ServiceNow’s 2Q25: A Masterclass in Platform Leverage

How Deal Composition, AI Governance, and Strategic Capital Allocation Signal a New Era of Enterprise Control

TLDR

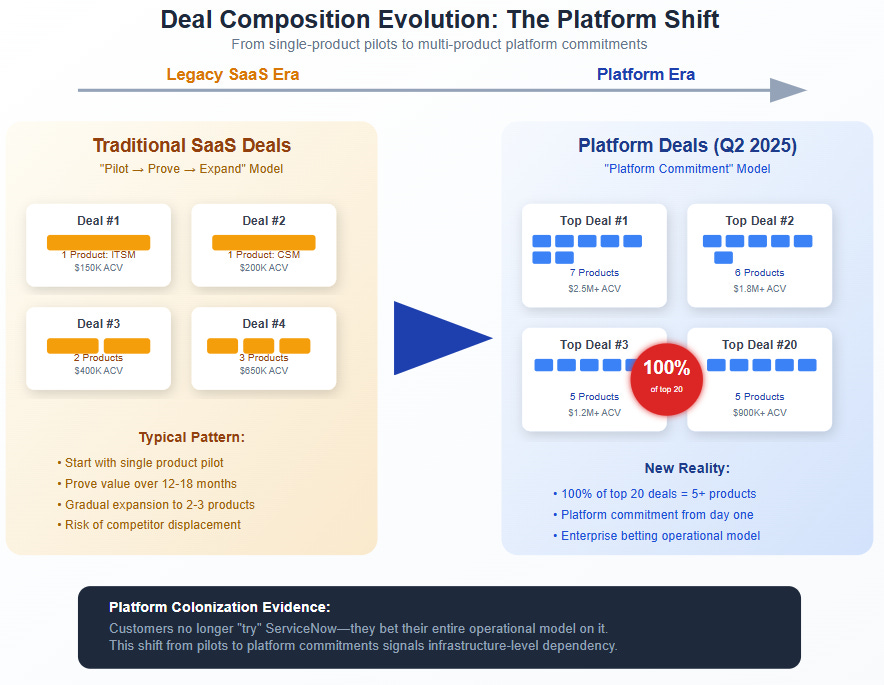

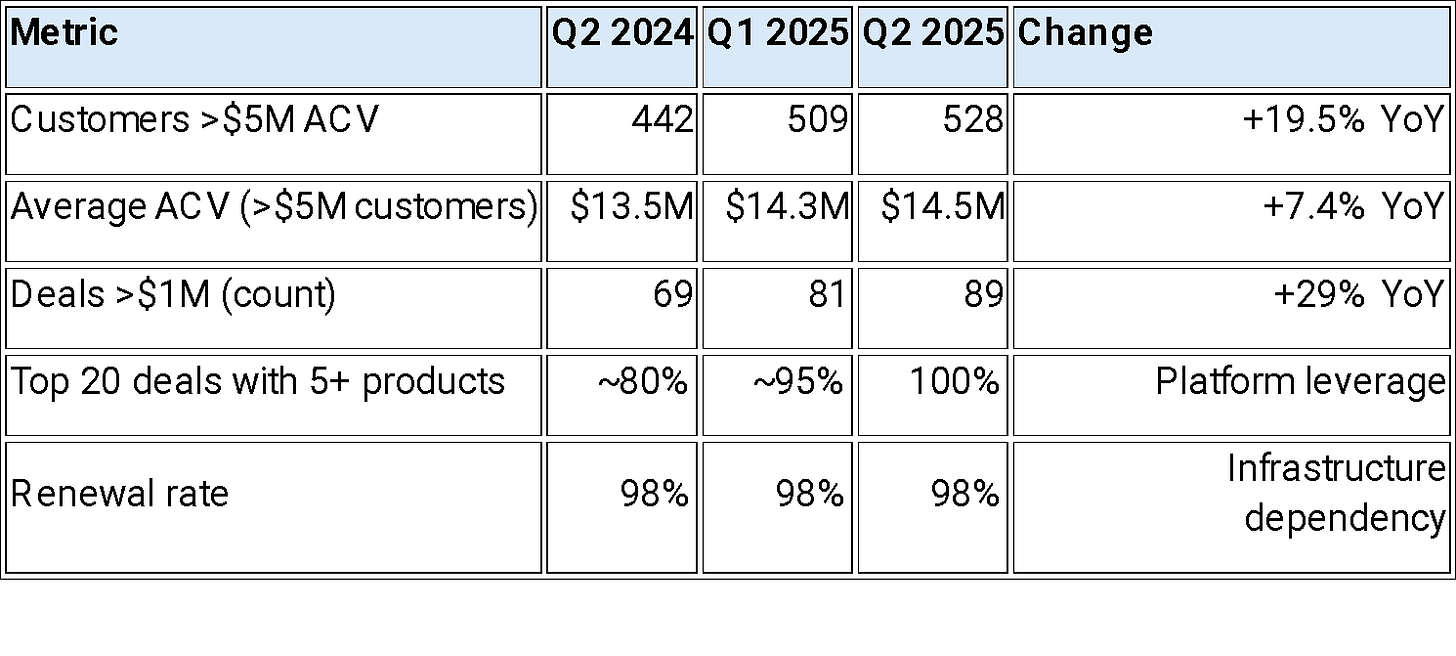

ServiceNow’s Q2 marked a shift from software vendor to enterprise infrastructure provider, with 100% of top 20 deals including 