The Interface Collapse: How Snowflake Is Winning the AI Era by Making Expertise Obsolete

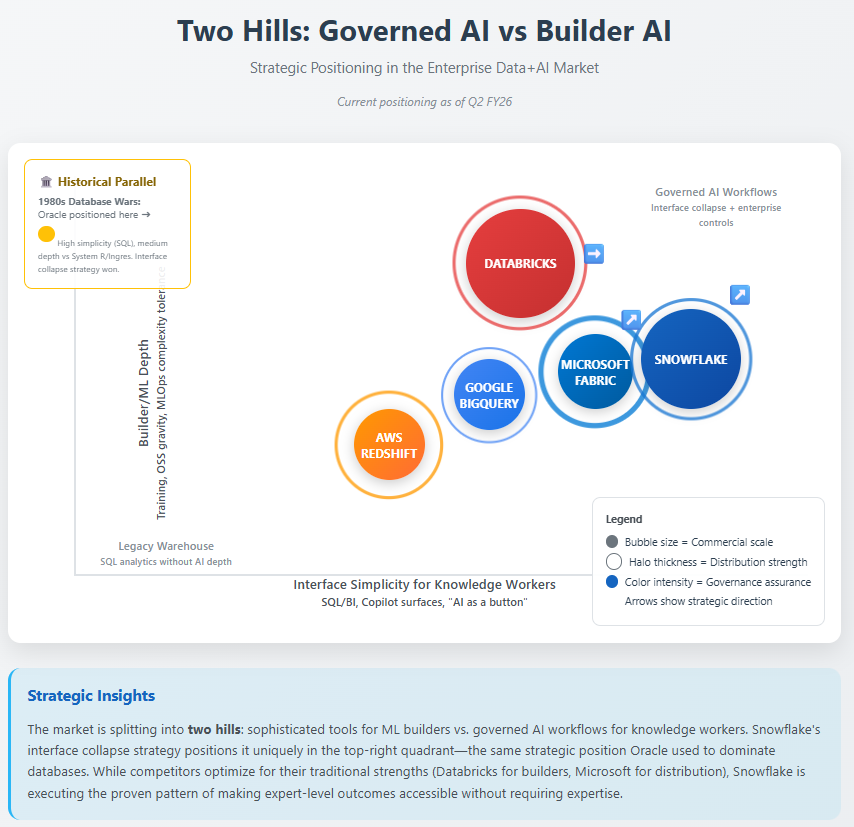

Forget the model wars. Snowflake is doing to AI what Oracle did to databases—removing complexity, collapsing interfaces, and capturing the enterprise

TL;DR:

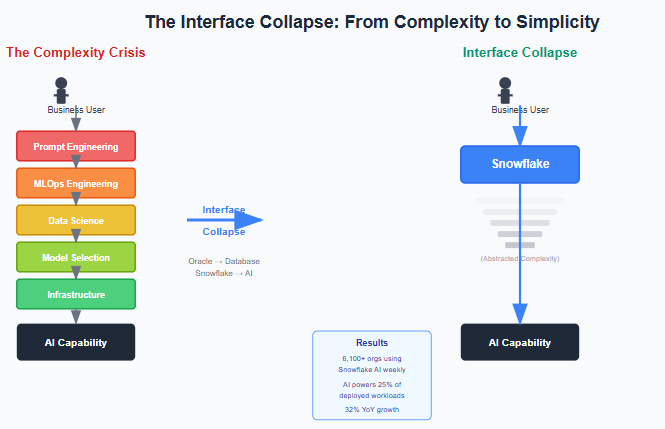

From DBA to AI Without the Experts: Snowflake’s original breakthrough was eliminating the need for database administrators through architectural abstraction. It's now applying the same “interface collapse” playbook to enterprise AI—bypassing the need for prompt engineers or data scientists.

AI for the Analyst, Not the Engineer: With tools like Cortex and Snowflake Intelligence, AI becomes a SQL function or a plain English query—no infrastructure, model tuning, or specialist teams required. 6,100 orgs now use Snowflake AI weekly, with AI powering 25% of deployed workloads.

Distribution Is Destiny: Snowflake’s Azure partnership and Microsoft integrations embed its AI inside everyday tools like Power BI and Teams, giving it an interface advantage competitors can’t easily match—making the business user the new AI developer.

