Synopsys: The Certainty Machine

How Synopsys Built an Empire by Selling Guarantees, Not Just Software

It’s the moment every chip designer dreads. After 18 months of obsessive work and hundreds of millions in R&D, the first batch of silicon wafers arrives from the factory. Under the microscope, the design is a perfect city of transistors, a masterpiece on paper. But when the power is switched on, there is only silence. A microscopic timing error—a signal arriving a few picoseconds too late—has turned a revolutionary breakthrough into a billion-dollar paperweight.

This isn't a hypothetical. It was the terrifying reality of the semiconductor industry, a world haunted by the chasm between a brilliant design and a working product. As chips became exponentially more complex, that chasm widened, threatening to swallow Moore's Law itself. The industry's greatest challenge wasn't innovation; it was uncertainty.

And in a world plagued by uncertainty, one company decided to sell the one thing no one else could: a guarantee.

In 1986, a small team led by Dr. Aart de Geus spun out of General Electric to form Synopsys, armed not with a better design tool, but with a different philosophy. Their breakthrough, synthesis technology, was a way to automatically translate an engineer's high-level idea into a detailed, verified circuit layout. It was the first step toward replacing prayer with proof. From that quiet obsession with solving the industry's most unglamorous problem, an $85 billion titan would emerge, an empire built not on manufacturing silicon, but on guaranteeing its success.

The Architecture of Trust

Before Synopsys, designing a chip was an artisanal craft. Engineers were digital masons, painstakingly laying out individual logic gates by hand in a process that was slow, error-prone, and fundamentally limited in scale. The company’s first breakthrough, the Design Compiler, changed everything. It was a revolutionary translator that could take an engineer’s high-level description of what a chip should do and automatically generate a detailed, gate-level blueprint of how to build it. Suddenly, engineers could think in terms of architecture, not just transistors. It was the leap from laying bricks to designing skyscrapers.

This breakthrough established Synopsys as the backbone of digital design flows—a market segment where it commands an estimated 60% share today.

Over time, the company expanded into verification, IP, and AI-powered automation, reinforcing its leadership. That original innovation is still the reason an estimated 90% of the world’s most advanced chips rely on Synopsys software.

But this breakthrough unleashed a demon of its own: exponential complexity. The firehose of logic created by Design Compiler could build cities of silicon so vast that no human could possibly inspect them for flaws. The chasm between a brilliant design on paper and a working product in hand widened into a terrifying abyss. The industry's greatest challenge was no longer creation; it was confidence.

While rivals built faster tools for design creation, Synopsys obsessed over a more fundamental problem: verification. They understood that in the high-stakes gamble of silicon, the most valuable position wasn't the creative artist, but the final arbiter of truth.

Their masterstroke was conquering Signoff, the final, non-negotiable checkpoint before manufacturing. Their PrimeTime tool became the industry's undisputed Supreme Court of Silicon, providing the ultimate verdict on whether the billions of signals on a chip would work in perfect harmony.

This wasn't just a better product; it was an architectural power play.

By becoming the official source of truth for timing, Synopsys made itself indispensable. Competitors could build a faster tool, but they couldn't replicate the ecosystem's trust. You could design a chip without Synopsys, but you couldn’t launch it.

The Two Decade Climb To Titan

In the early 2000s, as the dot-com bubble burst, a different kind of arms race was accelerating in Silicon Valley. Moore’s Law was a relentless mandate, and chip designs were growing so complex that old workflows were buckling. It was in this crucible of complexity that Synopsys began its methodical ascent from a useful tools vendor to essential, irreplaceable infrastructure.

Act I: The Grind of Integration (The 2000s)

While others chased fleeting business models, Synopsys focused on a different problem: fragmentation. The chip design world was a chaotic bazaar of niche "point tools" that didn't talk to each other.

Synopsys’s strategy was to consolidate. The 2001 acquisition of Avant!, its fiercest rival in physical implementation, was the checkmate move.

For the first time, one company could offer an end-to-end digital design flow, from RTL synthesis to physical layout. With this, Synopsys turned a collection of disparate tools into a unified platform. It was a vision that convinced early customers like Samsung, then building its foundry business, to commit fully—a partnership that would power Samsung’s rise into a global chip titan.

