Spotify Q2 2025: Demolition Dust or Skyscraper Steel?

When Markets Miss the Forest for the Falling Trees

TLDR

Accounting Smoke Obscures Strategic Firepower: Spotify’s stock fell 12% on headline misses—€80M revenue shortfall, €0.42 EPS loss, weak Q3 guide—but these were driven by non-fundamental factors: a €104M FX headwind and €115M in Swedish payroll taxes linked to stock appreciation. Strip those out, and underlying performance was strong: MAUs beat by 7M, Premium subs by 3M, and free cash flow hit a record €700M (+43% YoY).

From Freemium to Framework: Platform Economics in Motion: The company is undergoing a structural evolution—from a dual-revenue freemium model to a subscription-centric platform with variable margin levers (e.g., audiobooks, video, AI-enhanced discovery). Ad gross margins expanded 495bps despite modest top-line ad growth, signaling a shift toward quality yield over inventory volume.

AI, Capital Discipline, and Optionality: Spotify is transforming into an AI-native platform—improving product velocity, engagement (AI DJ +45% YoY), and long-term data moats. The €8.4B cash balance, $2B buyback authorization, and “SAC-to-LTV constitution” reflect capital allocation maturity. Near-term volatility masks a business laying structural foundations for durable platform power in audio, education, and beyond.

In the summer of 1930, as the Great Depression deepened and unemployment soared, John D. Rockefeller Jr. made what seemed like a catastrophically ill-timed decision: he would proceed with the largest private building project in modern history. While other developers abandoned construction plans and the real estate market collapsed, Rockefeller committed to spending $250 million—roughly $4 billion in today's money—on a complex of buildings in midtown Manhattan.

To contemporary observers, the decision appeared disastrous. The noise, dust, and disruption of demolishing three city blocks drew constant complaints. Critics called it "Rockefeller's Folly." The financial press questioned the wisdom of such massive spending during economic uncertainty. Street-level chaos made it impossible to envision the final result.

Yet by 1939, Rockefeller Center stood complete: a masterpiece of urban planning that would generate returns for decades and fundamentally reshape how Americans thought about commercial real estate. The critics who focused on the demolition dust had missed the steel framework of something transformational being built.

This distinction—between surface disruption and structural progress—captures precisely what happened when Spotify reported Q2 2025 earnings on July 29th. A 12% stock decline following the announcement suggested investors saw only falling debris. But underneath the accounting dust of foreign exchange headwinds and Swedish payroll tax quirks, Spotify was quietly installing the steel beams of its next evolutionary phase.

This is Chapter 3 of Spotify's transformation from distribution disruptor to discovery platform to something even more ambitious: a demand-shaping engine for the entire audio economy. And like Rockefeller Center, the true scale of what's being built becomes clear only when you look past the immediate noise to the structural foundation being laid.

Deconstructing the "Disappointment"

When markets punish a stock 12% in a single day, the conventional wisdom assumes something fundamental went wrong. In Spotify's case, three headline metrics seemed to confirm this narrative: revenue missed consensus by €80 million, earnings per share collapsed from an expected €1.97 profit to a €0.42 loss, and third-quarter guidance came in below Street expectations.