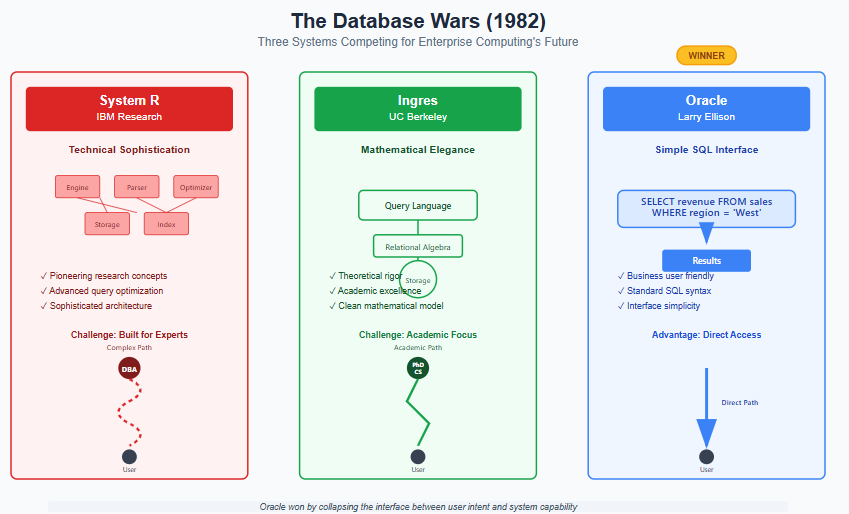

In 1982, three database systems competed for the future of enterprise computing. System R, developed by IBM's research division, was the most technically sophisticated—a marvel of engineering that pioneered many concepts still used today. Ingres, created at UC Berkeley, was the most elegant, favored by computer science academics for its mathematical rigor and clean architecture. Oracle, led by the brash Larry Ellison, was neither the most powerful nor the most beautiful. But Oracle had something different: it made SQL accessible not just to database administrators, but to business users who simply wanted answers from their data.

While IBM and Ingres focused on building better engines for experts, Oracle collapsed the interface between user intent and system capability. A marketing analyst didn't need to understand B-tree indexes or query optimization—they could write "SELECT revenue FROM sales WHERE region = 'West'" and get an answer. The database administrator's complex role became less central, and Oracle's consumption exploded.

This pattern of "interface collapse"—the strategic elimination of complexity layers that require specialized knowledge—represents the most powerful force in enterprise technology. It's not about dumbing down systems, but about making expert-level outcomes accessible to non-expert users without sacrificing capability. The winners aren't those who build the most sophisticated tools for specialists, but those who eliminate the need for specialists altogether.

Today, this same pattern is playing out in enterprise AI, and Snowflake is executing Oracle's playbook with striking precision.

Snowflake's First Collapse: Eliminating the Database Administrator

To understand Snowflake's AI opportunity, we must first examine how the company achieved its initial success through interface collapse. Before Snowflake's emergence in 2012, enterprise data warehousing required constant human intervention. Teradata systems demanded capacity planning months in advance. Hadoop clusters needed armies of engineers to configure and tune. Oracle databases required DBAs who understood the arcane art of query optimization and storage management.

The complexity wasn't incidental—it was structural. Every query had to be planned for, every workload had to be architected, every performance problem had to be debugged by someone who understood the intricate relationship between data storage, query processing, and system resources. The DBA wasn't just helpful; they were indispensable.

Snowflake's architectural insight—separating compute from storage in the cloud—wasn't primarily about technical elegance. It was about interface collapse. By eliminating the need for capacity planning, query tuning, and infrastructure management, Snowflake collapsed the interface between "I need to analyze data" and "I need to configure a database system." Users could simply load their data and start querying, with the system automatically scaling, optimizing, and managing itself.

This interface collapse translated directly into Snowflake's extraordinary financial performance during its hyper-growth phase. The consumption-based model worked because users no longer needed to predict their requirements—they could start small and expand organically as they discovered new use cases. Net revenue retention rates exceeding 170% reflected not just customer satisfaction, but the elimination of barriers that previously constrained data warehouse usage. When complexity disappears, consumption expands.

