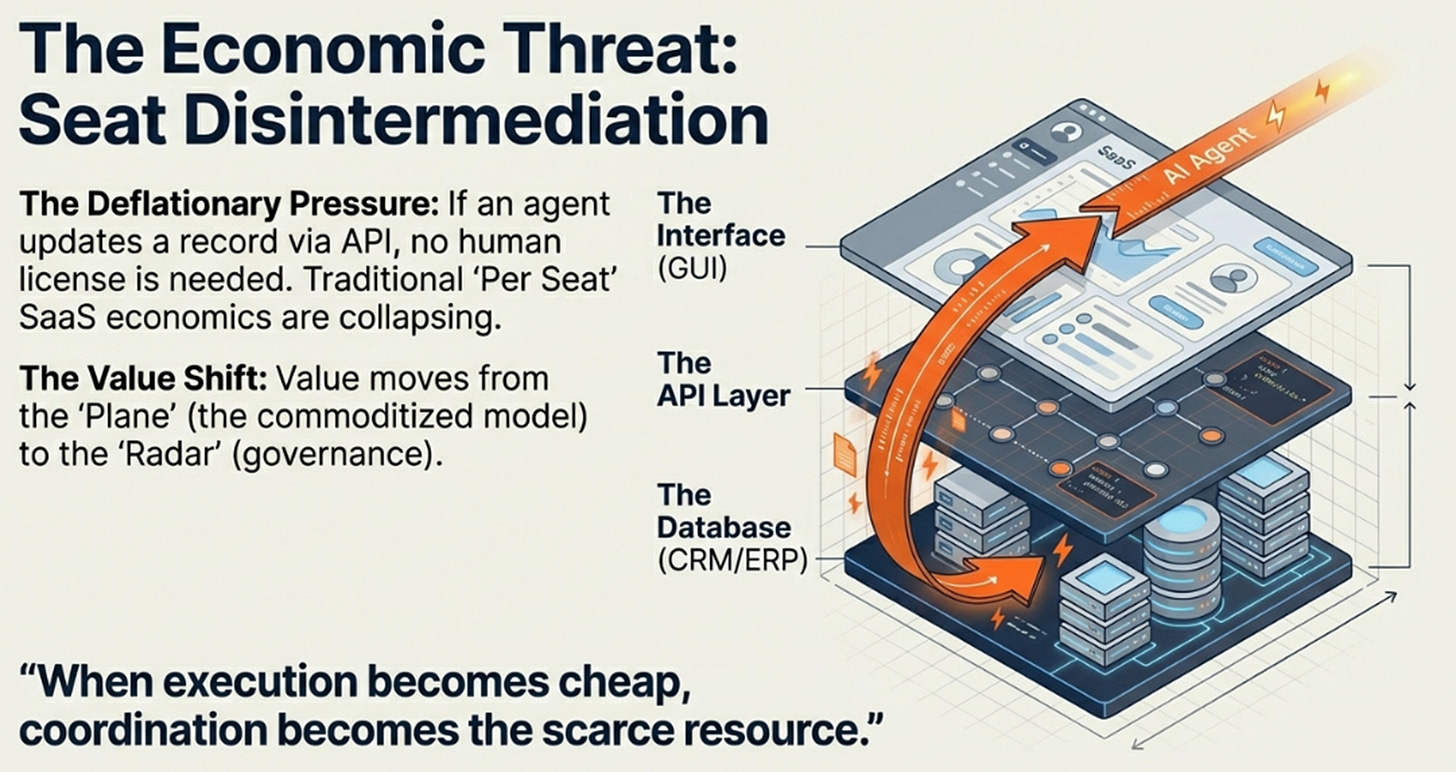

These agents don’t use graphical interfaces. They access APIs and terminals. They don’t need “seats”, the fundamental unit of SaaS economics. If an agent reads Salesforce and updates records without a human opening the UI, why does that human need a license? This “seat disintermediation” fear drove software stocks lower in early 2026 despite strong fundamentals.

But something more fundamental is breaking. Shadow AI, employees running unauthorized tools through personal accounts, is high-speed traffic in uncontrolled airspace. Ninety-seven percent of developers use AI assistants before official policies permit. Sixty-eight percent of organizations experienced AI-related data leaks in 2025.

The Coordination Imperative has arrived: when execution becomes cheap and abundant, coordination becomes the scarce resource. Value shifts from the plane (the model, commoditizing) to the radar and tower. ServiceNow isn’t building the fastest plane. It’s building air traffic control.

