The Constraint That Built an Empire: Xiaomi's Engineered Escape

How a self-imposed margin limit forced the creation of consumer technology's most sophisticated profit redistribution machine - and why the market is still pricing the components instead of the system

TL;DR:

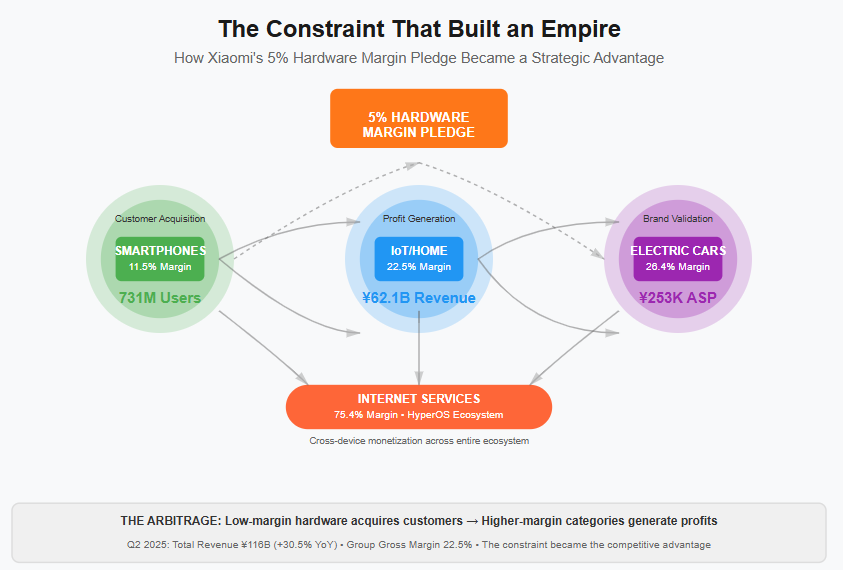

The trap that built the machine: Xiaomi’s 5% hardware margin pledge looked like a cap on growth, but it forced the company to turn phones into customer acquisition devices rather than profit centers.

Profit by redistribution: IoT, appliances, EVs, and services became the real engines of margin, with smartphones acting as the entry point into a high-value ecosystem.

Market mispricing: Investors still value Xiaomi as a hardware maker, ignoring the system-level arbitrage that makes it more resilient — and more valuable — than peers stuck in commodity cycles.

The Promise That Became a Prison

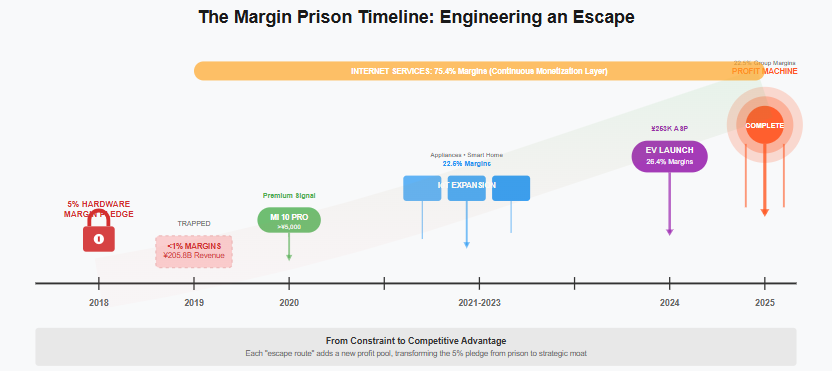

April 25, 2018. Just ahead of Xiaomi’s landmark IPO, Lei Jun stands before investors and makes what would become the company’s sacred covenant: overall hardware net margins will forever remain below 5%. The assembled analysts nod approvingly. This is Xiaomi’s DNA, their competitive differentiation against premium-priced competitors like Apple and Samsung. It’s their brand promise to consumers worldwide - honest pricing, incredible value, technology for everyone.

The numbers seemed to validate the approach. For fiscal year 2019, Xiaomi would report RMB 205.8 billion in revenue, up dramatically from the previous year’s RMB 174.9 billion. They had shipped 146.4 million smartphones globally, claiming significant market share worldwide. Their IoT business reached RMB 62.1 billion in revenue, connecting 235 million devices. By any measure, this was a remarkable success story.

But hidden within that success was a constraint more severe than outsiders realized. The overall hardware net margin wasn’t just below 5% - it was below 1%. Lei Jun had created what amounted to a break-even hardware business, generating virtually no profit from the products that drove most of Xiaomi’s revenue and attention.

This wasn’t sustainable long-term strategy; it was strategic necessitation. Every smartphone sold profitably brought Xiaomi closer to a margin ceiling that would eventually force them to either cut prices further or stop growing. The promise wasn’t just marketing - it was a trap that threatened to cap the company’s potential just as they were reaching scale.