The numbers tell the story: from IPO in 2020 through fiscal 2022, Snowflake's revenue grew from $592 million to $2.07 billion while maintaining gross margins above 75%. The company wasn't just growing—it was proving that interface collapse creates sustainable competitive advantages. Customers who adapted their workflows to Snowflake's simplified paradigm found switching back to complex alternatives increasingly costly, not because of technical lock-in, but because of operational transformation.

The AI Interface Crisis

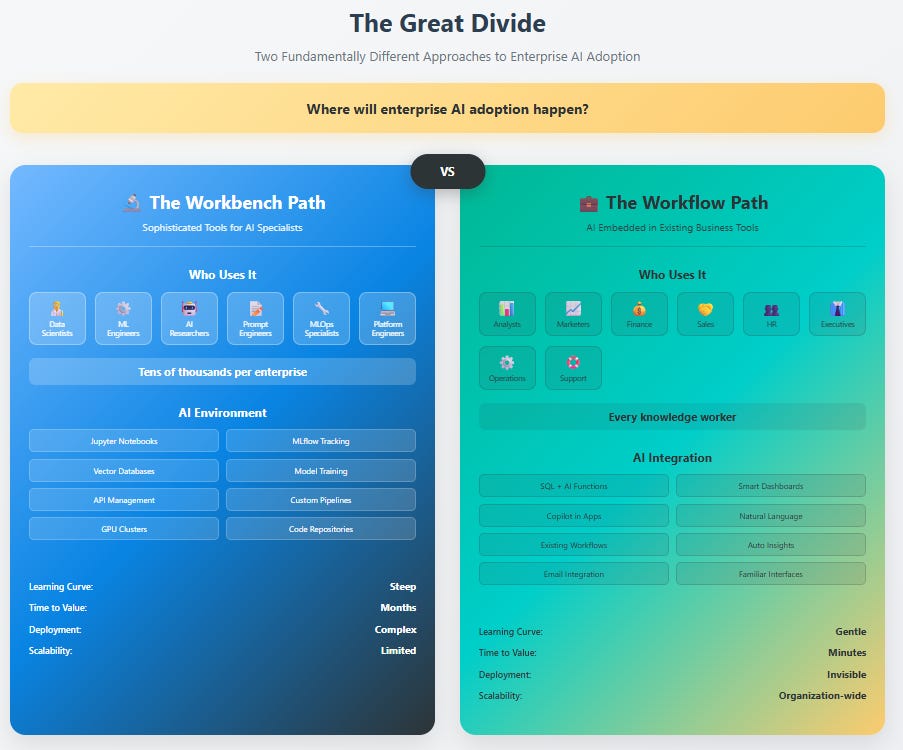

Fast-forward to 2024, and enterprise AI presents a strikingly similar complexity crisis. Large language models like GPT-4 and Claude demonstrate remarkable capabilities, but the interface between business problems and AI solutions requires new categories of specialists: prompt engineers, MLOps engineers, data scientists, and AI researchers. A marketing director who wants to analyze customer sentiment must navigate model selection, prompt optimization, fine-tuning decisions, and deployment architecture—or rely on technical teams to build these solutions.

This complexity barrier explains why, despite billions in AI investment, most enterprise AI initiatives remain in pilot phase. The problem isn't capability—it's accessibility. Companies have powerful AI tools but lack the human expertise to deploy them at scale across business workflows.

The market's response has been predictably focused on building better tools for these new experts. Databricks emphasizes sophisticated model training and deployment capabilities. Hyperscale cloud providers offer ever-expanding catalogs of AI services and APIs. Countless startups pitch themselves as "AI infrastructure" for technical teams.

But this creates the same dynamic that existed in the database market thirty years ago: increasingly sophisticated tools that require increasingly specialized knowledge to use effectively. The interface between user intent and system capability becomes more complex, not less.

The Second Collapse Strategy

Snowflake's AI strategy represents a fundamental rejection of this complexity-first approach. Rather than building better tools for AI experts, the company is attempting to eliminate the need for AI expertise altogether. This isn't about creating simplified versions of existing AI tools—it's about collapsing the interface between business problems and AI solutions.

