ServiceNow Earnings: The Gatekeeper Moment

From Workflows to the Control Plane of Enterprise AI

TL;DR:

Owning the Front Door: ServiceNow’s Q3 results mark its pivot from workflow automation to AI orchestration — positioning itself as the governance layer between employees, agents, and systems.

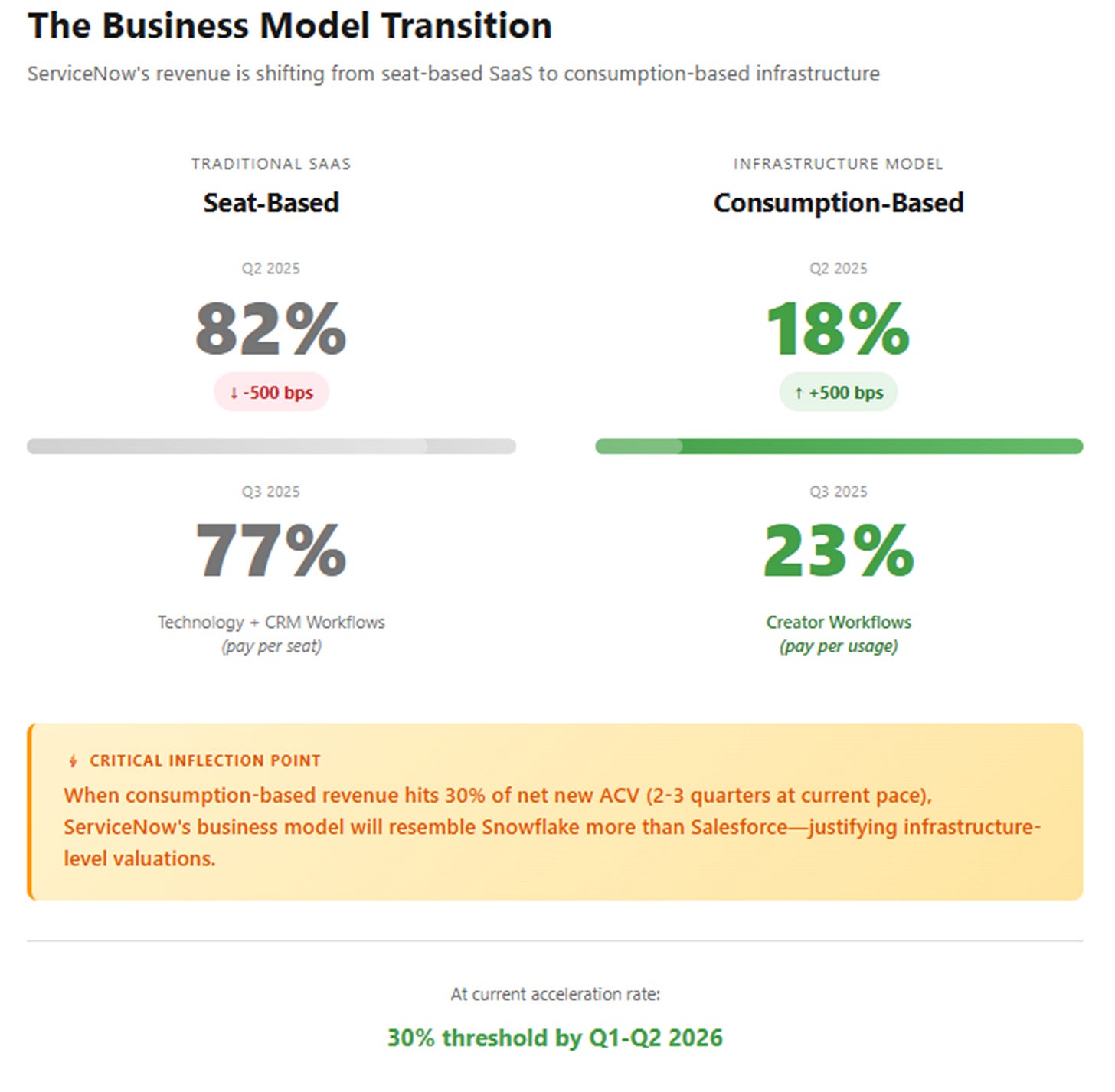

The Hidden Model Shift: Creator Workflows surged to 23% of net new ACV, signaling a move from seat-based to consumption-based revenue — a transformation akin to Snowflake or Databricks economics.

