The Gridmind Imperative: How Schneider Electric Became the Control Stack for the AI-Era Energy System

TLDR

From Hardware to Intelligence: Schneider Electric has transitioned from a hardware supplier to the invisible control layer of the modern, decentralized energy grid by enabling real-time sensing, routing, and optimization via platforms like EcoStruxure and AVEVA.

Architect of the “Gridmind”: It now operates as the “nervous system” of the energy ecosystem, coordinating distributed energy flows across billions of endpoints: from data centers to cities and prioritizing intelligence over capacity.

Strategic and Financial Momentum: Positioned at the nexus of electrification, AI, and digital infrastructure, Schneider is now seeing the payoff through margin expansion, strong organic growth, and accelerating digital and recurring revenue streams.

Introduction: The Programmable Grid

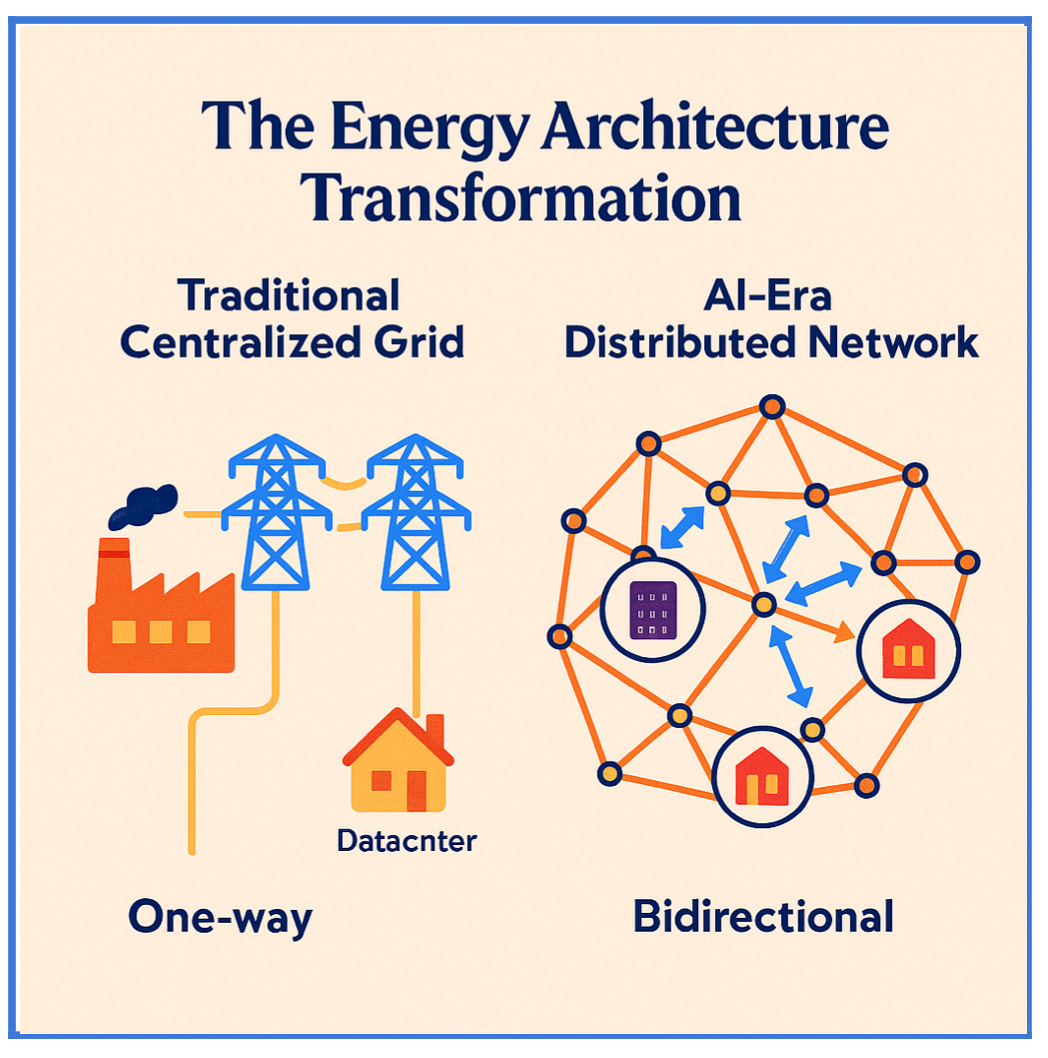

The global energy system is undergoing a foundational shift. What was once a linear, centralized grid designed for one-way power delivery is becoming a distributed, software-defined network. One that must adapt in real time to surging demand, decentralized generation, and climate pressures. In this evolving landscape, programmability is no longer a feature. It’s a necessity.