5+ products—clear evidence of platform consolidation and deep integration across workflows.

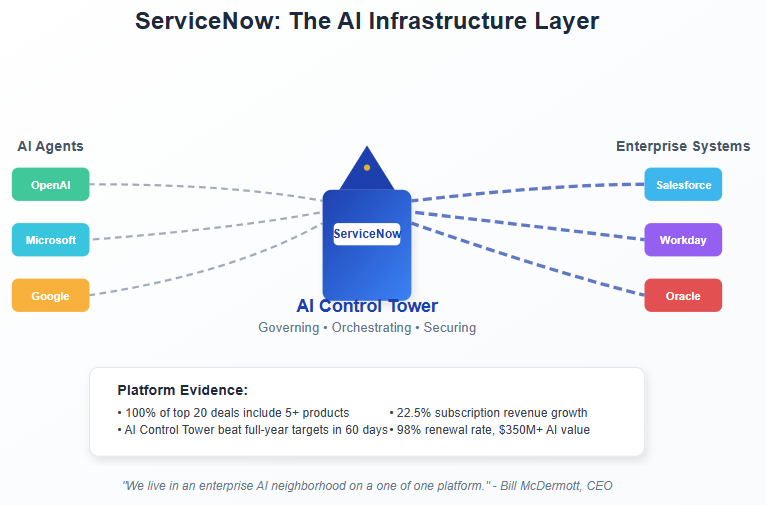

The breakout success of AI Control Tower signals a strategic pivot: by governing third-party AI tools alongside its own, ServiceNow positions itself as the central orchestrator of enterprise AI, transforming potential competitors into dependencies.