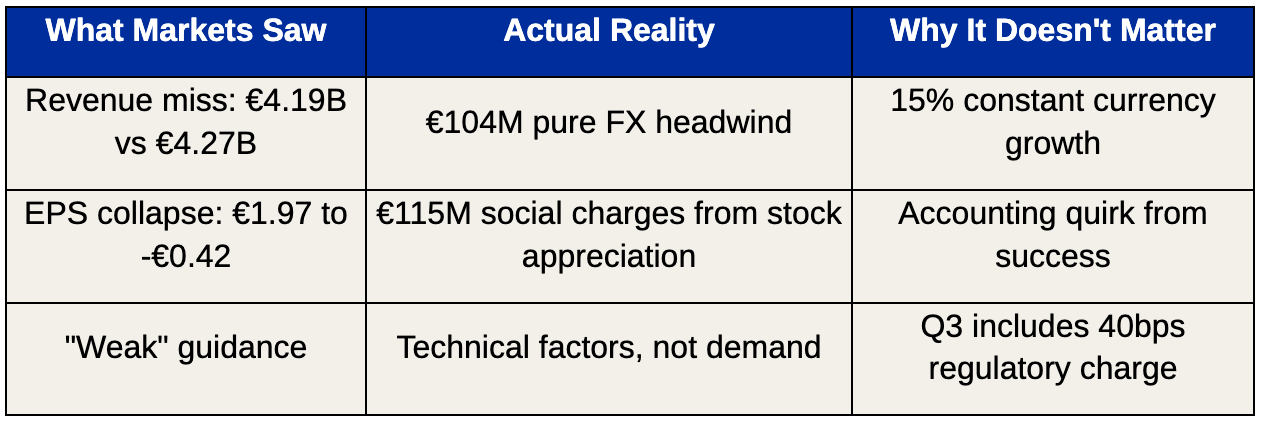

Yet these headline misses tell a story about accounting mechanics, not business fundamentals. Consider what markets saw versus underlying reality:

The revenue shortfall came entirely from a €104 million foreign exchange headwind—the dollar weakened against the euro during the quarter, making Spotify's global revenue worth less when translated back to euros. Strip out currency effects, and revenue grew 15% year-over-year, accelerating from the prior quarter.

The earnings collapse presents an even more revealing case study in market myopia. Of the €2.39 swing from expected profit to actual loss, €115 million came from what Spotify calls "Social Charges"—Swedish payroll taxes tied to the intrinsic value of employee stock options. When Spotify's stock price rises during a quarter, these taxes increase proportionally. The €98 million surprise above forecast reflected nothing more than Spotify's stock appreciating faster than management expected when setting guidance.

In other words, Spotify was penalized by investors for the accounting side effects of its own stock success.

Meanwhile, the metrics that actually matter for long-term value creation told a different story entirely. Monthly active users reached 696 million, beating guidance by 7 million and representing the second-highest Q2 user additions in company history. Premium subscribers hit 276 million, exceeding expectations by 3 million. Most importantly, free cash flow reached a Q2 record of €700 million—a 31% increase from the prior quarter and 43% growth year-over-year.

The key insight: The market punished Spotify for the side effects of a strong stock price and dollar weakness—both positive indicators disguised as negative ones.

