2025 Investment Strategy Revealed

Beyond policy euphoria, the real work begins.

Markets have steadied, but the story is far from over. The adrenaline of policy breakthroughs has given way to the discipline of execution — and our Investment Committee’s latest outlook reflects exactly that balance: optimism with guardrails

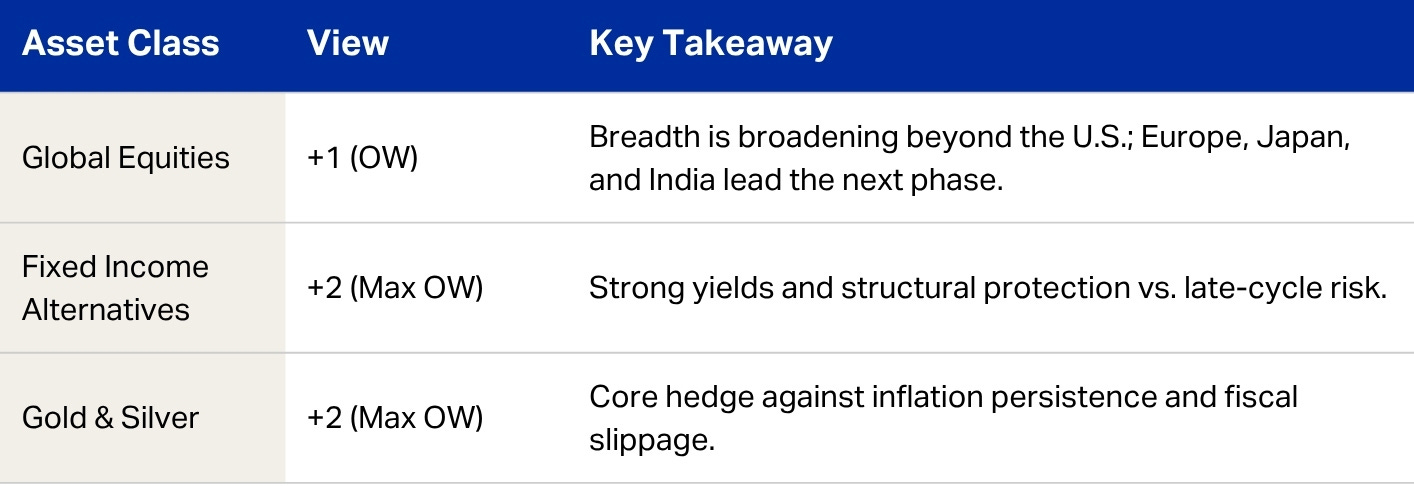

Equities: Broadly overweight.

Market leadership is finally broadening beyond the U.S. Europe is rediscovering fiscal muscle, Japan is rewarding shareholders like never before, and India’s time correction has reset the stage for structural growth. The next chapter of this rally is more global — and more interesting.

Fixed Income Alternatives: Maximum overweight.

When traditional credit stops paying you for the risks you take, it’s time to rethink income. Floating-rate, senior lending, and infrastructure debt remain our preferred engines of steady return — the quiet power beneath the portfolio surface.

Gold & Silver: Maximum overweight.

The fiscal math hasn’t changed, and neither has our conviction. With deficits entrenched and inflation sticky, precious metals stay the anchor — not a hedge of fear, but of foresight.

The full story

The Plateau Paradox: Investing Beyond Policy Euphoria —unpacks how we’re positioning portfolios for the next phase of this cycle: steady, selective, and still full of opportunity.

📅 November 5, 2025

🕓 4:30 PM SGT/HKT | 2:00 PM IST | 12:30 PM GST