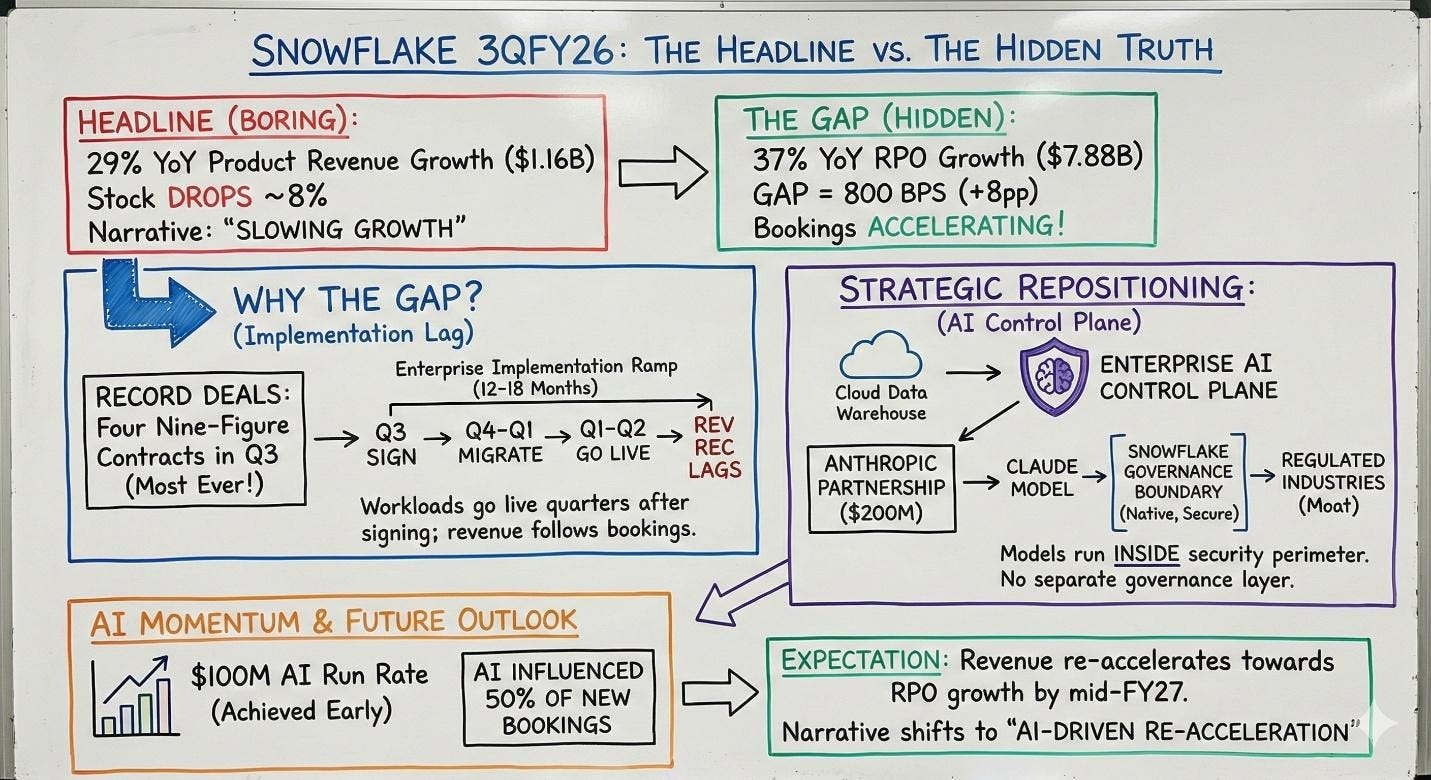

Snowflake 3QFY26 Earnings: The 800 Basis Points Nobody Noticed

Snowflake 3QFY26 Earnings: The 800 Basis Points Nobody Noticed

TL;DR:

The 800 bp spread between RPO and revenue marks a fundamental shift: enterprise bookings are accelerating again.

The Anthropic partnership embeds AI inside Snowflake’s governance perimeter — a structural advantage Databricks can’t replicate.

Snowflake is expanding from data warehousing to AI-driven enterprise automation, with early AI revenue already at a $100M run rate.

From Bloomberg:

Snowflake Inc. reported fiscal third-quarter product revenue of $1.16 billion, up 29% YoY, slightly ahead of analyst estimates. The company raised its full-year revenue guidance and announced a $200 million partnership with AI startup Anthropic.