Yet even as these successes were being achieved, the seeds of a strategic pivot were being sown. The launch of the Mi 10 Pro in early 2020, priced above RMB 5,000, would be the first concrete sign of the coming premiumization push. Growing emphasis on offline retail expansion was accelerating - over 1,800 Mi Home stores by year-end 2019. And persistent questions about the long-term IoT strategy and its relationship to the core phone business hinted at deeper integration plans.

These weren’t diversification plays or random product extensions. They were the first systematic attempts to engineer an escape from the margin prison.

Engineering the Arbitrage

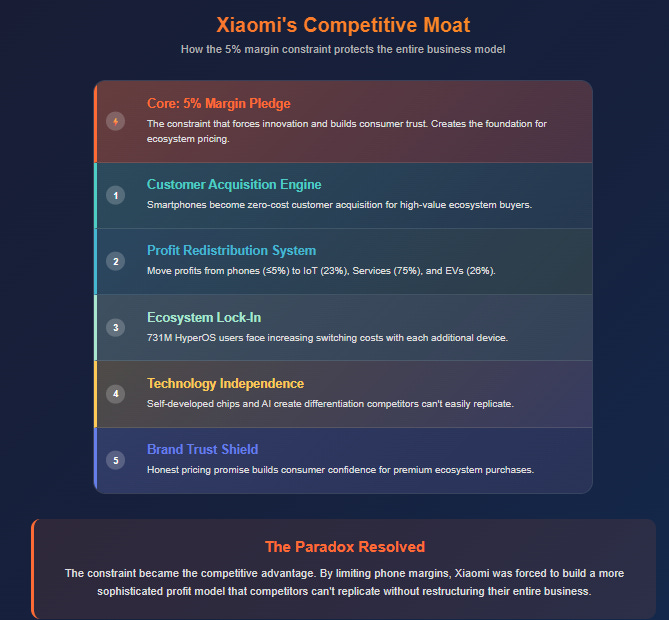

Rather than break his hardware margin promise - and with it, Xiaomi’s core value proposition - Lei Jun chose a more elegant solution: engineer around the constraint entirely. The margin limit would remain sacrosanct for hardware, but it would only apply to the customer acquisition layer of a much more sophisticated economic machine.

The insight was both simple and revolutionary: if you can’t make money selling phones, use phones to acquire customers you can monetize through different categories entirely.

Consider what Xiaomi built between 2019 and 2025:

The phone became the customer acquisition system.

Instead of maximizing profit per device, smartphones became a high-quality customer acquisition vehicle operating at or near the margin pledge. But not just any customers - the right customers. Xiaomi’s premiumization strategy wasn’t about raising phone margins; it was about attracting users with higher disposable income who would make ecosystem purchases. By Q2 2025, 27.6% of Xiaomi’s China smartphone sales were priced above RMB 4,000, up from roughly 10% in 2019. These weren’t just higher-margin phones - they were higher-value ecosystem prospects.

Global scale amplified this effect. Maintaining the #3 worldwide smartphone position for over 20 consecutive quarters created massive ecosystem entry points. Each phone sold represented not a margin opportunity but a lifetime monetization opportunity across multiple categories.

The home became the profit generation center.

The IoT business evolved from selling smart speakers and fitness bands to major appliances that command substantial margins. In Q2 2025, AC shipments exceeded 5.4 million units with 60% year-over-year growth. More importantly, the entire AIoT segment achieved 22.5% gross margins, sustaining above 20% for four consecutive quarters.

This margin structure was impossible under the old smartphone-centric model. These profits exist precisely because smartphones serve as customer acquisition, eliminating the traditional customer acquisition costs that burden appliance manufacturers. A customer acquired through a Xiaomi phone purchase might subsequently buy RMB 8,000 worth of appliances at 25% margins. The total customer economics fundamentally changed.

The car validated the entire model.

The electric vehicle business represents the ultimate test: can Xiaomi’s manufacturing excellence and brand trust extend to the highest-value, most complex consumer purchase?

The results validate the strategy. In Q2 2025, Xiaomi delivered 81,302 EVs with gross margins of 26.4% and an average selling price of RMB 253,662. This isn’t sustainable through promotional pricing or cost subsidization. The modular design approach, where multiple vehicle models share standardized components, creates economies of scale even before achieving massive absolute volumes.

Most importantly, the EV business proves that the margin constraint was never about manufacturing capability or brand limitations. Xiaomi can build premium products that command luxury margins when freed from the customer acquisition role that smartphones serve.

The software stack created sustainable differentiation.