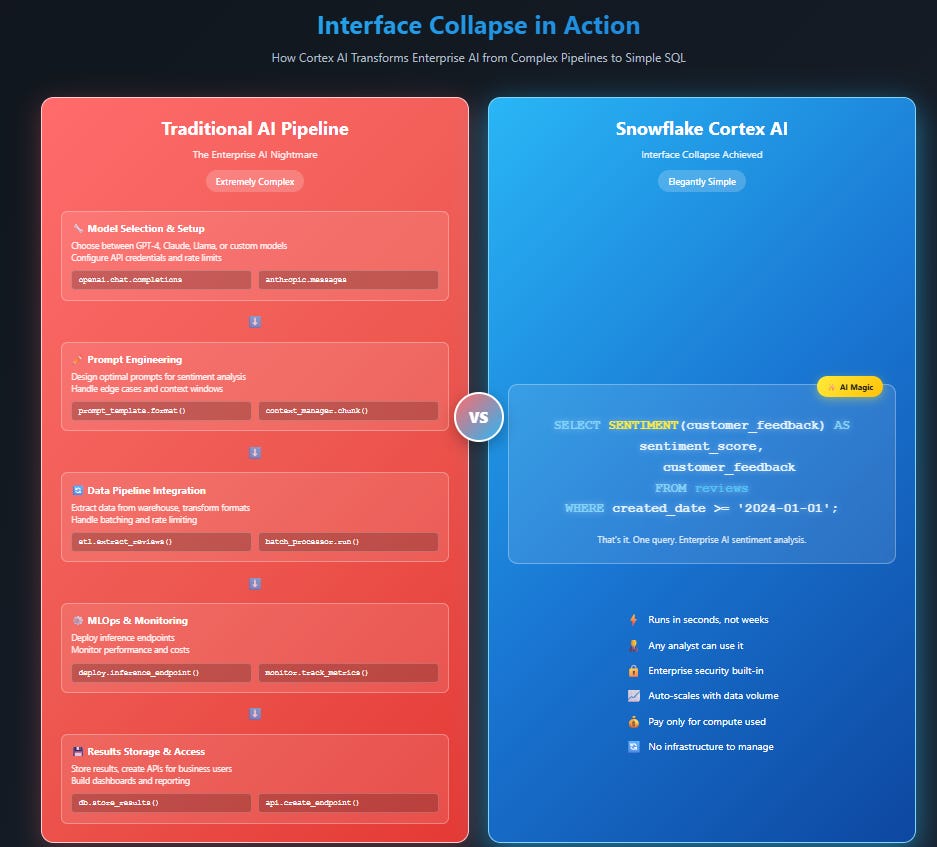

Consider Cortex AI, Snowflake's integrated AI service. Instead of requiring users to select models, manage deployments, or optimize prompts, Cortex embeds AI capabilities directly into SQL queries. A business analyst can write "SELECT SENTIMENT(customer_feedback) FROM reviews" and get sentiment analysis results without understanding transformer architectures or model training. The complexity of AI implementation disappears into the platform.

Snowflake Intelligence extends this interface collapse to natural language interactions. Users can ask questions about their data in plain English and receive answers that leverage both structured and unstructured data sources. The system automatically handles query planning, model selection, and result formatting—all the technical complexity that would normally require specialized teams.

The early evidence suggests this strategy is working.

In Snowflake's Q2 FY26 earnings call, CEO Sridhar Ramaswamy revealed that AI now influences nearly 50% of new logo wins, with over 6,100 accounts using Snowflake's AI capabilities weekly. Perhaps more tellingly, AI powers 25% of all deployed use cases—indicating integration into everyday business workflows rather than specialized pilot projects.

These metrics represent interface collapse in action. When 6,100 organizations can deploy AI capabilities without building specialized teams, the complexity barrier has been meaningfully reduced. When AI influences 50% of new customer decisions, the conversation has shifted from technical capability to business outcomes.

The Platform Expansion Paradox

Snowflake's embrace of open data standards—Apache Iceberg, Spark compatibility, and external data processing—might appear defensive, a response to competitive pressure from data lakehouse architectures. This interpretation misses the deeper strategic logic: interface collapse expansion.

By supporting data wherever it lives, Snowflake collapses the interface between "data exists in multiple formats and locations" and "analytics happens in one governed environment." Customers no longer need to choose between data flexibility and analytical simplicity—they can process Iceberg tables, run Spark workloads, and query object storage through Snowflake's unified interface.

This strategy expands the billable surface area without requiring data migration. Snowflake makes money when compute runs, not when data moves. By processing external data through its consumption-based model, the company can capture value from the entire enterprise data estate rather than just the subset migrated to its proprietary storage.