The headline was boring: Snowflake grew 29% YoY. The stock dropped about 8% in after-hours trading. Traders debated whether 29% YoY “beat” or “missed” the buy-side whisper number of 31%. The consensus: slowing growth, expensive stock, nothing to see here.

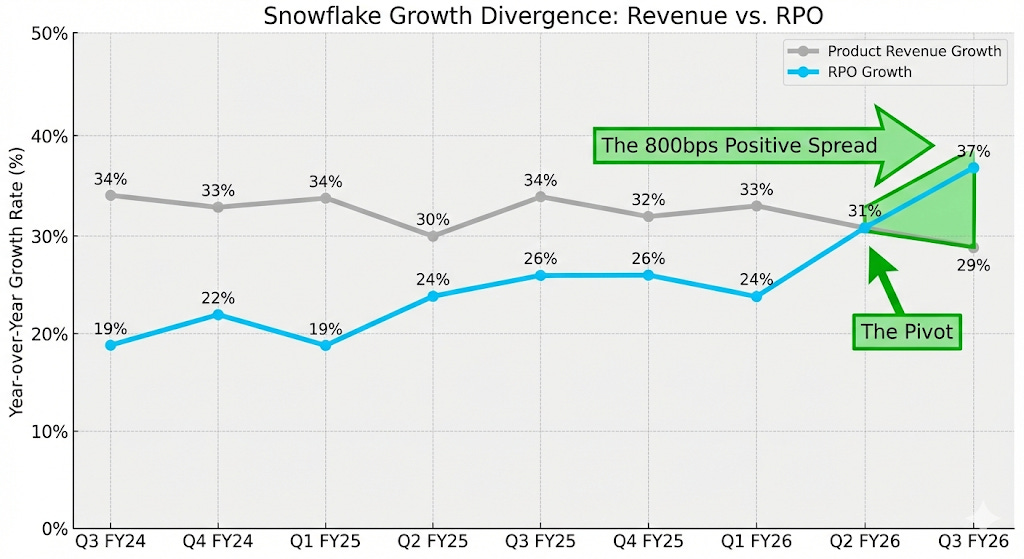

But the media missed the only number that matters: RPO grew 37% YoY.

That 800 basis point gap — bookings accelerating while revenue decelerates — is the largest positive spread Snowflake has posted in over two years. And it means the “slowing growth” narrative is about to collapse.

The Gap

Here’s the eight-quarter view:

For two years, revenue growth outpaced RPO growth. That’s what you’d expect during an optimization cycle: customers consuming existing commitments faster than signing new ones. The business was healthy but not accelerating.

That flipped in Q2 and widened dramatically in Q3. Enterprises are now signing contracts faster than they can deploy workloads.

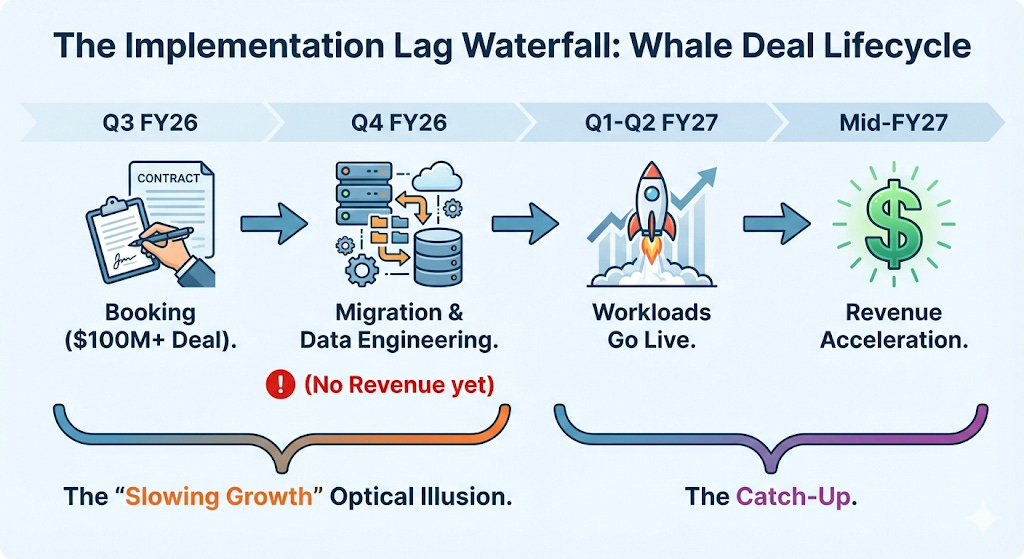

The mechanism is straightforward: Snowflake signed four nine-figure deals this quarter, more than any quarter in company history. Those four deals alone likely added $400M+ to RPO. But large enterprise contracts have 12-18 month implementation ramps. The CIO signs in Q3; the data migration starts in Q4; the workloads go live in Q1-Q2. Revenue recognition lags by design.