Building the Radar and the Radio

ServiceNow’s fourth-quarter moves reveal architectural strategy:

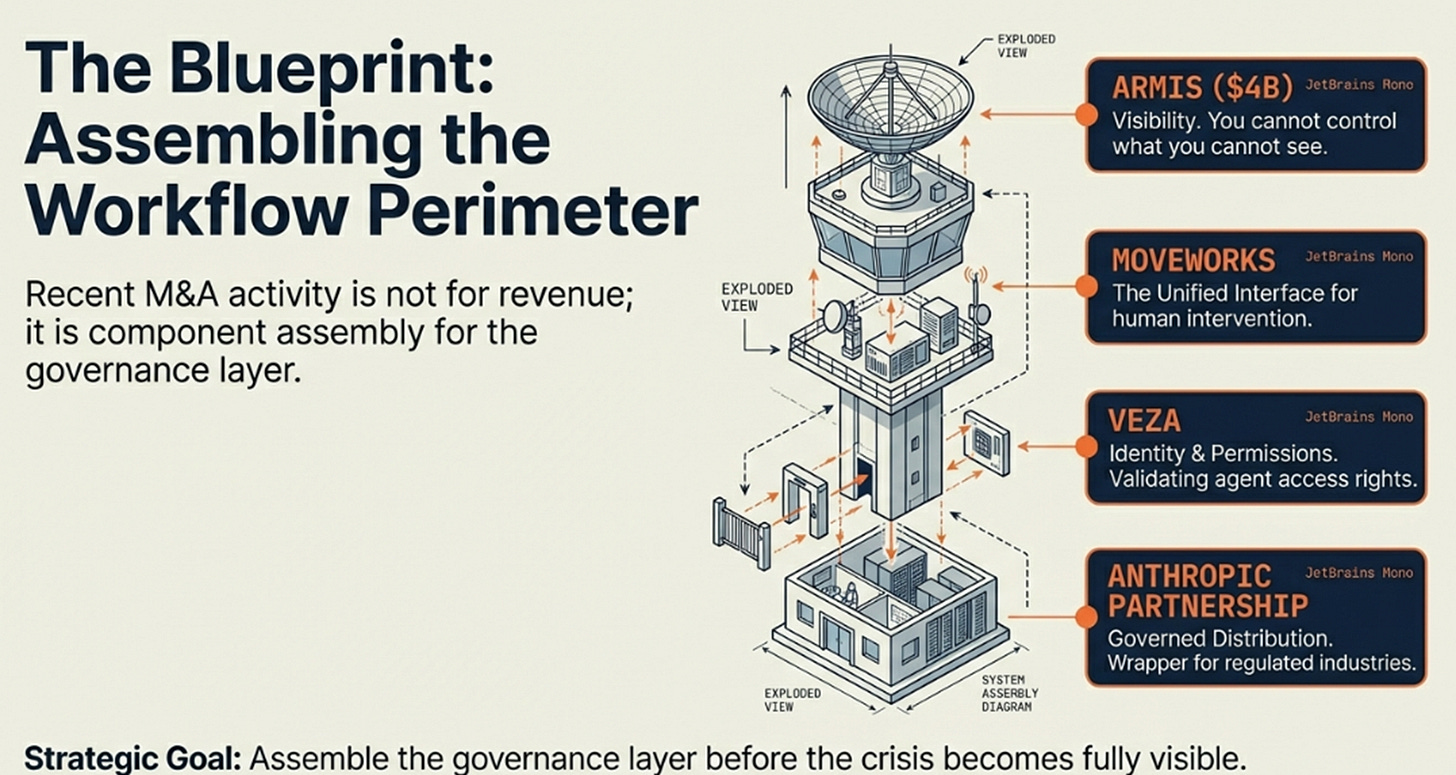

Anthropic partnership: Claude Code proved enterprises want autonomous agents, but banks and healthcare can’t use Claude directly, compliance violation. ServiceNow becomes governed distribution, wrapping Claude in audit trails and approval workflows. Revenue model: margin on token consumption plus compliance layer.

Armis acquisition ($4B+): AI-generated code shows 10x spike in security findings, 40% higher secret leakage in AI-active repositories. Armis provides asset visibility, you cannot control what you cannot see. ServiceNow is buying the solution before the crisis becomes fully visible.

Veza acquisition: Identity and permissions for autonomous agents. When an agent needs to read a data warehouse, update CRM, and file a support ticket, who validates those permissions?

