Tencent's 3Q25 Earnings: AI Dividend

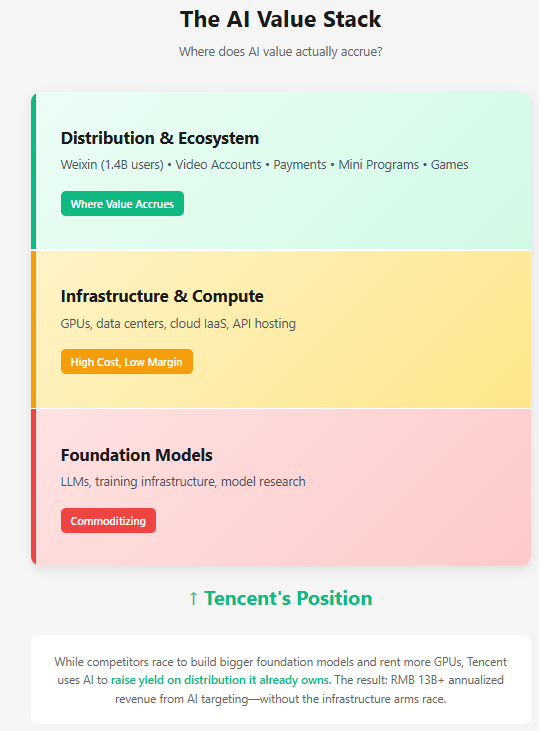

Forget foundation models and GPU arms races—Tencent’s Q3 earnings reveal where AI value actually accrues: owning the user, not the infrastructure.

TL;DR

AI is a Yield Enhancer, Not a Cost Center: Tencent’s 700bps spread between gross profit and revenue growth stems from AI-powered monetization, not cost-cutting—proving the real AI value lies in leveraging existing user networks.

Distribution Is the Strategic Moat: With Weixin as China’s digital operating system, Tencent doesn’t need to win in model training—it wins by extracting more value from the users it already owns.

Platformization Unlocks Margin Expansion: Whether in social, gaming, or commerce, Tencent’s strategy is clear: build platforms, deploy AI internally, and raise efficiency—driving structural re-rating potential.

The AI arms race has settled into a depressingly familiar pattern: massive capital outlays, foundation models racing toward commoditization, and a vague promise that revenue will eventually show up. Today’s narrative is defined by the capex line—who’s spending $50 billion, who’s building what datacenter, which consortium is backing which model. The market has decided that AI value accrues to those who build the biggest first.

Tencent’s Q3 earnings suggest the opposite: AI’s value accrues to those who already own the user relationship.

The headline numbers are straightforward enough—15% revenue growth, 22% gross profit growth, that familiar 700 basis point spread. Bloomberg read this as Tencent taking a “measured approach” to AI development, as if the company were somehow lagging behind the capex brigade. This is exactly backwards. Tencent isn’t being measured; it’s being profitable. The difference is everything.

The Distribution Premium

To understand what’s happening, you have to start with where Tencent sits. Weixin isn’t an app—it’s the operating system for Chinese digital life. The question was never whether Tencent could build a world-class foundation model. The question was whether they could use AI to raise yield on the 1.4 billion users already flowing through their rails.

The answer is now three quarters long.

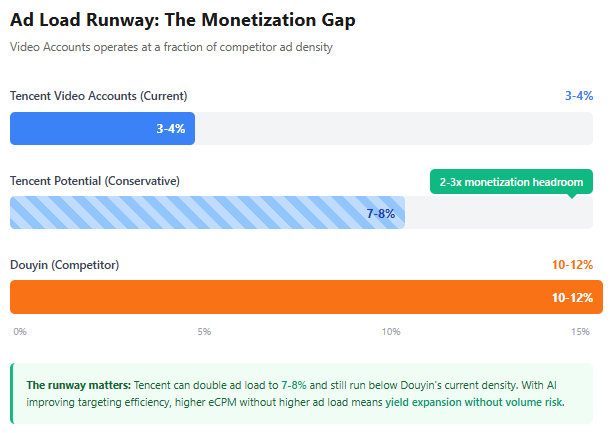

That 700 basis point spread between gross profit and revenue growth? That’s not efficiency gains or cost cutting. It’s an AI dividend. Here’s CFO James Mitchell: roughly 10 percentage points of the 21% advertising growth came from higher eCPM driven by AI-powered targeting. Do the math—RMB 3.3 billion in a single quarter, over RMB 13 billion annualized, from doing a better job matching ads to users inside a closed loop where Tencent sees both impression and transaction.

This is what AI monetization looks like when you own distribution: you don’t sell the picks and shovels, you just mine more efficiently.

The mechanism matters. Video Accounts operates at 3-4% ad load versus Douyin’s 10-12%. For two years, analysts have asked when Tencent would close that gap. Management’s answer has been maddeningly consistent: we’re preserving user experience. But the subtext was always clear—they were uncertain where the ceiling was. AI changes this calculation entirely. Better targeting means higher eCPM without higher ad load. You can raise yield without raising volume, which is the magic formula for margin expansion.

President Martin Lau made the strategic choice explicit: “We actually believe that there’s no insufficiency of GPUs for us at this moment for our internal use. And there is some limiting factor for external cloud revenue.”

Translation: we’re pointing our AI investments inward, at advertising and payments and content, not outward at low-margin infrastructure revenue. While rivals chase IaaS league tables, Tencent is quietly raising the capture rate on value created *within its own ecosystem*. The constraint isn’t compute—it’s how fast they can deploy models against their own inventory.