This transformation is being accelerated by the convergence of four structural forces: mass electrification across sectors, the digitalization of infrastructure, industrial decarbonization mandates, and the exponential rise in AI workloads. These forces are not merely technological but they are economic, political, and environmental. The result is a grid that must think, respond, and evolve on demand.

In this new energy architecture, the ability to generate power is less valuable than the ability to coordinate it. Intelligence that is embedded in the form of real-time data, analytics, and automation is the control layer that determines resilience, efficiency, and independence. Schneider Electric has moved decisively into this layer,

positioning itself not as a traditional utility or OEM, but as the invisible logic behind the grid’s next act.

Where others see assets, Schneider sees systems. Where others invest in steel, Schneider programs capability. As electrification spreads and grid fragmentation increases, the company’s software-first architecture offers a scalable, capital-light alternative to legacy infrastructure expansion. It doesn’t need to own the grid to shape it. It just needs to control how it thinks.

I. Strategic Realignment with Global Megatrends

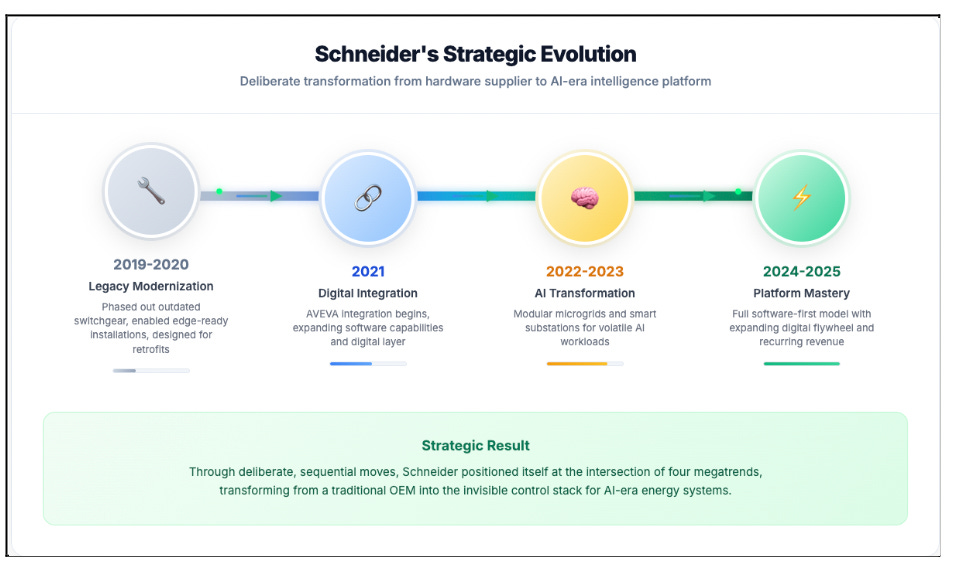

Schneider Electric’s transformation wasn’t accidental. It was engineered around four global forces that are now reshaping the energy landscape: electrification, digital infrastructure, industrial decarbonization, and AI-driven power demand. Rather than chase these trends, Schneider embedded itself within them by ensuring that it would become indispensable as each wave matured.

▪ Electrification

The shift toward electrification is not just about replacing fossil fuels with cleaner energy. It represents a broader redefinition of power as the default fuel for mobility, industry, and heating. Schneider anticipated this pivot early. By modernizing its product portfolio and phasing out outdated switchgear, enabling edge-ready installations, and designing for retrofits. It made electrification viable at the building, campus, and municipal level. It no longer sells megawatts; it enables the infrastructure that makes them usable, efficient, and autonomous.

▪ Digital Infrastructure

The COVID-19 era exposed a critical vulnerability in global infrastructure: what couldn’t be monitored or controlled remotely, failed under stress. Schneider doubled

down on its digital layer. Platforms like EcoStruxure and AVEVA were deployed across logistics hubs, factories, data centres, and utilities that converted static infrastructure into connected, upgradeable systems. Hardware became the entry point. Software became the lock-in.

▪ Industrial Decarbonization

For years, emissions were seen as reputational risk. Now, they’re financial liabilities. Schneider met this shift with a suite of services and software that help customers measure, manage, and minimize carbon exposure not just for ESG compliance, but for cost efficiency and asset optimization. Tools like AVEVA PI System and EcoAct have turned Schneider into both an advisor and an enabler of decarbonized industrial operations.