Strategic Narratives in Tension: Three Interpretations

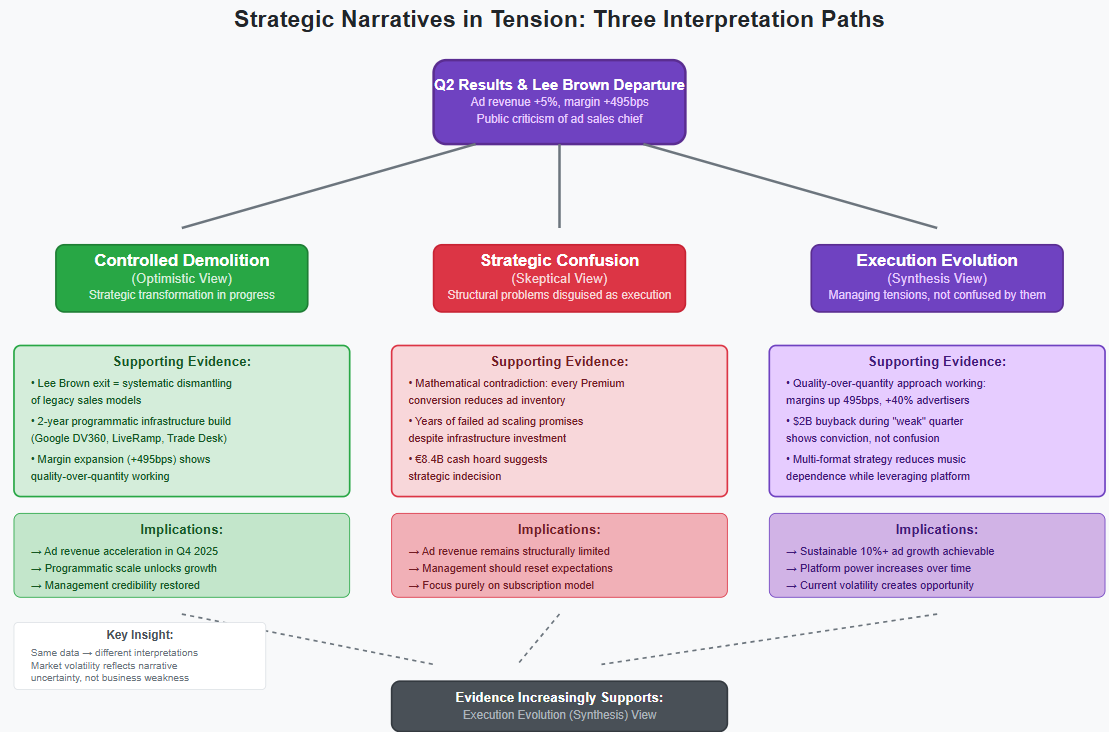

Three competing interpretations of Spotify's Q2 results have emerged among analysts and investors, each capturing part of a complex reality that resists simple categorization.

The "Controlled Demolition" Theory (Optimistic)

The first interpretation views recent developments as evidence of deliberate strategic transformation. Under this framework, the departure of longtime advertising chief Lee Brown wasn't scapegoating but a signal that Spotify is systematically dismantling legacy sales models that can't scale. The public criticism accompanying his exit—unusually harsh by corporate standards—represented management's declaration that relationship-based direct sales must give way to programmatic automation.

This theory finds support in Spotify's advertising infrastructure investments. The company has spent two years building programmatic capabilities through partnerships with Google's DV360, LiveRamp, and The Trade Desk. The current weakness in advertising revenue—just 5% constant currency growth despite 10% growth in ad-supported users—represents the painful but necessary transition period as Spotify forces adoption of scalable systems over comfortable but limited direct relationships.

The "Strategic Confusion" Theory (Skeptical)

The second interpretation suggests Spotify's advertising challenges reflect deeper structural problems rather than execution issues. This view emphasizes the mathematical reality that every user conversion from free to Premium directly reduces advertising inventory. Since Spotify's core strategy involves converting free users to paid subscriptions, the advertising business faces inherent constraints that execution improvements can't overcome.

Proponents of this theory point to years of failed promises about advertising revenue scaling and question whether the €8.4 billion cash position reflects strategic indecision rather than patient planning. If the advertising model has structural limitations, they argue, management should explicitly reframe investor expectations rather than continuing to promise growth that contradicts the platform's conversion incentives.

The "Execution Evolution" Theory (Synthesis)

The third interpretation synthesizes elements of both previous theories while acknowledging the complexity of platform economics. This view suggests that management understands the structural tensions in their business model but is actively managing them rather than being confused by them.

Evidence for this synthesis comes from how Spotify has handled the advertising revenue challenge. Rather than simply pursuing volume growth, the company has focused on improving advertising gross margins, which jumped 495 basis points year-over-year to 18.3%. This represents a quality-over-quantity approach that optimizes for contribution rather than top-line growth.

The evolution interpretation also explains why Spotify doubled its share buyback authorization to $2 billion during a quarter of "disappointing" results. This isn't the behavior of a confused management team—it's the action of executives who see current stock weakness as disconnected from business fundamentals and are willing to deploy capital accordingly.

After examining the evidence across multiple quarters, the data increasingly supports the execution evolution interpretation. But the real test lies not in quarterly results but in how Spotify is restructuring the fundamental economics of platform competition.

The Ad Business: Demolition in Progress

To understand what's happening with Spotify's advertising business, we need to examine both the numbers and the strategic signals management is sending.

The Numbers Tell a Complex Story

Ad revenue: +5% constant currency vs +10% free user growth

Ad-supported gross margin: 18.3% (+495 basis points year-over-year)

Active advertisers: +40% year-over-year growth

These metrics reveal a business optimizing for different objectives than simple revenue growth. While top-line advertising revenue growth lags user growth, margin expansion and advertiser base growth suggest infrastructure improvements are working.

The Lee Brown Signal

The departure of Spotify's Global Head of Sales wasn't merely a personnel change—it was a strategic declaration. The public criticism that accompanied his exit represented management's explicit statement that relationship-based sales models can't scale in the programmatic era. As Alex Norström noted during the earnings call, they needed to "accelerate the transformation of this business."

