Tencent - The Patience Premium

Why Tencent’s Reluctance to Monetize Is Its Most Valuable Asset

TL;DR:

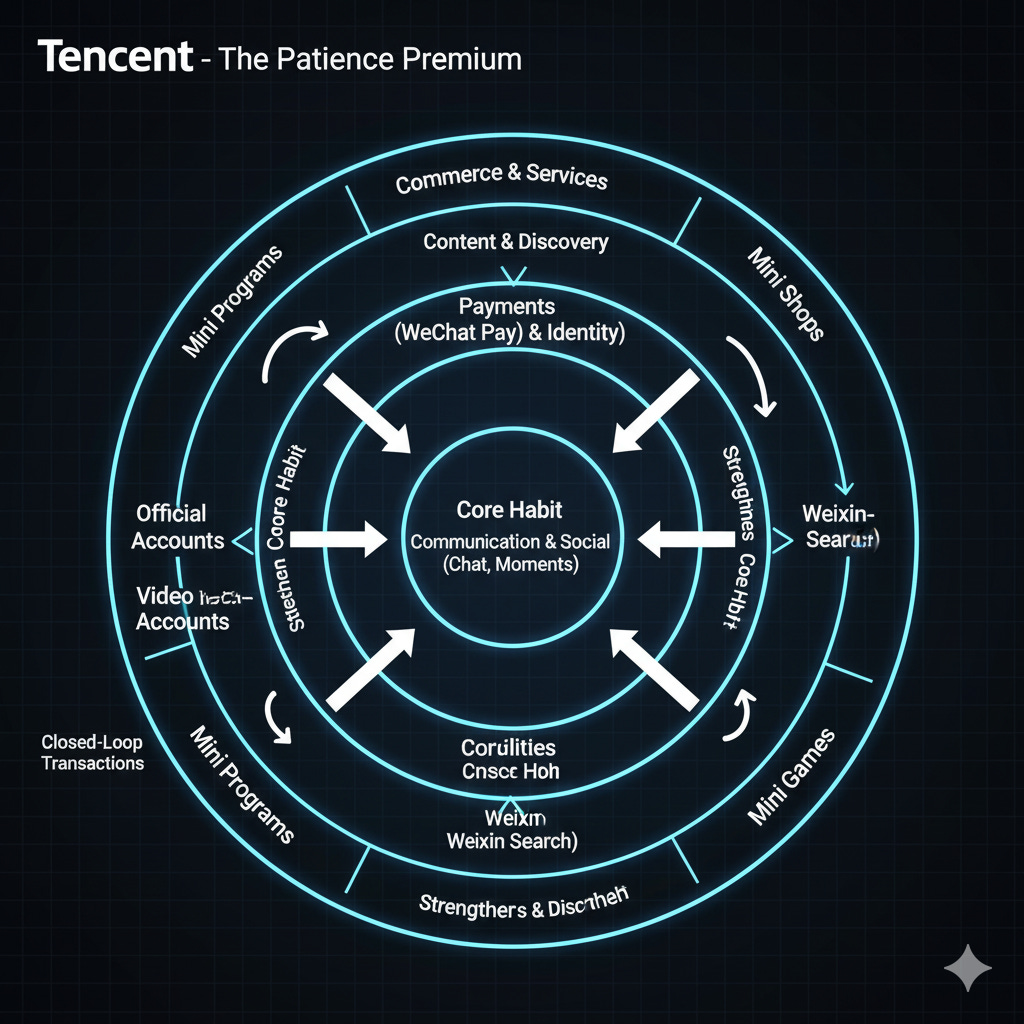

Tencent is strategically under-monetizing key products like Video Accounts, Weixin Search, and Mini Programs, maintaining low ad loads and platform fees to preserve user experience and embed deeper into user behavior.

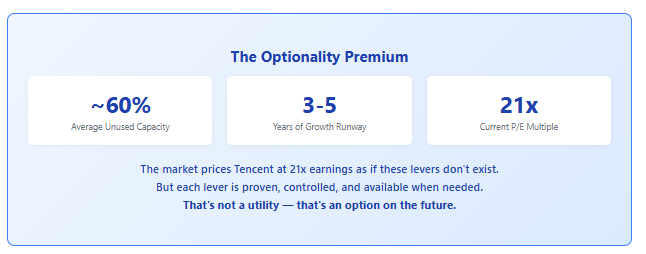

This restraint creates latent revenue levers that can be pulled gradually and profitably — a luxury competitors don’t have. Markets misprice this optionality by valuing Tencent like a mature utility, not a compounder.