▪ AI-Driven Energy Demand

AI workloads particularly in hyperscale data centres are pushing the grid to its limits. These workloads are volatile, energy-intensive, and intolerant of downtime. Utilities can’t adapt fast enough. Schneider stepped into the gap with modular microgrids, smart substations, and self-balancing infrastructure that behaves like software: programmable, fast-ramping, and autonomous. Its systems are becoming the invisible default in mission-critical environments where uptime is non-negotiable. In 2025, Schneider solidified this with the acquisition of Motivair by enhancing its liquid cooling capabilities and deepened its NVIDIA collaboration to co-design AI-native data centre architectures.

These megatrends are not temporary. They are structural. And by aligning early, Schneider has ensured that its architecture is not just compatible with the future but it is foundational to it.

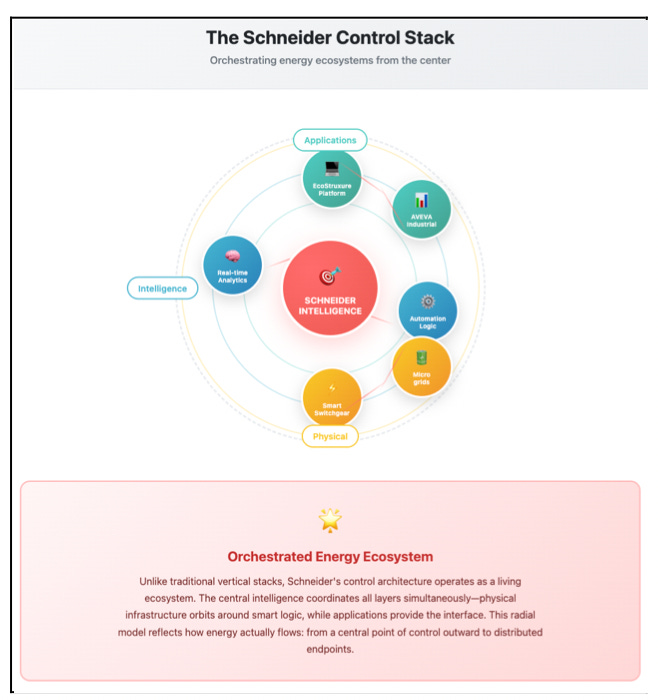

II. The Control Stack: Software-Defined Infrastructure

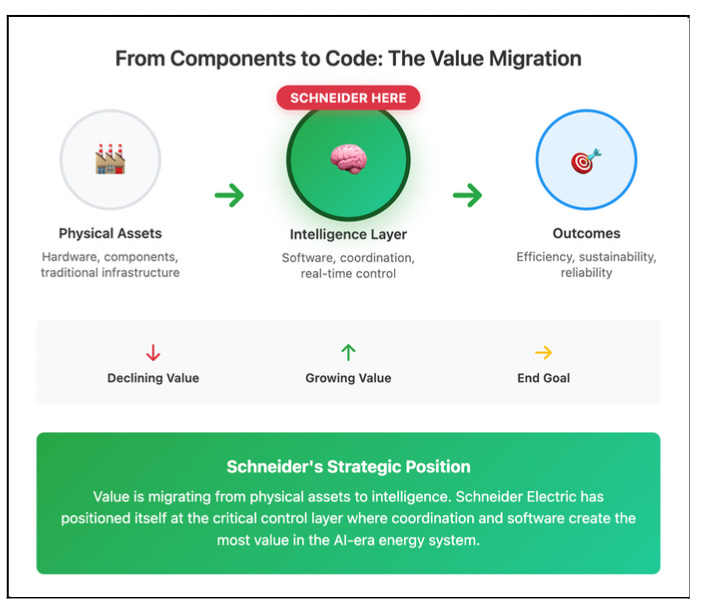

Schneider Electric’s transformation lies in enabling distributed, intelligent control not by owning power assets, but by embedding logic where energy is used. Rather than generating or distributing electricity, Schneider orchestrates its flow, shifting value from physical infrastructure to the intelligence that governs it. The result is a model that empowers buildings, campuses, and data centres to self-manage energy with autonomy and precision.