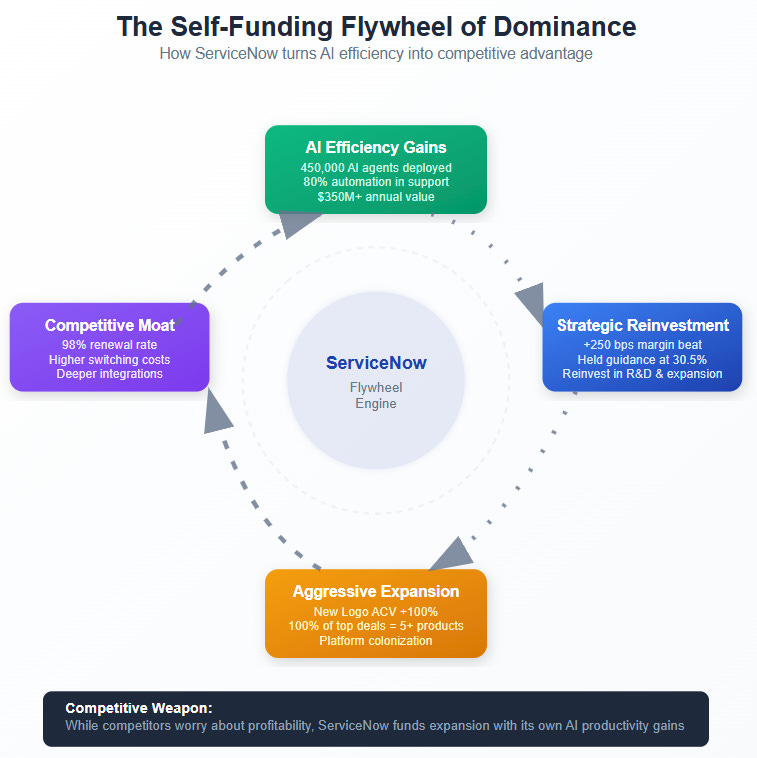

Disciplined reinvestment of AI-driven efficiency gains is powering a self-funding growth engine, enabling ServiceNow to expand aggressively while preserving long-term margin leadership and entrenching its competitive moat.

From Bloomberg:

ServiceNow Inc. gave a strong outlook for revenue growth and touted customer adoption of its artificial intelligence software tools. Subscription revenue in the period ending in September will be about $3.26 billion, the company said Wednesday in a statement. Analysts, on average, estimated $3.21 billion, according to data compiled by Bloomberg. ServiceNow attributed the strong results to adoption of Now Assist, the company's generative AI product, which requires a more-expensive subscription tier to use.

My first thought reading ServiceNow's Q2 results: this wasn't just another software company beating estimates. This was a masterclass in how to systematically dismantle an entire industry's competitive dynamics while building something entirely new.

The headline numbers are impressive—22.5% subscription revenue growth, 500 basis point cRPO beat, 250 basis point operating margin expansion. But the real story is buried in a single data point that most analysts glossed over: all of ServiceNow's top 20 deals included five or more products. Not most deals. Not some deals. All of them.

That's not cross-selling. That's platform colonization.

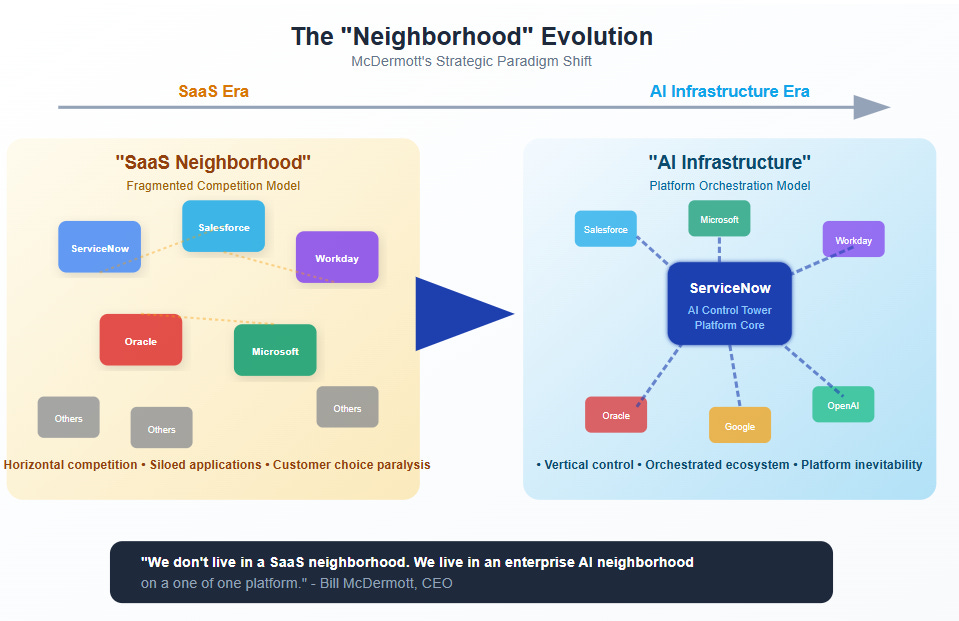

The "Neighborhood" Declaration of War

CEO Bill McDermott's most revealing comment wasn't about revenue or AI adoption. It was this: "We don't live in a SaaS neighborhood. We live in an enterprise AI neighborhood on a one of one platform."