Moveworks (closed December 2025): Unified interface for humans to communicate with the system.

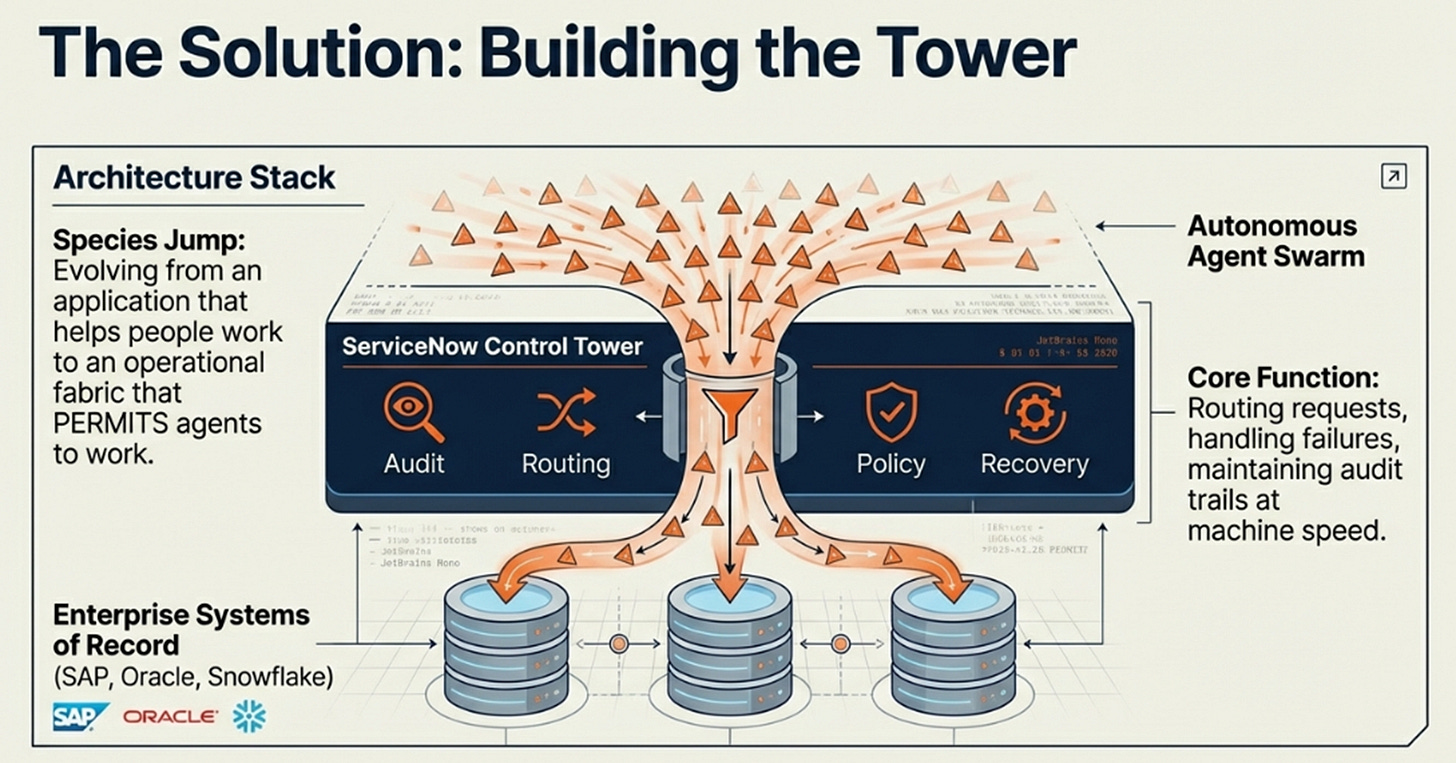

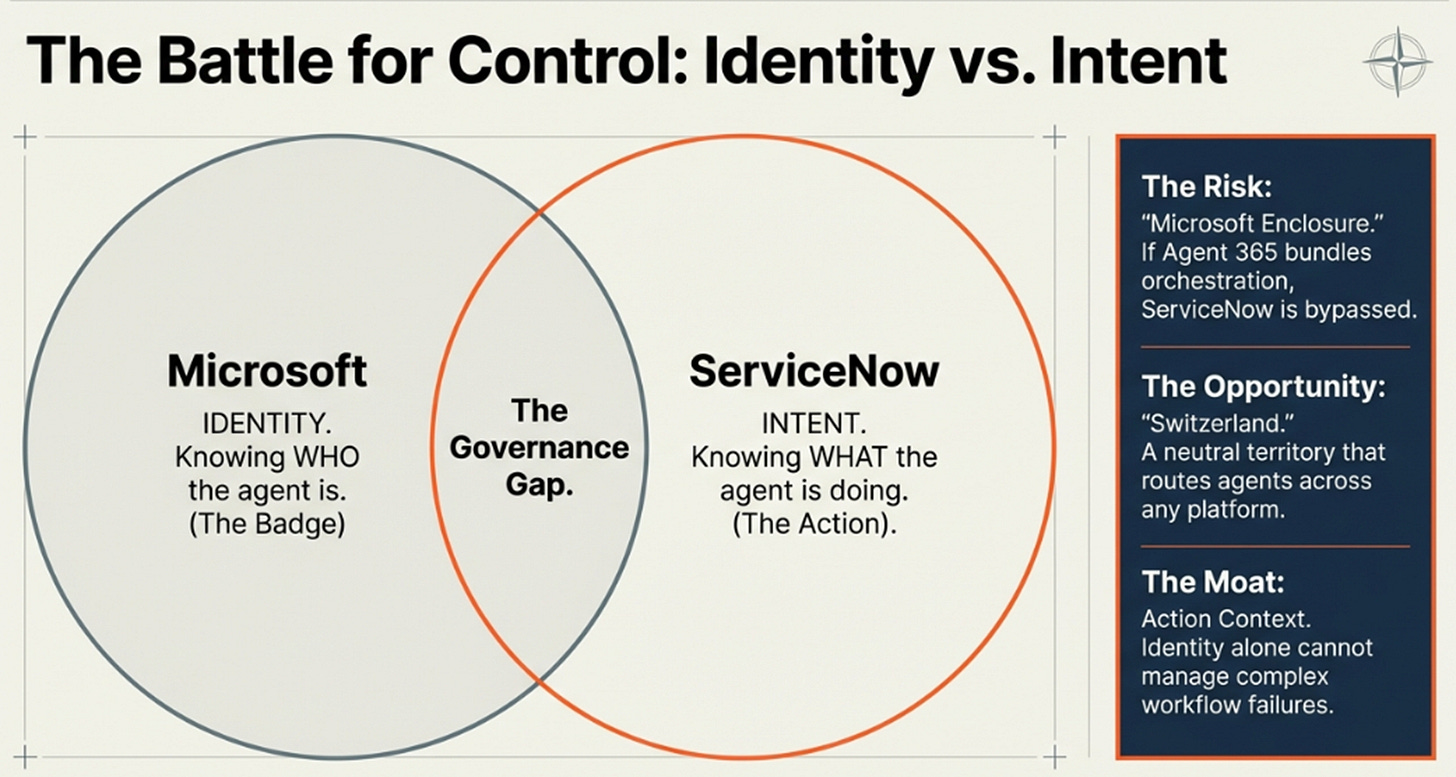

These aren’t revenue-padding acquisitions. ServiceNow is assembling components to govern a workforce without physical presence that doesn’t open applications. Microsoft Agent 365 owns the identity perimeter, who can this agent authenticate as? ServiceNow owns the workflow perimeter, which agent executes which process? Adjacent control points, not competitive.

The critical insight: agents make execution cheap; they make permissioned execution expensive.

Why the Altitude Gauge Shows Deceleration

Fourth-quarter results showed physics asserting itself:

Subscription revenue $3.47B, up 21% (19.5% constant currency)

cRPO $12.85B, up 25% reported, 21% constant currency (100bps from Moveworks)

Q1 guide 18.5-19% constant currency: includes 100bps Moveworks, 150bps hosting headwind = 17-18% organic