The economics are compelling: Snowflake reported over 1,200 accounts using Iceberg tables in Q2 FY26, with Snowpark Connect for Apache Spark entering public preview. These aren't customers choosing Snowflake over alternatives—they're customers bringing additional workloads to Snowflake's compute engine while maintaining their existing data architecture choices.

The Microsoft Distribution Multiplier

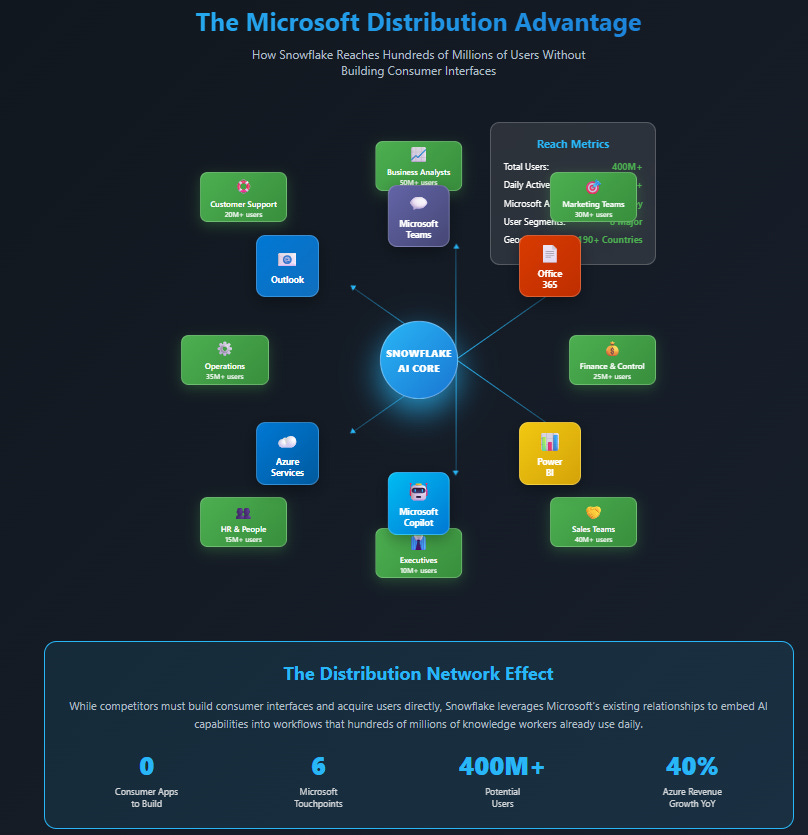

Perhaps the most underappreciated aspect of Snowflake's interface collapse strategy involves its partnership with Microsoft. This isn't merely a cloud infrastructure relationship—it's interface distribution at scale.

Microsoft's business applications—Teams, Office 365, Power BI, and the emerging Copilot suite—represent the daily workflows of hundreds of millions of knowledge workers. By integrating Snowflake's AI capabilities into these interfaces, the company can reach end users without requiring them to learn new tools or change existing workflows.

The evidence is already visible in financial results. Snowflake's Azure-based revenue grew 40% YoY in Q2 FY26, the fastest growth among major cloud platforms. More importantly, management highlighted co-selling success through Microsoft's field organization, indicating that Snowflake's capabilities are being embedded into Microsoft's customer conversations.

This distribution strategy creates an asymmetric advantage. While Databricks and other competitors must build their own user interfaces and distribution channels, Snowflake can leverage Microsoft's existing touchpoints with business users. The interface collapse happens not through Snowflake's own applications, but through applications users already trust and understand.

Measuring Interface Collapse Success

The challenge in analyzing Snowflake's AI transformation lies in distinguishing between adoption theater and genuine interface collapse. Many enterprise software companies report impressive AI adoption metrics that reflect pilot projects rather than production workflows.

The key leading indicators involve conversion patterns: Do AI capabilities expand from single use cases to multiple workflows? Do customers deploy AI capabilities across entire departments rather than specialized teams? Do AI workloads generate meaningful consumption growth rather than one-time experiments?

Snowflake's Q2 FY26 results provide early positive signals. The acceleration in revenue growth to 32% YoY, combined with stable net revenue retention of 125%, suggests that new capabilities are driving genuine usage expansion. The addition of 50 new customers with trailing twelve-month revenue exceeding $1 million—a company record—indicates that platform expansion is enabling larger initial deals.