This wasn't scapegoating—it was a signal that Spotify is dismantling legacy direct-sales infrastructure to force adoption of automated systems that can handle tens of thousands of advertisers rather than hundreds.

The Structural Question

The fundamental challenge remains: Can ads scale meaningfully without undermining subscription conversion?

The mathematical reality is stark. Every successful conversion from a free user to Premium subscriber removes advertising inventory from the platform. With conversion rates "ticking up nicely," as management noted, the addressable advertising audience faces structural constraints.

Spotify's strategic response appears to be quality over quantity. Rather than maximizing advertising inventory, they're optimizing yield from a more targeted, highly-engaged audience. The 495 basis point margin expansion suggests this approach is working financially, even if it constrains top-line growth.

The critical test comes in Q4 2025: Can Spotify achieve constant currency advertising growth above 10% while maintaining margin improvements? This metric will determine whether the current transformation represents successful strategic pivot or structural limitation.

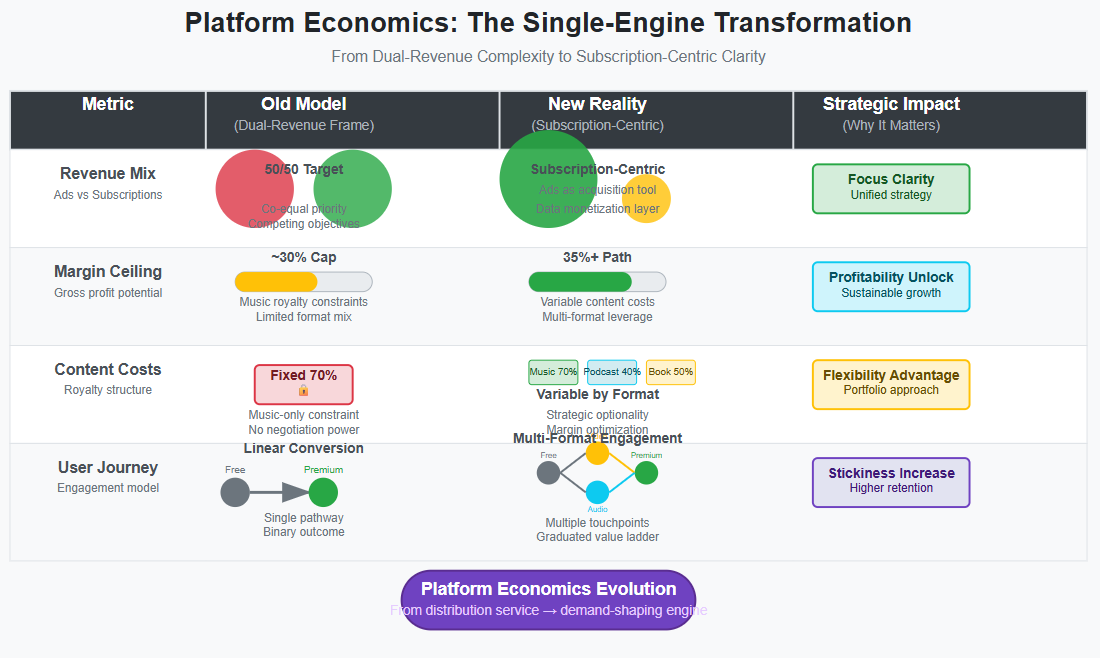

Platform Economics: The Single-Engine Transformation

To understand what Spotify is building, it helps to examine how the company's economic model has evolved from its original conception. The transformation becomes clear when comparing the old framework with emerging reality:

The Evidence of Transformation

The Q2 results provide compelling evidence that this transformation is working:

Premium gross margin: 33.1% (+171 basis points year-over-year)

Multi-format engagement: Video users consume 1.5x more than audio-only listeners

Audiobook listening hours: +35% year-over-year growth

Free-to-Premium conversion rates: "ticking up nicely" per management

When Spotify launched its advertising-supported tier in 2008, the vision was straightforward: create a "freemium" model where advertising revenue from free users would supplement subscription revenue from paid users, eventually building a balanced dual-revenue platform.

But as the platform scaled and competitive dynamics intensified, this dual-revenue model revealed inherent tensions that couldn't be resolved through execution improvements alone. The core tension is mathematical: every successful conversion from a free user to a Premium subscriber removes advertising inventory from the platform.