History favors patient optimizers like Tencent: in crisis, they quietly expand margins and unlock value, while others scramble. The harvest is just beginning — and the current valuation gives you the upside optionality for free.

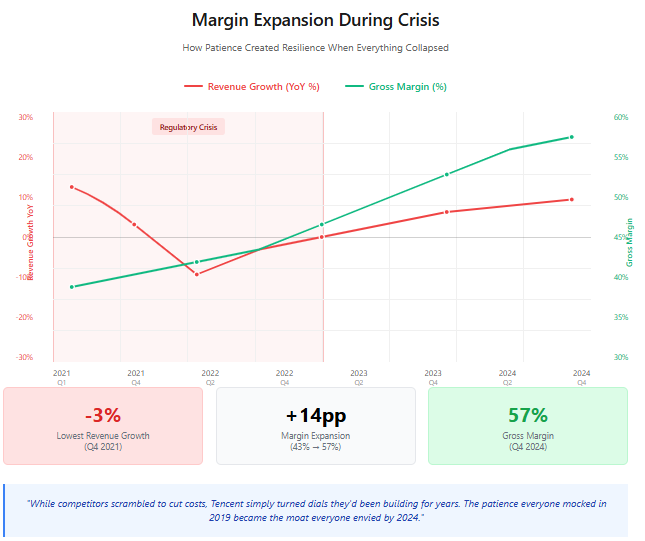

Tencent’s Q2 2025 earnings call contained a remarkable admission. Video Accounts, their short-form video product competing with ByteDance’s Douyin, had grown advertising revenue by over 60% YoY. The remarkable part wasn’t the growth rate. It was what CEO Pony Ma said next: “We continue to maintain conservative ad loads to preserve user experience.”

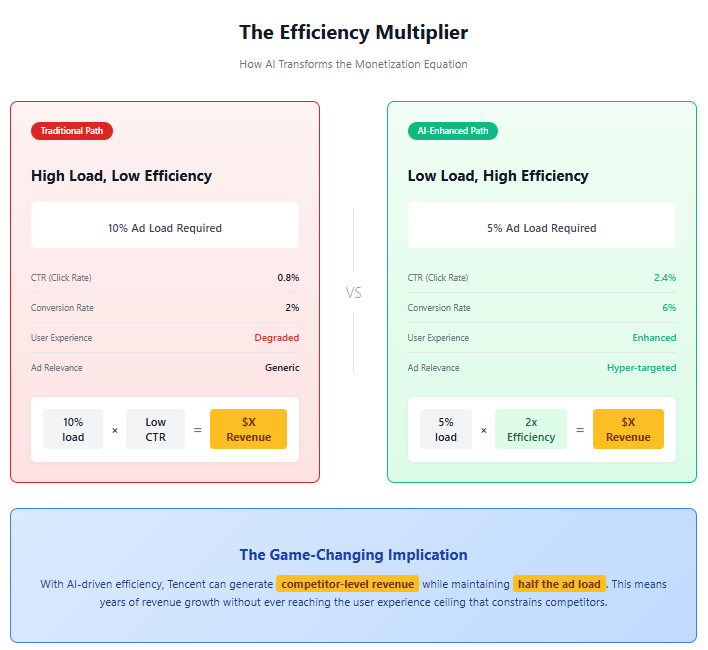

Conservative meant 3-4% — one ad per 25-30 videos. Douyin runs at 10-12%. Instagram Reels at 8-10%. By maintaining one-third the ad density of competitors, Tencent was leaving billions of RMB on the table. Every. Single. Quarter. The market was pricing Tencent like a mature utility that had exhausted its growth options.

This is the paradox: Why does a company with the discipline to leave money on the table trade at a discount to companies frantically grabbing every dollar they can?

The answer reveals something fundamental about how markets misprice optionality.

