The Edison Loop: How GE Vernova Rewired Industrial Power for the AI Century

From Niagara's turbines to data-driven grids—and the paradox of becoming indispensable

TLDR

GE Vernova, reborn from the ashes of GE's conglomerate collapse, has emerged as a mission-critical infrastructure platform—serving the AI-driven energy demands of the 21st century with fast-ramping turbines, HVDC grids, and predictive intelligence.

Its transformation mirrors software economics: 68% of revenue now comes from long-term service contracts, and every hardware installation feeds a self-improving data flywheel that compounds reliability, margins, and switching costs.

But strategic dominance invites scrutiny: Regulatory pressure, geopolitical fault lines, and tech platform inversion risk now threaten GE Vernova’s hard-won control over the world’s most valuable utility layer—electricity coordination in the AI era.

Executive Summary

“The Edison Loop” traces the remarkable rebirth of General Electric through the lens of GE Vernova—a company that has repositioned itself from a bloated conglomerate into the operating system of the global AI economy.

Anchored by Edison’s century-old insight that true power lies not in the bulb but in controlling the system, the article shows how GE Vernova took that principle global, intelligent, and real-time.

Starting from the historical magic of Niagara Falls in 1895, the narrative charts GE’s descent into complexity and crisis during the 2000s, followed by its bold breakup in 2021. From that unbundling, GE Vernova emerged in 2023—perfectly timed with the surge in AI-driven electricity needs.

The transformation included a shift to service-based recurring revenues and a hardware-enabled intelligence layer. With success came paradox: regulatory scrutiny, global political sensitivity, and the looming threat of digital infrastructure players building competing optimization layers.

Ultimately, GE Vernova exemplifies a new class of companies that merge physical infrastructure with software coordination.

Yet, it faces the same dilemma Edison never could:

Can any one entity safely control the nervous system of the modern energy economy—and should it?

On September 30, 1895, a crowd gathered at the base of Niagara Falls as Westinghouse engineers prepared to make history. When they threw the switch, General Electric turbines began converting the thundering cascade into something unprecedented: 15,000 kilowatts of alternating current that would travel 26 miles to illuminate Buffalo, New York. Across the city, gas lamps flickered and died as electric bulbs blazed to life. Witnesses reported smelling ozone in the air and hearing an electric hum that seemed to vibrate through the very ground beneath their feet.

What appeared magical quickly became invisible infrastructure.

But the real insight belonged to Thomas Edison, whose company had helped engineer this marvel. Edison understood something profound: the light bulb was never the business. The business was controlling the entire system—the generators, the transmission lines, the meters, the maintenance contracts. Whoever controlled the backbone shaped every market built atop it.

128 years later, as artificial intelligence rewrites the rules of electricity demand, one company is rediscovering the transformative power of controlling the entire system.

Act I: The Conglomerate Drift

By the year 2000, General Electric had evolved far beyond Edison's focused vision. The company that once mastered the elegant simplicity of electrons flowing through copper wire had become something else entirely: a sprawling industrial conglomerate with tentacles reaching into jet engines, television networks, and subprime mortgages. The logic seemed unassailable—diversification would spread risk and smooth cyclical volatility.

But complexity mathematics work differently than financial theory suggests.

Every new business unit doesn't just add revenue; it doubles coordination costs and halves management focus.

In an internet era where investors increasingly reward clarity and transparency, GE began to resemble what one analyst memorably called a "spreadsheet Frankenstein"—a creation stitched together from disparate parts that nobody could fully understand.

The reckoning came in 2008. GE Capital, the financial services arm that had grown to represent nearly half the company's profits, began unraveling as subprime mortgages soured. The opacity that had once been tolerated as the price of diversification suddenly became toxic. Investors fled, and GE's market capitalization collapsed from roughly $590 billion in 2000 to $110 billion by 2020.

Could a 130-year-old industrial giant remember Edison's original insight about the power of focused system control?

The answer would require one of the most dramatic corporate transformations in modern business history.

Act II: The Great Unbundling

In November 2021, GE's board approved a decision that would have seemed unthinkable just a decade earlier: a complete breakup of the industrial conglomerate into three independent, publicly traded companies. GE Aerospace would house the aviation business, GE HealthCare would focus on medical technology, and GE Vernova would become a pure-play energy infrastructure company.

This wasn't financial engineering; it was strategic repositioning.