The key question is implementation velocity. If Snowflake can onboard these whales in two quarters instead of four, the 37% RPO growth converts to 35%+ revenue growth by mid-FY27. If implementation drags, the gap persists longer but the eventual catch-up is larger.

Either way, the 29% headline understates what’s actually happening in the business.

The Control Plane

So why are enterprises signing nine-figure commitments now? My read is that Snowflake used the consumption optimization cycle to quietly reposition — from cloud data warehouse to enterprise AI control plane — while no one was watching.

The $200 million Anthropic partnership is the clearest signal. Most coverage treated it as “Snowflake pays for AI models.” That misses the architectural significance.

Here’s the competitive landscape:

The hyperscalers are vertically integrating: their cloud, their data, their AI models, their governance layer. Microsoft has this locked up with OpenAI. Google has it locked up with Gemini. AWS is the odd one out — no proprietary frontier model, so they run a marketplace.

Snowflake’s strategic problem was obvious: they’re a horizontal layer in a vertically-integrating world. If Microsoft convinces enterprises that Fabric + OpenAI is the default, Snowflake becomes a legacy vendor.

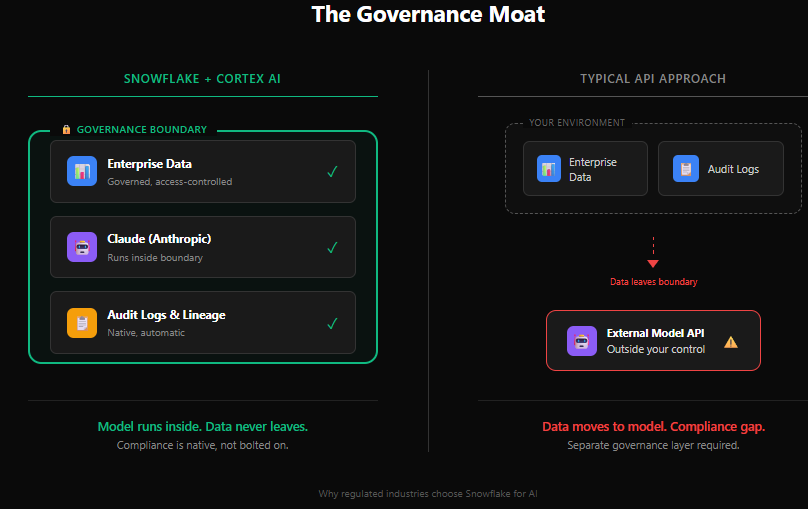

The Anthropic partnership is the counter-move. But the $200M isn’t about access to Claude — anyone can get that through Bedrock. It’s about making Claude native to Snowflake’s governance boundary.

Cortex AI’s key technical difference is that models run inside Snowflake’s security perimeter. For regulated industries — financial services, healthcare, government — this means audit trails, data lineage, role-based access controls, and compliance logging are native. There’s no separate governance layer for AI. The model is subservient to the data governance framework that’s already in place.

Databricks, by contrast, typically calls models via external APIs. Every time data leaves the warehouse to hit a model endpoint, it creates a compliance gap. You need a separate governance layer, separate audit trails, separate access controls. For a bank or a hospital, that’s a problem.

The $200M isn’t a cost center; it’s the price of making Claude a feature of Snowflake’s governance layer rather than a standalone choice. Databricks can offer Claude via Bedrock, but they can’t make it native to the compliance boundary. That’s the moat.

CEO Sridhar Ramaswamy’s quote confirms the scale:

“We are already processing trillions of Claude tokens per month through Snowflake.”

“Trillions” implies tens of millions of dollars in AI consumption already flowing. This isn’t a partnership announcement; it’s a disclosure of existing production usage. The enterprises signing nine-figure deals aren’t betting on a roadmap. They’re scaling something that already works.