The Seattle Precedent

In 1995, Barnes & Noble was the undisputed king of book retail. They had perfected the superstore model — 150,000 titles, coffee shops, leather chairs. Wall Street loved the predictable same-store sales growth and expanding margins. The stock traded at premium multiples befitting a category killer.

That same year, Jeff Bezos was shipping books out of his garage. Amazon lost money on nearly every order. But Bezos wasn’t optimizing for 1995. He was building optionality for 2005.

The distinction mattered. Barnes & Noble had to maximize revenue per square foot to satisfy quarterly earnings. Every decision flowed from that constraint. Amazon could lose money on books while building logistics, payments, and customer relationships. They were accumulating options, not earnings.

We know how this ended. Barnes & Noble’s optimization became their prison. Amazon’s patience became their moat. The company that looked irrational for refusing to monetize became the most valuable retailer on Earth.

The pattern repeats across technology history: Companies that defer gratification accumulate compound advantages. Companies that maximize today mortgage tomorrow.

Tencent learned this lesson. Then they weaponized it.

The Art of Strategic Restraint

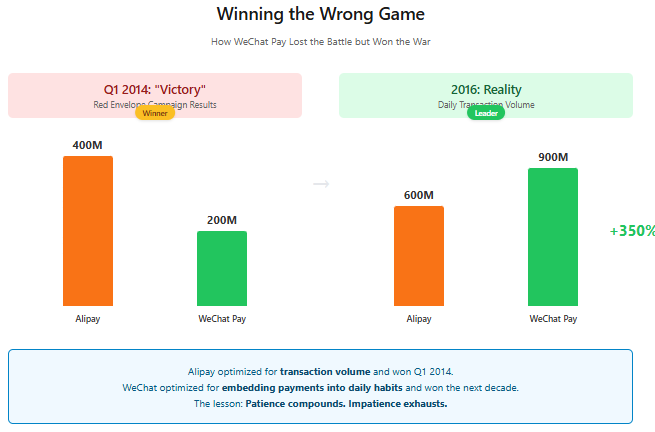

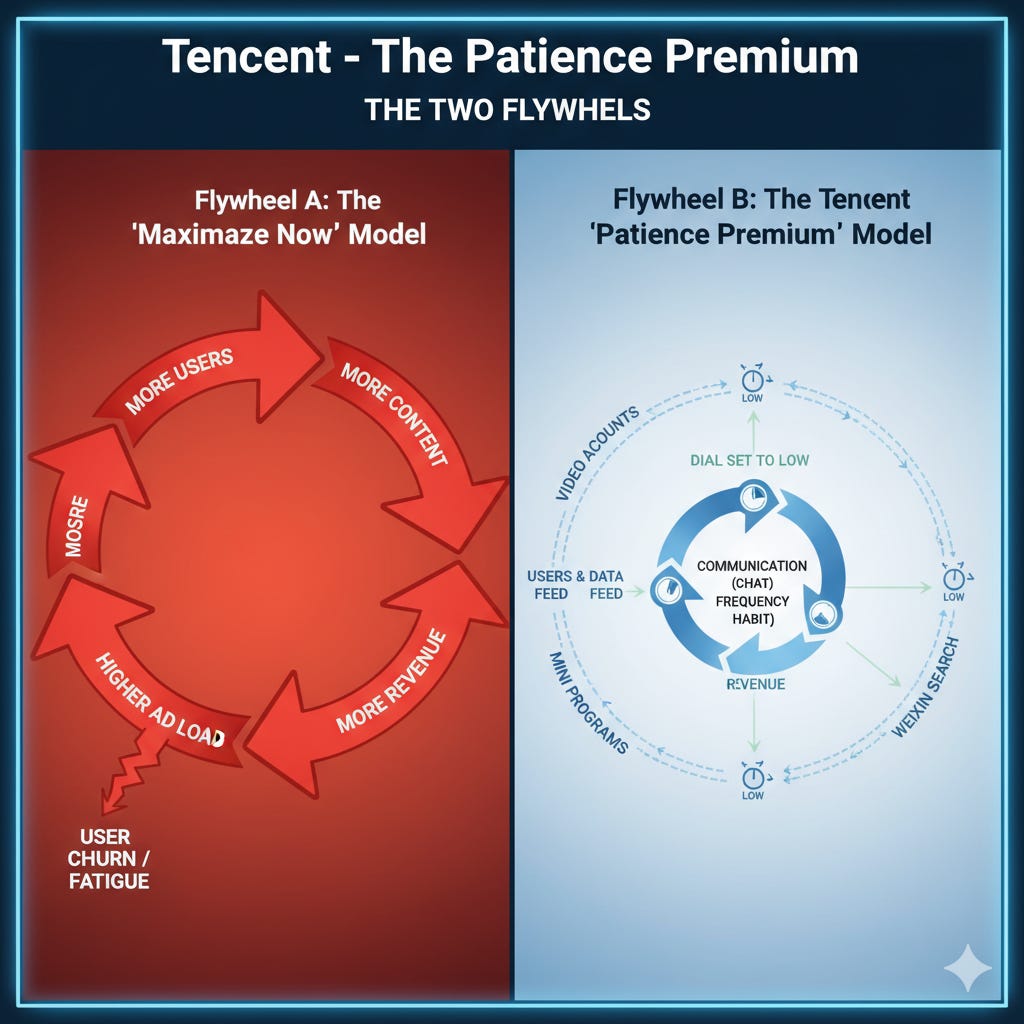

Lunar New Year 2014 should have been Alibaba’s moment of triumph. Their red envelope campaign — digital hongbao sent via Alipay — had crushed Tencent’s WeChat in raw numbers. Four hundred million envelopes versus two hundred million. Jack Ma’s team celebrated their decisive victory in mobile payments.