The counter-intuitive insight driving the split was that specialization would unlock more strategic options than diversification ever had. By shedding the complexity of managing disparate businesses, each entity could pursue focused excellence and capital allocation discipline that the conglomerate structure had made impossible.

GE Vernova officially launched in January 2023, just as the world's electricity infrastructure was about to face its greatest challenge in generations.

The timing would prove more than coincidental—it was destiny.

Act III: The AI Catalyst

The public debut of ChatGPT in November 2022 marked more than a breakthrough in artificial intelligence—it signaled the beginning of an electricity revolution. As AI workloads surged from research labs into mainstream deployment, powering everything from search engines to creative tools, electricity demand forecasts were rewritten almost overnight. Hyperscale data centers, once content with predictable baseload consumption, began demanding something entirely different: constant, dense, fast-ramping power that could scale instantly with computational needs.

By 2025, AI-driven electricity consumption was projected to represent 6% of the US grid—a tripling of previous forecasts. This wasn't just more demand; it was a fundamentally different kind of demand that required fast-ramping turbines, flexible transmission infrastructure, and sophisticated grid management software.

GE Vernova found itself at precisely the right intersection of these forces. Their gas turbines could ramp up and down quickly to match AI workload variability. Their high-voltage direct current (HVDC) transmission systems could efficiently move massive amounts of power over long distances from generation sources to data center clusters. Their grid automation software could manage the complex orchestration required to keep electrons flowing reliably to both traditional consumers and AI infrastructure.

The convergence was remarkable: GE Vernova spun out as an independent company exactly when its integrated capabilities became the critical path for the AI economy.

Act IV: The Intelligence Layer—Beyond Selling Metal

What emerged from this transformation wasn't simply a more focused version of the old GE. It was something categorically different: a company that had discovered how to build recurring revenue streams and competitive moats in the physical world using principles that had previously only worked in software.

Consider the three pillars of GE Vernova's platform:

Power: The gas, steam, and nuclear turbine business now generates 68% of its revenue from long-term service agreements rather than equipment sales. Every turbine installation becomes a 20-30 year recurring revenue stream, with GE Vernova managing everything from predictive maintenance to performance optimization. The incentive structure has flipped entirely: the company now profits more when customer equipment runs reliably than when it breaks down and needs replacement parts.

Wind: After facing severe margin pressure in 2021-2022, the wind business has been restructured around the massive Haliade-X offshore turbine, with 107-meter blades that can generate more power per installation. Onshore wind operations returned to profitability, with EBIT margins swinging from -6% to +4% in 2023. The focus shifted from competing on price to competing on total system performance and reliability.

Electrification: This segment manages the increasingly complex job of moving electricity from generation sources to consumption points. With a 15 GW HVDC backlog and over 3,000 digital twin deployments, GE Vernova is essentially building a programmable electricity network that can be optimized in real-time based on supply, demand, and grid conditions.

The hidden transformation underlying all three pillars is that every piece of GE Vernova equipment has become a sensor in what is rapidly becoming the world's largest energy intelligence network. Every turbine rotation, every temperature fluctuation, every grid voltage measurement feeds into predictive models that can forecast equipment failures 30 days in advance and optimize energy flows across entire regional grids.

Act V: Physical-Platform Flywheel

What GE Vernova has built defies traditional industrial categories. It's a platform that creates network effects in the physical world—something most people assumed was impossible.

The flywheel works like this: more equipment installations generate more operational data, which improves predictive models, which enables better service and higher uptime, which creates stickier customer relationships and justifies premium pricing, which funds more installations and R&D investment. Unlike software platforms where network effects can emerge quickly, physical infrastructure platforms create switching costs measured in decades rather than months.

This creates a compounding competitive advantage that traditional manufacturing approaches cannot match. Competitors like Siemens Energy can build excellent individual components, but they cannot replicate 30 years of global fleet performance data or the integrated intelligence layer that GE Vernova has constructed across generation, transmission, and optimization.

(I spoke with a utility CTO in the Midwest who described GE Vernova's system dashboard as "mission control for electrons"—a single interface where operators can see real-time performance data from dozens of power plants, predict maintenance needs weeks in advance, and optimize electricity flows across multi-state transmission networks.)

Act VI: The Valuation Revolution

Financial markets initially struggled to categorize what GE Vernova had become.