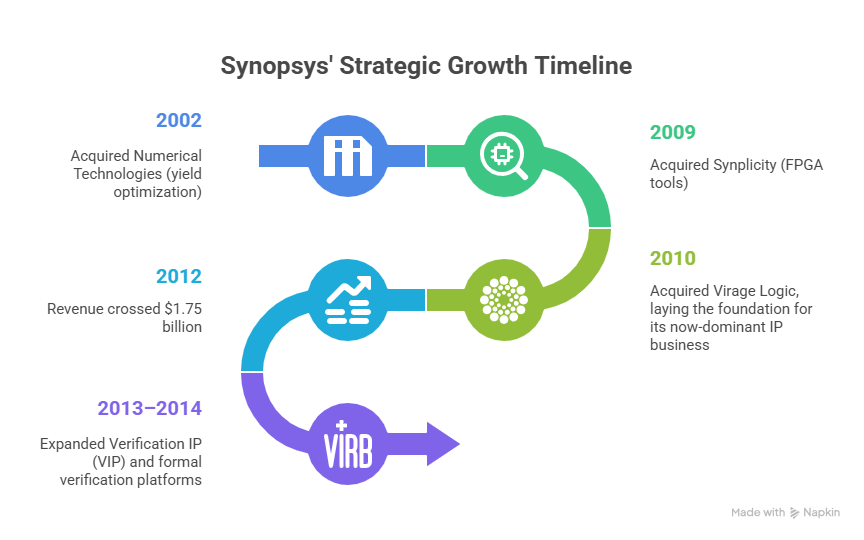

With its starting revenue just clearing $1 billion, Synopsys used its profitability as a weapon. It continued its "string of pearls" strategy, acquiring key technologies like Numerical (2002) for yield optimization and Virage Logic (2010), which laid the foundation for its now-dominant IP business. It was turning itself from a niche EDA vendor into a multi-pronged platform spanning EDA, IP, and verification. The financial discipline was evident: operating margins, in the mid-teens in the early 2000s, expanded to over 20% by 2014.

Act II: The Complexity Tailwind (The 2010s to Today)

The dawn of the mobile and cloud revolutions changed everything. As designs moved to advanced nodes—28nm, then 14nm, then 7nm—the cost of a single design error exploded into the hundreds of millions of dollars. For most, this complexity was a headwind. For Synopsys, it was a jet stream.

The integrated platform it had patiently built was now the only viable way to manage the risk. Companies like Apple, Nvidia, and Qualcomm deepened their reliance, effectively making Synopsys the "Intel Inside" of the design process itself—invisible to consumers, but indispensable to the companies powering every smartphone and data center.

By 2018, revenue had reached $3.1 billion, and free cash flow conversion was consistently over 100% of net income—a testament to the business’s capital efficiency.

Then, in 2020, Synopsys unleashed DSO.ai, the industry’s first AI-driven design platform. It was a landmark moment. The software could autonomously explore thousands of design possibilities, delivering up to 20% improvements in performance and power while compressing months of engineering work into days. With over 300 production tape-outs by 2024, it cemented Synopsys’s technical leadership.

When Complexity Became the Moat

The dawn of the AI era raised the stakes to an entirely new level. Suddenly, the challenge wasn't just managing millions of transistors, but trillions. An AI accelerator wasn't a simple component; it was a universe of logic on a chip. The risk of the billion-dollar paperweight became a near certainty.

It was in this crucible of extreme complexity that the Synopsys strategy achieved its final form.

Its Fusion Design Platform evolved into a fully automated assembly line for silicon, seamlessly combining the conceptual "what" of a design (synthesis), the physical "how” (implementation), and the verified "is it correct?" (signoff). This eliminated the dangerous, time-consuming handoffs between different tools—the very gaps where projects went to die.

For the world's leading technology giants, this platform became a necessity. The link was direct and non-negotiable: the explosive growth in AI applications translated into absolute demand for the one platform that could de-risk these colossal designs. Synopsys wasn't just benefiting from the AI trend; it had become a fundamental prerequisite for it.

The IP Moat: Selling Prefabricated Trust

This empire of certainty rests on a second, equally powerful pillar. Synopsys understood that the ultimate form of certainty wasn't just guaranteeing the process of design, but also guaranteeing the parts.

When a company like NVIDIA designs a new AI chip, its genius is in the unique architecture. Its engineers shouldn't waste time reinventing the standard, mission-critical 'plumbing' like USB ports, PCIe interconnects, or memory interfaces. Yet for years, that’s exactly what happened across the industry—a colossal waste of talent and time.

Synopsys saw this as another chasm of uncertainty to be conquered. This insight sparked a series of strategic acquisitions, none more important than the 2010 purchase of Virage Logic. Virage didn’t just sell code; it provided silicon-proven IP—pre-designed memories and logic cells that were already battle-tested and verified to work.

With this move, Synopsys wasn't just selling software anymore. It was offering certified, prefabricated components for the digital skyscraper.