Except Tencent wasn’t measuring envelopes. They were measuring something else: which app became the default for the ritual itself. Alipay optimized for transaction count. WeChat optimized for embedding payments into why people gathered — the relationships, the tradition, the social fabric of the holiday.

Within two years, WeChat Pay had become the default payment method for hundreds of millions of users. Not through subsidies or merchant incentives, but through patience. They won by choosing the right game.

This philosophy — build dependency, not revenue — became Tencent’s core strategic insight. And they applied it everywhere.

When Mini Programs launched in 2017, Apple and Google were taking 30% of all app revenue. Tencent charged effectively zero. Merchants kept asking about the business model. Tencent kept giving the same answer: “We’re focused on user experience.” Translation: We’re building the casino, not playing the games.

When Video Accounts launched in 2020, Douyin was already printing money at 10%+ ad loads. Tencent started at less than 1%. They could have matched Douyin immediately. They chose not to.

When Weixin Search began showing commercial intent, Baidu was extracting maximum revenue per query. Tencent monetized minimally. Another lever built but not pulled.

By 2020, Western analysts were exasperated. Every earnings call included some variant of “When will you monetize?” Tencent’s management gave the same patient non-answer. They were building something more valuable than revenue: the ability to generate revenue whenever they chose.

Then 2021 arrived, and that ability became salvation.