At the centre of this approach is a modular platform that includes smart switchgear, substations, microgrids, and digital systems like EcoStruxure and AVEVA. These technologies work in concert to optimize load, integrate renewables, and respond in real time. Infrastructure is no longer static; it is upgradeable, adaptable, and built to evolve. Schneider’s systems are deployed across both mission-critical and everyday environments, serving everything from hyperscale data centres to urban campuses.

Unlike traditional utility models that rely on centralized control, Schneider installs intelligence at the edge. Control resides at the breaker, the meter, and the substation that is closer to where energy is actually consumed. This proximity allows for faster, more localized decision-making, and significantly reduces reliance on centralized grid operations.

The architecture is also highly scalable, without the delays and restrictions imposed by utility franchises or regulatory approvals. Schneider’s edge-first systems can be deployed rapidly in both developed and emerging markets, bypassing the inertia of traditional grid upgrades with modular, install-ready solutions.

In essence, Schneider is virtualizing the grid. Through software-defined coordination, fragmented energy assets act in unison. Energy flows are no longer engineered through hardware alone, but programmed through code that enables adaptability, resilience, and intelligence at scale. The company’s true competitive edge is not in owning the power, but in shaping how it behaves. As of H1 2025, Schneider reported that 60% of its revenues are now derived from digital solutions and services that is a milestone validating the increasing monetization of its grid intelligence stack.

III. Business Model Shift: From Products to Platforms

Schneider Electric’s transformation isn’t just technological it’s economical. The company has shifted its model from one-time product sales to platform-led, recurring engagement. What began as a provider of physical infrastructure has evolved into an enabler of continuous intelligence.

Hardware is still foundational, but it now acts as a gateway to software, data, and services. Each deployment embeds Schneider deeper into operations, monetizing outcomes like uptime, efficiency, and emissions reduction rather than just hardware volume.

This evolution is powered by software ecosystems like EcoStruxure and AVEVA, which connect and automate assets across industries. They transform static infrastructure into dynamic systems by enabling diagnostics, remote control, and performance optimization without needing new installations.

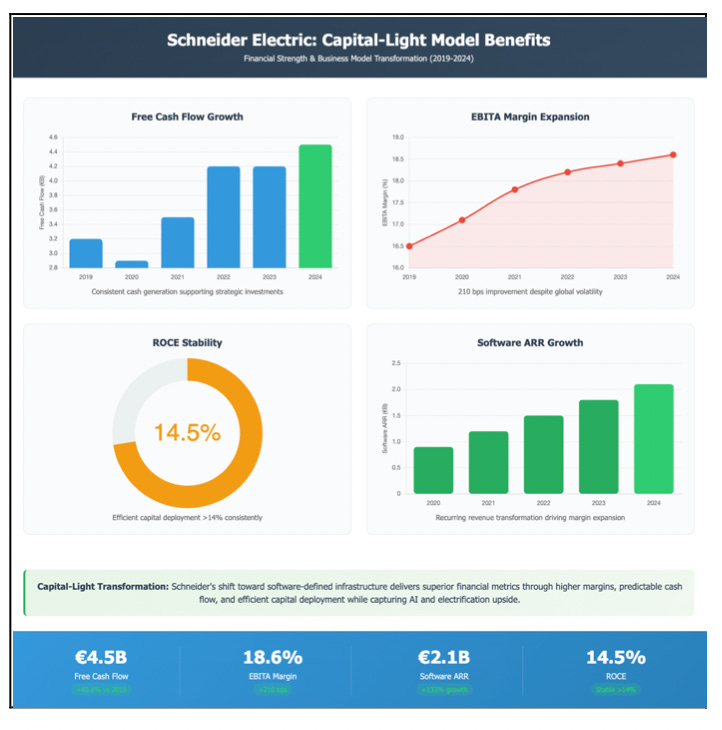

The result is a stronger financial model: higher margins, predictable cash flow, and deeper customer lock-in. As recurring digital revenue grows, Schneider becomes less tied to capex cycles and more aligned with long-term operational outcomes. AVEVA’s subscription model is on track for full transition by 2027, with ARR growing 12% YoY in H1 2025, reinforcing Schneider’s recurring digital revenue trajectory.

This shift positions Schneider not just as a seller of equipment, but as the logic layer customers rely on to run their infrastructure and keep it getting smarter over time.