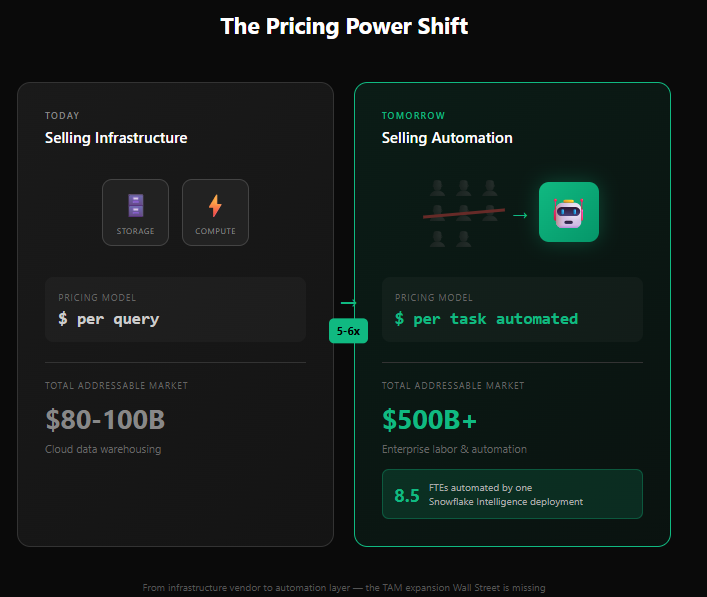

The TAM Expansion

There’s a second repositioning happening alongside the governance play, and it’s potentially more important.

Ramaswamy mentioned an example on the call:

“A global SaaS platform automated work equal to 8.5 FTEs using Snowflake Intelligence.”

The 8.5 FTE example is the Rosetta Stone. Snowflake wants us to stop thinking about AI as faster queries and start thinking about it as labor substitution. If that frame sticks, the TAM isn’t data warehousing — it’s enterprise automation, and the pricing power multiples.

Consider the math. A data analyst costs $150-200K fully loaded. If Snowflake Intelligence replaces 8.5 of them, that’s $1.3-1.7 million in annual labor cost avoided. What would a company pay Snowflake for that capability? A lot more than they’d pay for incremental compute and storage.

Snowflake disclosed they hit $100 million in AI revenue run rate this quarter — a quarter ahead of expectations. They also disclosed that AI influenced 50% of new bookings and that 28% of deployed use cases now incorporate AI features.

My read on the $100M number: it’s intentionally sandbagged. Management said it’s “predominantly” Cortex AI and Snowflake Intelligence. That word — predominantly — implies exclusions. If 28% of use cases incorporate AI, there’s significant AI-influenced consumption in core workloads that isn’t being counted.

They’re establishing a conservative baseline so they can show dramatic growth over the next four quarters. Expect the AI run rate to 3-5x by this time next year, with the narrative shifting from “AI is real” to “AI is driving re-acceleration.”

The Risk — And What It Means for Valuation

So here’s the tension I can’t resolve from the outside: we don’t know if the AI business is accretive or dilutive.

Snowflake held product gross margins at 76% this quarter, roughly flat with prior periods. That’s impressive given AI workloads require expensive GPU inference and the Anthropic partnership presumably involves revenue sharing.

But they haven’t disclosed AI-specific unit economics. The $100M run rate could be at 76%+ gross margin (accretive to the model) or 55% gross margin (dilutive). The Anthropic revenue share could be 20% or 40%. We don’t know.

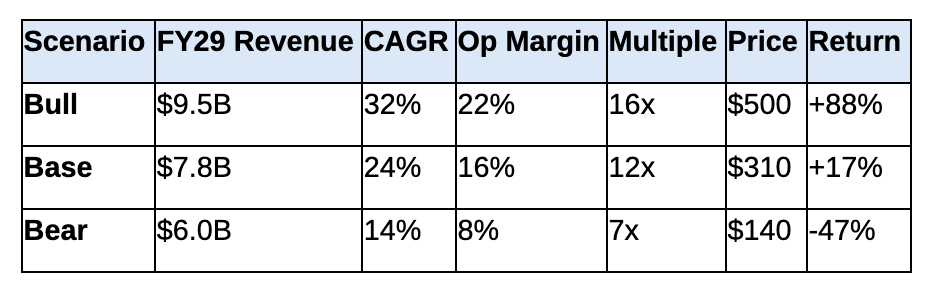

This matters because the stock you’re buying depends entirely on which version of Snowflake materializes. At today’s $265 (16.8x EV/Sales), you’re paying for something between these three outcomes:

Bull Case: $500 in three years (+88%)

Snowflake becomes the enterprise AI control plane. Revenue re-accelerates to 32% CAGR as RPO converts and AI drives expansion. AI reaches 30% of revenue by FY29 at 72%+ gross margins. Operating margins expand to 22% as the business scales. The market re-rates to 16x forward revenue for a durable 30%+ grower with margin expansion.