The Crucible

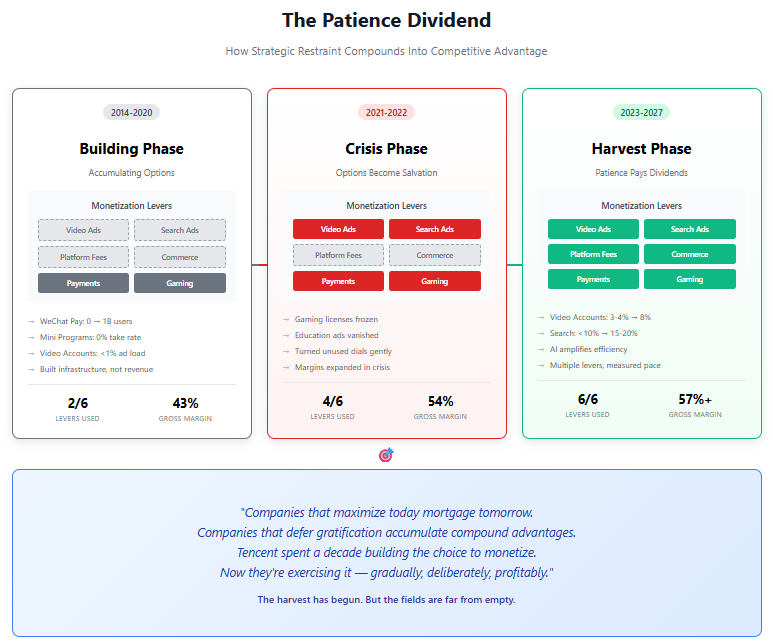

The regulatory storm hit Chinese internet companies like a tsunami. Gaming licenses froze for nine months. Minors could play just three hours per week. The online education sector — 20% of digital ad spend — vanished overnight. For the first time in company history, Tencent reported declining revenue. Profits plunged 25%.

The market’s verdict was swift and brutal: Chinese tech was uninvestable. The growth story was over. Sell everything.

But something curious happened inside Tencent’s financial statements. While revenue declined, gross margins expanded from 43% to 47%. Then 50%. Then 54%. By 2024, they had reached 57% — during what was supposed to be an existential crisis.

This wasn’t cost-cutting. Headcount remained stable. R&D spending increased. The margin expansion came from somewhere else: revenue mix.

Video Accounts ad load increased from less than 1% to 3-4% — still far below competitors, but pure margin at the increment. Weixin Search monetization began scaling from zero. High-margin Mini Games and platform fees grew faster than low-margin segments.

Every lever worked precisely because it hadn’t been overused. While competitors scrambled to cut costs, Tencent simply turned dials they’d been building for years. Gently. Partially. Leaving plenty of room for future turns.

The company that looked foolish for under-monetizing in 2019 looked genius by 2023. Patience had become performance.

The Mispricing Machine

Markets are prediction machines, but they have consistent blind spots. One of the largest: They price what companies are doing, not what they could do.

Consider Tencent’s current position. At HKD 662, the stock trades at 21 times forward earnings with consensus modeling compression to 17.5 times by 2027. Embedded in that multiple is a specific worldview:

Video Accounts’ torrid growth will slow because ad load must be near ceiling

Margin expansion was one-time cost optimization that can’t repeat

AI investments will be margin dilutive with uncertain returns

ByteDance is winning the future, Tencent is defending the past

Each assumption seems reasonable until you examine the facts.

Video Accounts runs at 3-4% ad load. Peers sustainably run at 10-12%. That’s not opinion or projection — it’s mathematical reality. If Tencent simply moved to 8% (still below peers), that alone drives 3-5 years of 15-20% advertising growth. The lever exists. It hasn’t been pulled.

Weixin Search remains below 10% of advertising revenue. In closed-loop ecosystems where search leads to transaction, 15-20% is normal. Another 3-5 years of growth from a dial turn.

Commerce take rates remain minimal while competitors extract 5-8%. Gaming focuses on evergreen titles rather than hit-driven volatility. Cloud prioritizes high-margin proprietary services over commodity infrastructure.

Everywhere you look, Tencent has built levers and chosen not to pull them. The market prices the company as if those levers don’t exist.

The Variant Perception

Here’s what makes this mispricing actionable: The levers aren’t theoretical. They’re proven by competitors, validated by Tencent’s own experiments, and controlled by management with a decade-long track record of patient execution.

The bear case isn’t that these levers don’t exist — it’s that pulling them might hurt engagement. But we have natural experiments. When Video Accounts increased ad load from 1% to 3%, engagement metrics improved because better monetization funded better content and creator tools. When Search added commercial results, user satisfaction increased because purchase intent got fulfilled faster.

The real risk isn’t that monetization hurts the product. It’s that Tencent remains too patient while competitors get aggressive. But that’s like criticizing Warren Buffett for holding too much cash — the discipline that looks like weakness becomes strength when opportunities emerge.

At current valuations, the market offers a remarkable proposition: Pay utility multiples for a company with social network monetization potential. Buy the floor, get the optionality for free.