Rather than treating this as a problem to be solved, Spotify has begun reframing it as a strategic advantage to be leveraged. Instead of promising advertising revenue will reach arbitrary percentage targets, management increasingly positions advertising as customer acquisition and data monetization infrastructure that supports subscription growth.

This reframing becomes clear when examining segment-level performance. Both Premium and advertising-supported segments are improving profitability, but they're optimizing for different objectives: Premium margins reflect pricing power and content cost leverage, while advertising margins reflect yield optimization on strategically constrained but higher-quality inventory.

The platform economics transformation also appears in how Spotify approaches new content formats. Video podcasts don't simply extend the existing audio model—they create viewing experiences designed to generate different types of engagement data while appealing to user segments with different monetization preferences.

Similarly, Spotify's expansion into audiobooks follows a different economic logic than music streaming. Audiobook content operates under different royalty structures that provide higher gross margins, while the format itself enables both subscription and transaction-based monetization.

This multi-format approach reveals Spotify's evolution toward what we might call "demand-shaping" rather than demand-serving. Instead of simply providing access to existing content, Spotify increasingly influences what content gets created, how it gets distributed, and how audiences discover it.

AI as Central Operating System: The Compounding Advantage

Perhaps the most significant development in Spotify's Q2 results received relatively little attention from investors focused on advertising revenue and earnings misses. During the earnings call, Chief Product and Technology Officer Gustav Söderström outlined how artificial intelligence is becoming not just a feature but the central operating system for Spotify's entire platform.

Gustav Söderström's Strategic Insight

"The application that has the most engagement gets better the fastest"

This observation captures something profound about competitive dynamics in the AI era. Unlike previous machine learning systems that reached performance plateaus, generative AI models continue improving as they process more data and user interactions.

The Data Moat Evolution

Spotify's AI transformation involves building entirely new types of datasets:

Traditional dataset: Song-to-song relationships based on listening patterns

New dataset: English sentences to musical preferences through natural language interaction

Future advantage: Reasoning-based experiences vs. predictive algorithms

When users can make requests like "play that song where Bruce Springsteen invites a fan on stage in the music video" and the system understands they want "Dancing in the Dark," it demonstrates capabilities that extend far beyond traditional recommendation systems.

Execution Velocity Improvements

The AI transformation has dramatically accelerated Spotify's development capabilities:

10x faster Ubiquity rollouts across partner devices

6x faster feature scaling for new product launches

AI DJ engagement: +45% year-over-year growth

This acceleration comes partly from AI-powered development tools that help engineers prototype and test new features more rapidly. But the more significant factor is how AI enables mass personalization without mass customization costs.

Investment Implications

Each new format that Spotify adds—video, audiobooks, educational content—enriches the training data for its AI systems, creating accelerating returns to scale. This creates what economists call increasing returns to scale in AI development, where each user interaction makes the platform more valuable not just for that individual but for all users globally.

For Spotify, this dynamic creates a compounding competitive advantage that becomes harder to replicate over time. Competitors can build similar AI features, but they can't easily replicate the engagement volume and diversity that trains Spotify's models.

Capital Allocation Maturity: The $2B Signal

One of the most revealing aspects of Spotify's Q2 results had nothing to do with quarterly performance and everything to do with long-term strategic thinking. During a quarter when headlines focused on earnings misses and advertising challenges, Spotify's board quietly doubled the company's share buyback authorization from $1 billion to $2 billion.

The Strategic Framework

The capital allocation picture reveals sophisticated planning:

€8.4B cash position provides substantial strategic flexibility

€1.7B notes due March 2026 represent the primary near-term obligation

$2B buyback authorization (doubled from $1B) signals confidence in intrinsic value

SAC-to-LTV discipline serves as "new internal constitution" for spending decisions

Reading the Tea Leaves

This timing—announcing increased capital returns during apparent operational difficulties—reflects sophisticated capital allocation thinking that markets often miss during periods of short-term volatility. The decision signals management's confidence that current stock weakness represents market inefficiency rather than fundamental deterioration.

