The Great Energy Mismatch

Why the AI Era Is Re-architecting Power — and Where Markets Are Still Blind

TLDR

AI’s Power Demand Is Breaking the Grid: The exponential surge in AI compute is triggering a crisis of speed, not just scale. AI data centers need gigawatts of power in months, while the legacy grid requires years to respond. This misalignment is pushing companies to build their own private power systems—just as railroads once built private telegraphs—leading to a splintering of the energy system and windfall profits for players like Constellation Energy and Vistra that already own fast-deployable capacity.

A New Modular Energy Stack Is Emerging: The shift mirrors the rise of cloud computing: energy is becoming modular, horizontal, and intelligent. Value is migrating from merely owning megawatts to orchestrating them. Hardware (e.g., GE Vernova turbines), software (e.g., Schneider Electric dispatch OS), integrated providers (like NRG), and infrastructure financiers (like Brookfield) form a new "energy cloud" that optimizes for time-to-power rather than commodity kilowatt-hours.

Systemic Fragmentation: The rise of private microgrids creates a two-tier energy future: premium power for hyperscalers and wealthy users, and costly, unstable supply for everyone else. This transformation—largely outside regulatory control—poses risks ranging from cyberattacks and political backlash to systemic vulnerabilities like gas reliance and energy populism. The foundational question: will this private buildout integrate into a resilient national mesh, or entrench permanent energy inequality?

In the winter of 1851, the Pennsylvania Railroad faced an impossible coordination problem. The company's trains were moving freight and passengers across hundreds of miles of track, but communication between stations still relied on horseback riders and the U.S. postal system. A derailment in Ohio might not reach headquarters in Philadelphia for days, while cargo sat stranded and passengers fumed. The railroad's growth had outpaced the infrastructure designed to support it.

The solution was radical for its time: Pennsylvania Railroad built its own telegraph network, stringing wires alongside the tracks and hiring operators to coordinate train movements in real-time.

Within a decade, the railroad's private telegraph system was more reliable than the federal mail service. What began as a corporate necessity became a competitive advantage, and eventually, a new industry standard.

By 1860, private telegraph networks had proliferated across America's railroad system. The companies that had been forced to build their own communication infrastructure discovered they could sell excess capacity to other businesses, creating an entirely new revenue stream. The public postal system, designed for a slower era, found itself increasingly irrelevant for time-sensitive communications.

Today, we're witnessing a remarkably similar dynamic, but with electrons instead of telegrams. The AI boom has created an energy coordination problem that the existing power grid simply cannot solve, forcing companies to build their own private power infrastructure. Just as the railroads couldn't wait for the postal system to catch up, today's AI companies can't wait for the electric grid to catch up.

The stakes, however, are far higher.

AI's Time-Crisis for Electrons

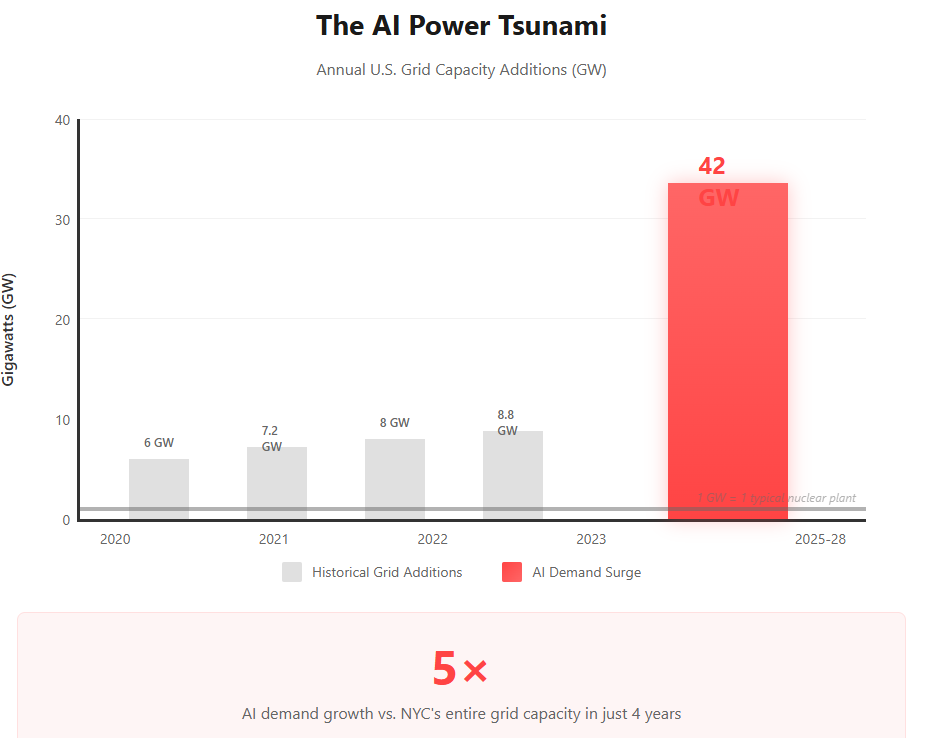

Source: U.S. Energy Information Administration (EIA) – Annual Energy Outlook Reports, Goldman Sachs Research, Morgan Stanley, CEG VST transcripts

The numbers are staggering.