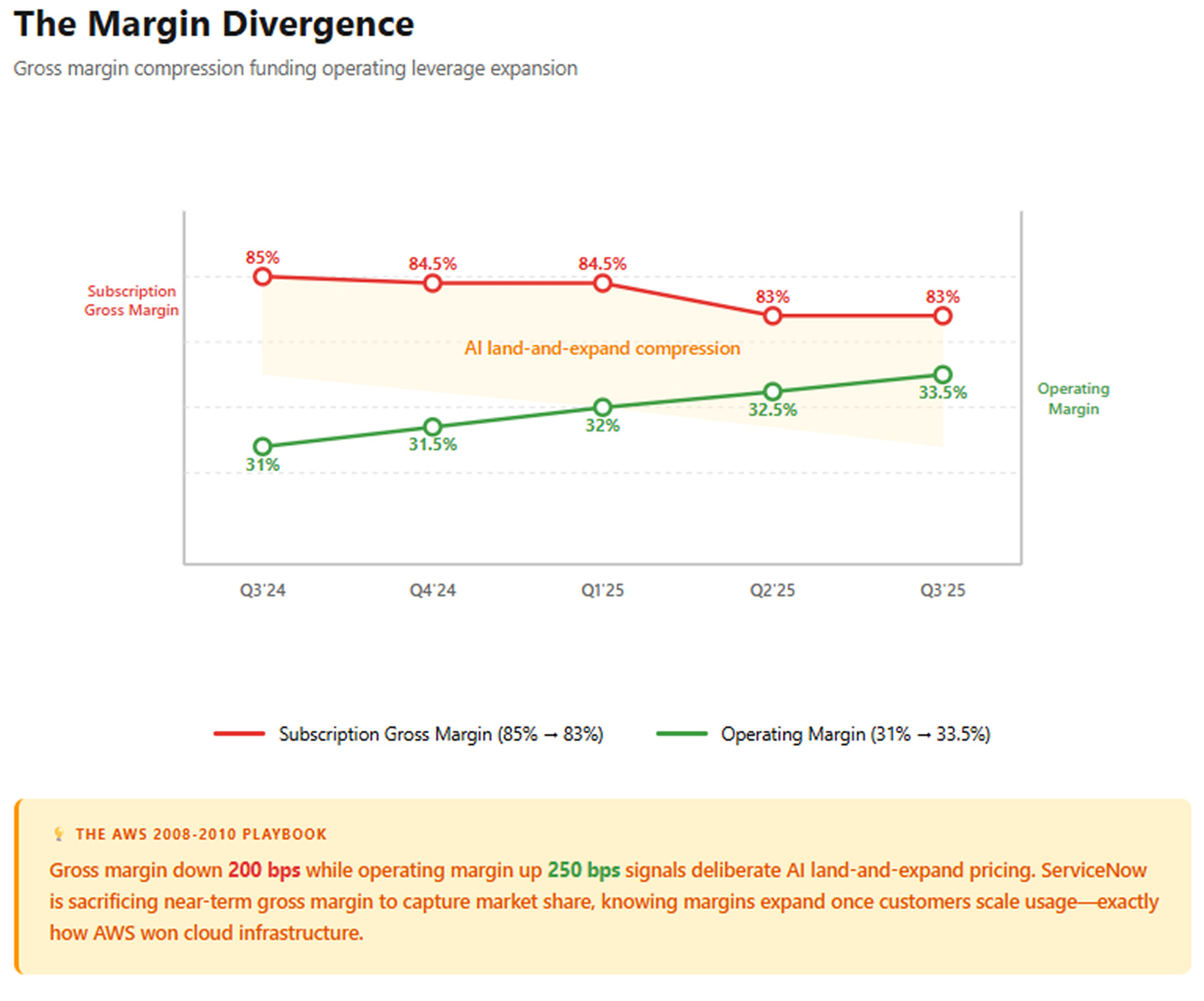

Margins as Strategy, Not Risk: Short-term gross margin compression mirrors AWS’s early playbook — land-and-expand AI usage now, monetize later as operating leverage kicks in.

From the Q3 2025 earnings release:

ServiceNow reported third quarter subscription revenues of $3,299 million, representing 21.5% YoY growth and 20.5% in constant currency, exceeding guidance across all topline growth and profitability metrics.

In consumer technology, the front door to applications moved from icons to algorithmic feeds. Users stopped opening apps—they let feeds decide what to show them. The companies controlling those feeds became the most valuable in the world.