The strategic logic unfolds across multiple timeframes:

Immediate: Opportunistic repurchases during volatility to take advantage of market inefficiency

Medium-term: Formal capital return policy post-debt retirement in March 2026

Long-term: Acquisitions in AI/education adjacencies that leverage core platform capabilities

Key Insight

This isn't excess cash sitting idle—it's strategic positioning for the next platform evolution. The March 2026 debt maturity provides a natural inflection point for more systematic capital returns, while maintaining optionality for transformational investments.

CEO Daniel Ek's description of the company's "SAC to LTV framework" as a "new internal constitution" reflects this maturation. Rather than pursuing growth at arbitrary rates, Spotify now requires mathematical justification for spending based on projected long-term returns.

Investment Scenarios & Price Targets

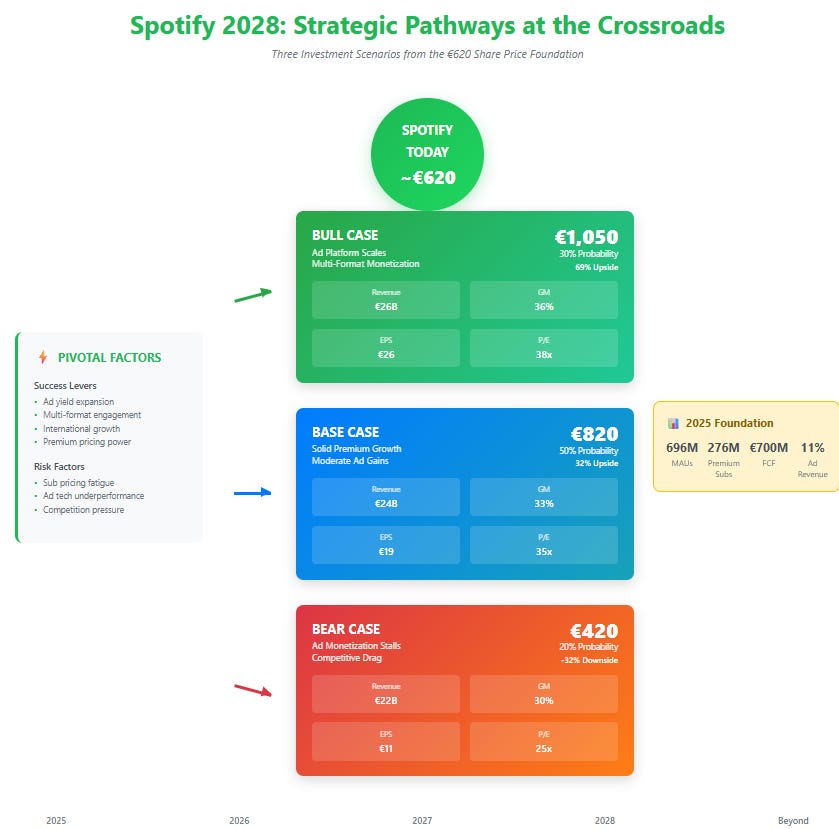

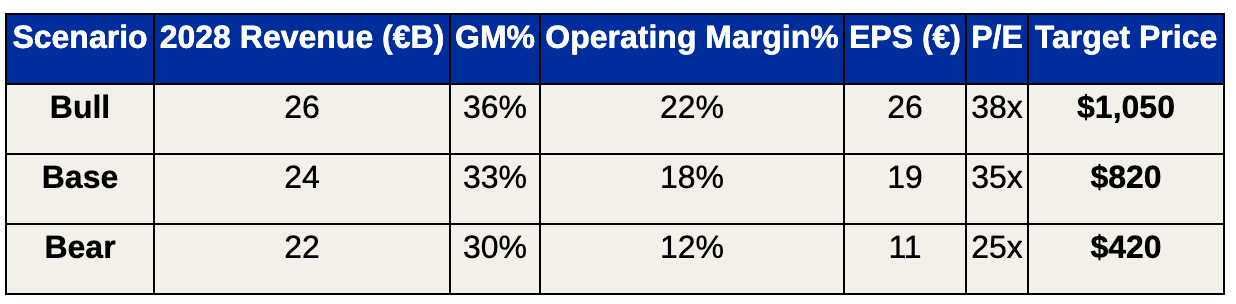

The complexity of Spotify's current position requires scenario-based thinking rather than linear extrapolation. Consider three plausible outcomes over the next three years:

Bull Case Scenario

In the optimistic scenario, Spotify successfully scales its programmatic advertising infrastructure to capture 25% of total revenue by 2027, up from roughly 11% currently. This assumes the current advertising transformation resolves favorably, with constant currency growth rates reaching double digits by Q4 2025 and accelerating thereafter.