AI data centers are projected to add 42 gigawatts of incremental demand to the U.S. electrical system by 2028—equivalent to building roughly 40 nuclear power plants in just four years. To put this in perspective, that's five times the capacity of New York City's entire grid, arriving faster than any previous industrial transformation in American history.

But the real crisis isn't the magnitude of demand—it's the speed at which it's arriving. Hyperscalers like Microsoft, Google, and Amazon are building data centers on 18-month cycles, while new power plants and transmission lines require 7-10 years to plan, permit, and construct. This represents a fundamental collision between "just-in-time" digital culture and "long-cycle" physical infrastructure.

The traditional utility model was engineered for predictable, gradual growth. Demand would increase by 1-2% annually, giving utilities decades to plan capacity additions and spread costs across their customer base. The AI revolution has shattered this assumption, creating exponential demand spikes concentrated in specific regions with little advance warning.

Near-term winners: Companies with existing baseload capacity are experiencing a windfall. Constellation Energy (CEG), with its fleet of nuclear plants, and Vistra Corp (VST), with its gas and battery portfolio, are seeing their assets run at maximum capacity factors while commanding premium pricing. These companies benefit from what economists call "capacity scarcity rents"—the extra profit earned when supply is constrained.

The Four Mismatches Driving Fragmentation

The breakdown between AI demand and grid supply manifests across four critical dimensions, each creating distinct investment opportunities:

The speed mismatch is perhaps most acute. While AI companies need power purchase agreements signed within months of site selection, utility-scale generation projects require years of environmental review, permitting, and interconnection studies. A hyperscaler planning a new data center cannot wait for a transmission line that might be completed by 2032.

The scale mismatch reflects the exponential nature of AI workloads. Training a large language model requires exponentially more compute—and thus power—than traditional server applications. But the electrical grid can only add capacity in large, discrete chunks, creating a fundamental mismatch between how AI scales and how power systems scale.

The reliability mismatch is equally critical. AI training runs can cost millions of dollars and must complete within tight deadlines. The difference between 99.5% reliability (44 hours of downtime annually) and 99.99% reliability (53 minutes annually) can mean the difference between a successful model deployment and a catastrophic failure.

Finally, the location mismatch pits AI companies' preference for coastal markets with fiber infrastructure and technical talent against a power grid designed around cheap fossil fuel plants, often located hundreds of miles from population centers.

Each mismatch creates pressure for private solutions, but here's the vicious cycle: every private workaround makes the public grid more expensive per remaining customer, accelerating the next customer exodus. As high-value industrial customers build their own power infrastructure, the fixed costs of maintaining the public grid get spread across fewer users, raising rates for everyone else.

Building the New Energy Stack

What's emerging isn't just a collection of private power plants—it's an entirely new energy value chain that mirrors the transformation of computing over the past two decades. The old energy model was vertically integrated: utilities owned generation, transmission, and distribution. The new model is horizontal and modular:

Hardware Kits: Companies like GE Vernova are manufacturing standardized, fast-deploy power systems that can be shipped and installed like industrial equipment. These aren't traditional power plants built from scratch on-site—they're modular systems designed for rapid deployment.

Orchestration Software: Schneider Electric and others are developing AI-powered software that can balance loads, predict demand, and optimize dispatch across distributed resources. This is the "operating system" layer that turns dumb hardware into intelligent grids.

Integrated Providers: Companies like Vistra and NRG are bundling generation, storage, and retail services into comprehensive solutions. They're not selling electricity—they're selling energy certainty.

Capital Catalysts: Investment firms are financing and operating these systems, treating power infrastructure like cloud data centers—standardized, scalable, and optimized for specific customer needs.

The key insight: value creation is migrating from owning megawatts to controlling dispatch intelligence. Just as cloud computing shifted value from owning servers to orchestrating compute resources, the energy transformation is shifting value from owning power plants to optimizing power networks.

Platform Gravity — Energy's Cloud Moment

This transformation exhibits the same platform dynamics that drove the cloud computing revolution. Network effects are emerging as more microgrids connect to intelligent dispatch systems. Each additional node provides more data about demand patterns, weather impacts, and optimal routing, making the entire network more efficient.