In enterprise, the front door is moving from applications to governed agents. Employees state intent to an AI agent, which decides which systems to invoke, under what policies. ServiceNow’s Q3 results provide the clearest evidence yet that the company is positioning itself to own that door.

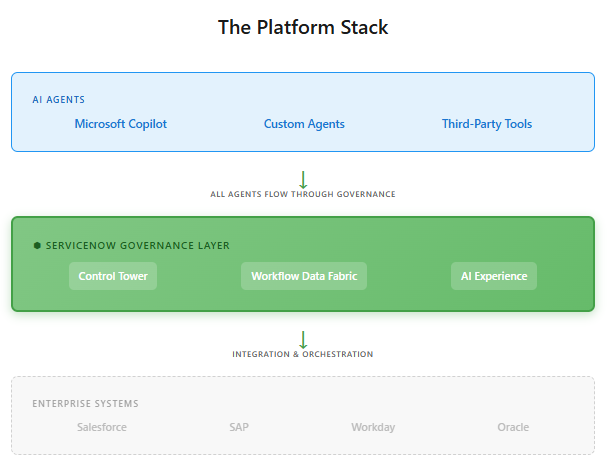

Becoming the Control Plane

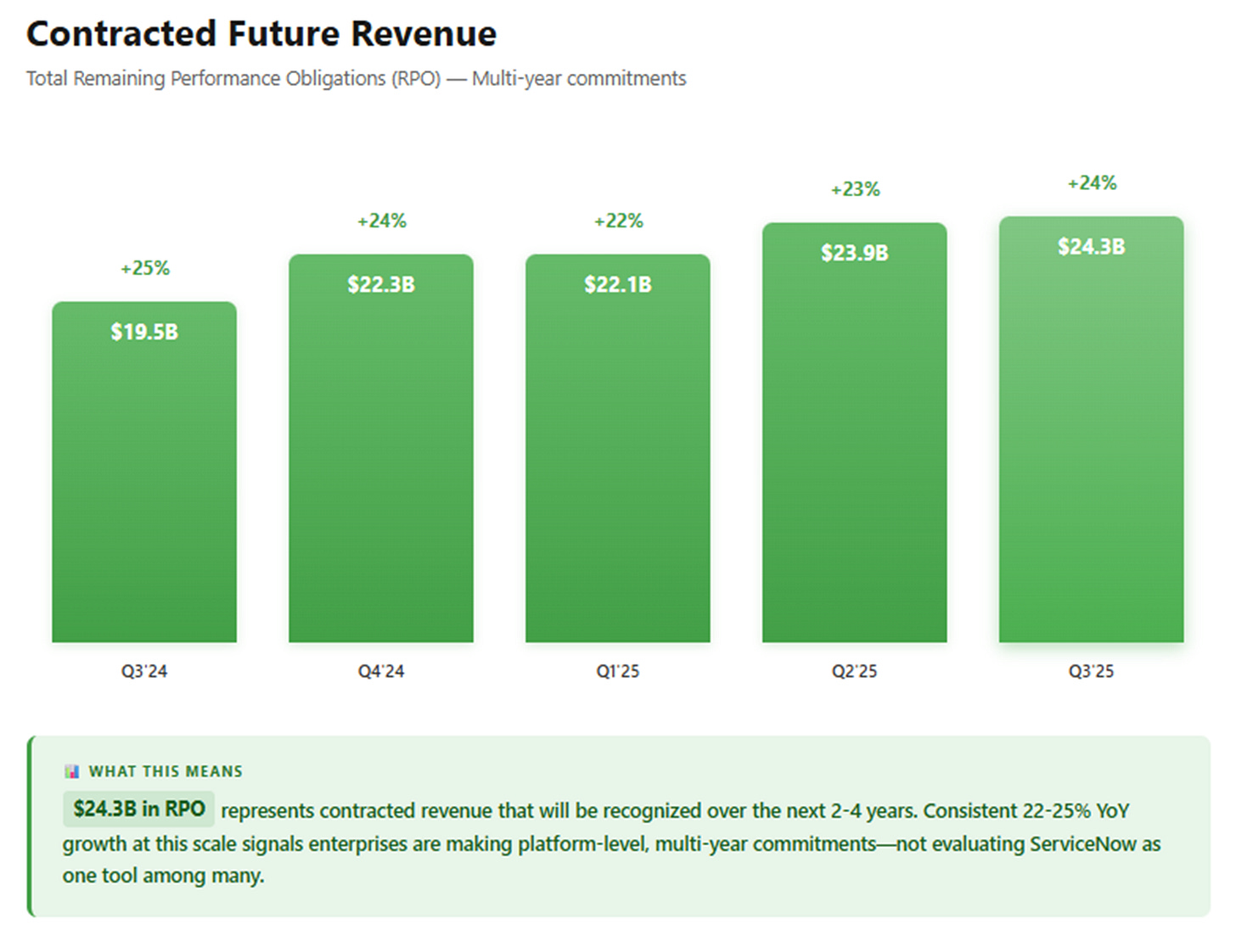

ServiceNow beat across metrics: $3.30B subscription revenue (+20.5% constant currency), $11.35B in remaining performance obligations (+20.5%), 33.5% operating margin. But the numbers aren’t the story—the products are.

AI Experience is described as “the intelligent entry point for employees to access information, delegate tasks, and collaborate with AI.” Not “a better way to use ServiceNow”—the entry point. Zurich, the platform release, delivers what management calls “breakthrough innovations for multi-agentic development” with built-in security controls and autonomous workflows. AI Control Tower provides what CFO Gina Mastantuono called the “single pane of glass” for governing AI agents across the enterprise.

These aren’t application features. They’re infrastructure control points.

The partnership strategy reinforces this positioning. NVIDIA (Apriel 2.0 integration + AI Factory reference architectures) provides compute; ServiceNow provides orchestration. FedEx Dataworks integrates global logistics intelligence through ServiceNow’s workflow platform—proof of expansion beyond IT into operational technology. GSA OneGov creates standardized federal licensing, making ServiceNow the default platform across government agencies.

Each partnership extends reach while reinforcing ServiceNow as the mandatory integration point. FedEx doesn’t replace logistics systems—it routes them through ServiceNow. Federal agencies don’t rip out infrastructure—they add ServiceNow as the orchestration layer.

Customer behavior validates the strategy. ServiceNow now has 553 customers at $5M+ ACV (up from 503), with average contract values continuing to climb. The company closed 103 transactions over $1M in net new ACV. At $13B in revenue, deals this size signal platform-level decisions, not departmental purchases. Renewal rates of 98% (excluding one Federal agency closure) are exceptional at this scale.