IV. Market Opportunity - AI, Grid Fragmentation & Sector-Agnostic Growth

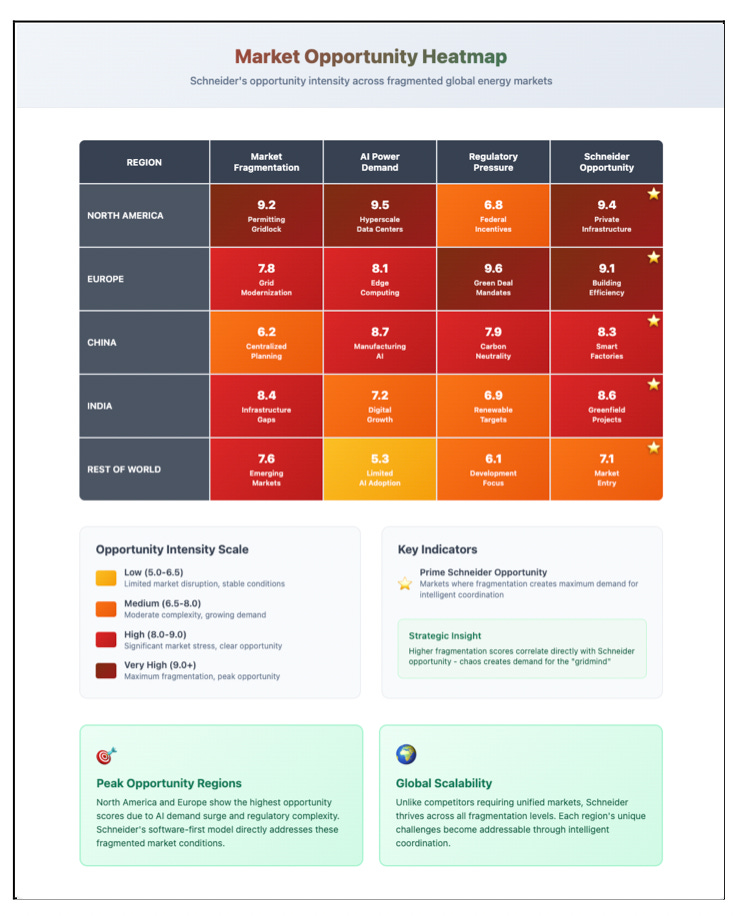

The modern energy landscape isn’t just growing it’s splintering. AI, electrification, and policy inertia are pulling the grid in opposite directions. Schneider Electric isn’t trying to unify this complexity. It’s turning it into a growth engine.

As AI workloads reshape power demand, data centres have become energy- intensive, high-risk assets. They can’t afford outages. They can’t wait for grid upgrades. Schneider delivers what utilities can’t: programmable, modular energy that moves at the speed of inference. This is already materializing: data centre-related systems drove strong backlog growth in North America, India, and the Middle East in Q2, enabling 15% growth in North America alone.

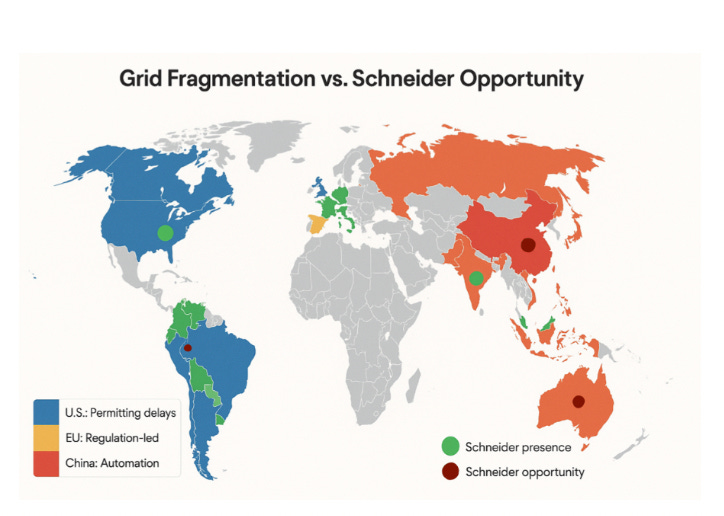

At the same time, energy systems around the world are diverging. The U.S. is gridlocked by permitting delays. Europe is regulation-led. China is automating its industrial base. Schneider doesn’t need a unified market as it thrives in disorder. Its software-first systems are region-agnostic, plug-and-play, and ready to scale.

Crucially, Schneider isn’t tied to one sector. It shows up wherever infrastructure needs to think faster whether that’s a hospital, factory, metro, or logistics hub. Its opportunity isn’t vertical. It’s systemic.

In a world of fragmented grids and volatile demand, Schneider has found its edge: turning infrastructure chaos into programmable order.