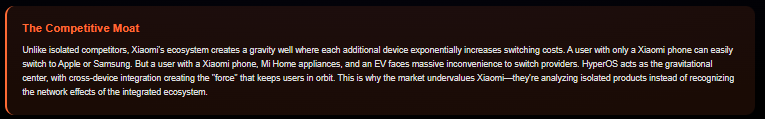

HyperOS, connecting 731 million monthly active users across smartphones, IoT devices, and EVs, isn’t just a user interface - it’s the business model enabler. Cross-device integration creates switching costs that didn’t exist when Xiaomi sold individual products. Users invested in the Xiaomi ecosystem face significant inconvenience switching to competitors, even if individual products are superior.

This integration also enables monetization vectors impossible in single-device businesses. Internet services revenue reached RMB 9.1 billion in Q2 2025, with overseas markets representing 32.9% of the segment - a record high. While internet services gross margins historically ran around 64.7% in 2019, they have improved significantly under current reporting definitions, reaching 75.4% in Q2 2025, reflecting the evolution toward higher-margin services.

The genius becomes clear when you consider alternatives. Traditional consumer electronics companies face identical commoditization pressure but lack systematic solutions. They can raise margins temporarily through premium positioning or cost reduction, but market forces eventually compress profits back toward commodity levels. Xiaomi engineered a different solution: use commodity-margin products to acquire customers, then monetize them through categories where customer acquisition costs approach zero.

The Machine in Operation

By Q2 2025, Xiaomi’s profit redistribution machine was fully operational, and the results validate the strategic logic. Total revenue reached RMB 116 billion, up 30.5% year-over-year, with group gross margins of 22.5% - impossible under the old smartphone-centric model.

The margin arbitrage is working exactly as designed. Smartphones operate at 11.5% gross margins, honoring the spirit of the original pledge while serving their customer acquisition function. IoT devices deliver 22.5% gross margins, providing stable cash flow that funds long-term investments. EVs achieve 26.4% gross margins, driving revenue growth and validating premium brand extension. Internet services maintain historically high margins, creating scalable profit from the customer base acquired through hardware.

This isn’t just financial engineering - it’s competitive strategy. When Tesla cuts EV prices to stimulate demand, Xiaomi can maintain pricing because EVs aren’t their only profit center. When smartphone competitors engage in margin-destroying promotion wars, Xiaomi can participate because phones aren’t their primary profit driver. The diversified profit pool creates resilience that single-category companies cannot match.

The network effect is beginning to emerge as well. Cross-device behavioral data enables predictive services across home, mobile, and automotive contexts. International expansion proves the model works beyond China - overseas internet services revenue represents one-third of segment total. Technology independence through self-developed chips and AI models reduces supplier dependency while creating differentiation.

Most importantly, the hardware margin pledge is no longer a constraint - it’s a competitive signal. By maintaining “honest pricing” on phones while generating profits elsewhere, Xiaomi builds consumer trust that enables higher-margin purchases in adjacent categories. Customers understand that Xiaomi phone value comes from ecosystem integration, not margin extraction, making them more willing to invest in the broader system.

Why Now? The Market’s Blind Spot

Despite clear evidence that the profit redistribution machine is operational and scaling, the market continues to value Xiaomi primarily as a hardware company. At 28.8x forward P/E, the stock trades at multiples reflecting steady but unexceptional growth expectations, not the emergence of a new economic model.

The market is making three fundamental mistakes:

First, analyzing segments separately instead of recognizing the integrated arbitrage system. Automotive analysts evaluate EV delivery numbers. Smartphone analysts track handset shipments and market share. Consumer electronics analysts monitor IoT revenue growth. They’re analyzing the components rather than understanding the function of the machine itself. They see “smartphone company + EV company + appliance company” when they should see “customer acquisition system + profit generation system + brand validation system.”

Second, treating EV margins as cyclical instead of structural. Conventional wisdom suggests that 26.4% gross margins are unsustainable - that competitive pressure will inevitably compress them toward industry norms. This analysis ignores the modular design advantages and manufacturing excellence that enable these margins. More importantly, it misses that EV profitability doesn’t need to maximize margins - it needs to validate the premium brand positioning that enables ecosystem sales.

Third, underestimating services acceleration. The market models gradual services growth over 5-10 years, similar to other hardware companies’ transitions. But Xiaomi’s services growth is accelerating because of EV adoption and IoT scale, not despite it. Each EV sold creates ongoing software monetization opportunities. Each IoT device adds behavioral data that enables predictive services. The services inflection is happening now.

The catalyst timeline makes this opportunity time-sensitive. Multiple proof points are converging over the next 12-18 months:

EV operating profitability is targeted for H2 2025, proving the automotive business can stand alone financially while serving its strategic ecosystem role. Services revenue inflection will become undeniable as cross-device integration creates monetization vectors. European expansion validation through the 2027 launch timeline will demonstrate global applicability. Technology independence will deliver measurable competitive advantages as self-developed chips and AI models mature.