603 customers >$5M ACV, up 20%

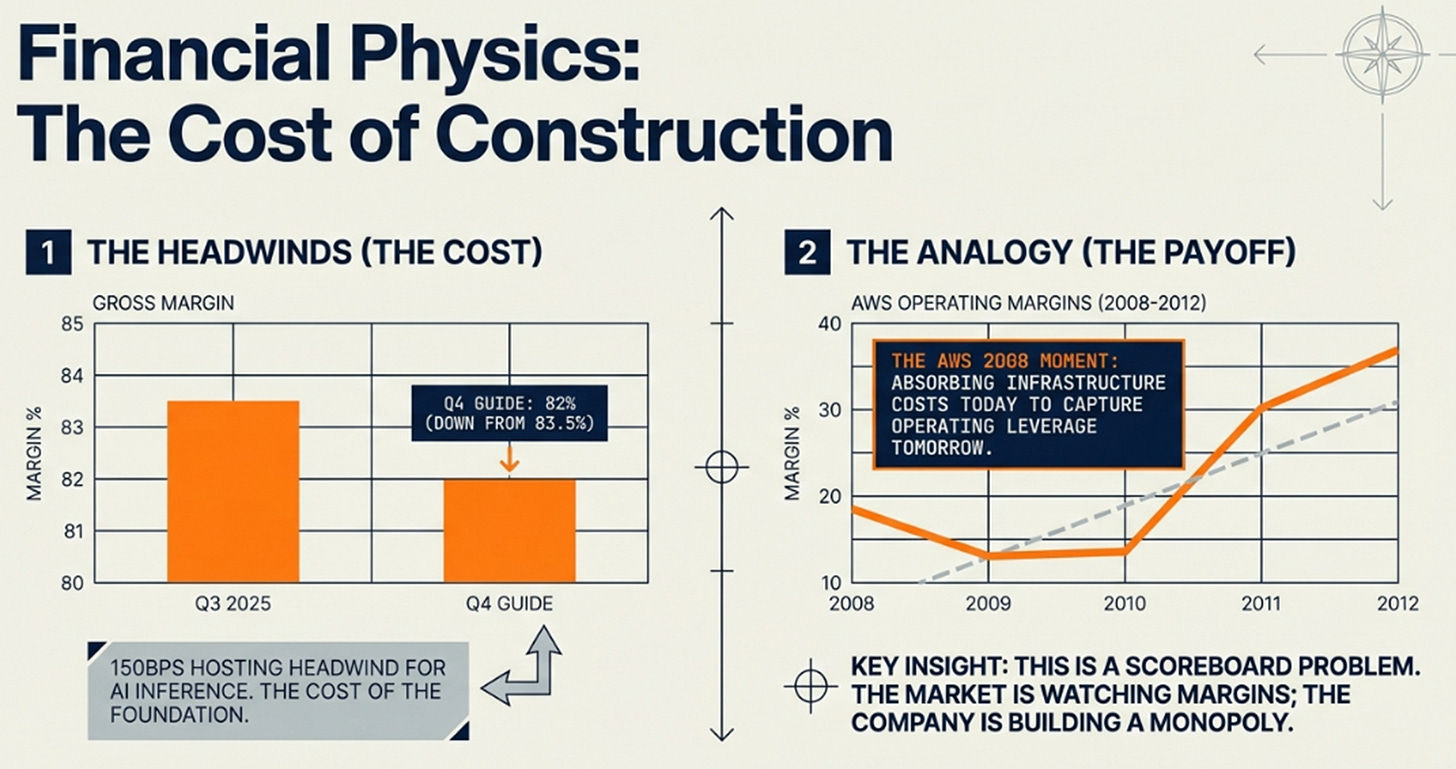

Subscription gross margin guided to 82% (from 83.5%)

Now Assist: $600M+ net new ACV, more than doubled YoY

The market focused on deceleration, organic growth toward high-teens at $13B scale. But the business model is pivoting underneath. Seat-based pricing is deflationary when agents replace humans clicking interfaces. Consumption-based pricing is inflationary when agent activity increases work routing complexity.

ServiceNow previously disclosed Creator Workflows (consumption-based) at 23% of net new ACV in Q3, up from 18%. Q4 provided no update. When metrics improve, management highlights them. Either the mix stalled or Moveworks created comparison issues. Either way, reduced transparency into the consumption transition is concerning.

The 82% margin guidance represents building costs. AI inference expenses are real; ServiceNow is absorbing them to land customers, betting on future operating leverage. This mirrors AWS 2008-2010: compress margins during land-and-expand, capture leverage as usage compounds.

The stock fell because markets reward compute/memory while punishing software on seat fears. ServiceNow didn’t provide clean “AI revenue line item” or headline re-acceleration. This is a scoreboard problem: investors watch the wrong metric.

What the Market Is Missing: The Coordination Imperative

Consensus treats ServiceNow as maturing SaaS vendor using M&A to mask slowing growth. AI helps but doesn’t change category. Fair value: 30-35x earnings for quality mature software.

The variant: ServiceNow is executing a “species jump”, evolving from application that helps people work to operational fabric that permits agents to work.