V. Financial Strength, Risks & Defensibility

Schneider Electric has built a solid financial foundation around a capital-light, software-led model. As its revenue base shifts toward recurring software and services, the company benefits from strong margins, stable cash flow, and lower exposure to hardware cycles. Free cash flow consistently supports reinvestment in digital growth, acquisitions, and long-term resilience.

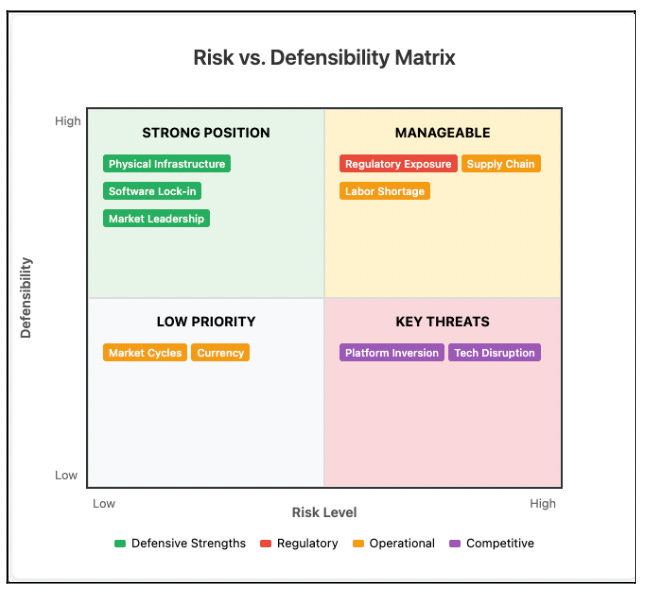

But strength doesn’t mean immunity. As Schneider becomes more embedded in mission-critical infrastructure from data centres to public utilities the risk landscape is evolving.

Regulatory exposure is rising. As Schneider’s platforms begin to control real-time electricity flows across campuses, cities, and even portions of national grids, governments may move to classify these systems as critical infrastructure. That would bring oversight, compliance burdens, and potential constraints on how Schneider operates in key markets. The very logic layer that gives it power may soon require regulatory permission to expand further.

Supply-side pressures also persist. Demand for medium-voltage gear, AI-ready power systems, and skilled labour continues to rise often faster than global capacity can match. Lead times and execution complexity can strain even the best operators, especially in emerging markets or high-growth segments like microgrids.

Platform inversion is another strategic risk. Cloud hyper-scalers such as AWS, Google, and Microsoft are investing in their own microgrid platforms and energy management tools. While Schneider still powers much of that infrastructure in the background, the long-term threat of disintermediation especially in the data centre vertical is real.

That said, Schneider’s defensibility runs deep. Its systems are physically embedded, operationally indispensable, and increasingly tied to long-term digital contracts. It’s difficult to rip out or replicate the kind of integration Schneider provides across hardware, software, and service layers.

The challenge ahead is not just continuing to scale but doing so with governance, resilience, and adaptability. Critically, Schneider’s 2025 performance to date

matches its long-term thesis. While industrial automation remains pressured (-1% sales in H1), energy management posted double-digit growth and digital services continued expanding. Compared to peers like ABB, Siemens, and Eaton, Schneider is performing competitively especially in AI infrastructure and sustainability leadership, where it is considered a front-runner. Schneider must navigate the tension between becoming essential and remaining agile.

Conclusion: From Components to Code

Schneider Electric’s transformation is more than a case study in industrial reinvention it’s a blueprint for how infrastructure companies must operate in a programmable world. By embedding intelligence where energy flows, Schneider has turned passive hardware into active systems, and legacy assets into living, learning networks.

Its systems no longer just carry power but they coordinate it. Every switchgear, microgrid, and dashboard it deploys becomes part of a distributed logic layer that senses, adapts, and optimizes in real time. This isn’t just smart energy as it’s energy with agency.

What sets Schneider apart is its ability to operate across complexity without demanding control. It doesn’t need to own the grid to shape its future. By becoming the digital thread running through physical infrastructure, it positions itself not as a supplier, but as the operating system of energy’s next chapter.

The future grid won’t be defined by who builds the most capacity, but by who programs how that capacity behaves. In that future, Schneider isn’t just participating. It’s quietly running the code. It’s not just metaphorical. Schneider’s 2025

sustainability score (SSI: 8.8/10) and growing share of digital revenues confirm that its evolution from hardware vendor to energy OS is more than narrative - it’s operational and measurable.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.