Combined with continued Premium subscriber growth and pricing power from multi-format engagement, this scenario projects 2028 revenue of €26 billion with gross margins reaching 36% as advertising yields improve and lower-royalty content gains share.

The margin expansion comes from three sources: advertising revenue scaling with higher contribution margins, audiobook and educational content growing to meaningful percentages of usage, and premium tier pricing power from enhanced value propositions.

Base Case Scenario

The moderate scenario assumes more modest advertising progress, with ad revenue reaching roughly 18% of total revenue by 2027. This reflects successful programmatic infrastructure deployment but acknowledges structural constraints from subscription conversion rates.

Premium subscriber growth continues at current rates, supported by international expansion and multi-format engagement, reaching approximately 350 million paying users by 2028. Revenue reaches €24 billion with gross margins stabilizing around 33% as format mix improvements offset advertising yield limitations.

Bear Case Scenario

The pessimistic scenario assumes advertising revenue growth fails to accelerate meaningfully, remaining below 8% constant currency growth and limiting ad revenue to 15% of total revenue long-term. Competitive pressure from Apple, YouTube, or emerging platforms could slow Premium subscriber growth rates, while pricing power might prove limited.

Even in this scenario, Spotify's strong cash generation and balance sheet position limit downside risk, with 2028 revenue reaching €22 billion and gross margins around 30%.

Key Variables to Monitor

The scenarios hinge on several critical factors:

Ad revenue scaling: Bull case requires 25% of revenue by 2027

Margin expansion: Sustainable improvement via format mix and pricing power

Capital returns: Accelerating deployment after debt maturity in March 2026

At current prices around $600, these scenarios suggest asymmetric risk-reward characteristics that favor patient investors. The base case alone provides 33% upside, while the bull case offers 75% potential returns.

Risk Framework & Trip-Wires

While Spotify's fundamental business appears strong, the company's strategic transition creates specific risks that investors should monitor through measurable indicators:

Execution Risk

The most immediate risk involves advertising revenue trajectory. If Spotify's programmatic infrastructure investments fail to generate meaningful yield improvements, the company faces the prospect of advertising revenue remaining structurally limited while management credibility deteriorates.

The specific trip-wire: constant currency advertising revenue growth below 8% for two consecutive quarters, particularly if occurring alongside continued strong growth in ad-supported user counts.

Competitive Risk

Spotify's current dominance—45% of global paid subscribers and 65% of total streams—provides substantial defensive positioning, but sustained erosion could signal broader platform vulnerabilities.

Key indicator: Premium subscriber growth falling below 8% year-over-year for multiple quarters, particularly if coinciding with market share gains by Apple Music, YouTube Music, or emerging competitors.

Regulatory Risk

European proposals for "fair share" bandwidth taxes could require streaming platforms to pay telecommunications companies for network usage, potentially adding 100-120 basis points of costs to gross margins.

While such regulations remain uncertain and would likely affect all platforms equally, concrete proposals that create asymmetric cost structures could undermine Spotify's scale advantages.

Strategic Risk

The risk that receives less attention but could prove most significant involves management's ability to deploy growing cash generation effectively. If Spotify's cash position continues growing without meaningful deployment through acquisitions, accelerated investments, or capital returns, it would suggest strategic indecision.

Trip-wire: buyback authorization remaining largely unused through mid-2026, indicating management reluctance to execute on stated capital allocation priorities.

Catalyst Timeline: What to Watch

Spotify's strategic transition creates multiple inflection points over the next 24 months that could significantly impact investor perception:

Near-term (6-12 months)

Ad business inflection: Constant currency growth exceeding 10%

Super Fan tier launch: Initial pricing and adoption metrics for premium tiers

Buyback execution: €200-300M deployment demonstrating capital allocation discipline

Medium-term (12-24 months)

Debt retirement: March 2026 notes repayment clearing path for systematic capital returns

Capital return policy: Formal framework announcement for ongoing shareholder value creation

Market share data: Evidence of maintaining or expanding platform dominance

Long-term (24+ months)

Platform expansion: Education vertical scaling beyond pilot programs

Margin targets: Sustainable 35%+ gross margins across business segments

AI monetization: B2B licensing opportunities or enterprise product launches

The most immediate catalysts center on advertising revenue and margin expansion. Q3 and Q4 2025 earnings will be critical for validating the transformation thesis, particularly whether constant currency advertising growth can exceed 10% while maintaining margin improvements.