The Numbers

Let me be specific about what this means over three years:

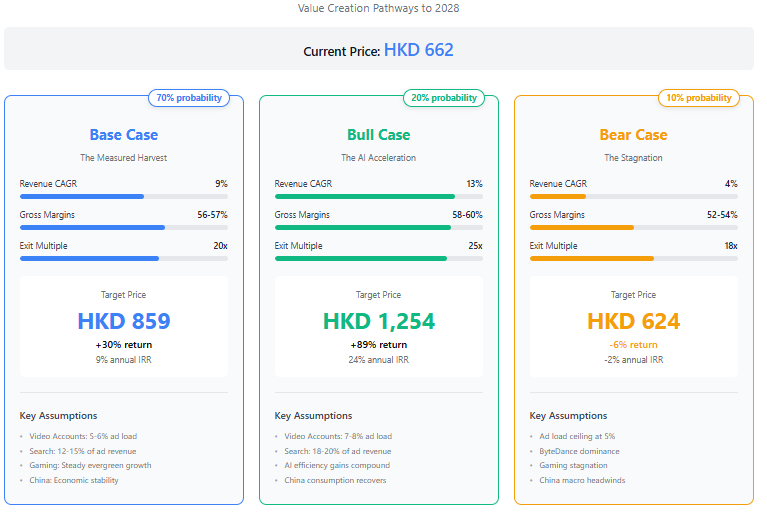

Base Case (70% probability): The Measured Harvest

Assumptions: Video Accounts ad load increases to 5-6%. Weixin Search reaches 12-15% of advertising revenue. Gaming stays resilient through evergreen focus. China muddles through. Revenue compounds at 9% (advertising 12-14%, gaming 8-10%, FinTech/cloud 5-7%). Gross margins hold at 56-57%.

Result: HKD 859 (+30%). The company executes its proven playbook. Nothing heroic required.

Bull Case (20% probability): The AI Acceleration

Assumptions: AI transforms advertising efficiency, enabling higher ad loads without engagement penalty. Video Accounts reaches 7-8% load. Search becomes 18-20% of advertising. China consumption recovers. Revenue compounds at 13%. Margins expand to 58-60% as mix shift accelerates.

Result: HKD 1,254 (+89%). The market re-rates Tencent as an AI winner, not legacy incumbent.

Bear Case (10% probability): The Stagnation

Assumptions: ByteDance wins decisively. Ad load ceiling emerges at 5%. China consumption stays depressed. Revenue compounds at 4%. Margins compress to 52-54% as competition intensifies.

Result: HKD 624 (-6%). Even disaster scenarios provide limited downside at current valuations.

The Dashboard

Forget quarterly noise. Five numbers reveal whether the thesis is working:

Gross Margin: Above 57% and rising = mix shift working. Below 55% = competitive pressure winning.

Video Accounts Growth: Above 40% = plenty of runway. Below 20% = approaching ceiling.

Revenue Growth: Above 12% = multiple expansion likely. Below 6% = value trap forming.

Payment Ticket Size: Turning positive = China recovering. Declining 5%+ = macro headwind intensifying.

Management Language: “Optimizing monetization” = harvest beginning. “Preserving experience” = patience continuing.

The beauty is transparency. Unlike speculating on new products or market expansion, these are dials Tencent controls. We can watch them turn in real time.

The Lesson of Lunar New Year

Return to those red envelopes in 2014. Alibaba celebrated victory because they counted transactions. Tencent played a different game — they counted relationships. One company optimized for the quarter. The other optimized for the decade.

A decade later, WeChat Pay processes more transactions daily than Alipay managed in that entire Lunar New Year campaign. The patience premium compounded.

Today, that same dynamic plays out across Tencent’s empire. While competitors exhaust their monetization options, Tencent accumulates more. While others harvest frantically, Tencent plants patiently. While markets price companies on current extraction, Tencent builds future optionality.

At HKD 662, the market says this patience has no value. The consensus models compression to 17.5 times earnings by 2027 — the multiple of a company with no choices left.

But Tencent has more choices than ever. Ad loads at one-third of sustainable levels. Search monetization in its infancy. Commerce take rates near zero. AI efficiency gains just beginning. Each lever proven by competitors. Each lever controlled by management. Each lever available when needed.

Some companies monetize because they must. Tencent monetizes when they choose.

That’s not a utility. That’s an option on the future of Chinese consumer attention, priced like the options have already expired.

The harvest hasn’t even begun.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.