I've been covering enterprise software for over a decade, and I've never heard a CEO so explicitly reject the entire valuation framework used to assess their company. McDermott wasn't just using colorful language—he was delivering a calculated strike against every assumption Wall Street makes about enterprise software competition.

Think about what he's really saying: stop comparing us to Salesforce, Workday, or Oracle. Their entire architectural paradigm—siloed, application-centric cloud software—is legacy thinking. We are the next-generation architecture.

The proof is in the execution. ServiceNow deployed 450,000 AI agents internally and achieved 80% automation in support functions, generating an estimated $350+ million in operational value annually. While competitors promise AI will make customers more productive, ServiceNow is demonstrating it by automating away most of their own workforce.

This isn't just product-market fit. This is platform inevitability.

The AI Control Tower Checkmate

Here's where ServiceNow's strategy gets particularly brilliant. Instead of trying to build every AI capability themselves, they invited competitors' AI agents to run through their governance platform.

On the surface, this sounds almost generous. In practice, it's strategic genius.

CFO Gina Mastantuono noted that AI Control Tower beat full-year targets in just 60 days. But here's the deeper implication: once a customer's CISO mandates that all AI agents—regardless of vendor—must run through ServiceNow's Control Tower for security and compliance, ServiceNow becomes the non-negotiable gatekeeper for enterprise AI.

They're not competing with OpenAI or Microsoft's AI tools. They're governing them. They're turning potential threats into dependencies while extracting value from every AI interaction in the enterprise.

This is platform strategy at its finest: create the rules of engagement, then profit from everyone who wants to play.

The Platform Consolidation Evidence

The progression is unmistakable. ServiceNow isn't just growing—they're systematically absorbing enterprise workflow budgets that used to be distributed across dozens of vendors.

New logo ACV grew over 100% year-over-year, which tells us customers are making much larger initial platform commitments rather than piloting individual applications. This suggests enterprises have moved past "trying" ServiceNow to betting their operational model on it.

The Margin Discipline as Competitive Weapon

Here's where ServiceNow's strategy gets particularly sophisticated. Despite a 250 basis point operating margin beat, management held full-year margin guidance steady at 30.5%. They're deliberately reinvesting AI-driven efficiency gains rather than dropping them to the bottom line.

Mastantuono was explicit about this choice: "We're reserving the opportunity to lean into investment because the opportunity we're seeing with AI is so massive."

This is strategic capital allocation disguised as prudence. ServiceNow is using their own productivity improvements to fund market expansion at precisely the moment when competitors are struggling with profitability. They're creating a self-funding flywheel of dominance.

The message to competitors is brutal: we can fund a price war, a hiring war, or an R&D war using our own efficiency gains. Can you?

Most SaaS companies would take the margin expansion and call it a day. ServiceNow is using it as ammunition to accelerate market capture while competitors worry about profitability.

What This Really Means

ServiceNow's Q2 results represent something more significant than strong execution or market leadership. They demonstrate the emergence of a new category of enterprise software that transcends traditional competitive dynamics.

The company has achieved what every platform dreams of: becoming essential infrastructure rather than replaceable application. The 98% renewal rate and expanding deal sizes indicate customers aren't choosing ServiceNow—they're depending on it.

Looking forward, I expect ServiceNow to continue this trajectory until they hit regulatory scrutiny, which becomes inevitable once they control too much enterprise infrastructure. But that's a high-quality problem that likely takes 3-5 years to materialize.

The immediate implication is that ServiceNow is no longer competing for market share. They're defining what the market becomes. Every workflow they absorb, every AI agent they govern, every integration they enable creates additional switching costs while expanding their platform's value.

McDermott's "neighborhood" comment wasn't marketing speak. It was a declaration that the SaaS era is ending and the AI infrastructure era is beginning. ServiceNow just showed us what the winners look like.

#EnterpriseAI #ServiceNow #PlatformStrategy #AITransformation #SaaS #CIO #AIgovernance #EnterpriseSoftware #B2BTech #DigitalTransformation $NOW $IGV

General Disclaimer: The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.