This created the world’s largest library of reusable, pre-verified IP—a portfolio so vast that today, its building blocks are used in virtually every advanced chip on the planet.

The company's dominance here comes from holding the #1 market position in interface IP, with a catalog of over 7,500 pre-verified blocks. Synopsys rigorously tests this IP with every major foundry, removing immense risk and development time.

Furthermore, these blocks snap seamlessly into its Fusion Compiler platform, creating a frictionless workflow competitors can't match.

This creates a powerful feedback loop: by providing the essential connectivity for nearly every major chip, Synopsys gains an unparalleled view into the industry's future, allowing it to build the IP its customers will need years before they ask for it.

The Business Model: The Art of the Long-Term Lock-In

To understand why Synopsys became so central to the AI revolution, one must understand the elegant mechanics of its business model. Unlike companies tied to the volatile sales cycles of gadgets, Synopsys's revenue is tied to the steady, multi-year R&D budgets of the companies planning tomorrow's world.

This model creates profound stability. As former CFO Trac Pham highlighted, having a massive, multi-year, non-cancellable backlog acts as a shock absorber against market volatility. Once a customer like Apple or NVIDIA commits to the Synopsys platform for a three-to-five year cycle, its entire design methodology becomes intertwined with it.

Customers don't just use Synopsys software; they build their entire R&D organizations around it. The cost of switching isn't measured in dollars, but in the risk of project failure and years of lost progress.

This architecture of certainty extends deep into the company's financial foundation. At its core sits a fortress of committed revenue: a backlog that has grown to over $15 billion. This isn't a forecast; it's a book of ironclad, non-cancellable contracts. This financial moat effectively decouples Synopsys from the feast-or-famine cycle of hardware sales. Its fate is tied to the sacrosanct, long-term R&D budgets of the world's leading technology companies, allowing Synopsys to invest confidently in the decade-long, multi-billion dollar R&D efforts required to solve the next generation of complexity.

The Great Duopoly: A Tale of Two Citadels

In the rarified air of electronic design automation, there are no scrappy startups. There are only two empires—Synopsys and Cadence—that rule the digital continent. To an outsider, they may look like interchangeable titans, but their dominance stems from different architectural philosophies.

The Citadel of Logic

Synopsys’s fortress sits on the bedrock of pure digital logic. It invented commercial synthesis and its command over the place-and-route process for the most advanced chips remains the industry's default. Its verification tools act as the final, unblinking eyes that audit nearly every major AI and high-performance computing design. This is the company's heartland: the brutal, hyper-complex world of ones and zeros at massive scale.

The Analog Realm

Cadence, its peer and rival, reigns supreme in the different world of analog and mixed-signal design. Its Virtuoso platform is the essential workbench for the artisans who craft the sensitive, real-world interfaces of a chip—the components that touch light, sound, and radio waves. While Synopsys masters the logic, Cadence masters the physics. Cadence is not behind; it is simply the master of a different, equally critical domain.

Yet, Synopsys possesses a structural advantage that creates a uniquely powerful gravitational pull—a self-reinforcing flywheel that even Cadence cannot fully replicate.

It begins with its industry-leading portfolio of interface IP. A customer licensing a Synopsys USB or memory controller is not just buying a component; they are buying into an ecosystem. This heavily incentivizes—and often implicitly requires—customers to use Synopsys's own verification tools. The more designs that use Synopsys IP, the more battle-tested that IP becomes, making it the default choice. The more customers use its tools to validate that IP, the deeper their workflows integrate and the higher the switching costs soar.

This is the Synopsys flywheel: IP drives tool adoption, which drives deeper integration, which in turn reinforces the dominance of the IP. It is a virtuous cycle of lock-in, a strategic moat built not on superior technology alone, but on the compounding weight of the entire ecosystem.

A Lead Measured in Silicon

In chip design, the only metric that can’t be faked is the tape-out—the final, irrevocable commitment of a blueprint to silicon. It's the scoreboard. And in the race to automate design with AI, that scoreboard reveals a clear leader.

Synopsys's DSO.ai, launched in 2020, got a crucial head start. By the time Cadence brought its rival Cerebrus to market a year later, Synopsys was already accumulating proof. As of early 2025, customers have used DSO.ai in over 300 production tape-outs.

Cadence, by contrast, offers no such number. Its commentary speaks of “strong customer engagement”—a whisper against the roar of Synopsys’s quantified success.