This matters because agent proliferation amplifies coordination demand. Old model: one human used fifty applications. Emerging model: fifty specialized agents each handle narrow functions. Who routes requests to correct agents? Who handles failures? Who maintains audit trails at machine speed? This is switching capacity at scale.

ServiceNow already transitioned to consumption pricing (Creator Workflows) while competitors like Salesforce and Adobe remain seat-dependent. The market punishes ServiceNow for a problem already addressed.

The moat is Action Context, not data ownership, but knowledge of what users are trying to accomplish. Microsoft knows who you are (identity). ServiceNow knows what you’re trying to do (workflow intent). Adjacent layers; both required.

The sequential dependency: Workflow orchestration only becomes valuable after identity governance deploys. You cannot route agents through workflows if they’re not first authenticated. Microsoft Agent 365 must reach critical mass before ServiceNow’s layer becomes mandatory. That’s an 18-24 month dependency.

Specifically: Microsoft must get Agent 365 to 20-30% of its Microsoft 365 base (90-135 million seats) before enterprises have enough authenticated agents to need ServiceNow’s orchestration layer. Microsoft’s current penetration is undisclosed but likely <10%. At historical enterprise software adoption curves, 20%+ penetration takes 18-24 months from general availability. Only then does ServiceNow’s $600M Now Assist opportunity scale to multi-billion.

The risk: Microsoft could extend Agent 365 to include workflow orchestration (Power Automate integration), enclosing ServiceNow entirely. The opportunity: ServiceNow becomes “Switzerland” that works across any identity provider, capturing value even when not owning the base layer.