The remaining performance obligations chart in the investor deck tells the real story: $24.3B in contracted future revenue, up 24% YoY. Enterprises are making multi-year commitments to ServiceNow as infrastructure.

The Business Model Transition Nobody’s Watching

Buried in the investor presentation is the metric that matters most for long-term trajectory.

Net new annual contract value by product:

Technology Workflows: 53% (down from 56%)

CRM & Industry: 24% (down from 26%)

Creator Workflows: 23% (up from 18%)

Creator Workflows—App Engine, Workflow Data Fabric, RaptorDB—jumped 500 basis points in one quarter.

This matters because of the underlying business model. Technology Workflows (IT Service Management, IT Operations) are seat-based subscriptions—you pay based on employee count. Creator is consumption-based—you pay based on usage intensity, not user count.

When Creator hits 30% of net new ACV (possibly 2-3 quarters at current pace), ServiceNow’s revenue model will resemble Snowflake or Databricks more than Salesforce or Workday. That’s when infrastructure-level valuations become fully justified.

Management didn’t highlight this shift on the earnings call. My read: they don’t want attention on what’s likely temporary margin pressure during land-and-expand, knowing margins expand once customers scale usage.

But this is the business model transition happening beneath quarterly noise.

The Margin Strategy

Subscription gross margin compressed 200 basis points year-over-year (85% to 83%). Operating margin expanded 250 basis points (31% to 33.5%).

The bearish interpretation: AI is structurally margin-dilutive. Token costs are eating gross margin faster than revenue grows.

The bullish interpretation: this looks exactly like AWS in 2008-2010. Temporary gross margin compression during land-and-expand, followed by massive operating leverage once customers scaled usage. ServiceNow is deliberately pricing AI aggressively to capture share, knowing they can expand margins once customers are locked in.

I lean bullish for two reasons.

First, management guided full-year free cash flow margin to 34%, up 250 basis points. They’re not worried about the trajectory.