The iOS Uncertainty Premium

Which brings us to the Apple deal, announced the day after earnings. The market treated it as risk removal—settled terms, 15% commission instead of 30%. I think it’s something more interesting: runway extension.

Mini Programs and Mini Shops have been the most important Tencent story that nobody can quantify. Management has built every piece of the commerce stack—image search, AI recommendations, social gifting, payment rails—while keeping take rates near zero. Every quarter, someone asks about GMV. Every quarter, management demurs. The tell isn’t what they say; it’s what they don’t want to guide to yet.

The Apple deal removes the uncertainty premium that was suppressing the final 25-30% of potential supply. Before this, any merchant or developer building aggressively on iOS faced existential platform risk. Apple could demand 30%, or change terms, or ban WeChat entirely. That uncertainty didn’t just affect economics—it affected *investment confidence.

Now a Mini Shops merchant on iOS pays Apple 15%, pays Tencent an eventual 5-8% platform fee, and keeps 77-80%. Compare that to Tmall, where all-in costs (including the mandatory ad spend to get visibility) leave merchants with 60-65%. The unit economics favor Weixin’s closed-loop model before you factor in the social graph and conversion data.

This is the third major commerce platform emerging in China, but it’s built on distribution that Tencent already owns. The question was never whether they’d monetize it. The question was when the ecosystem would be mature enough that raising take rates didn’t kill growth. The Apple deal accelerates that maturity by making iOS supply confident enough to invest at scale.

Platformization as Margin Expansion

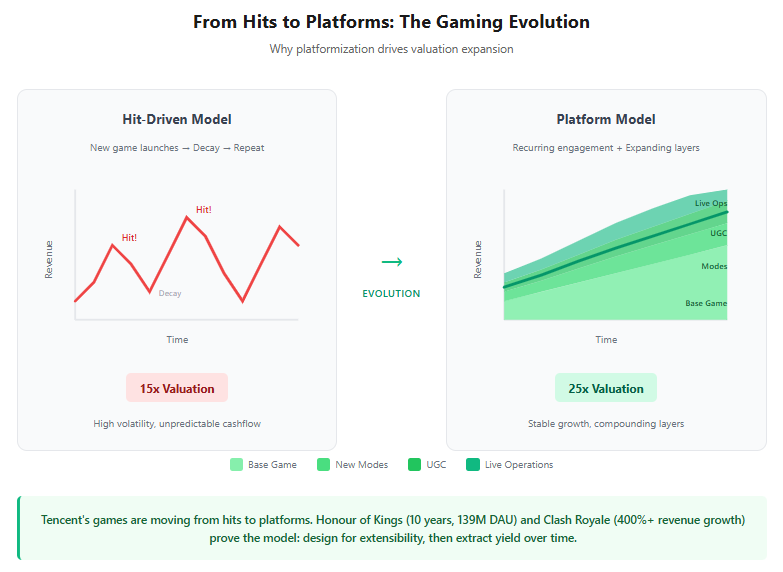

The gaming story fits the same pattern. International games growing 43% sounds bubbly until you parse it—some is acquisition, some is upfront revenue timing. Underlying growth is probably high-teens. That’s still impressive, but it’s not the point.

The point is platformization.

Honour of Kings at 139 million DAU on its 10th anniversary. Clash Royale at all-time highs, up 400%+ year-over-year. These aren’t new hits. They’re old games behaving like social networks—more modes, more UGC, more live operations layered onto fixed infrastructure. Revenue becomes recurring. Margins improve as the platform cost gets amortized across more engagement.

James Mitchell again: “Delta Force unusually is built from day one to support platformization in terms of its modularity.” This is Tencent’s gaming strategy in one sentence. Design for extensibility. Build the platform first, then extract yield over time.

This fundamentally changes how you should value the gaming segment. A hit portfolio trades at 15x earnings. A platform with recurring engagement and improving capture trades closer to 25x. Tencent is somewhere in between but moving inexorably toward the latter.

The Re-rating Mechanism

Which brings us to valuation. Tencent trades at 21x forward earnings. That multiple embeds a specific worldview: mature social company, decent but unspectacular growth, China regulatory discount, no new revenue drivers worth premium pricing.

The market is pricing Tencent like a business that’s done improving.

But three consecutive quarters of 700 basis point gross profit leverage tells a different story. If this continues through 2026, Tencent hits 60% gross margins. At that point, the debate shifts from “is this structural?” to “how long can it continue?”—and multiple expansion follows.

Here’s the math: If Tencent’s AI dividend is real, that 4-turn gap closes. On 13-14% EPS growth, that gets you to HKD 1,100-1,150 within 18 months from today’s HKD 647 based on about 25x NTM PE.

The risk is execution. Video Accounts engagement could crack as monetization rises. International games could decelerate faster than expected. China consumption could hit payment volume. Any of these breaks the pattern.

But patterns matter. And after three quarters, this one is beginning to look structural. The key metrics to watch: gross profit growth staying above revenue, advertising growth above 18%, and management language shifting from “nascent recovery” to “sustained improvement.”

If those hold, the re-rating won’t be gradual. It’ll be sharp, and it’ll be soon.

Because the market has been asking the wrong question. It hasn’t been “how will Tencent compete in AI?” It’s been “how will AI make Tencent more valuable?” Three quarters of evidence suggest we finally have the answer.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.