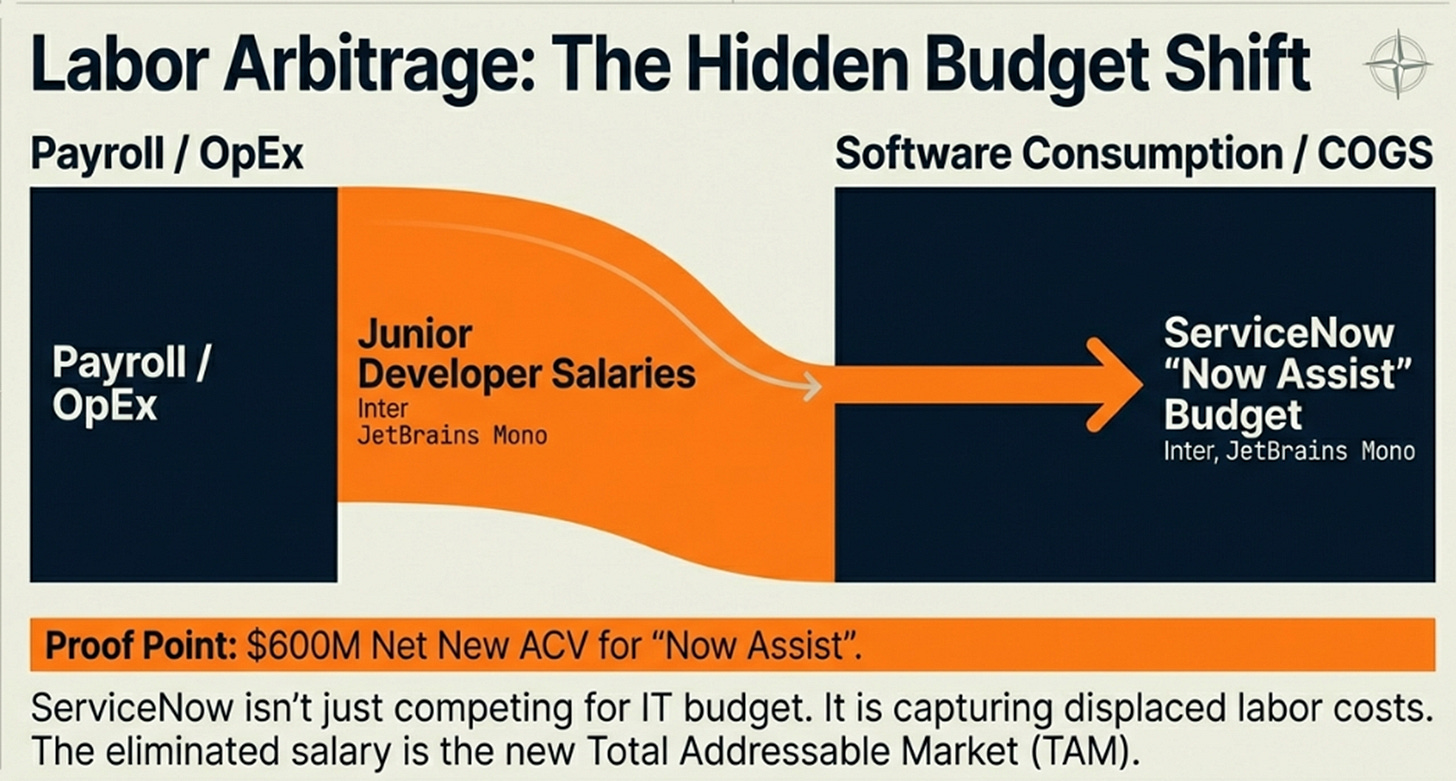

Finally, the labor arbitrage: market fears junior developer role elimination. Variant: ServiceNow captures budget previously allocated to junior salaries. The $600M Now Assist proves enterprises will make that trade.

Three Flight Paths: 2026-2028

Starting point: ~$129/share (split-adjusted, 5-for-1 December 2025), 31.5x FY26 P/E.

BULL: The “Oracle of AI” Outcome , $240-250

Agentic chaos forces CIOs to mandate ServiceNow as sole authorized control point. Consumption revenue explodes, replacing seat revenue at 2:1+ ratio.

Revenue CAGR: 22% (AI grows from $1.2B/8% in FY26 to $6.5B/28% in FY28)

Subscription gross margin: 82% → 84%

FCF margin: 36% → 40%

Exit multiple: 35x FCF

Requires: Microsoft Agent 365 at 30%+ penetration by FY27. Creator Workflows >40% of net new ACV. Margins stabilize then expand. Ideally, major security incident validates governance demand.

BASE: The “Defensive Utility” Outcome , $185-195

Consumption transition succeeds gradually. AI offsets seat deflation without purely adding. ServiceNow becomes steady-state IT utility.

Revenue CAGR: 18% (AI grows from $1.0B/6.5% to $3.0B/14%)

Subscription gross margin: stays 82%

FCF margin: 36% → 37%

Exit multiple: 28x FCF

What happens: AI monetizes but doesn’t accelerate growth materially. Consumption mix unclear. Federal weak through FY27.

BEAR: The “Microsoft Enclosure” Outcome , $115-125

Microsoft Agent 365 wins via identity advantage. Agents bypass ServiceNow to act directly on data. ServiceNow relegated to legacy help desk.

Revenue CAGR: 14% (AI slows to $1.5B/8% by FY28)

Subscription gross margin: 82% → 80%

FCF margin: 36% → 34%

Exit multiple: 20x FCF

What breaks: Agent 365 adoption slow OR Microsoft bundles orchestration. Enterprises resist consumption pricing. Salesforce Agentforce fragments market. M&A integration disappoints.

The Flight Instruments

Track these quarterly:

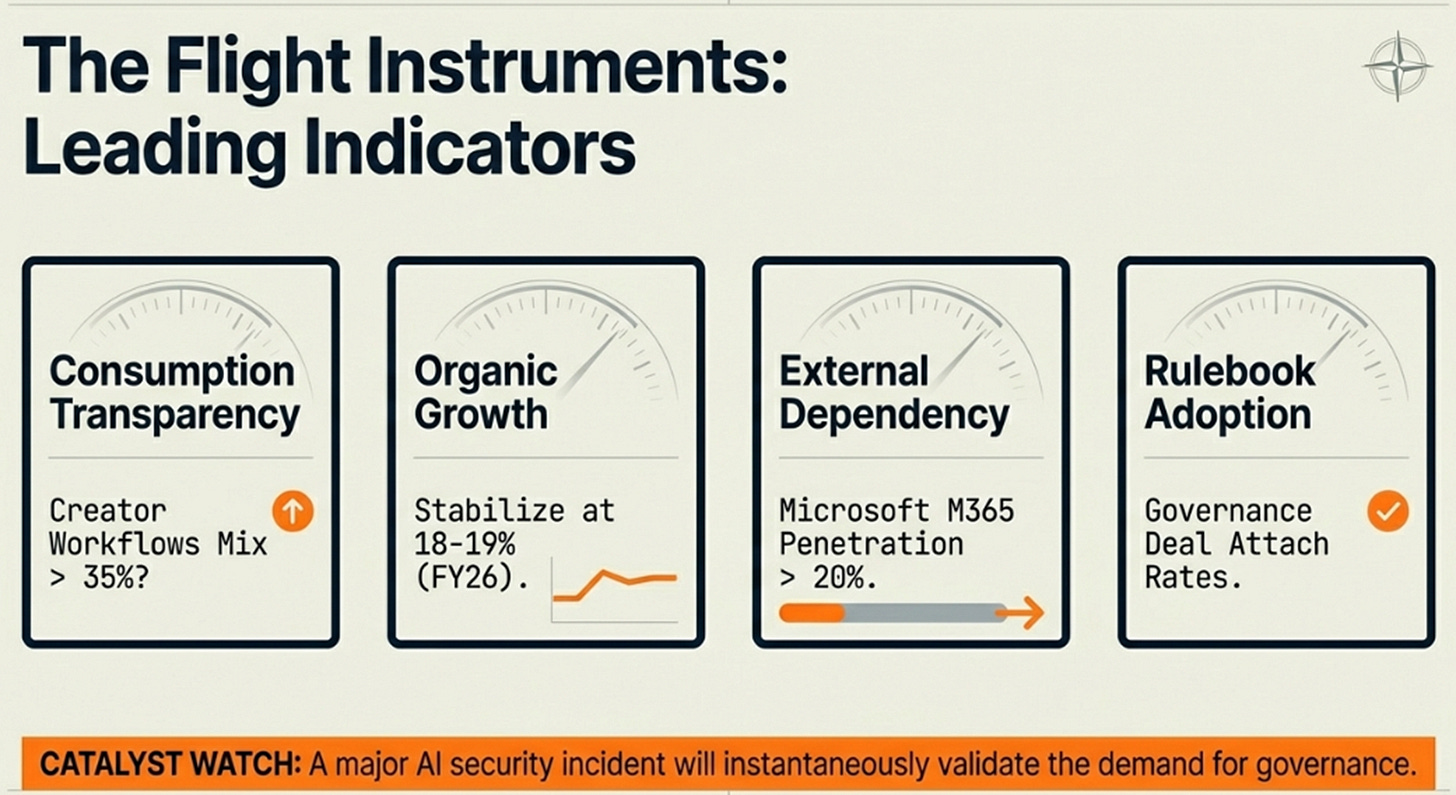

· Consumption transparency: Creator Workflows disclosure resumed? Bull: >35% by Q4’26. Bear: hidden or <25%.

· Organic growth: Strip M&A/FX. Bull: stabilizes 18-19% FY26, re-accelerates 20%+ FY27. Bear: below 16% by FY27.

· Margin behavior: Subscription gross margin progression. Bull: 82% → 83% by Q4’26. Bear: declines to 80-81%.

· Rulebook adoption: Evidence ServiceNow inserted into change approval/audit loops for agents. Multi-product governance deals, Control Tower attach rates.

· Customer concentration: Customers >$5M ACV growth. Bull: 20%+ sustained. Bear: <15%.

External dependencies:

· Microsoft Agent 365 penetration: Bull: disclosed >20% of M365 base by mid-FY26. Bear: no metrics or <10%.

· AI security incidents: Major breach attributed to ungoverned agents validates governance surge.

· Federal recovery: GSA OneGov revenue timing. Bull: accelerates Q2/Q3 FY26.

The Sky Is Getting Crowded

The 1956 collision wasn’t about aircraft being unsafe. It was about density requiring centralized control. The paper purchase order wasn’t valuable because it was paper, it enforced permissioned action through approval chains and audit trails.

Agents bring enterprises back to that truth at machine speed. Software interfaces were the control point for twenty years because that’s where humans interacted with systems. When agents bypass interfaces, control migrates.

ServiceNow’s Q4 matters because the “control tower layer” is becoming a budget line item. $600M Now Assist, billions in security/identity acquisitions, partnerships with frontier AI providers, all point the same direction.

The question isn’t whether autonomous agents work. It’s who governs them when they do.

The tower is going up. ServiceNow’s bet: they’re building it. Microsoft’s bet: they already own it through identity. One of them is wrong.

At $129 and 31.5x earnings, ServiceNow is priced as high-quality software with AI optionality. Bull case requires proving AI isn’t optionality, it’s the next category ServiceNow dominates. Base case: steady compounder without re-rating. Bear case: enclosure or fragmentation.

The sky is getting crowded. Whether ServiceNow becomes the FAA of enterprise AI or just another airline waiting for clearance determines which future materializes.

All prices split-adjusted for 5-for-1 stock split, December 2025.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.