That one-year lead has compounded into a formidable moat. Each of those 300 tape-outs isn't just a sale; it's a real-world training session that makes the AI smarter. This is the classic data flywheel that analysts from J.P. Morgan to Wells Fargo consistently highlight as Synopsys’s “first-mover scale.” In the world of silicon, a year is an eternity. Synopsys used its head start to build a lead that is now measured not just in time, but in proof.

The AI that Builds the AI

As the AI revolution began to demand silicon of unimaginable complexity, Synopsys recognized a profound paradox: human engineers, the creators of AI, were becoming the bottleneck. The design space for a modern chip had become an ocean of possibilities too vast for any team to navigate. A working design was achievable, but the optimal design was lost in a fog of infinite choice.

Synopsys’s response was to infuse the blueprint itself with a brain. It pioneered the use of AI in the design flow, creating a tool called DSO.ai (Design Space Optimization). Think of it not as a tool, but as an AI co-pilot that works 24/7, tirelessly exploring millions of design pathways impossible for humans to consider.

This wasn't an incremental improvement; it was a fundamental shift. The results were staggering. In a world where single-digit percentage gains are celebrated, customers saw power reductions of up to 25% and productivity gains that shaved months off brutal project timelines. Major players like Samsung publicly stated that DSO.ai allowed them to achieve performance targets they previously thought were unattainable. The demand was immediate and explosive, driving Synopsys's AI-related orders up by 140% in its first full year.

In a stroke of recursive genius, Synopsys is now using AI to forge the very silicon that powers the AI revolution. It has become the indispensable enabler, the AI that builds the AI.

Conscripted into the Chip War

For decades, Cadence and Synopsys were commercially neutral software vendors. Today, they are strategic chokepoints in a new Cold War. Their code has become an instrument of statecraft, and their stock prices are tethered to the geopolitical whims of Washington D.C.

This transformation was not a choice.

The U.S. government, in its bid to stall China’s technological ascent, recognized a profound vulnerability: you cannot design a modern, advanced semiconductor without the Synopsys-Cadence duopoly. There is no viable alternative.

Washington weaponized this dependency. By placing Chinese tech giants on an export-control list, the U.S. effectively revoked their license to innovate. Designing a cutting-edge chip at 3nm or 5nm becomes a near-impossible task. The software duopoly was, in essence, conscripted.

For investors, this is a double-edged sword. On one hand, it creates the ultimate moat. The U.S. government has effectively outlawed the rise of a serious Chinese competitor, turning their market position into a geopolitical fact. On the other, it introduces a volatile new risk. Their revenue streams in China, representing 17% of their 2023 total, are capped by law, and the threat of further restrictions creates a persistent uncertainty.

Cadence and Synopsys now operate within a golden cage. They are more dominant than ever, but they are no longer fully in control of their own destiny.

The Final Frontier: From Silicon to System

Now, Synopsys is making its next great strategic bet, expanding its guarantee from the chip to the entire system. The pending $ 19 billion acquisition of Ansys, is the cornerstone of this ambition.

For decades, the architects of the chip and the engineers of the physical product it powered lived in separate universes. The Ansys acquisition bridges that gap. It's like giving a skyscraper architect not only the blueprints but also a perfect, physics-based simulation of how it will behave in a hurricane—all before a single brick is laid.

By integrating Ansys's simulation with its EDA platform, Synopsys aims to be the first company that can create a true “digital twin” of a complex product.

This move catapults Synopsys beyond silicon, establishing it as the indispensable engineering partner for the entire era of intelligent systems. It is the ultimate expansion of the core mission: to conquer uncertainty, wherever it exists.

The Certainty of Everything

Synopsys's thirty-year journey reveals something profound about how technology businesses create lasting value. The companies that ultimately win aren't necessarily those that build the flashiest products. They're the companies that become essential to everyone else's success.

This required a fundamentally different approach:

Instead of just selling tools, Synopsys sold certainty.

Instead of focusing on features, Synopsys built an integrated, trusted platform.

Instead of optimizing for single transactions, Synopsys optimized for deep, long-term integration.

The patience required for this approach cannot be overstated. For decades, Synopsys built its empire quietly, focusing on the unglamorous but essential work of verification and integration. But it understood something many technology companies miss: in a rapidly evolving, high-risk industry, the most defensible position is not the builder of the product, but the final arbiter of its possibility. It wins not by being the most innovative chip designer, but by being the gatekeeper that makes all other innovation possible.

The dread of the billion-dollar paperweight has been replaced by the quiet hum of automated signoff, a process now measured in hours, not months, with near-zero defects.

In the age of AI, certainty isn’t a feature—it’s the substrate. And Synopsys prints it.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.