However, critical validation metrics remain undisclosed. Snowflake has not yet provided quantitative data on AI-specific consumption, attach rates for new capabilities, or revenue attribution to different product categories. Until these metrics emerge, the financial impact of interface collapse remains inferential rather than demonstrated.

The falsification tests are clear: If AI adoption doesn't convert to measurable revenue growth by Q4 FY26, the interface hasn't truly collapsed. If customers continue to require professional services for AI deployment, complexity remains too high. If net revenue retention degrades below 120%, interface collapse isn't driving the usage expansion that justifies the strategy.

Competitive Response Timing

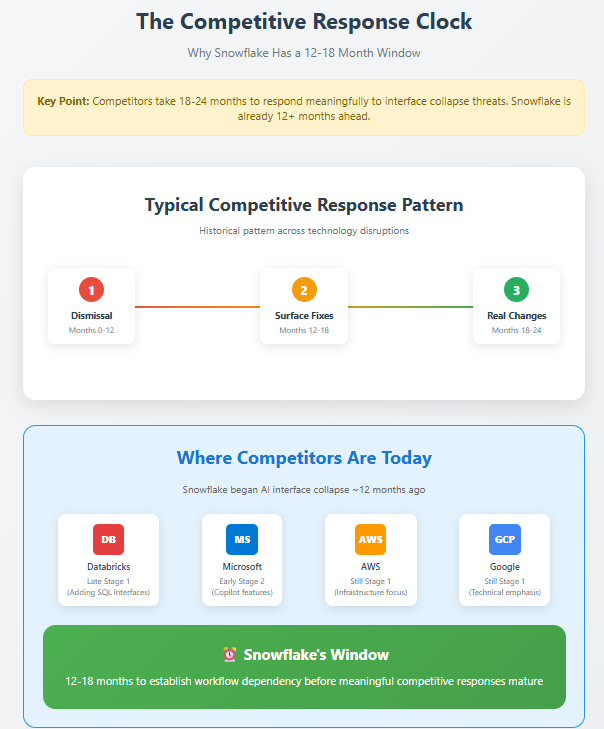

Historical analysis suggests that incumbent responses to interface collapse threats follow predictable patterns. Initial dismissal gives way to feature matching, which eventually evolves into architectural responses—but this process typically requires 18-24 months from threat recognition to credible competitive alternatives.

Databricks is beginning to add SQL-first interfaces and simplified AI deployment options, but these represent surface-level changes to an architecture designed for expert users.

Microsoft is developing Fabric as a Snowflake alternative, though this effort faces the classic challenge of integrated versus best-of-breed positioning.

Hyperscale cloud providers continue to focus on infrastructure and services rather than end-user interfaces.

The strategic clock matters because interface collapse advantages compound over time. As users adapt workflows to simplified paradigms, switching costs increase not through technical lock-in but through operational dependency. The first mover in successful interface collapse often maintains advantage even after competitors develop similar capabilities.

Snowflake appears to have a 12-18 month window to establish interface collapse dominance before competitive responses mature. The Q2 FY26 results suggest this window is being used effectively, though execution risks remain substantial.

The Economics of Simplicity

Interface collapse fundamentally alters the economics of enterprise software by enabling broader organizational adoption without proportional increases in support costs. When complexity barriers disappear, usage can expand horizontally across departments and vertically within workflows, driving consumption growth that exceeds account expansion.

This dynamic appears to be emerging in Snowflake's business model. The company added 529 employees in Q2, including 364 in sales and marketing, while maintaining operating margins of 11%. This suggests that interface collapse enables more efficient go-to-market motions—simplified products require less technical selling and support.

However, AI infrastructure costs present new challenges. GPU-intensive workloads carry different cost structures than traditional data processing, potentially pressuring the gross margins that have historically supported Snowflake's consumption model. The company's ability to maintain product gross margins near 76% while scaling AI capabilities will determine whether interface collapse can preserve profitability during the platform transition.

Management's guidance for full-year fiscal 2026—product gross margins of 75% with operating margins of 9%—suggests confidence in managing these dynamics. But the guidance doesn't yet reflect the full impact of AI infrastructure scaling, leaving margin sustainability as a key execution risk.