What has to happen: RPO converts to 34%+ revenue growth by mid-FY27. AI margins prove accretive. NRR inflects back above 128%. Anthropic partnership delivers measurable wins in regulated industries. Nine-figure deal cadence sustains.

Base Case: $310 in three years (+17%)

Solid execution, but AI is a growth driver rather than a transformation. Revenue grows at 24% CAGR, gradually decelerating to low-20s. AI reaches 20% of mix but doesn’t fundamentally change the trajectory. Margins expand to 16% as growth matures. Multiple compresses to 12x as growth slows — a quality compounder, not a re-rating story.

What happens: Competitive markets, gradual NRR decline to 120%, AI margins around 65% (neutral). Databricks and hyperscalers remain credible alternatives. A good business in a crowded market.

Bear Case: $140 in three years (-47%)

AI economics disappoint and competitive pressure intensifies. AI margins are 50-55%, compressing blended gross margins to 68%. Databricks wins “good enough” positioning at lower price. Microsoft Fabric bundles aggressively. NRR declines to 110% as customers optimize or churn. Revenue decelerates to 14% CAGR. Multiple compresses to 7x.

What goes wrong: Governance moat proves narrower than expected. Open-source models commoditize Claude’s advantage. The $200M Anthropic deal becomes a sunk cost. RPO growth normalizes without revenue catch-up.

The variant perception is simple: the market is pricing closer to base/bear. The 37% RPO gap, Anthropic architecture, and $100M AI run rate suggest bull is more likely than the stock implies.

What to Watch

The thesis hinges on a few trackable signals:

RPO-to-Revenue Conversion: Does revenue growth re-accelerate toward RPO growth? Bull signal: 33%+ by Q2 FY27. Bear signal: gap persists without catch-up.

AI Margin Disclosure: When management breaks out AI-specific gross margins — or if blended margins compress — we’ll know if AI is accretive or dilutive. This is the single most important unknown.

NRR Trajectory: Stable at 125% for two quarters. Bull signal: inflects above 128%. Bear signal: declines below 120%.

Nine-Figure Deal Cadence: Four in Q3 was a record. Bull signal: 2-3 per quarter becomes normal. Bear signal: reverts to 0-1.

The Synthesis

Snowflake used the consumption optimization cycle to reposition as the enterprise AI control plane while no one was looking. The 37% RPO gap is the first proof that repositioning is working. Four nine-figure deals — more than any quarter in history — suggest large enterprises are making strategic commitments, not just renewing warehouse contracts.

The market sees a data warehouse worth 10-12x revenue. I see an enterprise AI control plane worth 16-18x — if AI margins are accretive.

The $200M Anthropic partnership is cheap if it secures that multiple; it’s expensive if it’s just feature parity with Databricks. The margin disclosure next quarter resolves that tension. That’s the single number I’m watching.

Until then, the 800 basis points tell the story. Bookings are accelerating. Revenue will follow. The “slowing growth” narrative has about two quarters left to live.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.

Hey Qi — good question. I’d frame SNOW vs Databricks less as a “who has the better data platform?” fight and more as where the enterprise wants to anchor governance + consumption when AI moves from prototypes to production workflows.

Databricks is still the default for teams that want maximum flexibility (engineering-first, notebooks, custom pipelines/model training, deep Spark-native workflows). That tends to win in orgs where the center of gravity sits with ML/data engineering. Snowflake’s edge is the opposite: it’s optimizing for the business-user interface (BI + SQL + increasingly “ask the data” via agents) inside a governed perimeter. In regulated industries especially, keeping AI inference and the “agent layer” inside the same RBAC/lineage/audit boundary as the data is a structural advantage. That’s why the competition isn’t just “traditional BI drives Snow’s growth” — it’s that BI is becoming the distribution channel for AI, and Snowflake is trying to collapse “BI → AI → action” into one governed control plane.

My base case is co-existence: Databricks wins more of the builder workflows; Snowflake wins more of the operator/consumer workflows (finance, risk, GTM, ops) where time-to-value + governance dominate. What would change my mind: (1) if Databricks proves it can deliver the same “easy-button agents” with equivalent governance and a truly business-native interface, or (2) if Snowflake can show AI isn’t just a feature but a measurable consumption re-accelerant (NRR inflecting up, RPO converting faster, and evidence AI workloads are margin-accretive).

Considering the AI narrative, how do you think the competition between Snowflake's data platform and Databricks' platform, since traditional BI dirves Snow's growth.