Competitive Context: Platform Power vs. Market Position

Understanding Spotify's competitive position requires examining both current advantages and emerging challenges across multiple dimensions.

Spotify's Structural Advantages

45% global paid streaming market share provides scale advantages in content negotiations

65% of total music streams demonstrates platform dominance beyond just subscription metrics

Largest engagement-driven AI training dataset creates compounding competitive advantages

These metrics reflect not just market position but platform power—the ability to influence industry dynamics rather than simply participate in them.

Emerging Competitive Challenges

Apple's ecosystem lock-in and payment control creates structural advantages in user acquisition and retention

YouTube's video content integration appeals to younger demographics with different consumption preferences

TikTok's attention economy disruption changes how people discover and consume music

Strategic Response

Spotify's multi-format platform evolution represents a strategic response to these challenges. Rather than competing solely as a music service, Spotify is evolving from music-centric to audio-centric to attention-centric platform.

This evolution explains investments in video podcasts, audiobooks, AI features, and educational content. Each format expansion reduces dependence on music streaming while leveraging core discovery capabilities.

The competitive context also explains why AI investments are strategic necessities rather than optional enhancements. In an attention economy where multiple platforms compete for user time, the ability to deliver more relevant, engaging experiences becomes the primary differentiator.

Embracing the Complexity

When John D. Rockefeller Jr. committed to building Rockefeller Center during the Great Depression, critics focused on the immediate disruption while missing the structural advantages being created. The project provided employment during economic uncertainty, established new standards for commercial development, and generated returns that sustained wealth for generations.

Spotify's Q2 2025 results present a similar test of perspective. Investors fixated on foreign exchange headwinds, Swedish payroll tax technicalities, and advertising revenue growth rates are observing the demolition dust of a company in strategic transition.

The Fundamental Insight

Spotify is simultaneously:

Operationally excellent: Record FCF generation, accelerating user growth, expanding engagement across formats

Strategically evolving: Ad model transformation, AI integration, platform expansion into adjacent markets

Communicatively challenged: Market confusion about business model priorities and strategic direction

This complexity creates volatility that markets often interpret as weakness. But the pattern of cash flow growth, margin expansion, and user engagement improvements suggests a company that understands these tensions and is actively managing them.

The Investment Opportunity

The 12% post-earnings decline represents a classic case of market myopia—punishing short-term accounting noise while ignoring fundamental business strength and strategic progress. Valuations around $600 per share assume modest growth and limited margin expansion, despite evidence of accelerating cash generation and improving platform economics. For investors willing to look past quarterly accounting noise to structural business trends, these prices offer asymmetric opportunity.

The Steel Beneath the Dust

The evidence of structural progress appears in metrics that matter for long-term value creation:

€700M quarterly FCF validates sustainable cash generation capabilities

Margin expansion across segments confirms platform economics evolution is working

AI infrastructure investment creates durable competitive advantages that compound over time

Capital allocation discipline signals management maturity and shareholder focus

Spotify's transformation from music distribution service to discovery platform to demand-shaping engine represents one of the most complex strategic evolutions in modern technology. The company is simultaneously rebuilding advertising infrastructure, expanding into new content formats, developing AI-powered features, and managing mathematical tensions between subscription conversion and advertising inventory optimization.

This complexity creates the volatility that some interpret as confusion. But for patient investors who can distinguish between surface disruption and structural progress, the demolition dust will settle to reveal the skyscraper steel being erected beneath.

The only question is whether investors can see through the immediate noise to the platform power being built for the next decade. For those who can, current prices offer the opportunity to invest in one of the most sophisticated platform transformations of the streaming era, at valuations that reflect temporary accounting complications rather than fundamental business trajectory.

The steel framework is already visible for those willing to look past the dust.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.