Was it an industrial manufacturing company that should be valued on traditional price-to-earnings ratios? Or was it something else entirely?

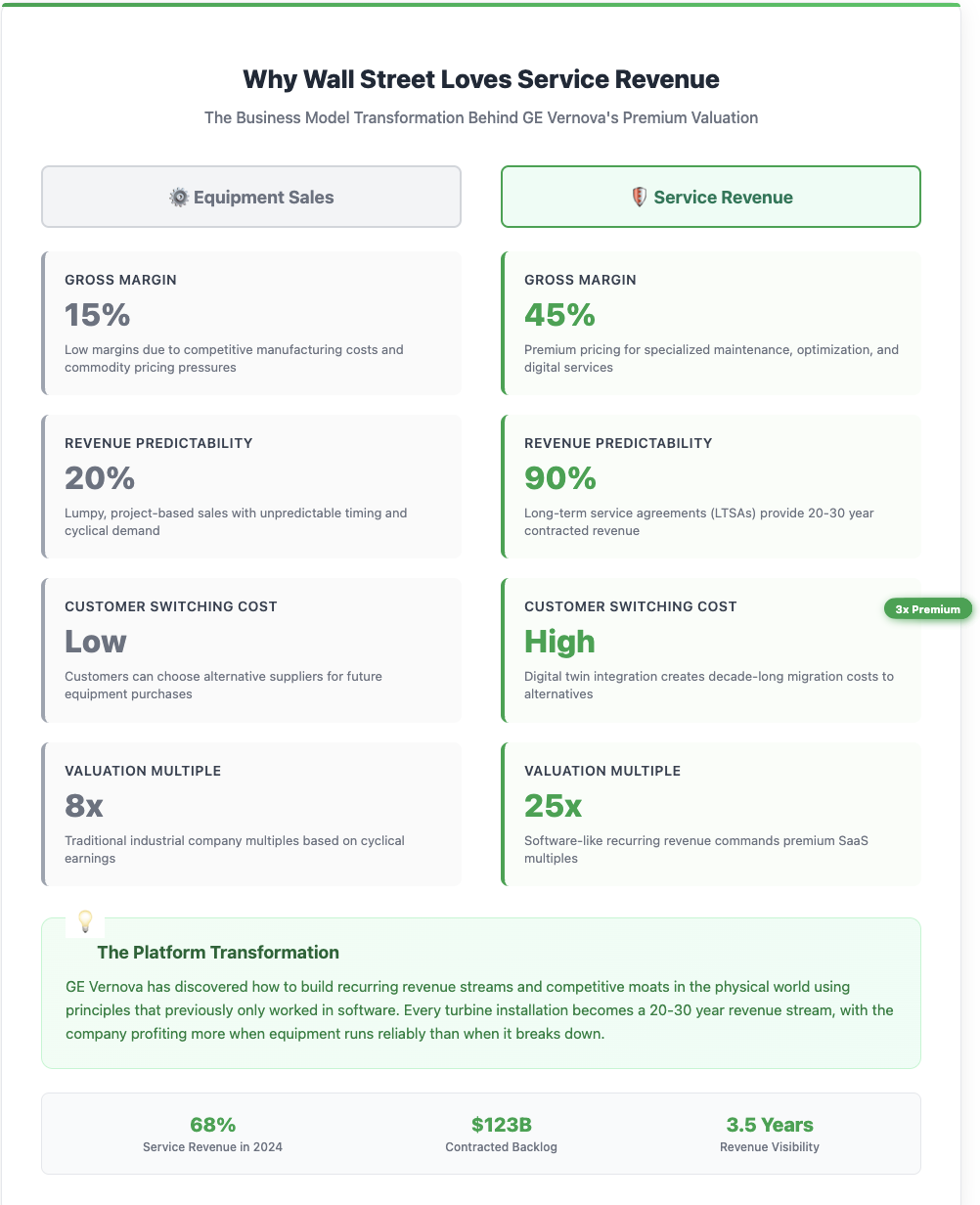

The answer became clear as investors recognized the infrastructure-as-a-service business model. Instead of lumpy equipment sales with unpredictable timing, GE Vernova had built contracted revenue streams that looked remarkably similar to software-as-a-service businesses. Wall Street began valuing the company using backlog-to-cashflow multiples, treating contracted service agreements like recurring revenue subscriptions.