The Strategic Bet: Workflows Over Workbenches

The fundamental wager underlying Snowflake's AI strategy concerns how enterprise AI adoption will ultimately unfold. The company is betting that success comes from embedding intelligence into existing business workflows rather than training users to adopt new AI workbenches.

This represents a direct challenge to the prevailing approach of building sophisticated tools for AI specialists. Instead of creating better environments for data scientists and ML engineers, Snowflake is making those roles less central to AI deployment. Business analysts, marketing managers, and financial controllers can access AI capabilities through interfaces they already understand, without developing new technical expertise.

The market size implications are substantial. Rather than addressing the population of AI specialists—tens of thousands of professionals across large enterprises—interface collapse can potentially reach every knowledge worker who interacts with data. This expands the total addressable market from specialized teams to entire organizations.

Early customer examples support this thesis. BlackRock uses Snowflake's AI capabilities to create comprehensive client intelligence systems accessible to relationship managers rather than just data analysts. Thomson Reuters deploys AI-powered agents across finance and HR functions, not just technical teams. These implementations suggest that interface collapse can indeed enable broader organizational AI adoption.

Investment Implications

From an investment perspective, Snowflake's Q2 FY26 results should be understood as early evidence of successful interface collapse execution rather than cyclical recovery from the optimization period. The revenue acceleration to 32% YoY growth, combined with expanding operating margins and stable retention metrics, suggests that new capabilities are driving genuine business expansion.

However, the investment thesis requires distinguishing between tactical and strategic risks. Sales complexity, competitive response pressure, and margin management represent execution challenges that could impact near-term results. The more fundamental risk involves whether interface collapse can be sustained as competitors develop simplified alternatives and customers become more sophisticated in their AI requirements.

Current valuation appears to reflect the success of Snowflake's first interface collapse—the data warehouse transformation—without fully incorporating the potential of the second collapse involving AI and platform expansion. This creates potential mispricing, though the magnitude depends on execution success over the next 12-18 months.

Position building ahead of AI monetization disclosure makes sense for investors comfortable with execution risk, particularly if opportunities emerge to add shares during any valuation compression. The key inflection point will be management's first quantitative disclosure of AI consumption metrics, which would validate the interface collapse thesis and likely trigger multiple expansion.

The Pattern Completion

Oracle's victory in the 1980s database wars wasn't predetermined. System R had IBM's resources, Ingres had academic credibility, and numerous other competitors possessed technical advantages in specific areas. Oracle won because it recognized that enterprise software success ultimately depends not on building the most sophisticated system, but on collapsing the interface between user intent and system capability.

Thirty years later, enterprise databases are indeed powerful, but they're largely invisible to end users. Marketing analysts run complex queries without understanding indexes or joins. Financial controllers access real-time data without configuring database systems. The complexity that once required specialized database administrators has been abstracted away, enabling broader organizational access to data insights.

Snowflake's AI strategy represents a bet that the same pattern will unfold in enterprise AI. Five years from now, powerful AI capabilities will be embedded throughout business workflows, but users won't need to understand transformer architectures or prompt engineering. The complexity that currently requires specialized AI teams will be abstracted away, enabling every knowledge worker to leverage artificial intelligence in their daily work.

The Q2 FY26 results provide the first concrete evidence that this interface collapse is beginning to work. Revenue acceleration, customer expansion, and usage metrics all point toward successful execution of a strategy that seemed speculative just two years ago. Whether Snowflake can complete this transformation before competitors develop credible simplified alternatives will determine not just the company's financial performance, but the structure of the enterprise AI market for the next decade.

The strategic question isn't whether interface collapse will happen—history suggests it's inevitable. The question is whether Snowflake can execute this transition successfully enough to establish the same dominant position in AI workflows that Oracle achieved in database management. The early evidence suggests the answer may be yes, but the ultimate outcome depends on execution discipline over the next twelve to eighteen months.

For investors willing to bet on interface collapse over technological sophistication, Snowflake represents a rare opportunity to invest in a proven pattern at the beginning of a new cycle. The alternative is waiting for certainty, by which time the mispricing opportunity will likely have resolved itself.

Disclaimer:

The content does not constitute any kind of investment or financial advice. Kindly reach out to your advisor for any investment-related advice. Please refer to the tab “Legal | Disclaimer” to read the complete disclaimer.