Second, the efficiency gains in R&D and sales aren’t just cost-cutting—they’re demonstrating product value. R&D headcount grew 3.7%, sales 3.2%, against 22% revenue growth. ServiceNow deployed 450,000 AI agents internally and achieved 80% automation in support functions. They’re proving the economics work before asking customers to make the same bet.

The margin question resolves in 2-3 quarters. If subscription gross margin stabilizes at 82-83% while operating margins continue toward 35%, the land-and-expand strategy is working.

Federal: Mechanical, Not Structural

Q4 guidance implies 17.5-18% constant currency growth, down from 20.5% in Q3. Mastantuono attributed this to Federal: “U.S. Federal agencies are currently navigating changes, from tightening budgets to evolving mission demands. The recent government shutdown may also impact deal timing.”

The market interpreted this as weakness. I think that’s wrong.

Management admitted half of Q3’s cRPO beat came from Q4 renewals pulled forward. The Q4 deceleration is partly mechanical—ServiceNow captured Q4 revenue in Q3, making year-over-year comparison harder.

More importantly, Mastantuono noted Federal “exceeded internal net new ACV expectations” in Q3. So Federal beat expectations and signed the GSA partnership, yet we’re supposed to believe it’s causing the deceleration?

Given ServiceNow’s seven-quarter beat streak, they’ve earned credibility. The Federal caution appears genuine conservatism around timing, not demand weakness.

The GSA partnership could drive 20%+ Federal growth once budget uncertainty clears. The agreement standardizes licensing across agencies—exactly the kind of platform decision that compounds over years.

The Federal headwind is likely 2-3 quarters. But it provides cover for managing expectations as the company transitions from low-20s growth to high-teens at $13B scale.

Which is still exceptional execution.

The Valuation Framework

At $880 per share with 210M diluted shares, ServiceNow has a market cap around $185B. With roughly $8B in net cash, enterprise value is approximately $177B.

Using guidance for $13.2B revenue and 34% free cash flow margin, ServiceNow should generate roughly $4.5B in free cash flow for fiscal 2025.

Forward EV/FCF: ~39x

The expansion case requires visible AI consumption revenue. When AI reaches 5%+ of revenue with discrete disclosure, the comp set shifts. Instead of Salesforce or Workday (SaaS apps), ServiceNow gets compared to Snowflake or Datadog (usage infrastructure). Those trade at 45-50x forward FCF because revenue scales with customer success, not just seats.

ServiceNow’s $1B AI revenue target for 2026 represents roughly 7-8% of projected revenue. If they hit that with stable margins, infrastructure re-rating becomes justified.

The contraction case happens if Q4 misses the 19% constant currency cRPO guide, or if AI metrics stay opaque. Without usage visibility, ServiceNow remains premium SaaS, and the multiple compresses toward 30-35x.

My view: evidence supports expansion over 12-18 months. Product strategy, partnerships, and customer commitment patterns suggest successful infrastructure positioning. Near-term deceleration is maturation at scale, not competitive loss.

Fair value today: $900-1,000. Compelling entry: $800-850 on macro weakness. 2026-2027 target: $1,400-1,600 as AI consumption becomes material.

What to watch:

· Q1 2026 guidance is the real test. 18-20% constant currency makes high-teens the floor. 16-18% means deceleration continues.

· Creator mix each quarter. When it hits 28-30% of net new ACV, the consumption model is winning.

· Subscription gross margin trajectory. Stabilization at 82-83% while operating margins expand validates land-and-expand. Continued compression below 82% makes dilution concerns real.

· Federal timing on GSA implementation determines whether rebound happens in fiscal 2026 or 2027.

The AWS Playbook

ServiceNow isn’t trying to build the best AI models or most intelligent agents. They’re building the layer that governs all agents—theirs and everyone else’s.

Amazon didn’t win cloud with the fastest processors or most storage. They won by becoming the platform every company had to use, then captured value from everything running on top.

ServiceNow is executing the same playbook for enterprise AI. If enterprises standardize on ServiceNow for AI governance the way they standardized on AWS for cloud, the valuation framework changes entirely.

Execution risk remains. Hyperscaler competition is real. The timeline could extend beyond expectations. But Q3 provided the clearest evidence that ServiceNow is becoming the mandatory integration point for enterprise AI.

Once usage economics surface in the P&L, the market should stop comparing ServiceNow to Salesforce and start comparing it to the infrastructure layer it’s becoming.

The front door moved. ServiceNow is positioned to own it.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.