The rerating was dramatic. GE Vernova's stock has outperformed the broader market by 35% year-to-date in 2025, as investors recognized that the company's $123 billion contracted backlog provides approximately 3.5 years of forward revenue visibility—the kind of predictability that commands premium valuations in any industry.

The category confusion was resolved by recognizing that GE Vernova represents something new: the convergence of industrial manufacturing and utility infrastructure, optimized through software intelligence.

It's both a maker of physical equipment and a provider of ongoing optimization services—an integrated platform rather than a traditional vendor relationship.

Act VII: The Paradox of Infrastructure Success

But success in critical infrastructure comes with its own constraints, and GE Vernova is beginning to discover the paradox that has shaped every dominant infrastructure company in history: the more essential you become, the more regulated you get.

There's a fundamental tension between the invisible hand of market competition and the visible coordination required for critical infrastructure to function reliably. Most markets work well with multiple competing providers, but power grids—like telephone networks or internet backbones—require seamless integration and real-time coordination that often favor consolidated control.

The historical irony is striking. GE originally diversified into multiple industries partly to escape the utility-like regulation and cyclical constraints of the power generation business. By becoming a focused, successful energy infrastructure company, GE Vernova is inadvertently recreating the regulatory attention that the old conglomerate structure was designed to avoid.

Edison controlled his electrical system because it was small and local—a few city blocks in Manhattan.

But can any single company control a system that spans continents and connects billions of intelligent devices?

The question becomes more pressing as GE Vernova's intelligence platform grows more comprehensive and more essential to grid stability.

Act VIII: Geopolitics & Risk Dashboard

GE Vernova's success is attracting attention from more than just financial markets and regulators. The company is becoming strategically important in ways that create both opportunities and vulnerabilities:

Carbon policy pressure: European Union proposals to ban unabated natural gas peaking plants by 2035 require GE Vernova's turbines to achieve 50% hydrogen fuel blending by 2029—a technically challenging timeline that could reshape the entire business model.

Data center limits: Electricity capacity constraints have forced Dublin and Frankfurt to implement data center moratoria, creating the risk that 10-15 GW of projected turbine orders could slip beyond 2027 if AI infrastructure deployment faces regulatory bottlenecks.

Quality incidents: Offshore wind blade failures, including a $10.5 million settlement related to Nantucket projects, demonstrate how individual component problems can create system-wide margin pressure in the capital-intensive wind business.

Platform inversion risk: Amazon Web Services has quietly assembled an internal team focused on power procurement optimization for its own data centers—raising the possibility that cloud providers might build their own energy intelligence platforms rather than rely on traditional infrastructure vendors.

The China response: As GE Vernova's technology becomes more strategically important, China is accelerating state investment in indigenous energy infrastructure capabilities, potentially fragmenting the global market along geopolitical lines within 5-10 years.

The success spotlight creates its own problems. Winning breeds regulatory attention, and indispensability attracts unwanted political scrutiny. Countries are beginning to ask whether they're comfortable with private companies controlling the intelligence layers of critical energy infrastructure.

Act IX: Competitive Landscape Evolution

The competitive dynamics around GE Vernova are shifting in ways that transcend traditional industrial rivalry. While incumbent competitors like Siemens Energy continue to focus on component excellence—building better individual turbines or transmission equipment—they lack the integrated data stack and service model that creates GE Vernova's platform advantages.

More interesting are the non-obvious threats emerging from unexpected directions. Technology companies like Amazon and Google, accustomed to building platforms that coordinate millions of distributed components, are beginning to apply similar thinking to energy infrastructure. If cloud providers decide to backward-integrate into power procurement and grid optimization for their own data centers, they could potentially build competing intelligence platforms that treat traditional equipment vendors as commoditized suppliers.

The switching cost reality provides some protection—utilities that have integrated GE Vernova's digital twins and predictive analytics into their operations face decade-long migration costs to alternative systems. But the question isn't whether defensive moats exist; it's how long they'll remain effective as the underlying technology and competitive landscape evolve.

There's also the risk of platform inversion, where utilities gradually become endpoints on technology companies' energy optimization platforms rather than customers of traditional infrastructure vendors. This would represent a fundamental power shift in the industry—from equipment vendors serving utility customers to platform companies coordinating both utilities and equipment as interchangeable components in larger optimization systems.