Better efficiency translates to lower costs, which attracts more customers, creating a virtuous cycle. The companies that achieve scale first will have sustainable competitive advantages through superior data and optimization capabilities.

Switching costs are substantial and growing. Unlike traditional utility service, modern energy solutions involve bespoke power purchase agreements, on-site generation assets, and integrated management systems. Once committed, customers are locked in for a decade or more.

Capital requirements create massive moats. Unlike pure software platforms, energy platforms require billions in steel, lithium, and real estate for each expansion. This creates natural barriers to entry and tends toward oligopoly market structures.

The parallel to Amazon Web Services is striking: what started as internal infrastructure to solve Amazon's own scaling problems eventually became a standalone business serving other companies. We're beginning to see similar dynamics as companies that built private power infrastructure discover they can monetize excess capacity.

Regulators on a Different Clock

While private energy networks proliferate, regulators are fighting the last war. The Federal Energy Regulatory Commission continues to litigate transmission fees and interconnection standards while 500-megawatt corporate campuses plug directly into private gas turbines, bypassing the regulated grid entirely.

The fundamental problem is a mismatch of timescales. Policymakers operate on political horizons of 2-4 years, matching election cycles. Energy infrastructure investments require payback periods of 20-30 years. But AI technology refreshes happen every 6-18 months, creating entirely new requirements before regulators can adapt.

This creates a perverse outcome: regulations designed to prevent monopoly abuse may actually accelerate systemic fragmentation. While FERC debates whether to approve nuclear power purchase agreements, the same customers are already building on-site gas turbines that will come online next year.

Event-driven opportunity: The upcoming Q4 2025 FERC ruling on transmission fees could create significant volatility in regulated utility stocks, presenting options-based strategies for sophisticated investors.

Second-Order Ripple Effects

The energy transformation is creating consequences that extend far beyond electricity markets:

Grid Bifurcation: We're witnessing the emergence of "premium power zones" where corporations and wealthy communities enjoy 99.99% reliability through private infrastructure, while everyone else depends on an increasingly expensive public grid. This isn't just an economic divide—it's a fundamental infrastructure divide.

Land and Water Populism: Data centers are competing with local communities for scarce resources, creating conflicts that mirror the fracking battles of the 2010s. The difference: these facilities are owned by some of the world's most valuable companies, creating stark wealth disparities.

Gas as Shadow Liquidity: Natural gas peaker plants can ramp quickly to meet demand spikes, making them the "shadow banking" of the energy system. Just as off-balance-sheet financing helped trigger the 2008 financial crisis, the growing reliance on rapid-fire gas plants could create systemic vulnerabilities.

Cyber-Physical Attack Surface: Every inverter, battery system, and smart meter becomes a potential entry point for malicious actors. Unlike traditional cybersecurity, energy cybersecurity failures can cause physical damage and endanger lives.

Macro hedge considerations: Investors should consider gas call options to hedge supply shocks, carbon allowances to benefit from nuclear's clean attributes, and interest rate caps given infrastructure's duration sensitivity.

The Investment Playbook: From Analysis to Alpha

The following frameworks are illustrative only and not investment advice.

Three Time-Horizon Buckets

Theme-by-Theme Investment Theses

Nuclear PPAs ≠ Commodity Power: Constellation Energy's 20-year indexed contracts with Meta and other hyperscalers lock in predictable cash flows. The company guides $8.90-$9.60 EPS for 2025, supported by capacity factors above 94%. Key risk: Regulatory pushback on nuclear license transfers.

Gas = Liquidity: NRG and Vistra benefit from peaker margin expansion when AI demand spikes. These companies can deploy new capacity in 18-24 months versus 7+ years for nuclear. Key risk: Natural gas price volatility and methane regulations.

Kit Makers: GE Vernova's gas turbine orders surged triple-digits in Q1 2025 as AI forces "buy-versus-permit" decisions. The company benefits regardless of which fuel source wins. Key risk: Global turbine oversupply driving price competition.

Dispatch Operating Systems: Schneider Electric trades at 17× EV/EBITDA for a control-point platform generating 25%+ ROE. Their Energy & Sustainability Services division grew 11.5% in 2024. Key risk: Competition from cloud providers entering energy software.

Rack + Megawatts Convergence: Brookfield, Blackstone, and DigitalBridge are building integrated data center and power platforms. These companies own both the compute and the electricity, capturing value across the entire stack. Key risk: Valuations sensitive to interest rate environment.

Key Performance Indicators to Monitor

Risk Management Toolkit

Monitor for political and regulatory backlash against private power infrastructure. If energy inequality becomes a major political issue, we could see heavy regulation of private energy systems. Maintain hedges through gas call options, carbon allowances, and interest rate caps.