When these proof points converge, the market will be forced to revalue Xiaomi from a hardware company (25-30x P/E) toward something reflecting ecosystem economics (35-45x P/E). The current valuation represents the arbitrage opportunity between present perception and emerging reality.

The Numbers: Three Ways This Plays Out

From the current price of HKD 56 and market capitalization of HKD 1.46 trillion, three scenarios capture the range of potential outcomes over the next three years:

Bear Case (15% probability): HKD 25-40, representing -30% to -55% downside

The complexity trap scenario assumes the profit redistribution machine breaks down under operational strain. Managing smartphones, appliances, and automobiles simultaneously proves beyond organizational capability. Quality issues mount, capital is burned without achieving synergies, and the company retreats to focus on core categories.

Key assumptions: Revenue CAGR slows to 8-12% as execution problems emerge. Services remain at 15-20% of total revenue as ecosystem integration fails. EV margins compress below 18% due to competitive response. The market continues viewing Xiaomi as a cyclical hardware manufacturer, applying 18-25x P/E multiples.

Base Case (60% probability): HKD 90-120, representing +60% to +115% upside

The steady execution scenario assumes the arbitrage system scales as designed without achieving exceptional network effects. EV production grows to 500-750k annual deliveries with margins stabilizing around 20-22%. Services revenue reaches 25-30% of total by 2027. IoT margins remain healthy above 20%. Smartphone business continues effective customer acquisition.

Key assumptions: Revenue CAGR of 18-22% driven by steady ecosystem expansion. Operating margins improve to 10-12% as higher-margin segments scale. The market gradually recognizes the hybrid model, applying 30-35x P/E multiples reflecting both hardware and ecosystem characteristics.

Bull Case (25% probability): HKD 180-220, representing +220% to +290% upside

The ecosystem breakthrough scenario assumes network effects emerge that create genuine competitive moats. HyperOS becomes sticky enough to generate measurable switching costs. Cross-device integration creates user experiences competitors cannot replicate. Services monetization accelerates beyond expectations.

Key assumptions: Revenue CAGR reaches 25-30% as ecosystem effects compound. Services reach 35-40% of revenue by 2028 with expanding international presence. EV business achieves 1M+ deliveries while maintaining 25%+ margins. The market re-rates Xiaomi toward ecosystem company multiples, applying 40-50x P/E multiples similar to other technology leaders.

The probability weightings reflect both opportunity and execution risk. Success requires exceptional performance across diverse business models simultaneously. However, current evidence suggests the strategy is working - profit redistribution is operational, margins are expanding where predicted, and ecosystem integration is creating measurable customer benefits.

Critical tracking metrics include:

EV gross margins sustained ≥20-22% quarterly, with at least one quarter of operating profitability in H2 2025

AIoT gross margins maintained ≥20% with major appliance growth >30% annually

China smartphone premium mix progression toward 30%+, handset gross margins ≥12% during cycle peaks

Services overseas share >35% of segment, with disclosure of paid cross-device features and attachment rates

The Paradox Resolved

Lei Jun’s hardware margin pledge - the constraint that appeared to limit Xiaomi’s growth potential - ultimately became the forcing function that drove them to build a more sophisticated and defensible business model than traditional hardware companies could achieve.

This represents a classic example of constraint-driven innovation. The technology industry, analysts, and investors remained fixed on the idea that hardware companies make money by selling hardware at higher margins. Lei Jun was forced to discover that hardware companies can make money by using hardware to acquire customers for higher-margin adjacent categories.

The competitive implications extend beyond Xiaomi. Other consumer electronics manufacturers face identical commoditization pressures but lack systematic solutions. They can temporarily raise margins through premium positioning or cost reduction, but market forces eventually compress profits back toward commodity levels. Only Xiaomi has engineered a systematic escape from the margin prison that affects the entire industry.

The investment opportunity exists because the market continues using the old analytical framework - examining margin trends within individual product categories rather than recognizing profit redistribution across categories. Current multiples reflect hardware company economics while the actual business model resembles customer acquisition and lifetime value optimization.

The transformation is essentially complete. Xiaomi generates higher aggregate margins than most traditional hardware companies while maintaining price competitiveness in customer acquisition categories. They’ve achieved sustainable differentiation through ecosystem integration while building scalable profit centers that don’t depend on any single product’s success.

For investors, the opportunity lies in recognizing that the constraint didn’t limit Xiaomi’s potential - it forced them to reimagine what a consumer technology company could be. The company that once trapped itself with a margin promise has systematically escaped while competitors remain imprisoned by commoditization dynamics.

The 5% hardware margin pledge wasn’t a strategic limitation; it was the catalyst for building a consumer technology empire. Sometimes the best way to solve a constraint isn’t to remove it, but to architect around it so completely that it becomes your competitive advantage.

That’s not just a business strategy lesson - it’s an investment thesis disguised as a smartphone company.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.