Act X: The Infrastructure Intelligence Pattern

What's happening with GE Vernova isn't unique to energy infrastructure. Similar transformations are occurring across every category of critical systems:

Xylem is building smart water grids that use sensor networks and predictive analytics to optimize water distribution and detect leaks before they become emergencies. Autonomous rail dispatch systems use real-time data to coordinate train movements across continental networks. Programmable telecommunications substations enable dynamic network reconfiguration based on traffic patterns and equipment availability.

The universal formula is becoming clear: Physical assets + Data intelligence + Platform effects = sustainable industrial advantage. Companies that can combine deep expertise in physical infrastructure with comprehensive data collection and intelligent optimization software are creating competitive moats that pure manufacturing approaches cannot match.

This represents the sunsetting of pure manufacturing in critical infrastructure sectors. The future belongs to companies that can manage the increasing complexity of interconnected systems rather than simply building better individual components.

The meta-insight is even more profound: in the age of artificial intelligence, whoever controls the optimization layer increasingly controls everything else. The most valuable position isn't owning the physical assets—it's managing the intelligence that determines how those assets perform, interact, and evolve.

Act XI: The Jobs-to-be-Done Evolution

Understanding GE Vernova's strategic position requires recognizing how the fundamental job of energy infrastructure has evolved:

In 1895, the job was simply "make electricity reliable"—get power from Niagara Falls to Buffalo without the lights going out.

By the 2000s, deregulation and competition shifted the focus to "make electricity cheap"—optimize for lowest cost per kilowatt-hour delivered.

Today, with AI workloads and renewable integration, the job has become "make electricity intelligent and instantly responsive"—coordinate complex, real-time balancing of variable supply and demand across interconnected networks.

Looking ahead, the emerging job appears to be "make electricity programmable and predictable"—enable software-defined energy systems that can be optimized, upgraded, and reconfigured through code rather than physical infrastructure changes.

As this job-to-be-done continues evolving, the strategic question becomes whether GE Vernova's current advantages compound or get commoditized. Companies that defined the requirements for one generation of infrastructure don't automatically win the next generation—but they do have unprecedented insight into what's coming and what will be required to deliver it.

Closing Loop: Back to Niagara—The Control Question

Standing at the base of Niagara Falls today, you can still see the power station that General Electric helped build in 1895. The turbines have been upgraded and the control systems modernized, but the fundamental mission remains unchanged: convert natural forces into electricity that powers human civilization.

What's different is the definition of what needs to be powered.

In 1895, electricity illuminated homes and ran factory machinery. In 2025, electricity trains artificial intelligence systems that are reshaping every aspect of human knowledge and capability. The electrons flowing from Niagara now contribute to training language models, generating synthetic media, and powering autonomous systems that would have seemed like pure magic to those 19th-century engineers.

GE Vernova has rediscovered Edison's foundational insight about the power of controlling entire systems rather than just selling individual components. But they've applied that insight to a scale and complexity that Edison never imagined: continental power grids serving billions of people and increasingly intelligent devices.

The transformation is remarkable, but it raises a fundamental question that Edison never had to confront. Edison controlled his electrical system because it was small and local—a few Manhattan city blocks where he could personally oversee every generator, wire, and light bulb.

Can any single company control a system that spans continents, connects billions of intelligent devices, and manages the electron flows that power the global AI economy?

In rediscovering Edison's insight about system control and applying it to the age of artificial intelligence, GE Vernova may have discovered something even more profound: that in the intelligence age, optimization layers become more powerful than the physical infrastructure they manage. Software-defined control systems can coordinate, upgrade, and reconfigure physical assets at speeds and scales that were previously impossible.

But what happens when governments realize what they've allowed to be built? When policymakers understand that a single company's algorithms increasingly determine how electricity flows to data centers, hospitals, factories, and homes across multiple countries? When the intelligence layer becomes so essential that losing access to it could cripple entire national economies?

The Edison Loop has come full circle, but the stakes have grown exponentially. The company that figures out how to manage the transition from Edison's local control to global coordination—while navigating the inevitable political and regulatory responses to that concentration of power—will define the infrastructure backbone of the 21st century.

The lights are still on, but the definition of light itself has been revolutionized. And unlike Edison's era, when the consequences of innovation stayed safely contained within city blocks, the next chapter of this story affects every electron flowing through every wire on the planet.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.