Key Investment Takeaway

Value is migrating from owning megawatts to controlling dispatch intelligence. Time-to-power is becoming the new competitive moat, and the companies that can collapse deployment timelines will capture disproportionate value as the energy platform economy emerges.

Societal Cross-Examination

The energy transformation raises profound questions about equity, democracy, and technological governance. The equity time-bomb is already ticking as affluent corporate customers secure premium power reliability while residential customers face rising rates and increasing blackout risks. Reliable power is increasingly essential for remote work, medical devices, and basic communication—an energy divide could quickly become a broader social divide.

The tension between democracy and algorithmic dispatch is more subtle but potentially more consequential. Traditional utilities operate under democratic oversight, with rate increases requiring public hearings and major decisions subject to regulatory review. Private energy platforms make dispatch decisions through proprietary algorithms optimized for efficiency and profit, not democratic accountability.

The pace of change is forcing this choice by default rather than design. While public institutions debate energy policy, private companies are building the infrastructure that will determine America's energy future. By the time democratic processes catch up, the new system may be too entrenched to alter.

Two 2035 Scenarios & Likely Beneficiaries

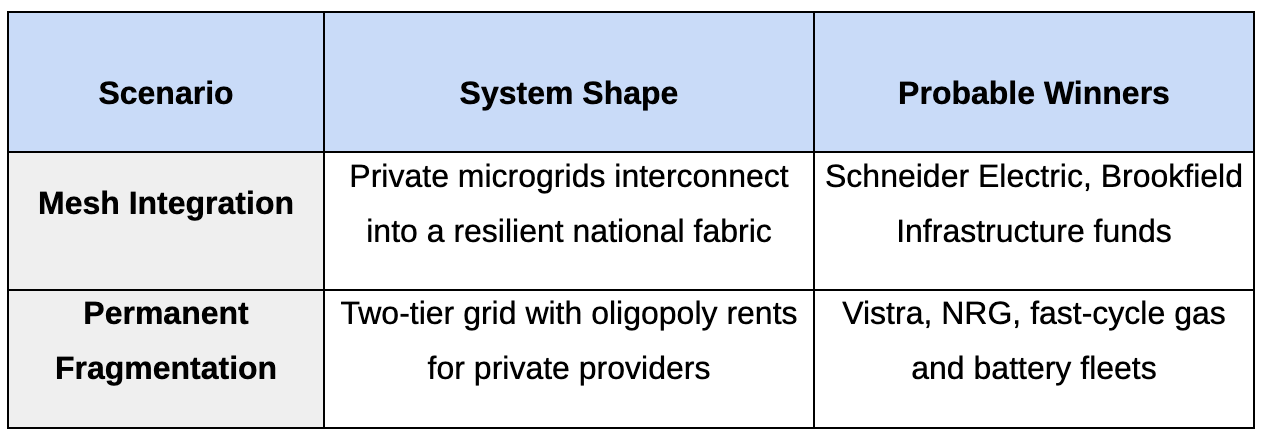

The Mesh Integration scenario sees today's private microgrids eventually interconnecting into a more resilient national network, similar to how the early internet connected disparate computer networks. The winners would be companies that provide the software and integration services to make this possible.

The Permanent Fragmentation scenario sees the current two-tier system becoming entrenched, with private providers capturing oligopoly rents while public infrastructure degrades. The winners would be companies that can deploy private power solutions quickly and efficiently.

From Telegraphs to Terawatts

The Pennsylvania Railroad's private telegraph network eventually became Western Union, one of America's first great technology companies. What began as a corporate necessity evolved into public infrastructure, but only after decades of fragmentation and consolidation that created enormous advantages for the first movers.

The question facing America today is whether we'll follow a similar path with energy infrastructure. Will today's patchwork of corporate microgrids eventually coalesce into a more resilient national mesh, or will they entrench a two-tier energy society where access depends on economic status?

The historical precedent suggests both outcomes are possible, but the transition period will be turbulent. The companies that solve the AI energy mismatch won't just profit from their solutions—they'll shape the basic conditions under which all other businesses operate.

The telegraph analogy reveals a deeper truth: the scarce commodity isn't electrons; it's time-to-power. In an era where AI training runs cost millions and must complete within tight deadlines, energy becomes a time-critical resource rather than a commodity. The companies that can collapse time-to-power will own the next era of compute, and by extension, the next era of economic growth.

The great energy mismatch of the AI era isn't just a technical problem to be solved—it's a transformation that will determine who controls the infrastructure of the future. The only question is whether we'll recognize the transformation while there's still time to influence its direction.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.